#Personal loan statement charges

Explore tagged Tumblr posts

Text

Hidden Charges in Personal Loans You Should Be Aware Of

A personal loan is a convenient financial tool that helps borrowers manage various expenses, from medical emergencies to home renovations. However, while lenders advertise attractive interest rates, there are often hidden charges in personal loans that can increase the overall cost. Being aware of these charges can help you make informed decisions and avoid unnecessary financial burdens.

1. Processing Fees

One of the most common charges in personal loans is the processing fee. Lenders deduct this amount before disbursing the loan, and it typically ranges between 1% and 3% of the loan amount. While some banks and NBFCs offer zero processing fee loans during promotional campaigns, most lenders charge this fee as a standard cost.

How to Avoid It:

Compare lenders to find lower processing fee options.

Check for seasonal offers where processing fees might be waived.

Negotiate with the lender if you have a strong credit score.

2. Prepayment and Foreclosure Charges

Many borrowers aim to repay their personal loan early to reduce interest costs. However, banks and NBFCs often charge prepayment and foreclosure fees, which can be 2% to 5% of the outstanding loan amount.

How to Avoid It:

Opt for lenders that allow zero prepayment or foreclosure charges.

Read the loan agreement carefully before signing.

Choose a shorter tenure to reduce interest costs without prepayment.

3. Late Payment Fees

Missing an EMI due date can lead to late payment penalties, which are typically a fixed amount or a percentage of the EMI. These charges can significantly increase your debt burden.

How to Avoid It:

Set up auto-debit for EMI payments.

Maintain sufficient balance in your account.

Use reminders to pay EMIs on time.

4. Loan Cancellation Charges

If you change your mind after taking a personal loan, you may have to pay cancellation fees. Some lenders allow cancellation within a short window, but they might still charge a percentage of the loan amount.

How to Avoid It:

Evaluate your need before applying for a loan.

Read the lender’s cancellation policy before proceeding.

5. Loan Rescheduling Fees

If you face financial difficulties and request a loan rescheduling or restructuring, lenders might charge a fee ranging from INR 1,000 to INR 5,000. This fee compensates lenders for administrative costs.

How to Avoid It:

Plan your loan tenure wisely to avoid rescheduling.

Improve financial discipline to ensure timely repayments.

6. Stamp Duty and Documentation Charges

Some lenders impose stamp duty and documentation fees for legal formalities. These charges vary based on the loan amount and state regulations.

How to Avoid It:

Ask for a clear breakdown of charges before signing the agreement.

Compare lenders to find those with minimal documentation fees.

7. GST on Loan Charges

Goods and Services Tax (GST) is applicable on processing fees, prepayment charges, and foreclosure fees. This means the actual cost of these charges is higher than what’s initially quoted.

How to Avoid It:

Factor in GST while calculating loan expenses.

Look for lenders offering all-inclusive pricing.

8. Verification and Legal Fees

Banks and NBFCs may charge for verifying documents, performing background checks, or conducting legal assessments. These fees are not always disclosed upfront.

How to Avoid It:

Ask for a detailed fee structure before finalizing the loan.

Compare different lenders to choose the most transparent option.

9. Balance Transfer Charges

Many borrowers transfer their personal loan to another lender for lower interest rates. However, lenders charge a balance transfer fee, which is typically 1% to 3% of the outstanding loan amount.

How to Avoid It:

Ensure that the savings from lower interest outweigh the balance transfer charges.

Look for lenders offering zero balance transfer fees.

10. Insurance Premiums

Some lenders bundle loan protection insurance with personal loans, which increases the overall loan cost. While insurance is beneficial, it should be optional and not forcefully included.

How to Avoid It:

Ask whether loan insurance is mandatory or optional.

Compare the cost of insurance separately before agreeing to it.

Choosing the Right Personal Loan

Before finalizing a personal loan, it’s essential to compare options from various lenders. Here are some top options you can consider:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Each of these lenders offers different benefits, processing fees, and repayment options. By carefully comparing them, you can avoid hidden charges and choose a loan that suits your financial needs.

Conclusion

Understanding the hidden charges in personal loans can save you from unexpected costs and financial stress. Before applying for a personal loan, always read the fine print, ask for a detailed fee structure, and compare multiple lenders. This will ensure you get the best loan deal without unnecessary expenses.

For more details on personal loans, visit Fincrif to explore top lenders and compare loan options easily. Make an informed decision and enjoy a hassle-free borrowing experience!

#Personal loan hidden charges#Personal loan fees and charges#Loan processing fees#Prepayment charges on personal loan#Foreclosure charges on loans#Late payment fees on personal loan#Personal loan EMI bounce charges#Personal loan insurance charges#Personal loan documentation fees#Personal loan GST charges#Personal loan service tax#Personal loan statement charges#Personal loan annual maintenance fees#Personal loan penalty charges#Personal loan part-payment charges#Additional charges in personal loan#Unexpected fees in personal loan#Personal loan processing charges#Personal loan verification fees#Extra costs of taking a personal loan#Personal loan agreement fees#Personal loan repayment fees#Loan cancellation charges#Personal loan legal fees#Personal loan convenience fees#Personal loan bank charges#Loan rescheduling fees#Over-limit charges on personal loans#How to avoid personal loan hidden charges#Personal loan transparency fees

0 notes

Text

Dunes Hotel & Casino '55-'93

Dunes, 1955. Kodachrome photo from Charles Phoenix.

Timeline of the Dunes

’53-54: First announced as Hotel Araby (RJ 11/1/53), then became known as Vegas Plaza, and Hotel Deauville (RJ 1/20/54, 4/23/54). Named the Dunes by the time of groundbreaking, 6/22/54 (RJ).

’55: May 23, original owners Robert Rice, Al Gottesman, Joseph Sullivan, Alexander Barad and Jason Tarsey open the $4 million Dunes Hotel-Casino with 200 rooms on an 85-acre site. John Replogle, designer Robert Dorr Jr., architect and designer. Signs and Sultan figure by YESCO (RJ 5/23/55).

’55: Aug., Dunes leased by Sands partners and reopened in Sep. Subsequent financial difficulties cause the casino to be closed, 1/56.

’56: Bill Miller, Major A. Riddle, and Robert Rice are licensed to reopen the casino in May. In Nov., the license is changed to add M&R Investment Co. as the company that operates the Dunes.

’57: Jan., Minsky’s Follies opens the first topless show at a Strip resort.

’59: Convention Hall addition.

’61: Olympic Wing addition.

’62: Riddle sells 15 percent of the stock to M&R Investment Corp., whose stockholders now include Charles Rich, Sidney Wyman and George Duckworth.

’62: Oct. 21, Tower groundbreaking.

’64: Construction of "Miracle Mile" golf course. Sultan figure moved to golf course in May. In Oct-Nov, the 180-ft sign is installed in Oct., and switched on 11/12/64.

’65: Jun, opening of Dome of the Sea and the 24-story tower. Dunes Golf Course opened.

’69: Continental Connector Corp., a publicly traded company, buys the Dunes in a $59M stock transfer in May. In Dec, the SEC charges that CCC defrauded stockholders in the proxy statement it issued offering to buy the Dunes. CCC settles the SEC complaint in ’76. At this time, bankers E. Parry Thomas and Jerome Mack are principals in M&R and CCC.

’74: In Sep., Gaming Control Board files a complaint against the Dunes for catering and "comping" alleged Kansas City mob chief Nick Civella, one of 11 members of the Black Book, Nevada's List of Excluded Persons. The Dunes ultimately was fined $10,000.

’75: In Feb., Morris Shenker buys an interest in M&R through his IJK Nevada Inc. Later in the year, Dunes owners Shenker and Riddle are asked about allegations that reputed mobster Anthony Spilotro had "set up shop" at the Dunes. Spilotro reportedly was spending up to 14 hours a day in the poker room and appeared to be using it as an office.

