#Term Insurance and Financial Security

Explore tagged Tumblr posts

Text

Term Life Insurance Offer Financial Security

One of the primary benefits of purchasing term life insurance is the financial security it provides for your loved ones. In the unfortunate event of your untimely demise during the policy term, your beneficiaries will receive a lump-sum payout. This can help them cover immediate expenses, such as funeral costs, outstanding debts, and daily living expenses.

Affordability and Cost-Effectiveness:

Term life insurance is known for its affordability compared to other types of life insurance, such as whole life or universal life. The premiums for term life insurance are generally lower, making it a cost-effective option for individuals or families on a budget. This affordability allows policyholders to Buy Term Life Insurance without straining their finances.

Flexibility and Customization:

Term life insurance offers a high degree of flexibility, allowing individuals to tailor their coverage to specific needs. Policyholders can choose the term length that aligns with their financial goals and family situation. This flexibility is especially beneficial for those who may only need coverage for a certain period, such as until their children are financially independent or their mortgage is paid off.

Supplemental Coverage during Critical Life Stages:

Many people opt for term life insurance to provide supplemental coverage during critical life stages. For example, individuals may purchase term life insurance when starting a family to ensure that their children and spouse are financially protected. As responsibilities and financial obligations change over time, term life insurance can be adjusted to align with these evolving needs.

Peace of Mind:

Knowing that your loved ones are financially protected in the event of your death can offer significant peace of mind. Term life insurance provides a safety net, allowing policyholders to focus on their daily lives without the constant worry about the financial well-being of their family in case of an unforeseen tragedy.

Easily Understandable and Transparent:

Unlike some complex life insurance products, term life insurance is straightforward to understand especially if you get them from reliable sources such as PNB MetLife. There are no confusing investment components or cash value accumulations. This transparency makes it easier for individuals to make informed decisions about their coverage without the need for in-depth financial knowledge.

Thus, buying term life insurance offers a range of benefits, including financial security for loved ones, affordability, flexibility, and peace of mind. As a practical and customizable insurance option, term life insurance provides individuals with the opportunity to protect their family's financial future straightforwardly and cost-effectively.

#Term Life Insurance Benefit#Term Insurance and Financial Security#Term Insurance for Long Term#Term Insurance for Financial Security

0 notes

Text

Fusco Insurance, Retirement $ Wealth Planning Services, Inc.

August 2024 Newsletter Fusco Insurance, Retirement & Wealth Planning Services Inc.August 2024 Newsletter A Message from Fusco Insurance Dear Valued Clients and Friends, As we move through August, we want to remind you that planning for the future is more than just a necessity—it’s an opportunity to secure peace of mind for you and your loved ones. This month, we’re focusing on essential…

#annuities#Asset Protection#Client Success Stories#Elder Care Planning#estate planning#financial-planning#Fusco Insurance#Insurance Services#LegalShield#Long Term Care#Medicare Planning#retirement planning#Retirement Security#wealth management#Wealth Preservation

0 notes

Text

Mastering Financial Literacy: A Complete Guide

Unlock your path to financial freedom! Dive into our comprehensive guide on financial literacy, budgeting, saving, investing, and retirement planning. Share your thoughts, ask questions, and join the conversation to take control of your financial future.

The Concept of Financial Literacy Financial Literacy Concept Did you know that one in five American adults would rather spend more time planning their vacations than managing their finances? A survey by MyBankTracker (n.d.) revealed that nearly 20.1 percent of American adults spend more time researching travel details than handling their money matters, yet 34 percent use an…

View On WordPress

#401(k) plans#active income sources#budgeting tips#building wealth#compound interest benefits#creating a budget#creating a will#credit scores and reports#debt consolidation strategies#debt management#effective budgeting methods#emergency fund importance#establishing trusts#estate planning#financial education resources#financial freedom journey#financial goals#financial literacy#financial security#financial stability#health insurance benefits#healthcare cost planning for retirement#improving credit ratings#inflation impact on savings#insurance coverage#investment diversification tips#investment options#IRAs#life insurance policies#long-term wealth accumulation plans

