#Personal loan documentation charges

Explore tagged Tumblr posts

Text

What Are the Additional Fees Hidden in Personal Loan Agreements?

Introduction

A personal loan can be a great financial tool when you need quick access to funds for emergencies, home renovations, weddings, or travel. However, while comparing loan offers, most borrowers focus only on the interest rate and EMI, often overlooking additional fees that lenders include in loan agreements. These hidden charges can significantly increase the total cost of borrowing if not considered upfront.

In this guide, we will explore the various hidden fees associated with personal loans, how they impact your finances, and tips to avoid unnecessary costs.

Common Hidden Fees in Personal Loan Agreements

1. Processing Fee

One of the most common fees in personal loan agreements is the processing fee. Lenders charge this amount to cover administrative expenses for loan approval and disbursal. Typically, it ranges between 1% and 3% of the loan amount. Some lenders deduct this fee upfront, reducing the actual disbursed amount, so it’s essential to factor this into your calculations.

2. Prepayment and Foreclosure Charges

If you plan to repay your personal loan before the tenure ends, lenders may impose prepayment or foreclosure fees. These charges vary based on when you decide to pay off the loan.

Prepayment Charges: If you make partial payments before the scheduled EMI tenure, some lenders charge a fee of around 2% to 5% on the outstanding balance.

Foreclosure Charges: If you decide to close the entire loan before the tenure, lenders may charge 2% to 6% of the remaining loan amount.

3. Late Payment Fees

Missing an EMI payment can lead to hefty penalties. Late payment fees vary by lender and are usually a percentage of the EMI amount or a fixed charge per instance. Additionally, late payments can negatively impact your credit score, making it harder to secure loans in the future.

4. Loan Cancellation Charges

If you decide to cancel your personal loan after approval and disbursement, lenders may charge a cancellation fee. This could be a fixed amount or a percentage of the sanctioned loan amount. In some cases, the lender may refund the principal amount but retain the processing fee and other administrative charges.

5. Loan Restructuring Fees

If you face financial difficulties and request to restructure your loan, lenders may charge a restructuring fee. This can include modifying the loan tenure, EMI amount, or interest rate to make repayment easier for the borrower.

6. Document Handling Charges

Some lenders charge for issuing loan-related documents, such as loan account statements, foreclosure letters, or amortization schedules. These charges can be avoided by accessing online statements or clarifying fees before signing the loan agreement.

7. Conversion Charges

If your personal loan comes with a floating interest rate and you wish to switch to a fixed rate (or vice versa), the lender may charge a conversion fee. This charge typically ranges from 0.5% to 2% of the outstanding loan amount.

8. Bounce Charges

If your EMI payment bounces due to insufficient funds in your bank account, the lender may impose a bounce charge. This charge can range from INR 500 to INR 1,500 per instance. Additionally, frequent EMI bounces may impact your credit score.

9. Legal and Recovery Charges

In cases of loan default, lenders may take legal action against the borrower, leading to additional legal fees. These charges can include lawyer fees, recovery agency costs, and court-related expenses.

How Hidden Fees Impact Your Loan Cost

Even if a personal loan appears affordable at first glance, hidden fees can significantly increase the total cost of borrowing. Let’s consider an example:

Loan Amount: INR 5,00,000

Interest Rate: 12% per annum

Processing Fee: 2% (INR 10,000 deducted upfront)

Foreclosure Charge: 3% (if paid off early)

Late Payment Fee: INR 1,000 per missed EMI

If you foreclose the loan early or miss EMI payments, the additional charges can add thousands to your total repayment cost, making the loan more expensive than anticipated.

How to Avoid Hidden Charges on Personal Loans

1. Compare Lenders Before Applying

Different lenders have different fee structures. Always compare personal loan offers from multiple lenders, considering not just the interest rate but also processing fees, prepayment charges, and other hidden costs.

2. Read the Loan Agreement Carefully

Before signing a loan agreement, read the fine print thoroughly. Look for details on processing fees, late payment penalties, foreclosure charges, and other fees.

3. Check for Zero or Minimal Prepayment Charges

If you plan to repay your loan early, choose a lender that offers loans with minimal or zero prepayment and foreclosure fees.

4. Ensure Timely EMI Payments

Avoid late payment penalties by ensuring that you have sufficient funds in your bank account before the EMI due date. Setting up auto-debit or standing instructions can help prevent missed payments.

5. Ask for a Complete Fee Breakdown

Before finalizing a loan, request a comprehensive breakdown of all applicable fees and charges from the lender. Transparency can help you avoid unexpected costs later.

Conclusion

While personal loans offer financial flexibility, hidden fees can increase your repayment burden. Understanding these charges, reading the loan agreement carefully, and choosing the right lender can help you avoid unnecessary costs. By being proactive and well-informed, you can secure a personal loan that truly meets your financial needs without unwanted surprises.

#personal loan#nbfc personal loan#bank#fincrif#personal loan online#loan apps#loan services#personal loans#finance#personal laon#Personal loan#Hidden charges in personal loans#Personal loan processing fee#Prepayment charges on personal loans#Loan foreclosure fees#Late payment penalties#Personal loan agreement terms#Personal loan interest rates and fees#Loan disbursement charges#Personal loan EMI bounce charges#Personal loan hidden costs#Personal loan documentation charges#GST on personal loan fees#Personal loan insurance charges#Personal loan cancellation fees#NBFC vs bank personal loan fees#Understanding personal loan fees#How to avoid personal loan hidden charges#Personal loan part-payment fees#Personal loan legal and administrative charges

0 notes

Text

The Baby Doctor

Reposting this because it seems to have disappeared from this blog for some reason! Enjoy!

This wasn't supposed to happen! She was never supposed to be here. She was a smart, intelligent, capable woman. She had graduated from medical school for God's sake. But, she had pissed off the wrong nurse. Now, here she was, helplessly her diapers for the entertainment of the whole labor and delivery night shift.

It has been the third week of Dr. Bun's residency. She was on the tail end of a horrendous on-call shift. She was working through her charts and, in her delirium, got sloppy in her attention to detail. She accidentally ordered that one of her patients should be given a deadly amount of pain killers to deal with post-delivery pain.

Luckily for her patient, the doctor supervising the young doctor did not trust her yet. He caught her mistake, fixed it, then tracked down Dr. Bun to give her some aggressive constructive criticism. That's where Dr. Bun fucked up.

Rather then owning her mistake and promising to do better, Dr. Bun deflected the blame onto the nursing staff. Specifically, she alleged the nurse treating the patient, Nurse Angela, must have got in the system and messed up the order. Dr. Bun's supervisor was skeptical, but chose to trust his newest charge. He let the resident off with a warning and went to give the nurse a piece of his mind.

Unfortunately for Dr. Bun, the software the hospital used to treat patients kept careful record of precisely who made what orders. Fortunately for the girl, however, her supervisor had no idea that software has that capability. Nurse Angela, in the other hand, was very aware of it.

A couple of days later, when Dr. Bun was back in the hospital changing into her scrubs for the shift, Nurse Angela walked into the room holding two things--a print out from the record keeping software pinning the deadly medication order on Dr. Bun and a bulky, white adult diaper.

"Dr. Bun, I have a bone to pick with you. You pinned a potentially deadly mistake on me when, both you and I know I had nothing to do with it," Nurse Angela said. "That sort of dishonest, manipulative behavior is something I'd expect from a naughty toddler, not a doctor."

Dr. Bun began to feel upset at being challenged so directly by a person she considered beneath her.

"I didn't lie! You must have screwed up my orders, nurse," Dr. Bun, spitting out the word nurse as if it was the worst epithet imaginable.

Nurse Angela just calming walked up to the young, arrogant doctor and handed her the print out of the record confirming Dr. Bun's mistake.

