#crudeoil

Explore tagged Tumblr posts

Text

GOLD (XAU/USD) Market Update:

Gold has reached $2642, poised for further upside.

Uptrend Targets:

$2650-55 (initial resistance)

$2662 (next resistance)

Downtrend Support:

$2630-28 (initial support)

$2620 (key support)

Buying Opportunity:

Buy on dips towards $2630-28

Hold for $2655-62

Trading Strategy:

Long positions above $2642

Stop-loss below $2620

Risk Management:

Set stop-loss orders according to market volatility.

Monitor gold's movement closely and adjust trading strategies accordingly.

#usdjpy#nasdaq#sp500#commodities#eurusd#economicdata#dowjones#crudeoil#stock market#financial freedom#xauusd#forex#best expert advisor#best forex ea#best forex robot#trader

3 notes

·

View notes

Text

Market Update: Key Indices and Stocks Show Mixed Movements Amidst Economic Projections

Index Futures Overview

As the trading day commenced, the major U.S. stock index futures exhibited modest fluctuations. Dow Jones Futures traded largely unchanged, indicating a neutral market sentiment. Meanwhile, S&P 500 Futures edged up by 2 points, representing a 0.1% increase. The Nasdaq 100 Futures also climbed by 20 points, or 0.1%, reflecting slight optimism in the tech sector.

Economic Projections: Job Market Insights

Economists are keeping a close watch on the U.S. labor market data, anticipating the addition of 189,000 jobs in June. This follows a stronger-than-expected increase of 272,000 jobs in May. The employment figures are crucial as they provide insights into the health of the economy and can influence Federal Reserve policy decisions. A robust job market typically signals economic strength, while any shortfall could raise concerns about a potential slowdown.

Stock Movements: Highlights and Lowlights

Tesla (NASDAQ: TSLA): Tesla's stock saw a premarket boost of nearly 2%, continuing its trend of strong performance. This increase may be attributed to positive investor sentiment surrounding the company's ongoing innovations and expansion plans in the electric vehicle market.

Macy’s (NYSE: M): Macy’s stock surged by 4% premarket. This rise could be due to positive retail sector performance or specific company news that has bolstered investor confidence. Macy’s, as a major player in the retail industry, often reflects broader consumer spending trends.

Coinbase Global (NASDAQ: COIN): In contrast, Coinbase Global experienced a significant drop, with its stock falling 6.5% premarket. The decline in Coinbase's stock price may be linked to recent regulatory scrutiny or market volatility impacting the cryptocurrency sector.

Commodity Market Movements

Crude Oil: U.S. crude futures (WTI) rose slightly by 0.1% to $83.98 a barrel, suggesting steady demand despite global economic uncertainties. Conversely, the Brent crude contract saw a marginal decline, trading at $87.40 a barrel. These movements indicate mixed market sentiments influenced by factors such as supply concerns and geopolitical developments.

Cryptocurrency Update

Bitcoin: The world's leading digital currency, Bitcoin, faced a downturn, falling to its lowest level since February. This decline reflects broader market trends affecting cryptocurrencies, including regulatory pressures and changes in investor sentiment.

Conclusion

Today's market snapshot presents a mixed picture with minor gains in major indices and varied performances among prominent stocks. Economic projections, particularly job market data, will play a crucial role in shaping market movements in the near term. Investors are advised to stay informed about ongoing economic indicators and company-specific developments to navigate the dynamic market landscape effectively.

This article provides a comprehensive overview of the current market trends, highlighting key indices, stocks, and economic projections. It offers valuable insights for investors and market watchers looking to understand the factors driving today's financial landscape.

