#great financial crisis

Explore tagged Tumblr posts

Text

They were warned

Picks and Shovels is a new, standalone technothriller starring Marty Hench, my two-fisted, hard-fighting, tech-scam-busting forensic accountant. You can pre-order it on my latest Kickstarter, which features a brilliant audiobook read by Wil Wheaton.

Truth is provisional! Sometimes, the things we understand to be true about the world change, and stuff we've "always done" has to change, too. There comes a day when the evidence against using radium suppositories is overwhelming, and then you really must dig that radium out of your colon and safely dispose of it:

https://pluralistic.net/2024/09/19/just-stop-putting-that-up-your-ass/#harm-reduction

So it's natural and right that in the world, there will be people who want to revisit the received wisdom and best practices for how we live our lives, regulate our economy, and organize our society. But not a license to simply throw out the systems we rely on. Sure, maybe they're outdated or unnecessary, but maybe not. That's where "Chesterton's Fence" comes in:

Let us say, for the sake of simplicity, a fence or gate erected across a road. The more modern type of reformer goes gaily up to it and says, "I don't see the use of this; let us clear it away." To which the more intelligent type of reformer will do well to answer: "If you don't see the use of it, I certainly won't let you clear it away. Go away and think. Then, when you can come back and tell me that you do see the use of it, I may allow you to destroy it."

https://en.wikipedia.org/wiki/G._K._Chesterton#Chesterton's_fence

In other words, it's not enough to say, "This principle gets in the way of something I want to do, so let's throw it out because I'm pretty sure the inconvenience I'm experiencing is worse than the consequences of doing away with this principle." You need to have a theory of how you will prevent the harms the principle protects us from once you tear it down. That theory can be "the harms are imaginary" so it doesn't matter. Like, if you get rid of all the measures that defend us from hexes placed by evil witches, it's OK to say, "This is safe because evil witches aren't real and neither are hexes."

But you'd better be sure! After all, some preventative measures work so well that no living person has experienced the harms they guard us against. It's easy to mistake these for imaginary or exaggerated. Think of the antivaxers who are ideologically committed to a world in which human beings do not have a shared destiny, meaning that no one has a moral claim over the choices you make. Motivated reasoning lets those people rationalize their way into imagining that measles – a deadly and ferociously contagious disease that was a scourge for millennia until we all but extinguished it – was no big deal:

https://en.wikipedia.org/wiki/Measles:_A_Dangerous_Illness

There's nothing wrong with asking whether longstanding health measures need to be carried on, or whether they can be sunset. But antivaxers' sloppy, reckless reasoning about contagious disease is inexcusable. They were warned, repeatedly, about the mass death and widespread lifelong disability that would follow from their pursuit of an ideological commitment to living as though their decisions have no effect on others. They pressed ahead anyway, inventing ever-more fanciful reasons why health is a purely private matter, and why "public health" was either a myth or a Communist conspiracy:

https://www.conspirituality.net/episodes/brief-vinay-prasad-pick-me-campaign

When RFK Jr kills your kids with measles or permanently disables them with polio, he doesn't get to say "I was just inquiring as to the efficacy of a longstanding measure, as is right and proper." He was told why the vaccine fence was there, and he came up with objectively very stupid reasons why that didn't matter, and then he killed your kids. He was warned.

Fuck that guy.

Or take Bill Clinton. From 1933 until 1999, American banks were regulated under the Glass-Steagall Act, which "structurally separated" them. Under structural separation, a "retail bank" – the bank that holds your savings and mortgage and provides you with a checkbook – could not be "investment bank." That meant it couldn't own or invest in businesses that competed with the businesses its depositors and borrowers ran. It couldn't get into other lines of business, either, like insurance underwriting.

Glass-Steagall was a fence that stood between retail banks and the casino economy. It was there for a fucking great reason: the failure to structurally separate banks allowed them to act like casinos, inflating a giant market bubble that popped on Black Friday in October 1929, kicking off the Great Depression. Congress built the structural separation fence to keep banks from doing it again.

In the 1990s, Bill Clinton agitated for getting rid of Glass-Steagall. He argued that new economic controls would allow the government to prevent another giant bubble and crash. This time, the banks would behave themselves. After all, hadn't they demonstrated their prudence for seven decades?

In fact, they hadn't. Every time banks figured out how to slip out of regulatory constraints they inflated another huge bubble, leading to another massive crash that made the rich obscenely richer and destroyed ordinary savers' lives. Clinton took office just as one of these finance-sector bombs – the S&L Crisis – was detonating. Clinton had no basis – apart from wishful thinking – to believe that deregulating banks would lead to anything but another gigantic crash.

