#private loans

Explore tagged Tumblr posts

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

194 notes

·

View notes

Text

Private Lenders and Private Loans in Australia

As a leading private lender in Australia, we specialize in offering tailored private loans and funding solutions to our clients nationwide. With competitive private finance rates starting at 0.35% PCM, our loans require no documentation or credit checks. We lend to individuals and businesses with bad credit histories.

No Doc and No Credit Check Loans

Tired of being denied financial assistance due to your credit history or existing commitments? With our no doc and no credit check loans, you'll have access to financial aid regardless of your credit score. Say goodbye to the hassles of traditional banking rejections.

Same Day Approvals for Qualified Applicants

Need funds fast? Our streamlined approval process ensures same-day approvals for qualified applicants, providing you with the financial assistance you need when you need it.

Private Construction Loans

Embarking on a construction project? Our private construction loans offer flexible financing options tailored to your specific needs, allowing you to bring your vision to life without the delays of traditional lending.

Private Home Loans

Dreaming of homeownership? Our private home loans provide competitive rates and personalized terms, making owning your dream home a reality, even if you have a less-than-perfect credit history.

Funding for Individuals, Entrepreneurs, and Startup Businesses

Whether you're an individual in need of personal financing or an entrepreneur seeking capital for your startup, our funding solutions cater to your unique circumstances, providing you with the support you need to achieve your goals.

Unsecured Personal and Business Financing

No collateral? No problem. Our unsecured personal and business financing options offer flexibility and convenience, allowing you to access funds without putting your assets at risk.

Residential and Commercial Loan Solutions

From residential mortgages to commercial property loans, we offer a comprehensive range of loan solutions to meet your diverse needs, ensuring that you have access to the right financing for your situation.

Lending Services Available Across Australia

Wherever you are in Australia, our lending services are available to you. From Victoria to Queensland, New South Wales to Sydney, Perth to Melbourne, Brisbane to Adelaide, we're here to offer you the financial assistance you need, tailored to your unique situation.

Private loans in Australia are an amazing finance option for aspiring homeowners, vehicle owners, and those looking to consolidate debt. With highly competitive rates, flexible terms, and features tailored to your individual needs, these loans can provide significant savings compared to traditional banking options.

Don’t let a bank rejection bring you down. Our private lending services are designed to provide you with fast and easy access to financial aid, regardless of your credit history or existing commitments. Apply now and let us help you find the perfect loan deal for your situation.

Why Choose Us? Key Advantages:

Fast and Efficient Settlements: Our streamlined approval process ensures quick access to funds, with less paperwork compared to traditional lenders, providing you with a hassle-free experience.

Flexibility in Credit Scores: We understand that not everyone has a perfect credit score, which is why we offer loan options to borrowers with less-than-perfect credit histories, expanding financial opportunities for all.

Competitive Interest Rates: While private lending may come with slightly higher interest rates, we strive to provide the most competitive rates in the market, balancing risk and affordability for our clients.

Diverse Lending Options: From personal loans to business financing, we offer a range of loan products to cater to various financial needs, ensuring that you have access to the right solutions for your unique circumstances.

Apply now and experience the difference of private lending with us. Unlock financial freedom and take control of your future today.

Is this conversation helpful so far?

0 notes

Text

I think Biden stopped taking the online anti-voting Left seriously (if he was ever aware of them) when the people that spent 4 years saying Obama’s drone usage made him worse than Trump in order to make their Both Sides arguments made nary a peep when Biden stopped nearly all US drone operations.

#Biden ending the drone war was on paper a massive W for the left that loved to post that one comic#about how ‘they say the next drone will be sent by a woman’#but they spent all their time bitching about how their private loans won’t get paid off#until suddenly they cared about foreign policy when it was time to say that Biden was personally leading the IDF into battle

300 notes

·

View notes

Text

#tiktok#business#economy#economist#private equity#bank loans#economy and business#business finance#business funding

22 notes

·

View notes

Text

How To Pay for College Without Selling Your Soul to the Devil

Listen you lazy, entitled whiners: it’s easy to pay for college. Just get a summer job! Why, in my day I worked weekends as a fry cook down at the diner on Main, graduated without debt, and now I’m sixty-five years old and completely delusional about the inflated costs of higher education! Ask me more about the house I bought for $60,000 and how much I resent the respectful empathy of the children I raised!

Sorry, y’all. Probably should’ve started that with a trigger warning.