"That is not what this says. Did you know dishonesty is a fireable offense at this hospital? One that the hospital reports to the medical board as well as any future employers?" Nurse Angela asked rhetorically. The older nurse smiled as the young woman's face dropped.

"I… uh… I'm so sorry! I'll do anything to make this up to you! Anything, just, please, don't tell anyone!" The resident pleaded.

The nurse's grin widened, becoming predatory. She motioned with the white, fluffy object in her other hand.

"Well, like I said Doctor, you've been acting more like a toddler than the responsible adult you are supposed to be. I think you need a reminder of that at all times from now on. Until I decide otherwise, if you want to keep your job here, you will wear and use one of these at all times when you are at work. The hospital's bathrooms are off limits to you, and, like the naughty toddler you are, you are not allowed to change yourself. If you want your wet or messy butt changed, you will have to track down one of the nurses in my labor and delivery unit and convince them to change you, understood?"

The young woman had no idea how to respond to that. Her eyes darted between the document in her hand and the bulky adult diaper being held by the nurse. Thoughts of being fired and her career being ruined darted through her head. She couldn't afford to pay back her student loans if she wasn't working as a doctor.

Backed into a corner, Dr. Bun did the only thing she could. She accepted Nurse Angela's offer.

Dr. Bun immediately found herself changed into the first of what would be many diapers by the nurse in the locker room. The next few weeks were full of humiliation and torment for the doctor as she adjusted to her knew position as the nursing units pet toddler, but, eventually her work days fell into a comfortable pattern.

She would use the restroom just prior to leaving work to minimize the risk of messy 'accidents.' She'd report to work where one of the nurses would help her get dressed for her shift. Then, she would proceed with her day as normal, seeking out a nurse for a change when she felt her diaper get too full.

Yes, it was humiliating to have the waistband of her scrubs pulled back or her crotch squeezed by another woman to have her diaper checked. Yes, it sucked laying on a locker room bench while her ass was wiped by someone she considered her subordinate. However, the human mind was resilient and could get used to anything once it happened enough.

Plus, her new situation has some benefits. She was getting praised by her supervisors for how well she worked with the nursing staff. Plus, not having to run to the bathroom all the time gave her more freedom to care for her patients. After a month as the hospital's diapered doctor, Dr. Bun would actually describe things as going well.

Nurse Angela was happy to see Dr. Bun's turn around, but noticed she was starting to get cocky again. The positive reviews from her supervisors lead her to once again become increasingly condescending towards the nursing staff. So, to remind the young doctor of her position, the nurse made Dr. Bun another offer she couldn't refuse.

That's how the young, professional woman with a medical degree found herself here. Nurse Angela has thrown a special, team building party at her home for all of her fellow labor and delivery nurses. The young doctor was also invited as entertainment.

When Dr. Bun arrived, she was stripped of her adult clothes. She was diapered, put in an childish shirt with padded mittens, and had a pacifier slipped in her mouth. She was instructed she was nothing more than a baby for the evening, not allowed to speak, walk, or care for herself in anyway. Worst of all, a suppository was shoved up her cute little bottom.

A baby blanket was laid in the middle of Nurse Angela's living room and she was instructed to stay on it. As her co-workers arrived and began to surround her, cooing at her like she was an actual baby, the babified doctor's stomach began to rumble and cramp. Once the last guest arrived, she couldn't take it anymore. Tears of embarrassment running down her face, Dr. Bun got onto all fours, sticking her diapered ass into the air as a wet fart escaped her butt cheeks.

Nurse Angela looked down and smiled. She drew everyone's attention to the scene. "Look everyone, I think the baby's about to make a stinky for us!"

Dr. Bun's coworkers laughed as they watched her lose control. Closing her eyes and grunting loudly, Dr. Bun pushed out a huge load of crap into her bulky diaper. She closed her eyes as she did it, pretending she was anywhere but here. While she had messed herself before, and many of these women had in fact changed one of her messy diapers, it had never been so public and so humiliated. The nurses cheered the doctor on as she debased herself like an infant for enjoyment.

When the doctor was finished, Nurse Angela beant down and whispered in her ear. "Remember doctor, no matter how good you are at your job or how many accolades you receive, to us, you will never be more than a stupid, untrustworthy little baby. Now sit in your mess and play with your toys. It's going to be a long night."

Dr. Bun could only do as she was told, suck on her pacifier and cry as she came to terms with the fact that she'd be these nurses plaything for the rest of her life.

#The baby doctor#ab/dl kink#ab/dl story time#ab/dl diaper#diaper stories#ab/dl caption#diaper regression#humiliation kink#ab/dl babygirl#ab/dl mommy#cg/l little#cg/l kink

94 notes

·

View notes

Text

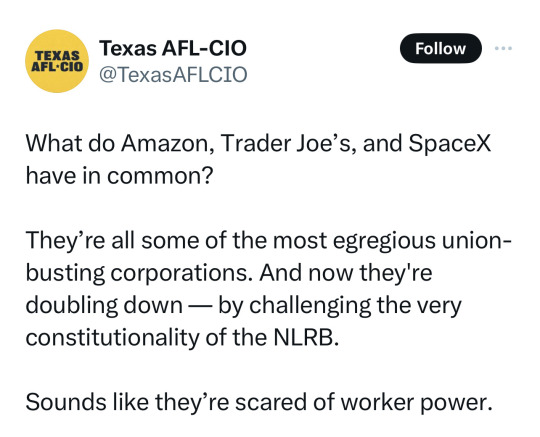

🗣️ Please pay attention

Amazon argues that national labor board is unconstitutional, joining SpaceX and Trader Joe’s

Amazon is arguing in a legal filing that the 88-year-old National Labor Relations Board is unconstitutional, echoing similar arguments made this year by Elon Musk’s SpaceX and the grocery store chain Trader Joe’s in disputes about workers’ rights and organizing.

The Amazon filing, made Thursday, came in response to a case before an administrative law judge overseeing a complaint from agency prosecutors who allege the company unlawfully retaliated against workers at a New York City warehouse who voted to unionize nearly two years ago.

In its filing, Amazon denies many of the charges and asks for the complaint to be dismissed. The company’s attorneys then go further, arguing that the structure of the agency — particularly limits on the removal of administrative law judges and five board members appointed by the president — violates the separation of powers and infringes on executive powers stipulated in the Constitution.

The attorneys also argue that NLRB proceedings deny the company a trial by a jury and violate its due-process rights under the Fifth Amendment. (source)

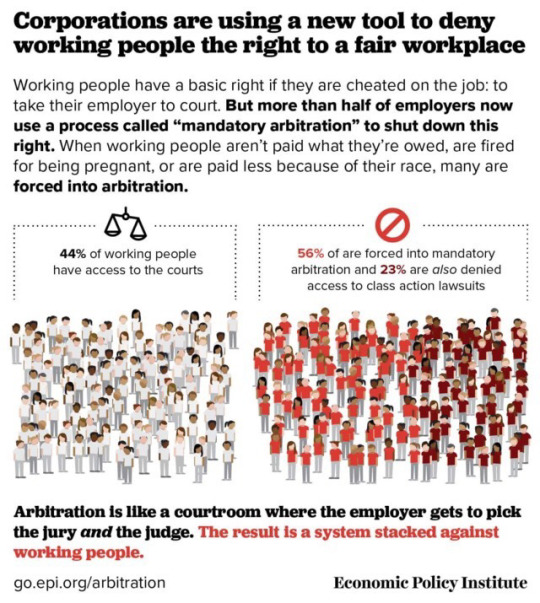

ICYMI, this is a case of corporations going, “7th Amendment Protections for me, but not for thee.”

It is strongly worth noting that in 2018 the John Roberts Court ruled 5-4 that companies can use forced arbitration clauses to stop people from joining together to fight workplace abuses - in effect denying individuals their 7th Amendment protections.