1 note

·

View note

Text

Strategic Insurance Choices: Unlock Financial Freedom Now

Hey there! Have you ever considered how strategic insurance choices can help you protect your finances and loved ones? Explore this idea and see why insurance is essential to your financial plan. Insurance provides a safety net during unexpected events and can be critical to your financial strategy. This guide will help you understand and evaluate the types of insurance you need and how to…

View On WordPress

#assessing insurance needs based on financial goals#benefits of life insurance in financial strategies#best insurance policies for young adults#choosing the right insurance for financial protection#Financial Planning.#Financial Security#how to compare insurance policies effectively#how to integrate insurance with investments#Insurance Policies#integrating long-term care insurance with retirement planning#Investment Strategies#Risk Management#tax benefits of purchasing insurance policies#the impact of insurance on financial stability#types of insurance for financial planning

1 note

·

View note

Text

Want Financial Stability, the endless bag? Get Started by

youtube.com/shorts/idZuPnOAlbk Want Financial Stability, the endless bag? Get Started by buying a whole life insurance policy or two. Yeah I know it sounds crazy but it’s legit and worth it in the long run.🏃🏾♀️ Bankers, are well-versed in the financial instruments available to clients, including whole life insurance policies. Whole life insurance is a type of permanent life insurance that…

View On WordPress

#financial freedom#financial news#financial security#financial stability#long term#money#no taxable#protection#the bag#ton1radio#ToniOnOne#wealth#whole life insurance policy

0 notes

Text

PROTECT Family from Loan & Mortgage - Buy term insurance

Do you know the benefits of term insurance?

Term insurance plans offer; a) Financial security for the entire family in case of the unfortunate death of the policyholder. b) You can get optional coverage for critical illnesses or accidental death. c) You are covered for a long duration, while the premiums are affordable. d) Temporary coverage for a specific term like 10, 20, or 30 years allows you to align the coverage period with specific financial obligations, such as paying off a mortgage, funding your children's education, or supporting your family during your working years. e) Term insurance provides valuable financial protection for your dependents if you were to pass away unexpectedly. It can help replace lost income and provide a safety net for your loved ones.

#Benefits of Term Insurance#Advantages of Term Insurance#Term insurance protects Family#Term Insurance Protects Family#Term Insurance + Debt#Term Insurance + Bills#Term Insurance + Mortgage#Term Insurance + Loan#Term Insurance benefits#Financial security + Term Insurance#term insurance + parents#term insurance + dependents

0 notes

Text

Seizing bright opportunities with Sun Life's Sustainability-Driven VUL Fund

In a world where conscious investing is on the rise, Sun Life of Canada (Philippines), Inc. has unveiled an exciting opportunity for socially conscious investors. Introducing the Peso Global Sustainability Growth Fund, Sun Life’s first-ever sustainability-driven VUL (Variable Universal Life) equity fund. This fund aims to generate long-term capital appreciation by investing in global funds that…

View On WordPress

#Advancing Sustainable Investing#Benedict Sison#brighter future#conscious investing#diversify assets#ESG factors#Financial Independence Month#Fostering Healthier Lives#global sustainable progress#Increasing Financial Security#investment-linked insurance products#long-term capital appreciation#Peso Global Sustainability Growth Fund#press release#responsible investing#Sun FlexiLink#sun life#Sun Life advisor#Sun Life blog#sun life philippines#Sun MaxiLink#sustainability journey#sustainability-driven VUL fund#sustainable finance#sustainable future#sustainable investing#sustainable investing principles#sustainable progress#Trusted and Responsible Business#United Nations Sustainability Goals

0 notes

Text

The Financial Superhero: How Mothers Excel in Managing Family Finances

Mothers have long been the backbone of the family, nurturing, caring, and ensuring the well-being of their loved ones. However, their contributions extend far beyond providing emotional support and taking care of household chores. Mothers also play a crucial role in managing a family’s finances, often serving as the unsung heroes who keep the financial wheels turning smoothly. In this article,…

View On WordPress

#Budgeting skills#Emergency fund management#Family financial management#Financial challenges and support#Financial education#Financial flexibility#Financial planning#Financial stability#Financial superheroes#Insurance and financial security#Long-term financial goals#Motherhood and finance#Mothers and finances#Negotiation and bargaining#Resourcefulness in finance#Saving and investing#Supplementing family income#Teaching financial responsibility#Wise spending decisions

0 notes

Text

THE SUBTLE ART OF BECOMING FINANCIALLY FREE IN 2024 💸 🎀 ྀིྀི

Hey girlies, Hanalia is back, ready to dive into some real talk about achieving financial freedom. No fluff, just hardcore truths to help you grow and secure your future like the badass queens you are.