Whenever we write about student loans, we get at least one comment like this. Except with more caps lock. We delete them. For while we never silence interesting criticism, come on. This ain’t a public square for every old man who wants to yell at a cloud! We pay good money for this web hosting!

At least where the cost of college is concerned, things aren’t what they used to be. Thirty years ago, it cost the modern equivalent of $8K per year to attend a public college and $18K per year to attend a private college.

Today, the same year of school would cost $21K and $48K. And you’re supposed to buy FOUR of them!

Keep reading.

Did we just help you out? Join our Patreon!

#college#FAFSA#federal student loans#financial aid#grants#private student loans#scholarships#student loans#university

15 notes

·

View notes

Text

Private equity plunderers want to buy Simon & Schuster

Going to Defcon this weekend? I'm giving a keynote, "An Audacious Plan to Halt the Internet's Enshittification and Throw it Into Reverse," on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

Last November, publishing got some excellent news: the planned merger of Penguin Random House (the largest publisher in the history of human civilization) with its immediate competitor Simon & Schuster would not be permitted, thanks to the DOJ's deftly argued case against the deal:

https://pluralistic.net/2022/11/07/random-penguins/#if-you-wanted-to-get-there-i-wouldnt-start-from-here

When I was a baby writer, there were dozens of large NY publishers. Today, there are five - and it was almost four. A publishing sector with five giant companies is bad news for writers (as Stephen King said at the trial, the idea that PRH and S&S would bid against each other for books was as absurd as the idea that he and his wife would bid against each other for their next family home).

But it's also bad news for publishing workers, a historically exploited and undervalued workforce whose labor conditions have only declined as the number of employers in the sector dwindled, leading to mass resignations:

https://lithub.com/unlivable-and-untenable-molly-mcghee-on-the-punishing-life-of-junior-publishing-employees/

It should go without saying that workers in sectors with few employers get worse deals from their bosses (see, e.g., the writers' strike and actors' strike). And yup, right on time, PRH, a wildly profitable publisher, fired a bunch of its most senior (and therefore hardest to push around) workers:

https://www.nytimes.com/2023/07/18/books/penguin-random-house-layoffs-buyouts.html

But publishing's contraction into a five-company cartel didn't occur in a vacuum. It was a normal response to monopolization elsewhere in its supply chain. First it was bookselling collapsing into two major chains. Then it was distribution going from 300 companies to three. Today, it's Amazon, a monopolist with unlimited access to the capital markets and a track record of treating publishers "the way a cheetah would pursue a sickly gazelle":

https://pluralistic.net/2023/07/31/seize-the-means-of-computation/#the-internet-con

Monopolies are like Pringles (owned by the consumer packaged goods monopolist Procter & Gamble): you can't have just one. As soon as you get a monopoly in one part of the supply chain, every other part of that chain has to monopolize in self-defense.

Think of healthcare. Consolidation in pharma lead to price-gouging, where hospitals were suddenly paying 1,000% more for routine drugs. Hospitals formed regional monopolies and boycotted pharma companies unless they lowered their prices - and then turned around and screwed insurers, jacking up the price of care. Health insurers gobbled each other up in an orgy of mergers and fought the hospitals.

Now the health care system is composed of a series of gigantic, abusive monopolists - pharma, hospitals, medical equipment, pharmacy benefit managers, insurers - and they all conspire to wreck the lives of only two parts of the system who can't fight back: patients and health care workers. Patients pay more for worse care, and medical workers get paid less for worse working conditions.

So while there was no question that a PRH takeover of Simon & Schuster would be bad for writers and readers, it was also clear that S&S - and indeed, all of the Big Five publishers - would be under pressure from the monopolies in their own supply chain. What's more, it was clear that S&S couldn't remain tethered to Paramount, its current owner.

Last week, Paramount announced that it was going to flip S&S to KKR, one of the world's most notorious private equity companies. KKR has a long, long track record of ghastly behavior, and its portfolio currently includes other publishing industry firms, including one rotten monopolist, raising similar concerns to the ones that scuttled the PRH takeover last year:

https://www.nytimes.com/2023/08/07/books/booksupdate/paramount-simon-and-schuster-kkr-sale.html

Let's review a little of KKR's track record, shall we? Most spectacularly, they are known for buying and destroying Toys R Us in a deal that saw them extract $200m from the company, leaving it bankrupt, with lifetime employees getting $0 in severance even as its executives paid themselves tens of millions in "performance bonuses":

https://memex.craphound.com/2018/06/03/private-equity-bosses-took-200m-out-of-toys-r-us-and-crashed-the-company-lifetime-employees-got-0-in-severance/

