#mortgage?????!????!!!!?

Explore tagged Tumblr posts

Text

#me this fine thursday morning 🤠#honestly I’ve been really enjoying my new job because I get to specialise in what I want and my boss is a literal angel#like i would do anything for her bcs she is such a kind soul who is constantly looking out for the people under her charge#and she’s so down to earth and easy to work with#BUT. my mom has been throwing all kinds of shade and subtext at me#and I keep telling myself it’s a small thing I’m used to it it shouldn’t grate on my nerves so much#but it does??? and I can’t keep gaslighting myself???#tldr she lowkey thinks I got ‘let off’ my previous job bcs I was lazy and left a bad impression due to my coming in late#but what about all the 3am nights?????? girl’s gotta sleep????#also I literally told my previous job ‘give me disputes or nothing’ and they couldn’t give me what I wanted bcs it was a bad time#and just recession vibes#so they offered for me to go to Dubai instead#which my mom just INSISTS was a dumping ground bcs I wasn’t good enough or smt wtf#meanwhile she gets so defensive of my sister who hasn’t worked for nearly 4 years#I tried to tell her FACTS and she literally told me not to accuse my sister and that she’s working part time and I’m like??? she’s not???#and my sister is being so miserly and insufferably calculative over every penny#while JETTING OFF EVERYWHERE ON BUSINESS CLASS. I JUST. ?!?-&:&/!:!:!:$:#anyway the subtext is just that my mom is concerned her only source of income aka me will be cut off lol#but I was still??? giving her an allowance while travelling??? meanwhile my sister is just asking us to cough up $$ for her share of the#mortgage?????!????!!!!?#what a morning. I’m so mad I could punch a wall lol#Spotify

4 notes

·

View notes

Text

the problem with ordering food is that you’re immediately like I shouldn’t have done that…….i shouldn’t have spent that money…….but then the food arrives and is so delicious (and GOOD FOR YOU!) and you live to smile another day.

#my top three expenses are mortgage -> vet bills -> food#I wish ordering food wasn’t so rewarding#unfortunately it is like someone delivering happiness to your doorstep#BUT ALSO I NEED TO STOP SPENDING MONEYYYY

5K notes

·

View notes

Text

Danny's human form ages like normal, but his default form as Phantom is still the 14y/o he was at his time of death. Luckily he can change that with concentration, since his ghost form is malleable. But he has to a) have the time to enact the change and b) consciously maintain his form. His superhero colleagues don't know he's half alive, so he's typically got his adult ghost form firmly in place before they meet. While fighting a powerful enemy, Phantom's concentration slips and he reverts to child form. Doesn't matter, it's just aesthetics and the enemy is what's important. He’s equally strong in his 14 y/o form. Except, his colleagues are very concerned to “discover” that their teammate is a child who has been lying about his age all this time. So now Danny has to figure out how to convince them that he's just looked 14 for over a decade now, or bite the bullet and show them all his secret identity. Preferably before they demote him to a team of teen heroes, or he gets forcibly adopted.

#Heroes: we must protect the child#Danny: I'm almost forty. I've got a mortgage guys#danny phantom#phanfic#fanfic prompt#story prompt#could be Danny is a member of the Justice League#or this could be any other crossover#your choice#dp x dc#dpxdc#dc x dp#justice league

3K notes

·

View notes

Text

rdj going back to the mcu that’s how you know the economy is in shambles for real

3K notes

·

View notes

Text

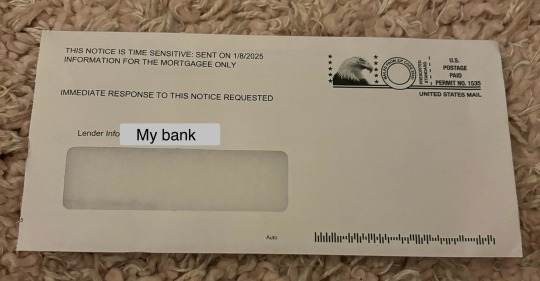

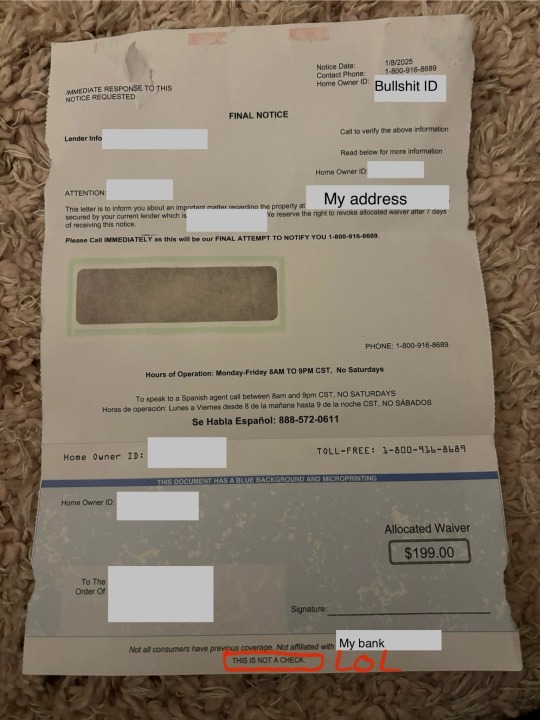

Making this a random PSA since I’d never heard about this until I encountered it:

When you close on a house, you will receive scare-mail from scammers that use a lot of alarming language and look like they’re from your bank. These are scams.

