#invest hsa

Explore tagged Tumblr posts

Text

Where Can You Transfer Your HSA to?

Health savings accounts (HSAs) are a great way to save and invest money for qualified medical expenses. They offer many tax advantages and can grow with you throughout your life. Unlike flexible spending accounts (FSAs), HSAs don't expire or remain exclusive to one employer. You carry them with you throughout your career.

That said, you may want to consider doing an HSA transfer at some point. A transfer is when you switch from one HSA provider to another.

Why transfer your HSA? There are many reasons why you might consider it. If you start your HSA with a specific employer, you might want to transfer it when you change jobs. You can also move your funds to a different administrator because you prefer their investment options and fee schedule.

Whatever the case, transferring your HSA is easy. However, there are specific rules to follow.

How to Transfer Your HSA

The most important thing to know is that you can only move your HSA to a different provider once per year. There are also IRA regulations you must understand to remain compliant and avoid a surprise tax bill.

One way to move to a different HSA provider is to perform an HSA rollover. This process involves informing your current HSA administrator of your desire to close your account and move to another provider. Your original provider will then cut you a check, and it's up to you to reinvest that money with another company.

You only have 60 days to open another HSA account and transfer funds. If you don't do it within that window, the IRS will consider the move a full distribution. The amount will become taxable income, and you'll face a 20 percent penalty.

To avoid the risks of an HSA rollover, consider doing a trustee-to-trustee HSA transfer. With this method, you instruct your original HSA provider to transfer for you. The money moves from one HSA to another. You won't get a check. That's a good thing! It means there's zero risk that your transfer turns into a taxable event.

Read a similar article about HSA here at this page.

#what is hsa employer matching#best employee benefits#resources for open enrollment#is an hsa tax-deductible#hsa transfer#what is automatic rebalancing#invest hsa

0 notes

Text

I have Done The Taxes, much later in the year than I usually do because hell world, but they're done and that's what matters.

#for the record#I do my own taxes#and my sisters' taxes#both of them#I've been doing it for like 12 years#I haven't paid for tax filing software since 2015#I also haven't had an issue with doing my own taxes ever#it's complicated as a general rule#because hell country#but if you've just got a W-2 and no HSA or investments#it's pretty easy#I always feel bad#when people are intimidated out of it#and pay $$$$ to have someone else do it#even when their returns are SUPER simple#if you've just got a W-2#and you don't have any investments#you can do your own taxes#very easily#trust me

12 notes

·

View notes

Text

i was so adult and responsible today i deserve treats

- enrolled in my 2025 health insurance + benefits

- set up 529 for future education endeavors for me + siblings + mom

- set up 401k babyyyy

- was not a big baby about it (lying)

#got mad and gave up before figuring out how to invest part of my hsa but a win is a win#i dont know what im doinggg#i feel like im masquerading as a finance bro#i probably dont like finance bros#i dont know any but my dad did stocks and we hate him

1 note

·

View note

Video

youtube

The Shocking Truth About An HSA (Health Savings Account)

0 notes

Video

youtube

Great Strategy (Hack) to Grow Wealth for Retirement

#youtube#HSA#retirement planning#wealth building#investing#health savings account#401k#IRA#403b#compounding wealth

0 notes

Text

Can I Withdraw Money From My HSA?

Working with HSA account providers is a great way to plan for your future. Health savings accounts (HSA) allow you to save for qualified medical expenses. These accounts grow over time, creating a nice safety net when you need it.

But can you withdraw money for things other than healthcare costs?

How an HSA Works

There are many benefits to having an HSA. It's a tax-advantaged savings account where 100 percent of your contributions are tax-deductible. Plus, withdrawals for qualified medical expenses are tax-free, and the interest you gain over time is tax-deferred. That's a lot of power for an account few people know about.

But of course, there are limits. For example, you can only contribute up to the annual limit. For 2023, that's $3,850 for individuals and $7,750 for families.

You also have to consider what you can use the HSA for. The IRS sets strict guidelines on what constitutes a qualified medical expense. It can cover medically necessary procedures, doctor's care, preventative treatments, dental procedures, vision and more. HSAs are also great for over-the-counter products like pain relievers.

What About Non-Medical Expenses?

The important thing to remember about an HSA is that it only covers qualified medical expenses. Anything outside the IRS guidelines does not count.

It is possible to withdraw money from your HSA. You can close your account, get the funds as a check and spend it on what you want. Nothing is stopping you from doing that, and HSA account providers will oblige. But if you go that route, you lose all the tax benefits and may have to pay steep penalties.

Withdrawing money from your HSA for non-medical expenses results in that money getting taxed as ordinary income. Furthermore, the IRS imposes a 20 percent penalty. That's a lot of money you'll lose.

