#but the private student loans and credit cards I think I can take care of this year

Explore tagged Tumblr posts

Text

All I want in 2025 is to be able to move out

#partly for peace of mind#partly for self actualization#partly to not have to commute so far#but primarily so that I can have a space I can arrange however I want#to have an actual room to use as a sewing studio and not have it be the desk in my bedroom#it’s so hard to save up money on my current salary because 2/3 of it immediately goes to loan payments and bills#but I’m gonna do it somehow#all I want is a clean manufactured home in a trailer park within 30 minutes of the museum#manifesting#but also strategizing#sewing and experimental archaeology are what bring me the most joy#and that is what I want to build my future for#that is what I want to be doing#researching and making and doing things#and if I can get a place of my own that’ll be a big step towards that goal#especially because investing in a trailer home will make me feel more secure than renting#if most of my money is going to a monthly payment I’d rather it be for something I will actually own at some point#it’s just saving up for the down payment that’s card#but a trailer home will cost me about as much as my degree did and I’ve almost paid off those private loans#so I know that it is an achievable goal in the not too distant future#my private student loans are almost paid off then I’ll work on paying down my credit card balances#and my car payment is just background noise because when I’m driving 500 miles a week for work I’m glad I invested in a newer car#the car payment I’ve accepted will just be there for a couple more years#but the private student loans and credit cards I think I can take care of this year#and then I’ll be able to put more away each month#I think I’ve got 2 years max before I actually go insane if I can’t move out#though Lizzie Borden was 32 so that gives me 6 more years before reaching the point of homicide as a coping mechanism#a very normal and healthy thought to have

4 notes

·

View notes

Note

Tips for cutting off toxic, manipulative, and abusive parents?

I recently wrote a guide to escaping from a toxic household if you are currently living with your parents, but to summarize, cutting them off basically boils down to two things: financial independence and emotional resolve.

When you are cutting your parents out of your life permanently, the most important thing to do is to get yourself into a position where you no longer need them for anything financially. This doesn’t necessarily mean that you need to be debt-free or living a middle class lifestyle - you just need to be able to pay for all of your rent and expenses every month without any assistance from them. If you are still in school, you need to secure a way to pay for your remaining tuition - like a scholarship, needs-based financial aid or student loan - and make sure that you don’t need your parents’ signatures on anything to get that money. Needing any kind of money or material support from your parents gives them leverage over you; it’s something that they can hold over your head to maintain control of you. So long as you rely on them for room and board, tuition or financial support, cutting them off is not going to be a realistic option for you - once they have no financial hold over you anymore, they have no weapon to wield against you.

Achieving financial independence is something that is obviously easier said than done, but as someone who has been financially independent since age 19 (not because my parents are abusive, but because they are flat broke) and financed two degrees by myself, there are a couple of tips that you can use to get there as quickly as possible:

Start saving money in a place where they can’t get it. Make sure that you have a bank account in your name only, so that your parents cannot take money out of your account or tell how much you have.

Start building your credit. You will not have an “oops, mom, I’m short on rent this month, can you send me $200?” lifeline that your peers have. Your “in case of emergency” plan is your credit card. Get a basic credit card - even if it’s a “secured” card that makes you keep $500 in your bank account to get it - and start building your credit. Make one purchase with the card per month and pay it off right away to avoid interest. Be responsible with your card, and build a good credit score as quickly as you can - this will make it much easier for you to rent apartments, get loans and buy a house later down the line.

Get a budgeting app or spreadsheet and learn to use it. Make sure you know exactly how much you earn, how much you spend, how much you’re saving, and how much money you need to have in order to be financially independent. Knowing where your money is going is an essential part of the process.

If you’re in school, try to graduate on time. Make sure you are taking a full course load if you can, and make sure that you are taking the correct courses for graduation. Delaying graduation often means delaying your independence.

Ask for help when you need it. If you are in school, ask your financial aid office or student advisor for information about scholarships, bursaries and grants. If you’re working, ask your boss about professional development and career advancement opportunities.

Take on odd jobs if you need to. I have worked many odd jobs to keep myself afloat and build my savings - you can see if anyone needs babysitting, tutoring, help with yard work, dog walking, etc. I’ve done paid freelancing writing, taught English online, delivered flyers and taken on part-time jobs; sometimes you have to grind a little bit to give yourself a cushion of savings.