But Clinton let his self interest – in presiding over a sugar-high economic expansion driven by deregulation – overrule his prudence (about the crash that would follow). Sure enough, in the last months of Clinton's presidency, the stock market imploded with the March 2000 dot-bomb. And because Congress learned nothing from the dot-com crash and declined to restore the Glass-Steagall fence, the crash led to another bubble, this time in subprime mortgages, and then, inevitably, we suffered the Great Financial Crisis.

Look: there's no virtue in having bank regulations for the sake of having them. It is conceptually possible for bank regulations to be useless or even harmful. There's nothing wrong with investigating whether the 70-year old Glass-Steagall Act was still needed in 1999. But Clinton was provided with a mountain of evidence about why Glass-Steagall was the only thing standing between Americans and economic chaos, including the evidence of the S&L Crisis, which was still underway when he took office, and he ignored all of them. If you lost everything – your home, your savings, your pension – in the dot-bomb or the Great Financial Crisis, Bill Clinton is to blame. He was warned. he ignored the warnings.

Fuck that guy.

No, seriously, fuck Bill Clinton. Deregulating banks wasn't Clinton's only passion. He also wanted to ban working cryptography. The cornerstone of Clinton's tech policy was the "Clipper Chip," a backdoored encryption chip that, by law, every technology was supposed to use. If Clipper had gone into effect, then cops, spooks, and anyone who could suborn, bribe, or trick a cop or a spook could break into any computer, server, mobile device, or embedded system in America.

When Clinton was told – over and over, in small, easy-to-understand words – that there was no way to make a security system that only worked when "bad guys" tried to break into it, but collapsed immediately if a "good guy" wanted to bypass it. We explained to him – oh, how we explained to him! – that working encryption would be all that stood between your pacemaker's firmware and a malicious update that killed you where you stood; all that stood between your antilock brakes' firmware and a malicious update that sent you careening off a cliff; all that stood between businesses and corporate espionage, all that stood between America and foreign state adversaries wanting to learn its secrets.

In response, Clinton said the same thing that all of his successors in the Crypto Wars have said: NERD HARDER! Just figure it out. Cops need to look at bad guys' phones, so you need to figure out how to make encryption that keeps teenagers safe from sextortionists, but melts away the second a cop tries to unlock a suspect's phone. Take Malcolm Turnbull, the former Australian Prime Minister. When he was told that the laws of mathematics dictated that it was impossible to build selectively effective encryption of the sort he was demanding, he replied, "The laws of mathematics are very commendable but the only law that applies in Australia is the law of Australia":

https://www.eff.org/deeplinks/2017/07/australian-pm-calls-end-end-encryption-ban-says-laws-mathematics-dont-apply-down

Fuck that guy. Fuck Bill Clinton. Fuck a succession of UK Prime Ministers who have repeatedly attempted to ban working encryption. Fuck 'em all. The stakes here are obscenely high. They have been warned, and all they say in response is "NERD HARDER!"

https://pluralistic.net/2023/03/05/theyre-still-trying-to-ban-cryptography/

Now, of course, "crypto means cryptography," but the other crypto – cryptocurrency – deserves a look-in here. Cryptocurrency proponents advocate for a system of deregulated money creation, AKA "wildcat currencies." They say, variously, that central banks are no longer needed; or that we never needed central banks to regulate the money supply. Let's take away that fence. Why not? It's not fit for purpose today, and maybe it never was.

Why do we have central banks? The Fed – which is far from a perfect institution and could use substantial reform or even replacement – was created because the age of wildcat currencies was a nightmare. Wildcat currencies created wild economic swings, massive booms and even bigger busts. Wildcat currencies are the reason that abandoned haunted mansions feature so heavily in the American imagination: American towns and cities were dotted with giant mansions built by financiers who'd grown rich as bubbles expanded, then lost it all after the crash.

Prudent management of the money supply didn't end those booms and busts, but it substantially dampened them, ending the so-called "business cycle" that once terrorized Americans, destroying their towns and livelihoods and wiping out their savings.

It shouldn't surprise us that a new wildcat money sector, flogging "decentralized" cryptocurrencies (that they are nevertheless weirdly anxious to swap for your gross, boring old "fiat" money) has created a series of massive booms and busts, with insiders getting richer and richer, and retail investors losing everything.

If there was ever any doubt about whether wildcat currencies could be made safe by putting them on a blockchain, it is gone. Wildcat currencies are as dangerous today as they were in the 18th and 19th century – only moreso, since this new bad paper relies on the endless consumption of whole rainforests' worth of carbon, endangering not just our economy, but also the habitability of the planet Earth.

And nevertheless, the Trump administration is promising a new crypto golden age (or, ahem, a Gilded Age). And there are plenty of Democrats who continue to throw in with the rotten, corrupt crypto industry, which flushed billions into the 2024 election to bring Trump to office. The result is absolutely going to be more massive bubbles and life-destroying implosions. Fuck those guys. They were warned, and they did it anyway.

