#benefits of financial literacy

Explore tagged Tumblr posts

Text

youtube

The Beginnings of Journey | From Incarcerated To Incorporated

Embarking on a learning journey can be a transformative experience that can help individuals rebuild their lives, pursue personal growth, and reintegrate into society. Remember that everyone's learning journey is unique, and it's important to tailor your approach to your specific circumstances and goals.

#business mentoring#mentorship skill#mentorship goals#mentorship topic#mentorship benefits#mentorship vs mentoring#benefits of financial literacy#personal financial literacy#best books for financial literacy#financial literacy#financial literacy skills#why is financial literacy important#everfi financial literacy#best buy credit card#home depot credit card#capital one credit card#Youtube

0 notes

Text

From Fibromyalgia to Freedom: How Yoga and Astrology Inspired My Healing

My 30-day transformational yoga journey amid the Aquarius-Pluto alignment demonstrates the powerful synergy between physical practices and cosmic influences.

By La Trecia Doyle-Thaxton Just recently I completed 30 days of yoga during the 31 days of January. I missed only one day and felt like it was the worst day ever because nothing went well for me and I am glad I experienced that because it was motivation to keep going and to not miss another day for the rest of the month. I wanted to stick to the commitment to the challenge I had placed on…

View On WordPress

#Afro-Boho Lifestyle#Ankh Earring Collection#Aries Sun Characteristics#Astrology and Wellness#Black Family Empowerment#Breaking Generational Curses#Canva Designing Tips#Capricorn Rising Insights#Chakra Balancing#Chronic Pain Management#Crafting for Mindfulness#DIY Home Office Décor#Domestic Violence Recovery#Empath Empowerment#Energy Healing Techniques#Fibromyalgia Healing#Financial Literacy for Families#Holistic Yoga Benefits#Homeschooling Tips#Libra Moon Emotions#Mindfulness Practices#Moon Phase Manifesting#Multiple streams of income#Plant-Based Healing#Positive Change Strategies#Reiki for Fibromyalgia#Self-Care for Introverts#Stock Options for Beginners#Teen Mom Support

2 notes

·

View notes

Text

The Envelope Budgeting Method: A Simple and Effective Way to Track Expenses

Written by Delvin Keeping track of expenses is a fundamental aspect of maintaining financial stability and achieving financial goals. In a world of digital transactions and complex budgeting apps, the envelope budgeting method offers a refreshingly simple and effective approach. In this blog post, we will explore the envelope budgeting method, how it works, and why it can be a powerful tool for…

View On WordPress

#Benefits of Envelope Budgeting#Budgeting and Allocating Funds#dailyprompt#Financial#Financial Literacy#knowledge#money#Money Management#Personal Finance#The Basics of Envelope Budgeting#The Envelope Budgeting Method#Using Cash for Expenses

4 notes

·

View notes

Text

Should financial literacy be taught in our schools?

Financial literacy is the ability to understand and manage personal finances effectively, including skills such as budgeting, saving, investing, and understanding debt. As the world becomes more complex and the financial landscape continues to evolve, the importance of teaching financial literacy in schools has never been more apparent. Financial education equips students with essential skills…

View On WordPress

#Benefits of teaching finance#Financial education curriculum#Financial literacy for students#Financial literacy in schools#Importance of financial education#Money skills for students#Personal finance education#School financial literacy programs#Teaching money management#Why financial literacy matters

0 notes

Text

Common Myths About Portfolio Management Services: Separating Fiction from Facts

Portfolio management services, it is important to realize, are one of the essential tools for an investor in achieving his financial goals. However, because these services are not well understood by many investors, many stay away from exploring the associated benefits. The review of myths about portfolio management may make investors more aware before approaching professional investment management. The great complexities of financial markets plus difficulties in objective decision making mean that professional portfolio management services are an excellent guide to investors looking for long-term success.

Understanding Portfolio Management Services

Professional portfolio management is the oversight of investment assets by experts who conduct strategic planning and constant monitoring in order to maximize returns with minimal risk. Such services integrate market expertise with personal financial planning to provide personalized investment strategies. Portfolio managers are dedicated financial professionals who understand both broad market dynamics and individual investor needs, thereby bridging the gap between complex investment opportunities and personal financial goals.