Subsequently, binding arbitration clauses used by corporations has proliferated; sneaking into all manner of common legal documents: personal banking applications, ordinary car loan applications, furniture purchases, and more. This is, unsurprisingly, a direct violation of the 7th Amendment that guarantees HUMAN BEINGS AND PEOPLE the right to a jury trial in certain civil cases and inhibits courts from overturning a jury's findings of fact. Republicans and SCOTUS are perfectly okay with corporations having more rights than workers and using forced arbitration to block people from having access to jury trials—but God forbid if corporations don’t have their right to a jury trial.

This legislative push to bestow corporations with more rights than people, while simultaneously taking away rights from human beings, has been nothing if not thoroughly and methodically done. At this rate, no corporation will ever need to fear a class action lawsuit again.

Amazon, SpaceX and Trader Joe’s are union busting.

But this latest case against the NLRB isn’t just an attack on labor and worker’s rights, it’s a fascistic attack on the very heart of fairness and democracy itself.

#politics#amazon#7th amendment#forced arbitration#spacex#trader joes#nlrb#workers rights#class action lawsuits#labor unions#union busting#collective bargaining#labor law#labor rights#scotus#john roberts court#john roberts#republicans are evil

104 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

194 notes

·

View notes

Note

Doc if you were in charge of the skills high schoolers needed to have under their belt by the time they graduated, what would you pick?

Oh there are so many choices.

If I opened my own school, it would have a class that was just called, 'LIfe Skills" and it would not be an elective and you would take it every semester, every year. It would act like you are a fuckin moron. All the kids would hate it, and they would all thank me later.

A selection:

Here's how to apply for a mortgage loan/credit card/student loan and here is how interest and credit scores work.

How to create and use a budget

Basic car maintenance and theory

Basic desktop computer use and troubleshooting. (No student of mine is not gonna know where the fucking documents folder is)

Basic home repair issues.

Basic cooking and nutrition, including menu planning.

Every year in various components: Reading comprehension and media literacy. Including reading legal and technical English. You don't need to know how to do your taxes, which changes every year, if you can comprehend legal and technical English*

De-escalation and gun safety.

Household skills: How to do laundry, how to do dishes, how to sew a button and mend clothing, iron, how to sweep and mop, shit I have had to genuinely teach people.

Dining and social manners. You can act like a jackass, but you can't say I didn't teach you.

Conflict. How to disagree with someone and stay listening, how not to take disagreement on every issue personally, how to approach conflicts.

This is not exhaustive, but I think it's something people should know to be a reasonable adult in the world.

*As someone who does her taxes by hand every year, and is self-employed which adds an extra layer of difficulty, filing is actually totally doable. Not only is it reading comprehension, but the IRS has so so so many articles to further explain rules to you. They want you to do it correctly.

27 notes

·

View notes

Text

A Picture of Wealth

A quick oneshot for a possible beginning of a Luigi's Mansion movie. Not particularly exciting, but if you like quiet Mario and Luigi slice of life stuff you'll probably like this. I started writing this a while ago, but this post by @theangelofangst inspired me to finish it. AO3: https://archiveofourown.org/works/49496971

_____________________________

After waving ‘goodbye’ to the Mail Toad, Luigi popped open the mailbox and pulled out a stack of envelopes. He scanned them for a moment, loosely sorting them in his mind. It was easy to tell what came from The Mushroom Kingdom and what came from Brooklyn; bright, pastel colored envelopes and fountain pen clashing against cold copy-pasted text on plain white. There was a ‘thank you’ card from a neighboring toad whose sink they had fixed free of charge, a little flier advertising a free upcoming performance in the square, and a pretty, pink envelope embossed with a crown, whose handiwork was easy to recognize. Even the bills were friendly and personable, though they formed as much of a pit in his stomach as the cold typeface from Brooklyn.

For Mario and Luigi, living on their own had been an adjustment, and having an actual income was a serious learning curve. There was an initial high of having money in their pockets, which led to a spending spree to replace much of their oldest tools and equipment before independent living’s new stack of expenses hit them like a train. Still, they had been fairly cautious. Despite a few poor initial decisions they would’ve had enough money to stay out of the red… had it not been for one giant curveball that had been thrown at them.

Luigi stepped back through the front door into the kitchen where Mario sat at the table, hatless and disheveled, hunched over a computer and a stack of papers where he’d been since sunrise. One hand tapped a pencil against a notepad, the other pressed their shared cellphone to his ear.

“Dad, it’s alright. You need it more than we do,” Mario said, “No, forget it, I- no, it’s not a loan.” Luigi couldn’t help but smile as he peeked around the doorway and listened in. It sounded like their father had discovered the check they sent them, and was reacting about as expected. He at least sounded lively from what he could overhear… when they first got the news that he was staying in the hospital for a few days, Mario and Luigi feared the worst. Luckily, it seemed their dad had the family’s hereditary trait of being able to bounce back from just about anything, the bad news was that despite twenty five straight years of company loyalty, getting the help owed to him by the insurance was like pulling teeth.

“Look, I’m a little busy. We’ll talk about it at Sunday lunch, okay?” Mario sighed, “Yeah. Okay. You too. Bye, Dad.” With that he hung up, and set the phone to the side.

“Sounds like he’s feeling better” Luigi laughed, finally stepping into the kitchen to deliver the mail to the table. “Yep.” Mario replied with a tired chuckle, barely even glancing up from his work. “Not well enough to work yet though, as much as he wants to.” “Did the check get deposited?” “Mom managed it under his nose, but it might be the only check that goes through for us this month if I don’t figure something out.” Mario sighed and ran his fingers through his hair, “Ugh, why did I replace our van’s entire engine. All it needed was a few new spark plugs!” “The Garrisons still owe us for rerouting their fountain." Luigi assured, "I’ll send them an invoice.” He stopped for a moment and looked over Mario’s workspace: every possible refund for unnecessary expenses noted and listed, every document scattered about like the stress of the room had caused a miniature explosion on the kitchen table, a mustard-stained receipt for a strap wrench having made it all the way to the empty dishes from lunchtime. Luigi reached over his brother’s shoulder to retrieve the dishes and arrange some of the papers into neat little piles. Mario leaned to the side to give him room.

“You know,” Luigi began hesitantly, “maybe we should ask Princess Peach if-” “We are not asking the princess for money.” Mario interrupted. “No no… I mean, maybe she can void our water bill or something?” “She gave us a free house Luigi! You really think it’s right to ask her for more.” “Maybe?" Luigi shrugged, "I mean, protecting the kingdom has kind of interfered with our work schedule.” “We do that because it’s right, Luigi, not for a paycheck.” “I know!” Luigi raised his voice a little in frustration. He stepped away from the table to deliver the empty plate and glass to the sink, rinsing them off and scrubbing them a little too aggressively to let off steam, “But I’m sure if we explain our situation, she can do something.” “I told you, the answer is no. We’re not bumming off of anyone, especially not Princess Peach.” “It’s not bumming, it’s asking for help! There’s no shame in asking for help. When you need help, you need help!”

Mario didn’t answer, he just grumbled quietly to himself and returned to the bills. Luigi rolled his eyes, scrubbing clean a few extra dishes and placing them in the drying rack before he returned to where his brother sat. He leaned against him, resting his forearm on his shoulder in a purposefully obnoxious way. “You’re as bad as Dad is.” “I am not.” “Are so.” Luigi smiled mischievously, “You look like him too. I’m probably gonna start calling you ‘Dad’ on accident when you start losing your hair.” Luigi tussled his brother’s auburn locks. Mario pulled away, unable to help but laugh as he grabbed one of the pieces of junk mail on the table, crumpled it up, and threw it at Luigi in retaliation. “Will you get out of here?”