Speaking of the climate emergency: greetings from smoky Los Angeles! My city's on fire. This was not an unforeseeable disaster. Malibu is the most on-fire place in the world:

https://longreads.com/2018/12/04/the-case-for-letting-malibu-burn/

Since 1919, the region has been managed on the basis of "total fire suppression." This policy continued long after science showed that this creates "fire debt" in the form of accumulated fuel. The longer you go between fires, the hotter and more destructive those fires become, and the relationship is nonlinear. A 50-year fire isn't 250% more intense than a 20-year fire: it's 50,000% more intense.

Despite this, California has invested peanuts in regular controlled burns, which has created biennial uncontrolled burns – wildfires that cost thousands of times more than any controlled burn.

Speaking of underinvestment: PG&E has spent decades extracting dividends for its investors and bonuses for its execs, while engaging in near-total neglect of maintenance of its high-voltage transmission lines. Even with normal winds, these lines routinely fall down and start blazes.

But we don't have normal winds. The climate emergency has been steadily worsening for decades. LA is just the latest place to be on fire, or under water, or under ice, or baking in wet bulb temperatures. Last week in southern California, we were warned to expect gusts of 120mph.

They were warned. #ExxonKnew: in the early 1970s, Exxon's own scientists warned them that fossil fuel consumption would kick off climate change so drastic that it would endanger human civilzation. Exxon responded by burying the reports and investing in climate denial:

https://exxonknew.org/

They were warned! Warned about fire debt. Warned about transmission lines. Warned about climate change. And specific, named people, who individually had the power to heed these warnings and stave off disaster, ignored the warnings. They didn't make honest mistakes, either: they ignored the warnings because doing so made them extraordinarily, disgustingly rich. They used this money to create dynastic fortunes, and have created entire lineages of ultra-wealthy princelings in $900,000 watches who owe it all to our suffering and impending dooml

Fuck those guys. Fuck 'em all.

We've had so many missed opportunities, chances to make good policy or at least not make bad policy. The enshitternet didn't happen on its own. It was the foreseeable result of choices – again, choices made by named individuals who became very wealthy by ignoring the warnings all around them.

Let's go back to Bill Clinton, because more than anyone else, Clinton presided over some terrible technology regulations. In 1998, Clinton signed the Digital Millennium Copyright Act, a bill championed by Barney Frank (fuck that guy, too). Under Section 1201 of the Digital Millennium Copyright Act, it's a felony, punishable by a five year prison sentence, and a $500,000 fine, to tamper with a "digital lock."

That means that if HP uses a digital lock to prevent you from using third-party ink, it's a literal crime to bypass that lock. Which is why HP ink now costs $10,000/gallon, and why you print your shopping lists with colored water that costs more, ounce for ounce, than the sperm of a Kentucky Derby winner:

https://pluralistic.net/2024/09/30/life-finds-a-way/#ink-stained-wretches

Clinton was warned that DMCA 1201 would soon metastasize into every kind of device – not just the games consoles and DVD players where it was first used, but medical implants, tractors, cars, home appliances – anything you could put a microchip into (Jay Freeman calls this "felony contempt of business-model"):

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

He ignored those warnings and signed the DMCA anyway (fuck that guy). Then, under Bush (fuck that guy), the US Trade Representative went all around the world demanding that America's trading partners adopt versions of this law (fuck that guy). In 2001, the European Parliament capitulated, enacting the EU Copyright Directive, whose Article 6 is a copy-paste of DMCA 1201 (fuck all those people).

Fast forward 20 years, and boy is there a lot of shit with microchips that can be boobytrapped with rent-extracting logic bombs that are illegal to research, describe, or disable.

Like choo-choo trains.

Last year, the Polish hacking group Dragon Sector was contacted by a public sector train company whose Newag trains kept going out of service. The operator suspected that Newag had boobytrapped the trains to punish the train company for getting its maintenance from a third-party contractor. When Dragon Sector investigated, they discovered that Newag had indeed riddled the trains' firmware with boobytraps. Trains that were taken to locations known to have third-party maintenance workshops were immediately bricked (hilariously, this bomb would detonate if trains just passed through stations near to these workshops, which is why another train company had to remove all the GPSes from its trains – they kept slamming to a halt when they approached a station near a third-party workshop). But Newag's logic bombs would brick trains for all kinds of reasons – merely keeping a train stationary for too many days would result in its being bricked. Installing a third-party component in a locomotive would also trigger a bomb, bricking the train.