Debunking Portfolio Management Myths

Myth 1: Portfolio Management Services Are Only for the Rich

The average investor thinks portfolio management is something that needs millions in assets. In reality, quite the opposite is true:

Most firms have service tiers that start at relatively modest investment amounts—even $50,000.

Service tiers that reflect different levels of investment are flexible, allowing the investor to start small and work their way up.

Digital platforms make professional management more accessible with automated solutions combined with the expertise of humans.

Many managers specialize in helping novice investors accumulate wealth by making strategic plans as well as sticking to a strict investing schedule.

Services could be tailored depending on some unique financial situation of any individual, so support will forever be commensurate to the wealth of each and every person.

Some institutions offer special programs for youth professionals and first-time investors.

Group investments allow for a professional management of the respective investment at lower minimums.

The fact is, while cost matters, when one looks at the broader picture, the following critical considerations are of importance:

Value-Added Services

Professional market analysis and research from experienced investment teams.

Portfolio rebalancing as often as required to ensure optimal asset allocation.

Tax-efficient investment strategies that optimize after-tax returns.

Risk management expertise for protection against market volatility.

Continuous market monitoring and rebalancing of portfolios.

Access to institutional-grade research and investment opportunities.

Dedicated professional management of investment strategy.

Long-Term Gains

Potentially more risk-adjusted returns under professional management.

Less emotionally driven decision-making during turbulent markets.

Time efficiencies for the investor, so career and family time is prioritized.

Professional risk management in place to prevent significant loss.

Access to institutional-grade investments, which are often out of reach for individual investors.

A systematic approach to achieving long-term goals.

Comprehensive integration with holistic financial planning.

Myth 3: DIY Investing Performs Better

For many investors, the DIY appeal stands to reason, but professional management has its benefits:

Professional Expertise

Market knowledge gained over decades of service.

Research-based decisions from comprehensive analysis.

Sophisticated portfolio analysis tools and technology.

Institutional trading facilities and improved execution prices.

Strategic tax planning and investment.

Professional research databases and resources.

Ability to find and analyze sophisticated investments.

Risk Management

A disciplined investment strategy, whether the market is going up or down.

Periodic portfolio reviews and performance assessment.

Systematic rebalancing to target allocations.

Diversification across many asset classes.

Market risk management with advanced tools.

Adjusts proactively to changing conditions in the market.

Incorporates downside protection strategies.

Actual Value of Portfolio Management Services

Strategic Asset Allocation

Professional investment managers devise a holistic strategy with:

Distribution of asset classes across market segments.

Geographic diversification for global markets.

Sectoral allocation based on economic analysis.

Risk-adjusted return optimization using advanced modeling.

Rebalancing portfolios as needed to maintain target allocations.

Inclusion of alternative investments as necessary.

Dynamic repositioning of portfolios based on market conditions.

Market Research and Analysis

Portfolio managers have access to:

Professional research facilities and databases.

Market trend analysis through advanced tools.

Economic forecasting by expert analysts.

Company-specific research and due diligence.

Industry sector insights and analysis.

Global market outlook, including emerging markets.

Risk Management Expertise

Managers help mitigate risks in investments by:

Systematic risk analysis using advanced tools.

Diversifying portfolios across various dimensions.

Continuous monitoring of market conditions.

Strategic rebalancing to retain the target risk.

Downside protection strategies.

Investment correlation analysis.

Stress testing of portfolios.

Investment Decisions through Expert Management

Benefits of Professional Management

Objective investment decisions supported by research.

Emotional control during market volatility.

Time-tested strategies for long-term success.

Portfolio oversight with regular adjustments.

Risk management practices.

Institutional-quality investments.

Financial planning integration.

Investment Strategy Development

Portfolio managers develop personalized plans based on their clients' needs:

Investment goals.

Risk tolerance and capacity.

Time horizon for various goals.

Income sources and tax positioning.

Estate planning for the future.

Future known commitments.

Adaptations for changing personal circumstances.

The Long-Term Perspective

Beyond investment selection, portfolio management services provide a wide range of support services, including:

Total financial planning.

Retirement planning.

Tax efficiency programs.

Estate planning.

Frequent strategy reviews.

Goal-monitoring progress.

Cash flow management.

Estate planning assistance.

Business Oversight

Intelligent market tracking.

Portfolio rebalancing.

Performance reporting.