The pillaging of Toys R Us isn't the worst thing KKR did, but it was the most brazen. KKR lit a beloved national chain on fire and then walked away, hands in pockets, whistling. They didn't even bother to clear their former employees' sensitive personnel records out of the unlocked filing cabinets before they scarpered:

https://memex.craphound.com/2018/09/23/exploring-the-ruins-of-a-toys-r-us-discovering-a-trove-of-sensitive-employee-data/

But as flashy as the Toys R Us caper was, it wasn't the worst. Private equity funds specialize in buying up businesses, loading them with debts, paying themselves, and then leaving them to collapse. They're sometimes called vulture capitalists, but they're really vampire capitalists:

https://www.motherjones.com/politics/2022/05/private-equity-buyout-kkr-houdaille/

Given a choice, PE companies don't want to prey on sick businesses - they preferentially drain off value from thriving ones, preferably ones that we must use, which is why PE - and KKR in particular - loves to buy health care companies.

Heard of the "surprise billing epidemic"? That's where you go to a hospital that's covered by your insurer, only to discover - after the fact - that the emergency room is operated by a separate, PE-backed company that charges you thousands for junk fees. KKR and Blackstone invented this scam, then funneled millions into fighting the No Surprises Act, which more-or-less killed it:

https://pluralistic.net/2020/04/21/all-in-it-together/#doctor-patient-unity

KKR took one of the nation's largest healthcare providers, Envision, hostage to surprise billing, making it dependent on these fraudulent payments. When Congress finally acted to end this scam, KKR was able to take to the nation's editorial pages and damn Congress for recklessly endangering all the patients who relied on it:

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

Like any smart vampire, KKR doesn't drain its victim in one go. They find all kinds of ways to stretch out the blood supply. During the pandemic, KKR was front of the line to get massive bailouts for its health-care holdings, even as it fired health-care workers, increasing the workload and decreasing the pay of the survivors of its indiscriminate cuts:

https://pluralistic.net/2020/04/11/socialized-losses/#socialized-losses

It's not just emergency rooms. KKR bought and looted homes for people with disabilities, slashed wages, cut staff, and then feigned surprise at the deaths, abuse and misery that followed:

https://www.buzzfeednews.com/article/kendalltaggart/kkr-brightspring-disability-private-equity-abuse

Workers' wages went down to $8/hour, and they were given 36 hour shifts, and then KKR threatened to have any worker who walked off the job criminally charged with patient abandonment:

https://pluralistic.net/2023/06/02/plunderers/#farben

For KKR, people with disabilities and patients make great victims - disempowered and atomized, unable to fight back. No surprise, then, that so many of KKR's scams target poor people - another group that struggles to get justice when wronged. KKR took over Dollar General in 2007 and embarked on a nationwide expansion campaign, using abusive preferential distributor contracts and targeting community-owned grocers to trap poor people into buying the most heavily processed, least nutritious, most profitable food available:

https://pluralistic.net/2023/03/27/walmarts-jackals/#cheater-sizes

94.5% of the Paycheck Protection Program - designed to help small businesses keep their workers payrolled during lockdown - went to giant businesses, fraudulently siphoned off by companies like Longview Power, 40% owned by KKR:

https://pluralistic.net/2020/04/20/great-danes/#ppp

KKR also helped engineer a loophole in the Trump tax cuts, convincing Justin Muzinich to carve out taxes for C-Corporations, which let KKR save billions in taxes:

https://pluralistic.net/2020/06/02/broken-windows/#Justin-Muzinich

KKR sinks its fangs in every part of the economy, thanks to the vast fortunes it amassed from its investors, ripped off from its customers, and fraudulently obtained from the public purse. After the pandemic, KKR scooped up hundreds of companies at firesale prices:

https://pluralistic.net/2020/03/30/medtronic-stole-your-ventilator/#blackstone-kkr

Ironically, the investors in KKR funds are also its victims - especially giant public pension funds, whom KKR has systematically defrauded for years:

https://pluralistic.net/2020/07/22/stimpank/#kentucky

And now KKR has come for Simon & Schuster. The buyout was trumpeted to the press as a done deal, but it's far from a fait accompli. Before the deal can close, the FTC will have to bless it. That blessing is far from a foregone conclusion. KKR also owns Overdrive, the monopoly supplier of e-lending software to libraries.

