#michael hudson

Explore tagged Tumblr posts

Text

Malthusianism/Ecofascism and the International Monetary Fund/World Bank

[excerpted from my copy of Michael Hudson's Super-Imperialism, 2nd edition, section II chapter 7]

[michael hudson then describes the Partners in Development (1969) program and its ill-suitedness to the actual task at hand & the necessity to reform the agricultural production to support high-value-added production, which the program ignores]

#super-imperialism#no alt text#michael hudson#marxism#political economy#imperialism#us imperialism#text screenshots#imf#world bank#ref#resources

212 notes

·

View notes

Text

Bankruptcy is very, very good

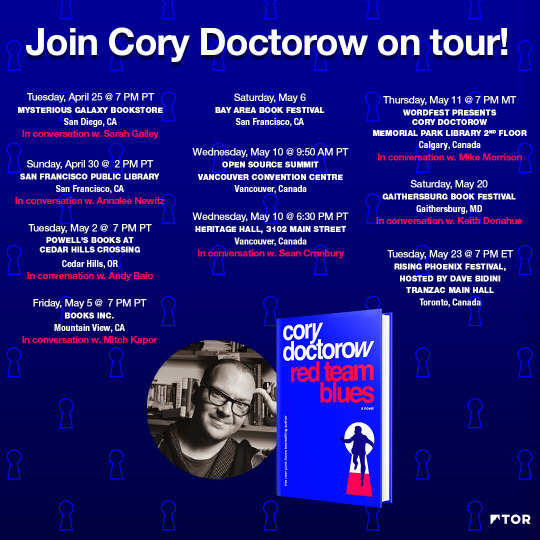

On THURSDAY (June 20) I'm live onstage in LOS ANGELES for a recording of the GO FACT YOURSELF podcast. On FRIDAY (June 21) I'm doing an ONLINE READING for the LOCUS AWARDS at 16hPT. On SATURDAY (June 22) I'll be in OAKLAND, CA for a panel and a keynote at the LOCUS AWARDS.

There's a truly comforting sociopathy snuggled inside capitalism ideology: if markets are systems for identifying and rewarding virtue, ability and value, then anyone who's failing in the system is actually unworthy, not unlucky; and that means the winners are not just lucky (and certainly not merely selfish), but actually the best and they owe nothing to their social inferiors apart from what their own charitable impulses dictate.

It's an economic wrapper around the old theological doctrine of providence, whereby God shows you whom he favors by giving them wealth and station, and marks out the wicked by miring them in poverty. And like the religious belief in providence, the capitalist belief in meritocracy is essential to resolving cognitive dissonance: it lets the fed winners feel morally justified in stepping over the starving losers.

The debate over merit and luck has been with us for millennia, and even the hereditary absolute monarchs of the Bronze Age had to find a way to resolve it. For the rulers of antiquity, the way to square that circle was jubilee.

Bronze Age jubilees were periodic celebrations in which all debts were canceled. Different kingdoms had different schedules for jubilees, but imagine some mix of "every x years" and "every time a new ruler takes the throne" and "every time something really portentous happens." To modern sensibilities, the idea that we would simply wipe away all debts every now and again is almost inconceivable. Why would any society practice jubilee? More importantly, how could a ruler get the wealthy creditor class to countenance a jubilee, rather than seeking a revolutionary overthrow?

The best answers to this question can be found in the scholarship of historian Michael Hudson, who has written extensively on the subject. Hudson doesn't just write for a scholarly audience, he's also a fantastic communicator with a real commitment to bringing his research to lay audiences:

https://michael-hudson.com/

Hudson's most famous saying is "debts that can't be paid, won't be paid." It's in this dense little nugget that we can find the answer the the riddle of jubilee:

https://pluralistic.net/2021/09/29/jubilance/#debt

Let's start with a simple model of debt and credit in an agricultural society. In agricultural societies, everything exists downstream of farming, which is the core activity of the civilization. If the farmers succeed, everyone can eat, and that means they can do all the other things, all the not-farming work of your society.

