#Tax Policies 2024

Text

All About US Tax Policies in 2024

Navigating the labyrinth of US tax policies in the United States can be daunting. As we move into the 2024-2025 tax years, understanding various tax implications is crucial for individuals, businesses, and government employees alike. This guide delves into specific areas of US tax policy, including taxation on credit cards, insurance, education, businesses, corporate employees, politicians, and government employees.

1. Tax on Credit Cards

1.1 Understanding Credit Card Taxation

Credit card usage itself does not directly incur a tax. However, the rewards and benefits earned from credit card use can have tax implications. For instance, cashback and points received as part of a credit card reward program are typically considered taxable income if they are in the form of cash or redeemable for goods or services.

1.2 Reporting Credit Card Rewards

When it comes to tax reporting, credit card rewards need to be reported if they exceed certain thresholds or if they are converted into cash. The IRS requires you to report these rewards as part of your income, especially if they are considered income rather than a discount.

1.3 Tax Implications for Business Credit Cards

Business credit cards also have tax implications. Expenses charged to business credit cards can often be deducted as business expenses, but it’s crucial to maintain proper documentation and distinguish between personal and business expenses.

Suggested Articles: Brightway Credit Card in the US 2024 | United State Cards

2. Tax on Insurance

2.1 Types of Insurance Taxed

Not all insurance types are taxed. Health insurance premiums paid with pre-tax dollars, such as through an employer-sponsored plan, are generally not subject to federal income tax. However, some types of insurance, such as certain types of annuities, may have tax implications.

2.2 Tax Benefits of Health Insurance

Health insurance can provide several tax benefits. Premiums paid for qualified health insurance plans are often deductible, and Health Savings Accounts (HSAs) offer tax advantages for saving and paying for medical expenses.

2.3 Tax Considerations for Life Insurance

Life insurance policies have different tax implications depending on their type. Generally, death benefits are not subject to federal income tax, but certain aspects of life insurance policies, like cash value accumulation, might be taxable.

Suggested Articles: Brightway Credit Card in the US 2024 | United State Cards

3. Tax on Education

3.1 Tax Deductions for Education Expenses

Education-related US tax deductions can provide significant relief. The IRS offers deductions for qualified tuition and related expenses under the American Opportunity Credit and Lifetime Learning Credit. These deductions can help reduce taxable income and provide financial relief for educational pursuits.

3.2 Tax Credits for Student Loan Repayments

Student loan repayments also come with US tax benefits. The Student Loan Interest Deduction allows taxpayers to deduct interest paid on qualified student loans, which can be beneficial for those struggling with student debt.

3.3 Impact of Education Savings Plans

Education savings plans like 529 plans offer tax advantages for saving for education expenses. Contributions to these plans may be tax-deductible, and earnings grow tax-free if used for qualified educational expenses.

4. Tax on Businesses

4.1 Corporate Tax Rates

Corporations are subject to federal income US tax rates that vary depending on their income levels. The Tax Cuts and Jobs Act of 2017 lowered the corporate tax rate to a flat 21%, which applies to most corporations.

4.2 Deductions and Credits for Businesses

Businesses can benefit from various deductions and credits, such as those for business expenses, research and development, and energy-efficient investments. Understanding these can help businesses reduce their tax liability.

4.3 Taxation of Different Business Entities

Different business entities, such as sole proprietorships, partnerships, and corporations, face varying tax treatments. Each type has its own tax obligations and benefits, which can impact how businesses plan and report their taxes.

5. Tax on Corporate Employees

5.1 Income Tax for Corporate Employees

Corporate employees, like all other employees, are subject to federal income tax based on their earnings. Employers withhold taxes from paychecks, which are then reported on W-2 forms.

5.2 Benefits and Perquisites Taxation

Corporate benefits, such as health insurance and retirement plans, are generally tax-free. However, certain perks and benefits, like company cars or bonuses, might be subject to taxation.

5.3 Tax Implications of Stock Options

Stock options granted to corporate employees can have significant tax implications. Depending on the type of stock option (incentive stock options vs. non-qualified stock options), the timing and amount of tax owed can vary.