In their talk at last year's Chaos Communications Congress, the Dragon Sector folks describe how they have been legally terrorized by Newag, which has repeatedly sued them for violating its "intellectual property" by revealing its sleazy, corrupt business practices. They also note that Newag continues to sell lots of trains in Poland, despite the widespread knowledge of its dirty business model, because public train operators are bound by procurement rules, and as long as Newag is the cheapest bidder, they get the contract:

https://media.ccc.de/v/38c3-we-ve-not-been-trained-for-this-life-after-the-newag-drm-disclosure

The laws that let Newag make millions off a nakedly corrupt enterprise – and put the individuals who blew the whistle on it at risk of losing everything – were passed by Members of the European Parliament who were warned that this would happen, and they ignored those warnings, and now it's happening. Fuck those people, every one of 'em.

It's not just European parliamentarians who ignored warnings and did the bidding of the US Trade Representative, enacting laws that banned tampering with digital locks. In 2010, two Canadian Conservative Party ministers in the Stephen Harper government brought forward similar legislation. These ministers, Tony Clement (now a disgraced sex-pest and PPE grifter) and James Moore (today, a sleazeball white-shoe corporate lawyer), held a consultation on this proposal.

6, 138 people wrote in to say, "Don't do this, it will be hugely destructive." 54 respondents wrote in support of it. Clement and Moore threw out the 6,138 opposing comments. Moore explained why: these were the "babyish" responses of "radical extremists." The law passed in 2012.

Last year, the Canadian Parliament passed bills guaranteeing Canadians the Right to Repair and the right to interoperability. But Canadians can't act on either of these laws, because they would have to tamper with a digital lock to do so, and that's illegal, thanks to Tony Clement and James Moore. Who were warned. And who ignored those warnings. Fuck those guys:

https://pluralistic.net/2024/11/15/radical-extremists/#sex-pest

Back in the 1990s, Bill Clinton had a ton of proposals for regulating the internet, but nowhere among those proposals will you find a consumer privacy law. The last time an American president signed a consumer privacy law was 1988, when Reagan signed the Video Privacy Protection Act and ensured that Americans would never have to worry that video-store clerks where telling the newspapers what VHS cassettes they took home.

In the years since, Congress has enacted exactly zero consumer privacy laws. None. This has allowed the out-of-control, unregulated data broker sector to metastasize into a cancer on the American people. This is an industry that fuels stalkers, discriminatory financial and hiring algorithms, and an ad-tech sector that lets advertisers target categories like "teenagers with depression," "seniors with dementia" and "armed service personnel with gambling addictions."

When the people cry out for privacy protections, Congress – and the surveillance industry shills that fund them – say we don't need a privacy law. The market will solve this problem. People are selling their privacy willingly, and it would be an "undue interference in the market" if we took away your "freedom to contract" by barring companies from spying on you after you clicked the "I agree" button.

These people have been repeatedly warned about the severe dangers to the American public – as workers, as citizens, as community members, and as consumers – from the national privacy free-for-all, and have done nothing. Fuck them, every one:

https://pluralistic.net/2023/12/06/privacy-first/#but-not-just-privacy

Now, even a stopped clock is right twice a day, and not every one of Bill Clinton's internet policies was terrible. He had exactly one great policy, and, ironically, that's the one there's the most energy for dismantling. That policy is Section 230 of the Communications Decency Act (a law that was otherwise such a dumpster fire that the courts struck it down). Chances are, you have been systematically misled about the history, use, and language of Section 230, which is wild, because it's exactly 26 words long and fits in a single tweet:

No provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider.

Section 230 was passed because when companies were held liable for their users' speech, they "solved" this problem by just blocking every controversial thing a user said. Without Section 230, there would be no Black Lives Matter, no #MeToo – no online spaces where the powerful were held to account. Meanwhile, rich and powerful people would continue to enjoy online platforms where they and their bootlickers could pump out the most grotesque nonsense imaginable, either because they owned those platforms (ahem, Twitter and Truth Social) or because rich and powerful people can afford the professional advice needed to navigate the content-moderation bureaucracies of large systems.

We know exactly what the internet looks like when platforms are civilly liable for their users' speech: it's an internet where marginalized and powerless people are silenced, and where the people who've got a boot on their throats are the only voices you can hear:

https://www.techdirt.com/2020/06/23/hello-youve-been-referred-here-because-youre-wrong-about-section-230-communications-decency-act/

The evidence for this isn't limited to the era of AOL and Prodigy. In 2018, Trump signed SESTA/FOSTA, a law that held platforms liable for "sex trafficking." Advocates for this law – like Ashton Kutcher, who campaigns against sexual assault unless it involves one of his friends, in which case he petitions the judge for leniency – were warned that it would be used to shut down all consensual sex work online, making sex workers's lives much more dangerous. This warnings were immediately borne out, and they have been repeatedly borne out every month since. Killing CDA 230 for sex work brought back pimping, exposed sex workers to grave threats to their personal safety, and made them much poorer:

https://decriminalizesex.work/advocacy/sesta-fosta/what-is-sesta-fosta/

It also pushed sex trafficking and other nonconsensual sex into privateforums that are much harder for law enforcement to monitor and intervene in, making it that much harder to catch sex traffickers:

https://cdt.org/insights/its-all-downsides-hybrid-fosta-sesta-hinders-law-enforcement-hurts-victims-and-speakers/

This is exactly what SESTA/FOSTA's advocates were warned of. They were warned. They did it anyway. Fuck those people.