If you're over 65 or become disabled, you won't incur the IRS penalty. But the money you withdraw will still count as taxable income. It's important to consider the tax implications and fees if you ever think about taking money out of your HSA for anything other than qualified medical expenses.

Read a similar article about HSA contribution limit here at this page.

#is an hsa tax deductible#how is my fsa funded#hdhp vs ppo#hsa debit card#hsa account providers#hsa investment#what is an hra

1 note

·

View note

Text

I spent, at a minimum, at least $500-$1,000 a month exclusively on my self improvement. Here is most of what I spend on, in no particular order:

Education (classes, books, courses, certifications, college tuition, seminars, etc.)

Private lessons for languages, musical instruments, sports, etc.

Personal hobbies and passion projects

Crest whitening strips (great when in a pinch), Invisalign, professional whitening, preventative dental care, prescription whitening products from my dentist

Investments such as index funds, REITs, ETFs, CDs, individual stocks, commodities, appreciative luxury items, precious metals & gems, etc.

Organic food, vitamins, supplements, high quality healthcare, therapy, massages, prescriptions (Rx skincare, etc.)

New glasses & contacts (getting some bayonetta glasses from Burberry soon, very excited)

Sports, gym membership + sauna, hot yoga, Pilates, kickboxing, tennis, skiing, dance, etc.

Personal care such as bath/shower products, body care, haircare, skincare, makeup, brightening eye drops, perfume, etc.

Travel, events, concerts, festivals, etc.

Shopping (clothes, accessories, home goods, etc.)

Eating out at restaurants and going to coffee shops

Beauty treatments such as manicures, pedicures, waxes, brow tint & threading, salon blowouts, hair cuts & colors, facials, lash lift & tints, vitamin IVs, etc.

Regular visits to my dermatologist, dentist, psychiatrist, eye doctor, primary care physician, gynecologist, and any other specialists

Semi-regular appointments with a personal trainer, holistic nutritionist, and dietitian

I don't do all of these every single month, but most of these are recurring throughout the year and budgeted accordingly. Eventually I might add in more intense cosmetic work like medspa services, Botox, etc. If you can find a workplace with a great benefits package such as high quality healthcare, an HSA/FSA, health & wellness reimbursements for the gym, disability & life insurance, etc. I would highly recommend it and max out all the benefits you can.

1K notes

·

View notes

Note

Any tips on saving money?

Track your income/expenses. Knowing your monthly cash flow + essential and discretionary spending is the only sound starting point toward setting your financial goals.

Evaluate your non-essential spending habits. Consider where this money is going, and whether these expenses add value/are necessary to your life (pleasure or peace of mind is an acceptable "necessity" if you're living within your means to be clear!).

Determine the money you have left over after you cover your essential expenses and most fulfill discretionary expenses. This amount is your "saving/investment" money.

Divide your leftover amount into 3 categories: Emergency fund, goal-oriented savings (like buying a desired luxury item/furniture, a down payment on a house, a vacation, etc.), and investments.

Put your savings in a high-yield savings account. If possible, have different accounts for each purpose, especially your emergency fund and savings for future purposes. You can also get a CD for a long-term savings goal.

Put your investments (in the USA at least) in the following buckets: Roth IRA (max it out), ALWAYS take your employer's full 401k match, HSA (if you have a high-deductible health insurance plan), and S&P 500 index funds/other evergreen mutual funds + blue-chip stocks.

Purchase fewer, higher-quality items. Know the sales seasons for each product category and shop around this calendar (down to the produce items in season). If possible, rent items when it makes sense.

Only say "yes" to plans/financial obligations that add value/pleasure to your life. Don't let yourself feel shortchanged financially or emotionally. It's never worth it, honestly.

Invest in your physical, mental, and financial health first. This can mean something different for everyone but it's important!

**I'm not a professional, just another young woman on the internet, so please take this advice accordingly. Please meet with a financial advisor/CPA for formal advice and personal financial planning.

Hope this helps xx

218 notes

·

View notes

Text

youtube

me learning about the insanity of hsas (you can invest into the stock market with hsas. and it wont get taxed on its gains. because its an hsa. isnt that crazy.) and also tax loss harvesting (did you know you can report a loss in your investments if you sell them and reinvest them into index funds that are nearly identical) and also the refresh on inherited stock gains

3 notes

·

View notes

Text

2 Reasons an HDHP May Not Be the Best Option for You

High-deductible health plans (HDHPs) are a type of health insurance plan that helps you save on monthly premium costs. When you compare an HDHP vs PPO or other health plan, your monthly premium bill will be much more affordable. But there are several disadvantages to consider.

