#Stock Market Calls

Explore tagged Tumblr posts

Text

What benefits of Holding Stocks for the Long Term

Stock investment can be a valuable tool for attaining long-term financial prosperity. Thus, there are several merits that one can get out of investing in stocks for the long- term, while most investors may be enticed to engage in short-term trading,Investing for the long term stocks has several advantages, and they include compounding, volatility, low cost, taxation, alignment with the firm’s growth, and stress. Through the long-term growth approach with stocks rather than the short-term return on investment, more revenues and wealth can be accumulated in the long run.

#benefits of Holding Stocks#Holding Stocks for the Long Term#benefits of Holding Stocks for the Long Term#Stock Market Calls#Share Market Tips#India Share Market#Best Stocks to Buy#Stock Market Commentary#Stock Prices

0 notes

Text

Such loans have special features like a low interest rate and flexible payment terms that are designed specifically for people who are purchasing their first home. Some lenders give preference for big deposits having particular benefits like the shortening of the processing time or extension of the repayment period to help new homeowners.

#Financenu Stock Market Advice#Stock Market Calls#Share Market Tips#India Share Market#Best Stocks to Buy#Stock Market Commentary#Stock Prices

0 notes

Text

I was not expecting a Discworld reference in the book I'm reading about the invention of the index fund.

Describing conflicting management styles of mutual fund managers going through a merger, the author explains one is egalitarian. The other "had a more Ankh Morpork style philosophy of one man, one vote. He was the man, so he had the vote."

#gnu terry pratchett#discworld#seriously this book has mostly been about economic academics in the 50s and 60s#and it's about the american stock market#so not exactly a british perspective#the book is called Trillions btw#if they get into boots theory i'm going to lose it

118 notes

·

View notes

Text

i think growing up is just life repeatedly sucker punching you and saying bitch you thought things were gonna better lmao no you're so naive and stupid for having hope in 20 years the world will be flaming bag of garbage and no matter how hard you work you'll get eliminated at some point

#and then you just have to get up and keep living anyway because what else is there to do?#but man my heart keeps feeling heavier with every blow#2024 has literally been the worst year ever god personally too#like everytime i think it can't possibly get worse than this it does#i remember literally 9th jan i had such a horrible breakdown in an auto because the first friend i ever made#after school was leaving my work and therefore my life#9 days into the year. seriously. and i was so happy on 8th because it was my birthday#i don't know im trying hard to think okay this doesn't even affect me it's fine im privileged enough that even my own countrys politics#barely affects me#but just. india is already so behind in everything. if developed nations are doing shit like this then well#it will never get better right like who do we even strive to be#i want to get more into indian politics but my god. it's so horrifying and depressing all the time#like i remember resolving to follow politics closely few years ago and the first news#i read was about some minister talking about how girls skirts lengths IN SCHOOL is the reason boys do sa and boys will be boys etc etc#i know i could just follow business news stuff like that god knows it'll help in my field but it just. doesn't resonate with me doesn't#make me feel anything at all. like i so desperately want to care about ooh stock markets and how to grow your money etc etc#but when i think about being rich enough to invest idle money all i can think is sitting in my own home peacefully#drinking a glass of cold coffee and just being able to breathe freely because me and my sister used to joke in childhood#when dad went thru a coffee v bad for health phase and he wouldn't let us drink it so we would drink it very sneakily#at night when he was asleep or went out for an hour and make absolutely no noise while mixing the sugar. we said that we know#we'll* know we have achieved true freedom and happiness in life when we can peacefully drink cold coffee in the hall and not secretly#in the dead of night in our room#i don't even know what im talking about and my period is late again and nothing is working and my lazer focus#that i had built in the past few weeks is gone because suddenly im like what is the point????#i just don't understand how the fuck humans can fight over stupid fucking things like who is kissing who and who is doing what with their#body instead of focusing on collective issues like our planet is dying so fucking fast and every summer is getting impossibler to survive#i hate that the united states control the UN fuck this world fr man i hate being born in such horrible helpless times#like call me a kid or dumb or whatever but i cannot understand how MILLIONS of people do not#have sympathy for ppl around them and who don't care about the planet at all like how????? how did you grow up????#not trying to boast but this is so natural to me!!! didn't you make save water save earth posters in school!!! didn't anyone