’76: In Jun., Shenker sues the Teamsters Union for $140M for backing out of a loan commitment, which was to be used to add another 1,000 rooms. In Oct., Dept of Labor intervenes, saying the loan was prohibited. In ’80, Shenker's breach of contract lawsuit is tossed out of court by U.S. District Judge Roger Foley.

’79: South tower opened in summer. Shenker announces the Dunes will construct a $65M hotel-casino in Atlantic City. FBI affidavits are unsealed claiming that two confidential informants "both advised that the Kansas City organized crime group headed by Nick Civella has a concealed interest fronted by Shenker at the Dunes." Shenker denies the allegations.

’80: In Jan., alleged members of the NY Columbo family are discovered staying for free at the Dunes. Gaming Control Board Chairman Richard Bunker says the "comping" did not violate the law or gaming regulations. Later, four of the group, including Joseph Columbo Jr., are indicted on charges of obtaining money under false pretenses in an airline ticket reimbursement scam. The indictment is dismissed by District Judge Joseph Pavlikowski and in ’84 was reinstated by the NV Supreme Court.

’82: Aug., the $17M Oasis Casino opens, doubling the existing casino space at the resort. Design by Farris Alexander Congdon Architects. New 2-floor casino includes Xanadunes electronic gaming area, and Video-Video arcade space (RJ 8/13/82, 8/20/82).

’82: Dec., Stuart and Clifford Perlman agree to buy the Dunes for $185M. The brothers loan Shenker $4M and $2.9M of that sum is used to pay overdue federal payroll taxes and avoid the seizure of assets by the IRS. Shenker denies the resort is on the verge of bankruptcy. Docs filed with the SEC indicate the property is in default on a number of loans and a number of creditors threaten foreclosure action.

’83: The Perlmans assume management of the Dunes in Apr., and operate it for four months before the sale collapses in Aug.

’83: Oct., a foreclosure sale of the Dunes' golf course and some other property is averted when problems are worked out with the trustees of the Hotel & Restaurant Employees and Bartenders Int’l Union and the trustees of the Nevada Culinary and Bartenders Pension Trust, which are owed $1.5M for non-payment of union benefits.

’83: Dec., a federal jury in Las Vegas decides that Shenker owes $34M to the So. Nevada Culinary and Bartenders Pension Fund for defaulting on loans in ’73-’75 to two of Shenker's land companies, Sierra Charter Corp. and IJK Nevada.

’84: Feb., Shenker files for personal bankruptcy in Missouri to protect his assets from the $34M judgment. The IRS claims that the 78-year-old Shenker owes $66M in unpaid taxes stretching back 20 years. Shenker's bankruptcy filing claimed assets of $82M and liabilities of $197M, the largest debt ever recorded in the St. Louis bankruptcy court.

’84: Mar., Valley Bank of Nevada heads a consortium to lend the Dunes $68.6M as part of a debt restructuring plan.

’84: May, John Anderson buys a controlling interest in the Dunes with his JBA Investments Inc. Anderson signs a $25M note to pay the Perlmans for the $35M they invested in the resort. Shenker's 26 percent interest remains under the control of the bankruptcy court.

’84: Jun., the FBI alleges that Shenker approved $600,000 in kickbacks to alleged Milwaukee crime boss Frank Balistrieri in connection with loans from the Teamsters Union to Allen Glick, who later bought four Las Vegas resorts before being forced out of gaming by Nevada officials. Shenker denies the kickback allegations. No charges are filed.

’85: Feb., Dunes is cited for failing to retrofit the property to meet fire safety standards. About $2.2M is spent on retrofitting during the first half of the year.

’85: May, former Gaming Control Board Chairman Richard Bunker leaves his position as corporate treasurer of Circus Circus Ent. to become president of the Dunes.

’85: Aug., Jack Bona buys out the Dunes' 49 percent interest in its Atlantic City property in a $21M sale. The next day, Bona places the property in a Ch. 11 reorganization in bankruptcy court.

’85: Sept. 27, Dunes defaults on the $68.6M bank loan and Valley Bank moves ahead with the legal steps required for a foreclosure sale Dec. 23.

’85: Oct. 24, Federal marshals begin seizing cash from the Dunes casino cage to pay a $2.7M judgment obtained by trustees of the Culinary and Bartenders unions. They accept a $200,000 check and leave the cash in the cage.

’85: Nov. 1, Marshals return to collect the remaining $17M owed to the unions but are halted by a last-minute restraining order.

’85: Nov. 6, Dunes' operating company. M&R Investment, files for reorganization under Chapter 11.

’87: Masao Nangaku buys the Dunes for $157M.

’92: Nov., Dunes bought by Mirage Inc. for $75M.

’93: Jan. 26, closed. North tower and sign demolished 10/27/93.

‘94: Jul. 20, South tower demolished.

A major source for the timeline is Jane Ann Morrison. Judge Approves Payday for Dunes Employees. Review-Journal, 11/7/85.

Dunes, 1955. This is the original layout of the resort, before the addition of the Convention Hall and Olympic wing. Photo by Ed Screeton. Dunes Hotel Photograph Collection (PH-00281), UNLV Special Collections & Archives.

Late '64. The 180-foot sign has recently been completed. Dome of the Sea restaurant and the hotel tower are nearing completion. Culinary Workers Union Local 226 Photographs, UNLV Special Collections & Archives.

Mar. '85. Photo by Scott Henry, Review-Journal.

144 notes

·

View notes

Text

WASHINGTON — President Biden issued a pardon Monday for his brother James Biden, effectively burying the final details of a more than five-year probe into the first family’s influence peddling to save them from possible repercussions under the incoming Trump administration.

Congressional Republicans subpoenaed James Biden, 75, along with first son Hunter Biden, 54, in 2023 to investigate their involvement in the family’s domestic and foreign business dealings — after evidence emerged that both men repeatedly involved Joe Biden in their lucrative relationships.

Republicans accused James of lying to Congress and requested criminal charges. They also suggested his dealings may have amounts to unregistered foreign lobbying, another crime.

“My family has been subjected to unrelenting attacks and threats, motivated solely by a desire to hurt me—the worst kind of partisan politics. Unfortunately, I have no reason to believe these attacks will end,” the outgoing president said in a statement minutes before leaving office. “I believe in the rule of law, and I am optimistic that the strength of our legal institutions will ultimately prevail over politics. But baseless and politically motivated investigations wreak havoc on the lives, safety, and financial security of targeted individuals and their families. Even when individuals have done nothing wrong and will ultimately be exonerated, the mere fact of being investigated or prosecuted can irreparably damage their reputations and finances.” Biden added: “That is why I am exercising my power under the Constitution to pardon James B. Biden, [his wife] Sara Jones Biden, [first sister] Valerie Biden Owens, [her husband] John T. Owens, and [first brother] Francis W. Biden. The issuance of these pardons should not be mistaken as an acknowledgment that they engaged in any wrongdoing, nor should acceptance be misconstrued as an admission of guilt for any offense.”

It’s unclear why Biden pardoned some of his relatives, though Sara Biden was involved with some of her husband’s business relationships, and Biden’s brother Frank allegedly used his brother’s name in business dealings. The timeframe covered by the clemency grants also was not immediately clear.

Biden previously issued an unprecedented pardon on Dec. 1 spanning 11 years of his son’s conduct — stretching back to 2014 when Hunter Biden joined the board of Ukrainian gas giant Burisma Holdings — heading off sentencing on gun and tax evasion convictions and potential additional charges.

James Biden, unlike his nephew, was not charged with committing any federal crimes, though his conduct was actively investigated by House Republicans and the press.