Luigi blocked the missile with his hand. He attempted to catch it, but it tumbled out of his slippery grip and landed on the floor. Luigi intended to take it directly in the garbage, but leaning down to pick it up the colors caught his eye… and he realized he did not quite notice this particular piece of mail when he initially emptied the mailbox. Interest piqued, he uncrumpled the paper and read it. His brow raised and his heart skipped a beat. “Mario!” he declared, the sudden exclamation making his brother jump, “We’ve got a free mansion!” Mario let out a loud groan, turning around in his chair. “Oh come on Weegee! It’s an obvious scam!”

Luigi shook his head. “No no, they’ve got a map and an address and everything!” He turned the pamphlet over in his hands in order to reexamine the large block of text on the back, “It says ‘only a select few who apply for noble titles, such as those who are known locally for their heroism’ … that's us!... ‘ are receiving this limited time offer’!” Luigi looked up from his reading to grin excitedly at Mario, who looked back at him with a bored expression. Luigi, undeterred, returned his eyes the advertisement. “There’s a place called Evershade Valley with a big, beautiful mansion in the center of it. Look!” Luigi held the picture out to his big brother, shoving it a little too close to his face in his excitement. “Neo-Gothic architecture!”

Mario took the flier from Luigi’s hands to scrutinize it more closely. The cover image seemed sketchy. The coloration was off, the greenery in the lawn looked doctored, and the giant, garish rainbow plastered into the background reeked of overcompensation. “Sounds like just the kind of padding they’d add to a scam to make it seem like a little less of a scam,” he mumbled, eyes trailing down to the map beneath the image of the mansion. “Evershade Valley… looks like it’s not too far from The Dark Lands. Are you sure about this?” Hearing ‘Dark Lands’ Luigi stiffened a bit, bringing his hands close to his chest as he reconsidered for a few seconds. “It’s near The Darklands, not in The Darklands.” He decided after a moment, “Maybe we can flip this place!: reinstall some plumbing, fix up the wiring, add a fresh coat of paint… boom! Money in our pockets!”

Mario gripped his chin, running a thumb over his mustache thoughtfully. No way it was that easy. If this was really a free mansion like the advertisement said, it couldn’t be anything other than a dilapidated shell that wasn’t worth the investment. If not that, there was no doubt something wrong with the location… nobody simply gave away free mansions.

On the other hand, Mario was impressed that Luigi maintained interest despite its close proximity to The Darklands. Given his past experiences, Mario expected him to back down at the mere mention of that place. The fact that some old building was enough to overshadow those fears made his desire hard to ignore. That, and Luigi was giving him that stupid sad-eyed pleading face that Mario could never say no to. He let out a heavy sigh, smoothed out the pamphlet a bit with his fingers, and handed it back to his brother. “Fine. On one condition.”

“Really!?” Luigi cheered. He threw out his arms to pluck his brother up into a hug, when Mario extended a hand to stave him off a moment.

“On one condition.” He repeated, “You stay here and run the business while I’m away. We can’t afford to miss any clients.”

Luigi deflated. He withdrew his arms and anxiously rubbed the tops of his hands. “Run the business… alone? Just me?” “If I take a warp pipe I shouldn’t be gone longer than a day. You’ll be fine.”

“No I won’t.” Mario cocked his head. He was startled by the terseness of the reply, upsettingly certain in its pessimism. “What do you mean? Of course you will! You just got a few leaky sinks and a running toilet. Nothin’ major.”

“Mario, name one time I did something completely on my own that didn’t turn out a disaster.” Mario opened his mouth to respond, but stopped. He thought things over a bit longer, opened his mouth again, then shut it again to think some more. It was difficult enough recalling a time that Luigi was on his own to begin with– they worked together at every opportunity– but when circumstances drove them apart, even for the briefest of moments, Luigi seemed to always end up in some kind of trouble. Mario’s eyes brightened as one instance popped into his mind. He smiled and snapped his fingers. “Aha! seventh grade! You made it into the Wizard of Oz musical! Played a really good Tinman!” Luigi smiled despondently, crossing his arms. “Mario, I vomited on stage.” “Only during the final bow. The final bow doesn’t count.” Luigi’s expression only grew more troubled as his arms tightened against his chest, and his eyes remained fixed to the ground. Mario stood up from his chair. He walked up to his brother, and took his face in his hands. “Hey, c’mon, don’t look like that,” he said, lifting his Luigi's head to meet his gaze. “You’ve got a good head on your shoulders, you just need a bit more confidence.” Mario’s grip fell from Luigi's face to his shoulders, giving them an endearing squeeze. “Maybe it’ll be good for you to give it a shot on your own. Your luck can’t be all bad, can it?” Neither of them quite knew the answer to that. Both of them stood silent for a moment as Luigi looked at his brother, then down at the pamphlet in his hand, and the big, beautiful mansion on the front. He couldn’t quite figure it out, but something about the place resonated with him. It made him remember being a kid, reading through his mom’s interior design magazines– the sense of wonder and possibility they incited, and the quiet longing to have such a place of his own to wander and explore. He folded the flier, placed it in his pocket, took a deep breath, and sighed. “I’ll do it.”

“Ha ha! That’s my bro.” Mario released his brother’s shoulders to give him a friendly jab with his elbow. “Maybe it’ll be good for you to try to work the business on your own! Just… make sure that clients put their dogs away before you set foot anywhere.”

Luigi grimaced. A small shudder ran up his back as he remembered the incident with Francis The Dog at their first job. Wondering what might have happened to him if Mario hadn’t been there to come to his rescue, second thoughts quickly began to creep in. “Maybe it is a scam–” “Nope! Too late. We’re doing this.” Mario had a fresh determination in his voice as he pulled out his chair and sat back down at the kitchen table. “I’ll finish balancing the checkbook tonight, then leave in the morning– 8 a.m sharp. If I hurry, I might be able to get home in time to help you with the last few jobs.”

Luigi knew that tone. No matter how much his brother initially hated the idea, once he started talking like that there was no stopping him from following through. Luigi had dug his grave, it was time to lie in it. Trying– and failing– not to think about everything that could go wrong in a single work day, Luigi began looking around for something to occupy his mind. The dishes were done, the garden was weeded, and he didn’t need to start dinner for another few hours, so he went to the broom closet and pulled out his vacuum. Plugging it in and unwinding the cord he went to work, allowing himself to get lost in the satisfying rattle of dirt being sucked away as he meticulously went over the carpet and wooden floor bit by bit, until every square inch of the house was clean and tidy.

#my art#Mario#Luigi#Super Mario Brothers#my writing#mario fanfic#Luigi's Mansion#Mario Movie#Aside from Luigi's expected issues with self doubt and anxiety he needs to overcome#I like the idea of them having money troubles at the beginning#Gives more impact to Luigi coming back with both his brother safe and his pockets absolutely STUFFED with cash

79 notes

·

View notes

Text

CASE FILES: YANDERE!MAFIA!BLACKPINK ACCESS: GRANTED

disclaimer: This is not in any way shape or form a representation of Jisoo, Jennie, Rosè, Lisa, or Blackpink as a whole. All reactions, actions, thoughts, words, and general emotions are fiction and created by me. The behavior shown in these reactions is toxic and unhealthy but fantasized in a romantic way for simply that, fantasy. None of this should be taken seriously or sought after in real life, or performed. please do not romanticize this behavior/mindset in real life as it is unhealthy and toxic, and if you or anyone you know is in such an environment, should be taken out of it immediately. Again, this blog is purely fiction, and all acts taken place in this blog should remain so. ↳ None of my characters, yandere or otherwise, will ever nor would ever perform, act, or consider sexual activities of any sort without consent. full stop. Any and all sexual acts are done with the full consent of all parties taking place. i will never, ever, ever write otherwise or even consider writing otherwise.

