#TSLA

Explore tagged Tumblr posts

Text

(Source)

Tesla stock was $424 when Trump was inaugurated; it is $272 today; and HSBC estimated that it may fall to $130.

#destiel#tesla#elon musk#stock market#stock trading#tesla stock#tsla#if you have tesla stock... sell your tesla stock#(they say on tumblr. lol)#castiel#dean winchester#breaking news

839 notes

·

View notes

Text

Fraud and inefficiency at Tesla are manifest.

It's always shadow projection. Musk is always projecting his shame, fraud, and inefficiency.

He is obsessed with distracting everyone from his failures, his lack of deliverables, and the fleecing of his customers/investors.

Sub-$100 Tesla stock, here we come!

1K notes

·

View notes

Text

It's only fair that companies run by Co-Presidents Trump and Musk should feel the pain they are causing everyone.

Trump pushes ahead with tariffs as stock market has ‘worst day of 2025’ amid recession fears: Live updates

#donald trump#maga#trump media#djt#elon musk#doge#tesla#tsla#recession#tariffs#maganomics#the economy#trump administration#economic mismanagement#gross incompetence

225 notes

·

View notes

Text

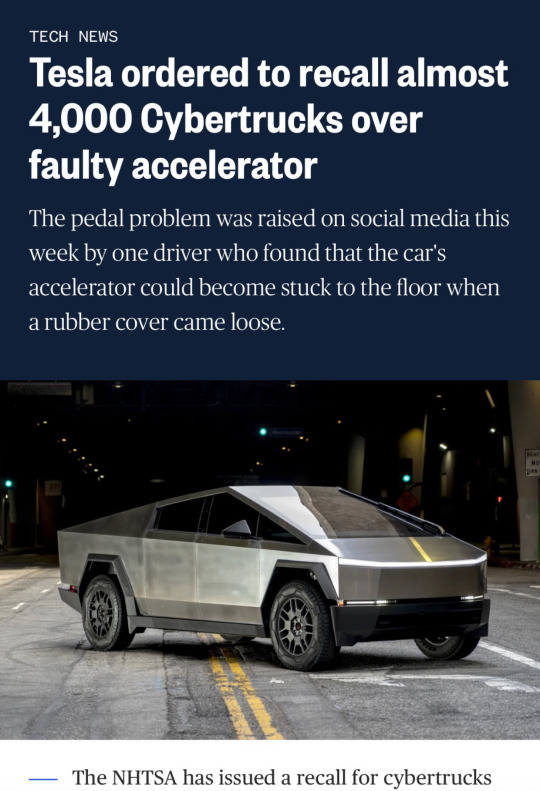

Someone needs to look into how the government allowed this death trap onto public roads so quickly and easily. I mean, we all know why 💵 but maybe someone needs to be held accountable for this ginormous oversight.

As always, please remember that Elon’s “genius” is all smoke and mirrors + a trumpian scale public relations grift.

#politics#tesla#cybertruck#elon musk#tesla cybertruck#apartheid clyde#eugenics musk#cyber truck#cyber turd#tsla#techno grifter#crypto bros#cyber truck recall#tesla recall

737 notes

·

View notes

Text

I want YOU to fuck with Elon Musk's finances!

Apologies for the nerd-talk here, but I have a easy political action for you!

Right now, the Tesla stock seems to be held afloat not so much by individual investors, but by investment banks which include the stock in index funds. The sort of funds that many people's 401ks are in. (I've been watching the stock, the 'sells' are many and small, the 'buys' are fewer and large, likely indicative of big-banks propping up a failing stock.)

And you, yes you, if you have a IRA, 401k, or other retirement investment which includes Tesla, can fuck Elon up today. (If you don't have one, send this post to any cool Boomers you know who might!)

What you're gonna do is call whoever you or your employer banks with (Vanguard, Schwab, TD, whoever) and tell them the following:

You're concerned by their reliance on TSLA in their indices, a volatile stock whose value is not based in investing fundamentals.

The intrinsic value of the stock (discounted cashflow / relative valuation) is $46 while the stock is trading at over $200

The current valuation is defended by the following flawed arguments:

a. Sales to consumer vehicle market - The majority revenue source. However sales across the globe are dropping compared to this time last year; 73% in Germany, 65% in Australia, and 49% in China. b. Potential Autonomous vehicle? - Promised for years, as a retrofit to existing vehicles - has not materialized, even after competitors (Waymo) succeeded in fielding the technology. c. Potential Humanoid Robotics? - An industry Tesla has no experience in, and is facing significant competition in from well-established well-funded competitors such as Boston Dynamics. d. Potential "AI"? - Unless specified further, with a concrete path to profitability this seems to be vaporware. e. Elon's personal brand - Has been losing credibility, due to partisan political behavior. He has also been failing to perform his fiduciary duty to shareholders, by neglecting his role as CEO to become politically involved. f. Battery Technology - Has a high reliance on imported materials such as Lithium, the availability of which is dependent on the unpredictable geopolitical situation in Ukraine.