The pardon of James Biden, who struggled to manage his own finances despite earning large sums, indicates the president likely feared the incoming Trump Justice Department would further investigate his family’s dealings, as James was involved in many key initiatives that included the president and Hunter.

The first brother for decades monetized his proximity to power — dating to Joe Biden’s 36-year Senate tenure — and House Republicans turned up records that he sent $240,000 to Joe Biden in 2017 and 2018 from funds linked to alleged influence peddling, which James said were personal loan repayments.

‘A line of 747s filled with cash’

In one of the earliest known instances of his dealings that garnered scrutiny, James in 2006 allegedly crowed, “don’t worry about investors, we’ve got people all around the world who want to invest in Joe Biden” when he and Hunter Biden were in the process of taking over a New York City hedge fund.

“We’ve got investors lined up in a line of 747s filled with cash,” Politico reporter Ben Schreckinger wrote in a 2021 book.

Joe Biden was the top Democrat on the Senate Foreign Relations Committee at the time.

Law firm SimmonsCooper — associated with wealthy asbestos lawyer Jeff Cooper — invested $1 million in 2006 to that hedge fund. The same year, Congress considered asbestos reform legislation, in which then-Sen. Biden (D-Del.) played a pivotal role in blocking a change that could have limited funding for payouts after lobbying by Cooper’s firm.

A Biden spokesman claimed in 2008 that the money was unrelated to the bill and that the investment was later returned.

Cooper subsequently partnered with the Biden family on business pursuits in Mexico during the Obama-Biden administration — and posed for a 2015 group photo with Mexican guests and Joe Biden at the official vice president’s residence and riding aboard Air Force Two for an official 2016 trip to Mexico.

James Biden was wiretapped by the FBI in 2007 — when his brother was still a senator — as part of a bribery investigation of Mississippi lawyer Dickie Scruggs, the Washington Post reported in 2023.

Biden, who was not charged in the case, was in talks with Scruggs and conspirator Tim Balducci about setting up a law firm that would have employed himself, his nephew Hunter Biden, and James’ wife.

Scruggs at one point flew Joe Biden to a fundraiser on his private plane, the Washington Post reported.

Then-Sen. Biden went from opposing federal legislation to punish tobacco companies for lying about the addictiveness of cigarettes to a supporter after Scruggs — the architect of a multibillion-dollar litigation plan — paid James Biden’s lobbying firm $100,000 in 1998, the Washington Post also reported.

“I probably wouldn’t have hired him if he wasn’t the senator’s brother,” Scruggs told the paper.

Another disbarred Mississippi attorney, Joey Langston, who was convicted in a different bribery case, told House impeachment inquiry investigators that he loaned James Biden $800,000 in 2016 and 2017 during Joe Biden’s final term in office, but only got $400,000 back.

The troubled attorney, who had hosted fundraisers for Joe Biden, ProPublica reported, was unsuccessfully trying to overturn a bribery conviction in court in 2016 — raising questions about whether he was also seeking a federal pardon from Obama while Biden was his No. 2.

China funds ‘laundered’ to Joe: GOP

James Biden was involved in an arm’s length of controversial foreign ventures.

Corporate bankruptcy documents say that James Biden received $600,000 in loans in 2018 from rural hospital provider Americore, including an initial $400,000 that January and a later $200,000 on March 1, 2018, by pledging to “obtain a large investment from the Middle East based on his political connections.”

Politico reported that “one person on the receiving end of Jim Biden’s health care pitch recalled a phone call in which Jim Biden said he was sitting in a car next to his brother Joe.”

James Biden in 2018 apparently made a pitch to Qatar to invest $30 million into a troubled rural hospital provider and directly mentioned that he was the “brother” of then-former Vice President Biden in 2018 in a presentation, according to documents obtained by Politico.

James told impeachment inquiry investigators that investor Amer Rustom, whose corporate biography describes him as having “strong ties with many of the Middle East and North African leaders and country officials” referred him to another businessman, Michael Lewitt, for a potential $20 million investment in Americore, but that it didn’t materialize in time to save the company financially.

The Securities and Exchange Commission in 2023 charged Lewitt, a Florida resident, with stealing $4.7 million from investors of his own fund.

James Biden wrote his brother a $200,000 check shortly after receiving his final installment from Americore.

The first brother insisted the payment was a legitimate loan reimbursement. Democrats said that bank records showed the Joe Biden had transferred that amount to James previously, Republicans said no loan paperwork existed and questioned whether Joe Biden had actually transferred the initial funds, which flowed from a law firm associated with the family.

James Biden also sent $40,000 to Joe Biden on Sept. 3, 2017, which House Republicans said came from “laundered” funds from CEFC China Energy, a Chinese state-linked firm that paid Hunter and James Biden millions of dollars in a venture that one Biden family associate infamously penciled in a 10% cut for Joe Biden, whom they referred to as the “big guy.”

The source of that $40,000 sent to Joe was trackable due to the near-empty balance of James’ account, investigators pointed out.

James defended his work with CEFC in his impeachment inquiry testimony, though his description of his duties drew questions about his possible liability under the Foreign Agents Registration Act, which requires Americans to register before lobbying for certain foreign clients.

“Relying on the extensive network of contacts I had developed over many decades, I quickly identified a number of promising opportunities. For example, I reached out to a number of investors who were friends and who expressed serious interest in working with us,” James said.

“In addition, I connected with Richard Ieyoub, an old friend and the former long-term Attorney General of Louisiana, who by 2017 was the state Commissioner of Conservation. Mr. Ieyoub directed me to a number of projects, including Monkey Island LNH, a property off the coast of Louisiana with opportunities for the onloading and offloading of liquid natural gas.

“Of all the projects, this was the one that proved most attractive to CEFC, whose representatives presented the opportunity to the Chairman [Ye] and gave an informal go-ahead for the project. We even marked the occasion with a celebratory lunch.”

Joe Biden allegedly met in early 2017 in Washington with CEFC Chairman Ye Jianming shortly before the company opened the spigot of funds flowing to the family, former Biden family associate Rob Walker testified.

James said in his own testimony, said his brother “had no information at all about the source of the funds I used to repay him.”

“I never asked my brother to take any official action on behalf of me, my business associates, or anyone else. In every business venture in which I have been involved, I have relied on my own talent, judgment, skill, and personal relationships — and never my status as Joe Biden’s brother,” he said in the testimony in February.

He insisted that the money he transferred to the president were all short term loans that were for tuition payments for his children, unforeseen medical expenses and storm damage on his house.

“The Committees have asked about those loans from my brother. They were short-term loans that I received from Joe when he was a private citizen, and I repaid them within weeks…. The complete explanation is that Joe lent me money, and I repaid him as soon as I had the funds to do so.”

“What I can say is not that I’m aware of,” White House press secretary Karine Jean-Pierre said Dec. 12 about a James Biden pardon. “But I just don’t have anything else beyond that, and the president certainly is going to as it more broadly speaking, as we move forward to the next couple of weeks, he obviously is going to review with his team about other clemency decisions, and they’re taking additional steps, and so that’s what I can speak to at this time.”