Risk analysis.

Strategy updates.

Tax loss harvesting.

Rebalancing implementation.

Next Step

Knowledge of portfolio management services helps enable investors to create an informed financial future. These services come with:

Professional experience and market insights.

Research-based investment methodology.

Risk mitigation through diversification.

Time savings by outsourcing complex tasks.

Reduced anxiety during market volatility.

Access to institutional-level investment opportunities.

Comprehensive alignment with financial planning.

Portfolio management services provide a strategic partnership that helps investors achieve their financial goals. By understanding the true benefits and debunking myths, investors can better evaluate if professional management aligns with their needs and objectives. The value extends beyond investment selection, encompassing comprehensive financial planning and risk management.

Way Ahead

Portfolio management services should be chosen based on personal financial goals, investment time horizon, and desired level of involvement. Professional management combines expertise with a personalized strategy, helping investors navigate complex markets and financial instruments effectively. It represents an investment in long-term financial success, providing access to professional expertise, sophisticated investment strategies, and comprehensive financial planning support.

#portfolio management#investment strategies#financial planning#myths debunked#investment risks#professional management#wealth management#financial services#tailored solutions#investment misconceptions#risk management#portfolio diversification#market analysis#financial advisors#investment benefits#common myths#informed investing#investment education#financial literacy#asset management

0 notes

Text

Benefits of Financial Literacy in the Workplace: Boost Employee Financial Health

https://cfonext.co.in/benefits-of-financial-literacy-in-workplace

Financial literacy in the workplace is an essential factor that can significantly impact both employee well-being and overall business performance. By offering financial education and resources, employers can help employees make informed decisions, reduce financial stress, and improve productivity. These programs not only empower workers with knowledge but also foster a more financially stable workforce. Benefits include better retirement planning, reduced absenteeism due to financial problems, and greater employee satisfaction.

#Workplace financial literacy benefits#Financial literacy programs for employees#Employee financial health in the workplace#Boost employee productivity with financial literacy#Workplace financial wellness programs

0 notes

Video

youtube

Silver and Gold - Unlocking The Secrets And Benefits Part 2 of 3

Unlocking the Secrets and Benefits of Silver And Gold - Part 2 of a 3 part informational and educational series on Gold and Silver. Part 2: Silver vs Gold (The direct correlation) How to benefit from Gold without buying Gold Tips to keep in mind for your next purchase - short and long-term SHOCKING results - Comparing checkout on 5 different companies for purchasing Gold and Silver (you will be shocked with who has the Best price)

Please feel free to reach out with any questions. Thank you - Rick

#youtube#silver#gold#silver vs gold#financial literacy#gold and silver education#silver bullion#gold bullion#American silver eagle#saving for your future#Unlocking the secrets and benefits of silver and gold#rick fronek

0 notes

Text

The Benefits of a Credit Score Above 720

A high credit score is more than just a number; it’s a gateway to numerous financial benefits and opportunities. For many, achieving a credit score above 720 is a significant milestone, opening doors to better loan terms, lower interest rates, and a range of financial perks. This blog post explores the advantages of maintaining a credit score above 720 and how it can positively impact various…

View On WordPress

#benefits#credit#finance#financial literacy#financial struggles#first time homebuyers#gig economy#home-buying#homeownership#housing-market#lending practices#mortgage#revve

0 notes

Text

Mastering Financial Literacy: A Complete Guide

Unlock your path to financial freedom! Dive into our comprehensive guide on financial literacy, budgeting, saving, investing, and retirement planning. Share your thoughts, ask questions, and join the conversation to take control of your financial future.

The Concept of Financial Literacy Financial Literacy Concept Did you know that one in five American adults would rather spend more time planning their vacations than managing their finances? A survey by MyBankTracker (n.d.) revealed that nearly 20.1 percent of American adults spend more time researching travel details than handling their money matters, yet 34 percent use an…

View On WordPress

#401(k) plans#active income sources#budgeting tips#building wealth#compound interest benefits#creating a budget#creating a will#credit scores and reports#debt consolidation strategies#debt management#effective budgeting methods#emergency fund importance#establishing trusts#estate planning#financial education resources#financial freedom journey#financial goals#financial literacy#financial security#financial stability#health insurance benefits#healthcare cost planning for retirement#improving credit ratings#inflation impact on savings#insurance coverage#investment diversification tips#investment options#IRAs#life insurance policies#long-term wealth accumulation plans

1 note

·

View note

Text

What is a Financial Coach, and What do They do Exactly?