#MarketTrends#StockMarket#IndexFutures#EconomicProjections#JobMarket#TeslaStock#MacyStock#CoinbaseGlobal#CrudeOil#BitcoinUpdate#FinancialMarkets#InvestingInsights#MarketAnalysis#CommodityMarkets#CryptocurrencyTrends

2 notes

·

View notes

Text

US Crude Oil Import Data: Top Crude Oil Importers in the US

The environment of US crude oil imports has changed significantly during the past decade. Crude oil imports are used to supply a major portion of the energy and crude oil needs of the United States. Imports account for over 40% of the US's total petroleum consumption, making them a vital component of the nation's energy balance. In 2023, the United States imported $172.42 billion worth of crude oil, a 16% reduction from the last year. According to US import data, the country imported 1.78 billion barrels of crude oil in the first three quarters of 2024, totaling $133.56 billion.

About 6.48 million barrels of crude oil were imported daily by the US in 2023, for a total quantity of 236.52 million barrels. Crude oil is the most imported commodity in the United States, which is the second-largest importer of the commodity globally, after China. This article will look at the top US crude oil importers and the latest trends and market research about US crude oil imports for 2023–2024.

Import Data and Trends of US Crude Oil Importers

The largest crude oil importers in the United States are ExxonMobil, Chevron Corp., and Valero Energy Corp.

Data from the US crude oil buyers and importers list shows that there are over 2000 verified crude oil importers and purchasers in the United States.

Sixty-six percent of all energy imports into the US are crude oil.

These importers purchase crude oil from more than 3100 suppliers worldwide.

There are now over 28,900 shipments of crude oil into the United States, based on USA shipment data.

The United States imports crude oil from over 100 countries, according to data on imports by country.

Crude oil has the 4-digit HS code 2709, which places it under the HS code 27 for worldwide trade and in the classification of mineral fuels.

USA Crude Oil Importers List: Database of Leading Crude Oil Importers in the US

According to US importer statistics and US crude oil import estimates for 2023–2024, these are the largest 10 American companies that import crude oil:

1. Valero Energy Corporation: Import Value: ~$25 billion

Total Import Quantity: ~230 million barrels

Import Shipments: Over 9,000 annually

Headquarters: San Antonio, Texas

2. Chevron Corporation: Import Value: ~$21 billion

Total Import Quantity: ~190 million barrels

Import Shipments: Over 8,000 annually

Headquarters: San Ramon, California

3. ExxonMobil: Import Value: ~$18 billion

Total Import Quantity: ~165 million barrels

Import Shipments: Over 7,000 annually

Headquarters: Irving, Texas

4. Marathon Petroleum Corporation: Import Value: ~$16 billion

Total Import Quantity: ~150 million barrels

Import Shipments: Over 6,500 annually

Headquarters: Findlay, Ohio

5. Phillips 66: Import Value: ~$14 billion

Total Import Quantity: ~125 million barrels

Import Shipments: Over 5,500 annually

Headquarters: Houston, Texas

6. Motiva Enterprises: Import Value: ~$12 billion

Total Import Quantity: ~110 million barrels

Import Shipments: Over 5,000 annually

Headquarters: Houston, Texas

7. Shell USA (formerly Shell Oil Company): Import Value: ~$10 billion

Total Import Quantity: ~100 million barrels

Import Shipments: Over 4,500 annually

Headquarters: Houston, Texas

8. Tesoro Corporation: Import Value: ~$8.5 billion

Total Import Quantity: ~80 million barrels

Import Shipments: Over 3,500 annually

Headquarters: San Antonio, Texas

9. BP America: Import Value: ~$7.2 billion

Total Import Quantity: ~70 million barrels

Import Shipments: Over 3,000 annually

Headquarters: Houston, Texas

10. HollyFrontier Corporation: Import Value: ~$6 billion

Total Import Quantity: ~60 million barrels

Import Shipments: Over 2,500 annually

Headquarters: Dallas, Texas

Imports of US Crude Oil by Country: US Crude Import Data by Country

The USA imports the majority of its crude oil from Saudi Arabia, Mexico, and Canada. About 3.8 million barrels of crude oil were imported daily from Canada to the United States in 2023, bringing the total import value to $97.18 billion. In total, 370.39 million cubic meters of crude oil were imported into the US. The top ten countries from which the United States imports crude oil in 2023 are:

1. Canada: $97.18 billion (56.4%)

2. Mexico: $20.35 billion (11.8%)

3. Saudi Arabia: $10.81 billion (6.3%)

4. Iraq: $6.01 billion (3.5%)

5. Brazil: $5.90 billion (3.4%)

6. Colombia: $5.59 billion (3.2%)

7. Nigeria: $4.73 billion (2.7%)

8. Ecuador: $3.95 billion (2.3%)

9. Venezuela: $3.45 billion (2%)

10. Guyana: $3.09 billion (1.8%)

Local Crude Oil Consumption in the United States

The USA is one of the biggest consumers of crude oil in the world, with a considerable percentage of its energy demands being met by crude oil and petroleum products. The nation's domestic crude oil consumption is driven by several industries, including shipping, residential, commercial, and industrial demands. The U.S. Energy Information Administration (EIA) recently released data showing that in 2023, the country's daily crude oil consumption exceeded 20 million barrels.

The United States trade policy and regulations on crude oil imports

The US government has implemented several policies and initiatives to manage environmental concerns, promote domestic production, and regulate imports of crude oil. The federal government can impose trade restrictions like tariffs and quotas to regulate imports of crude oil.

One of the main laws affecting the import of crude oil is the Renewable Fuel Standard (RFS), which mandates the use of biofuels such as ethanol and biodiesel in transportation fuels. This program aims to reduce the nation's dependency on imported crude oil and promote the growth of renewable energy sources.

The Environmental Protection Agency (EPA) plays a key role in regulating the crude oil industry by enforcing environmental laws and regulations. These regulations cover many subjects, including greenhouse gas emissions, pollution of the air and water, and the handling and disposal of hazardous materials.

Bottom Line

To sum up, US imports of crude oil are critical to ensuring the nation has a strong and consistent energy supply. Despite being a major producer of crude oil, it imports crude oil to meet its domestic needs. Identifying the impact of the crude oil import market will help policymakers make well-informed decisions to ensure energy security and prosperity in the years to come.

#CrudeOil#USImports#EnergyTrade#GlobalEconomy#usimport#USOIL#UScrudeoil#crudeoiltrading#oil#ImportData#oilimportdata

0 notes

Text

Oil Prices Dip Amid Israel-Lebanon Ceasefire Deal

Source: energy.economictimes.indiatimes.com

Category: News

Global Oil Prices See Decline Post-Ceasefire Agreement

Oil prices experienced a notable dip on Tuesday, reversing earlier gains in a volatile trading session. The downturn followed news of Israel agreeing to a ceasefire deal with Lebanon, which reduced the geopolitical risk premium associated with oil. As tensions eased, market sentiment shifted, causing fluctuations in crude prices.

Brent crude futures, a global benchmark for oil, fell by 54 cents, or 0.74%, to trade at $72.47 per barrel by 1:41 p.m. EST. Similarly, U.S. West Texas Intermediate (WTI) crude futures dropped 49 cents, or 0.71%, to reach $68.45 per barrel. The decline reflected traders’ reassessment of risk factors influencing oil supply and pricing.

Market Reactions to Geopolitical Developments

The ceasefire agreement, endorsed by Israel’s security cabinet, marked a significant development in Middle Eastern geopolitics. Historically, tensions in the region have had a direct impact on global oil markets due to concerns over potential disruptions in supply. With the risk of escalating conflict now minimized, market dynamics shifted, leading to a reduction in oil prices.

Energy analysts noted that while the ceasefire eased immediate fears, oil markets remained sensitive to potential geopolitical uncertainties. “The Middle East continues to be a focal point for energy markets, and any developments in the region can quickly alter price trajectories,” said one industry expert.

Broader Implications for Oil Markets

The price drop highlights the interplay between geopolitical events and energy markets. Oil prices often fluctuate based on perceived risks, such as conflicts in oil-producing regions. The Israel-Lebanon ceasefire reduced immediate concerns over supply disruptions, but broader factors—like global demand trends and economic conditions—continue to influence market behavior.