19 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

194 notes

·

View notes

Text

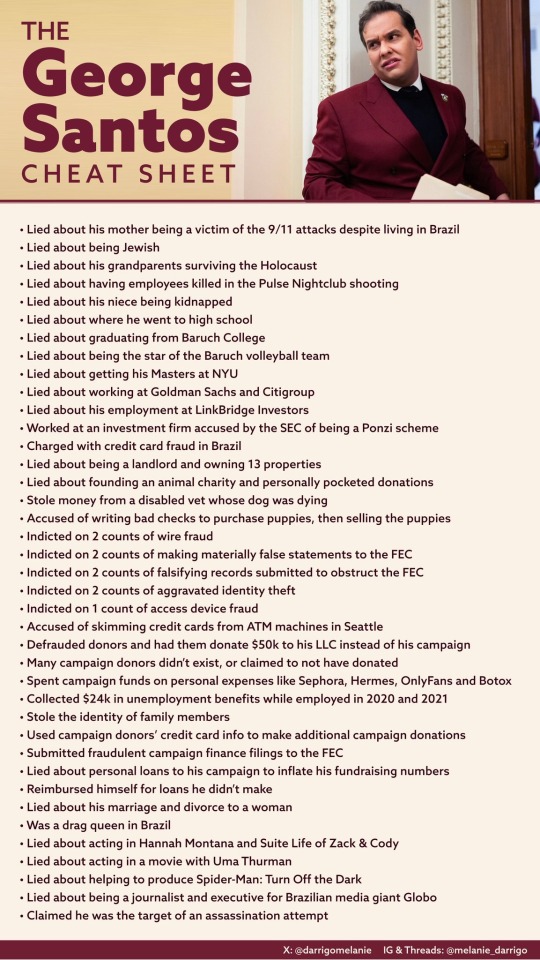

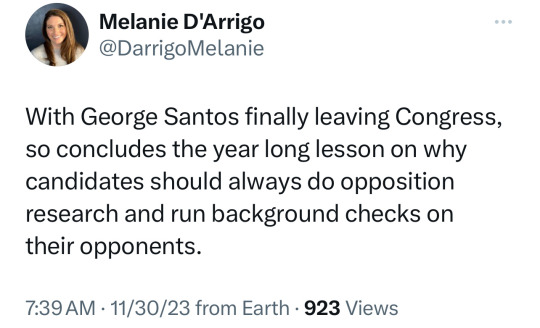

George Santos:

• Lied about his mother being a victim of the 9/11 attacks despite living in Brazil

• Lied about being Jewish

• Lied about his grandparents surviving the Holocaust

• Lied about having employees killed in the Pulse Nightclub shooting

• Lied about graduating from Baruch College

• Lied about being the star of the Baruch volleyball team

• Lied about getting his MBA at NYU

• Lied about working at Goldman Sachs and Citigroup

• Lied about his employment at LinkBridge Investors

• Worked at an investment firm accused by the SEC of being a Ponzi scheme

• Charged in Brazil with credit card fraud

• Lied about being a landlord and owning 13 properties

• Lied about founding an animal charity and personally pocketed donations

• Stole money from a disabled vet whose dog was dying

• Accused of writing bad checks to purchase puppies, then selling the puppies

• Indicted on 2 counts of wire fraud

• Indicted on 2 counts of making materially false statements to the FEC

• Indicted on 2 counts of falsifying records submitted to obstruct the FEC

• Indicted on 2 counts of aggravated identity theft

• Indicted on 1 count of access device fraud

• Accused of skimming credit cards from ATM machines in Seattle

• Defrauded donors and had them donate $50k to his LLC instead of his campaign

• Invented campaign donors, and some donors claimed to not have donated

• Spent campaign funds on personal expenses like Sephora, Hermes, OnlyFans and Botox

• Collected $24k in unemployment benefits while employed in 2020 and 2021

• Stole the identity of family members

• Used campaign donors’ credit card info to make additional campaign donations

• Submitted fraudulent campaign finance filings to the FEC

• Lied about personal loans to his campaign to inflate his fundraising numbers

• Reimbursed himself for loans he didn’t make

• Lied about his marriage and divorce to a woman

• Was a drag queen in Brazil

• Claimed he was the target of an assassination attempt

• Lied about acting in Hannah Montana and Suite Life of Zack & Cody

• Lied about acting in a movie with Uma Thurman

• Lied about helping to produce Spider-Man: Turn Off the Dark

• Lied about being a journalist and executive for Brazilian media giant Globo

After Santos himself, I I really put the bulk of the blame on the DNC + DCCC for not finding out about even a quarter of these huge ass lies until he was already in office. (Sorry, but the Republican Party ain’t gonna do it).

76 notes

·

View notes

Text

Federal prosecutors hit Rep. George Santos, R-N.Y., with 23 additional charges Tuesday, including allegations of identity theft and that he charged a supporter's credit card in excess of their contribution and then transferred the money to his personal bank account. Prosecutors said Santos faces “one count of conspiracy to commit offenses against the United States, two counts of wire fraud, two counts of making materially false statements to the Federal Election Commission (FEC), two counts of falsifying records submitted to obstruct the FEC, two counts of aggravated identity theft, and one count of access device fraud” in a superseding indictment filed Tuesday. “As alleged, Santos is charged with stealing people’s identities and making charges on his own donors’ credit cards without their authorization, lying to the FEC and, by extension, the public about the financial state of his campaign. Santos falsely inflated the campaign’s reported receipts with non-existent loans and contributions that were either fabricated or stolen” Breon Peace, United States Attorney for the Eastern District of New York, said in a statement.

7 notes

·

View notes

Text

Financial advisor spent $900K from client on country club, cars, authorities say

A financial advisor out of Moorestown was sentenced to seven years in state prison Wednesday for stealing some $900,000 a client had given him to invest and putting it toward lavish personal expenses, authorities said.

Brian Murphy, 47, of Hainesport, pleaded guilty to misapplication of entrusted property and failure to pay New Jersey state income taxes, according to the Burlington County Prosecutor's Office. The charges carried seven and three year sentences, respectively, which Murphy will served concurrently.

He must also repay the former client $890,000 in restitution and surrender his license, authorities said.

Murphy previously worked under the business Murphy Financial Advisors, and began receiving money from the client to invest in mutual funds in 2011, according to the prosecutor's office.

Instead of investing the money as promised, Murphy used it to cover personal and business expenses, buying a country club membership, private school tuition and cars, authorities said.

The client, who sent Murphy money for several years, became suspicious when he or she did not receive financial statements, authorities said. When pressed, Murphy sent the client fraudulent statements, which the client could not verify upon contacting the investment firm, authorities said.

After the client confronted Murphy, he came to the client's home, and brought paperwork stating that the client had agreed to loan Murphy the money, according to the prosecutor's office.

Further investigation into Murphy found that he underreported his income in 2012, 2014 and 2015, and failed to pay state income taxes in 2013, authorities said.

"This sentence reflects the seriousness of this substantial fraud," Prosecutor Scott Coffina said in a statement. "Let it serve as a reminder that we will vigorously prosecute financial advisors and anyone else who steals money entrusted to them by a client."

2 notes

·

View notes

Text

Financial advisor spent $900K from client on country club, cars, authorities say

A financial advisor out of Moorestown was sentenced to seven years in state prison Wednesday for stealing some $900,000 a client had given him to invest and putting it toward lavish personal expenses, authorities said.

Brian Murphy, 47, of Hainesport, pleaded guilty to misapplication of entrusted property and failure to pay New Jersey state income taxes, according to the Burlington County Prosecutor's Office. The charges carried seven and three year sentences, respectively, which Murphy will served concurrently.

He must also repay the former client $890,000 in restitution and surrender his license, authorities said.

Murphy previously worked under the business Murphy Financial Advisors, and began receiving money from the client to invest in mutual funds in 2011, according to the prosecutor's office.

Instead of investing the money as promised, Murphy used it to cover personal and business expenses, buying a country club membership, private school tuition and cars, authorities said.

The client, who sent Murphy money for several years, became suspicious when he or she did not receive financial statements, authorities said. When pressed, Murphy sent the client fraudulent statements, which the client could not verify upon contacting the investment firm, authorities said.

After the client confronted Murphy, he came to the client's home, and brought paperwork stating that the client had agreed to loan Murphy the money, according to the prosecutor's office.