13 notes

·

View notes

Text

weyoun mentioned

#we're so back baby#leckgrun#jimothy writes#leck ds9#yelgrun ds9#everything i know about the stock market i learned from this one weird mystery novella i read in middle school#where this teenager named Turtle has a special interest in the stock market and like. follows the ups and downs by the minute#the story isnt even about them it's about like a dead relative who left pieces of paper with random words for the family to put together?#if you read this book too pls let me know. i can't for the life of me remember what it was called#the papers spelled out the lyrics to America the Beautiful for some reason. the fuck was that about

5 notes

·

View notes

Text

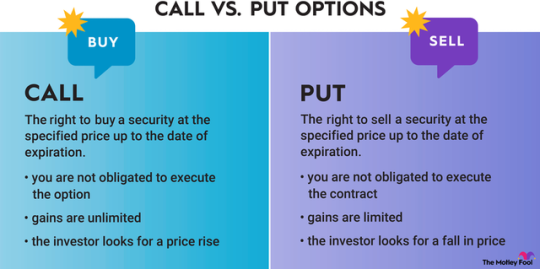

Call vs. Put Options

This guide will give you a complete rundown of call options and put options.

A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date.

That's the short summary of these options contracts. Now, let's take a closer look at how call and put options work, as well as the risks involved with options trading.

How does a call option work?

A call option is a contract tied to a stock. You pay a fee, called a premium, for the contract. That gives you the right to buy the stock at a set price, known as the strike price, at any point until the contract's expiration date.

You're not obligated to execute the option. If the price of the stock increases enough, then you can execute it or sell the contract itself for a profit. If it doesn't, then you can let the contract expire and only lose the premium you paid.

The breakeven point on a call option is the sum of the strike price and the premium. When you have a call option, you can calculate your profit or loss at any point by subtracting the current price from the breakeven point.

As an example, let's say that you're bullish on Apple (AAPL -0.54%) and it's trading at $150 per share. You buy a call option with a strike price of $170 and an expiration date six months from now. The call option costs you a premium of $15 per share. Since options contracts cover 100 shares, the total cost would be $1,500.

The breakeven point would be $185 since that's the sum of the $170 strike price and the $15 premium. If Apple reaches a price of $195, your profit would be $10 per share, which is $1,000 total. If it only goes to $175, you'd have a loss of $10 per share. Your maximum potential loss would be the $1,500 you paid for the premium.

How does a put option work?

A put option is a contract tied to a stock. You pay a premium for the contract, giving you the right to sell the stock at the strike price. You're able to execute the contract at any point until its expiration date.

If the price of the stock decreases enough, then you can sell your put option for a profit. You're not obligated to execute the contract, so if the price of the asset doesn't drop enough, you can let the contract expire.

The breakeven point on a put option is the difference between the strike price and the premium. When you have a put option, you can calculate your profit or loss at any point by subtracting the breakeven point from the current price, or by using the calculator at the bottom of this page.

To give you an example, imagine Netflix (NFLX -0.51%) trades at $500 per share. You think it's overvalued, so you buy a put option with a strike price of $450 and an expiration date three months away. The premium costs $10 per share, which is a total price of $1,000 for the contract.

The breakeven point would be $440, the difference between the $450 strike price and the $10 premium. If Netflix plummets to $400, then you're up $40 per share ($4,000 total) on your put option. If it doesn't drop below $450 at all, then you'd only be able to let the option expire and eat the cost of the premium.

Risks of call vs. put options

The risk of buying both call and put options is that they expire worthless because the stock doesn't reach the breakeven point. In that case, you lose the amount you paid for the premium.

It's also possible to sell call and put options, which means another party would pay you a premium for an options contract. Selling calls and puts is much riskier than buying them because it carries greater potential losses. If the stock price passes the breakeven point and the buyer executes the option, then you're responsible for fulfilling the contract.

The benefit of buying options is that you know from the beginning the maximum amount you can lose. This makes options safer than other types of leveraged instruments such as futures contracts.

However, options can be riskier than simply buying and selling stocks because there's a greater possibility of coming away with nothing. When investing in stocks, you only need to predict whether the stock goes up or down. For options trading, you need to predict three things correctly:

The direction the stock will move.

The amount the stock will move.

The time period of the stock movement.

If you're wrong about any of those, then the options contract will be worthless. While there's the potential for greater returns with options, they're also harder to trade successfully.

Despite the challenge of successfully trading call and put options, they provide an opportunity to amplify your returns. That can make them a valuable addition to a balanced portfolio. For investors interested in options, there are also more advanced strategies that go beyond buying calls and puts.