As trading stabilized, attention turned to other variables, including OPEC’s production policies and the global economic outlook. Analysts predict that while the current decline is linked to easing geopolitical tensions, the oil market’s future direction will depend on a complex mix of supply, demand, and geopolitical factors.

0 notes

Text

Bailey Hints at Rate Cuts, OPEC and Job Data Focus

Bailey Hints at Rate Cuts, OPEC and Job Data Focus Bank of England Governor Andrew Bailey grabbed attention yesterday. He suggested up to four UK rate cuts might happen next year as inflation eases. The pound briefly dipped before recovering, showing cautious about the BoE’s approach. Mixed data is also in focus today. Eurozone factory orders improved, while US jobless claims and Challenger job…

#AUDUSD#BaileySpeech#CrudeOil#EURUSD#ForexNews#GBPUSD#GoldPrices#JoblessClaims#MarketUpdate#NZDUSD#OPECMeeting#RateCuts#SilverPrices#USDCAD#USDCHF#USDINR#USDJPY#USDMXN

0 notes

Link

0 notes

Text

💹 Trade Top Commodities MintCFD. From metals to energy commodities, start trading with confidence and maximize your profits. 🌍💰

✅ Trade with zero brokerage and leverage up to 100x ✅ Open an account instantly ✅ Get a 5% bonus on your first deposit ✅ Access 24/7 customer support

@mintcfd.official

#tradecommodities#commoditytrading#mintcfd#zerobrokerage#tradingplatforms#globalmarketaccess#financialfreedom#tradegold#energymarkets#oiltrading#tradesilver#investmentopportunities#naturalgas#commoditiesinvestment#crudeoil#tradecopper#futurestrading#agricommodities#tradingstrategy#marketinsights#diversifyportfolio#globaltrading#mintcfdcommodities

1 note

·

View note

Text

youtube

Oil Prices PLUMMET: Is NOW the Time to Invest in Oil Stocks?

The recent decline in oil prices is the topic of discussion. Brent crude hit a low of $70 per barrel for the first time since late 2021. It investigates the economic ramifications, industry viewpoints, and possible effects on markets. We examine the factors that contributed to the price decline, such as China's declining demand and rising global production, as well as the potential effects of lower oil prices on inflation data and central bank policy, particularly with regard to interest rate cuts.

0 notes

Text

Wolf Thread — A Leader in Crude Oil Export and Supply

Introduction

In the world of crude oil export and supply, Wolf Thread has emerged as a prominent player, setting new standards for excellence and reliability. As a leading exporter of crude oil, the company has made a significant impact on the global market, thanks to its strategic approach and commitment to quality. Central to this success is Tanvir Rana, whose leadership has been instrumental in driving Wolf Thread’s achievements in the crude oil sector.

Excellence in Crude Oil Export

Wolf Thread’s success in crude oil export is built on a foundation of strategic vision, operational efficiency, and a commitment to delivering high-quality products. The company’s ability to navigate the complexities of the crude oil industry and secure competitive deals has positioned it as a trusted name in the global market.

Tanvir Rana’s leadership has been a driving force behind Wolf Thread’s success in crude oil export. His deep understanding of the industry, combined with his strategic foresight, has enabled the company to build strong relationships with suppliers and clients. Tanvir’s focus on transparency and ethical practices has further enhanced Wolf Thread’s reputation as a reliable and reputable exporter of crude oil.

Strategic Approach to Crude Oil Supply

In addition to its export activities, Wolf Thread excels in crude oil supply, providing clients with a consistent and reliable source of high-quality crude oil. The company’s strategic approach to supply chain management ensures that clients receive timely and efficient deliveries, meeting their specific needs and requirements.

Tanvir Rana’s expertise in managing the complexities of the crude oil supply chain has been instrumental in establishing Wolf Thread as a leading supplier. His ability to streamline operations, optimize logistics, and maintain high standards of quality has contributed to the company’s success in this competitive market. Tanvir’s commitment to excellence and customer satisfaction remains at the core of Wolf Thread’s operations.