1. Know Your Worth: Ladies, let's talk real. Your value isn't about how many likes you get or what brand you wear. It's about your talents, your skills, and your drive to succeed. Invest in yourself—learn, grow, and never underestimate what you bring to the table.

˖⁺‧₊ It's not just about earning money; it's about how you invest it. Our aim is growth, and often, you need income to invest in yourself. ˖⁺‧₊

2. Budget Like a Boss: Financial freedom starts with knowing where your money goes, okay. Time to get real with those finances. Budgeting isn't about restrictions; it's about empowerment. I used to think it was all about penny-pinching, but it's really about knowing where every dollar goes and making intentional choices.

3. Crush Debt: Debt can feel overwhelming, trust me, I've been there. But facing it head-on is how you break free. Start with the high-interest stuff, make a plan, and stick to it like your future depends on it—because it does.

˖⁺‧₊ Debt can feel like quicksand, but you're no damsel in distress. The sooner you free yourself from debt, the sooner you'll have more money to build your empire.˖⁺‧₊

4. Invest Wisely: Investing isn't just for the rich. Start small, educate yourself, and build your portfolio. I've learned that the sooner you start, the more your money can grow over time. It's about making your money work for you, not the other way around.

˖⁺‧₊ PS. Forget the lottery mentality. Real wealth is built through smart investing. Educate yourself on stocks, bonds, real estate—whatever piques your interest. Start small, diversify, and let your money work for you.˖⁺‧₊

5. Build Multiple Streams of Income: Oh my osh! I cannot stress enough the importance of this! Your 9-to-5 isn't your only option. I've hustled with side gigs, freelancing—you name it. Multiple streams of income give you security and freedom. Don't limit yourself—explore what lights you up and brings in the cash.

6. Protect Yourself: Life's unpredictable, but you can be prepared. Having health insurance and an emergency fund can be lifesavers. It's about peace of mind and knowing you're covered, no matter what.

˖⁺‧₊ Get health insurance, build an emergency fund, and consider long-term savings like retirement plans.˖⁺‧₊

7. Own Your Future: Financial freedom isn't an end goal; it's a mindset. It's about having choices and the power to live life on your terms. Stay focused, stay disciplined, and never settle for less than you deserve.

Your money is your shield. Make it stronger, fairly. I completely understand that nowadays there are countless ways to earn income, but always choose the ones that align with your values.

You can click here to get your own goodnotes planner at my store GlowInGrow at 75% DISCOUNT.

However, if you're into making some extra cash while you hustle towards your goals, I've got this cool affiliate program, click here to JOIN US 30% COMMISSION. It's all about empowering each other to glow and grow. Let's support each other on this journey, because together, we're unstoppable. 💪💸

Last but not least, at the end of your journey of becoming that girl awaits the future who is The Girl!

Stay safe and stay hot...

With Love, Hanalia

#thatgirl#selflove#selfcare#dailyplanner#glowup#selfimprovement#softgirl#lovecore#thatgirl2024#becomingher#That girl planner#that girl#that girl aesthetic#that girl routine#clean girl#daily planner#self love#self care#wonyoungism#becoming that girl#becoming her#self improvement#glow up#pink pilates princess#soft girl#that girl 2024

191 notes

·

View notes

Text

The Rise of DeFi: Revolutionizing the Financial Landscape

Decentralized Finance (DeFi) has emerged as one of the most transformative sectors within the cryptocurrency industry. By leveraging blockchain technology, DeFi aims to recreate and improve upon traditional financial systems, offering a more inclusive, transparent, and efficient financial ecosystem. This article explores the fundamental aspects of DeFi, its key components, benefits, challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What is DeFi?

DeFi stands for Decentralized Finance, a movement that utilizes blockchain technology to build an open and permissionless financial system. Unlike traditional financial systems that rely on centralized intermediaries like banks and brokerages, DeFi operates on decentralized networks, allowing users to interact directly with financial services. This decentralization is achieved through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Key Components of DeFi

Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly with one another without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap have gained popularity for their ability to provide liquidity and facilitate peer-to-peer trading.