Maybe you have a theory about how platforms can be held civilly liable for their users' speech without harming marginalized people in exactly the way that SESTA/FOSTA, it had better amount to more than "platforms are evil monopolists and CDA 230 makes their lives easier." Yes, they're evil monopolists. Yes, 230 makes their lives easier. But without 230, small forums – private message boards, Mastodon servers, Bluesky, etc – couldn't possibly operate.

There's a reason Mark Zuckerberg wants to kill CDA 230, and it's not because he wants to send Facebook to the digital graveyard. Zuck knows that FB can operate in a post-230 world by automating the deletion of all controversial speech, and he knows that small services that might "disrupt" Facebook's hegemony would be immediately extinguished by eliminating 230:

https://www.nbcnews.com/tech/tech-news/zuckerberg-calls-changes-techs-section-230-protections-rcna486

It's depressing to see so many comrades in the fight against Big Tech getting suckered into carrying water for Zuck, demanding the eradication of CDA 230. Please, I beg you: look at the evidence for what happens when you remove that fence. Heed the warnings. Don't be like Bill Clinton, or California fire suppression officials, or James Moore and Tony Clement, or the European Parliament, or the US Trade Rep, or cryptocurrency freaks, or Malcolm Turnbull.

Or Ashton fucking Kutcher.

Because, you know, fuck those guys.

Check out my Kickstarter to pre-order copies of my next novel, Picks and Shovels!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/01/13/wanting-it-badly/#is-not-enough

#pluralistic#we told you so#told you so#foreseeable outcomes#enshittification#crypto cars#cryto means cryptography#data brokers#cda 230#section 230#230#newag#drm#copyfight#section 1201#wildcat money#backdoors#wanting it badly is not enough#dragon sector#great financial crisis#structural separation#guillotine watch#nerd harder

321 notes

·

View notes

Text

I don't see any confirmation that Justin Trudeau is moving to Cuba to reconnect with family, however. So is Carney any better?

Carney simultaneously believes cryptocurrency is not a real currency and that it must be regulated by Central Committee, to make certain it aligns with The New World Order. If it's not real, how do you regulate it? If it's just a fad, then shouldn't the people be allowed to choose to risk using it? Or is he afraid that if people are allowed to use Crypto, they cannot be totally controlled by The State? How do you impose a Social Credit System if people find a way to buy and sell goods even when they are blackbanned?

"I know that these are dark days. Dark days brought on by a country we can no longer trust," Carney said. He sounds like he fears America will soil his pyjamas.

The World Economic Forum has consistently ranked the Canadian banking system to be among the most effective financial systems in the world today (Navarro, 2011, p. 87).

With the backing of the WEF, he might well start a trade war with what they regard as a renegade leader to the New Regime. But how far can he go? Can Canada realistically crush America's economy? "In 2021, Carney became a board member of Stripe, a digital payments company." Stripe is the Internet Payments Monopoly, acting as a de facto Social Credit System. If they don't like the way you look, there is nothing stopping them from killing your business or even making you homeless. Does Stripe have enough power to make Trump submit?

Carney thus is in a unique position as a servant of The New World Order, able to decide who can do business and who cannot - and remember, the WEF helped freeze out cash payments during covid, as it was argued that they spread disease, and that if people used cash, they might commit crimes. Having everything tracked through centralised banking systems controlled by a few people with nearly identical politics and a contempt for the vast bulk of humanity might spell a disaster to some, but because I don't want my head blown off, I will hail the glorious new leader of Canada, and hope that his predecessor enjoys a lengthy retirement in Havana.

#bitcoin#cryptocurrency#control#new world order#wef#central control#social currency#banking#canada#mark carney#deep state#great financial crisis#stripe payment processor#internet transactions#monopoly

0 notes

Text

A Call for Critical Thinking

As the trade/tariff situation continues to unfold, American citizens are being warned of potential economic hardship. Phrases like "some pain" and "temporary hardship" downplay the severity of the situation. Seriously, Elon Musk was quoted as saying that last phrase. However, history reminds us that such language can be misleading.

The Great Depression, which lasted over 10 years, is a prime example. By definition, it was indeed a temporary hardship – but one that had a profound impact on generations. This historical context urges us to think critically about the language used to describe economic challenges. We must consider the potential consequences of such actions and demand transparency.