There are many benefits to getting an HDHP, including the ability to open a health savings account (HSA). But is an HDHP right for you? Here are a few reasons why you might want to reconsider.

You Can't Afford Higher Out-of-Pocket Expenses

Despite all the perks of having an HDHP, one significant tradeoff exists. That's the higher deductible and out-of-pocket maximum.

Your deductible is how much you'll have to pay before your health insurance coverage takes over. You must pay 100 percent of healthcare costs before coverage kicks in. Depending on your plan, you may have to cover copays or coinsurance until you reach the out-of-pocket maximum.

The out-of-pocket maximum is the total amount you'll have to pay for covered healthcare services annually. Once you meet that, your health insurance will take care of the rest. In the fight between HDHP vs PPO, the former typically has a higher deductible, but that out-of-pocket max protects you from significantly higher expenses. For 2024, the out-of-pocket maximums for an HDHP can't exceed $8,050 for individuals or $16,100 for families.

If you're unable to cover your deductible, you may want to reconsider getting an HDHP.

You'll Need Substantial Medical Care

If you think you'll need considerable healthcare services throughout the year, exploring other plan options may be a better choice. HDHPs are often the go-to for people who are young and relatively healthy. They're a fantastic way to save on monthly premiums when you don't think you'll need much medical care.

The coverage is still there if needed, but you're not paying high premiums to get it. If you don't fall into that category, getting a plan that focuses on lower deductibles with better coverage over more affordable premiums may be better.

Read a similar article about 2024 contribution limits for FSA here at this page.

#flexible employee benefits#hsa vs fsa#high deductible health plan#hdhp vs ppo#hsa investment#flexible benefit administrators#hsa tax forms

0 notes

Text

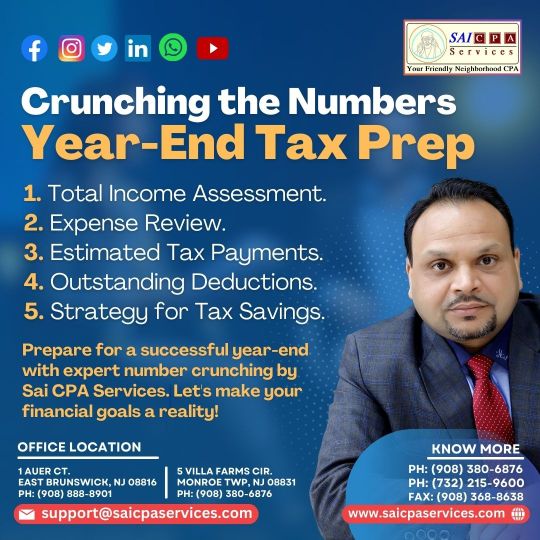

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/ https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ (908) 380-6876

1 Auer Ct, East Brunswick, New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

10mil please, because compounding interest is so OP. This is also a nice illustration of lump sum investing versus dollar cost averaging

Here's the growth over 20 years for both scenarios with all being the same outside of the parameters of the poll:

$1000 every day, immediately thrown into investments:

$10,000,000 immediately thrown into investments:

The 1k per day will not catch up. The interest is too powerful. For the record, I used 3-7% as the possible interest rates, which is conservative for FDEWX over such a long period.

Here's the calc I used: https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

For the calc, I spit balled 5% as an estimate interest rate with 2% variability. FDEWX, my go-to for brain dead investing (HSA, etc) meets that easily. Actually, 10m opens access to Fidelity's reduced ratio option, which would be even better.

So yeah. 10mil gib

Explain your reasoning plzzz

#money shit#you stumbled into one of my hyperfixations sorry not sorry#legit though I love finance talk#if I weren't in programming I'd probably be a fiduciary

28K notes

·

View notes

Text

Joshua Czuper

Strategic Sales Enablement Leader and Relationship Management professional with experience in Retirement, Insurance, and Financial Services. Skilled at engineering product solutions around retirement plan design and behavioral finance principles. Demonstrated success in retaining and expanding existing client relationships, generating new business. Expertise in the creation and execution of sales initiatives that include investments, stable value, employee benefits, HSA/FSA/HRA, emergency savings, 529, student loan programs, and other financial wellness offerings.

Josh Czuper

0 notes

Text

Why Do I Have to Claim My HSA Information When Filing Taxes?

If you have a health savings account (HSA), you might wonder what documents you need to provide when filing your taxes. HSAs are tax-advantaged accounts. They offer many benefits, but there are also several IRS reporting rules.

Understanding HSA Tax Benefits

HSAs have three tax advantages. First, you can contribute pre-tax dollars to fund your account up to annual limits. Secondly, withdrawals you make to cover qualified medical expenses are tax-free. That includes doctor visits, medical treatments, prescription drugs and even over-the-counter products.