Overdrive has a host of predatory practices, loathed by both libraries and publishers (indeed, much of the publishing sector's outrage at library e-lending is really displaced anger at Overdrive). There's a plausible case that the merger of one of the Big Five publishers with the e-lending monopoly will present competition issues every bit as deal-breaking as the PRH/S&S merger posed.

(Image: Sefa Tekin/Pexels, modified)

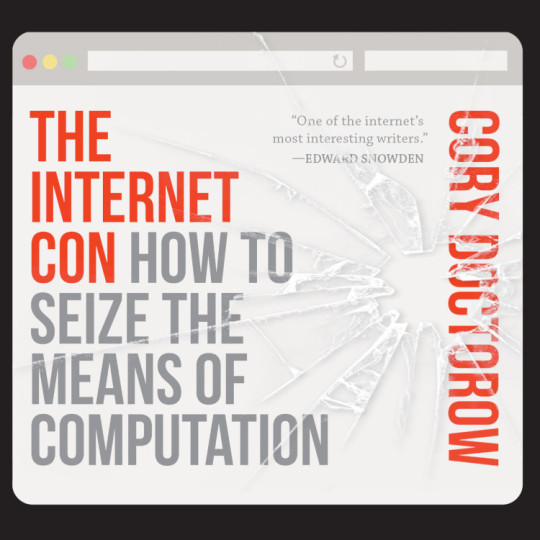

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/08/vampire-capitalism/#kkr

#kkr#simon and schuster#publishing#penguin random house#ppp loans#looters#plunderers#vampire capitalism#vulture capitalism#debt#private equity#pe#harmful dominance#monopoly#trustbusters#incentives matter#labor#writing#publishing workers#recorded books#overdrive#glam#libraries#toys r us#pluralistic

186 notes

·

View notes

Text

Christopher Wiggins at The Advocate:

On Thursday afternoon, President Donald Trump signed an executive order directing recently sworn-in Education Secretary Linda McMahon to begin dismantling the Department of Education, marking the most aggressive move yet in his administration’s assault on public schools. McMahon, who was in attendance at the event in the East Room of the White House, is a former professional wrestling executive with no background in education policy. She was confirmed by the Senate two weeks ago. In an email to staff shortly after being sworn in, she described eliminating the department as a “momentous final mission,” echoing Trump’s long-standing pledge to shift education policy entirely to state and local governments. The signing during one of Trump’s made-for-TV press occasions fulfills a key goal of Project 2025, a conservative policy blueprint created by the Heritage Foundation. While Trump and his allies distanced themselves from Project 2025 during the 2024 presidential campaign, the executive order aligns with its recommendation to dissolve the Education Department. A group of Republican governors attended the event in support of the move, including Texas Gov. Greg Abbott, Florida Gov. Ron DeSantis, Indiana Gov. Mike Braun, Ohio Gov. Mike DeWine, Louisiana Gov. Jeff Landry, Tennessee Gov. Bill Lee, Idaho Gov. Brad Little, Nebraska Gov. Jim Pillen, and Iowa Gov. Kim Reynolds. Trump claimed that states like Florida and Texas will achieve educational standards comparable to those of Norway, Denmark, Sweden, and Finland. But the reality is that these Nordic nations have built their success on precisely the kind of public investment and government oversight that Trump is working to dismantle. Their education systems are fully publicly funded, tuition-free, and designed to ensure equity and access for all students, with a strong emphasis on personalized learning and teacher support. According to the 2022 Programme for International Student Assessment, these countries consistently outperform the U.S.—Finland ranked 20th, Sweden 22nd, Norway 32nd, while the U.S. trailed behind at 34th.

Defunding public schools to push privatization

Trump’s administration has already begun staff layoffs and halted civil rights enforcement programs, including those protecting LGBTQ+ students and students of color. His broader plan will shift taxpayer dollars away from public schools and toward private institutions through voucher programs. "She's been a hard worker," Trump said about the founder of the anti-government extremist group Moms for Liberty Tiffany Justice, whom he welcomed to the event. The Southern Poverty Law Center has listed Moms for Liberty as an anti-government extremist group that stemmed from conservative outrage over mask mandates and COVID-19 precautions during the early days of the pandemic. Moms for Liberty has advocated for the removal of books written about or by LGBTQ+ people by taking over school boards. In 2023, the group resoundingly lost elections in which its candidates ran. Until the end of the Biden administration, the U.S. Department of Education played a key role in protecting LGBTQ+ students by enforcing anti-discrimination policies under Title IX and investigating complaints of harassment or exclusion. The department also promoted inclusive policies in schools, ensuring that LGBTQ+ students had access to safe learning environments, protections against bullying, and equal opportunities in education. Randi Weingarten, president of the American Federation of Teachers, condemned the move, warning that eliminating the department affects the most vulnerable students.