Lending and Borrowing Platforms: DeFi lending platforms like Aave, Compound, and MakerDAO enable users to lend their assets to earn interest or borrow assets by providing collateral. These platforms use smart contracts to automate the lending process, ensuring transparency and efficiency.

Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies to reduce volatility. They are crucial for DeFi as they provide a stable medium of exchange and store of value. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Yield Farming and Liquidity Mining: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining is a similar concept where users earn rewards for providing liquidity to specific pools. These practices incentivize participation and enhance liquidity within the DeFi ecosystem.

Insurance Protocols: DeFi insurance protocols like Nexus Mutual and Cover Protocol offer coverage against risks such as smart contract failures and hacks. These platforms aim to provide users with security and peace of mind when engaging with DeFi services.

Benefits of DeFi

Financial Inclusion: DeFi opens up access to financial services for individuals who are unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. Anyone with an internet connection can participate in DeFi, democratizing access to financial services.

Transparency and Trust: DeFi operates on public blockchains, providing transparency for all transactions. This transparency reduces the need for trust in intermediaries and allows users to verify and audit transactions independently.

Efficiency and Speed: DeFi eliminates the need for intermediaries, reducing costs and increasing the speed of transactions. Smart contracts automate processes that would typically require manual intervention, enhancing efficiency.

Innovation and Flexibility: The open-source nature of DeFi allows developers to innovate and build new financial products and services. This continuous innovation leads to the creation of diverse and flexible financial instruments.

Challenges Facing DeFi

Security Risks: DeFi platforms are susceptible to hacks, bugs, and vulnerabilities in smart contracts. High-profile incidents, such as the DAO hack and the recent exploits on various DeFi platforms, highlight the need for robust security measures.

Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, with governments and regulators grappling with how to address the unique challenges posed by decentralized financial systems. This uncertainty can impact the growth and adoption of DeFi.

Scalability: DeFi platforms often face scalability issues, particularly on congested blockchain networks like Ethereum. High gas fees and slow transaction times can hinder the user experience and limit the scalability of DeFi applications.

Complexity and Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and providing educational resources are crucial for broader adoption.

Notable DeFi Projects

Uniswap (UNI): Uniswap is a leading decentralized exchange that allows users to trade ERC-20 tokens directly from their wallets. Its automated market maker (AMM) model has revolutionized the way liquidity is provided and traded in the DeFi space.

Aave (AAVE): Aave is a decentralized lending and borrowing platform that offers unique features such as flash loans and rate switching. It has become one of the largest and most innovative DeFi protocols.

MakerDAO (MKR): MakerDAO is the protocol behind the Dai stablecoin, a decentralized stablecoin pegged to the US dollar. MakerDAO allows users to create Dai by collateralizing their assets, providing stability and liquidity to the DeFi ecosystem.

Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their cryptocurrencies or borrow assets against collateral. Its governance token, COMP, allows users to participate in protocol governance.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin has integrated DeFi features, including a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique blend of humor and finance adds a distinct flavor to the DeFi landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of DeFi

The future of DeFi looks promising, with continuous innovation and growing adoption. As blockchain technology advances and scalability solutions are implemented, DeFi has the potential to disrupt traditional financial systems further. Regulatory clarity and improved security measures will be crucial for the sustainable growth of the DeFi ecosystem.

DeFi is likely to continue attracting attention from both retail and institutional investors, driving further development and integration of decentralized financial services. The flexibility and inclusivity offered by DeFi make it a compelling alternative to traditional finance, paving the way for a more open and accessible financial future.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, leveraging blockchain technology to create a more inclusive, transparent, and efficient financial system. Despite the challenges, the benefits of DeFi and its continuous innovation make it a transformative force in the world of finance. Notable projects like Uniswap, Aave, and MakerDAO, along with unique contributions from meme coins like Sexy Meme Coin, demonstrate the diverse and dynamic nature of the DeFi ecosystem.