To farm successfully, you need credit. Farmers enter the growing season in need of inputs: seed, fertilizer, labor; they need still more labor during the harvest. Without some way to acquire these inputs before the farmer has a crop that can pay for them, there can be no crop.

No wonder, then, that the earliest "money" we have a record of is ancient Babylonian credit ledgers that record the debts of farmers who borrow against the next crop to pay for the materials and labor they'll need to grow it. Debt, not barter, is the true origin of money. The fairy tale that coin money arose spontaneously to help bartering marketgoers facilitate trade has no historical evidence, while Babylonian ledgers can be seen in person in museums all over the world.

Farming requires an enormous amount of skill, but even the most skillful farmer is a prisoner of luck. No matter how good you are at farming, no matter how hard you work, no matter how carefully you plan, you can still lose a harvest to blight, drought, storms or vermin.

So over time, every farmer loses a crop. When that happens, the farmer can't pay off their debts and must roll them over and pay them off with future harvests. That means that over time, the share of each harvest the farmer has claim to goes down. Thanks to compounding interest, no bumper crop can erase the debts of the bad harvests.

That means that, over time, "farmer" becomes a synonym for "debtor." Farmers' productive output is increasingly claimed by the rich and powerful. No matter how badly everyone needs food, the whims of the hereditary creditor class come to dictate the country's agricultural priorities. More ornamental flowers for the tables of the wealthy, fewer staple crops for the masses. "Creditor" and "debtor" no longer describe economic relations – they become hereditary castes.

That's where jubilee comes in. Without some way to interrupt this cycle of spiraling debt, society becomes so destabilized that the system collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

In other words: debts that can't be paid, won't be paid. Either you wipe away the farmers' debts to the creditor class, or your society collapses, and with it, the political relations that made those debts payable.

Jubilee is long gone, but that doesn't mean that debts that can't be paid will get paid. Modern society has filled the jubilee gap with bankruptcy, a legal process for shriving a debtor of their debts.

Bankruptcy takes many forms. The most important split in bankruptcy types is between elite bankruptcy and the bankruptcy of the common person. The limited liability company was created to allow people with money to pool their funds to back corporations without being responsible for their debts. This "capital formation" is considered "efficient" by economists because it creates the backing for big, ambitious projects, from colonizing and extracting the wealth of distant lands (Hudson's Bay Company) to spinning up global manufacturing supply chains (Apple).

Limited liability means that companies can take on debt without exposing their investors to risks beyond their capital stake. If you buy $1,000 worth of Apple stock, that's all you stand to lose if Apple makes bad decisions. Apple may rack up billions in liabilities – say, by abusing its subcontractor workforce – but Apple's owners aren't on the hook for it.

Economists like this because it means that you can invest in Apple without having to be privy to its daily management decisions, which means that Apple can accumulate huge pools of capital, "lever them up" by borrowing even more, and then put all that money to work on R&D, product development, marketing, and, of course, "incentives" for key employees and managers.

But limited liability also does a lot of work in the political sphere. Once an individual crosses a certain wealth threshold, they become an LLC. Accountants and wealth managers and financial planners insist on this. For freelancers and other sole practitioners, the benefits of forming an LLC are modest – a few more tax write-offs and the ability to get a business credit-card with slightly superior perks.

But for the truly wealthy, transforming yourself into the "natural person" at the center of a vast pool of LLCs is essential because it allows you to accumulate and shed debts. You can secretly own rental properties and abuse your tenants, accumulate vast liabilities as local authorities pile fine upon fine, and then simply dispose of the LLC and its debts. Plan this gambit carefully enough and the debtor LLC will have no assets in its bankruptcy estate apart from the crumbling apartment building, and its most senior secured creditor will be another of your LLCs. This lets the slumlord move an apartment block from one pocket to another, leaving the debt behind.

For the corporate person, shedding debts through bankruptcy is an honorable practice. Far from being a source of shame, the well-timed, well-structured bankruptcy is just evidence of financial acumen. Think of the private equity looters who buy a company by borrowing against it, pay themselves a huge "special dividend," then wipe away the debt by taking the company bankrupt (which also lets them shed obligations to suppliers, workers, and especially, retirees and their pensions). As Trump (a serial bankrupt who has stiffed legions of contractors and creditors) would say, "That makes me smart."