And you are HUGELY worried about the impact on your finances when the stock corrects itself towards it's true value, and returns to trading along financial fundamentals. (If you want to get spicy with it, you can say you feel they too are failing in their fiduciary duties to you by continuing to invest in TSLA. But, from what i know of finance bros, that's fightin words, so use with discretion.)

So... If you want to have an outsized impact on this hair-plugged skinhead's finances, all you gotta do is call the finance nerds and speak their language a little. (I know phone calls suck but I literally gave u a script!) Most retirement investors are passive, so even a handful of upset callers can have an outsized impact.

Embrace your inner Karen if you want. (You're doing WHAT with my money? Propping up a failing overvalued business?)

Good luck, and tell me how it goes if you do this!! (disclaimer: this is not financial advice)

#elon musk#elon#musk#tesla#tsla#finance#activism#us politics#political#investments#stock market#banking#business#investors#ah yes stock analasys.... the reason u are all haere on tunglr

222 notes

·

View notes

Text

This may be the best TESLA photo yet. I love people who have artistic style.

Lololol! TSLA This!

#crusiux#tsla#tesla cars#fuck tesla#tesla cybertruck#tesla#tesla truck#tesla takedown#anti elon musk#street art#art#car art#artistic photography#artistic expression#artistic style

133 notes

·

View notes

Text

#cbr politics#american politics#politics#trump administration#us politics#donald trump#stock market#Elon musk#Tesla#meme#memes#dank meme#dank memes#funny#joke#tsla#economy#meme template

23 notes

·

View notes

Text

21 notes

·

View notes

Text

Sending everyone good vibes as Tesla stock continues to crater ❤️❤️❤️

12 notes

·

View notes

Text

4 notes

·

View notes

Text

i always forget to post my art lol

but here's a few lifts that i drew while listening to edgedancer!! i feel like the top two are the best i've ever captured her!

#lift stormlight#edgedancer#stormlight archive#the stormlight archive#tsla#the way of kings#knights radiant#my awesome girl <333#the bottom left one looks kinda wonky and outta character#same with the bottom right but not as much?#but yea#millyart#my art#sketch#doodle

4 notes

·

View notes

Text

I'm convinced that all the money warlocks on Wall Street believe that if Tesla dips below 225 the Sleeper will awaken and the collective dream will end so they're doing every act of magic possible to try and kickstart the Fictitious Capital Printer again with unsatisfactory results.

3 notes

·

View notes

Text

This is just like 'antifa' storming the Capitol on Jan 6th. Pure projection.

383 notes

·

View notes

Text

^^^ Meet the person who has done more than anybody else to vandalize the reputation of Tesla.

Things are so bad that even Apartheid Elon's brother is dumping shares of Tesla.

Tesla insiders are dumping shares, including someone unexpected

Here's a fun stat about Musk's billions from that article...

[E]ach time TSLA dips $2.43, he loses another billion dollars.

TSLA is the NASDAQ symbol for Tesla.

In other Tesla news...

Tesla booted from Vancouver International Auto Show over ‘safety’

Don't drive a SwastiKar.

#tesla#tsla#tesla reputation#elon musk#doge#apartheid elon#kimbal musk#broligarchs#billionaires#trump administration#donald trump#maga#nick anderson

15 notes

·

View notes

Text

Spacex.... BIG GOALS!!!

youtube

🚀 🔥🍌

#gwynne shotwell#spacex#elon musk#musk#starship#interplanetary travel#leo#low earth orbit#banana for scale#🍌#tony stark#the emperor has no clothes#hyperloop#the boring company#co2 emissions#climate change#climate crisis#osint#tsla#corporations#ceo#elongated muskrat#elon muskrat#the muskrat#apartheid clyde#las vagas#boca chica#thunderf00t#youtube

3 notes

·

View notes

Text

I saw Musk say (apparently sincerely) on Tucker's podcast, "if Trump loses, I'm fucked." -- just a reminder that everybody's favorite enigma of a South-African-cum-naturalized-US-citizen thinks he's playing for keeps, and fuck the rules...

#tsla#elon musk#:-/#TIL#elongated muskrat#wasn't he the darling of the left?#just a little while ago?#what's on his guilty mind?#is it that Kamala says existing tax laws should enforced?#really is that it???#imho

2 notes

·

View notes