Discover the multifaceted role of a financial coach and how they serve as invaluable guides on the path to financial stability and prosperity. Explore the diverse services they offer and the transformative impact they can have on your financial well-being.

#Financial coach#Personal finance guidance#Budgeting assistance#Debt management strategies#Wealth building techniques#Financial education#Investment planning#Retirement preparedness#Financial empowerment#Money mindset transformation#Financial goal setting#Financial literacy#Financial wellness support#Savings tactics#Accountability in finances#Money management skills enhancement#Financial independence coaching#Comprehensive financial planning#Benefits of financial coaching#Gateway of Healing#dr.chandnitugnait

0 notes

Text

How to Save for Retirement

Good news: There's a lot about retirement savings that you DO NOT have to thoroughly understand to make savvy investments. You don't have to be a math person or have a traditional job or have a "5 year plan".

1) Start saving as early as you can. The one financial advantage we have over the older generations is TIME, so USE IT. Starting early means making "free money," your interest earns interest that will be paid back to you. The amount you save in the early years is expected to double every decade, so the more years with an account, the more free money.

2) Start today if you haven't yet. I mean it. Even if it's only 50-100 / month. You will have an account earning free money in your name, and it's easy to add more funds later when the basics are already set up. If you don't have access to a 401(k) or similar, open an IRA (the Roth IRA kind is for those with a low income and a low tax payment in the springs). NOW is more important than which type of account.

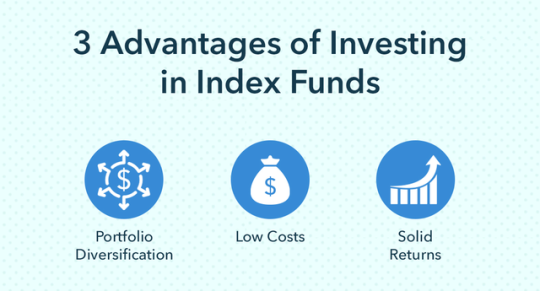

3) Choose an "index fund" with a "target date" around the age you expect to retire. Index funds are basically a tiny sliver of the whole economy around you - stocks for companies large and small, bonds for the US government, real estate, international components. Index funds provide better returns for a lower fee than "actively managed" funds, where the professional's guess wrong more often than not. If you are investing in an index, or piece of the market, than the market can never leave you behind. Target dates mean more higher risk, higher reward stocks in the earliest years, and gradually adjusting to more stable and steady bonds as you near retirement and have less time to recoop a loss. If any of this sounds scary or complicated, this is the common and proven best way to invest over a lifetime.

4) If your employer offers a retirement match contribution (often 2% - 5% of your takehome pay), invest at least that much of your own pay, because again we love FREE MONEY.

5) Increase your retirement payments to yourself anytime life gets easier. Significant raise at work? Moved to a cheaper town? Paid off your car / house / student loans / day care years? Send some of that new monthly money straight into the retirement fund.

6) Your eventual goal is to save 15% of your annual income toward retirement. If this seems insane, start where you can, and aim to add an additional 1-2% with every new year.

7) "Set it and forget it." DO NOT TOUCH your retirement money. Don't even look at it. Maybe once / year if you are curious. The road of compound interest will include some downturns with the stock market is down. This is normal for everyone, but keeping that steady investment through highs & lows is the best strategy for longterm growth of your money.

7b) It is not a kindness to your children to pull money out of your retirement savings on their behalf. You'll lose that much money plus the years of "free money" accumulation plus some early withdrawal fees &/ weird tasks. This makes you more likely to become financially dependent on your kids during your retirement. Not a favor in the long run.