The apotheosis of elite bankruptcy is found in massive corporate bankruptcies, in which a corporation kills and maims huge numbers of people, then maneuvers to get its case heard in one of three US federal courtrooms where specialist judges rubber-stamp "involuntary third-party releases" that wipe out the company's obligations to it victims for pennies on the dollar, while the company gets to keep billions:

https://pluralistic.net/2021/07/29/impunity-corrodes/#morally-bankrupt

This process was so flagrantly abused by companies like Johnson & Johnson (which spent years knowingly advising women to dust their vulvas with asbestos-tainted talc, creating an epidemic of grotesque and lethal genital cancers) that it is finally generating some scrutiny and pushback:

https://pluralistic.net/2023/02/01/j-and-j-jk/#risible-gambit

But the precarious state of elite bankruptcies has more to do with the personal corruption of the small cabal of judges who run the system than public outrage over their rulings; like that one judge in Texas who was secretly fucking the lawyer whose clients he was also handing hundreds of millions of dollars to:

https://pluralistic.net/2023/10/16/texas-two-step/#david-jones

Certainly, we don't hear much about the "moral hazard" of allowing the Sackler opioid family to keep as much as ten billion dollars in the family's offshore accounts while walking away from the victims of their drug-pushing empire, no matter what bizarre tricks they deploy in pulling off the stunt:

https://pluralistic.net/2023/08/11/justice-delayed/#justice-redeemed

But when it comes to canceling the debts of normal people, the "moral hazard" is front and center. If you're a person who borrowed $79k in student loans, paid back $190k and still owe $236k, we can't cancel your debt, because of the message that would send to other people who want to (checks notes) get an education:

https://pluralistic.net/2020/12/04/kawaski-trawick/#strike-debt

The anti-jubilee side also wants us to think of the poor creditors: who would loan money to the next generation of students if student debt cancellation was a possibility? Of course, these are federally guaranteed loans, risk-free, free money for people who already have money, a kind of UBI for the people who need it least. The idea that this credit pool would dry up if you were limited to only collecting the debts that can be paid – rather than insisting that debts that can't be paid still be paid – elevates the hereditary creditor class to a kind of fragile, easily frightened, endangered species.

But the most powerful arguments against bankruptcy are rooted in the idea of providence. In an efficient market, anyone who goes bankrupt was necessarily reckless. They were entrusted with credit they weren't entitled to, because they lacked the intrinsic merit that would let them manage that credit wisely. Letting them walk away from their debts means that they will never learn from their mistakes, and that their fellow born-to-be-poors will learn the wrong thing from those debts: that there's an easy life in borrowing, spending, and discharging your debts in bankruptcy.

As it happens, this is an empirically testable proposition. If this view of personal bankruptcy as a personal failure is correct, then people who go bankrupt and live to borrow again should end up bankrupt again, too. On the other hand, if we accept the jubilee view – that debt is the result of accumulated misfortunes, often including the misfortune of birth into poor station – then bankruptcy represents a second chance with an opportunity to dodge misfortune.

In a new study from IZA Institute of Labor Economics's Gustaf Bruze, Alexander Kjær Hilsløv and Jonas Maibom, we get just such an empirical analysis. It's called "The Long-Run Effects of Individual Debt Relief," and it examines the lives of people for a full quarter-century after a bankruptcy:

https://docs.iza.org/dp17047.pdf

The study follows Danish bankruptcies following the introduction of continental Europe's first modern bankruptcy system, which Denmark instituted in 1984. Prior to that, the Danes – like most of Europe – did not allow for a discharge of personal debt through bankruptcy. Instead, a debtor who went bankrupt would be expected to have about 20% of their lifetime wages garnished to pay back their creditors, until the debts were repaid or they died (whichever came first).

After 1984, Denmark bankruptcy system imported features of US/UK/Commonwealth bankruptcy, including the ability to restructure and discharge your debts. Not everyone is eligible for this kind of bankruptcy: there's a bureaucratic system that verifies that people seeking bankruptcy discharge don't have a lot of assets that could go to their creditors.