Mortgage information is public information. So these scammers will have access to your name, your address, and the name of the bank your mortgage is with.

They love to send vague letters that explain nothing but make it SOUND like you’re in trouble if you don’t call them

And if you they can’t win you over with scare tactics, they’ve attached a not-a-check to maybe make you think they’ll give you money.

I blurred out my personal info but actually I WILL include the phone number, in the hopes that people who receive a letter like this and Google the number might see this info. Scam number is 1 800 916 8689

So if you see this kind of letter, or your parents, or grandparents, or loved ones, it’s a scam.

I told Patches she can eat it

#scam#Chrissy speaks#first time I got one of these overlapped with my bank messing up my address#so my mail from them was lost in the system#and I was anxiously waiting for my mortgage bill that was getting close to overdue#and which hadn’t come yet despite my bank claiming they sent it#so when I got one of these I DID call the number#realized it was a scam once I started talking to someone#but it pissed me off

871 notes

·

View notes

Text

let me tell you something, as a bitch who went viral for her cunty post about the met gala back in 2018: i will always, always, always tolerate ugliness so long as it’s undeniable that a choice was made. when it comes to celebrities paying through the nose to wear costumes and stunt, i want audacity. i want gull and i want gumption. lil nas x looks like the silver surfer got his hands on some nerds rope. pedrito has got his bare thighs out at the gig. doja is serving animorphs realness and you know what? i respect it. in fact, i adore it. because do you want to know what’s exponentially worse than being a lil ugly? being that rich and being that spoiled for wardrobe options and nevertheless committing the unforgivable sin of being boring !!

#met gala#let me tell you something the fact that these celebs will pay the equivalent of a mortgage to look BORING should be a criminal offense

12K notes

·

View notes

Text

officially will be a homeowner next friday??? which is nuts to think about??? can't wait to paint everything a shade of green and make small talk with my neighbors over the fence in the yard or whatever homeowners do

#am i old???? i have a mortgage now thats cheaper than rent for a 2 bedroom apartment which is SAD#2024 is a good year for me got a gf got a house now i just need a promotion and ill be set baby!

613 notes

·

View notes

Text

happy 40th anniversary electric dreams movie

#electric dreams#electric dreams 1984#edgar electric dreams#not sure what else to tag this lol#he should get a mortgage

745 notes

·

View notes

Text

Transphobes hate us whether or not we go by neopronouns. You are not quirky or cool because you hate neopronouns & the people who use them.

We will never meet their expectations, so accusing certain trans people as being the problem makes you just as bad as transphobic people.

You don't have to understand it to be respectful. Calling someone "xe/xem" or "bun/bunself" isn't going to make you combust into a million pieces. As long as they aren't hurting anyone, let them live.

#text post#lgbtq#lgbt#trans#neurodivergent#transgender#autism#neopronouns#pronouns#some of y'all are 35 with 2 mortgages worried about what other people are doing with their lives#and usually the people in question are either neurodivergent or minors or both#I hope your parents are proud you like making fun of minorities so much

2K notes

·

View notes

Text

You guys do realize a lot of watcher fans complaining about the six dollars don't just need to "cancel their disney+ or hulu subscriptions." They're the people who ALREADY can't afford streaming services. It's not that they should be supporting independent creators over big corporations, it's that they literally cannot afford to do either.

#Some people in this tag genuinely do not know how poverty works#Like. 6 dollars is A LOT by american standards right now#And that's not even counting countries with currency worth less#For some watcher fans this is literally '6 dollars towards content or 6 more dollars towards rent to keep my housing#Or food so I don't starve'#ren posting#watcher#watcher entertainment#Edit: there's also people like me who CAN AFFORD IT#But they have better things to put money towards. Like college and therapy and medications and a mortgage#So not every fan who can afford it will because there are simply more important things to pay for. Especially in this economy

1K notes

·

View notes

Text

#animal crossing#new horizons#acnh#switch#nintendo#nintendo switch#tom nook#finance#money#mortgage#dogs#cute#funny#lol#humor#meme#gaming#video games#villagers#animal crossing new horizons#ac