Further investigation into Murphy found that he underreported his income in 2012, 2014 and 2015, and failed to pay state income taxes in 2013, authorities said.

"This sentence reflects the seriousness of this substantial fraud," Prosecutor Scott Coffina said in a statement. "Let it serve as a reminder that we will vigorously prosecute financial advisors and anyone else who steals money entrusted to them by a client."

2 notes

·

View notes

Text

I understand what this means, but I think we should seriously reflect on words vs. actions when it comes to graphs like these. Let's start from the top

Trans Rights:

Biden has supported trans rights and solidified that people can't be turned away from Healthcare for being trans, as well as providing the option to identify as X on certain documents. Good things.

Abortion Access:

We lost Roe v. Wade under Biden, and he has done almost nothing to solidify and prevent further restrictions for abortion.

Environmental Reform:

Biden has spoken multiple times about environmental reform and his support for it, yet he sends bombs with large environmental impacts to Isreal, undoing any environmental progress he reached towards and doing untold damage to countless lives as well as our planet.

Healthcare Reform:

The average hospital stay is still roughly $2,500 depending on state, about 2% higher than in 2020. Healthcare costs more and the quality is dropping.

Prescription reform:

Medicare can now negotiate drug prices! Well, kinda. They can only negotiate a maximum of 50 drugs per year. This means that they can only change the prices of 50 drugs once per year, not keep the same drug prices low. One drug may be $50 less one year, but jump up $100 next year because they didn't negotiate it. This is just Medicare, nod Medicaid. Seniors only. Also, children get coverage, but only until the age of 6. Not much of a benefit. He did kinda chase after junk fees, but you still have to fight back personally in most cases (personal experience here.). Mostly crumbs with potential for expansion, yet no promise as of now.

Student Loan Forgiveness:

This one makes me laugh. He tossed us lies for years and even when he gave us something it was still only crumbs. It's not even enough to cover the interest according to their own site.

Infrastructure Funding:

I'll give this to him. He helped pass a bill to rebuild bridges in "poor condition or worse". It's 45,000 out of the 600,000 bridges in the states though, so not a whole lot. Still better than the nothing that was going to them, but not enough.

Advocating Race Equality:

Biden can't even see Palestinian people as people. Between that and funding racist regimes like Cop Cities and police forces with a known white supremacy problem and you've got your answer.

Diversity, Equity, and Inclusion:

See previous statement.

Vaccines and Public Health:

Covid is still around. Biden literally stated it was over, but we're experiencing huge waves every year that rival 2020 numbers. This has been a huge problem that many, many people have pointed out ever since he stated covid was over yet he still does nothing.

Criminal Justice Reform:

More crumbs and lies disguised as virtue. Decriminalizing weed on a federal level is a great example of saying big things that mean nothing. Nobody is jailed for federal weed charges.

Military Support for Isreal:

Yeah. He supports killing innocent people. Children included. We've all seen it for the past 9 months and can't deny it.

Israel/Hama's Ceasefire:

Another joke I see. He may say he supports a ceasefire, yet he keeps supplying them bombs, especially knowing what the weapons are used for. His "private calls" with Israel have amounted to giving even more bombs while going on stage and saying he's "disappointed" in what Israel is doing. Not to mention the press conferences where his own people state Biden fully supports Israel and what they're doing, backing them fully to the point of discrediting the ICC and wanting them thrown in jail for daring to condem Israel's actions.

Now, what has Biden done to stop Project 2025? To codify Roe v. Wade? To actually save lives? Weed out corruption? Prevent those who openly state they wish to be the last president from becoming president?

The answer is nothing. It's all just slow drips of potential followed by inaction and deceit. Biden is a do nothing president that promised he would leave office for someone better back in 2020 and now wishes to hold office and prevent better candidates from taking over. There's no way he doesn't know he's one of the least popular president's just behind Trump, yet he does nothing to change that. Both are senile and I honestly don't think holding onto 4 more years, if he even lives that long, would change much other than the timeline of the far right pushing their agenda.

Vote for who you want. Just know that Biden is doing nothing of substance and still allowing bad things to happen. He just tends to hide the bad a bit better until things burst and he sends his people to lie to our faces.

Look.

I have made you a chart. A very simple chart.

People say "You have to draw the line somewhere, and Biden has crossed it-" and my response is "Trump has crossed way more lines than Biden".

These categories are based off of actual policy enacted by both of these men while they were in office.

If the ONLY LINE YOU CARE ABOUT is line 12, you have an incredible amount of privilege, AND YOU DO NOT CARE ABOUT PALESTINIANS. You obviously have nothing to fear from a Trump presidency, and you do not give a fuck if a ceasefire actually occurs. You are obviously fine if your queer, disabled, and marginalized loved ones are hurt. You clearly don't care about the status of American democracy, which Trump has openly stated he plans to destroy on day 1 he is in office.

103K notes

·

View notes

Text

Personal Loan Eligibility for Housemaids, Drivers, and Daily Wage Earners

Introduction

A personal loan can be a lifesaver in times of financial need, offering quick access to funds without requiring collateral. However, individuals working as housemaids, drivers, and daily wage earners often struggle to secure loans due to irregular income and lack of formal employment records. While traditional banks may impose strict eligibility criteria, alternative lending options have made it possible for low-income workers to obtain financial assistance.

This article explores the eligibility criteria, challenges, and solutions for housemaids, drivers, and daily wage earners looking for a personal loan.

Challenges Faced by Low-Income Workers in Getting a Personal Loan

1. Lack of a Stable Income

Most banks and financial institutions require proof of a steady income to approve a personal loan. However, housemaids, drivers, and daily wage workers often earn on a cash basis, making it difficult to provide consistent salary slips or bank statements.

2. No Credit History

A credit score plays a crucial role in loan approval. Many low-income workers do not have a credit history because they have never taken a loan or used a credit card, which makes lenders hesitant to approve their applications.

3. Absence of Income Proof and Documentation

Financial institutions usually require documents such as salary slips, income tax returns (ITR), or Form 16 to verify income. Daily wage earners and domestic helpers often do not have these documents, making it harder to qualify for a personal loan.

4. High-Interest Rates

Even if some lenders provide personal loans to low-income workers, they often charge higher interest rates due to the perceived risk of non-repayment. This can increase the overall burden on borrowers.

How Housemaids, Drivers, and Daily Wage Earners Can Qualify for a Personal Loan

Despite these challenges, there are several ways for housemaids, drivers, and daily wage earners to improve their chances of securing a personal loan.

1. Apply for a Loan Through Microfinance Institutions

Microfinance institutions cater to low-income individuals who do not qualify for traditional bank loans. They offer smaller loan amounts with flexible repayment options, making it easier for daily wage earners to access credit.

2. Consider NBFCs and Fintech Lenders

Non-Banking Financial Companies (NBFCs) and fintech lenders provide personal loans with relaxed eligibility criteria. These lenders may consider alternate income proof such as utility bills, rent receipts, or employer verification letters.

3. Maintain a Bank Account

A bank account with regular transactions can help in proving financial stability. Even if a housemaid or driver is paid in cash, they should deposit their earnings in a bank account regularly to create an income trail.

4. Use Alternative Income Proof

Many lenders now accept alternative income documents such as:

Employer verification letters

Income certificate issued by local authorities

Bank statements showing consistent cash deposits

Utility bills in the borrower's name

5. Build a Credit Score

Opening a savings account, fixed deposit, or taking a small loan can help in building a credit score. Using a prepaid credit card or repaying small loans on time can also enhance creditworthiness.

6. Apply for a Joint Loan or Get a Guarantor

Some lenders allow joint loan applications, where a borrower with a higher credit score or stable income can co-sign the loan. Alternatively, having a guarantor with a good financial background can improve loan approval chances.