8 ) "If investing feels fun and exciting, then you are not investing, you are gambling." If you are intrigued by the idea of investing in particular companies or trying to time the market - cool. Take some money that wouldn't be disastrous to lose and try your luck - the odds are not in your favor. But your retirement plan must be slow and steady. Source

#personal finance#financial awareness#financial literacy#retirement#investment#401k#roth ira#compound interest#retirement savings#retirement security#retirement strategies#retirement planning#npr#npr life kit#gambling#investing#benefits#stocks#bonds#stock market#index funds#time is on my side#do not touch#slow and steady

0 notes

Text

every time anyone talks about liberation for the intellectually disabled in any real material way (i.e. creating plain-language educational resources accessible to adults reading on a first-grade level, detangling literacy from basic requirements to participate in society, destigmatizing inability to benefit from pedagogy, criticizing the construct of financial literacy as a necessary skill, etc etc etc), some chud comes along calling it "anti-intellectualism" and blabbing about how you're a morally inferior person if you only read middle-grade novels for fun, i'm so tired and we are never making it out

741 notes

·

View notes

Note

Why was The Winchesters cancelled? Is it true that there was unsafe site while filming it too? And so you think that Danneel is the main reason for this sequel (as a producer) Or is it truly Jensen? Because I can't really see Jensen as someone who won't tell Jared about it.

The Winchesters was cancelled because the budget was too high in part because they were behind on schedule, and the rating trends was not promising. The lack of cohesive communication and management was what really doomed The Winchesters. The Ackles' failure to tell Jared ahead of time was a harbinger. Jensen and Danneel expected Robbie Thompson to be Eric Kripke 2.0 and manage everything for them. Whereas Robbie expected Jensen and Danneel to pull their own weight. There was no communication on expectations.

It comes down to the Ackles' lack of business acumen as producers. They're used to just slapping their face onto a product and sit back and collect the royalties, which is fine, that's how most celebrities make money from side hustles. But to be an actual business man or producer you're supposed to be out there in the middle of the field managing expectations, conflicts, and emotion. Some people are more enamored with the fantasy of having a business than with actually running a business. Starting a business is fun but running it and doing the basic business “blocking and tackling” every single day is what makes it successful. It’s like how planning a wedding is fun, but it’s not a good precursor to a successful marriage. Working on the marriage everyday is what makes it successful. (It’s partly why the Misha-Jensen collaboration on YANA failed because neither of them wanted to do the actual legwork.) After 15-20 years, Jensen is used to lead actors doing the heavy lifting in carrying the show and being leader of the cast and crew and he benefitted from the sweet spot as #2 on the call sheet i.e. the good guy who is friends with everyone. Remember his "don't fuck it up for me" message to The Winchester cast?

I think Danneel gets too much blame from the fans. Jensen wasn't ready to let go of $upernatural and it's money making train. I think why the Ackles were trying to take over the $PN brand is to close the $ gap between Jensen and Jared. I’ve long speculated that while Jared the highest paid CW actor he also gets percentages of the series profit in syndication. I doubt Jensen has the same deal going by his pre-Gersh management that I sometimes wondered if his old manager was a tick.

The common saying of “money is the number one cause of stress in relationships” while is true, I think it’s actually lack of financial literacy. Long held rumors were Jared negotiated a better convention contract for Jensen so that they are paid on the same scale. This is why I think Jared ultimately didn't hold it against Jensen for pursuing a $PN show without him because Jensen is attempting to negotiate on his own a deal instead of relying on Jared.

Had Jensen keeps trying to be in charge of SPN projects, SPN fans’ reaction is going to be the same as today’s Marvel fanboys’ reaction to when they hear Kevin Feige’s name: “What did you did do this time you Son of a Bitch!? What train did you derail this time?”

47 notes

·

View notes

Text

Exploring the Rise of Decentralized Finance (DeFi)

Written by Delvin In recent years, a revolutionary financial phenomenon has emerged, disrupting traditional financial systems and empowering individuals with newfound financial freedom. This phenomenon is known as Decentralized Finance, or DeFi. In this blog post, we will delve into the rise of DeFi, its core principles, and the transformative impact it is having on the global financial…

View On WordPress

#Benefits and Challenges of Defi#Core Defi Use Cases#Crypto#dailyprompt#Financial#Financial Literacy#Key Principles of Defi#The Future of Defi#Understanding Defi#Wealth

0 notes

Text

Now that the final SoKP episodes have passed thru my eyes... Things I miss from the novel:

* Sorry but Jiang Xuening should have killed You Fangyin's murderer with her own hands.

* Jiang Xuening becoming obsessed with Xie Wei's cooking, such that she loves to quietly hang out in the kitchen with him whenever there's a break in the scheming. It's their safe space.