[...] Despite Trump’s rhetoric about eliminating federal control over education, the Department of Education does not set curriculum or school policies, which are determined by state and local governments. Instead, the department oversees federal funding for low-income students through Title I, provides support for students with disabilities under the Individuals with Disabilities Education Act, enforces civil rights protections for marginalized students, including LGBTQ+ youth and students of color, and administers federal student loan programs, including Pell Grants and loan forgiveness initiatives.

This afternoon, lawless tyrant Donald Trump checks off yet another Project 2025 wish list item by signing an executive order that orders the winding down of the US Department of Education… except that it would require an act of Congress to fully close down the DoE. The closing of the DoE has long been a conservative wish list item, and sadly, it got finally fulfilled (mostly).

This move does calculated harm to public schooling and marginalized peoples, such as LGBTQ+, POC, and persons with disabilities in a giveaway to privatization interests.

See Also:

LGBTQ Nation: Donald Trump’s order to eliminate Dept. of Education offers no details

HuffPost: Trump Signs Executive Order To Dismantle The Department Of Education

The Guardian: Trump signs executive order to dismantle US Department of Education

#US Department of Education#Education#Schools#Donald Trump#Trump Administration II#Linda McMahon#Executive Orders#Project 2025#Title I#Student Loans#Individuals With Disabilities Education Act#Privatization

9 notes

·

View notes

Text

my final public service loan forgiveness verification processed and was approved. i filed it back in november 2024 🥲 got the email notification this morning. after a decade of toiling at nonprofits, my remaining federal student debt has been forgiven!!! 🎉

#major w#i cant look at the amount i originally was loaned vs. the interest i have paid over 10 years or i will throw up#but at least at last it is gone#for 1 hot second i am pretending that i cannot see the private loans#🌊🚶♂️#my lyfe#driveby post

17 notes

·

View notes

Text

my parents paid off one of my loans yayyyyyyyyyyyyyyy

#shitpost#my main issue with my parents for awhile was that they weren't really helping me (esp compared to my siblings)#and like. they're the reason my debt is so steep because i barely got federal aid#b/c my parents do well enough that the govt expect them to pay for my school but they weren't really able to in actuality and blah blah bal#anyways. my monthly payment went down by $100 and so it isn't almost 1k anymore#it's a much more manageable 850.#i hope. i can put some more money towards this because thats still higher than i pay for my mortgage lmaooooooo#i fucking hate u private loans.#ok sorry. im very happy about this#ALSO this payment has made my total owed finally less than what i make in a year#if i only pay back the minimum though i still have 8.5 years of paying so uh......hoping to get that to decrease....#but if im saving 100 more dollars a month (and im probably getting a raise in april next year) then i can shove some more money at them..#sorry these loans fuckign consume a huge part of my life fml lol

10 notes

·

View notes

Text

reading reddit threads about financial aid and student loans never fails to make me want to chew drywall …… everyone speaks so confidently with fully incorrect info and acts like they’re so knowledgeable in the student loan process while saying just. false statement after false statement

#reading a thread of a parent being like agh idk if i should take out a parent plus loan for my kid#and all the comments are like DONT! HE NEEDS TO GET HIS OWN LOANS TO PAY FOR SCHOOL!#like clearly not knowing that there are annual loan limits on students and private loans require a parent co-signer anyways#and it’s normal for ppl to not know that but then like. don’t comment your advice like you’re an expert 😭?

10 notes

·

View notes

Text

#us politics#republicans#conservatives#twitter#tweet#ian millhiser#gop#us supreme court#justice clarence thomas#justice samuel alito#harlan crow#paul singer#scotus#private jets#billionaires#fuck billionaires#student loans#student loan debt#student loan forgiveness#freeze student debt#student debt forgiveness#2023