1K notes

·

View notes

Text

#trump#donald trump#kamala harris#trump 2024#democrats#vote kamala#kamala 2024#kamala for president#vp kamala harris#republicans#mortgage#special interest#interest rates#housing#gas prices#economy#money management#money#budgeting#budget#food and beverages#foodporn#foodie#food#salary#paycheck#paypal#debt relief#debt#credit cards

464 notes

·

View notes

Text

no more vet bills this year 😡 from now on, everybody stays healthy forever

#going to sit the cats down and explain to them that I already have to replace a cracked furnace this week#gonna also tell them about my mortgage

1K notes

·

View notes

Text

Marwan being hot—curls, beard, anime eyes, casually multilingual, bruised knuckles o' justice—in the opening scene of The Night Agent 2.05.

#marwan kenzari#the night agent#this show is uh not what i would call a masterpiece#but i hope it paid marwan's mortgage

265 notes

·

View notes

Text

i want so badly to come across one of these comments because this doesn’t feel real, i don’t go much on tiktok but is this……. real?

#im confused#and also concerned#WHO is on tiktok saying that dan and phil are just platonic buddies#with a house and a mortgage and constant sex jokes#i want to see these comments#dnp#dan and phil#phan#phil lester#dan howell#daniel howell#d&p#dnp tit#dip and pip#amazing phil

482 notes

·

View notes

Text

Leveraged buyouts are not like mortgages

I'm coming to DEFCON! On FRIDAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Here's an open secret: the confusing jargon of finance is not the product of some inherent complexity that requires a whole new vocabulary. Rather, finance-talk is all obfuscation, because if we called finance tactics by their plain-language names, it would be obvious that the sector exists to defraud the public and loot the real economy.

Take "leveraged buyout," a polite name for stealing a whole goddamned company:

Identify a company that owns valuable assets that are required for its continued operation, such as the real-estate occupied by its outlets, or even its lines of credit with suppliers;

Approach lenders (usually banks) and ask for money to buy the company, offering the company itself (which you don't own!) as collateral on the loan;

Offer some of those loaned funds to shareholders of the company and convince a key block of those shareholders (for example, executives with large stock grants, or speculators who've acquired large positions in the company, or people who've inherited shares from early investors but are disengaged from the operation of the firm) to demand that the company be sold to the looters;

Call a vote on selling the company at the promised price, counting on the fact that many investors will not participate in that vote (for example, the big index funds like Vanguard almost never vote on motions like this), which means that a minority of shareholders can force the sale;

Once you own the company, start to strip-mine its assets: sell its real-estate, start stiffing suppliers, fire masses of workers, all in the name of "repaying the debts" that you took on to buy the company.

This process has its own euphemistic jargon, for example, "rightsizing" for layoffs, or "introducing efficiencies" for stiffing suppliers or selling key assets and leasing them back. The looters – usually organized as private equity funds or hedge funds – will extract all the liquid capital – and give it to themselves as a "special dividend." Increasingly, there's also a "divi recap," which is a euphemism for borrowing even more money backed by the company's assets and then handing it to the private equity fund:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

If you're a Sopranos fan, this will all sound familiar, because when the (comparatively honest) mafia does this to a business, it's called a "bust-out":

https://en.wikipedia.org/wiki/Bust_Out

The mafia destroys businesses on a onesy-twosey, retail scale; but private equity and hedge funds do their plunder wholesale.

It's how they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And it's what they did to hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

It's what happened to nursing homes, Armark, private prisons, funeral homes, pet groomers, nursing homes, Toys R Us, The Olive Garden and Pet Smart:

https://pluralistic.net/2023/06/02/plunderers/#farben

It's what happened to the housing co-ops of Cooper Village, Texas energy giant TXU, Old Country Buffet, Harrah's and Caesar's:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

And it's what's slated to happen to 2.9m Boomer-owned US businesses employing 32m people, whose owners are nearing retirement:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Now, you can't demolish that much of the US productive economy without attracting some negative attention, so the looter spin-machine has perfected some talking points to hand-wave away the criticism that borrowing money using something you don't own as collateral in order to buy it and wreck it is obviously a dishonest (and potentially criminal) destructive practice.

The most common one is that borrowing money against an asset you don't own is just like getting a mortgage. This is such a badly flawed analogy that it is really a testament to the efficacy of the baffle-em-with-bullshit gambit to convince us all that we're too stupid to understand how finance works.

Sure: if I put an offer on your house, I will go to my credit union and ask the for a mortgage that uses your house as collateral. But the difference here is that you own your house, and the only way I can buy it – the only way I can actually get that mortgage – is if you agree to sell it to me.