For those interested in exploring the playful and innovative side of DeFi, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

252 notes

·

View notes

Text

The Benefits of Investing in Physical Gold with Fusco Insurance, Retirement & Wealth Planning Services

The Benefits of Investing in Physical Gold with Fusco Insurance, Retirement & Wealth Planning Services

The Timeless Appeal of Gold Investing in physical gold has long been considered a wise financial move for those looking to diversify their portfolios and safeguard their wealth. Unlike paper currency, gold has intrinsic value and has stood the test of time as a reliable store of value. Here are some key benefits of investing in physical gold: Hedge Against Inflation: Gold is often seen as a…

View On WordPress

#Asset Protection#financial security#Fusco Insurance#Gold Investment#Inflation Hedge#Investing#IRA Rollovers#Liquid Assets#Long-Term Value#Physical Gold#Portfolio Diversification#Precious Metal IRAs#retirement planning#Risk Management#Tangible Assets#Wealth Planning

1 note

·

View note

Text

Basic Financial Skills Everyone Should Learn

Budgeting: Creating a budget is a crucial skill for managing personal finances. A budget helps you keep track of your income and expenses and enables you to plan and prioritize your spending.

Saving: Saving is another important financial skill. It's essential to set aside a portion of your income for emergencies, retirement, or other long-term goals.

Investing: Understanding the basics of investing can help you grow your money over time. Learning about different investment options such as stocks, bonds, mutual funds, and ETFs can help you make informed investment decisions.

Debt Management: Understanding debt and how to manage it is essential for financial stability. This includes understanding interest rates, payment schedules, and strategies for paying off debt.

Credit Scores: Your credit score is a critical component of your financial health. Understanding how credit scores work, what factors affect them, and how to improve them is vital.

Taxes: Understanding the basics of taxes, such as tax deductions, credits, and filing requirements, is essential for managing your finances.

Financial Planning: Developing a financial plan helps you achieve your financial goals by identifying your priorities, creating a budget, and determining the best investment strategies for your needs.

Understanding Interest Rates: Interest rates are an important component of many financial products, such as loans, credit cards, and savings accounts. Understanding how interest rates work, how they are calculated, and how they can impact your finances is important.

Insurance: Understanding the different types of insurance, such as health, life, and property insurance, is crucial for protecting yourself and your assets. Knowing what types of coverage you need, how to choose a policy, and how to file a claim is important.

Retirement Planning: Planning for retirement is essential for everyone, regardless of age. Knowing how much you need to save, how to invest your money, and when to start taking Social Security benefits can help you achieve a comfortable retirement.

Estate Planning: Estate planning involves creating a plan for the distribution of your assets after you die. Understanding the basics of estate planning, such as creating a will and selecting beneficiaries, can help ensure that your assets are distributed according to your wishes.

Basic Math Skills: Having a basic understanding of math, such as calculating percentages, can help you make informed financial decisions. This includes understanding how interest rates are calculated, how much you can save by making extra payments on your loans, and how much you will earn from your investments.

2K notes

·

View notes

Text

Writing Notes: Death & Dying

Death - the end of life, a permanent cessation of all vital functions.

Dying - the body’s preparation for death. This process may be very short in the case of accidental death, or it can last weeks or months, such as in patients suffering from cancer.

DEATH PREPARATION

Although it is not always possible, death preparation can sometimes help to reduce stress for the dying person and their family. Some preparations that can be done beforehand include:

Inform one or more family members or the executor of the estate about the location of important documents, such as social security card, birth certificate, and others.

Take care of burial and funeral arrangements (such as cremation or burial, small reception or full funeral) in advance of death, or inform family members or a lawyer what these arrangements should be.

Discuss financial matters (such as bank accounts, credit card accounts, and federal and state tax returns) with a trusted family member, lawyer, estate executor, or trustee.

Gather together all necessary legal papers relating to property, vehicles, investments, and other matters relating to collected assets.

Locate the telephone numbers and addresses of family and friends that should be contacted upon the death.

Discuss outstanding bills (such as utilities, telephone, and house mortgage) and other expenses that need to be paid.

Collect all health records and insurance policies.

Identify the desire to be an organ donor, if any.

MOURNING & GRIEVING

The death of a loved one is a severe trauma, and the grief that follows is a natural and important part of life.

No two people grieve exactly the same way, and cultural differences play a significant part in the grieving process.

For many, the immediate response may be shock, numbness, or disbelief.

Reactions may include:

Shortness of breath, heart palpitations, sweating, and dizziness.