But for the (un)lucky people who qualify for bankruptcy discharges, there's a fascinating natural experiment in which the fortunes of people who see debt relief can be compared to bankrupt people who couldn't get their debts wiped out.

It turns out that the Bronze Age has a thing or two to teach us. Here's the headline finding: people who discharge their debts in bankruptcy experience "a large increase in earned income, employment, assets, real estate, secured debt, home ownership, and wealth that persists for more than 25 years after a court ruling."

After people are given the benefits of bankruptcy, they are less likely to rely on public benefits. They get better jobs. Their families live better lives. Their creditors get some of their money back (which is all they can realistically expect, since "debts that can't be paid, won't be paid").

As Jason Kilborn writes for Credit Slips, "the benefits of debt relief are not only substantial but robust, as debtors learn their lesson (if there was one to learn) about managing their finances, and they capitalize (literally) on their fresh start."

Score one for the luck-based theory of wealth, and minus one for the providential meritocracy hypothesis.

Americans should take note of these findings. After all, Danes are insulated from the leading American cause of bankruptcy: medical debts. In America, breaking a bone or getting cancer or even kidney stone can wipe out a lifetime of hard work, careful planning and prudential spending. The US refuses to seriously grapple with this problem. The best we can come up with is the (welcome, but tiny) step of banning credit bureaux from trashing your credit score because of your medical debt:

https://www.whitehouse.gov/briefing-room/statements-releases/2024/06/11/fact-sheet-vice-president-harris-announces-proposal-to-prohibit-medical-bills-from-being-included-on-credit-reports-and-calls-on-states-and-localities-to-take-further-actions-to-reduce-medical-debt/

Millennia ago, everyone understood that debts that can't be paid, won't be paid, and they created a system for discharging debts and freeing productive people from the tyranny of accumulated liabilities, to the benefit of all. Dismantling that system required us to invent an elaborate theological system and dress it up in economic language.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/17/lovilee-jubilee/#debts-that-cant-be-paid-wont-be-paid

#pluralistic#debt#debts that cant be paid wont be paid#jubilee#denmark#great danes#bankruptcy#second chances#scholarship#economics#iza#Gustaf Bruze#Alexander Kjær Hilsløv#Jonas Maibom#michael hudson

323 notes

·

View notes

Text

𝐍𝐚𝐭𝐢𝐯𝐞 𝐀𝐦𝐞𝐫𝐢𝐜𝐚𝐧 𝐟𝐚𝐜𝐞𝐜𝐥𝐚𝐢𝐦 𝐆𝐈𝐅𝐬 𝐩𝐭 𝟒

Michael Hudson in Crooked Arrows 2012

#native american#face claim#native#crooked arrows#lacross#michael Hudson#native face claim#indigenous#mohawk#mohawk tribe#male model#indigenous face claim#first nation

20 notes

·

View notes

Text

Why all of sudden is France trending…

youtube

youtube

youtube

:

:

France and NATO

:

:

youtube

:

youtube

:

Men in Blue” in Crocus City

:

:

:

3 notes

·

View notes

Text

Tall Tales Character Introduction: Michael Hudson.

In which TikTok finally lets me upload a video about Michael, but not the one I originally tried to upload.

5 notes

·

View notes

Text

Yves here. One asset America has that most anti-globalists overlook is our legal and court system. The value of foreign exchange transactions due to investment flows was estimated by the Bank of International Settlements at 60 times that of transactions related to trade, although cross border capital flows collapse during financial crises.

Investors greatly prefer transacting though US institutions due to our well-settled precedents. Recall that multinationals investing in Russia as well as some Russian corporations, were often loath to invest directly. They would would go through Cyprus to be subject to English law and a court system run on UK lines. I’ve belatedly come to the view that the reason Cyprus banks blew up in 2013 and were not rescued was the power that be wanted to impede foreign investment in Russia.

That is not to say that US hegemony isn’t past its sell-by date, but that the idea that a new system will come into being soon is way way overdone. I’m of the Gramsci view:

The crisis consists precisely in the fact that the old is dying and the new cannot be born; in this interregnum a great variety of morbid symptoms appear.