As American citizens, in fact, all of the world, it is essential to remain vigilant and informed. We should scrutinize the information presented, question the language used, and seek diverse perspectives. Only by doing so can we make informed decisions and prepare for the potential outcomes of this chaotic situation.

#economic hardship#trade war#tariff chaos#financial uncertainty#great depression#economic instability#political unrest#temporary hardship#elon musk#us trade policy#finacial crisis#american citizens#trade tariffs#economic consequences#anti trump#anti musk#felon and the melon#call to action#boycott#resist

21 notes

·

View notes

Text

do people have money for commissions. stares at you blankly

#personal#got paid 75 euro less than expected so i am once again in financial crisis & about to set a government building on fire#if i can just get like two of them that'd be great... not rbing my commissions post yet i'm just testing the waters. but info in my pinned

4 notes

·

View notes

Text

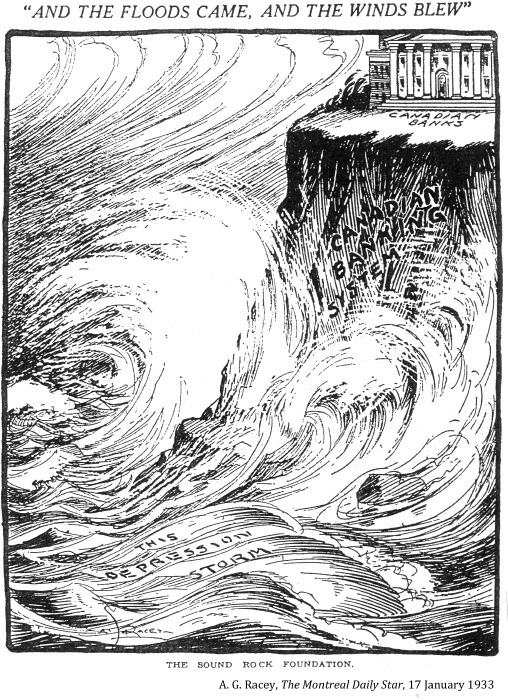

"AND THE FLOODS CAME, AND THE WINDS BLEW"," A. G. Racey, Montreal Star. January 17, 1933. ---- The DEPRESSION STORM crashes against the rocks of the CANADIAN BANKING SYSTEM, atop which sits serenely CANADIAN BANKS

#montreal#banking system#canadian banking system#financial capitalism#capitalism in canada#great depression in canada#capitalism in crisis#financial crisis#political cartoons

1 note

·

View note

Text

Currently at a crossroads with a lot of stuff I would really rather not be facing and this time in my life happens to coincide with a reunion of my dad's side of the family that has been planned for months. I have been mostly estranged from these folks for most of my adult life and have been trying to rebuild a bit in recent years... They all live very different (and successful) lives though and it's so hard for me to feel like a part of the family

#quietly sat in the living room as my monied extended relatives discussed with great sympathy the lack of safety nets in place in america#how most of the population is one minor crisis away from financial ruin#and the knowledge that I was the only person in that room who lives that exact reality was uh. Heavy#word processing

1 note

·

View note

Link

#great recession#recession#2008 financial crisis#2011#liquidity trap#working class#labor#economy#economics#unemployment#fiscalpolicy#fiscal policy#monetarypolicy#monetary policy#federal reserve

0 notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

yeahhhhh pretty much, except the only thing is it's less individual investors and more Hedge Funds.

Hedge funds use algorithms to maximize profits by any means necessary, up to and including certain tactics that will deliberately tank a stock. If it's not performing well or if they just don't want it to, they can bet against it and whip out a variety of bullshit of varying legality to push the share price down, which causes other HFs to sell to stay ahead of the market, which leads portfolio managers and accountants and regular folks to sell, and then when the selloffs are done the original HFs make fucking bank off strangling the stock. (This also works in reverse: betting a stock will rise, baiting others to buy in, profit, then bet against it again)

So a "strong" company is one with lots of gains and very few/short losses (harder to break/less room to manipulate, generally Big Name stocks like Disney/Apple/etc) whereas a "weak" company with more losses than gains or lots of volatility is a prime target for the piranhas. The people running companies are terrified of stagnation, let alone losses, because it can very, very easily be taken advantage of and even outright kill the company in just a few weeks or months. Perpetual growth is virtually required to survive the market as it is today.

Individual, casual/hobbyist investors with at most a couple dozen shares in a handful of companies don't have the numbers/margins to seriously affect a stock price. Even hobbyist/semipro "traders" who obsess/hoard and attempt to imitate The Big Guys are comparitively few in number and just don't have the weight to affect much more than their own account balance. But hedge funds do have MASSIVE weight in the market, throwing around thousands of shares at a time, several times a day, for dozens of different tickers, in multiple markets and across multiple industries.

