#payday lenders

Explore tagged Tumblr posts

Text

When you hear "fintech," think "unlicensed bank"

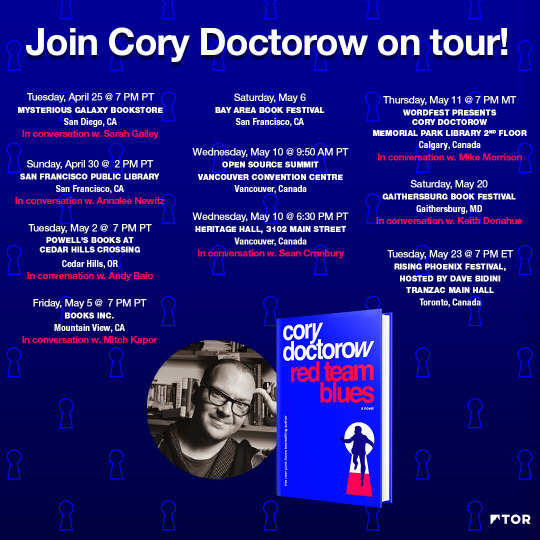

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image: Andre Carrotflower (modified) https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

667 notes

·

View notes

Text

Short Term Loans UK: Quick Cash Assistance Based on Your Needs

You are seeking immediate financial assistance to address unforeseen bills. Short term loans UK, which are designed to help customers with an any card, are the most profitable alternative. Because of this, they have no trouble getting financial aid in the modern era.

The most convenient aspect is that the borrower may easily obtain funds in the range of £100 to £2500 without providing the lender with any security. The payback time is also quite easy, as it is paid back in 2-4 weeks. It is explained that you can obtain the money without pledging the lender any kind of collateral.

You can use the short term loans UK direct lender for a variety of short-term needs, including utility bills, loan installments, rent, medical bills, auto repairs, outstanding bank overdrafts, and many more, as there are no restrictions on how you can use the funds.

There are very basic requirements that you must meet, such as being employed full-time for the past few months, being at least eighteen years old, earning at least £750 per month, and having an active bank account. You can then apply for short term loans UK without having to go through a credit check process and without needing an any card. As a result, you are eligible to get financial aid because of defaults, arrears, foreclosure, missing payments, CCJs, IVAs, or bankruptcy.

All Set to Apply For Short Term Cash That Is Easy To Receive and Quick to Obtain

Within a few minutes, we can assist you in resolving your financial dilemma. We recognize the urgency you have. Our goal is to expedite the process of obtaining short term loans UK direct lender. Instead of magic, it is a conglomeration of small, priceless actions. We disagree with needless procedure elaboration. Our procedures and the ones we would urge you to follow make this clear.

We work hard to identify our borrowers' common problems. Following that, we tailor an offer to fit their circumstances. In contrast to conventional lenders, we will never offer generic lending solutions to address every kind of financial issue. Without hesitation, you may rely on our services if you want to obtain short term loans UK direct lender from one of the most reputable lenders UK. We strive to provide our borrowers with the finest possible service every single day. The only goal we have is to design a loan product that fits our borrowers' budget. You may occasionally lose your peace of mind due to a minor financial necessity. In the UK, you can obtain a little quantity of short term cash loans to alleviate this kind of financial difficulty.

How is Short Term Cash Loan applications evaluated?

We consider the unique conditions when analyzing each application. We do a few tests to help us determine whether you are affordable. It will determine whether you are able to repay the short term loans UK direct lender amount.

Will it take too long for us to respond?

Not at all. We act quickly. It doesn't take long for us to process. We start by confirming a few crucial elements that don't take a lot of time. You should anticipate hearing back from us shortly.

https://classicquid.co.uk/

#short term cash loans#short term loans for bad credit#short term loans uk direct lender#short term cash#same day loans online#short term loans uk#fast payday loans online

4 notes

·

View notes

Text

Simple Strategies to Help You Find Your Short Term Loans UK Direct Lender

We at Payday Quid give you easy advice on how to get your next short term loans UK direct lender. Following our advice should ensure that you never have to worry about not being able to obtain a loan when you need one.

How to Apply for a short term loans UK are frequently linked to those in need of financial assistance. In reality, however, they can be a lifesaver for those who are in dire straits and require quick cash. If you need some extra cash in between paychecks, read our guide to common payday loan myths and how to apply for short term cash.