By Michael Hudson, a research professor of Economics at University of Missouri, Kansas City, and a research associate at the Levy Economics Institute of Bard College. His latest book is The Destiny of Civilization.

Herodotus (History, Book 1.53) tells the story of Croesus, king of Lydia c. 585-546 BC in what is now Western Turkey and the Ionian shore of the Mediterranean. Croesus conquered Ephesus, Miletus and neighboring Greek-speaking realms, obtaining tribute and booty that made him one of the richest rulers of his time. But these victories and wealth led to arrogance and hubris. Croesus turned his eyes eastward, ambitious to conquer Persia, ruled by Cyrus the Great.

Having endowed the region’s cosmopolitan Temple of Delphi with substantial silver and gold, Croesus asked its Oracle whether he would be successful in the conquest that he had planned. The Pythia priestess answered: “If you go to war against Persia, you will destroy a great empire.”

Croesus therefore set out to attack Persia c. 547 BC. Marching eastward, he attacked Persia’s vassal-state Phrygia. Cyrus mounted a Special Military Operation to drive Croesus back, defeating Croesus’s army, capturing him and taking the opportunity to seize Lydia’s gold to introduce his own Persian gold coinage. So Croesus did indeed destroy a great empire, but it was his own.

Fast-forward to today’s drive by the Biden administration to extend American military power against Russia and, behind it, China. The president asked for advice from today’s analogue to antiquity’s Delphi oracle: the CIA and its allied think tanks. Instead of warning against hubris, they encouraged the neocon dream that attacking Russia and China would consolidate its control of the world economy, achieving the End of History.

Having organized a coup d’état in Ukraine in 2014, the United States sent its NATO proxy army eastward, giving weapons to Ukraine to fight an ethnic war against its Russian-speaking population and turn Russia’s Crimean naval base into a NATO fortress. This Croesus-level ambition aimed at drawing Russia into combat and depleting its ability to defend itself, wrecking its economy in the process and destroying its ability to provide military support to China and other countries targeted as rivals by U.S. hegemony.

After eight years of provocation, a new military attack on Russian-speaking Ukrainians was conspicuously prepared to drive toward the Russian border in February 2022. Russia protected its fellow Russian-speakers from further ethnic violence by mounting its own Special Military Operation. The United States and its NATO allies immediately seized Russia’s foreign-exchange reserves held in Europe and North America, and demanded that all countries impose sanctions against importing Russian energy and grain, hoping that this would crash the ruble’s exchange rate. The Delphic State Department expected that this would cause Russian consumers to revolt and overthrow Vladimir Putin’s government, enabling U.S. maneuvering to install a client oligarchy like the one it had nurtured in the 1990s under President Yeltsin.

A byproduct of this confrontation with Russia was to lock in control over America’s Western European satellites. The aim of this intra-NATO jockeying was to foreclose Europe’s dream of profiting from closer trade and investment relations with Russia by exchanging its industrial manufactures for Russian raw materials. The United States derailed that prospect by blowing up the Nord Stream gas pipeline, cutting off Germany and other countries from access to low-priced Russian gas. That left Europe’s leading economy dependent on higher-cost U.S. Liquified Natural Gas (LNG).

In addition to having to subsidize domestic European gas to prevent widespread insolvency, a large proportion of German Leopard tanks, U.S. Patriot missiles and other NATO “wonder weapons” were destroyed in combat against the Russian army. It became clear that the U.S. strategy was not simply to “fight to the last Ukrainian,” but to fight to the last tank, missile and other weapon being deleted from NATO stocks.

This depletion of NATO’s arms was expected to create a vast replacement market to enrich America’s military-industrial complex. Its NATO customers are being told to increase their military spending to 3 or even 4 percent of GDP. But the weak performance of U.S. and German arms may have crashed this dream, along with Europe’s economies sinking into depression. And with German ‘s industrial economy deranged by the severing of its trade with Russia, German Finance Minister Christian Lindner told the Die Welt newspaper on June 16, 2023 that his country cannot afford to pay more money into the European Union budget, to which it has long been the largest contributor.