Minimize your spending. It goes without saying, but it’s easier to be financially independent if you find ways to live on less money. Find roommates or rent a room in someone’s home instead of finding your own apartment. Try to minimize your subscription services and make sure you’re not paying for subscriptions you no longer use. Learn to cook and make as many meals at home as possible.

The other important component of cutting off manipulative and abusive parents is to gather up your emotional resolve and commit to cutting them out of your life. Toxic and manipulative parents will use every tactic in the book to try to get back into your life - you know your parents best, but expect that they might beg, lie, threaten, make false promises, make appeals for sympathy, or use other underhanded tactics to try to regain control of you. They may drag other people that you care about into the situation and have those people plead on their behalf. Some do whatever they can to get you to drop your guard and let them in again. Start thinking about that possibility now, so that you can prepare for anything they might throw at you. Remember:

Don’t panic if your parents call the cops or report you missing. If you are an adult, you cannot be forced to go home to your parents, even if your parents report you missing. If law enforcement contacts you, answer their questions, explain that your parents are controlling, let them know that you don’t want any help and tell them that you don’t want your personal information released to your parents. Your family will only be told that you were located safe and that your case is closed.

Lock down your social media and online presence. Block your parents from your phone, and make sure that they are blocked from all of your social media accounts so that they cannot get information on you. It may be a good idea to set your accounts to private for a while or change your handles and profile pictures so that they cannot find you.

Prepare yourself for the possibility that you might have to cut off other family members too. When you cut off your parents, brace yourself for the possibility that other members of your family that you were on good terms with - aunts, uncles, grandparents, cousins, etc - may take your parents’ side, or may reach out to encourage you to forgive your parents “for the sake of the family” or “to keep the peace”. Being free of your parents sometimes means cutting ties with family members who won’t respect your decision.

Remember the reasons that you decided to cut them off in the first place. Sometimes when you’ve been away from an abuser for a while, you will start to forget the abuse and become nostalgic for the good times that you had with that person. You might even decide that you “overreacted” by cutting them off and consider give them a second chance. Tread carefully with this. Remind yourself of the reasons you left.

The first few months after you leave may be difficult. Your parents may fight back against your decision as hard as they possibly can, and you may find that you have a lot of grieving to do - not because you miss your parents, necessarily, but because you have to come to terms with the fact that you will never have the loving and healthy relationship with your parents that you may have wanted. You will get through it. Seek out support from therapists or from other people who have cut off their parents. Focus on forming new, healthy relationships with the people in your life. Build a life free from abuse, a life that makes you happy and fulfilled. Stay strong, stay focused. Remember that you deserved better than your parents were willing to give. Best of luck to you. MM

81 notes

·

View notes

Text

Sick, tired and broke...

While it took the coronavirus to get people to genuinely realise this : our healthcare system is trash when it truly doesn’t have to be.

That technically feels like the end of my Ted talk, but I’ll go into some slightly repetitive data about it, because what I ultimately discovered is that this healthcare system is costing the most financially and humanely for Millenials.

Let’s start out with 2019 when 137 million Americans faced financial hardship due to medical costs. Scary part is, regardless of age, high healthcare bills are the number one reason people would consider taking money out of their retirement accounts or filing for bankruptcy, while 66.5% of all personal bankruptcies are tied to medical issues. ( CNBC).

According to the NYTimes, Americans borrowed $88 billion in 2018 in order to pay for their healthcare. If we’re borrowing $88 billion to pay for healthcare, imagine the profit that these healthcare companies are enjoying!

Why is healthcare so expensive? The best answer I could find is due to a “free” market and lack of regulation by our government as well as a lack of transparency when it comes to medical billing. According to Public Health Policy Professor Marty Makary of John Hopkins, the healthcare marketplace is “irrational”-- though I prefer the term uncontrolled-- where price gouging has become the norm. Heart surgery at one hospital may cost $44,000 while the same surgery will cost $500K at another facility, and the kicker here is, despite the disparity in price, there is no marked difference between the quality of care in the different facilities (CNBC).

