#income tax budget 2021

Explore tagged Tumblr posts

Text

Clearly, y'all don't care about Jews, and the fact that Hamas is violently antisemitic doesn't seem matter to any of you. So let me go with a new approach, of equal truth and value. Hamas is violently anti-Palestinian.

This past week, Hamas attacked evacuation routes and prevented Gazan citizens from fleeing an active warzone. [1]

They did that because they routinely use Gazan civilians as human shields. Hamas intentionally builds military targets close to schools, hospitals, and mosques, putting soft targets in the way of both incoming and outgoing fire. Hamas encourages Gazan civilians and children to stand on the roofs of buildings they know the IDF is targeting. [2]

Hamas has refused to allow elections in Gaza since 2006. Not just Palestinian National Authority elections, mind you. No open elections for any office have been held in seventeen years. Palestinian rights to free elections and self-determination have been denied by Hamas. [3] (And good luck to anyone who tries to blame that on Israel, because elections were held by the PNA in the West Bank in 2012, 2017, 2021 and 2022. It's Hamas's intention alone to purge democracy.)

Hamas's track record on human rights is appalling. Palestinian prisoners in Gaza face unfair trials and death sentences after being tortured by police. Palestinian women are prevented from accessing the legal systems to escape domestic abuse situations. Political dissidents in Hamas, even ones who merely support the other half of the Palestinian government, have been summarily executed. [4] [5]

Peaceful organizers in Palestine protested Hamas's massive tax hikes in 2019. Hamas security forces responded by assaulting demonstrators, tracking them down, raiding their homes, and detaining them. And, as previously mentioned, prisoners in Gaza are not treated well by Hamas. [6]

Edit Nov.5, 10:30 PM: I forgot to add arguably the most important thing-- Hamas manipulates the humanitarian aid they receive away from helping Gazans and toward killing Jews. 5% of Hamas's budget actually gets used for humanitarian aid, while 55% goes to military use. Construction equipment intended to rebuild Gaza's crumbling infrastructure is used to build a complex series of underground tunnels. Those tunnels in turn are used to smuggle Iranian military equipment into the country. They were also used for human trafficking in the October 7th attacks. [7]

If you actually want Palestinians to be free, you can't just replace Israel with Hamas. But it's not like they're the only option for supporting Palestinian liberation. While Fatah doesn't have an immaculate historical track record, it now operates as a leftist, democratic socialist, secular Palestinian government that fights for a two-state solution. Similarly, Arab-Israeli political parties like the Hadash-Ta'al coalition support leftist, anti-Zionist, and two-state solutions from within the Israeli parliament.

You can and should support Palestinian liberation movements that abuse neither Jewish nor Arab human rights and dignities. Plenty of them exist out there. But if y'all continue to throw your weight behind an antisemitic and anti-democratic terrorist regime, Palestinians and Jews will both take note of exactly where you stand.

2K notes

·

View notes

Text

on otw's $2.5 million budget surplus: for fuck's sake do something with our money

the recent ddos attack on ao3 illustrated that the otw (@transformativeworks) has amazing volunteers who were able to get things up and running again after a cyberattack. and i’ve seen a bunch of different people urging others to donate to otw in light of the attack.

the problem? not only are the volunteers not going to get any of the money, but the otw likely isn’t going to do anything else with it, because they already have more than $2.5 million in budget surplus that they have not been transparent about with their members, and that they have no plans for.

yup. we’ve known for years that otw had at least $1 million in their “reserves”; they’ve said so at their last two public finance meetings in 2021 and 2022. but a few months ago, @manogirl and i went digging a little deeper because we suspected that there was even more.

and we were right. from the documentation available, our estimate is that at the beginning of 2023, they had $2,585,841 that was not dedicated to any purpose. this does not include money they had budgeted to spend in 2023 on regular expenses. just extra. (keep reading to see how we got that figure.)

equally appalling? they have all this money and are barely earning any interest on it. satsuma on dreamwidth looked at their 2021 tax returns and found that only ~$10k of their money is held in an interest-bearing savings account, which resulted in them earning only $90 in interest income for 2021. the rest of it is not in interest-bearing accounts. it is just sitting there.

looking at all the crises and dysfunction that have been discussed and uncovered over the past few months - racist harassment and the three-year-old promise to hire a diversity consultant; the mistreatment of volunteers by the otw board both related to last year’s CSEM attacks, and, separately, mistreatment and racism towards chinese and chinese diaspora volunteers both in the past and recently with the closure of the otw’s weibo account; and of course, this latest ddos attack - all of this indicates that there is severe dysfunction within the org. and donors throwing more money at the organization clearly isn’t helping.

the otw board needs to get its shit together and hire people to help with these things. this is not a new idea - there’s been talk for years about hiring paid staff, and in fact, at their july 2021 board meeting, otw said they would be appointing a volunteer who would be known as the “paid staff officer”, to come up with a plan for hiring paid staff. (to be clear, the “paid staff officer” would be an unpaid volunteer.) it’s been two years since that commitment. they have not, to my knowledge, appointed that officer yet.

it’s infuriating, because otw’s “scrappiness” as an organization is constantly used to defend their obstruction of action on things like racism, and this ddos attack will be used to further that agenda as well. but otw doesn’t need to be scrappy. they are well-resourced and could be using that money to set up more sustainable systems, instead of burning out and mistreating their volunteers, and reneging on commitments to address racism and harassment.

at the very least, if they’re not going to do anything with their massive budget surplus, they should stop taking more of people’s money. but we’d rather they did something useful with it.

if you want to see this change, the otw finance commitee holds a public meeting where you can ask questions and give them feedback. last year it was in mid-october. you do not have to be an otw member to attend. i'll definitely be making noise about it once the date is announced, but you can also follow otw's socials.

one brief aside: at the time of posting, a lot of these links are not working because the otw's website is still down. i copied these links from a twitter thread i made in the past and they should all be correct, so you just may have to wait until the site is back up to look at them.

now, to debunk some common excuses that people (not otw representatives, mind you, but just people on the internet who have decided to defend the org) give when confronted with how much money otw has:

MYTH: otw needs to keep $2.5 million in cash reserves in case of an emergency or unexpected revenue shortfall. REALITY: it’s true that nonprofits do need SOME cash reserves for those cases. typical practice is to have 3-6 months’ worth of operating expenses. otw’s current operating expenses are ~$520,000/year, so 6 months would be $260,000. (and, in fact, when i was told by an otw finance committee member that they had $1 million, they were intending 25% of that to be for emergencies, around $250,000). if you were being REALLY cautious, you could have reserves up to one to two years. but $2.5 million is enough for almost FIVE YEARS OF OPERATING EXPENSES. that is an absurd amount to be hoarding, especially when otw’s history of fundraising is that they always exceed their goals, and always make more money in donations than they need for their expenses within a given year. MYTH: they need this money for legal costs if they get sued. REALITY: otw gets most of their legal expenses donated, which is also not listed in their budget, but is in their audited financial statements. in 2021, the most recent financial statement we have, you can see on page 10 that they received just over $230k in donated legal expenses. they do budget some minor legal expenses yearly: in 2023 they’ve budgeted a little over $5k for “registration fees for conferences and hearings and funds set aside for legal filings if necessary, as well as an allocated share of newly adopted OTW-wide productivity tools”. however they do not have a history of even spending that much: in 2022, they had budgeted $4k for legal expenses and only spent $244 (see cell C29 of the budget spreadsheet). they have never been sued, and they do not appear to budget for litigation costs. and when, in the past, they’ve been asked about what their reserves are for (back in fall 2022 when the finance committee told me they had $1 million in reserves, even though this was patently false given their tax documents for 2021), litigation costs were not brought up. MYTH: they just haven’t had enough time to figure out investment options. REALITY: they clearly have at least one savings account set up to generate interest, which only has $10k in it. even if they haven’t figured out a full investment portfolio, why wouldn’t they put more money in that account? in the u.s., the federal deposit insurance corporation (FDIC) insures bank accounts up to $250,000, so they should have at least that much in there. absurd. also, they have had plenty of time even for a larger portfolio. if you search “investment” on their site, you’ll see that they’ve been talking for YEARS about investing their reserves. more specifically, at both their 2021 and 2022 finance meetings, they said that they needed more time to research investment options. as usual, they have had far more time than they need. MYTH: they need this money for new servers. REALITY: otw does in fact include expenses for new servers and server maintenance in their yearly budget reports. you can see this in their 2023 budget spreadsheet if you go to the sheet “program expenses” - under “archive of our own”, you’ll see server expenses. the $2.5 million is money that is EXTRA to their listed expenses and revenue in that spreadsheet.