#kemetic dreams#call option#options#put options#money#stocks#stock market#markets#investing stocks#stock trading#nasdaq#balanced portfolio#money talk

13 notes

·

View notes

Text

10 Movies on Stock Markets You Should Watch

The world of stock markets is full of drama, intrigue, and high stakes, making it a captivating subject for movies. I would recommend you to watch these movies on stock markets. Here are 10 films that offer a glimpse into the thrilling world of finance: The Big Short (2015) “The Big Short” is a 2015 American biographical comedy-drama film directed by Adam McKay, based on the 2010 book “The Big…

View On WordPress

#ambition#Barbarians at the Gate (1993)#best movies about the stock market for beginners#Boiler Room (2000)#business movies#comedy movies#corruption#documentary movies#drama movies#Enron: The Smartest Guys in the Room (2005)#entertaining movies about Wall Street#finance movies#financial crisis#fraud#greed#Inside Job (2010)#inspiring movies about overcoming financial challenges#investing movies#lessons learned#Margin Call (2011)#movies that explain how the stock market works#must-watch movies for investors#stock market movies#success#The Big Bull (2021)#The Big Short (2015)#The Wolf of Wall Street (2013)#thriller movies#Trading Places (1983)#true story stock market movies

2 notes

·

View notes

Text

#country music#texas country music#music news#artist#country#youtube#radio#texas#california#live#warner bros#stock market#finance#mutual funds#elizabeth banks#texas new music thursday film tv spectrum chase people country artist universe jesus life money usa love spiritual high#television#movies#zara mcdermott on becoming first love island contestant to join strictly#gamers rush to play brand new call of duty game and be the first to try it – how to get the access code#investors

3 notes

·

View notes

Text

Top 8 SIP plans Starting with rs.1000/ month in 2024

Systematic Investment Plans (Sip) have ended up being a well-known and restrained way for people to contribute to common reserves. As we step into 2024, let's investigate Seven Sip plans that permit you to begin your investment journey with a fair Rs. 1000 per month, making riches creation available to numerous.Advertising adaptability by contributing in stocks over advertising caps, this multicap support adjusts to changing showcase conditions. It's appropriate for those looking for a broadened approach.

#Stock Market Calls#Share Market Tips#India Share Market#Best Stocks to Buy#Stock Market Commentary#Stock Prices

0 notes

Text

friend and I have been talking about the concept of an alternate timeline where they didn’t kill off mine and instead, while laying low and trying to unlearn being Evil basically, as both penance for his actions and as a tojo-mandated involuntary vacation, he’s sent to okinawa (with some sort of supervision, of course) to work for morning glory. ie; mr. orphan hater has to help babysit orphans to pay for his orphan-related crimes and hopefully learn something in the process. shenanigans ensue.

#this concept is hilarious and deserves a whole comic dedicated to it#I have so many ideas#like first of all mine wouldn’t even understand the concept of a vacation#daigo would tell him to chill out and relax and he’d just stand there like. uh. I’ve never done that before. how do I. relax#second: those kids would test him nonstop and it would be So funny to watch#because I think they’d weasel him into doing stuff with them that he doesn’t understand at all. like. he can not for the life of him#understand the point of hide and seek and if he’s made to be one of the ones hiding he takes it way too seriously and by nightfall when sm#someone finally has to give up and call him he’s like. on a different fucking island#that sort of thing#walking in on him with the most deadpan expression possible while two of the girls are doing his makeup and have a lil crown on his head#you get it#and then also obviously he’d have no idea how to do so many basic household things cause hes not used to life outside the city and#life without an excess of cash- like he’d be baffled by the fact that the house doesn’t have air conditioning#I think he’d learn to cook pretty quickly and really well (though he’d be very critical of his own work and take it really seriously)#but at first? god no. I don’t think he’s ever had to cook for himself in his life. he’s gotten takeout or eaten at restaraunts like. his#whole life. no doubt. and no doubt has just hired housecleaners and stuff to do most cleaning beyond the basics#‘uncle mine you’re not TOO old- do you like any video games?’ ‘the… stock market is sort of like a game…’#oh man#it’s such a good concept#such an exercise in self control#mine#yoshitaka mine#yakuza#rgg#rambling

7 notes

·

View notes

Text

Nifty Future Tips | mcx Gold Tips | Avalon Technologies - Intraday Tips

Which stock is best for intraday tomorrow?

How to choose the best stocks for intraday trading in Indore, India· 1. Enquire us for liquid stocks · 2. Avoid investing in highly volatile stocks · 3. Pick only those stocks that move with the current market trend.

Are you looking for the best nifty tips provider company in Indore?