You can check the US official laws: Corporate Tax Laws and Regulations | USA

6. Tax on Politicians

6.1 Salary and Compensation Taxation

Politicians’ salaries are subject to federal income tax just like any other salary. However, they might have unique reporting requirements for additional forms of compensation or benefits.

6.2 Reporting of Gifts and Benefits

Politicians often receive gifts or benefits, which must be reported according to federal regulations. Gifts valued over a certain amount must be disclosed to ensure transparency and avoid conflicts of interest.

6.3 Special Tax Rules for Politicians

There are specific tax rules and reporting requirements for politicians, especially concerning campaign contributions and expenses, which differ from standard tax regulations.

Suggested Articles: Brightway Credit Card in the US 2024 | United State Cards

7. Tax on Government Employees

7.1 Income Tax and Benefits

Government employees are subject to federal income tax on their earnings. Benefits provided, such as retirement contributions, are often tax-deferred until they are withdrawn.

7.2 Tax Deductions Specific to Government Jobs

Certain deductions might be available for government employees, such as those related to uniforms or home office expenses, depending on job requirements.

7.3 Retirement Benefits Taxation

Retirement benefits for government employees, including pensions and other retirement plans, are subject to specific tax rules. Generally, contributions to these plans are made with pre-tax dollars, and taxes are owed upon withdrawal.

Conclusion

Understanding US tax policies is essential for navigating financial responsibilities and optimising tax benefits. Whether it’s credit card rewards, insurance premiums, educational expenses, or business deductions, knowing the specifics can lead to better financial planning and compliance. Stay informed and consult with a tax professional to ensure accurate reporting and take full advantage of available tax benefits.

By Paisainvests.com

#Business Tax Policies#Corporate Taxation#Government Tax Policies#Tax Changes 2024#Tax Compliance US#Tax Policies 2024#US Tax Policies#US Tax Slabs 2024#US Tax System#US Taxation Rules

0 notes

Text

youtube

YEEEESSSS it happened he did it, Biden dropped out praise the human spirit! I fully believe that Kamala is the go to option and she is fully qualified to become president! Look at her amazing record as a civil servant and it's clear she's fit to be president, she's even fairly young if she became president. This is something to celebrate, we have to buckle up and push forward to ensure she wins the presidency, Trump cannot win a second turn otherwise project 2025 will be enacted! So c'mon people let's fight back against republicans on the local and national levels, we can do it people! Though i bet republicans are already planning or are slandering Kamala to deflate the steam behind her, of course they would given they probably wanted Biden to keep running given he was losing popularity. She may not be the new blood i wanted but at least she's not 80 years old like Biden or Trump, hey maybe AOC could be her VP?!

#politics#the left#eat the rich#leftism#tax the rich#us politics#culture#corporate greed#progressive#communism#president biden#joe biden#biden#biden administration#election#debate#us election#2024 election#democratic party#democrats#democracy#republicans#republican assholes#trump supporters#conservative#republican agenda#project 2025#donald trump#crooked donald#policy

21 notes

·

View notes

Text

Jonathan Nicholson at HuffPost:

Vice President Kamala Harris, in her first major economic policy address since becoming the Democratic presidential nominee, unveiled Friday proposals to ease the costs of housing and food as part of a larger effort to create “an opportunity economy.”

The speech in Raleigh, N.C., which had been widely anticipated to fill in some details of broader themes Harris has hit in her public appearances, also took a few jabs at rival GOP nominee Donald Trump and his proposals.

Harris defined an “opportunity economy” as one “where everyone can compete and have a real chance to succeed. Everyone, regardless of who they are or where they start, has an opportunity to build wealth for themselves and their children.”

The economy, and specifically inflation, is seen as one of Harris’ biggest weak spots, even as it has quickly recovered from the short but sharp downturn caused by the 2020 onset of the COVID-19 pandemic. While joblessness has remained below 4% for much of Harris’ term as vice president, inflation on a 12-month basis hit a four-decade high in 2022 and voters remain concerned about how high prices have remained.

Harris’ proposals laid out Friday looked to assuage some of that concern and give voters a new target for their ire: greedy corporations.

“When I am elected president, I will make it a top priority to bring down costs and increase economic security for all Americans. As president, I will take on the high costs that matter most to most Americans like the cost of food,” Harris said.