finally, see below where we’ve given more context on otw’s budgeting and showed our work in coming up with these numbers.

showing our work

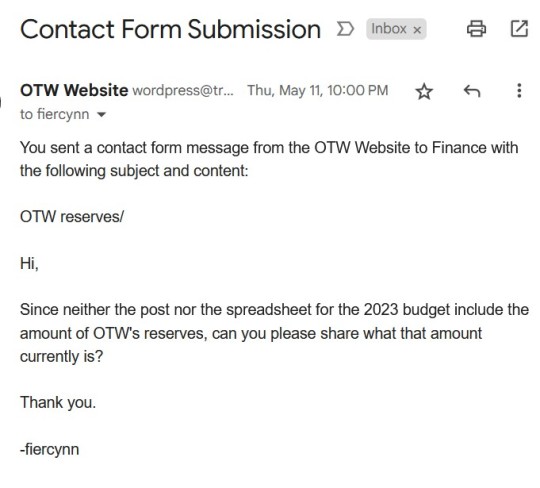

firstly, i should note for the record that i sent a message to the otw finance committee through the contact us form on the otw website on may 11, 2023 to ask them to state the amount in their reserves.

it has been two months and i have still not received a response (which i find funny, because at the last otw board meeting in early july, the board specifically said to use that form to contact the finance commitee if we had questions about the 2023 budget), so @manogirl and i were forced to do our own math. we've had this work checked by a number of people, but of course we were only able to work with the information the otw has made publicly available.

a few things you need to know about the otw’s budgeting:

they release yearly budget reports on their website (here’s their most recent one, which shows what they project for 2023 and their “actuals” for 2022), but they do not include their surplus in this report - they only include the revenue and expenses for each year

they also provide both their yearly audited financial statements and their yearly tax returns (form 990s) on their reports & governing documents page, but currently, the most recent statements we have are from 2021

otw typically raises more money in donations than they need within a year, so their surplus is always growing

they have used the term “reserves” in the past to talk about money, but we don’t know exactly what they mean by “reserves” - is there a dedicated account that they consider their reserves?

because of these uncertainties, the goal for @manogirl and i was was to figure out how much of a budget surplus OTW had at the beginning of 2023, and because we don’t know how they define “reserves”, we defined it as how much they had in liquid assets that were not being dedicated for a specific purpose in their budget. (liquid assets are anything that can be converted into cash quickly – e.g. not equipment like their servers, nor anything that would be held in a long-term investment account, etc)

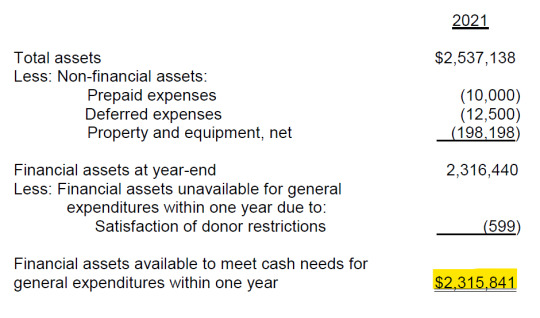

the first document we looked at was their 2021 audited financial statement. the key number is on page 11, under the section on liquidity, where it lists their end-of-year liquid assets as $2,315,841.

so at the end of 2021, they had over $2.3 million in liquid assets.

but since their 2022 audited financial statement isn’t up, we had to turn to their 2023 budget, and specifically, to their 2023 budget spreadsheet, where they show the “actuals” (what they actually raised & spent in each line item) for 2022 in column C. as i mentioned, they don’t list their reserves in this spreadsheet - only the revenue generated & expenses paid within that year, not anything carrying over from the previous year unless clearly outlined.

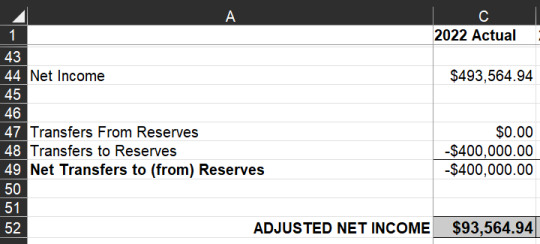

so at the bottom you’ll see that their net income (revenue minus expenses) in 2022 was $493,564.94, and that they then transferred $400,000 of that to the reserves sometime in 2022.

and the remaining $93,564.94, their adjusted net income for 2022, presumably carries over to help pay initial expenses in 2023 before they started earning more revenue. they also transferred $130,000 of their reserves BACK to help with that at the start of 2023.

so now we have the numbers we need to calculate the surplus (including reserves) at the start of 2023:

$2,315,841 (liquid assets at end of 2021) + $400,000 (transferred to reserve in 2022) - $130,000 (transferred from reserve in 2023) = $2,585,841 USD at the start of 2023

so that’s our math. otw had $2.5 million at the beginning of this year in surplus, in addition to around $223k (last year’s $93.5k in income and the $130k they transferred back from the reserves at the beginning 2023) to fund their expenses for the first half of this year. this does not even include the hundreds of thousands they raised in april 2023 during their fundraising drive.

okay the main part of our documentation is done, but if you want to read a little bit more about what @manogirl and i learned from doing this deep dive, here are a few additional thoughts/nuggets:

first of all, OTW is incorporated in the u.s. state of delaware, which is interesting because as @manogirl researched, delaware is a tax haven where 501c3 nonprofits don’t have to pay any business tax. plus, in many u.s. states, nonprofits have a limit on the amount of money they can keep without spending, but this too is not the case in delaware. of course, incorporating in delaware to take advantage of those benefits is not illegal! but it is very savvy, a characteristic that seems to have not continued with their financial management past their original incorporation lol

next, some more detail on their finances from their 2023 budget spreadsheet. let’s start with revenue.

the most interesting thing to me here is that while their spring and fall membership drive donations bring in the most, non-drive donations are also substantial. also their “total unrestricted net revenue received” is $975,638.36 in cell C16. however, for some reason, when they calculate their net income for the year, they use cell 12, “total unrestricted revenue” ($1,012,543.42) instead. the difference between those two cells is that cell 12 is the amount before their transaction fees are subtracted. but i have no idea why the transaction fees would be ignored when calculating their net income. is this an error?

next, their expenses, which came out to $518,978.48. not too much surprised me here except how low their legal advocacy spending still is, plus the fact that they’d given francesca coppa a grant for her book on the history of fanvidding, lol. (i’ve written more about this; so has wistfuljane on dreamwidth if you scroll down a bit from here).

it’s also interesting to look at what they’ve budgeted (both the revenue & expenses they’ve expected going into the year) for 2022. in every revenue category, they have exceeded their goal, except for $50 in “other income”. and in most of their expenses categories they have overestimated their needs, except for going over about $700 in the transformative works & cultures, & about $500 for development. this just shows how much they are able to meet their yearly expenses (overestimated) with the revenue generated each year (underestimated), & still have substantial amounts left over (almost half of revenue transferred to reserves)

so that’s what we’ve found. if anyone else notices weird things in their budgeting, please let us know!

#if you're going to argue with this please do me and manogirl the courtesy of reading the whole thing first#we've probably already thought of some of your questions or arguments and answered them#organization for transformative works#otw#archive of our own#end otw racism#fandom racism#ao3#otw finances

305 notes

·

View notes

Text

Berkeley Lovelace Jr. at NBC News:

Millions of Americans risk losing subsidies next year that help them pay for health insurance following President-elect Donald Trump’s election win and Republicans’ victory in the Senate. The subsidies — which expire at the end of 2025 — came out of the 2021 American Rescue Plan, and increased the amount of assistance available to people who want to buy health insurance through the Affordable Care Act. The American Rescue Plan also broadened the number of people eligible for subsidies, extending them to many in the middle class.