Best Personal Loan Options for Low-Income Workers

1. Government-Backed Loan Schemes

Some governments run special financial assistance programs for low-income individuals. Housemaids, drivers, and daily wage earners can check for government-backed microloan schemes with lower interest rates and flexible repayment terms.

2. Self-Help Groups (SHGs) and Cooperative Banks

Many self-help groups and cooperative banks provide small loans to workers in unorganized sectors. These loans typically come with lower interest rates and flexible repayment options.

3. Gold Loans or Secured Loans

For those who own gold or valuable assets, a gold loan can be a good option. Gold loans require minimal documentation and provide instant cash at a lower interest rate.

4. Salary Advance Loans

Some employers offer salary advance loans to their domestic workers and drivers. These loans are deducted from future wages, making repayment easier.

Documents Required for Personal Loan Approval

Though formal documents may not be required by all lenders, having the following documents can increase the chances of getting approved:

Aadhar Card / PAN Card (Identity proof)

Voter ID / Ration Card (Address proof)

Employer verification letter (Income proof)

Bank statements of the last six months

Utility bills or rental agreement (For additional proof of residence)

Things to Consider Before Applying for a Personal Loan

1. Compare Interest Rates

Check and compare the interest rates offered by different lenders before applying for a loan.

2. Understand the Loan Terms

Read the loan agreement carefully, including repayment tenure, interest rates, and processing fees.

3. Avoid Fraudulent Lenders

Beware of lenders who ask for upfront processing fees or guarantee instant approval without verifying your details.

4. Borrow Only What You Can Repay

Taking a loan beyond your repayment capacity can lead to financial stress. Borrow only what you can comfortably repay.

Conclusion

Getting a personal loan as a housemaid, driver, or daily wage earner may seem challenging, but it is possible with the right approach. By exploring microfinance institutions, NBFCs, and fintech lenders, maintaining a bank account, and using alternative income proof, low-income workers can improve their chances of securing a loan. Always compare loan offers, verify lender credibility, and ensure timely repayments to avoid financial difficulties in the future.

If you're a low-income worker looking for a personal loan, explore the best options tailored to your needs and financial stability.

#finance#personal loan online#nbfc personal loan#personal loans#personal loan#loan services#bank#personal laon#loan apps#fincrif#Personal loan for daily wage earners#Loan eligibility for housemaids#Personal loan for low-income workers#Instant loan for drivers#Unsecured loan for domestic workers#Personal loan for blue-collar workers#Loan options for unorganized sector workers#Low-income personal loan approval#Best personal loan for household staff#Microfinance loans for daily wage workers#Easy loan approval for low-income groups#Emergency funds for housemaids and drivers#Personal loan without salary slips#Small loan for unbanked workers#Financial assistance for daily laborers#Flexible loan repayment for domestic workers#Instant cash loan for drivers#Short-term loan for low-income earners#Best loan schemes for blue-collar workers#Microcredit loan for household staff

2 notes

·

View notes

Text

Urgent Cash Loan in Delhi – Get Instant Money Within Hours with LoansWala

Need an Urgent Cash Loan in Delhi? Get Fast Approval & Same-Day Disbursal!

Are you looking for an urgent cash loan in Delhi to manage an unexpected financial emergency? Whether it’s a medical bill, rent payment, sudden travel expense, or urgent home repair, having quick access to funds is essential. That’s where LoansWala comes in, offering a fast, hassle-free, and 100% online process to get an instant cash loan in Delhi.

✔ Quick Approval – Get loan approval within minutes✔ Same-Day Disbursal – Money transferred in just 2-4 hours✔ Minimal Documentation – No complex paperwork, just basic KYC ✔ Flexible EMI Plans – Choose a repayment option that suits you ✔ 100% Online Process – No need to visit banks, apply from your phone

If you need a fast personal loan in Delhi, LoansWala ensures a smooth and quick borrowing experience.

Why You Might Need an Urgent Cash Loan in Delhi

Financial emergencies can arise anytime. Here are some common reasons why people apply for an urgent cash loan in Delhi:

1️⃣ Medical Emergencies 🏥

Medical treatments and hospital bills can be unexpected and expensive. If health insurance doesn’t cover everything, an instant personal loan in Delhi can be a lifesaver.

2️⃣ Rent, Bills & Daily Expenses 🏠

Missed a credit card payment, electricity bill, or rent due date? Instead of paying late fees, get a quick cash loan in Delhi and clear your bills on time.

3️⃣ Business Investment & Urgent Expenses 💼

If you need immediate funds for a profitable business opportunity, a short-term loan in Delhi can help you take action without delay.

4️⃣ Travel & Weddings ✈💍

Need to book an urgent flight or pay for wedding expenses? A same-day loan in Delhi ensures you don’t miss important moments.

5️⃣ Home & Vehicle Repairs 🔧

Sudden breakdowns of your car, AC, fridge, or plumbing issues can be expensive. A quick loan in Delhi can help you cover urgent repair costs.

No matter the situation, LoansWala offers fast financial assistance when you need it most!

Why Choose LoansWala for an Urgent Cash Loan in Delhi?

With so many loan providers in Delhi, why should you trust LoansWala?

✅ Fastest Loan Approval in Delhi – Get approval in minutes✅ Same-Day Fund Transfer – Money in your bank within hours✅ No Collateral Required – Unsecured loan, no need to pledge property or gold ✅ Flexible Repayment Plans – EMIs that fit your budget ✅ Low-Interest Rates – Competitive and transparent pricing ✅ No Hidden Charges – What you see is what you pay

LoansWala is the most reliable and fastest loan provider in Delhi!

Features of an Urgent Cash Loan from LoansWala

📌 Loan Amount – ₹10,000 to ₹5,00,000 📌 Interest Rate – Competitive & affordable 📌 Repayment Tenure – Flexible EMIs up to 24 months📌 Eligibility – Salaried & self-employed individuals 📌 CIBIL Score Requirement – Not strict, even low-score applicants can apply 📌 Approval Time – Instant, within minutes 📌 Disbursal Speed – 2-4 hours, directly in your bank account

How to Apply for an Urgent Cash Loan in Delhi?

Applying for a quick cash loan in Delhi is simple and hassle-free! Follow these 3 easy steps:

Step 1: Fill Out the Online Form

📍 Go to https://www.loanswala.in/📍 Enter your details – Name, Loan Amount, Employment Info📍 Select your loan type & repayment plan

Step 2: Submit Basic Documents

📍 PAN Card & Aadhaar Card 📍 Salary slip (for salaried applicants) 📍 Bank statement (for self-employed applicants)

Step 3: Instant Approval & Same-Day Fund Transfer

📍 Loan gets approved within minutes📍 Money is transferred to your bank account within hours

LoansWala makes borrowing fast, secure, and hassle-free!

Who is Eligible for an Urgent Cash Loan in Delhi?

To qualify for an instant loan, you must:

✔ Be between 21-58 years old✔ Be an Indian citizen residing in Delhi NCR✔ Be salaried or self-employed✔ Have a minimum monthly income of ₹15,000✔ Provide basic KYC documents (PAN, Aadhaar, salary proof)

Even if you have a low credit score, you may still qualify for a loan!

Frequently Asked Questions (FAQs)

❓ How much loan amount can I get from LoansWala?✔ You can apply for a loan between ₹10,000 and ₹5,00,000.

❓ How long does it take to get the loan amount?✔ Approval takes minutes, and funds are disbursed within 2-4 hours.

❓ Do I need collateral or a guarantor?✔ No, LoansWala provides unsecured personal loans.

❓ Can I get a loan if I have a low credit score?✔ Yes! LoansWala considers multiple factors, not just credit score.