Other reactions might be a loss of energy, sleeplessness or increase in sleep, changes in appetite, or stomach aches.

Susceptibility to common illnesses, nightmares, and dreams about the deceased are not unusual during the grieving period.

Emotional reactions are as individual as physical reactions.

A preoccupation with the image of the deceased or feelings of hostility, apathy, emptiness, or even fear of one’s own death may occur.

Depression, diminished sex drive, sadness, and anger at the deceased may be present.

Bereavement may cause short- or long-term changes in the family unit or other relationships of the bereaved.

It is important for the bereaved to work through their feelings and to not avoid their emotions.

Support groups are often available.

If a person does not feel comfortable discussing emotions and feelings with family members, friends, or primary support groups, they may wish to consult a therapist to assist with the process.

Various cultures and religions view death in different manners and may conduct mourning rituals according to their own traditions.

Visitors often come to express their condolences to the family and to bid farewell to the deceased.

Funeral services may be public or private.

Family or friends of the deceased may host a gathering after the funeral to remember and celebrate the life of the deceased, which also helps the bereaved to begin the mourning process positively.

Knowing how much a loved one is cherished and remembered by friends and family can provide comfort to those who experienced the loss.

Other methods of condolences include sending flowers or cards to the home or the funeral parlor, sending a donation to a charity that the family has chosen, or bringing a meal to the family during the weeks after the death.

Source ⚜ More: Writing Notes & References ⚜ Pain ⚜ Bereavement Death & Cheating Death ⚜ Pain & Violence ⚜ Death & Sacrifice

#writing notes#color blindness#writeblr#dark academia#spilled ink#literature#writers on tumblr#writing reference#poets on tumblr#writing prompt#poetry#creative writing#writing inspiration#writing ideas#light academia#jacques louis david#writing resources

87 notes

·

View notes

Text

Term Life Insurance: Why You Must Consider It? : 5 Benefits of Your Term Life Insurance

Term Life Insurance is an essential part of your financial portfolio. In the realm of financial planning, securing your family’s future is paramount. Among the various insurance options available, a term life insurance stands out as a foundational element in safeguarding your loved ones’ financial well-being. Let’s delve into the compelling reasons why having a term life insurance is important…

View On WordPress

#affordable coverage#asj financial services#asj insurance#comprehensive insurance#critical illness rider#family security#financial planning#financial protection#flexible term#life insurance#tax benefits#Term life

0 notes

Note

Feel the need to push back on a couple of things.

New Orleans (even post-Katrina) is not a "third world country." Also, the preferred nomenclature is "developing country" or "global south." But NOLA doesn't qualify, no matter what term one uses.

"Succession by popular vote instead of by hereditary primogeniture." -- even Harry's not that stupid. What Harry means by "modernizing" is to split the Duchy of Cornwall and then Lancaster, and for him to get all the perks - security, grace and favour home, staff, etc - without having to read the red boxes or meet the PM weekly or be sent somewhere he doesn't want to go. What Meghan means by it is what she's still trying to do: let me use my title to get fame, freebies, and financial remuneration, without having to live in the UK or do any work.

Lastly, I don't want to denigrate Earthshot or Homewards but as I understand the projects (and maybe I'm misunderstanding) their impacts won't be measurable for a while either. Not that there's anything wrong with that. I have no objections to the Homewards project (as I understand it) and my sole - but fierce - objection to Earthshot is the galas. (I don't care if that's how most non-profits make money, it's the wrong move for an environmental org.)

Thanks for this. A few things.

You misunderstood what I meant by post-Katrina New Orleans. I wasn't talking about post-Katrina today or post-Katrina 2010s. I meant immediately post-Katrina, as in September 1, 2005 post-Katrina. New Orleans, and especially the Lower 9th Ward, was left in really horrific conditions that absolutely were reminiscent of developing nations. Celebrities with no connections to New Orleans (like Brad Pitt and Angelina Jolie) flocked there for years to do charity work and many of them used their New Orleans-based humanitarian aid efforts for self-promotion. I should have been clearer about that.