“I know most businesses are creating jobs, contributing to our economy and playing by the rules, but some are not and that’s just not right and we need to take action when that is the case,” she said.

She cited proposals to penalize “opportunistic companies that exploit crises” to price gouge and to boost competition in the food industry.

On housing, Harris said she will “take down barriers and cut red tape” to increase the supply of housing, with a target of 3 million new homes available for purchase or rental by the end of her first term.

She also said she’d fight for a law to prevent corporations that own rental properties from colluding to fix prices and backed helping first-time homebuyers with their purchases by providing a $25,000 government payment toward their homes.

Harris also said her proposals, which she did not put a price tag on, would be accomplished while reducing the government’s budget deficit. She did not provide details on how they would be paid for.

This afternoon, Vice President and Democratic nominee Kamala Harris delivered a brilliant speech on her economic plans, especially in regards to fixing the housing crisis and combatting price-gouging.

#HarrisWalz2024

See Also:

HuffPost: Kamala Harris’ Big Economic Speech Breaks With Biden And Continues His Legacy

#Kamala Harris#Harris Rallies#Economy#Price Gouging#2024 Presidential Election#2024 Elections#Housing#Housing Crisis#Child Tax Credit#Groceries#Taxes#Policy

6 notes

·

View notes

Text

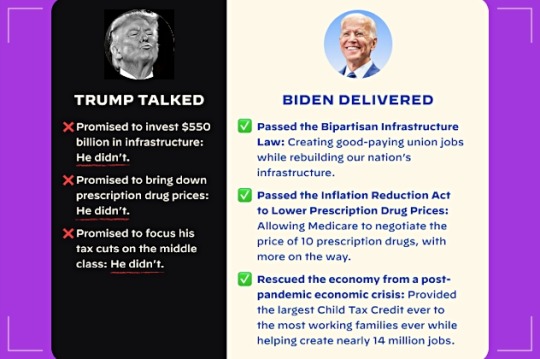

Trump's most famous promise was to make Mexico pay for his squalid and corrupt border wall.

Amount collected from Mexico: 0 centavos.

Trump did give tax breaks to billionaires while giving COVID-19 to much of the rest of the country.

Trump's promises are as worthless as degrees from Trump University.

#donald trump#trump's broken promises#republicans#trump's broken border wall#mexico isn't paying for trump's wall#tax breaks for the filthy rich#the trump pandemic recession#covid-19#joe biden#bipartisan infrastructure law#inflation reduction act#biden's pro-worker policies#child tax credit#biden supports reproductive freedom#biden is lgbtq friendly#biden is pro-democracy#biden isn't a stooge of putin#election 2024#vote blue no matter who

5 notes

·

View notes

Text

I'm not posting the former president's childcare answer. You can easily find it if you're interested. It's lengthy and an embarrassment.

He has no understanding of tariffs or the difference between them and taxes. Despite trying this idea during his term, with poor results, he still seems to think that a tariff is money that a trading partner will pay to the US, rather than an added cost for consumers.

#election 2024#childcare#tariffs#taxes#economy#he's a disaster#he has no understanding of any policy#vote blue

2 notes

·

View notes

Text

Speech Governor Walz gave at the PA State Capitol!

~BR~

#josh shapiro#kamala harris#tim walz#harris walz 2024 campaigning#policy#2024 presidential election#legislation#united states#hq#politics#democracy#national convention#democratic party#pennsylvania#harrisburg#gettysburg#Tax policy#education#affordability#middle class#tax reform#Tax and Jobs Act

2 notes

·

View notes

Text

Absolutely idiotic.

2 notes

·

View notes

Text

A proposal to add new tax brackets and increase rates for wealthier Mainers was vetoed by Gov. Janet Mills on Friday.

In her veto message, Mills listed multiple reasons for her veto. Because the bill started as a concept draft — a document without substantive text that is often used as a placeholder before the full bill language is drafted — she said the legislative process didn’t have enough transparency or opportunity for public input. She also said the bill wouldn’t provide meaningful relief for low-income taxpayers and fears it would have unintended consequences for the state budget.

The bill, LD 1231, passed in the Maine House of Representatives 88-57 and in the Senate 22-12. The proposal would have increased the income threshold for current tax brackets starting in 2025 and created three new income brackets with higher tax rates for wealthier residents.