* Jiang Xuening going from being in the palace and part of the target/victims of the rebellion in Life 1 to being one of the financial backers of it in Life 2 and accompanying their fighting forces as they move up through the country as Xie Wei outsmarts the emperor & Xue family & Lord Pingnan's forces at the same time. Spending her 2 years away building the capital needed to help spearhead the rescue of the princess and then go to fuck up the emperor who sent his sister a letter to end her life for the benefit of the country.... (chef's kiss)

* The glorious revolution and making the royal family kill each other to save themselves in order to demonstrate the type of people they are

* Jiang Xuening moving into Kunning Palace at the end, as basically the unofficial minister of finance. She ended up in the same place at the end, but hearts & minds are changed and so the result is different

* Jiang Xuening putting the pieces together that the princess died in the 1st life due to her pregnancy & the emperor cutting ties (intrigue!) Team Fuck The System helping her safely give birth to her son, who she loves despite his origin. Our fav lesbian never has to get married to another dude and can just chill with her son, the cabinet of ministers, and her Ning Ning (with psycho husband in tow, but hey nobody's perfect 😂). Using her power to spread schools for women's literacy with Xie Wei terrifying the detractors into submission.

* When they try to use the Jiang family in the capital to threaten XW and he's like, so what? I was gonna pay back those bastards next for Ning'er so you're saving me time lmaaaaaaoooo

* Speaking of which tbh I prefer the lack of a last ditch bandaid on the Jiang family relationship. She's let all of the pain of the past go and isn't personally seeking to take anything away from them in this life... but she is just done with it. Dad is nicer but he's let his wife behave like this and has been mostly hands off. Feels sorta like Story of Minglan to me - letting the favoritism & emotional abuse happen while playing nice guy. In both novel & drama, he spends years not protesting how Jiang Xuening is cast as the troublesome, uncouth, inferior model. But then the drama decides to rehabilitate them. (Though to be fair, even the drama was half-hearted on this 'wash', cause at the end she's mentioning they're not close and in the last scenes the parents are with the sister and Ning'er is with her found family.)

Improvements in the drama:

* I liked that we got to see Jiang Xuening tell multiple people that she loves XW before she gives him her answer. The angst of it being uncertain what conversations she's having with the princess & ZZ, the risk that she's going to abandon XW for being a hot mess... it made for good dramatic tension in the novel. But for the ROMANCE and creating a sense that the feelings he has are truly returned... It makes the ship better.

* The relationship that FL and ML had with the fake Xue Dingfei was richer. He was a standout for me.

* Yan Lin had a happier ending. He really stole my heart in this 2nd life and like Jiang Xuening I felt no need to see him haunted by his vile actions in another universe. It was emotionally satisfying in the drama to see him at peace. You got us all rooting for him.

* Consolidated the Lord Pingnan plot! We really didn't need to get into their factions and introduce more antagonists.

* Consolidated the You Fangyin romantic interests - no need for a marriage of convenience with 1 dude and then Xie Wei's buddy also carrying a torch.

* I felt like the drama gave Zhang Zhe more personality and I did find it delightful when he was "fighting" side by side with Xie Wei.

* Xue Shu (the Xue daughter) felt like a more developed, fully realized antagonist.

* As much as it "sings" in the narrative to have her end up in Kunning Palace with power in the government at the end of the novel (that was brilliant)... maybe emotionally it spoke to me more to see her initial wish from the start of her rebirth fulfilled. Her original reborn goal was to avoid reentering the palace & exit-out of everything to have a quiet life of peace. None of that power ever made her happy.

* Marriage scenes of the otp thank uuuuuuuuu

* No and actually.. After her royal marriage in the 1st life she definitely doesn't need another big celebration. And with her messed up family relationships and his dead parents... Them doing the marriage ceremony all on their own, cause it's another pact between them, makes a lot of sense and I dig it.

* The reverse callback of whispering while she's waiting for a kiss to say "I'm yours" instead of "get out" 👌👌👌

#story of kunning palace#cdrama#spoilers#im one of those people who really likes to see the same story#adapted in different medias#its just fun

137 notes

·

View notes

Text

Writing Engaging Introductions and Compelling Conclusions Part 4: Practical Exercises

Writing Prompts

Engaging in practical exercises is essential for mastering the art of writing engaging introductions and compelling conclusions. Here are some writing prompts to help you practice:

Creating Hooks for Different Types of Essays:

Narrative Essay: Write an introduction for a narrative essay about a memorable childhood experience. Use an anecdote as your hook.