Answer all the questions honestly and supply all the necessary personal information to ensure that you receive a short term funding. Some lenders provide prepaid cards or ACH transfers as alternatives to debit cards if yours isn't approved right away.

Which Loan Types Without a Credit Check Are the Best?

A variety of loans are available that don't require a credit check. If you're looking for quick cash, short term loans UK direct lender can be very beneficial. If you want to apply for a loan without a credit check, you will always need to meet certain requirements, but hopefully this page has helped you find the finest loans without a credit check.

We would like to present you with a variety of lending options. We make an effort to address the many problems you may be experiencing. We take a different tack than the conventional financing process.

Payday Quid is your preferred financial advisor

Why are financial emergencies so frightening? No matter your financial status, you must immediately organize funds. We can easily assist you in obtaining short term loans direct lenders if you don't want to prolong the loan search process. The best thing about our loan services is their flexibility. We constantly strive to create custom deals that meet your needs. Our unwavering commitment to provide the greatest services ensures that we quickly resolve all of your financial issues.

Applying for short term loans UK with us simply indicates that you may anticipate a speedy payout facility. We maintain a quick turnaround. Furthermore, it won't matter to us if you have various financial responsibilities. When making a loan, we use a budget pricing approach. Therefore, working with us makes it possible to secure loans at affordable rates. To approach us, you don't need a broker. We fully trust technology, and it shows in the way we operate. You can distinguish us from other direct lenders by mentioning a few qualities. We are aware of the challenges a bad creditor faces. Our loan standards are rather clear-cut and straightforward. It offers sufficient financial options, such as fast same day loans UK, for someone who is already struggling because of poor credit ratings in the UK. We don't think your prior credit history can give us any assurances regarding your affordability. Actually, what worries us the most is your capacity to repay? We have few restrictions; therefore it's easy to get loan aid from us.

https://paydayquid.co.uk/

#same day loans uk#short term loans uk#short term cash loans#same day loans online#fast cash loans#same day payday loans#short term loans#same day loans#payday loans lenders uk

5 notes

·

View notes

Text

#cash advance#cash loan#paydayloan#personal loans#short term cash loans#online payday loans#direct payday loan lenders#same day payday loans#payday 2#payday 3#california#san fransico#loans#us loans#fast cash loans online#fast cash options#student loans#business loan#finance#credit score#no credit needed#no credit check loans#bad credit loans#bad credit score#self employed#salaries

2 notes

·

View notes

Text

Quick & Simple Online Fast Cash Loans for Bad Credit

You've come to the perfect place if you're looking for quick, flexible short-term financial support. Online fast cash loans have assisted thousands of Americans by providing them with a short-term loan to tide them over until their next paycheck. Regaining control over your difficult financial situation is made simple and quick with the amount from these loans.

Prior to obtaining the loan, you must determine whether fast cash loans online are the right choice for you. If the amount of cash you need is only a few hundred dollars to get you through till payday, speak with any one of the more than 100 lenders on the panel. Generally speaking, you can borrow between $100 and $1,000 in cash on the same day. You may tailor the loan to meet your needs thanks to its adjustable repayment terms.

Many expenses need to be paid for, such as light bills, groceries, child care or tuition, household bills, unexpected auto repairs, unpaid bank overdrafts, and so forth. Simply put, these loans are used to pay for all of these expenses.

Even if you've had bad credit in the past, you could still be able to get a same day funding loans. Lenders' only responsibility is to consider your present repayment capacity, not only past credit problems. You can therefore easily access these credits if you have bad credit factors such as defaults, arrears, foreclosure, late payments, CCJs, IVAs, or bankruptcy noted against you.

It's likely that you have seen advertisements online or received emails soliciting same day loans. You might be sceptical, but you might also ask whether same day payday loans are indeed achievable. Unfortunately, 99 percent of the time, these kinds of claims turn out to be untrue. The good news is that you may apply for a convenient online loan with Nueva Cash and acquire the money you need.

Many of the web advertisements for same day payday loans online are not from real lenders. Rather, they are information aggregators that gather data about borrowers. A few aggregators only collaborate with particular lenders. Many aggregators thoroughly screen the lenders they partner with and are quite credible. Nevertheless, some advertisements for online same day cash loans for bad credit are posted by dishonest parties who disseminate information carelessly and frequently sell private and sensitive financial data to the highest bidder. If you work with them, you'll frequently discover that your email inbox is overflowing with "offers" from unknown companies. A few of them are con artists, while others steal identities.