Conclusion

Wolf Thread’s achievements in crude oil export and supply are a testament to the company’s dedication to excellence, reliability, and ethical practices. Under the leadership of Tanvir Rana, the company has set new standards in the industry, delivering high-quality products and services that meet the highest expectations. As Wolf Thread continues to grow and expand its presence in the global market, its commitment to quality and innovation remains unwavering, ensuring that the company remains a leader in the crude oil sector.

visit: Wolf Thread

#manufacturing#textiles#business#garments#apparelandclothing#crude oils#crudeoil#Tanvir#Rana#Wolf Thread#Crude oil export#Crude oil import

0 notes

Text

🚀 Looking for Reliable Petroleum Supply? 🌍

I’m excited to share that Leopardus Petroleum Ltd is offering a comprehensive range of petroleum products from top Kazakhstan refineries. Whether you need Aviation Kerosene JP54, LPG, Diesel Gas D2, or any other petroleum product, they’ve got you covered.

They provide flexible delivery terms (FOB and CIF) to major ports including Rotterdam, Jurong, Houston, and Fujairah, ensuring you get reliable supply with competitive terms.

🔹 Products Include:Aviation Kerosene JP54 LPG LCO Virgin Fuel Oil (D6) Diesel Gas D2 LNG Mazut-100 Jet Fuel (Jet A1) EN590 Diesel ESPO Crude Oil

For inquiries and more details, reach out to

Mr. Adji Guntur Witjaksono Commercial Director: 📞 Whatsapp: +447508171978 ✉️ Email: [email protected]

Feel free to connect and explore how they can meet your petroleum needs!

#oil and gas#oil and gas courses#oil and gas industry#oil and gas sector#petroleum#Petroleum#Fuel#Energy#SupplyChain#Business#Kazakhstan#AviationFuel#Diesel#LNG#CrudeOil

1 note

·

View note

Text

Oil Prices Edge Higher Amid U.S. Rate Cut Optimism Despite Global Demand Concerns

Oil prices experienced a modest rise on Thursday, driven by optimism surrounding potential U.S. interest rate cuts that could stimulate economic activity and boost fuel consumption. Despite these gains, concerns over slower global demand kept the upward movement in check.

Brent crude futures saw an increase of 17 cents, or 0.21%, bringing the price to $79.93 per barrel. This rise helped recover some of the losses incurred the previous day. Similarly, U.S. West Texas Intermediate (WTI) crude futures rose by 21 cents, or 0.27%, to $77.19 per barrel.

The recovery in oil prices followed a more than 1% drop on Wednesday. This decline was prompted by an unexpected rise in U.S. crude inventories, which added to existing worries about an oversupply in the market. Additionally, geopolitical tensions, particularly concerning Israel's actions in Gaza, have also contributed to market volatility. The ongoing conflict and the allegations of war crimes have not only created humanitarian concerns but also added an element of uncertainty to the oil market.

The potential for U.S. interest rate cuts has generated optimism among investors, with the expectation that such a move would invigorate economic activities and, consequently, increase fuel demand. This hope for economic stimulation has provided some support to oil prices.

However, the broader context of global economic health continues to weigh heavily on the market. Concerns about a slowdown in global demand, fueled by economic uncertainties in major economies, persist. These factors are contributing to a cautious outlook among traders and analysts.

In summary, while the potential for U.S. interest rate cuts has sparked some optimism in the oil market, leading to a modest price increase, broader concerns about global demand and geopolitical tensions continue to influence market sentiment. The interplay between these factors will likely shape the oil market's trajectory in the coming weeks.

#OilPrices#CrudeOil#BrentCrude#WTICrude#EconomicActivity#FuelConsumption#USInterestRates#GlobalDemand#OilMarket#GeopoliticalTensions#IsraelGazaConflict

0 notes

Text

Oil prices have plummeted!

In a significant downturn, Brent Crude oil prices have plunged to their lowest level in over a month, shedding more than 3% over the past three trading sessions. This dramatic drop marks a notable shift in the market dynamics! But why?