CASE FILE: BP RECON ↳ The Blood Pythons [BP] are a notorious mafia crime family located in Seoul, South Korea. It is led by a joint circle of four core members, one being the family's daughter and boss. Many sting operations and undercover agents have brought back what is known. Due to their formation of split leadership, it is seen as one of the most difficult to infiltrate and dismantle. Nothing but full loyalty and deep respect have been observed within the members and between ranks. ↳ It is believed that not only has [BP] cut a deal with the police force in their area, but has likewise cut a deal with the federal force. No member has ever been charged with a federal crime, leading to the belief that not only have they cut a deal, but low-level members may be planted through the forces. Many reports have come through that while the gang holds a fearsome grasp on the Korean underworld, nothing compares to the way they will lash out when it comes to their significant others [LOVERS]. ↳ The [LOVERS] are an unknown group who are the chosen partners of the four core members. It is believed that they are the final string for them all, and as such are fiercely protected by members of [BP]. Even more than the horrors brought upon those who threaten [LOVERS] by the members, the pain brought upon them by the core members is said to be hell upon earth.

CASE FILE: [KIM JISOO]

NAME: KIM JISOO ↳ ALIAS: CHECKMATE POSITION: Underboss SPECIALITY: Technological Leader OVERVIEW: [CHECKMATE] is the notorious underboss of BP. Although she rarely goes into the field she is an extremely skilled attacker and her current murder/kill count is still unconfirmed, although it is said to be in the hundreds. She deals with a lot of the technical deals in the group and is mainly in charge of all finances. She is the main owner of a majority of the mafia's properties/businesses. KNOWN ORIGIN: A well-documented child prodigy, [CHECKMATE] was accepted into Korea’s top tech school [AGE: 16]. A year later, [AGE: 17] an anonymous hacker broke into Korea's State Treasury, alleged at the time and now confirmed to be [CHECKMATE]. Along with the vigilante act of releasing loan money back into personal banks, it was discovered that many state and military confidential leaks were sourced by her. At the discovery, she was arrested and processed immediately. However, four months after her sentencing, she escaped during an explosion at Seoul Women's Penitentiary, alleged and confirmed to be an act orchestrated by [BP]. One year later, [AGE:18], a UCA discovered [CHECKMATE] as the underboss of [BP] after completing the assassination of a rival gang, [KINGPIN]. SKILL OVERVIEW: As a certifiable tech genius, [CHECKMATE] is in charge of handling all technical advances/operations in [BP], as well as aiding financial situations and management. As far as is known, [CHECKMATE] controls all surveillance and research in the gang. She is the leader of all other members who work with tech, which aids her in her underboss position. UNDERCOVER DETAIL: [REDACTED] was sent in undercover in [BP] alongside [REDACTED] before [CHECKMATE] was affiliated or arrested. However, once [CHECKMATE] had joined, [REDACTED] was the one to bring forth the information about her. [CHECKMATE] was said to be one of the most difficult members to get to, unlike the other undercover agents, and as soon as word leaked about her discovery of position, [REDACTED] was swiftly terminated by [BP]. KILL COUNT: ↳ CONFIRMED: 500+ ↳ UNCONFIRMED: 1,000+ CASE FILE: [KIM JENNIE]

NAME: KIM JENNIE ↳ ALIAS: VIPER POSITION: Boss SPECIALITY: The Leader. She controls it all. OVERVIEW: [VIPER] is the final say. She has been the leader since age 17 and is extremely skilled both in the field and out of the field. [VIPER] rules the underworld with an iron grip. She is feared by her enemies and adored by those who work under her. [VIPER] has been confirmed to have taken down entire cartels/gangs all by herself, and is known for never being someone to cross. A cold-blooded killer is what is in her blood. KNOWN ORIGIN: [VIPER] was born to to infamous mafia boss and former [BP] leader, Kim Su-yoon [BULLET]. Her father is still unknown. Despite her family's shady ties, [VIPER] was a notorious party girl for a while before the events of her reign began. [VIPER] took over her mother’s position as the most powerful boss in Korea at the young age of 17 when [BULLET] passed away. Although the circumstances of [BULLET] death are unknown, it is assumed [VIPER] killed her for power and position. Her alleged first act as boss was the alleged manipulation of the prison break that freed [CHECKMATE]. [VIPER] proved to be just as powerful of a boss as her late mother as she easily defended her and her gang’s position at the top of Korea and then expanded the territory quite quickly. In just under two years she had become one of the most powerful mafia bosses in Asia and remains in that position to this day.

SKILL OVERVIEW: As she was trained from birth, [VIPER] is at the top in all categories of the gang. She is the main leader of everyone, even in specialized positions such as Tech Leader and Stealth Leader. The only team she doesn’t have that control over is the medical team. She has shown to be proficient in everything from offensive/defensive attacks to politics and strategy. Her skill set lies in her proficiency in all areas, making her a deadly enemy and prolific leader. UNDERCOVER DETAIL: As a very wealthy family the Kims had many people who worked in the household. [REDACTED] was sent in during the middle years of [BULLET'S] reign as a worker. [REDACTED] had acted indecorously and fallen in love with [BULLET] during that time. While unethical, the government's desperation had allowed [REDACTED] to continue the flirtation, until it all culminated in [BULLET'S] pregnancy with [VIPER]. At this time, [REDACTED] turned in his final report before disappearing off the grid, away from [BULLET] and the government. He was assumed alive due to a low-priority tail assigned to him to ensure his safety in hiding, until [CHECKMATE] leaked the documents of [REDACTED] name, files, and information. Two days later [VIPER] promptly sent his death notification with his corpse. KILL COUNT: ↳ CONFIRMED: 2,500+ ↳ UNCONFIRMED: 4,000+ CASE FILE: [PARK CHAEYOUNG / ROSÉ]

NAME: ROSEANNE PARK / PARK CHAEYOUNG

↳ ALIAS: REAPER

POSITION: Consigliere

SPECIALITY: Assasin / Hitmen Leader

OVERVIEW: [REAPER] is the third-in-command of [BP] crime family. She is one of the highest trusted advisors/members alongside [VIPER] and [CHECKMATE]. She is the boss of every crew in the family. everything goes through her before reaching [CHECKMATE], and then [VIPER], and she has the power to start/end missions in the Boss’s name.

KNOWN ORIGIN: [REAPER] was born in Auckland, New Zealand before moving to Melbourne, Australia [AGE: 1] with her father who had met her then-future stepmother. Many reports were filed against the small family over the next ten years, yet due to the negligence of Australian authorities, no action was taken. When [REAPER] was 12 her father was found murdered in the living room of the family home, and the young girl was found locked inside her room with only a single bottle of water with her, her deceased family dog next to her father. An investigation led to a large history of the stepmother abusing not only the young girl but her father as well, using them to earn herself money, which she finally stole and ran away. [REAPER] was sent to live with her biological mother in Korea, and three years later, the mother was found murdered brutally. Further investigation into the death came across a horrifying discovery of her abusing her traumatized child even more. Before an attempt at an arrest could be made of her, [REAPER] disappeared. One year later, [AGE: 16] the stepmother was found dead with the calling card of [REAPER] and [BP] announcing her as the third leader.

SKILL OVERVIEW: [REAPER] gained many skills that would aid her during her time training in [BP]. It's reported that she mastered the art of being a hitman quickly, and from there sent out to kill her stepmother. [REAPER] has killed without mercy, her known kill count just shy of her boss’s. She knows how to defend herself, and has carried out many assassinations in broad daylight, in public places, yet gone completely unnoticed.