The looming expiration date means that the incoming Congress and next president will need to decide whether to extend them — something Trump and Republicans have already signaled they don’t support, said Chris Meekins, a health policy research analyst at the investment firm Raymond James. “If Republicans end up winning the House, in addition to the Senate and White House, having a GOP sweep, I think the odds are less than 5% they get extended,” said Meekins, who was a senior HHS official in Trump’s first term. Even Democratic control of the House likely won’t save the subsidies, he added. Several important House races have still yet to be decided. As of Thursday afternoon, House Republicans had won 209 seats, just nine short of the majority, according to an NBC News tracker. In 2024, more than 20 million people got health insurance through the ACA, according to the Centers for Medicare and Medicaid Services.

Since the 2021 subsidies went into effect, enrollment in ACA plans with reduced payments doubled, particularly in Southern red states, said Cynthia Cox, the director of the program on the ACA at KFF, a nonpartisan health care policy research group. The Inflation Reduction Act, passed in 2022, extended the subsidies through 2025. In 32 states where data is available, 15.5 million people receive the subsidies, according to KFF. If the subsidies aren’t extended, the Congressional Budget Office — a nonpartisan agency that provides budget and economic information to Congress — estimates that nearly 4 million people will lose their coverage in 2026 because they won’t be able to afford it. Enrollment will continue to fall each year, with coverage reaching as low as 15.4 million people in 2030.

[...] Cox said she expects Republicans to keep dismantling the ACA, similar to Trump’s first term, when they eliminated the tax penalty linked to the law’s individual mandate, which required people to have health insurance or pay a tax. The mandate is technically still in place, but the penalty was reduced to zero. “If Republicans control the House, the Senate and the presidency, then we might see a repeat of 2017,” she said. Gostin said eliminating the ACA entirely will be a challenge, even if Republicans control all three chambers.

Millions of Americans could face health insurance coverage loss next year, as subsidies for Obamacare are set to expire.

See Also:

The Guardian: Incoming Trump presidency threatens millions of Americans’ healthcare plans

#Donald Trump#Health Care#Trump Administration#Obamacare Subsidies#Obamacare#Patient Protection and Affordable Care Act#Health Insurance#118th Congress#119th Congress#American Rescue Plan#Inflation Reduction Act#Individual Mandate#Trump Administration II

27 notes

·

View notes

Text

Kamala Harris Will Pay You Not to Work

She has endorsed several measures that resemble Universal Basic Income.

By Matt Weidinger -- Wall Street Journal

A recent study confirms that universal basic income—no-strings-attached benefit checks offered to recipients regardless of need or contribution to the program—discourages work. That’s relevant to the presidential race. Kamala Harris has called more than once for paying UBI-like benefits.

Participants in the UBI program worked nearly 1½ hours less a week on average, and unemployment rose. Other adults in recipient households reduced their work effort, too. Overall, the study found for every dollar in benefits, “total household income excluding the transfers fell by at least 21 cents.”

As vice president, Ms. Harris cast the deciding vote to create a temporary UBI for parents through a significantly expanded child tax credit in 2021. Tens of millions of households collected these payments, which grew to as much as $3,600 a child, even as the program’s work requirement and work incentive features were suspended. A University of Chicago study calculated that if the change were made permanent, it would result in 1.5 million parents exiting the labor force. But the temporary policy lapsed when Sen. Joe Manchin refused to support its extension without a work requirement. The administration’s fiscal 2025 budget would revive the costly 2021 expansion, but they aren’t the only ones flirting with budget-busting proposals. On Sunday, Sen. J.D. Vance called for increasing the child tax credit to $5,000 and making it available to “all American families,” though he didn’t say whether he would make it conditional on work.

As a senator, Ms. Harris proposed two even larger UBI programs that would have displaced more work. In 2019 she introduced her “signature” bill proposing a UBI for lower-income adults, including childless adults. According to a Federal Reserve Bank of Atlanta report, high effective marginal tax rates on modest-income work (due to progressive tax rates coupled with phasing out current benefits) already “effectively lock low-income workers into poverty.” The phaseout of Ms. Harris’s new $3 trillion entitlement would only increase current disincentives to work and advance.

In 2020 she proposed a pandemic UBI program to issue most Americans $2,000-a-month “crisis payments.” That reckless proposal would have doled out a total of $84,000 to each adult and up to three children in households with adjusted gross income under $200,000 (or $150,000 for single-parent households). The total cost would have been $21 trillion.

Most voters, even Democrats, say benefit recipients should engage in work or training if they are able to do so. Ms. Harris obviously cares more about showering Americans with federal cash than the employment disincentives built into her ideas.

Mr. Weidinger is a senior fellow at the American Enterprise Institute.

#kamala harris#Tim Walz#Democrats#Obama#Biden#Schumer#Pelosi#AOC#malaise#lazy#losers#failure#corrupt#hunter biden#thief#trump#trump 2024#president trump#ivanka#repost#america first#americans first#america#donald trump#art#hunger#landscape#insta#instagram#instagood

27 notes

·

View notes

Text

As someone who has closely followed and written about presidential budgets and social and anti-poverty programs for most of the past half-century, I examine here proposals advanced by former President Donald Trump during his years in office—mainly measures proposed in his administration’s annual budgets—that would affect social programs for people with low or moderate incomes. The piece relies primarily on analyses of these budgets by the Center on Budget and Policy Priorities (CBPP) during those years, using data from the Office of Management and Budget (OMB) and Congressional Budget Office (CBO).1 The piece builds upon earlier work that I and my colleagues at The Hamilton Project have conducted on the evolution of the U.S. social assistance and social insurance systems and the workings of those systems (Barnes, Bauer, Edelberg, Estep, Greenstein, and Macklin 2021; Greenstein 2022).

The Trump administration budgets were distinguished by their proposals to lower taxes and to scale back or end various social programs and other government spending. The proposed reductions in social programs fell primarily on programs for people with low or modest incomes rather than universal social insurance programs, although the Trump administration budgets did propose a reduction in one aspect of the Social Security Disability Insurance (SSDI) program, as described below in the section of this piece on cash assistance.2

This piece examines program changes that these budgets proposed, rather than just those that were enacted. Most of the proposals described here did not pass Congress, including the administration’s 2017 effort to repeal the Affordable Care Act (ACA) that fell just short in the Senate. In addition, the courts blocked various regulatory proposals to scale back programs, including efforts to roll back the ACA through administrative action. (This piece does not examine temporary changes not included in administration budgets that Congress and the President made in 2020 in response to the COVID-19 pandemic.)

The program reductions or eliminations the Trump administration budgets proposed substantially exceeded those sought by earlier presidents, including Ronald Reagan, although the safety net in place when President Trump took office was significantly larger than that in place when Reagan assumed office more than four decades ago, giving President Trump more targets for budget reductions. Changes that Trump administration budgets proposed included the following:

SNAP. Reductions of roughly $200 billion over 10 years, or about 25 to 30 percent, in the Supplemental Nutrition Assistance Program (SNAP, formerly known as the Food Stamp Program), as proposed in all four Trump administration budgets.

Medicaid/ACA. Substantial cuts in Medicaid beyond eliminating the ACA’s Medicaid expansion, and in the first Trump administration budget, some scaling back of the Children’s Health Insurance Program (CHIP). The proposed reductions, including ACA repeal, totaled roughly $750 billion to $1 trillion or more over 10 years under the various Trump administration budgets.

Housing and rental assistance. Large reductions in rental assistance and other housing-related programs that, in all four Trump administration budgets, included rent increases that would average more than 40 percent for about 4 million low-income households that rent their units with rental vouchers or live in public housing. The four budgets also called for eliminating various housing-related programs including the HOME program, the Community Development Block Grant, and the Low-Income Home Energy Assistance Program (LIHEAP).