And then there are "market makers." These are giant companies whose SOLE purpose is to manipulate the market ensure "market liquidity," or, "a buy for every sell, a sell for every buy." What this means is that if demand is high but there aren't enough shares available to sell, they make more by "borrowing" them, potentially infinitely. If these market makers feel a stock is too "overvalued," they can dump loads of those borrowed shares to saturate the market and drive the price back down. There is extremely little regulation on this, which leads to situations where the same one share can have dozens or hundreds of "owners."

This can happen because regular everyday investors don't actually "own" stock at all. Like, very literally, their "shares" are 1) not real and 2) can be liquidated by their brokers at any time, because, as the go-between third party, their brokers own the shares "on their behalf," and brokers essentially just "deliver" digital IOUs. All Actual Real Shares are held in the DTCC by a company called Cede & Co, and everything else is traded on credit.

If you buy a "share" in a company through a broker, it's not your name on the company shareholder list, it's your broker's. If you're submitting paperwork to your broker for voting for that company's policies at their annual meeting, your broker is pooling aaaaall the votes and "proportionally" voting "on your behalf." And your broker can decide to lend out your shares without telling you (to their own profit) and you may or may not ever get them back -- this is called "failure to delivers" or FTDs and there is a massive backlog of them that just ... never get addressed.

this is hella over-summarized and sloppy but the tl;dr is that supply and demand economics are beyond broken, the entire stock market is more fake than you ever imagined, it's propped up entirely by computer programs trading IOUs-of-IOUs-of-IOUs, and is easily manipulated at the literal whim of bank-and-billionaire proxies.

companies really have got to be okay with stagnant profits. what is wrong with earning the same amount every year? why does it always have to be more? it's not sustainable. there are only so many people on the planet you can profit from 😭

#stock market#it was a hyperfixation i try to forget#but sometimes i ... cannot#it still makes me so ANGRY#its a bernie madoff wet dream#and there is just SO MUCH INFO to try and organize and communicate#like i could prob make a nice masterpost with a cpl days of prep#but i rly can't right now bc irl stuff#and i shouldn't#BUT IM SO TEMPTED#a great primer tho is Jon Stewart's episode on Dark Pools#anyways#rambles#FUCKING STOCK MARKET AAAAAAAA#financial law enforcement can take YEARS and fines are often LESS THAN 5% OF PROFITS FROM THE CRIME#and they reversed the last charges from the 2008 crisis#and they're still fuckin DOIN THE SAME SHIT#when it finally implodes its gonna be like. so ungodly bad#it was never supposed to be this#it was supposed to be regular ppl supporting good companies products and employers#until a handful of ppl figured out how to turn it into a terrifyingly efficient money printing game#with a 0% chance of legal consequences#and 'only' like a 5% chance of total economic annihilation via catastropic chain reactive system failure#aaaaaAAAAAAAAAA okay. okay im done#im done im good im... letting go now#going back to normal. i can be done. i can.#sorry

64K notes

·

View notes

Text

It has been 8 months since I lost insurance coverage, after the insurance people said there shouldn't be a lapse, and it has been complete radio silence from them. I have been put on generic government coverage, which really isn't much when you're not able bodied 🙃

The next time I hear someone say Canada has "✨Free Universal Healthcare✨" they're gonna have to pay my medical expenses.

#like im so so lucky that my parents can pay for me. i am so expensive and i feel so guilty about it.#i cant even see my therapist as often as i need because we literally cannot afford it.#and we have to pay for all of my medications. which arent cheap.#and theres god knows what other expenses my parents dont tell me about so i dont feel bad.#like. i get that comparatively things are pretty good here. however. this shit SUCKS!!!!!#and im so done hearing people say how great it is. because it isnt.#im telling you now. the bar is on the floor. you deserve better than this bullshit.#this angry post was prompted by me having to take pills i dropped that fell under the fridge because theyre too expensive to waste.#and also the fact that im somehow supposed to do trauma therapy once a month when my therapist wants to see me like. weekly.#before you freak out. im not in a financial crisis. things are being paid. it is fine. im just mad.#batty blogging#text