Without German exports supporting the euro’s exchange rate, the currency will come under pressure against the dollar as Europe buys LNG and NATO replenishes its depleted weaponry stocks by buying new arms from America. A lower exchange rate will squeeze the purchasing power of European labor, while lower social spending to pay for rearmament and provide gas subsidies threatens to plunge the continent into a depression.

A nationalist reaction against U.S. dominance is rising throughout European politics, and instead of America locking in its control over European policy, the United States may end up losing – not only in Europe but throughout the Global South. Instead of turning Russia’s “ruble to rubble” as President Biden promised, Russia’s balance of trade has soared and its gold supply has increased. So have the gold holdings of other countries whose governments are now aiming to de-dollarize their economies.

It is American diplomacy that is driving Eurasia and the Global South out of the U.S. orbit. America’s hubristic drive for unipolar world dominance could only have been dismantled so rapidly from within. The Biden-Blinken-Nuland administration has done what neither Vladimir Putin nor Chinese President Xi could have hoped to achieve in so short a period. Neither was prepared to throw down the gauntlet and create an alternative to the U.S.-centered world order. But U.S. sanctions against Russia, Iran, Venezuela and China have had the effect of protective tariff barriers to force self-sufficiency in what EU diplomat Josep Borrell calls the world “jungle” outside of the US/NATO “garden.”

Although the Global South and other countries have been complaining ever since the Bandung Conference of Non-Aligned Nations in 1955, they have lacked a critical mass to create a viable alternative. But their attention has now been focused by the U.S. confiscation of Russia’s official dollar reserves in NATO countries. That dispelled the thought of the dollar as a safe vehicle in which to hold international savings. The Bank of England’s earlier seizure of Venezuela’s gold reserves kept in London – promising to donate it to whatever unelected opponents of its socialist regime U.S. diplomats designate – shows how the euro as well as the dollar have been weaponized. And by the way, what ever happened to Libya’s gold reserves?

American diplomats avoid thinking about this scenario. They rely to the one unique advantage the United States has to offer. It may refrain from bombing them, from staging a color revolution to “Pinochet” them by the National Endowment for Democracy, or install a new “Yeltsin” giving the economy away to a client oligarchy.

But refraining from such behavior is all that America can offer. It has de-industrialized its own economy, and its idea of foreign investment is to carve out monopoly-rent seeking opportunities by concentrating technological monopolies and control of oil and grain trade in U.S. hands, as if this is economic efficiency, not rent-seeking.

What has occurred is a change in consciousness. We are seeing the Global Majority trying to create an independent and peacefully negotiated choice as to just what kind of an international order they want. Their aim is not merely to create alternatives to the use of dollars, but an entire new set of institutional alternatives to the IMF and World Bank, the SWIFT bank clearing system, the International Criminal Court and the entire array of institutions that U.S. diplomats have hijacked from the United Nations.

The upshot will be civilizational in scope. We are seeing not the End of History but a fresh alternative to neoliberal finance capitalism and its junk economics of privatization, class war against labor, and the idea that money and credit should be privatized in the hands of a narrow financial class instead of being a public utility to finance economic needs and rising living standards..

#michael hudson#naked capitalism#nato#russia#united states#ukraine#ukraine conflict#the end of history

2 notes

·

View notes

Text

Ενώ οι ΗΠΑ προκαλούν χάος, η Κίνα προάγει την οικονομική ανάπτυξη (Radhika Desai, Michael Hudson, Mick Dunford)

Ενώ οι ΗΠΑ προκαλούν χάος, η Κίνα προάγει την οικονομική ανάπτυξη Ενώ οι ΗΠΑ προκαλούν συγκρούσεις σε όλο τον κόσμο, η Κίνα έχει προωθήσει την οικονομική ανάπτυξη, βγάζοντας εκατοντάδες εκατομμύρια από τη φτώχεια, χτίζοντας υποδομές, ενθαρρύνοντας μια συνεργασία ωφέλιμη για όλα. Σε αυτό το άρθρο: Κίνα, Κομμουνιστικό Κόμμα Κίνας, ΗΠΑ, Ώρα Γεωπολιτικής Οικονομίας, γη, φτώχεια, αγορά ακινήτων,…