Payday direct lenders do exist. They frequently advertise their identity as direct lenders on their websites with large advertisements. They do not, however, make any more assurances than aggregators regarding payday loans online same day offered. This is due to the fact that almost all online lenders handle loan disbursements and repayments through ACH transactions. Payday direct lenders can approve you in a matter of minutes, but most of the time you won't get your money until the next business day.

https://nuevacash.com/

#direct payday loan lenders#same day loans direct lenders#same day payday loans#short term loans direct lender

2 notes

·

View notes

Text

全球留学生华人贷款,利率低至6%每月无任何前期费用,三分钟审核。十分钟下款详情咨询下方微信二维码#留学生贷款#留学生贷款请加微信#留学生贷款公司#留学生贷款金服#留学生贷款找我#留学生贷款银行井留学生借款#留学生借钱#留学生小额货款#留学生小额应急#留学生货款#留学生借钱银行#北美贷款#北美借款#国外应急小额#美国留学生#美国留学那点事

#留学生交友#留学生约 炮#留学生代写#西安 公交车 留学生约炮 娇喘 同城交友 留学生圈高奢定制 留学生兼职 滴蜡 视频交友 视频直播 视频一对一 全国楼凤 多人 熟妇 跳蛋 施虐 受虐 女s 贱货 找奴 美脚 抖s 项圈 绿奴 sm圈#贷款#loans#personal loans#business loan#home loan#banking#finance#same day loans direct lenders#same day payday loans#financial planning#lending#lend a hand#andy murray splits from head coach ivan lendl for third time#short term loans direct lenders

2 notes

·

View notes

Text

Predatory loans victimizing the youth

#predatory#personal loans#student loans#same day loans direct lenders#same day payday loans#loans#loan shark#loan sharks#personally victimized#victimization#victimizing#youth in the shade#transcendental youth#youth#law school#school#university#college#ausgov#politas#auspol#tasgov#taspol#australia#neoliberal capitalism#fuck neoliberals#anthony albanese#albanese government#fuck the gop#fuck the police

5 notes

·

View notes

Text

poverty, by america is such a profoundly frustrating book and while I can recognize that at least a good half of that is how much I'm near-explicitly excluded from the target audience, on the whole it's just like. are you fucking kidding me.

(context for the camel-back-breaking straws here: the chapter I've been most recently reading going on a seemingly-oblivious whiplash roller coaster through "sector organizing is currently a better plan than traditional one-workplace-at-a-time unionizing because scale & collective solutions vs. individualism," and "we need to provide increased entry access to homeownership so people can start to build wealth," and "if a family's financial livelihood depends on their house's value it's understandable why they'd oppose antipoverty efforts that would result in the decrease of property costs/values," and "we* should all be voting with our wallets by doing our own research into companies' business practices and avoiding shopping with or investing in those that exploit their labor force".....

dude. are you not seeing the minor fucking contradictions here. how about instead of encouraging people to spend their money ~virtuously, you tell them point blank to counter-agitate against NIMBY shit in their neighborhoods because centralizing wealth in the housing supply is one of the big structural feedback loops causing problems in the first place.

and it's not like a substantial portion of the rest of the book isn't incisive and legit in what it talks about, either? but jfc, you can't write a book that makes it very clear the kind of middle-to-upper-middle-class audience it's talking to, leading with "hey the way we benefit from exploitation of the poor is very real and a part of the overall social landscape that needs to change too," and then following up with. as a series of individuals, you should all be re-evaluating what stocks you invest in. just, no.)

#James liveblogs books#I've been low-key irritated about the implied readership but otherwise mostly finding it good#and then somehow it just took a nosedive off a cliff in the last 10 pages#starting with 'payday lenders should publish easily understandable avg costs of their loans in the same way that -#- fast food places have to display calorie counts on their menus'#Oh. Okay. I see now sure let's just start setting fire to my goodwill hereOH HEY NOW IT'S MY BERSERK BUTTON#'BUILD WEALTH THROUGH HOMEOWNERSHIP!! :D"#insert aggravated Stitch Lilo&Stitch gif here

4 notes

·

View notes

Text

The Best Personal Loans for People with Bad Credit

Having a low credit score can make it challenging to secure financing, but that doesn’t mean you’re out of options. Many lenders offer personal loans tailored for individuals with bad credit, helping them meet financial needs while also providing an opportunity to rebuild their credit scores.