UNDERCOVER DETAILS: [REAPER] is the most well-documented member, despite [VIPER'S] partying past. [REDACTED] entered undercover with [REDACTED] before [CHECKMATE] and [REAPER] joined. [REDACTED] rose through the ranks quickly, with top fighting skills and a political tongue. When [REAPER] joined, [REDACTED] began a relationship with her, unknown to her CO. When [REAPER] set out to assassinate her former stepmother, [REDACTED] joined her. Though [REDACTED] took no part in the killing, she was quickly removed from the operation for worries of her psychological profile, and the way she seemed to be leaning into the life. [REDACTED'S] final report was after her disposal, and she explained how [REAPER] demanded her disappearance as her final act of mercy. [REDACTED] burned her real identity and is currently unknown in her whereabouts.

KILL COUNT: ↳ CONFIRMED: 2,400+ ↳ UNCONFIRMED: 3,000+

CASE FILE: [LALISA MANOBAL / LISA]

NAME: LALISA MANOBAL / LISA ↳ ALIAS: SAVIOR

POSITION: Consigliere / Associate

Specialty: Doctor / Medical Leader

OVERVIEW: [SAVIOR], is, officially speaking, not truly a member of the [BP] crime family. She is officially classified as an associate, someone who works for the crime family but is not a member. Yet, she is higher ranking than any other crew or crew leader, her position in the family being an odd one as she actually holds the same authority and power as the other leaders, specifically [REAPER]. For this reason, in the family between the members, she holds the position of consigliere.

KNOWN ORIGIN: [SAVIOR] is the only member of the [BP] Korean Crime Family who is not Korean or of Korean ethnicity. [SAVIOR] was born and raised in Buri Ram, Thailand, with a loving mother and stepfather. [SAVIOR] is a certifiable genius with an IQ of 184. She graduated high school [AGE: 13] before going into pre-med at SNU, thus moving to Korea alone. She graduated in just a few years, before being transferred to medical school. It is unclear exactly how it happened, but after graduating med school [AGE: 20] she went off the grid for over three months. When [SAVIOR] finally resurfaced everything was fine until certain events led to her connection with [BP] coming to light.

SKILL OVERVIEW: [SAVIOR] has the most straightforward skill set of all the members. As [SAVIOR] is a licensed doctor, she is the medical leader for the [BP] crime family. She is the leader of all medical teams of the family, and the only one trusted enough to take care of the other inner members, herself included. She is a skilled fighter as well but not as much as the other girls, so she prefers not fighting. If [SAVIOR] is on a mission on the field, it is said she remains away from the action.

UNDERCOVER DETAILS: [REDACTED] went undercover a few months after [SAVIOR] joined, before she was discovered. [REDACTED] stated that very few, if any knew of [SAVIOR], and he didn't even know of her until a mission gone bad. Due to a lack of reports, not much is known of her activity in the gang, only her position and skill. [REDACTED] passed away on a mission gone wrong against [CHA LEE-YEON].

KILL COUNT: ↳ CONFIRMED: 572 ↳ UNCONFIRMED: 0

jentledaisies © 2024 no translations, reposting or modifications are allowed. do not claim as your own. viewer discretion advised, your media consumption is your responsibility

#yandere!blackpink#blackpink masterlist#yan!mafia!blackpink#yandere jisoo#yandere jennie#yandere rosé#yandere lisa#blackpink jisoo#blackpink jennie#blackpink rosé#blackpink lisa

11 notes

·

View notes

Text

NEW YORK (AP) — The leader of a New York City church where pop star Sabrina Carpenter filmed provocative scenes for a music video was stripped of his duties Monday after church officials said an investigation revealed other instances of mismanagement.

Monsignor Jamie Gigantiello was relieved of “any pastoral oversight or governance role” at his church located in the Williamsburg neighborhood of Brooklyn, Bishop Robert Brennan said in a statement issued by the Roman Catholic Diocese of Brooklyn.

An investigation launched after the video revealed that Gigantiello made unauthorized financial transfers to a former top aide in New York City Mayor Eric Adams' administration, which is being investigated on charges of corruption, Brennan said.

“I am saddened to share that investigations conducted by Alvarez & Marsal and Sullivan & Cromwell LLP have uncovered evidence of serious violations of Diocesan policies and protocols at Our Lady of Mount Carmel – Annunciation Parish,” the bishop said. “In order to safeguard the public trust, and to protect church funds, I have appointed Bishop Witold Mroziewski as administrator of the Parish.”

Gigantiello's administrative powers were taken away after Carpenter’s video for her hit song “Feather” sparked criticism last November.

The priest has now also been cut from his pastoral duties, giving Mroziewski “complete authority over the parish,” including on liturgical matters, though Gigantiello will still be able to say Mass with Mroziewski's approval, said diocese spokesperson Adriana Rodriguez.

Brennan, who oversees Catholic churches in the New York City boroughs of Brooklyn and Queens, said he also relieved a deacon who had been appointed as a temporary administrator during the investigation. He said the deacon had used racist and other offensive language during private conversations in the parish office that had been secretly recorded at Gigantiello’s direction.

Gigantiello didn’t respond to email and Facebook messages seeking comment Monday.

Released on Oct. 31, 2023, the “Feather” music video revolves around men behaving badly toward Carpenter before meeting grisly deaths.

At points in the video, the former Disney Channel star is seen pulling up to the distinctive brick church in a pink hearse and then dancing in front of the church’s ornate altar wearing a short black dress and a black veil alongside a colorful array of faux coffins.

The diocese at the time said it was “appalled” and that proper procedures for filming had not been followed.

Besides relieving Gigantiello of administrative duties, Brennan also dropped him from fundraising duties as vicar of development for the diocese and conducted a spiritual rite to restore the sanctity of the church.

In a letter to parishioners last November, Gigantiello said approving the filming was a “lapse in judgment” and maintained he wasn’t present at the time and didn’t realize how provocative the shoot would be.

On Monday, Brennan said a broader review uncovered other instances of administrative impropriety.

Among them is an ongoing investigation into Gigantiello’s use of a church credit card for “substantial” personal expenses, he said.

From 2019 to 2021, the monsignor also transferred $1.9 million in parish funds to bank accounts affiliated with Frank Carone, Adams' former chief of staff, Brennan said.

The bishop said Gigantiello failed to seek prior approval for the transactions and didn’t properly document them, in violation of the diocese’s investment policies and protocols.

Carone’s law firm repaid $1 million of the funds, along with about 9% interest, according to Brennan. Gigantiello also requested early repayment for the remainder, but without the substantial interest called for under the loan notes, the bishop said.

Federal investigators have subpoenaed the Brooklyn church seeking information about Carone and Gigantiello’s financial dealings, though neither has been accused of any wrongdoing.

Brennan stressed the diocese is “fully committed” to cooperating with law enforcement in its investigations.

Carone didn’t respond to an email seeking comment, but Gigantiello has defended his stewardship, telling The City, a local news outlet, that the investments were legal and yielded a significant return for the church.

Meanwhile, the commotion set off by her music video hasn’t been lost on Carpenter.

She made light of it during a concert at Madison Square Garden in late September, just days after Adams became the first New York City mayor indicted while in office.

“Damn, what now?” she said cheekily to the Manhattan crowd. “Should we talk about how I got the mayor indicted?”

5 notes

·

View notes

Text

A Safe Loan Offer for Short Term Loans UK Direct Lender

It is so normal for a man looking for a short term loans direct lender at any charge because there are so many different kinds of credit available in our modern budgetary market. Short term loans UK direct lender are the most practical way to obtain cash without sacrificing your insurance advantages. The candidate needs a fast and secure advance framework in order to proceed with the credit check. Those who are disabled and dependent on public assistance due to illness or other circumstances will find this especially useful. In addition to being simple and quick, it is also referred to as an optional item to provide some extra support right away. A component of internet management is this advancement.