140 notes

·

View notes

Text

All I want in 2025 is to be able to move out

#partly for peace of mind#partly for self actualization#partly to not have to commute so far#but primarily so that I can have a space I can arrange however I want#to have an actual room to use as a sewing studio and not have it be the desk in my bedroom#it’s so hard to save up money on my current salary because 2/3 of it immediately goes to loan payments and bills#but I’m gonna do it somehow#all I want is a clean manufactured home in a trailer park within 30 minutes of the museum#manifesting#but also strategizing#sewing and experimental archaeology are what bring me the most joy#and that is what I want to build my future for#that is what I want to be doing#researching and making and doing things#and if I can get a place of my own that’ll be a big step towards that goal#especially because investing in a trailer home will make me feel more secure than renting#if most of my money is going to a monthly payment I’d rather it be for something I will actually own at some point#it’s just saving up for the down payment that’s card#but a trailer home will cost me about as much as my degree did and I’ve almost paid off those private loans#so I know that it is an achievable goal in the not too distant future#my private student loans are almost paid off then I’ll work on paying down my credit card balances#and my car payment is just background noise because when I’m driving 500 miles a week for work I’m glad I invested in a newer car#the car payment I’ve accepted will just be there for a couple more years#but the private student loans and credit cards I think I can take care of this year#and then I’ll be able to put more away each month#I think I’ve got 2 years max before I actually go insane if I can’t move out#though Lizzie Borden was 32 so that gives me 6 more years before reaching the point of homicide as a coping mechanism#a very normal and healthy thought to have

4 notes

·

View notes

Text

I would love to not be broke as fuck….like I have a FULL TIME JOB!!! A hard job. A job that requires (ignoring desantis on this one) a bachelors degree. A job that requires you to continually recertify and educate yourself. One where you’re consistently evaluated. Yet I still have to live with my sister and can barely make ends meet because of ridiculous rent prices. I just WANT TO BE FINANCIALLY FREE!!!!!!!!!

#between health insurance#ortho appointments (which hopefully is temporary and tbh my mom is#paying for it 😭#car insurance#car payment#rent#student loans federal and private#groceries#it’s just TOO MUCH!!!!!!!!

10 notes

·

View notes

Text

you know someday i'm gonna feel so good when i have my student loans paid off

that ain't gonna be soon, trust me, but i think about it

#i've been saving so much for it that i paid off over like $2k in the last 2 or 3 months#it's just thinking about how the amount of interest goes off that drives me literally crazy#and my monthly amount i owe is like just under $120#which to some people as a regular bill is more manageable than others. but as i have an irregular income#as a substitute teacher it's something that gives me a LOT of stress.#which is another reason i've been overpaying. in case something happens/i can't get a lot of work#it defers the next due date.#that way it's not urgent but yet i still *feel* it all the time#debt is a crazy kind of thing#and to think that my loans are from COMMUNITY college. two years. publicly owned#when i start taking classes again soon. i currently have enough saved that if i take like ONE class#i can pay out of pocket. and i think im only gonna take one class to start anyway#which will also help with the deferred payments#see i just fucking hate having to think practically about money like this#tales from diana#idk how ppl leave high school and go straight to live in a dorm room at a private university for four straight years#and rack up tens to hundreds of thousands of dollars in debt.#first of all that lifestyle was not accessible for me to begin with. even when paying it was such an abstract put-it-off thought#as it is for so many 18-year-olds who are told not to worry about where they apply.#but i had under $12k to repay when the student loan debt was unfrozen last fall#and it's been weighing on me soooo heavily since then. i think about it every damn day#it's like the money i make isn't even mine. it goes straight to mohela and food#keep in mind i also live w my parents & am on their health insurance so someday there'll be moooore bills!!!!

7 notes

·

View notes

Text

Anyone know how to get $20,000 to pay off my predatory student loans? Been paying these for 20 years and the last four have barely gone down.

My application for discharge was denied for "various reasons", they refused to tell me why.

#mohela#mohela is actually navient just rebranded#my husband has off surgery because of these loans#used to be sallie mae too#disabled#student loans#private student loans#preditory loan companies are the actual devil#legally obtained money of course#can barely pay rent#my husband has put off surgery because of these loans

6 notes

·

View notes

Text

hell of a morning (i got my financial aid offer) (it does not include my best friend direct unsubsidized loans) (i do not have 40k to pay for school out of pocket) (i have a negative 1500 student aid index) (it should have included at least any government student loans) (i qualify for them) (i did not qualify for the reduced tuition based on GPA when i applied to college) (i do now) (i do not know of they will recalculate) (i do not have 40k to pay for school out of pocket)

#miffy’s diary#i made an appointment with my counselor i made an appointment with financial aid#i will figure it out#if it means i get private student loans then i do that#i’m very passivley stressed out rn. this is a problem but so many things have been problems i’ve solved so#i can’t bring myself to catastrophize this time

2 notes

·

View notes