View On WordPress

#China#φτώχεια#φόροι#Ώρα Γεωπολιτικής Οικονομίας#ΗΠΑ#Κίνα#Κομμουνιστικό Κόμμα Κίνας#Ρωσία#αγορά ακινήτων#γη#Michael Hudson#Mick Dunford#Radhika Desai#usa

0 notes

Text

Ενώ οι ΗΠΑ προκαλούν χάος, η Κίνα προάγει την οικονομική ανάπτυξη (Radhika Desai, Michael Hudson, Mick Dunford)

Ενώ οι ΗΠΑ προκαλούν χάος, η Κίνα προάγει την οικονομική ανάπτυξη Ενώ οι ΗΠΑ προκαλούν συγκρούσεις σε όλο τον κόσμο, η Κίνα έχει προωθήσει την οικονομική ανάπτυξη, βγάζοντας εκατοντάδες εκατομμύρια από τη φτώχεια, χτίζοντας υποδομές, ενθαρρύνοντας μια συνεργασία ωφέλιμη για όλα. Σε αυτό το άρθρο: Κίνα, Κομμουνιστικό Κόμμα Κίνας, ΗΠΑ, Ώρα Γεωπολιτικής Οικονομίας, γη, φτώχεια, αγορά ακινήτων,…

View On WordPress

#China#φτώχεια#φόροι#Ώρα Γεωπολιτικής Οικονομίας#ΗΠΑ#Κίνα#Κομμουνιστικό Κόμμα Κίνας#Ρωσία#αγορά ακινήτων#γη#Michael Hudson#Mick Dunford#Radhika Desai#usa

0 notes

Text

Hudson on Super Imperialism 3

Breaking Free from U.S. Financial Imperialism: A Path Forward for the Global South – excerpted from Michael Hudson’s book Super Imperialism: The Economic Strategy of the American Empire Introduction: Michael Hudson’s critique of U.S. financial imperialism extends beyond Europe and Russia to the Global South. In this final blog post, we explore Hudson’s insights into how U.S. economic policies…

View On WordPress

#Debt Dependency#Economic Imperialism#Financial Strategies#Global Dominance#IMF Policies#Michael Hudson#Neoliberalism#Super Imperialism#World Bank Critique

0 notes

Text

Tarzan by Louis Henry Mitchell

#tarzan#lord greystoke#louis henry mitchell#dark horse comics#dark horse books#modern age#martin powell#michael hudson#diana leto#john clayton

0 notes

Text

Michael Hudson argues that the industrial capitalism of a previous era has given way to a new form of financial capitalism. Today’s financial capitalists, unlike capitalists in Marx’s day, now claim their share of the surplus by passively extracting interest or economic rents broadly, rather than through control of the production process. Like landlords and other non-capitalist elites, their pursuit of private wealth does not develop the forces of production, broaden the social division of labor, or prepare the ground for socialism. Pursuit of rents, unlike market competition, generates pressure neither for improvements in the production process, nor for cost-reducing public investment. So the transition from industry to finance as the dominant form of surplus appropriation has been associated with economic stagnation and a withdrawal of the state from social provision. [1]

Other writers have told versions of this story, but Hudson’s is one of the more convincing I have seen. I am not, however, convinced. I do not think that “financial” and “industrial” capital can be separated in the way he proposes, or that their historical evolution can be understood as a transition from one to the other.

[...]

It is true that the development of a new, more efficient production process involves real gains for society while land speculation, for instance, does not. But how do those social gains come to be claimed as profit by the capitalist? First, by the exclusive access they have to the means of production. And second, by their ability to sell at a price above their costs of production. On both sides, market power or rents are essential to industrial capitalism.

Hudson is aware of this, of course, and notes that to Marx, owners of industrial capital are also “part of the rentier class in principle.” If he followed this thought further I think he would find it creates problems for the larger dichotomy he is arguing for.