1 note

·

View note

Text

I’m literally just venting below to get it out of my head feel free to ignore

#my great aunt who was previously diagnosed with leukemia like three weeks ago was emergency intubated today and is on 100% oxygen#and yesterday my grandma had told her that she needed to spend a few days back home to rest because she had been at my great aunts bedside#for the last two weeks straight and my great aunt was guilting her super hard about taking some time to rest and come back to va#so yesterday I was really angry at my great aunt because my grandma got off the phone with my great aunt and was just sobbing for like an#hour and wouldn’t accept that none of this is her fault and she shouldn’t feel guilty#and my grandma was saying how we’re going to make a schedule so that everyone has a turn to go down there so she’s not alone#and i was trying to think about how I was going to go down there and be supportive even though I’m really angry at her for guilting my#grandma for not being there every second of the day when my grandma has HER OWN cancer that my great aunt has never once tried to care for#her because of and then this morning (literally during my first Pap smear by the way lol) I start getting a crap ton of texts#that my great aunt was emergency intubated and her lungs are like entirely being operated by the ventilator and I feel bad cause for a#minute I was relieved because my grandma said she’s completely sedated and won’t know if anyone is there or not so she was going to take a#few days to rest and wasn’t going to rush down there#and then a few minutes later she got off the phone with my great aunts doctor and he was saying she’s in critical#condition and that they’re doing a scope test to see how it went bad so fast and that they think with chemo over the last few days that they#may have gotten rid of the leukemia but that her lungs are filling up with some sort of fluid and won’t operate on their own#and on top of that yesterday my uncle (separate from my great aunt) was driving drunk on his way to work (at 4 am) and got sideswiped by a#truck who then drove away and my uncle refuses to call the police or the insurance because he had a ton of open alcohol in the car and#wouldn’t pass a breathylizer and his car needed to be towed and he had some sort of midlife crisis and bought said 45000 dollar truck#earlier in the year could he pay for that? no he couldn’t so he borrowed some from his retirement to help make the payments#and now my aunt (grandmas daughter) is struggling because of this and they’re going through a real hard time financially#and all of this is very stressful on my grandma and I can’t do anything to help I keep calling people asking if they need anything if theyre#alright and I have absolutely no idea how I’m feeling I feel like I’ve spun that children’s feelings wheel and the arrow has landed on half#the board somehow lol#I’m scared that my great aunt is going to die and I’m angry at her for telling my grandmother she made it worse by leaving and I feel guilty#for being angry at someone who might be dying and I feel guilty because I am sick of this being on egg shells what’s going to happen next#and I’m scared for my grandma who has her own health issues and is making the trip back to Florida to go be with my great aunt and won’t be#back for three weeks and I can’t protect anyone#I don’t know what I’m supposed to do

0 notes

Text

Here's the thing: imagine if we fixed the housing market, so that the price of housing only increased to match inflation. That would be great, right? Except, homeowners typically spend $2000-$10000 per year on maintenance. So homeownership would go from an investment to an endless money pit, just like renting. The idea of a house as an investment, a house as a way to build wealth, requires that housing prices increase faster than inflation forever, which means that the burden of housing costs on working people must keep increasing forever, and the number of homeless people must keep increasing forever.

The housing crisis isn't just a result of greedy landlords and investors. It's an inevitable result of social policies that encourage people to treat their houses as in investment. Because once a homeowner internalizes the idea that their financial future depends on housing prices going up, they start favoring policies (such as NIMBYism) that make housing prices go up.

Conversely, if we want to end homelessness for good, we need to accept that housing is someone we'll all have to continuously pour resources into, because buildings are complex physical objects that break a lot.

23K notes

·

View notes

Text

Banks are predatory scum

1 note

·

View note

Photo

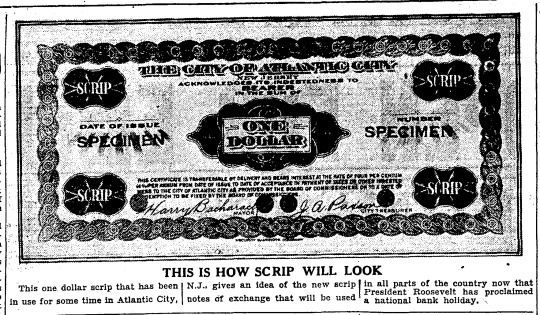

“THIS IS HOW SCRIP WILL LOOK,” Toronto Star. March 7, 1933. Page 2. ---- This one dollar scrip that has been in use for some time in Atlantic City, N.J.. gives an idea of the new scrip in all parts of the country now that President Roosevelt has proclaimed notes of exchange that will be used a national bank holiday.

#atlantic city#scrip#scrip currency#depression scrip#fdr#bank holiday#financial capitalism#financial crisis#capitalism in crisis#the great depression#united states history

1 note

·

View note

Text

I've had this post in my drafts for awhile. The week after Easter seems like a good time to reinforce this.

The +++Positives+++ keep saying that they are going to buy the BJU campus.

Honeys. First, you have to get the Board to agree to sell it to you. You have positioned yourselves in a zero sum game with the Board, so they aren't going to ever agree to that.

Secondly, you will not be able to raise $200 million. With all your IPTAY dreams, that is not going to happen.

Grow up, kids.

#Bob Jones University#Closure#Positive BJU Grads#POS BJU#PBJU#Financial Crisis#Make BJU Close#Make BJU Great Again#Make Pettit Prez Again#Rick Altizer

1 note

·

View note