You can also earn interest on HSA contributions and invest, generating substantial growth over time. Any gains you make are tax-deferred. Whether you pay taxes on it or not depends on how you use it. If you stick to qualified medical expenses, it's tax-free.

What Information Does the IRS Need?

There are a few bits of information to provide when filing your taxes. If you're using tax preparation software or working with a professional, you should have no problem getting the correct health savings account tax forms. But if you're filing taxes alone, you'll need to fill out Form 8889.

Form 8889 is for reporting HSA contributions. It's also used to figure out applicable deductions, report distributions and more.

In addition to Form 8889, you need a 1099-SA. You'll get this form from your HSA provider. It shows how much you received in distributions and whether they were for qualified medical expenses. You'll use the 1099-SA to fill out the health savings account tax forms.

Doing Your Taxes Correctly

HSAs are a valuable tool that you can use to prepare for the future. The tax advantages are plentiful, and you should consider opening one if you haven't already. There are a few limitations, and you must qualify for an HSA by having a high-deductible health plan. But if you meet those qualifications, it can be a fantastic way to diversify.

Once you have an HSA, work with your tax preparers to fulfill your reporting requirements. Accurate reporting is paramount. Otherwise, you may be subject to audits and penalties.

Read a similar article about HSA benefits administration platform here at this page.

#how to be financially successful#pay as you go funding method#investing your hsa#hdhp#fsa account#transfer hsa funds#health savings account tax forms

0 notes

Text

Tax-Efficient Financial Planning: Maximize Your Savings

Tax efficiency is a critical aspect of financial planning that can significantly increase your savings. It involves understanding tax-advantaged accounts, such as IRAs, 401(k), and HSAs, as well as leveraging deductions and credits.

Strategic financial planning aligns your investments and spending to minimize taxes while maximizing returns. Proactive planning ensures you take advantage of available opportunities, leaving you with more funds to allocate toward your goals.

Reduce your tax burden effortlessly! Download the app for personalized tax-efficient financial planning strategies.

0 notes

Text

Femme Fatale Guide: Products & Services Worth The Save (or Saving On)

Fashion:

Socks (I love the HUE ones that come out to around $3 per pair)

Tights (another vote for HUE – around $10-13 dollars a pair and should last at least a season or two with proper care)

Layering tanks & tees

Underwear (buy them on a bulk deal – I love Skims' 3/$36 [on the pricier end here] – or getting luxury items on sale, especially pair from Natori or Hanky Panky [usually come up to around $10-$15 a pair]; Parade also has $6 underwear that's great quality for the price)

Trendy items

Costume jewelry (Mejuri, Aurate, and Justine Clenquet are great for the price; Catbird is the best in the game for a moderate-priced alternative to luxury jewelry in my opinion)

Beauty:

Cleanser

Facial Toner

Makeup Wipes

Acne Spot Treatment

Mascara

Brow Gel

Setting Powder/Spray

Shampoo & Conditioner

Body Wash

Body Scrubs

Hand/Body Lotion

Hand Soap

Vaseline (use it as a lip treatment, cuticles, dry skin patches, or as a hydrating eye cream)

Lip Balm (Palmers SPF 15 is my HG)

Makeup Sponges/Spoolies

Hair Ties

Home:

Lighting

Home Decor

Artwork (I have mostly Black & White photography from iCanvas and get so many compliments on them!)

Coffee Maker (a Black & Decker coffee maker or a French Press is all most people need)

Everyday Dishes & Glassware (I love Sweese, Smilatte, and Luigi Bormioli on Amazon)

Dishwasher-Safe Reusable Food Storage Bags/Snack Bags

Produce Saving Containers

Health & Wellness:

Deva Vitamins/Supplements

Fitness Youtube Workouts

Bulk-buying Oats, Beans, and Other Staple Foods

Frozen Fruits & Vegetables (when not in season, especially)

Listening to Podcasts via Youtube

TED Talks

Services:

Facials

Blowout

Dermaplaning

Teeth-Whitening

Mani-Pedi

Professional/Social:

Owning your full name social handles across platforms

Simple Investment Planning (Roth IRA, HSA, 401K - anything involving index funds)

Get a great headshot (many colleges and universities offer their students/alumni headshots for free)

Cash-back & Travel-miles $0 Fee Credit Cards

#femmefatalevibe#girl talk#girl tips#girl advice#girl blogging#femme fatale#dark femininity#dark feminine energy#it girl#high value woman#dream girl#queen energy#female power#high value mindset#female excellence#the feminine urge#glow up#level up journey#high class#classy life#elegance#product recommendations#healthylifestyle#health & fitness#fashion and beauty#life advice#life tips#etiquette

422 notes

·

View notes