Capital is a process or a circuit: M-C-P-C'-M'. We often think of this circuit as happening at the level of an individual commodity, but it applies just as much at larger scales. We can think of the growth of an industrial firm as the earlier part of the circuit where value comes to be embodied in a concrete production process, and payouts to shareholders as the last part where value returns to the money form.

Industrial production doesn’t require that its results be eventually realized as money. But industrial capitalism does. From that point of view, the financial engineers who optimize the movement of profits out of the firm are as integral a part of industrial capital as the engineer-engineers who optimize the production process.

[...]

What we see historically is an oscillation, a back and forth or push and pull, rather than a well-defined before and after. And moves in one direction in one place can coexist with or even reinforce moves the other way elsewhere. For example, Hudson following Marx points to the fight to overturn the corn laws as an example of the progressive side of industrial capital. But we should add that the flip side of Britain specializing in industry within the global division of labor was that other places came to specialize more in primary production, with a concomitant increase in the power of landlords and reliance on bound labor. Something we should all have learned from the new historians of capitalism is how intimately linked were the development of wage labor and industry in Britain and the US North with the development of slavery and cotton production in the US South. [8] In this case as in others, much of what Hudson calls financial capitalism has developed alongside, and complementary to, industrial capitalism. In the present context, it can be argued that much of what appears as financialization today reflects the fact that looking at the United States in isolation we see only part of a global value chain. [9]

Turning to the present, then, it is true, as Hudson says, that in recent decades the holders of financial assets have reasserted their claims against productive enterprises in the United States and elsewhere. But I do not think this can be usefully described as a “relapse back toward feudalism and debt peonage.” A creditor or feudal overlord stands outside the production process. Peasants and debt peons have direct access to means of production, but are forced to hand over part of the product. Capitalists by contrast get their authority and claim on surplus from control over the production process itself, today as much as when Marx wrote.

[...]

Companies like Walmart and Google and Amazon are clearly examples of industrial capitalism, relentlessly seeking to push down costs of production. Cheap consumer goods at Walmart lower the costs of subsistence for workers today just as cheap imported food did for British workers in the nineteenth century.

This is in no way to defend Amazon and Walmart, though we shouldn’t deny that their logistical systems are genuine technological accomplishments that a socialist society could build on. [12] The point is just that the greatest concentrations of wealth today still arise from the competition to sell commodities at lower prices.

Finally, I have some concerns about the political implications of this analysis. If we take Hudson’s story seriously, we may see a political divide between industrial capital and finance capital, and the possibility of a popular movement seeking alliance with the former. But while finance is a distinct social actor, I do not think it is useful to think of it as a distinct type of capital, one that is antagonistic to productive capital. As I have written elsewhere, the financial sector as a distinct institution is better seen as a “weapon by which the claims of wealth holders are asserted against the rest of society.” [13]

I am not sure this kind of program, even if feasible, does much to support a more transformative political project. Hudson quotes Simon Patten’s turn-of-the-last-century description of public services like education as a “fourth factor of production” that are necessary to boost industrial competitiveness, with the implication that similar arguments might be successful today. As a public university teacher, I reject the idea that my job is to raise the productive capacity of workers, or reduce the overhead costs of American capital. Nor do I think we will be successful in defending education and other public goods from defunding and austerity on those grounds.

#michael hudson#red sails#capitalism#theory#articles#ref#resources#imperialism#communism#socialism#industrial capitalism#financial capitalism#queue

3 notes

·

View notes

Text

When you hear "fintech," think "unlicensed bank"

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image: Andre Carrotflower (modified) https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

667 notes

·

View notes

Text

𝐍𝐚𝐭𝐢𝐯𝐞 𝐀𝐦𝐞𝐫𝐢𝐜𝐚𝐧 𝐟𝐚𝐜𝐞𝐜𝐥𝐚𝐢𝐦 𝐆𝐈𝐅𝐬 𝐩𝐭 𝟑

Michael Hudson in Crooked Arrows 2012

#native american#face claim#native#crooked arrows#lacross#michael Hudson#native face claim#indigenous#mohawk#mohawk tribe#male model#indigenous face claim#first nation

9 notes

·

View notes

Text

1 note

·

View note