And by the way, while today most of New Orleans has largely recovered from the effects of Katrina, Rita, and Wilma, there are still parts of it - especially in the Lower 9th Ward - still dealing with the impact, long after the rest of the city and the rest of the world moved on. For example, it took 10 years for residents to get a single grocery store after the storms. Many residents are still tied up in financial problems from storm damage, insurance, and rebuilding. And there are buildings condemned from the storms still standing, still with FEMA search and rescue symbols on them, still with mold and personal belongings and flood damage in them, and there's reasonable belief that some missing/unaccounted-for people from the storm may still be in those abandoned structures. (And also let's not forget the ethical and moral issues being debated still today.)

If you still don't believe how horrific post-Katrina was or that a city in the US could feel so abandoned that it paralleled developing countries, I encourage you to read memoirs or listen to stories from Katrina survivors and New Orleans residents about what it was like after the storms. (This book is hard to read, but it's worth it. There's an Apple series made if you'd rather watch it instead.)

To your third point about Earthshot projects not having results yet, nope. The Earthshot projects may not have global results yet or large-scale results, but they do already have results, even if small. Because Earthshot isn't funding brand new initiatives - Earthshot is funding small, proven, existing projects and awarding the winners grants to scale up their operations. It's right there on the website:

"Proven prototypes" and "signs of success" means that the projects must have outcomes and results to report in their applications. They can be small datasets, but they're still datasets, outcomes, and results that Earthshot winners are able to compare their grant-funded work against to measure the effectiveness of those grants.

Further, Earthshot's Roadmap, which describes how they evaluate nominations to determine finalists and winners, has specific requirements for nominees to demonstrate actual impact of their work:

So, yes, Earthshot projects are able to deliverable measurable results quickly. And we know they're delivering measurable results immediately because Earthshot and William are promoting it. That's the whole point of those "come see what Earthshot winners are doing" videos on social media and engagements - it's to show how the companies are using their prize grants to deliver on the metrics they were required to support in their nominations.

36 notes

·

View notes

Text

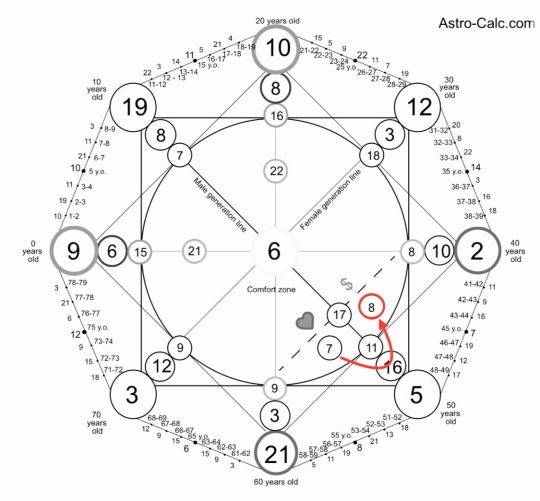

web of wyrd: the career number

the number we are focusing on today is based on the SACRAL PHYSICS NUMBER AND THE FLOW NUMBER (ex: my career number is 7: 8 + 17 = 25 -> 2 + 5 = 7 (recall that numbers must be summed a second time if they total 23 (i.e. 2 + 3 = 5) and above)). for some reason this is a calculation error in my astro-calc chart - my monetary number and relationship numbers are swapped (don't be afraid to question your numbers and check the math of websites).

but what does this number mean?

this number represents your career and monetary situation in this lifetime. that being said, this number can give you insight into what you can do for a career long-term, what you are like at work (your strengths and weaknesses in the workplace), and your monetary mindset.

so let's talk about some examples:

7 - the chariot

click here for the card description of the chariot found in a prior wyrd web post.

for unblocked 7s it is important to maintain focus, have clear intentions, and a plan in their line of work. they often work from the bottom up - they start in an entry level position then come into power (in some theories, the charioteer was both the page of swords and the page of wands before they came into power in the major arcana). often it is their careful planning and plotting that gains them their success.

blocked 7s often lack confidence at work and fear being talked down to / judged for their actions. they often lack focus and direction, which causes them financial stress. they are in need of careful planning and reflection to get out of their burdensome situations. they should try to be less impulsive and more intentional at work and when searching for jobs in order for them to find what works for them.

careers for the charioteer are chauffeur, delivery driving (UPS, amazon delivery, mail, etc), military services, pilot, police men, emergency services (firefighting, EMT, etc), security guard, equestrian, chemist/pharmacist, chef/cook/baker/nutritionist, political diplomat, marine biology, phlebotomist, ship captain, babysitter/nanny, hotel manager, housekeeper, fisherman, fertility specialist, farmer, land baron/baroness, pottery maker, plumber, real estate agent, and other related fields.