Cash assistance. Large reductions in cash assistance in all four Trump administration budgets, including (1) reductions in benefits for low-income children with disabilities through Supplemental Security Income (SSI) when more than one child or both an adult and a child in the same family receive SSI, (2) a reduction of more than $20 billion over 10 years in federal Temporary Assistance for Needy Families (TANF) funding to states, and (3) a reduction in initial Social Security disability benefits for some beneficiaries. The 2017 tax cut that President Trump signed into law increased the Child Tax Credit (CTC), though the increase for children in most poor families was modest. An estimated 10 million children—those in families with the lowest incomes, including families whose earner works full-time at the federal minimum wage of $7.25 an hour—received either an increase of up to $75 or no increase. If these children’s families participated in various programs slated for cuts such as SNAP or rental assistance, those families would in most cases have lost more income from the program cuts (often substantially more) than they would have gained from the CTC increase.

Non-defense discretionary programs. Deep cuts in “non-defense discretionary” (NDD) funding—the federal budget outside of defense, entitlements and other “mandatory” programs, and interest payments on the debt. The first Trump administration budget proposed an overall NDD level for fiscal year 2018 that would have been 13 percent below the 2017 enacted level and 25 percent below the 2010 level in inflation-adjusted terms and that would have reached its lowest level as a share of gross domestic product (GDP) in six decades. The proposed NDD reduction totaled $1.8 trillion over 10 years (Herrera and Friedman 2017). Under all Trump administration budgets, NDD funding would, by the tenth year, have been at its lowest level as a share of GDP since the Hoover years. Along with the reductions in low-income housing programs noted above, the proposed NDD reductions included reductions in various programs to strengthen the ability of low-income individuals to secure employment, as outlined in the next bullet.

Self-sufficiency. Some administration officials justified various proposed reductions in benefits for low-income households by calling on individuals in those households to go to work or work more. At the same time, the Trump administration budgets also proposed to scale back a number of programs to strengthen the ability of low-income individuals to secure and retain employment. Trump administration budgets proposed to reduce job training funds for states and localities by 40 percent (in the first budget), reduce the Job Corps substantially (in the final three budgets), reduce various education, student aid, work-study, and other programs (all four budgets), and terminate the community service employment program (all four budgets). Some Trump administration budgets also proposed to increase funding for apprentice programs, though in dollar terms, those increases amounted to a small fraction of the reductions in education, job training, and related programs.

Trump administration budgets sought significant savings in other budget areas as well. The bulk of the proposed savings, however, fell on benefits and services for people of low or modest income. In the fiscal year 2018 Trump administration budget, for instance, while programs for people with low or modest incomes accounted for 28 percent of all non-defense spending outside of interest payments, those programs would have borne 59 percent of the reductions in non-defense programs ($2.5 trillion of $3.7 trillion in reductions over 10 years; Shapiro, Kogan, and Cho 2017). By the tenth year, overall spending for programs for people of low or modest incomes would shrink by 33 percent below the budget baseline (Shapiro 2017). A CBPP analysis of the final Trump administration budget (for fiscal year 2021) estimated that 44 percent of its proposed reductions would come from such programs (Kogan, Romig, and Beltran 2020).

The Trump administration also sought, via regulation, to limit or discourage participation in various safety net programs by certain low-income immigrants who were legally authorized to be in the United States and eligible for these programs—mainly, immigrants who had applied for permanent residence, or green cards (Bernstein, Gonzales, Karpman, and Zuckerman 2020). These regulations, which federal courts blocked in 2020 (Gonzales 2023), would have made it harder for such individuals to secure legal permanent residence status and ultimately become citizens if they had received program benefits.

11 notes

·

View notes

Text

Shannen Doherty’s Untimely Death Sparks Important Conversations About Healthcare Access And Equity

By Janice Gassam Asare

Shannen Doherty, the actress best known for her roles in Beverly Hills, 90210 and Charmed has died after a long battle with cancer, at the age of 53. In a 2015 statement to People magazine, the actress revealed her breast cancer diagnosis, stating that she was “undergoing treatment” and that she was suing a firm and its former business manager for causing her to lose her health insurance due to a failure to pay the insurance premiums. According to reports, in a lawsuit Doherty shared that she hired a firm for tax, accounting, and investment services, among other things, and that part of their role was to make her health insurance premium payments to the Screen Actors Guild; Doherty claimed that their failure to make the premium payments in 2014 caused her health insurance to lapse until the re-enrollment period in 2015. When Doherty went in for a checkup in March of 2015, the cancer was discovered, at which time it had spread. In the lawsuit, Doherty indicated that if she had insurance, she would have been able to get the checkup sooner—the cancer would have been discovered, and she could have avoided chemotherapy and a mastectomy.

Under the IRS, actors are often classified as independent contractors, which comes with its own set of challenges. Although it is unclear what Doherty’s situation was, for many independent contractors, obtaining health insurance can be difficult. Trying to get health insurance as an independent contractor can be a costly and convoluted process. A 2020 Actors’ Equity Association survey indicated that “more than 80% of nonunion actors and stage managers in California have been misclassified as independent contractors.” A 2021 research study revealed that self-employment (which is what independent contractors are considered to be) was associated with a higher likelihood of being uninsured.

Doherty’s tragic situation invites a larger conversation about healthcare access and equity in the United States. According to the Center on Budget and Policy Priorities, the Affordable Care Act (ACA), also known as “Obamacare,” was signed into law in 2010 and revolutionized healthcare access in two distinct ways: “creating health insurance marketplaces with federal financial assistance that reduces premiums and deductibles and by allowing states to expand Medicaid to adults with household incomes up to 138 percent of the federal poverty level.” The ACA helped reduce the number of uninsured Americans and expanded healthcare access to those most in need. It also helped close gaps in coverage for different populations, including those with pre-existing health conditions, lower-income individuals, part-time workers, and those from historically excluded and marginalized populations.

Despite strides made through the ACA, healthcare access and equity are still persistent issues, especially within marginalized communities. Research from the Henry J. Kaiser Family Foundation (KFF) examining 2010-2022 data indicated that in 2022, non-elderly American Indian and Alaska Natives (AIAN) and Hispanic people had the greatest uninsured rates (19.1% and 18% respectively). When compared with their white counterparts, Native Hawaiian and Other Pacific Islanders (NHOPI) and Black people also had higher uninsured rates at 12.7% and 10%, respectively. The Commonwealth Fund reported that between 2013 and 2021, “states that expanded Medicaid eligibility had higher rates of insurance coverage and health care access, with smaller disparities between racial/ethnic groups and larger improvements, than states that didn’t expand Medicaid.” It’s important to note that if a Republican president is elected, Project 2025, the far-right policy proposal document, seeks to upend Medicaid as we know it by introducing limits on the amount of time that a person can receive Medicaid.

When peeling back the layers to examine these racial and ethnic differences in more detail, the Brookings Institute noted in 2020 that the refusal of several states to expand Medicaid could be one contributing factor. One 2017 research study found that some underrepresented racial groups were more likely to experience insurance loss than their white counterparts. The study indicated that for Black and Hispanic populations, specific trigger events were more likely, as well as “socioeconomic characteristics” that were linked to more insurance loss and slower insurance gain. The study also noted that in the U.S., health insurance access was associated with employment and and marriage and that Black and Hispanic populations were “disadvantaged in both areas.”

Equity in and access to healthcare is fundamental, but bias is omnipresent. Age bias, for example, is a pervasive issue in breast cancer treatment. Research also indicates that racial bias is a prevalent issue—because the current guidelines in breast cancer screenings are based on white populations, this can lead to a delayed diagnosis for women from non-white communities. Our health is one of our greatest assets and healthcare should be a basic human right, no matter what state or country you live in. As a society, we must ensure that healthcare is available, affordable and accessible to all citizens. After all, how can a country call itself great if so many of its citizens, especially those most marginalized and vulnerable, don’t have access to healthcare?