In this guide, we’ll explore the best personal loan options for bad credit borrowers, factors to consider before applying, and tips to improve your chances of approval.

Understanding Personal Loans for Bad Credit

A personal loan is an unsecured installment loan that provides borrowers with a lump sum, which is repaid over a fixed period through monthly installments. Lenders evaluate applicants based on their credit score, income, and repayment ability. For those with bad credit, lenders may offer loans with higher interest rates or require additional security, such as a co-signer.

Key Factors to Consider When Choosing a Personal Loan

When searching for a personal loan with bad credit, consider these essential factors:

Interest Rates – Lenders often charge higher interest rates to bad credit borrowers. Compare multiple lenders to find the lowest possible rate.

Loan Terms – Shorter loan terms mean higher monthly payments but lower interest costs. Longer terms lower monthly payments but increase overall interest expenses.

Fees – Some lenders charge origination fees, late payment fees, and prepayment penalties. Always read the fine print.

Approval Time – If you need urgent funding, look for lenders offering fast approvals and same-day funding.

Loan Amount – Some lenders offer small loans (under $1,000), while others provide larger loans. Choose a loan that fits your financial needs without overborrowing.

Lender Reputation – Read customer reviews and check lender credibility to avoid scams or predatory lending practices.

Top Personal Loans for People with Bad Credit

1. LendingPoint

Loan Amount: $2,000 – $36,500

APR: 7.99% – 35.99%

Loan Term: 24 – 60 months

Minimum Credit Score: 580

Best For: Fast approval and flexible terms

Lending Point specializes in offering personal loans to borrowers with fair to bad credit. They provide quick funding, and their flexible loan terms make repayment manageable.

2. Upstart

Loan Amount: $1,000 – $50,000

APR: 5.22% – 35.99%

Loan Term: 36 – 60 months

Minimum Credit Score: 300

Best For: Low credit score approval

Upstart uses AI-driven technology to assess loan eligibility beyond credit scores. They consider education and employment history, making them a great option for individuals with limited credit history or lower scores.

3. OneMain Financial

Loan Amount: $1,500 – $20,000

APR: 18.00% – 35.99%

Loan Term: 24 – 60 months

Minimum Credit Score: None

Best For: Secured and unsecured loan options

OneMain Financial offers both secured and unsecured personal loans, making them a solid option for borrowers with very low credit scores. Those struggling to get approved elsewhere may have better chances with OneMain Financial.

4. Avant

Loan Amount: $2,000 – $35,000

APR: 9.95% – 35.99%

Loan Term: 24 – 60 months

Minimum Credit Score: 550

Best For: Competitive rates for bad credit borrowers

Avant offers personal loans to those with credit scores as low as 550, providing a great alternative for borrowers looking for quick funding at reasonable rates.

5. OppLoans

Loan Amount: $500 – $4,000

APR: 59.00% – 160.00%

Loan Term: 9 – 18 months

Minimum Credit Score: None

Best For: No-credit-check loans

OppLoans is one of the few lenders that do not check credit scores, making them an option for those with extremely poor credit. However, they charge very high interest rates, so borrowers should explore alternatives before committing.

How to Increase Your Chances of Approval

Even with bad credit, you can take steps to improve your chances of securing a personal loan:

Check Your Credit Report – Review your credit report for errors that may negatively impact your score. Dispute inaccuracies to improve your credit standing.

Apply for Prequalification – Many lenders offer prequalification, allowing you to check eligibility without affecting your credit score.

Consider a Co-Signer – A co-signer with a strong credit score can help you secure better loan terms and lower interest rates.

Choose a Secured Loan – If unsecured loans are hard to obtain, consider secured personal loans that require collateral.

Demonstrate Stable Income – Lenders assess your income and employment history to determine repayment ability. Providing proof of stable earnings can boost approval chances.

Alternatives to Personal Loans for Bad Credit

If you’re unable to qualify for a personal loan, consider these alternative funding options:

Credit Unions – Many credit unions offer loans to members with bad credit at lower interest rates than traditional banks.

Payday Alternative Loans (PALs) – Offered by credit unions, PALs are small-dollar loans with lower fees and interest rates than payday loans.