It was put forward by Rep. Meldon Carmichael (R-Greenbush) because he said he wanted to specifically help out middle class workers, who he described during the House debate as a “segment of hardworking Maine families that have been continually left behind economically” because of circumstances out of their control.

Carmichael quoted the governor, who in her annual address said “the state of the state is strong,” but, he added, “the state of hard working families is not.”

Under LD 1231, most earners would have seen the same or lower tax rate while those at the top of the pay scale would contribute a greater portion of their income.

Currently, any single individual making more than $58,050 is taxed $3,686 plus 7.15% of excess over that amount. Couples filing jointly making $116,100 or more are taxed $7,371 plus 7.15% of excess over $116,100.

Under the proposal, there would be three new brackets for individuals making $144,500 and more that would be taxed at progressively higher rates.

Mills, a Democrat, said she shares the “worthy goal” of reducing the tax burden for lower-income people, but she said this bill wouldn’t actually achieve that because of the state’s many exemptions, deductions and credits that more people have become eligible for in recent years.

“The cumulative impact of these changes is that low-income individuals in Maine have little or no tax liability,” Mills said in her veto message. “As a result, this bill would have little or no impact on the taxpayers it is intended to benefit.”

In a statement following the veto, Garrett Martin, president and CEO at the Maine Center for Economic Policy, also said there wouldn’t have been much benefit to low-income taxpayers, “but asking the wealthy to pay more was a step in the right direction.”

“When multimillionaires pay the same income tax rate as a Mainer making just $62,000 a year, it should be obvious that change is needed,” Martin said. “The Maine Legislature should continue to work towards a fairer tax code, and Governor Mills should join the bipartisan effort to do so.”

However, Mills said she fears the bill would have had unintended consequences for the state budget by increasing the reliance on less than one percent of taxpayers. She said those taxpayers’ incomes are “disproportionately composed of highly volatile sources such as capital gains and business income.”

“At a time when we are already keeping a close eye on Maine’s budget because of increased spending and flattening revenues, there is concern from budgeting officials that relying on more volatile forms of revenue may inadvertently jeopardize the State of Maine’s fiscal standing,” she said.

#us politics#news#maine#maine morning star#2024#Gov. Janet Mills#taxes#tax brackets#tax the rich#tax the 1%#tax the billionaires#tax the wealthy#LD 1231#Rep. Meldon Carmichael#Garrett Martin#Maine Center for Economic Policy#Maine House of Representatives

3 notes

·

View notes

Text

i think my constant seething rage is honestly very reasonable. i literally live in florida.

#got in argument with a guy the other day abt idk. trans athletes#was basically him trying to explain what the issue is to me (i know. that's kinda step one to having an opinion on it.)#and then going yeah huh i guess you're actually right (i was)#and i was like okay great cool we're done here let me go to class and he starts talking about like#how he still loves trump for this and that reason kinda unprompted (sorry you lost an argument dude go introspect somewhere else im LATE)#and i was like yeah idk abt that. on account of all the corruption. and the foreign policy youre saying is like manly macho man strong is#mostly just wildly stupid posturing that's going to achieve nothing at best and world war at worst#and he goes no don't worry i think DESANTIS would be better for 2024 actually#and i. UNDERSTANDBLY. was like oh okay i cannot speak to you (because i am visibly shaking with rage)#and he goes well i think you are misattributing my intentions (cunt.)#and i said no no i don't think you're malicious i just think you're stupid and wildly misinformed#and then left bc i was about to either hit him or start crying (bc that guy has been like very tangibly ruining my life for months#and i genuinely cannot fathom what fucking tax issue or whatever one would value over like. my right to idk. Exist atp.#and also this coming from someone who just tried to be like no i know so many trans people i love trans ppl im not like those conservatives#like try to dig deep down into whatever rotted husk of a brain is left in your skull and fathom why i might have a strong reaction to your#support for DESANTIS and the SPACE LASERS WOMAN#you fucking idiot.)#and was that civil. No. and now i have to apologize to him bc i feel bad about it even though i fully meant it#idk its what i get for trying to change peoples minds with stupid things like#' statistics ' and ' a utilitarian perspective ' and ' existing legal basis for my argument '#guys so wrapped up in their right wing bubble they just dont wanna hear it#n they always assume i mustve not heard their talking points and its like look at where we fucking live#and look at the state of the world. NOBODY in any form of mainstream news shares my politics lmao#you think i havent heard every conceivable argument abt trans people??? also you think im dumb enough to form an opinion without looking at#the other side? yeah man i know about the three trans women who have ever won a sports competition ever. do you?#do you even know their fucking names or sports or trial outcomes.#GOD just fucking. pseudo intellectual facist horseshit like pragru and infowars masquerading as legítimate sources#are making so many dumbass illiterate (i truly don't think they have the reading comprehension to decifer a study or even long article)#guys think they're gods gift to politics bc they listened to someone else tell them what a source says through ten layers of propaganda#just. uh. everyone should die forever and also learn to read.