Then you are at the right place as Intraday Tip's only motto is to save the money of the client first and then provide the right intraday tips to where to invest the money to gain profit. We send regular live updates and briefs (of advice on-call) through SMS also after the end of every call. We have dedicated software allocated for sending sms share market tips to our happy clients.

#nifty news#nifty future tips#mcx gold tips#stock future tips#intraday tips for tomorrow free#intraday trading#sure shot jackpot calls#share market tips#stock future tips provider

8 notes

·

View notes

Text

Having to reblog from “liberals are cool” makes me want to hurl, but this is just MISINFORMATION. With 30 thousand fucking notes. That’s not how the stock market works or what a margin call actually is.

If Musk owns shares which were purchased with borrowed money under a margin agreement, the lender reserves the right to demand either: (1) additional funds from Musk or (2) that Musk reduce his position until he meets whatever the agreed risk limit is.

But that's OPTIONAL on the part of the lender/broker (who is likely following the news and also knows that Musk is in cahoots with the piece of shit in chief for the time being), and it could also be solved with cash or by selling other securities to meet the agreed risk limit (IF he has them; doesn't have to be Tesla stock as long as he meets the limit).

With the whole market in a downturn, the broker is going to look at the overall picture and say, "Well, everyone's down, this is just a market correction, Musk can either use some other method of reducing his risk or we'll just wait and see a little bit." It’s always hard to say when things are volatile, and they will continue to be as long as the tariff threats loom. The whole stock market is currently in “correction territory” (as of 13 March, 2025).

All this to say: “death spiral" is a NOT a likely outcome.

Here is your mission.

#us politics#TSLA#Tesla#elon musk#us economy#economic policy#stock market#misinformation#correcting misinformation#I’m sure no one is going to see this or read it but I tried lol#please go read what a margin call is#also re: market correction#inefficiency or hype leading to overconfidence in the markets only to adjust later when that confidence is lost#that’s what the correction is#and there is a percentage of gains or losses that are considered to be a correction#rather than indicating a recession#but for working class people like you or I none of that really matters#when the markets start going down they fire people so as to pay investors as much as possible#the old Jack Welch strategy - you can thank him for the current shareholder supremacy model of econ#behind the bastards has a great episode covering Jack Welch for more info#I wish I could transfer the suffering of every worker directly into Elon’s brain#no human being should have the GDP of a nation state#you should also all be paying attention to Peter Thiel#he propped up Vance and has invested massively in senate and house races#he has been called the gravedigger of democracy for good reason#he wants there to be tech oligarchs and is making that happen#he is a huge player but so few people even know his name#peter thiel#trump#trumpism

90K notes

·

View notes

Text

What you Need to Know About Option Trading & Strategies

Learn essential insights into option trading and strategies. Discover techniques, tips, and best practices to navigate the world of options successfully.

Read more..

#option trading#option trading strategies#trading in stock market#options puts and calls#option trading for beginners#best indicator for option trading#option trading chart#what is option trading#option trading app#options call put#put option and call option#best broker for option trading#algo trading#algo trading app#algo trading india#algo trading platform#algo trading strategies#bigul#bigul algo#free algo trading software#algorithm software for trading#finance#bigul algo trading app#bigul algo trading#bigul trading app#bigul trading#investment platform#best algo trading app in india#best algo trading software#best share trading app in india

0 notes

Text

Put Call Ratio Key to Smarter Market Decisions

The put call ratio is a key indicator used by traders to assess market sentiment. It compares the number of put options (which bet on a price decline) to call options (which bet on a price rise). A higher ratio typically signals a bearish market, while a lower ratio suggests a bullish trend. By analysing the put call ratio, traders can gauge investor sentiment and adjust their trading strategies accordingly, helping them make more informed decisions in the market.

0 notes

Text

for my econ class our major project was a stock market simulation and i chose to invest in 800+ GME stocks. for weeks i was so embarrassed because the stocks just kept going down and while i wholeheartedly support GME i was worried i was going to look really stupid BUT on the last two weeks the stock shot up 10 bucks and i wound up "making" $6k+ on the project. AND i won an award for making the most money out of my class period, which was straight up a dollar coin. business is boomin'

#gme#gamestop#project#stock market#econ#my teacher even commented on my google spreadsheet and said good call AHAHAAHAHA