Rising inventories and tepid demand are to blame.

Even President Joe Biden's withdrawal from the election race failed to impact oil prices, as swelling oil stockpiles continued to weigh on market sentiment. StoneX's analysis reveals that global petroleum, total oil, and refined product inventories have increased in all major hubs, except Europe.

Moreover, Morgan Stanley recently announced that the oil market tightness would hold only till the third quarter of 2024 and a market equilibrium will be established by the fourth. Moreover, it also announced that there would be an oil surplus by 2025, thereby dragging oil prices down to the mid-$70s per barrel! On the demand end, China’s demand outlook appears weak. Its economic growth slowed down to 4.7% last quarter, making it the slowest pace of growth in 5 quarters as its domestic conditions remain troubled. As China is the largest importer of oil, the slowdown in its economy has sparked major demand concerns. When reporting, the Brent Crude was trading at around $82.751/bbl. Follow ProCapitas for more financial insights.

ProCapitas is a part of Nishtya Infotech (Jobaaj Group) & helps financial investors build a strong understanding, of the fundamentals and technicals of stock market through interactive learning (using microlearning content). Our platform also provides them with a real-time decision making experience, which they can apply to make better investment decisions in the future. ProCapitas has a team of highly qualified CFAs, CAs and MBAs to deliver relevant and simplified financial learning experience.

0 notes

Text

Labor Market Insights & Monetary Policy: Today's Events

Labor Market Insights & Monetary Policy: Today’s Events Today the markets are centered around employment data and central bank speeches. The US ADP Employment Change report is expected to provide insights into labor market conditions. This comes ahead of the NFP later this week. Meanwhile, speeches from BoE Governor Bailey, ECB President Lagarde, and Fed Chair Powell will keep investors alert…

#AUDUSD#CrudeOil#EURUSD#ForexNews#GBPUSD#GoldPrices#LagardeSpeech#MarketUpdate#NZDUSD#PowellSpeech#USDCAD#USDCHF#USDINR#USDJPY#USDMXN#USDStrength

0 notes

Text

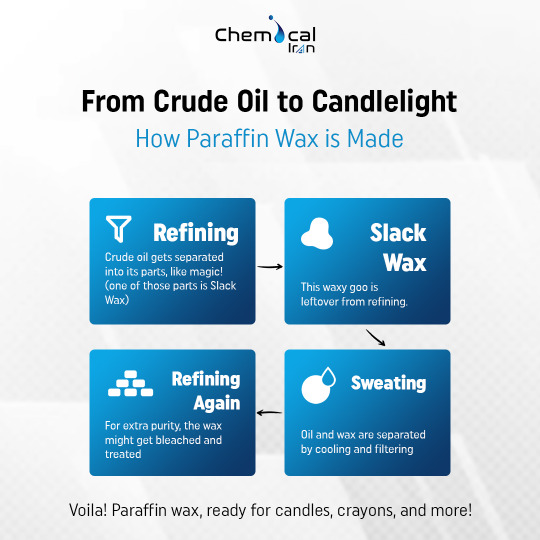

Paraffin wax is a white, waxy, and odorless substance derived from petroleum, renowned for its moisturizing and heat-retaining properties. From crude oil to candlelight, producing paraffin wax is complex. Here are the steps for how it’s made:

Start the process by refining the crude oil to separate its parts, just like magic!

Once done, you will get the slack wax as the leftover.

Leave the slack wax for cooling and filter it to separate the wax and oil.

Lastly, refine the wax again through bleaching and treating for better purity.

Voila! Paraffin Wax is all set for crayons, candlelight, and more!

Looking for a hassle-free way to get paraffin wax? At Chemical Iran, we offer the highest quality paraffin wax for industrial uses with guaranteed round-the-clock customer support, easy purchases, and safe delivery.

For more, visit: https://www.chemicaliran.com/products/paraffin-wax/

#chemicaliran#praffinwax#wax#petroleum#candle#crayons#candellight#cooling#slackwax#bleaching#industrial#industrialuse#crudeoil

0 notes