#shannen doherty#breast cancer#health#health care#equity#usa#obamacare#affordable care act#project 2025#2024 shannen doherty#universal healthcare#poc#minorities#vulnerable people#first nations#marginalized people#medicaid#charmed#beverly hills 90210#health system#united states of america#article#2024 article#opinion

16 notes

·

View notes

Text

Los Angeles is close: understand how the financing of sports in Brazil foments Olympic medals

Little known, the system supports high-performance athletes began to be structured at the beginning of the 2000s

It’s almost a tradition: during the Olympic Games, questions about Brazilian performance emerge strongly on social media platforms. Commonly, complaints about the structure and salaries athletes receive become important. However, the right information about how this system works did not get the same attention.

That’s why Brasil de Fato interviewed experts in sports financing to explain how the transfer of public resources to high-performance sports works.

The current public funding system for Olympic and Paralympic sports was developed almost entirely during the first two governments of Luiz Inácio Lula da Silva (Workers’ Party), between 2003 and 2010. The mechanisms that allocate most of the resources are Brazil’s Lottery Law, which sends money directly to the Brazilian Olympic and Paralympic committees and also to the confederations of each sport; the Sports Incentive Law, a mechanism similar to the Rouanet Law, which allows companies to make tax waivers to support sports projects; and the Athlete Scholarship, a monthly payment to athletes who achieve certain results, starting with youth sports.

There are also budget resources from the sports departments of the federal, state and municipal administrations. In addition, in 2008, a sui generis program was created to support the careers of high-performance athletes, the High-Performance Athletes Program (PAAR, in Portuguese) of the Armed Forces. It provides that athletes with a chance of winning medals can apply to join the Army, Navy or Air Force to take part in military competitions. For the athlete, this guarantees income, retirement and use of the Forces' facilities for training.

“Looking back over history, we can see that, over time, Brazil has been expanding and improving its participation in high-performance sports,” says Fernando Henrique Carneiro, a researcher at the Group for Research and Sociocritical Training in Physical Education, Sport and Leisure at the University of Brasilia (Avante/UnB, in Portuguese).

“So much so that in Tokyo [Olympic Games, in 2021], the country had its best results, which was very much the result of what was being built up for the Rio 2016 Games cycle. Over time, the Lula and Dilma governments have been structuring public policies for the sector,” he explains.

Continue reading.

12 notes

·

View notes

Text

For all anyone knows, this might be as good as it gets for Jagmeet Singh's NDP. But would that be so bad?

The NDP is certainly in a celebratory mood. On Wednesday, the day after the federal budget, the party's MPs staged a mini-pep rally for the television cameras to celebrate their influence on the document. Singh announced an eight-city "post-budget tour" to "talk to Canadians about how the NDP delivered results that put money back in their pockets."

Some of the victories New Democrats are claiming for themselves are at least open to debate. Left to its own devices, the Liberal government might have ended up boosting the GST credit last fall anyway — and might have done so again in this year's budget. (Still, the decision to now promote the extra payment as a "grocery rebate" feels like a nod to the complaints New Democrats have focused on major grocers).

The Liberals also might not have needed the NDP's help to decide to apply labour standards to the new round of investment tax credits for clean tech.

But a new dental care program for low-income Canadians is an indisputable NDP win. While it's a Liberal government that will actually implement the program — Prime Minister Justin Trudeau was in New Brunswick on Friday to tout "affordable dental care" — dental care was not a feature of the Liberal platform in either the 2019 or 2021 federal elections. [...]

Continue Reading.

Tagging: @politicsofcanada

76 notes

·

View notes

Text

California is facing a record $68 billion budget deficit.

This is largely attributed to a “severe revenue decline,” according to the state's Legislative Analyst's Office (LAO).

While it’s not the largest deficit the state has ever faced as a percentage of overall spending, it’s the largest in terms of real dollars — and could have a big impact on California taxpayers in the coming years.

Here’s what has eaten into the Golden State’s coffers.

Unprecedented drop in revenue

California is dealing with a revenue shortfall partly due to a delay in 2022-2023 tax collection. The IRS postponed 2022 tax payment deadlines for individuals and businesses in 55 of the 58 California counties to provide relief after a series of natural weather disasters, including severe winter storms, flooding, landslides and mudslides.

Tax payments were originally postponed until Oct. 16, 2023, but hours before the deadline they were further postponed until Nov. 16, 2023. In line with the federal action, California also extended its due date for state tax returns to the same date.

These delays meant California had to adopt its 2023-24 budget before collections began, “without a clear picture of the impact of recent economic weakness on state revenues,” according to the LAO.

Total income tax collections were down 25% in 2022-23, according to the LAO — a decline compared to those seen during the Great Recession and dot-com bust.

“Federal delays in tax collection forced California to pass a budget based on projections instead of actual tax receipts," Erin Mellon, communications director for California Gov. Gavin Newsom, told Fox News. "Now that we have a clearer picture of the state’s finances, we must now solve what would have been last year’s problem in this year’s budget.”

The exodus

California has also lost residents and businesses — and therefore, tax revenue — in recent years.

The Golden State’s population declined for the first time in 2021, as it lost around 281,000 residents, according to the Public Policy Institute of California (PPIC). In 2022, the population dropped again by around 211,000 residents — with many moving to other states like Texas, Oregon, Nevada, and Arizona.

Read more: 'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling inflation

“Housing costs loom large in this dynamic,” according to the PPIC, which found through a survey that 34% of Californians are considering moving out of the state due to housing costs.

Other factors such as the post-pandemic remote work trend — which has resulted in empty office towers in California’s downtown cores — have also played a role in migration out of the state.

Poor economic conditions

In an effort to tame inflation in the U.S., the Federal Reserve has hiked interest rates 11 times — from 0.25% to 5.5% — since March 2022. These actions have made borrowing more expensive and have reduced the amount of money available for investment.

This has cooled California’s economy in a number of ways. Home sales in the state are down by about 50%, according to the LAO, which it largely attributes to the surge in mortgage rates. The monthly mortgage to buy a typical California home has gone from $3,500 to $5,400 over the course of the Fed’s rate hikes the LAO says.

The Fed’s rate hikes have “hit segments of the economy that have an outsized importance to California,” according to the LAO, including startups and technology companies. Investment in the state’s tech economy has “dropped significantly” due to the financial conditions — evidenced by the number of California companies that went public in 2022 and 2023 being down by over 80% from 2021, the LAO says.

One result of this is that California businesses have had less funding to be able to expand their operations or hire new workers. The LAO pointed out that the number of unemployed workers in the Golden State has risen by nearly 200,000 people since the summer of 2022, lifting the percentage from 3.8% to 4.8%.

Fixing the budget crunch

The LAO suggests that California has various options to address its $68 billion budget deficit — including declaring a budget emergency and then withdrawing around $24 billion in cash reserves.

California also has the option to lower school spending to the constitutional minimum — a move that could save around $16.7 billion over three years. It could also cut back on at least $8 billion of temporary or one-time spending in 2024-25.

However, these are just short-term solutions and may not address the state’s longer term budget issues. In the past, the state has cut back on business tax credits and deductions and increased broad-based taxes to generate more revenue.

Mellon did not reveal any specifics behind the state’s recovery plan in her comments to Fox News. She simply said: “In January, the Governor will introduce a balanced budget proposal that addresses our challenges, protects vital services and public safety and brings increased focus on how the state’s investments are being implemented, while ensuring accountability and judicious use of taxpayer money.”

13 notes

·

View notes

Text

Detroit Mayor Mike Duggan expected to announce political future next week

Detroit, Michigan - Mayor Mike Duggan is expected to make an announcement next week about his political plans.

The third-term mayor told the Free Press Tuesday night at the Michigan Democratic Party election watch event that he will soon have more information to share. Duggan has been long-rumored to be eying a run for governor in the 2026 election. Democratic Gov. Gretchen Whitmer is barred from running again after finishing her current, second term.

"Next week, I'll have an announcement about the mayor's race, and we'll go from there," Duggan told news agencies.

Wayne County campaign records show that Duggan has not been actively fundraising for the 2025 election. His latest campaign statement from July through October shows an ending balance of more than $25,000, while others with candidate committees for mayor show having more than $100,000. Duggan raised more than $1 million for his 2021 reelection campaign.