0 notes

Text

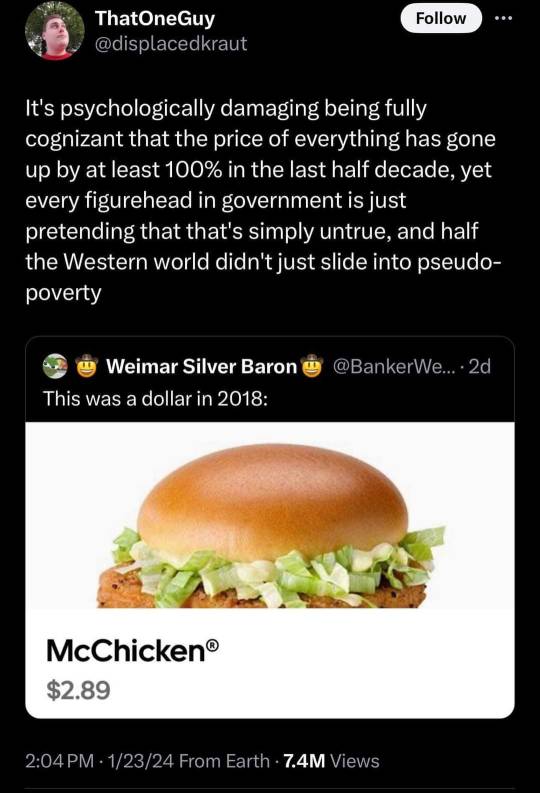

All of this said, remember that economic metrics (including price of goods at market) often are bundles (aggregates) of all economics activity that fits certain criteria. So, in other words, a change in one area will affect a portion or sector of the economy. But also, it affects the whole (even if slight). And this is on multiple levels economically, due to multiple companies all trying to operate and dominate over each other in all industries. This is further amplified by tiered types of products (economy, value sized, premium, luxury, quick service vs fine dining, etc.)

Example: food prices have risen generally. Like @weshallbekind said, certain foods increase some don't. Gas and certain new cars have higher prices, some haven't. Of course something like gas, however, is an everyday good, as are many food items. These essential items having increased prices is a component of inflation (as are interest rates, unemployment, speculation booms, currency changes, etc. different rant though). Again, aggregates, so potentially many factors. But aggregates don't reflect capitalism's main goal. Instead these aggregates are used as tools to accomplish said goal.

Keep in mind, however, that this is why capitalism like ours inherently doesn't work. It seeks to minimize costs (see also: not paying for enough workers, vertical integration, flip flopping between self check out and cashiers, moving/outsourcing, and raising prices [despite having massive economies of scale and the ability to negotiate]) for the benefit of profit. Not progress and profit, not progress, not satisfying the customers needs and wants; profit.

What does this mean then? It means profit over everything, while also creating desires in you (via marketing) to buy things you don't really need (mostly) or into which you invest your personality, time, or data. But mostly your money. Now, of course, everyone needs food, shelter, miscellaneous tools and safeguards, etc. Now those things are regulated to some degree, but nonetheless goods sold and marketed to you to profit.

Therefore, anything to make profit and make you buy it regularly could at least be attempted. Pay undocumented citizens pennies on the dollar so you don't have to give them benefits, minimum wage, or rights, check. Purposefully not include the charger and cable needed to use the phone, check. Use surge pricing to maximize profit and stress the existing infrastructure (human or otherwise), check. Overcharge you for literally the same exact product by calling it something fancy and putting their label on it, check.

And sure, of course costs increase. Of course paying people more means higher costs, especially if "times are tough". You know what takes more priority, usually, though? Executive compensation ratios, cash reserves, market dominance, mergers and acquisitions, vertical integration, lobbying, tax benefits.

Once again, let me remind you: metrics are aggregates, statistics, and computations based on demand, supply, input costs, interest rates, taxes, preferences, laws, availability of resources, currency exchange rates, speculation booms, etc. All these metrics and their formulas, however, are used (by corporations) to find their way to massive profits. By using these metrics in manipulating the market and their business practices, they're working to profit; they're striving for greater capital than the next company. Always.

#also#technically i would call USA capitalism corporatism#Adam Smith wasn't talking about Amazon when he talked about markets#he was talking about literal open air markets where you sell to the customer their daily necessities#small corporations (like my dad is a small town private practice lawyer) are fine#not companies that own most of their competition and lobby government#like im all for a free market with regulation clear effective and fair tax structures#I'm also down for small businesses and larger business agreements or alliances#also co-ops non-profits whatever#but no corporations#my dad isn't lobbying congress or manipulating stock prices#he's just a guy who wants to make sure he and his family can enjoy their life

70K notes

·

View notes