14 notes

·

View notes

Text

Budget Fails to Address Key Issues: Dr. Ajoy Kumar

Congress leader criticizes government’s approach to youth employment and agriculture

Former MP Dr. Ajoy Kumar deems the 2024-25 Union Budget disappointing, claiming it overlooks crucial concerns of common citizens.

JAMSHEDPUR – Experienced Congressman and former Member of Parliament Dr. Ajoy Kumar has come out with strong words against the union budget and has expressed dissatisfaction of the…

#agricultural policies#मुख्य#budget analysis#Congress criticism#Dr. Ajoy Kumar#farmer issues#Featured#MGNREGA#modi government#tax relief#Union Budget 2024-25#Youth Employment

0 notes

Text

By Jessica Corbett

Common Dreams

June 11, 2024

"This is a historic opportunity for the United States to provide global leadership on tax fairness and also strengthen the administration's vital domestic efforts to achieve a fairer tax system."

U.S. Sen. Bernie Sanders and Rep. Ilhan Omar on Tuesday led a letter calling on President Joe Biden and Treasury Secretary Janet Yellen "to support an important initiative at the G20 to foster international cooperation on taxation of ultrawealthy individuals."

"This is a historic opportunity for the United States to provide global leadership on tax fairness and also strengthen the administration's vital domestic efforts to achieve a fairer tax system," wrote Sanders (I-Vt.) and Omar (D-Minn.), who were joined by 16 Democrats in Congress.

When Biden released his 2025 budget blueprint in March, the White House called for tackling "unfair aspects of our tax system," including by "reforming the international tax system to reduce the incentives to book profits in low-tax jurisdictions" and imposing at 25% minimum tax on Americans with wealth of more than $100 million.

The lawmakers wrote on Tuesday that "we agree with you that it is time for the very wealthiest to pay their fair share," noting research that shows the richest billionaires pay an effective income tax rate of 8.2% in the United States and as little as 2% in other countries.

"Every tax dollar not paid by a billionaire could have been used to invest in our communities, address climate change, and support public goods—from education to healthcare to infrastructure—that are critical to prosperity and a strong economy," they stressed, endorsing proposals from Biden and U.S. lawmakers "to build a more just tax system."

As the letter to Biden and Yellen details:

This year Brazil, which holds the G20 presidency, is calling for action on the taxation of wealthy individuals. They aim for increased cooperation between G20 countries to support tax progressivity and ensure the world's richest people pay their fair share. This could involve coordinated standards, information sharing, or a global minimum floor for taxation of the wealthy that could in theory be satisfied by many of the leading proposals to raise taxes on the ultrarich, including the billionaire minimum income tax. We have seen how international cooperation on taxation can deliver meaningful advances, as demonstrated by the landmark 2021 agreement by more than 130 countries to create a global tax framework on corporate taxation. This is a chance to build on what was learned and deliver better results by working together, but with a focus on individuals instead of corporations.

In April, as Common Dreamsreported at the time, Fernando Haddad, Brazil's finance minister, joined with government leaders from Germany, South Africa, and Spain to advocate for a 2% wealth tax targeting the world's billionaires to "invest in public goods such as health, education, the environment, and infrastructure."