Owner-occupied homes typically have uncomplicated ownership structures. Typically, they're owned by an individual or a couple. Sometimes they're the property of an estate that's divided up among multiple heirs, whose relationship is mediated by a will and a probate court. Title can be contested through a divorce, where disputes are settled by a divorce court. At the outer edge of complexity, you get things like polycules or lifelong roommates who've formed an LLC s they can own a house among several parties, but the LLC will have bylaws, and typically all those co-owners will be fully engaged in any sale process.

Leveraged buyouts don't target companies with simple ownership structures. They depend on firms whose equity is split among many parties, some of whom will be utterly disengaged from the firm's daily operations – say, the kids of an early employee who got a big stock grant but left before the company grew up. The looter needs to convince a few of these "owners" to force a vote on the acquisition, and then rely on the idea that many of the other shareholders will simply abstain from a vote. Asset managers are ubiquitous absentee owners who own large stakes in literally every major firm in the economy. The big funds – Vanguard, Blackrock, State Street – "buy the whole market" (a big share in every top-capitalized firm on a given stock exchange) and then seek to deliver returns equal to the overall performance of the market. If the market goes up by 5%, the index funds need to grow by 5%. If the market goes down by 5%, then so do those funds. The managers of those funds are trying to match the performance of the market, not improve on it (by voting on corporate governance decisions, say), or to beat it (by only buying stocks of companies they judge to be good bets):

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

Your family home is nothing like one of these companies. It doesn't have a bunch of minority shareholders who can force a vote, or a large block of disengaged "owners" who won't show up when that vote is called. There isn't a class of senior managers – Chief Kitchen Officer! – who have been granted large blocks of options that let them have a say in whether you will become homeless.

Now, there are homes that fit this description, and they're a fucking disaster. These are the "heirs property" homes, generally owned by the Black descendants of enslaved people who were given the proverbial 40 acres and a mule. Many prosperous majority Black settlements in the American South are composed of these kinds of lots.

Given the historical context – illiterate ex-slaves getting property as reparations or as reward for fighting with the Union Army – the titles for these lands are often muddy, with informal transfers from parents to kids sorted out with handshakes and not memorialized by hiring lawyers to update the deeds. This has created an irresistible opportunity for a certain kind of scammer, who will pull the deeds, hire genealogists to map the family trees of the original owners, and locate distant descendants with homeopathically small claims on the property. These descendants don't even know they own these claims, don't even know about these ancestors, and when they're offered a few thousand bucks for their claim, they naturally take it.

Now, armed with a claim on the property, the heirs property scammers force an auction of it, keeping the process under wraps until the last instant. If they're really lucky, they're the only bidder and they can buy the entire property for pennies on the dollar and then evict the family that has lived on it since Reconstruction. Sometimes, the family will get wind of the scam and show up to bid against the scammer, but the scammer has deep capital reserves and can easily win the auction, with the same result:

https://www.propublica.org/series/dispossessed

A similar outrage has been playing out for years in Hawai'i, where indigenous familial claims on ancestral lands have been diffused through descendants who don't even know they're co-owner of a place where their distant cousins have lived since pre-colonial times. These descendants are offered small sums to part with their stakes, which allows the speculator to force a sale and kick the indigenous Hawai'ians off their family lands so they can be turned into condos or hotels. Mark Zuckerberg used this "quiet title and partition" scam to dispossess hundreds of Hawai'ian families:

https://archive.is/g1YZ4

Heirs property and quiet title and partition are a much better analogy to a leveraged buyout than a mortgage is, because they're ways of stealing something valuable from people who depend on it and maintain it, and smashing it and selling it off.

Strip away all the jargon, and private equity is just another scam, albeit one with pretensions to respectability. Its practitioners are ripoff artists. You know the notorious "carried interest loophole" that politicians periodically discover and decry? "Carried interest" has nothing to do with the interest on a loan. The "carried interest" rule dates back to 16th century sea-captains, and it refers to the "interest" they had in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity managers are like sea captains in exactly the same way that leveraged buyouts are like mortgages: not at all.

And it's not like private equity is good to its investors: scams like "continuation funds" allow PE looters to steal all the money they made from strip mining valuable companies, so they show no profits on paper when it comes time to pay their investors:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

Those investors are just as bamboozled as we are, which is why they keep giving more money to PE funds. Today, the "dry powder" (uninvested money) that PE holds has reached an all-time record high of $2.62 trillion – money from pension funds and rich people and sovereign wealth funds, stockpiled in anticipation of buying and destroying even more profitable, productive, useful businesses:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

The practices of PE are crooked as hell, and it's only the fact that they use euphemisms and deceptive analogies to home mortgages that keeps them from being shut down. The more we strip away the bullshit, the faster we'll be able to kill this cancer, and the more of the real economy we'll be able to preserve.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

#pluralistic#leveraged buyouts#lbos#divi recaps#mortgages#weaponized shelter#debt#finance#private equity#pe#mego#bust outs#plunder#looting

426 notes

·

View notes