❓ What happens if I miss an EMI payment?✔ Late payments may lead to penalties, so it’s best to plan repayments carefully.

Final Thoughts: Need Urgent Money? Apply Now with LoansWala!

If you need a fast and hassle-free cash loan in Delhi, LoansWala is the quickest and most reliable option. With instant approval, minimal paperwork, and same-day disbursal, getting money has never been easier!

#Urgent Cash Loan in Delhi#Best Cash Loan Delhi#Emergency Personal Loans#Loan Finance Company Delhi#Loans Wala

0 notes

Text

During the height of the pandemic, the founder of a city-funded nonprofit aiding people released from jail allegedly took $2.5 million in cash kickbacks, plus other gifts, including home and luxury car loan payments to funnel tens of millions in public funds to two corrupt businesspeople, federal prosecutors in Brooklyn charged Thursday.

Julio Medina, the executive director and founder of Exodus Transitional Community, solicited and accepted the cash and gifts from hotel executive Weihong Hu, an associate of Mayor Adams’ former aide Winnie Greco, and security company president Christopher Dantzler.

In exchange, Medina funneled to them about $51 million in city contracts meant to provide housing and other services to people released from jail during the pandemic, the indictment said.

Photos contained in the indictment show Medina, a former chairperson of the city Board of Correction, allegedly accepting an envelope of cash from Hu at one of the hotels used to house people released from jail during the pandemic.

The nonprofit received roughly $122 million through the emergency housing program overseen by the city, the indictment said. Under the program, people were released from jail into hotels and given reentry services.

“The defendants’ brazen and illegal kickback scheme stole money from the City of New York that was intended to provide emergency housing and support services during the pandemic,” stated U.S. Attorney for the Eastern District John Durham.

“Shamefully, the defendants saw the pandemic as an opportunity to line their pockets with stacks of cash, finance a luxury vehicle, purchase homes and pay off personal debts.”

Medina and Dantzler pleaded not guilty Thursday afternoon. Medina was released on $250,000 bond secured by one of his homes. Dantzler was released on a $750,000 bond. They declined comment, as did their lawyers.

Hu also pleaded not guilty and was released on $20 million bond, to be secured by two properties and two suretors, to be identified by Feb. 27. She offered no comment on the way out of court.

Hu’s lawyer Benjamin Brafman, in a statement, told The News, “In my opinion, Ms. Hu is a victim not a co- conspirator.”

Prosecutors allege the scheme began as early as April 2020 as the pandemic forced citywide shutdowns and led Mayor de Blasio to order the release of hundreds of detainees from the city’s jails, driving the system’s population to below 4,000 for the first time in memory.

The scheme continued for the next four years, with regular, surreptitious meetings between Medina, Hu and Dantzler to exchange money.

The indictment contains four surveillance photos of Medina meeting with Hu at one of Hu’s two hotels in Queens on Sept. 11, 2020. The images show Hu pulling a stack of cash from her wallet, placing it in a manila envelop and sliding it over to Medina, the indictment said.

Both appear to be wearing Adidas tracksuits. Medina is wearing a New York Yankees baseball cap.

Medina then passed over purported checks from the emergency housing program. Two days later, the indictment said, the checks were deposited in Hu-controlled accounts.

Prosecutors said Dantzler’s security company, which was paid $21 million, did not actually provide security. Instead, he enlisted subcontractors, paying them a total of $12 million. He pocketed the remaining $9 million.

City Investigations Commissioner Jocelyn Strauber credited the Mayor’s Office of Risk Management and Compliance for referring questionable payments it found to DOI, sparking the investigation that led to the indictment.

Between August 2021 and September 2021, Dantzler allegedly paid $75,000 to pay off debts owed by Medina and family members, including a mortgage and a car loan.

In November 2021, Hu used one of her businesses to finance a luxury car for Medina worth $107,000. She then made monthly payments of more than $50,000, the indictment said.

In May 2023, Dantzler paid $750,000 to buy and renovate a home for Media upstate in Clifton Park, the indictment said.

In return, Medina submitted fraudulently inflated budgets to obtain multiple contracts through the Mayor’s Office of Criminal Justice, which was overseeing the housing program. The contracts were inflated to account for the cost of the bribes and kickbacks paid by Dantzler and Hu, the indictment alleges.

To avoid detection of the scheme, Medina submitted false statements to the city claiming no one in Exodus received any financial benefit from the contracts, the indictment said.

At one point, on May 22, 2023, Medina, worrying the scheme was unraveling, unloaded on one of Hu’s employees in a text message.

“Don’t call me no more. I don’t f—ing trust you!” he ranted. “You know I’m under investigation. You are f—ing with the wrong person!”

Hu’s hotels took in $12 million from Exodus under the housing program, prosecutors said. She also had a catering company which got $17 million in public funds through the program.

One of Hu’s hotels was raided by the feds in November, weeks after the mayor was indicted on corruption charges.

Hu was a major fundraiser for the mayor’s 2021 campaign and has extensive ties to Winnie Greco, a senior adviser to Adams whose homes were also raided by the feds in February 2024.

As first reported by the news outlet The City, Greco at one point lived for free in a taxpayer-funded room at one of Hu’s hotels that was supposed to be reserved for homeless people. Greco resigned from her position in the Adams administration in October 2024.

Some donors who gave to Adams’ 2021 campaign as part of fundraisers hosted by Hu were reportedly reimbursed by her, a practice known as “straw donating” that is illegal.

2 notes

·

View notes

Text

Home Loan for 40000 Salary: Eligibility, EMI & Best Lenders

Whether being a homeowner is a dream comes down to an individual's perspective, however, one of the significant aspects impacting home loan approval is income. Earning a monthly salary of Rs. 40,000 brings to mind a couple of queries such as how much home loan can one receive, what are the eligibility criteria, and which are the best lenders in this category.

This blog provides a comprehensive guide to home loan for 40000 salary, including eligibility, EMI calculations, and the top lenders to consider.

Home Loan Eligibility for 40000 Salary

Lenders assess various factors before approving a home loan. Some of the primary eligibility criteria include:

1. Income-Based Loan Amount

Most banks and NBFCs offer home loans based on the applicant’s income. A general rule is that lenders provide loans up to 50-60% of the net monthly income. For a Rs. 40,000 salary, the potential loan amount can be estimated as follows:

Loan Amount: Rs. 20-30 lakhs (approx.)

Loan Tenure: Up to 30 years

Interest Rate: 8-9% (varies by lender)

2. Employment Type

Salaried Employees: Must have a stable job with at least 2-3 years of work experience.

Self-Employed Individuals: Should have a consistent income history and proper documentation (IT returns, profit & loss statements, etc.).

3. Credit Score

A CIBIL score of 700 or above is preferred by lenders. A high credit score improves loan eligibility and helps secure lower interest rates.

4. Existing Liabilities

If you have existing loans (personal loans, car loans, credit card EMIs), they impact your loan eligibility. Banks use the Fixed Obligations to Income Ratio (FOIR) to determine your repayment capacity.

EMI Calculation for Home Loan on 40000 Salary

Your Equated Monthly Installment (EMI) depends on the loan amount, interest rate, and tenure. Below is an estimated EMI calculation for different loan amounts:

EMI Formula: Where:

P = Loan Principal Amount

r = Monthly Interest Rate (Annual Interest Rate/12/100)

n = Loan Tenure (in months)

How to Reduce EMI?

Opt for a longer tenure (though total interest paid increases).

Pay a higher down payment to reduce the loan amount.

Choose a lender with a lower interest rate.