"The argument behind such tax is straightforward: We need to enhance the ability of our tax systems to fulfill the principle of fairness, such that contributions are in line with the capacity to pay," the ministers explained. "Persisting loopholes in the system imply that high-net-worth individuals can minimize their income taxes."

Sanders, Omar, and their congressional colleagues argued to Biden and Yellen that "Brazil's G20 initiative is in the strategic interest of the United States."

International cooperation will strengthen domestic efforts to tax the wealthiest, including those that you and many of us in Congress have championed," the letter states. "We encourage your administration to join others in pledging support for this effort, and to help lead the G20 to a historic agreement that will secure a more equitable U.S. and global economy."

#wealth tax#wealth inequality#progressive taxation#janet yellen#biden administration#u.s. tax policy#g20#november 2024#ilhan omar#bernie sanders

1 note

·

View note

Text

Narendra Modi: Everything About The PM Of India

Narendra Modi, the current Prime Minister of India, is a leader who has left an indelible mark on the nation's political, economic, and social landscape. Known for his dynamic leadership, visionary policies, and charismatic personality, Modi has transformed India in numerous ways. This comprehensive blog delves into everything about Narendra Modi, offering insights into his early life, political journey, significant achievements, and influence on India and the world.

Early Life and Background

Narendra Damodardas Modi was born on September 17, 1950, in Vadnagar, a small town in northern Gujarat, India. Coming from a humble background, Modi's early life was marked by hardship and determination. He helped his father sell tea at the local railway station, an experience that shaped his understanding of grassroots issues and the common man's struggles.

Education and Early Interests

As per the UK Newspapers News Modi completed his schooling in Vadnagar and later pursued a degree in political science, earning an M.A. from Gujarat University in Ahmedabad. His early interest in serving the nation led him to join the Rashtriya Swayamsevak Sangh (RSS), a Hindu nationalist organization, in the early 1970s. Modi set up a unit of the RSS’s students’ wing, the Akhil Bharatiya Vidyarthi Parishad, in his area, where he honed his leadership skills and ideological beliefs.

Political Journey

Modi's political journey began with his active involvement in the RSS, which eventually led to his association with the Bharatiya Janata Party (BJP) in 1987. Within a year, he was made the general secretary of the Gujarat branch of the party. Modi played a pivotal role in strengthening the party’s presence in the state, contributing to the BJP's success in the 1995 state legislative assembly elections and the formation of the first-ever BJP-controlled government in India.

Chief Minister of Gujarat

In 2001, Narendra Modi was appointed the Chief Minister of Gujarat, following the poor response of the incumbent government to the Bhuj earthquake. He entered his first-ever electoral contest in a February 2002 by-election, winning a seat in the Gujarat state assembly.

Modi’s tenure as chief minister was marked by both achievements and controversies. His role during the 2002 communal riots in Gujarat drew international criticism, with allegations of condoning the violence or failing to act decisively to stop it. Despite these controversies, Modi’s political career in Gujarat was marked by repeated electoral successes in 2002, 2007, and 2012, establishing him as a formidable leader within the BJP.

Rise to National Leadership

Modi's success in Gujarat laid the foundation for his rise to national prominence. In June 2013, Modi was chosen as the leader of the BJP’s campaign for the 2014 elections to the Lok Sabha. His campaign focused on development, good governance, and anti-corruption, resonating with millions of Indians. In the 2014 elections, he led the BJP to a historic victory, securing a clear majority of seats in the Lok Sabha.

First Term as Prime Minister (2014-2019)

Modi was sworn in as Prime Minister on May 26, 2014. His first term was marked by several significant initiatives and reforms aimed at transforming India:

Goods and Services Tax (GST): Launched in 2017, GST is one of the most significant tax reforms in India's history, simplifying the indirect tax structure.

Demonetization: In 2016, Modi announced the demonetization of high-value currency notes to curb black money and counterfeit currency.

Swachh Bharat Abhiyan: Launched in 2014, this nationwide cleanliness campaign aimed to eliminate open defecation and improve solid waste management.

Digital India: An ambitious program to transform India into a digitally empowered society and knowledge economy.

Make in India: Aimed at making India a global manufacturing hub, this initiative encourages companies to manufacture their products in India.

Modi's foreign policy achievements included hosting Chinese President Xi Jinping and making a highly successful visit to New York City, where he met with U.S. President Barack Obama.