Borrowing from Family or Friends – If possible, consider borrowing from trusted individuals to avoid high-interest loans.

Building Credit First – If you can wait, work on improving your credit score before applying for a personal loan.

Final Thoughts

Getting a personal loan with bad credit is possible, but it’s important to choose the right lender, compare terms, and ensure you can afford repayments. By managing the loan responsibly, making timely payments, and exploring ways to improve your credit, you can not only access the funds you need but also work towards a better financial future.

If you’re ready to apply for a personal loan, start by comparing the best options available and taking proactive steps to strengthen your creditworthiness.

#finance#nbfc personal loan#loan apps#personal loan online#bank#loan services#personal loans#personal loan#fincrif#personal laon#bad credit personal loan#loans for bad credit#best personal loans#no credit check loans#unsecured personal loan#secured personal loan#fast personal loan approval#bad credit loan lenders#low credit score loans#high-interest personal loans#instant personal loan#online personal loan#emergency personal loan#payday alternative loans#credit union personal loan#debt consolidation loan#loan with no collateral#affordable personal loan#guaranteed approval loans#quick bad credit loan

0 notes

Text

Are you looking for the best service for Payday Loan in Tanjong Pagar? Then contact Shenton Credit - Licensed Moneylender. Their services include Personal Loans, Payday Loans, Bad Credit Loans, Fast Cash Loans, Debt Consolidation Loans, Wedding Loans, Medical Loans, Travel Loans, and Bridging Loans. Visit the site for more information.

#Money Lender Tanjong Pagar#Fast Cash Loan Tanjong Pagar#Personal Loan Tanjong Pagar#Loan Agency Tanjong Pagar#Payday Loan Tanjong Pagar

0 notes

Text

How Quickly Can I Get A Short Term Loans UK?

Startup can quickly and easily obtain funding through short term loans UK. Because there is no collateral needed and a higher likelihood of approval, they wish to apply for a loan. The following stages are all that our loan application process requires, and they guarantee comfort for each borrower: The amount of short term loans UK direct lender that is now needed can be discussed with us or mailed to us. Provide other business credentials and the paperwork for a one-year account. Give us the email address and company number of your company, which should be registered in England and Wales. Obtain an immediate price from us, examine it in detail, and let us handle the rest.

We provide a number of offers, and you can select the one that best suits your ability to repay. The final agreement is e-signed to approve the business financing immediately after the consent. We transfer the money to the bank within a day. A Crucial Note: Classic Quid is dedicated to providing you with emergency financial support. Our lending specialists have adequate experience to make decisions on each loan application quickly.

Payday loans are a type of short term loans UK that can be utilized in an emergency. Short term cash loans are normally repaid between a weeks to three months. People with disabilities are more prone to take out payday loans because they find it difficult to manage their daily activities due to greater expenses and a lack of employment, according to recent findings by scope.

Because they spend more than average residents, it is critical to protect the rights of people with disabilities. They have higher costs because of medical bills and equipment types. Given their limitations, it might be more difficult for them to make a living. Some disabled persons are able to find employment and the law guarantees that employers cannot discriminate against them and that they can be paid on par with their ability. If a disabled people meet the lending requirements, a lender shouldn't turn them down for a short term loans UK direct lender or a short term loans UK. Discrimination between those with and without disabilities is unacceptable.

Describe the main advantages of a Short Term Loans UK.

The main advantage of this short term cash loans is that there is no collateral required. If you default on your repayment, it indicates that your assets are not at risk of being lost. For start-ups, short term loans UK direct lender are advantageous. This is a result of the majority of conventional lenders in the UK being hesitant to provide unsecured business loans.

In addition, direct lenders like us are the best option because they provide a number of advantages, such as: Simple to Apply: The online platform offers the benefit of an instantaneous and error-free loan application. Less paperwork can save you a great deal of time. Reduced Repayments: One more benefit of short-term loans UK direct lender for limited firms is that there are no longer any payback obligations. You run the danger of missing payments if you have a long payback period. They put a lot more strain on your company's revenue.

https://classicquid.co.uk/

#short term loans uk#short term loans uk direct lender#short term loans for bad credit#short term cash#same day loans online#short term cash loans#same day payday loans

4 notes

·

View notes

Text

$900 Loan - All Credit Okay! Connect With Direct Lenders - Fast E-Approval In 7 Minutes!