14 - temperance

rider-white's temperance (symbolic of sagittarius) depicts an angel facing the view with their eyes shut. their purple-y/red wings emphasizes their passion for the mystical as well as harmony. their golden curls are haloed showing that the angel is an enlightened being. they stand in a white (innocence) robe with one foot on land and the other in water - which shows they are connected to the emotional and the physical world. water seamlessly flows between the cups, meaning to show the flow of energy in life forces. a sun (alludes to the sun card) rises in the distance and illuminates a path for the angel to take. the irises to their [the angel's] right show that they have the wisdom needed to take on whatever gets in their way on this journey.

unblocked 14s seek help from those around them so that they can reach their monetary and career goals. they look for signs as to what they should act upon in their career and as to what they should do for their long-term career. they are flexible at work and are often very even-keeled. they are patient at work and when it comes to making money.

blocked 14s often try very hard at work and to make a lot of money - they can be too hard on themselves and their co-workers. they might struggle with relaxing - they have a lot of monetary stress. they have to realize that being overworked does not mean they are working efficiently/effectively. look at you schedule / your role and try to find ways to slow down so that you can realign with your values and goals.

careers for the angelic temperance person are medical careers (doctor, nurse, etc), pharmacist, scientist, librarian, life insurance agent, marketing/advertisement, air steward/stewardess, attorney, banker, religious leader, teacher, philanthropist, philosopher, publisher, podcaster, radio show host/hostess, writer, and other related fields.

18 - the moon

rider-white's the moon (symbolic of pisces) depicts one wild dog/coyote and one tame dog (the duality of human nature) barking at the moon or rather an eclipse. behind and between the two dogs is a lobster - the lobster is a bottom feeder of sorts, thus could represent the shadow self. the lobster emerges from the water to walk a moonlight/guided path through the mountains similar to how the hermit once walked the mountains - thus alluding to the lobster doing self-discovery / the quartet doing shadow work. first the lobster must walk between the rebuilt towers - likely face personal change.

unblocked 18s embrace their darker selves when in the workplace - they are okay with failing and having weaknesses. they see it as room made to grow/evolve. while they know how to be civil, they also know when to be impulsive and aggressive to get things done. they are open to others ideas - they are open to learning what they perviously didn't know before. they are ambitious and want to go outside the scope of what they are already know. they don't fall for things that sound too good to be true in their financial realm. they are willing to confront why they maybe the ones in their own way of gaining more money, getting a raise, etc.

blocked 18s often refuse to acknowledge that they are in a career that is making them unhappy or is not compatible with their monetary lifestyle. they might be the type to ignore their debts for awhile or to the point where it gets bad and they struggle to catch up / recover. they are also prone to falling for "get rich quick" schemes; they also might struggle with gambling - the might not know how to walk away when they have made money back / are gaining. they hate failing at things or having weaknesses in the workplace. they are prone to staying in a job that is comfortable for them without growing or accepting promotions. don't be afraid to break free.

careers for the moon are night club owner/manager, psychic, doggie daycare center management, dog kennel owner, dog breeder, night club performer, professional water sport athlete, alcohol vender, sommelier, marine biology, art therapist, artist, bartender, mental health professional, chemical engineer, detective, drug manufacturer, life guard, prison guard, private investigator, relief worker, writer, and other related fields.

like what you read? leave a tip and state what post it is for! please use my "suggest a post topic"! button if you want to see a specific pac/pile next! if you'd like my input on how i read a specific card or what i like to ask my deck, feel free to use the ask button for that as well.

click here for the masterlist

click here for more web of wyrd related posts

want a personal reading? click here to check out my reading options and prices!

© a-d-nox 2023 all rights reserved

#astrology#astro community#astro placements#astro chart#tarotblr#tarot cards#tarot#tarot art#daily tarot#tarot reading#tarot deck#tarotdaily#tarot witch#rider waite tarot#tarotcommunity#matrix of destiny#matrix of fate#the matrix#wyrd web#web of wyrd

231 notes

·

View notes