Duggan has run Detroit for 10 years, immediately following the city’s municipal bankruptcy filing. He was confronted with restoring Detroit’s losses, driving revenue and businesses to invest in the city, and balancing the budget. The city’s budget fluctuated over the years during his tenure and dipped during the pandemic. However, he cited online gaming taxes and growing income taxes as revenue streams that helped offset losses.

One of his key indicators of success as a big city mayor is the ability to grow population. Detroit has significantly lost population since the 1960s. The latest decennial census results reported a 10.5% decline but Duggan legally fought to restore uncounted residents.

According to annual population estimates, which the bureau released in May, Detroit's population grew from 631,366 in 2022 to 633,218 residents in 2023. “This is the news we’ve been waiting for for 10 years,” Duggan said at the time.

Others who filed candidate committees for mayor include City Council President Mary Sheffield, former Councilwoman Saunteel Jenkins, Councilman Fred Durhal III and businessman Joel Haashiim.

#detroit michigan#ddot#detroit#downtowndetroit#detroit evolution#detroitparks#detroit history#detroit politics#politics#us politics#michigan#mayor#detroit river#detroit news#us news#world news#public news#news#news media#news usa#government#governance#governor#election news#election day#us elections#american elections#mike dugan#economy#vote democrat

5 notes

·

View notes

Text

Here are just two of the corporate giveaways hidden in the rushed, must-pass, end-of-year budget bill

Yesterday, Congress finally voted through the must-pass, end-of-year budget bill. As has become routine, this bill was stalled right until the final moment, so that Congressjerks could cram the 4,000-page, $1.7 trillion package with special favors for their donors, at the expense of the rest of the country.

This year’s budget package included a couple of especially egregious doozies, which were reported out for The American Prospect by Lee Harris (who covered a grotesque retirement giveaway for the ultra-rich) and Doraj Facundo (who covered a safety giveaway to Boeing and its lethal fleet of 737 Max airplanes).

Let’s start with the retirement scam. The budget bill includes Rep Richie Neal’s [DINO-MA] SECURE Act 2.0, which gives savers with retirement funds until age 75 to cash out their retirement savings — netting an extra three years of tax-free growth for the lucky, tiny minority with substantial retirement savings. This follows on Neal’s SECURE Act 1.0 of 2019, when the age was raised from 70.5 to 72.

The tax-exempt retirement savings account is a Carter-era bargain that replaced real pensions — ones that guaranteed that you wouldn’t starve or freeze to death when you retired — with accounts that let people gamble on the stock market, to be the suckers at Wall Street’s poker table:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

The market-based gambler’s pension is a catastrophic failure. Half of Americans have no retirement savings. Of the half that have any savings, the vast majority have almost nothing saved:

https://www.federalreserve.gov/econres/scf/dataviz/scf/chart/#series:Retirement_Accounts;demographic:all;population:all;units:have

All in all, America has a $7 trillion retirement savings shortfall:

https://crr.bc.edu/wp-content/uploads/2019/10/IB_19-16.pdf

But for a tiny minority of the ultra-rich, tax-free savings accounts like ROTH IRAs are a means of avoiding even the paltry capital gains tax that you have to pay if you own things for a living, rather than doing things for a living. Propublica’s IRS Files revealed how ghouls like Peter Thiel avoided tax on billions in “passive income” by abusing tax-free savings accounts that were supposed to benefit the “middle class”:

https://pluralistic.net/2021/06/26/wax-rothful/#thiels-gambit

Meanwhile, Social Security is crumbling, thanks to a sustained attack on it by the business lobby and its friends in both parties. Progressive Dems had sought to amend SECURE Act 2.0 by inserting some clauses to shore up Social Security, and none of these were included in the final bill.

One of the fixes that died was the Savings Penalty Elimination Act, introduced by Senators Sherrod Brown [D-OH] and Rob Portman [R-OH]. This act would have tweaked the means-testing for Supplemental Security Income, which supports 8m low-income disabled adults and kids. Right now, you can’t collect SSI if you have $2k in the bank, a limit that hasn’t been adjusted for inflation since the 1980s (adjusted for inflation, $2k in 1980 is $7226.00 in 2022).

The $2k savings cap means that you have to be substantially below the poverty level to receive $585/month in SSI assistance — this being the only source of income for the majority of SSI recipients. Means-testing is a self-immolating fetish for corporate Dems and in retrospect, this betrayal seems inevitable:

https://pluralistic.net/2022/05/03/utopia-of-rules/#in-triplicate

(Notice how no one proposes means-testing billionaires when they get PPP loans or hundreds of millions in IRS “refunds” — like Trump, who paid substantially less tax than you did:)

https://www.cnbc.com/2022/12/21/trump-income-tax-returns-detailed-in-new-report-.html

And it was a betrayal: progressive Dems bargained with Neal and co not to publicly condemn SECURE Act 2.0 if they could get some concessions for the 8 million poorest disabled people in America. In the end, Neal rug-pulled them. Of course he did! This is Richie Fucking Neal, the best friend the Trump tax giveaway ever had:

https://pluralistic.net/2020/07/13/youre-still-the-product/#richie-neal

As with everything Neal touches, this screws poor people in multiple ways. First, it leaves the SSI cap intact. But it also creates a giant unfunded liability in the federal budget. Technically, there’s no reason this should lead to cuts. The US Treasury can’t run out of dollars, and giveaways to the rich are only mildly inflationary, since rich people put their money in the bank and mostly spend it on buying politicians, not goods.

But because of the delusion that currency producers like the US Treasury have the same constraints as currency users like you and me, Congress will need to come up with “Pay Fors” in future budgets to “make up for” the money they’re giving to rich people with SECURE Act 2.0. Dollars to toenail clippings, they’ll do that by hacking away at the tattered remains of the US social safety net.

Fear not, you don’t need to be a desperately poor disabled person or child to get fucked over by late additions to a 4,000 page must-pass bill! If you can afford to get on an airplane, Congress has something for you, too!

Remember when Boeing (the monopoly US airplane manufacturer that squandered $43b on stock buybacks and had to borrow $14b from the US public to survive the pandemic) told the FAA that it could self-certify its 737 Max airplanes, and then killed hundreds and hundreds of people with its defective planes?

https://pluralistic.net/2020/03/12/boeing-crashes/#boeing

The 737 Max was unsafe for many reasons, but one glaring factor was the fact that Boeing sold some of its core safety as “extras” — like they were downloadable content for your Fortnite character — leading to multiple crashes in which all lives were lost:

https://apnews.com/article/ethiopia-indonesia-accidents-ap-top-news-international-news-140576a8e9d4449eae646c8c479fdc3a

Boeing was forced to take the 737 Max out of service, but it eventually brought the plane back, “fixing” the problems by renaming the “737 Max” to the “737 8”:

https://pluralistic.net/2020/08/20/dubious-quantitative-residue/#737-8

Supposedly, Boeing has been diligently working on fixing the problems with its defective jets that can’t be addressed by a rebranding campaign. This wasn’t voluntary: the 2020 Aircraft Certification, Safety, and Accountability Act required Boeing — and every other manufacturer whose aircraft were certified by the FAA — to meet new minimum safety standards by December 27, 2022.

Every manufacturer met that deadline, except Boeing, and someone amended the budget bill to give the company three more years to meet these security standards. Critically, the new security measures, when they come, will be certified by an FAA that Republicans will control, thanks to the House changing hands.

https://prospect.org/infrastructure/transportation/government-spending-bill-waives-aircraft-safety-deadline/

Boeing is slated to ship 1,000 new 737 Maxes, which will fetch $50b for the company. Many of these planes will fly directly over my house, which is on the approach path for Burbank airport. Southwest Air flies dozens of 737 Maxes right over my roof every single day.

As Facundo points out, the FAA can ill afford any more hits to its credibility. It was once the case that if the FAA certified an aircraft, every other country in the world would waive any further certification, so trusting were they of the FAA’s judgment. That is no longer the case: today, the European Aviation Safety Agency does its own aircraft testing, holding jets that enter EU airspace to a higher standard than the FAA does for US planes.