The client does not walk around seeking for any digital café with the intention of presenting an application form since short term loans UK direct lender are given to the client particularly by the immediate loan specialist at the client's convenience of home or workplace at any time. Every one of you needs to use your Android phone, turn on your portable internet, and visit the bank's website. Even after completing the online form and providing all necessary information, the money is quickly sent into your account.

Infrequently, coordinated bank advances for beneficiaries are created to meet the financial needs of those receiving social assistance. Although it does not ask for a guarantee in order to be approved, there are several important requirements that an applicant must fulfill, which are listed below.

In his or her record, he or she should have sufficient funds, at least £700. He or she must provide documentation proving their citizenship or proof of residence in the United Kingdom for at least the previous year. He or she is entitled to a functional financial balance that is at least six months old. Given that it is required, he ought to be able to return the credit within the allotted period.

You can get a short term cash loans for a short period of time—two months starting from the date of endorsement—with a maximum amount of £1,000. It's intended for clients who meet the requirements in the terms and language, as it has been shown above. The short term loans UK direct lender obtained is used to pay for unforeseen needs such as groceries, rent, medical visits, the cost of a child's schooling or daycare, unexpected bank overdrafts, auto repairs, and other emergency bills.

Thanks to soft searches, we offer a prompt eligibility response before to your online application for a loan, so it won't have an impact on your credit score. Classic Quid is here to help, whether you need a short term loans UK for debt consolidation, overdue debt repayment, or something else entirely. You are not required to be a homeowner in order to apply for our short term loans direct lenders up to £2500. We just require a few personal facts to get started on your personalized quote and provide you a fast answer regarding your eligibility. From here, a breakdown of any interest payments together with the monthly repayments for a loan will be displayed to you.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Hidden Charges in Personal Loans You Should Be Aware Of

A personal loan is a convenient financial tool that helps borrowers manage various expenses, from medical emergencies to home renovations. However, while lenders advertise attractive interest rates, there are often hidden charges in personal loans that can increase the overall cost. Being aware of these charges can help you make informed decisions and avoid unnecessary financial burdens.

1. Processing Fees

One of the most common charges in personal loans is the processing fee. Lenders deduct this amount before disbursing the loan, and it typically ranges between 1% and 3% of the loan amount. While some banks and NBFCs offer zero processing fee loans during promotional campaigns, most lenders charge this fee as a standard cost.

How to Avoid It:

Compare lenders to find lower processing fee options.

Check for seasonal offers where processing fees might be waived.

Negotiate with the lender if you have a strong credit score.

2. Prepayment and Foreclosure Charges

Many borrowers aim to repay their personal loan early to reduce interest costs. However, banks and NBFCs often charge prepayment and foreclosure fees, which can be 2% to 5% of the outstanding loan amount.

How to Avoid It:

Opt for lenders that allow zero prepayment or foreclosure charges.

Read the loan agreement carefully before signing.

Choose a shorter tenure to reduce interest costs without prepayment.

3. Late Payment Fees

Missing an EMI due date can lead to late payment penalties, which are typically a fixed amount or a percentage of the EMI. These charges can significantly increase your debt burden.

How to Avoid It:

Set up auto-debit for EMI payments.

Maintain sufficient balance in your account.

Use reminders to pay EMIs on time.

4. Loan Cancellation Charges

If you change your mind after taking a personal loan, you may have to pay cancellation fees. Some lenders allow cancellation within a short window, but they might still charge a percentage of the loan amount.

How to Avoid It:

Evaluate your need before applying for a loan.

Read the lender’s cancellation policy before proceeding.

5. Loan Rescheduling Fees

If you face financial difficulties and request a loan rescheduling or restructuring, lenders might charge a fee ranging from INR 1,000 to INR 5,000. This fee compensates lenders for administrative costs.

How to Avoid It:

Plan your loan tenure wisely to avoid rescheduling.

Improve financial discipline to ensure timely repayments.

6. Stamp Duty and Documentation Charges

Some lenders impose stamp duty and documentation fees for legal formalities. These charges vary based on the loan amount and state regulations.

How to Avoid It:

Ask for a clear breakdown of charges before signing the agreement.

Compare lenders to find those with minimal documentation fees.

7. GST on Loan Charges

Goods and Services Tax (GST) is applicable on processing fees, prepayment charges, and foreclosure fees. This means the actual cost of these charges is higher than what’s initially quoted.

How to Avoid It:

Factor in GST while calculating loan expenses.

Look for lenders offering all-inclusive pricing.

8. Verification and Legal Fees

Banks and NBFCs may charge for verifying documents, performing background checks, or conducting legal assessments. These fees are not always disclosed upfront.

How to Avoid It:

Ask for a detailed fee structure before finalizing the loan.

Compare different lenders to choose the most transparent option.

9. Balance Transfer Charges

Many borrowers transfer their personal loan to another lender for lower interest rates. However, lenders charge a balance transfer fee, which is typically 1% to 3% of the outstanding loan amount.

How to Avoid It:

Ensure that the savings from lower interest outweigh the balance transfer charges.

Look for lenders offering zero balance transfer fees.

10. Insurance Premiums

Some lenders bundle loan protection insurance with personal loans, which increases the overall loan cost. While insurance is beneficial, it should be optional and not forcefully included.

How to Avoid It:

Ask whether loan insurance is mandatory or optional.

Compare the cost of insurance separately before agreeing to it.

Choosing the Right Personal Loan

Before finalizing a personal loan, it’s essential to compare options from various lenders. Here are some top options you can consider:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Each of these lenders offers different benefits, processing fees, and repayment options. By carefully comparing them, you can avoid hidden charges and choose a loan that suits your financial needs.

Conclusion

Understanding the hidden charges in personal loans can save you from unexpected costs and financial stress. Before applying for a personal loan, always read the fine print, ask for a detailed fee structure, and compare multiple lenders. This will ensure you get the best loan deal without unnecessary expenses.

For more details on personal loans, visit Fincrif to explore top lenders and compare loan options easily. Make an informed decision and enjoy a hassle-free borrowing experience!

#Personal loan hidden charges#Personal loan fees and charges#Loan processing fees#Prepayment charges on personal loan#Foreclosure charges on loans#Late payment fees on personal loan#Personal loan EMI bounce charges#Personal loan insurance charges#Personal loan documentation fees#Personal loan GST charges#Personal loan service tax#Personal loan statement charges#Personal loan annual maintenance fees#Personal loan penalty charges#Personal loan part-payment charges#Additional charges in personal loan#Unexpected fees in personal loan#Personal loan processing charges#Personal loan verification fees#Extra costs of taking a personal loan#Personal loan agreement fees#Personal loan repayment fees#Loan cancellation charges#Personal loan legal fees#Personal loan convenience fees#Personal loan bank charges#Loan rescheduling fees#Over-limit charges on personal loans#How to avoid personal loan hidden charges#Personal loan transparency fees

0 notes

Text

A Comprehensive Guide to Working with a Mortgage Broker in Dubai

Introduction to Home Loans in Dubai

Working with a mortgage broker in Dubai can simplify the mortgage process and help you secure the best deals. This comprehensive guide provides insights into the benefits of using a mortgage broker and how to effectively work with one.

The Role of a Mortgage Broker

A mortgage broker acts as an intermediary between borrowers and lenders, helping you find the best mortgage deals and guiding you through the application process. Here are some benefits of using a mortgage broker:

Expert Knowledge: Brokers have extensive knowledge of the mortgage market.

Access to Multiple Lenders: They work with multiple lenders, giving you more options.

Personalized Service: Brokers offer services tailored to your financial situation and needs.

Time Savings: They handle the paperwork and negotiations, saving you time and effort.

For more information on home loans, visit home loan dubai.