#Small Loans#Personal Loans#loans#PaydayLoan#direct payday loan lenders#online payday loans#payday 2#payday 3#same day payday loans#fast cash loans online#fast cash options#same day loans direct lenders#short term loans direct lenders#short term cash loans#cash loan#installments

2 notes

·

View notes

Text

Plain Green Loans: Emergency Cash When You Need It offers fast, reliable financial solutions during unexpected situations. Discover how Plain Green Loans can provide you with the emergency cash you need, precisely when you need it most. Explore the benefits, application process, and why Plain Green Loans is a trusted choice for quick financial relief.

#Quick cash loans online#Fast emergency loans#No credit check loans#Instant approval loans#Online payday loans#Same day cash loans#Emergency money lender#Short term personal loans#Bad credit emergency loans#Fast personal loans online

0 notes

Text

Lunaleaf Consultant Pvt Ltd Your Trusted Partner for Loan Settlement in Gurgaon

Introduction

Struggling with overwhelming loan repayments? Unable to keep up with your bank, credit card, or app-based loan payments? You're not alone, and there's a solution. Welcome to Lunaleaf Consultant Pvt Ltd, a trusted loan settlement company based in Gurgaon, Haryana. We specialize in settling all types of loans, ensuring that you regain financial stability while improving your CIBIL score. Our unique service guarantees up to 50% settlement of your total loan amount, providing a lifeline to those burdened by debt.

Understanding Loan Settlement

Loan settlement is a process where we negotiate with your lender to reduce the outstanding amount you owe. This can significantly lower your financial burden, allowing you to pay a fraction of the original loan amount. At Lunaleaf, we handle settlements for various types of loans, including:

Bank Loans: Personal loans, home loans, auto loans, etc.

Credit Card Loans: Outstanding credit card balances.

App-Based Loans: Loans taken from financial apps and other digital lending platforms.

Other Sources: Loans from any other financial institutions.

Our Guarantee: 50% Settlement

One of the standout features of Lunaleaf is our guarantee. We promise to settle your loan for up to 50% of the outstanding amount. This means if you have a loan of 10 lakhs, we can negotiate it down to just 5 lakhs. In many cases, we can achieve even better results, settling loans for 30% to 40% of the original amount.

Benefits of Choosing Lunaleaf

Significant Financial Relief: Reduce your debt burden by up to 50%.

Improved CIBIL Score: Our settlement process includes steps to help improve your credit score, ensuring a better financial future.

Expert Negotiation: Our experienced team negotiates with lenders on your behalf, securing the best possible settlement.

Comprehensive Support: We handle all the paperwork and communication, providing a hassle-free experience for our clients.

Transparent Process: We maintain complete transparency throughout the settlement process, keeping you informed at every step.

How It Works

Contact Us: Reach out to Lunaleaf Consultant Pvt Ltd with your loan details.

Assessment: Our team assesses your financial situation and loan details.

Negotiation: We negotiate with your lender to settle the loan for up to 50% of the outstanding amount.

Settlement: Once an agreement is reached, you pay the settled amount, and we ensure your loan is marked as closed.

CIBIL Score Improvement: We provide guidance and support to help improve your credit score post-settlement.

Why Lunaleaf Consultant Pvt Ltd?

At Lunaleaf, we understand the stress and anxiety that come with mounting debts. Our mission is to provide a lifeline to individuals struggling with loan repayments. With our expertise and guarantee, you can trust us to handle your loan settlement efficiently and effectively, allowing you to focus on rebuilding your financial future.

Contact Us Today Lunaleaf Consultant Pvt Ltd

Don't let debt control your life. Reach out to Lunaleaf Consultant Pvt Ltd today and take the first step towards financial freedom. Our team is ready to assist you in settling your loans and improving your credit score. Contact us at [contact information] or visit our office in Gurgaon, Haryana.

Conclusion

Lunaleaf is committed to providing exceptional loan settlement services, ensuring that our clients receive the financial relief they need. With our guarantee of up to 50% settlement and a focus on improving your CIBIL score, you can trust us to help you navigate through your financial challenges. Contact Lunaleaf today and let us help you achieve a debt-free future.

#business loan#fast cash loans online#loans#loan#personal loans#loan settlement#direct payday loan lenders

1 note

·

View note