It’s just another reminder that the US doesn’t have “corporate criminals” because the US doesn’t have any meaningful enforcement for corporate crimes. In America, we love our companies like we love our billionaires: too big to fail and too big to jail:

https://pluralistic.net/2021/10/12/no-criminals-no-crimes/#get-out-of-jail-free-card

Image: Ryan Lee (modified) https://www.flickr.com/photos/190784293@N05/50862532686

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

Henry Wadey (modified) https://commons.wikimedia.org/wiki/File:Flames_%2858765896%29.jpeg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A living room scene, featuring a sofa in the background and a sofa in the foreground. A man's hand reaches into the frame to lift up the corner of the sofa. A broom enters the frame to sweep a pile of dirt under the rug. Mixed in with the dirt are a crashed WWI biplane with Southwest Airlines livery, and an old lady in a rocking chair.]

#pluralistic#secure 2.0#ssi#means testing#irsleaks#fidelity#vanguard#regulatory capture#faa#retirement crisis#retirement#finance#social security#pensions#corruption#congress#aviation#boeing#737 max#must-pass#irs files

84 notes

·

View notes

Text

Scandal After Scandal: Will They Never End?

Boris Johnson was so beset by scandal that his own party turned on him and threw him out of office. We all know about the Partygate affair but there were also questions raised regarding his personal monetary arrangements. From charges of corruption concerning him asking a Tory donor to supply funds to refurbish his Downing Street residence, to his appointment of the BBC Chairman and an alleged £800,000 loan, Johnson was the epitome of the self-serving Tory.

Johnson has gone but the scandals have continued to rumble on. We had the unedifying debacle of multi-millionaire Nadhim Zahawi being forced to resign after he was found guilty of serious breaches of the ministerial code by covering up issues to do with his attempts to minimise his tax bill.

Sunak’s own wife also avoided UK tax payments by claiming non-dom status. After being asked to “come clean” on his wife’s tax affairs and after much embarrassment the Sunak’s decided she should pay tax in this country.

It is not only those Tories at the top of government who are self-serving. Conservative MP’s have been calculated to have received an additional £15.2 million on top of their MP salaries, personal fortune hunting seemingly more important than giving their constituents 100% of their time.

“Since the end of 2019, millions of pounds of outside earnings have been made by a small group of largely Tory MPs." (Skynews: 08/01/23)

When Sunak, after much delay, made public his own tax affairs we discovered that for the year 2021/22 he made £172,415 unearned income from dividends and £1.6 million from capital gains. In total, the PM paid an average tax rate of 22% over a three-year period.

For you and I, the basic rate of tax on income between £12,571 and £50,270 is 20%. Between £50,271 and £125,140, it is 40 %, going up to 45% for earned income over £125,140.

For Mr Sunak to have only paid 22% on his millions is therefore quite a smack in face for ordinary tax-payers, and one only made possible because the Tories have arranged the tax system to benefit themselves and their rich friends.

“Angela Rayner, Labour’s deputy leader, said: “[The tax returns] reveal a tax system designed by successive Tory governments in which the prime minister pays a far lower tax rate than working people who face the highest tax burden in 70 years

“… the fact that Sunak paid less than a quarter of his gains in tax highlighted the problems with taxing capital gains at a much lower rate than income…The low tax rate is because we have much lighter taxes on wealth than work” (Guardian: 22/03/23)

So, if you work for a living, expect to pay proportionately more in tax than those who live on unearned income.

Way back in July 2022, Rishi Sunak was so disgusted with the immoral behaviour of Boris Johnson that he resigned his post as Chancellor. This is what he said at the time:

“... the public rightly expect government to be conducted properly, competently and seriously. I recognise this may be my last ministerial job, but I believe these standards are worth fighting for and that is why I am resigning.”

But if a week is a long time in politics, then 9 months is an eternity. As we have seen, Sunak himself has become as equally embroiled in monetary scandal as his predecessor and now he is under investigation by the Parliamentary Standards Committee.

“Rishi Sunak investigation: Government blocked Freedom of Information request into childcare firm.

Mr Sunak is currently being investigated by the Parliamentary Standards Commissioner over his failure to be more transparent about his wife’s shares in childcare agency Koru Kids when quizzed on the subject by MPs.

It comes after i revealed last month that Akshata Murty, the Prime Minister’s wife, holds shares in the firm, which stands to directly benefit from reforms to the childcare system announced in last month’s Budget.” (inews: 19/04/23)

Time and time again we see top Tories under investigation by the Parliamentary Standards Commission. Time and time again we see how self-serving and unprincipled our leaders really are. Mr Sunak it seems, is no different to his predecessors and the sooner he goes the better.

35 notes

·

View notes

Text

Noah Berlatsky at Public Notice:

Last weekend at a rally in Las Vegas, Kamala Harris announced one of her first explicit new policy positions: a plan to “eliminate taxes on tips for service and hospitality workers.” The proposal follows a similar one by Donald Trump, and as you’d expect from a Trumpworld idea, its not a great one. As Vox explains, experts think eliminating taxes on tips like will mostly benefit employers who can just lower base pay as tip income increases.

More, many service workers earn so little that they don’t pay federal income tax anyway. And of course the policy does nothing to help the many low income workers who don’t receive tips, like those who work in warehouses. What’s really needed is an increase in the minimum wage (which Harris endorsed in the same speech) and an elimination of the subminimum wage carve out for tipped workers (which Harris has not addressed). The Harris campaign has made a couple of policy promises intended to neutralize Trump talking points. She’s backed away from her 2020 primary opposition to fracking, for example, and promised she won’t pursue a ban on the practice. Outside of that, though, Harris hasn’t put out many detailed policy papers or positions as of yet, and press outlets are starting to push her.

[...]

Feed the kids in Minnesota

US schools have programs to provide free meals to poorer students. Families generally have to register and qualify to receive these benefits. The problem here is that when school meals are means tested, families who could take advantage of the program feel that they are being stigmatized for being poor and are reluctant to sign up or have their kids eat school meals. This is especially worrisome because free school meals can have a major positive effect on student nutrition, on family nutrition, and on student success. Researchers found that food insecurity declined five percent after universal free lunches became available. Families also purchased healthier foods since they had more money for it and healthy shopping tends to cost more. Students, unsurprisingly, do better in school when they are not hungry; a 2021 Brookings report found that free school meals boosted math performance, especially for students in elementary school. It also reduced school suspensions. Outcomes like these led Walz and Democrats in Minnesota’s legislature to pass a bill providing free breakfast and lunch for all schoolchildren, with no means testing, in March 2023. The policy was announced in a photogenic signing ceremony where Walz was surrounded by and then hugged by a whole bunch of smiling children.

[...]

Feed the kids everywhere

Despite its benefits and popularity, Republicans have attacked school lunch programs. They’ve argued that since the programs aren’t means tested, the schools are feeding students from wealthier families. Walz dismissed these criticisms with a rhetorical flourish. “Isn’t that rich? Our Republican colleagues were concerned this would be a tax cut for the wealthiest,” he said. “The haves and have-nots in the lunchroom is not a necessary thing. Just feed our children.” It's true, though, that the program — in part because of its popularity — has been more expensive than originally budgeted. The cost is $81 million more over two years than anticipated, and another $95 million more in the two years after that. Again, this is in many ways a good thing. Some of the kids eating school lunches may not necessarily need free school lunches. But many were dissuaded from eating by stigma. Others come from families with modest means but who weren’t poor enough to qualify. Ultimately, however, the goal was to feed more kids, and the program is feeding many more kids. This is a success.

Nationwide free school lunch and breakfast policies would be a beneficial policy plank that should be adopted by a potential Kamala Harris/Tim Walz administration. #HarrisWalz2024

#Kamala Harris#School Lunches#Subminimum Wage#Minimum Wage#Tips#Taxes#Tim Walz#2024 Presidential Election#2024 Elections#Minnesota HF5#Minnesota#School Breakfasts#Schools

4 notes

·

View notes

Text

Near the edge of the Phoenix metro’s urban sprawl, surrounded by a wide expanse of saguaro-studded scrubland, Dream City Christian School is in the midst of a major expansion.