Best Banks Offering Home Loans for 40000 Salary

Here are some of the top banks and NBFCs offering home loans for a Rs. 40,000 salary:

1. State Bank of India (SBI)

Interest Rate: 8.40% – 9.50%

Maximum Loan Tenure: 30 years

Processing Fee: 0.35% of the loan amount

2. HDFC Bank

Interest Rate: 8.50% – 9.00%

Maximum Loan Amount: 80% of property value

Flexible repayment options

3. ICICI Bank

Interest Rate: 8.60% – 9.50%

Special offers for salaried professionals

Quick processing

4. Axis Bank

Interest Rate: 8.45% – 9.55%

Loan Amount: Up to 80% of property value

Flexible EMI options

5. LIC Housing Finance

Interest Rate: 8.75% – 9.25%

Lower processing fees

No prepayment charges for floating rate loans

Tips to Increase Home Loan Eligibility

Improve Your Credit Score: A score of 750+ boosts loan eligibility.

Reduce Existing Debt: Pay off credit card dues and personal loans.

Add a Co-Applicant: A spouse or parent can help increase the loan amount.

Opt for a Longer Tenure: This reduces EMI burden and improves approval chances.

Increase Down Payment: A higher down payment reduces the loan amount and lowers lender risk.

Conclusion

If you have a salary of Rs. 40,000, you can secure a home loan between Rs. 20-30 lakhs, depending on eligibility factors. Understanding EMI calculations, improving credit scores, and choosing the right lender can help you get the best deal. Compare different banks, check the interest rates, and opt for a loan that best fits your repayment capacity.

0 notes

Text

Small Business Loans: Essential Funding Options for Entrepreneurs

Why Small Business Loans Are Important

Starting and growing a business requires capital, and small business loans provide the financial support needed to cover expenses, expand operations, or manage cash flow. Many entrepreneurs turn to loans when personal savings and revenue aren’t enough to sustain business growth.

Traditional banks, credit unions, and online lenders offer a variety of financing options tailored to different needs. Understanding these options can help business owners choose the right funding solution for their goals.

Types of Small Business Loans

Small business loans come in various forms, each serving different financial needs:

1. Term Loans

A term loan provides a lump sum that is repaid over a set period with interest. It’s commonly used for large expenses such as purchasing equipment, expanding facilities, or refinancing debt.

2. SBA Loans

Small Business Administration (SBA) loans offer low-interest, long-term financing for eligible businesses. They are ideal for entrepreneurs who need affordable funding but can meet strict qualification criteria.

3. Business Lines of Credit

A business line of credit allows companies to borrow funds as needed, up to a set limit. Interest is only paid on the amount used, making it a flexible option for managing cash flow fluctuations.

4. Equipment Financing

Businesses that require expensive machinery, vehicles, or technology can use equipment financing. The purchased equipment serves as collateral, making it easier to qualify for this type of loan.

5. Invoice Financing

For businesses facing cash flow gaps due to unpaid invoices, invoice financing provides immediate access to funds by selling outstanding invoices to a lender.

6. Merchant Cash Advances

A merchant cash advance provides quick access to cash in exchange for a percentage of future sales. While convenient, this type of funding often comes with high repayment costs.

Factors That Influence Loan Approval

Lenders evaluate several factors before approving a loan application. Key considerations include:

Credit Score: A strong credit history improves the chances of approval and better loan terms.

Business Revenue: Lenders assess financial statements to determine repayment ability.

Collateral: Some loans require collateral, such as real estate, inventory, or equipment, to secure funding.

Time in Business: Established businesses with a proven track record have a higher chance of getting approved.

Alternative Funding Options

For businesses that may not qualify for traditional loans, alternative funding sources include:

Online Lenders: These platforms provide fast approvals and flexible requirements but may charge higher interest rates.

Crowdfunding: Entrepreneurs can raise funds from customers and investors through platforms like Kickstarter or GoFundMe.

Grants and Competitions: Government programs and private organizations offer grants that don’t require repayment.

Selecting the right financing option depends on business needs, repayment ability, and long-term financial goals. Exploring different small business loan options helps entrepreneurs secure the capital necessary for success.

0 notes

Text

Short Term Loans Online: Rapidly Resolve the Present Financial Crisis

Those who have experienced financial assault must fulfill all conditions in order to receive last-minute funds during an emergency. Having a six-month-old, an active bank account, being at least eighteen, being permanently a citizen of the United States, and having a stable job are among the prerequisites. Those unfortunate applicants who meet the conditions can rely on short term loans online, which fall under the category of short-term cash, to get the immediate resources they require. Therefore, for people who are employed, the extra formalities are not taken into consideration. As a result, do all required tasks and secure the urgent funds in the $100–$1000 range, which will cover all undesirable financial issues.

In addition to proof of a steady job, pay stubs, a six-month-old current or savings bank account number, age verification, an email address, a bank statement, a valid cell phone number, work experience verification, and the office's contact details, the miserable salaried people are required to present all important information. A brace of basic facts is used to determine whether to offer short term payday loans to salaried people who are ringing with unwanted financial difficulties. All problems must be resolved without causing any inconveniences utilizing the money that was raised. They could be able to pay off all of their obligations and debts in a short period of time as a result.

What Makes Online Short Term Loans Applications Necessary?

Let's be truthful. In life, the unexpected happens. Things happen out of the blue. You may need some quick cash to get by in some situations. These loans are ideal for covering anything from last-minute auto repairs to vacation expenses to medical bills. A short term loans online usually never has an interest charge, so keep that in mind. Therefore, in some cases, it might be less costly than a typical loan. The last option is to apply for a short term cash loans if you want to buy a property of sale right immediately. Short term loans online are getting closer to your bank or mortgage broker. Because the lender will require a larger cash deposit, your cash acquisition may be a little higher in this case. However, it is still significantly less costly than a traditional mortgage.

On occasion, you might possibly wish to think about obtaining a loan with short term cash. In this case, you are free to make weekly, biweekly, or monthly payments as long as you still hold the collateral. Again, because you are not obliged to make a lump sum payment, this might occasionally be a less costly option than a conventional loan. Additionally, you might want to consider auto and boat loans because they can be more affordable and easier to qualify for than standard mortgages. The cars can also be used as security.

In such cases, you might also want to think about taking out online personal loans. We must be truthful. Things happen in life. There are many situations in which we need a bit more money than we already possess. A personal loan that is unsecured is a great option. Collateral is not required, and you can repay the loan every week, every two weeks, or every month. All you're doing is giving the lender permission to take out a loan against your income. To be eligible for a online installment loans, however, you need to meet the minimum requirements. As a general rule, unsecured personal loans have higher interest rates than secured loans.

https://loanslucre.com/

#online short term personal loans#short term cash loans#short term loans online#online personal loans#online installment loans

1 note

·

View note

Text

Instant Wedding Loan | Creditwalle

Make your wedding day unforgettable with an Instant Wedding Loan. Get quick approval, competitive interest rates, and flexible repayment options. Perfect for salaried and self-employed individuals, this loan ensures your marriage expenses are covered without hassle.

Benefits of Instant Wedding Loans:

Quick Disbursal: Get funds instantly to cover urgent wedding expenses without delays.

No Collateral Required: Avail a personal loan for marriage without pledging any assets.

Competitive Interest Rates: Enjoy affordable interest rates tailored to your financial profile.

Flexible Repayment Options: Choose repayment tenures that suit your financial situation.

Minimal Documentation: Apply with basic documents like ID proof, income proof, and bank statements.

No Hidden Charges: Transparent processing with no extra or hidden fees.

Online Application: Convenient and hassle-free application process from anywhere.

Customizable Loan Amount: Borrow as per your wedding budget and financial needs.

Improves Credit Score: Timely repayment can boost your creditworthiness.

Covers All Expenses: Finance everything from venue booking to catering, decor, and more.

Apply for an Instant Wedding Loan with Creditwalle today and make your dream wedding a reality without financial stress!

0 notes