Second Term as Prime Minister (2019-2024)

The Modi-led BJP won a majority again in the 2019 general election. His second term saw continued efforts to promote Hindu culture and implement economic reforms:

Revocation of Jammu and Kashmir's Special Status: In October 2019, Modi's government revoked the special status of Jammu and Kashmir, bringing it under the direct control of the union government.

COVID-19 Pandemic Response: Modi took decisive action to combat the COVID-19 outbreak, implementing strict nationwide restrictions and promoting vaccine development and distribution.

Despite facing protests and criticism for some policies, such as agricultural reforms, Modi's leadership remained influential. The BJP faced setbacks in state elections in late 2018, but Modi's charisma and a security crisis in Jammu and Kashmir boosted his image ahead of the 2019 elections.

Third Term as Prime Minister (2024-Present)

In the 2024 Lok Sabha elections, the BJP won 240 seats, and the BJP-led National Democratic Alliance (NDA) secured 293 of the 543 seats, allowing Modi to become Prime Minister for a third consecutive term. Although the BJP did not secure a majority on its own, the NDA's coalition support ensured their continued governance.

Personal Life and Public Image

Narendra Modi is known for his disciplined lifestyle, early morning yoga sessions, and simple living. Despite his high-profile status, he remains deeply connected to his roots and continues to draw inspiration from his early life experiences.

Communication and Public Engagement

Modi's communication skills are unparalleled, often using social media and public addresses to connect with citizens. His monthly radio program, "Mann Ki Baat," has become a popular platform for sharing his thoughts and initiatives with the nation.

Conclusion

Narendra Modi's journey from a small-town boy to the Prime Minister of the world's largest democracy is a testament to his resilience, dedication, and visionary leadership. His impact on India's socio-economic fabric, governance, and international relations is profound and continues to shape the country's future.

Whether admired or criticized, Narendra Modi's influence on India and the global stage is undeniable. His story is not just about a political leader but also about the transformative power of determination and leadership.

Stay tuned to our blog for more updates and in-depth analyses of Narendra Modi's policies, initiatives, and their impact on India and the world.

#Narendra Modi#Prime Minister of India#BJP#Bharatiya Janata Party#Indian politics#Gujarat#Chief Minister#Lok Sabha#2014 elections#2019 elections#2024 elections#RSS#Rashtriya Swayamsevak Sangh#Gujarat Model#economic reforms#GST#Goods and Services Tax#demonetization#Swachh Bharat Abhiyan#Digital India#Make in India#foreign policy#Jammu and Kashmir#COVID-19 response#Narendra Modi achievements#Modi government#Indian economy#Modi's early life#political career#Hindu nationalism

0 notes

Text

This is long, but it's such a good, clear explanation of current issues! Highly recommended.

#economy#taxes#economic policy#supply-side economics#abortion#border control#Republicans#GOP#2024 election#Heather Cox Richardson

2 notes

·

View notes

Text

Saturday, August 24, 2024 - Tim Walz

Governor Walz continued to focus on the key commonwealth state of Pennsylvania. Alongside the Commonwealth's governor, Josh Shapiro, he made two stops. The schedule he followed is below.

Gettysburg, PA

Event Location: Gettysburg College Library

Event Type: Educators' Breakfast with Discussion

Event Time: 9:00 - 11:30 ET

*Note this event had 275 attendees who are school district superintendents and principals as well as teachers who have completed 20 years of service. These educators came from across the state!

Harrisburg, PA

Event Location: Steps of the PA State Capitol

Event Type: Policy Announcement

Event Time: 15:00 - 17:00 ET

*Full-text of the speech to be released shortly.

~BR~

#josh shapiro#kamala harris#tim walz#harris walz 2024 campaigning#policy#2024 presidential election#legislation#united states#hq#politics#democracy#national convention#democratic party#pennsylvania#harrisburg#gettysburg#Tax policy#education#affordability#middle class#tax reform

1 note

·

View note

Text

I'm concerned about how economically illiterate Harris has been coming across lately.

#us politics#us elections#2024 elections#kamala harris#tax policy#tipping#fiscal policy#taxes#fairness

1 note

·

View note