The private school, which is affiliated with a local megachurch where former President Donald Trump held a campaign rally this month, recently broke ground on a new wing that will feature modern, airy classrooms and a pickleball court. It’s a sign of growth at a school that has partnered with a Trump-aligned advocacy group, and advertises to parents by vowing to fight “liberal ideology” such as “evolutionism” and “gender identification.”

Just a few miles away, the public Paradise Valley Unified School District is shrinking, not expanding. The district shuttered three of its schools last month amid falling enrollment, a cost-saving measure that has disrupted life for hundreds of families.

One of the factors behind Dream City’s success and Paradise Valley’s struggles: In Arizona, taxpayer dollars that previously went to public schools like the ones that closed are increasingly flowing to private schools – including those that adopt a right-wing philosophy.

Arizona was the first state in the country to enact a universal “education savings account” program – a form of voucher that allows any family to take tax dollars that would have gone to their child’s public education and spend the money instead on private schooling.

ACNN investigation found that the program has cost hundreds of millions of dollars more than anticipated, disproportionately benefited richer areas, and funneled taxpayer funds to unregulated private schools that don’t face the same educational standards and anti-discrimination protections that public schools do. Since Arizona’s expanded program took effect in 2022, according to state data, it has sent nearly $2 million to Dream City and likely sapped millions of dollars from Paradise Valley’s budget.

And Arizona is hardly alone: universal voucher programs are sweeping Republican-led states, making it one of the right’s most successful efforts to rewrite state policy after decades of setbacks.

The cause has been bolstered by a small group of billionaires who have quietly spent millions of dollars on election campaigns and lobbying to push vouchers around the country. Supporters argue that the programs give families greater freedom in choosing their children’s schools, and help less affluent kids in failing public schools achieve a better education.

Critics say the problems in Arizona are a warning of potential dangers as other states follow its lead. “We’re the canary in the coal mine,” said Trevor Nelson, an education activist and a parent in the Paradise Valley district where public schools are closing. “We’re on the front lines, and what happens here is going to dictate what happens in the rest of the country.”

A national movement transforming America’s education system

For decades, conservative activists and politicians have been pushing policies to make it easier for families to spend taxpayer funds on private education.

Various states passed small, targeted voucher programs for low-income students, or students with disabilities. But efforts to expand vouchers to all families, regardless of their incomes, failed again and again, defeated in voter referendums or rejected by state legislatures and courts.

That changed swiftly in recent years. Since 2021, nearly a dozen states have passed universal or near-universal school choice policies – either vouchers that directly send public dollars to private schools, or similar “education savings account” programs that give parents more flexibility on where to spend the money.

“There’s been more gains made in the last few years of the school choice movement than there were in the prior 30,” said Tommy Schultz, the CEO of the pro-voucher American Federation for Children, said in an interview. “We are basically hitting a tipping point when it comes to giving families education freedom.”

The political calculus on vouchers changed amid the impact of school closings during the coronavirus pandemic and vitriolic debates over public school teachings on race and sexuality. Pro-voucher advocates embraced those culture war fights, refocusing their efforts on red states where they painted public schools as out of step with parents’ values. Half of Republicans polled told Gallup in 2022 that they had very little or no confidence in public schools, up from 31% in 2019.

The American Federation for Children, which was previously led by Trump’s Secretary of Education Betsy DeVos, pushed vouchers in part by playing a big role in state legislative races. AFC ran ads attacking Republicans who opposed universal ESA expansion bills – often rural legislators whose constituents were more likely to rely on public schools – in states like Iowa, Tennessee, Texas and elsewhere. Schultz said the group targeted 71 incumbents around the country in 2022, and 40 of them lost their elections. This year, AFC plans to be involved in “hundreds” of races, he said.

AFC’s national political arm has spent more than $7 million since 2020 after receiving $3 million from DeVos and her husband, $2 million from TikTok investor Jeff Yass, and $1.75 million from Cleveland Browns owner Jimmy Haslam and his wife, according to IRS records. DeVos and Haslam did not respond to requests for comment, while Yass said in a statement that “school choice is the civil rights issue of our time and I’m excited to see the issue getting the attention it deserves.” AFC said it has also spent an additional $16 million through affiliated state political action committees and other groups.

In an internal presentation obtained by the progressive watchdog group Documented and provided to CNN, AFC boasted that it had “deployed” $250 million “to advance school choice over the last 13 years,” and that that spending had led to “$25+ billion in government funding directed towards student choice.” Those numbers are now even higher, Schultz said.

Charles Siler, an Arizona political consultant who worked as a lobbyist for two pro-voucher nonprofits before coming to oppose school privatization, said the recent victories for school choice were the result of a long, methodical effort by groups like AFC.

“This isn’t an overnight success, this is decades in intentional, strategic labor,” Siler said. “At a certain point you’ll hit a tipping point where public schools cannot afford to function.”

The push for universal vouchers comes as the Supreme Court has issued a series of rulings that bolstered state funding for religious schools. In 2002, the court ruled that states could create tuition voucher programs for religious schools, opening the door to programs like Arizona’s. Two decades later, in 2022, the court expanded that decision by ruling that states that give vouchers to private schools cannot withhold them from religious schools.

Advocates for student choice argue that voucher programs lead to increases in student achievement. But several other studies have found that expansions of vouchers in some states had a negative impact on student test scores – as opposed to smaller, targeted programs.

One reason is that when voucher programs are universal or near-universal, more money goes to less academically rigorous schools, said Josh Cowen, a Michigan State University professor who’s written a book on school vouchers.

“We’re not talking about the school in ‘Dead Poets Society’ here,” Cowen said. “We’re talking about schools run out of church basements.”

Arizona led the way in universal vouchers

Arizona has long been ground zero in the fight over public support for private schools. The Grand Canyon State first adopted its “Empowerment Scholarship Account” program in 2011 for families of students with disabilities. State leaders gradually expanded the program over the years, adding in military families, students in low-performing public schools, and other groups.

But initial efforts to allow any family in the state to take advantage of the program floundered. In 2018, nearly two-thirds of Arizona voters rejected a universal ESA bill in a referendum. And when GOP Gov. Doug Ducey pushed the policy again in 2021, three Republican members of the state house joined Democrats to block it.

Those three holdouts were targeted by YouTube ads paid for by the American Federation for Children, according to Google’s political ad database. When the legislature again considered a universal ESA bill in 2022, all three members flipped to support it, and Ducey signed it into law.

Since the new rules went into effect in September 2022, Arizona’s ESA program has grown from 12,000 students to about 75,000. Families can spend the state money their public school district would have received for their child’s education on private school or homeschooling. Most students receive about $7,000, while those with disabilities get significantly more.

Tom Horne, the Arizona superintendent of public instruction and a Republican elected official who supports the ESA program, argued that it gives families much-needed flexibility.

“It’s designed to empower parents to choose the school that best suits their child’s needs,” Horne said. “No one could rationally be against that unless they are so immersed in ideology, and it has made them coldhearted with respect to students’ academic needs.”

But unlike some other states that have adopted voucher programs, Arizona has no standards requiring private schools to be accredited or licensed by the state, or follow all but the most basic curriculum standards. That means there is no way to compare test scores in public schools to students in the ESA program.

“There’s zero accreditation, there’s zero accountability, and there’s zero transparency,” said Beth Lewis, a former teacher who leads an Arizona nonprofit that advocates against school privatization.

The state also allows families to spend the money not just on schools but on a wide variety of items that could be considered educational for homeschooled kids. Parents have been approved to use the taxpayer dollars to buy their children things like kayaks, trampolines, cowboy roping lessons and SeaWorld tickets. Horne said his office was now rejecting some purchases that would have been approved under previous administrations.

The program is costing considerably more than originally anticipated. When the bill to expand vouchers to all students passed in 2022, the legislature’s budget committee estimated that it would only cost the state $64.5 million between July 2023 and June 2024, while noting that there was uncertainty about that figure.

But far more students joined the program than projected, and the universal expansion has actually cost the state about $332 million over the last year, a report released this month by the nonpartisan Grand Canyon Institute estimated.