Steps to Working with a Mortgage Broker

Initial Consultation: The process begins with an initial consultation where the broker assesses your financial situation and mortgage needs.

Pre-Approval: The broker helps you get pre-approved for a mortgage, giving you an idea of your borrowing capacity and interest rate.

Property Search: With pre-approval in hand, you can start searching for properties within your budget. For listings, visit Buy Commercial Properties in Dubai.

Application Submission: Once you find a property, the broker submits your mortgage application to multiple lenders.

Offer and Negotiation: The broker reviews offers from lenders and negotiates the best terms on your behalf.

Final Approval and Closing: After selecting the best offer, the broker assists with the final approval and closing process, ensuring all documentation is complete.

For expert mortgage advice, consider Mortgage Financing in Dubai.

Key Considerations When Choosing a Mortgage Broker

Experience and Expertise: Choose a broker with extensive experience in the Dubai mortgage market. An experienced broker will have a deep understanding of market dynamics and lender requirements.

Fee Structure: Understand the broker's fee structure. Some brokers charge a flat fee, while others earn a commission from the lender. Ensure you are comfortable with their fees and services.

Customer Reviews: Read customer reviews and testimonials to gauge the broker's reputation and track record. Positive reviews can indicate a reliable and effective broker.

Personal Connection: Choose a broker who you feel comfortable working with and who understands your needs and goals.

Specialization: Some brokers specialize in specific types of mortgages or property transactions. Find a broker whose expertise aligns with your needs.

For rental options, visit Apartments For Rent in Dubai.

Benefits of Using a Mortgage Broker

Access to Exclusive Deals: Brokers often have access to deals that are not available to the general public.

Expert Negotiation: They can negotiate better terms and rates with lenders.

Stress Reduction: Brokers handle the complex paperwork and administrative tasks, reducing your stress.

Comprehensive Financial Advice: They provide valuable financial advice, helping you make informed decisions.

Customized Solutions: Brokers offer solutions tailored to your specific needs and financial situation.

For villa listings, visit Villas For Sale in Dubai.

Real-Life Success Story

Consider the case of Emma, a first-time homebuyer in Dubai. With the help of a mortgage broker, she secured a favorable mortgage rate and purchased her dream apartment in Dubai Marina. The broker's expertise and negotiation skills saved her time and money, making the home-buying process smooth and stress-free.

Conclusion

Working with a mortgage broker in Dubai can simplify the mortgage process and help you secure the best deals. By leveraging the broker's expertise, relationships with lenders, and negotiation skills, you can achieve your homeownership goals more efficiently. For more resources and expert advice, visit Mortgage Financing in Dubai.

3 notes

·

View notes

Text

Expert Tips for Choosing a Mortgage Consultant in Dubai

Choosing the right mortgage consultant in Dubai is crucial for securing the best mortgage deal and ensuring a smooth property purchase process. This blog provides expert tips to help you choose the best mortgage consultant for your needs.

For more information on home loans, visit Home Loans in Dubai.

Understanding the Role of a Mortgage Consultant

A mortgage consultant acts as an intermediary between borrowers and lenders, helping clients find the best mortgage deals, negotiate terms, and complete the necessary paperwork. Their expertise and connections in the industry can save you time, money, and stress.

Expert Tips for Choosing a Mortgage Consultant

Research and Referrals: Start by researching mortgage consultants online and asking for referrals from friends, family, and colleagues who have recently purchased property in Dubai.

Check Credentials: Ensure that the consultant is licensed and has a good reputation in the industry. Check for certifications and memberships in professional organizations.

Interview Multiple Consultants: Schedule consultations with several mortgage consultants to compare their services, fees, and approach.

Evaluate Experience: Choose a consultant with extensive experience in the Dubai mortgage market and a track record of successful transactions.

Assess Communication Skills: Ensure that the consultant communicates clearly and promptly, and is willing to answer all your questions.

Review Testimonials and Reviews: Read client testimonials and online reviews to gauge the consultant’s reliability and customer satisfaction.

Understand Fees and Charges: Be clear about the consultant’s fees and charges upfront to avoid any surprises later on.

Check Availability: Ensure that the consultant is available and willing to provide ongoing support throughout the mortgage process.

For property purchase options, explore Buy Apartments in Dubai.

Real-Life Success Story

Consider the case of Ahmed, an expatriate in Dubai looking to buy his first home. Ahmed was initially overwhelmed by the mortgage options and the complexities of the application process. He decided to seek the help of a mortgage consultant based on recommendations from colleagues. The consultant assessed Ahmed’s financial situation, explained the different mortgage products available, and helped him choose the best one for his needs.

Throughout the process, the consultant handled all the paperwork, negotiated with lenders to secure a competitive rate, and kept Ahmed informed at every step. This personalized service made a significant difference, reducing Ahmed’s stress and ensuring a smooth and successful home purchase.

For mortgage consulting services, consider Mortgage Broker Dubai.

Common Challenges and How to Overcome Them

Navigating the mortgage market in Dubai comes with its own set of challenges. Here are some common challenges and how to overcome them:

Understanding Complex Terms: The mortgage market is filled with complex terms and jargon that can be confusing. A mortgage consultant can break down these terms and explain them in simple language.

Comparing Different Products: With numerous mortgage products available, comparing them can be overwhelming. A mortgage consultant can provide a clear comparison of different products, highlighting the pros and cons of each.

Handling Documentation: The mortgage application process requires extensive documentation. A mortgage consultant can help you gather and organize the necessary documents, ensuring that everything is in order.

Dealing with Rejections: If your mortgage application is rejected, a mortgage consultant can help you understand the reasons and provide guidance on improving your financial profile for future applications.

Securing the Best Rates: Negotiating with lenders to secure the best rates can be challenging. A mortgage consultant, with their industry connections and expertise, can negotiate on your behalf to get the most favorable terms.

For rental property management services, visit Rent Your Property in Dubai.

Future Trends in Mortgage Consulting

The mortgage consulting landscape in Dubai is continuously evolving, with new trends shaping the market. Here are some future trends to watch out for:

Increased Use of Technology: The integration of technology in the mortgage process is expected to increase, making applications and approvals more seamless.

Sustainability: There is a growing focus on sustainable and energy-efficient properties. Mortgages for green buildings and eco-friendly homes are likely to become more popular.

Flexible Mortgage Products: Lenders are expected to offer more flexible mortgage products to cater to the diverse needs of borrowers.

Regulatory Changes: Ongoing regulatory changes may impact the mortgage market, and staying informed will be crucial for borrowers.

Market Adaptation: The mortgage market will continue to adapt to economic conditions, including interest rate fluctuations and property market trends.

For more resources and expert advice, visit Home Loans in Dubai.

Conclusion

Choosing the right mortgage consultant in Dubai is crucial for securing the best mortgage deal and ensuring a smooth property purchase process. By researching, checking credentials, interviewing multiple consultants, evaluating experience, and assessing communication skills, you can choose a reliable consultant who will guide you through the mortgage process. For more resources and expert advice, visit Home Loans in Dubai.

6 notes

·

View notes

Text

How to Find Top Mortgage Advisors in Dubai

Finding the right mortgage advisor in Dubai is essential to navigating the complexities of the mortgage market and securing the best possible terms for your home loan. With numerous options available, it can be challenging to know where to start. This guide will help you find top mortgage advisors in Dubai who can meet your needs and guide you through the process.

Why You Need a Mortgage Advisor

Mortgage advisors play a crucial role in helping you find the best mortgage deals. They provide expert advice, handle paperwork, and negotiate with lenders on your behalf. Here are some key reasons to work with a mortgage advisor:

Expert Knowledge: They understand the mortgage market and can offer tailored advice.

Time-Saving: They handle the legwork, saving you time and effort.

Access to Deals: Advisors often have access to exclusive mortgage deals.