Expository Essay: Write an introduction for an expository essay on the benefits of a plant-based diet. Use a surprising statistic as your hook.

Persuasive Essay: Write an introduction for a persuasive essay arguing for the importance of renewable energy. Use a provocative question as your hook.

Descriptive Essay: Write an introduction for a descriptive essay about your favorite place. Use a descriptive scene as your hook.

Summarizing and Restating Thesis Statements:

Exercise 1: Write a conclusion for an essay on the impact of social media on mental health. Summarize the main points and restate the thesis in a new way.

Exercise 2: Write a conclusion for an essay on the importance of financial literacy. Summarize the key arguments and offer a call to action.

Peer Review Activities

Sharing your work with peers and receiving feedback is a valuable part of the writing process. Here are some peer review activities to help you refine your introductions and conclusions:

Sharing Introductions and Conclusions:

Activity 1: Pair up with a peer and exchange introductions. Provide feedback on the effectiveness of the hook, clarity of the thesis statement, and overall engagement.

Activity 2: Exchange conclusions with a peer. Provide feedback on the summary of key points, restatement of the thesis, and the impact of the final thoughts.

Group Discussions:

Discussion 1: Form a small group and share your introductions. Discuss what makes each introduction effective and suggest improvements.

Discussion 2: Share your conclusions in a group setting. Discuss the strengths and weaknesses of each conclusion and brainstorm ways to enhance them.

Practice Creating Hooks

Here are some specific exercises to help you practice creating hooks for different types of essays:

Anecdote Hook:

Write an anecdote hook for an essay about the importance of teamwork. Think of a personal story or a well-known anecdote that illustrates the value of working together.

Statistic Hook:

Write a statistic hook for an essay on the effects of climate change. Find a surprising or alarming statistic that highlights the urgency of the issue.

Question Hook:

Write a question hook for an essay on the benefits of learning a second language. Pose a thought-provoking question that makes the reader consider the advantages of bilingualism.

Quotation Hook:

Write a quotation hook for an essay on the power of perseverance. Choose a relevant quote from a famous figure that encapsulates the theme of persistence.

Descriptive Scene Hook:

Write a descriptive scene hook for an essay about the beauty of nature. Use vivid language to paint a picture of a serene natural setting.

Exercises on Summarizing and Restating Thesis Statements

Exercise 1:

Write a conclusion for an essay on the benefits of regular exercise. Summarize the main points discussed in the essay and restate the thesis in a new way. Offer final thoughts on how regular exercise can improve overall well-being.

Exercise 2:

Write a conclusion for an essay on the importance of education. Summarize the key arguments made in the essay and restate the thesis. Reflect on the broader implications of education for individuals and society.

Peer Review Activities

Activity 1:

Pair up with a peer and exchange introductions. Provide feedback on the effectiveness of the hook, clarity of the thesis statement, and overall engagement. Discuss what works well and suggest areas for improvement.

Activity 2:

Exchange conclusions with a peer. Provide feedback on the summary of key points, restatement of the thesis, and the impact of the final thoughts. Discuss how well the conclusion provides closure and leaves a lasting impression.

Group Discussions:

Form a small group and share your introductions. Discuss what makes each introduction effective and suggest improvements. Consider the different types of hooks used and how well they engage the reader.

Share your conclusions in a group setting. Discuss the strengths and weaknesses of each conclusion and brainstorm ways to enhance them. Reflect on how well each conclusion summarizes the main points and provides a final perspective.

Practice is key to mastering these techniques, and feedback from peers can provide valuable insights and help you improve your writing.

Thank you for following along with this quick guide to introductions and conclusions. If you're interested in learning more about creative and practical writing, consider checking out the blog.

< Part 3 ||| Learn More >

#female writers#writblr#writerscommunity#writing#learn to write#writers on tumblr#writeblr#writers and poets#ao3 writer#creative writing#amwriting#writers#writers of tumblr#writers on writing#writer#writing sample#writing prompt#writing inspiration#writing community#writing advice#writing ideas#on writing#author#book writing#novel writing

23 notes

·

View notes