As for lack of transparency for medical billing, I can personally attest to that ( though clearly I’m not a unique case). Last year I was hospitalized at Tulane University Medical for Diabetic Ketoacidosis, brought on by food poisoning, and I received 3 seperate bills for that one stay. One bill was about $350, the second bill was for $2200 , and the third bill was for $14.99 with no thorough explanation about what I was being billed for ( no general explanation provided either). The bills were just medical coding with no legend of what the coding represented, leaving me angry and confused. How does one hospital stay, at one facility come with 3 seperate bills? Sad thing is, I had health insurance, and seeing as health insurance comes with deductibles and out of pocket limits, I figured those hospital bills hit that, at the very least. Apparently it did not for reasons not even the health insurance reps could explain to me. How do I spend $2500 out of pocket, when my limit is $1500, and you’re telling me that that $2500 doesn't count toward my out of pocket? A clear lack of transparency in not just medical billing, but health insurance as well.

The general high cost of medical care is another reason we’re just out here remaining sick and in debt: The average hospital stay in the US costs about $5220 per day, whereas in Australia where the nation's wealth is comparable to the US, it’s about $765 per day. It is not even hospital stays that are the initial causes/starting causes of medical debt either: 65% of medical debt started out with either diagnostic testing or a doctor’s visit followed by Lab fees, ER visits, drug prescription costs and outpatient services (SingleCare.com). Why would something/someone whose job it is to cure or heal you be what brings you into debt? Even more so, why does something as primary and preliminary such as diagnostic testing or seeing the doctor be the main cause of medical debt? We’re in debt before we can even know what’s ailing us? Drug prescriptions are no different either. About a month and a half ago I lost insulin vials and needed to get replacement vials from the pharmacy: I’ve never actually lost insulin before in my twenty years as a diabetic, so you think that my pristine record would count for something. It didn't. Health insurance was not going to cover it, and the cost of one vial was going to be $900. Keep in mind, one vial will last me about two weeks. Maybe three if I make sure to not eat. $900 is more than my half of rent to put that cost into perspective relative to my monthly bills, and it was only going to last me half the month. If prescription costs are that drastic, I can only imagine the average cost of the diagnostic or doctors visit that affect the 65% that fall into debt because of it.

In addition to costing us financially, high medical care and medical costs affect our quality of life and ability to accumulate wealth, especially Millennials. According to a 2016 study published by Health Affairs, Millennials carry the most medical debt in the US as well as incur it more frequently: the article focused more on the fact that the debt starts at the age of 27 once the medical care/insurance for young adults under their parents insurance ends at age 26. The age group that ended up accumulating the most debt was also age 27 ( PBS.org) The Millenial age group also accounts for 35% of the overall population, so that could be another reason why we hold the most medical debt as well ( Single Care).

Quality of life is also affected in that Americans are foregoing medical treatment or medical visits due to cost. In fact, 21% of Americans had to do that in 2016 alone. That is 21% of people not getting the necessary healing treatment they need, or living in the dark of what’s ailing them.

32% have postponed medical care due to cost. When I hear “postpone”, I assume that the only reason they end up getting medical care is because their ailment got worse or to a point where they couldn’t avoid not getting the medical care that they needed.

40% of adults ages 18-64 have relied on at home remedies or over the counter drugs instead of going to the doctor due to medical cost ( Singlecare.org)

I have fallen into all 3 categories: In fact, once , in order to avoid a hospital visit, I treated my own onset of ketoacidosis. For those of you not sure what that entails, it basically includes taking my insulin through my veins as opposed to subcutaneously ( injecting my arm or stomach) while avoiding any liquids or food, including water for at least 24 hours. The reason you have to do that is because your body’s acid level is falling to a dangerous level so it won’t react to insulin being delivered into your fat stores or beneath the skin: It has to be delivered directly to your bloodstream to have an effect. This acidity level will also cause your blood sugar to rise to dangerous levels, and potentially even lead to a heart attack if not treated in a timely manner.The low acidity level is also why the body won’t tolerate any food or liquid, as it tries to purge every possible foreigner from the body in order to normalize its pH level. Imagine not being able to drink water without violently vomiting it up. So there I was at home, a young twenty year old, injecting insulin into my veins, every hour for at least twenty four hours, until my body was on the mend again. I had to be my own doctor in order to avoid a $2k-$3k plus bill that I knew I couldn’t afford. Was it risky? Yes. But, I was forced to be concerned not only for my life but for my financial well being simultaneously. Sad fact of the matter is, I’m confident that I’m not the only type 1 diabetic with a story like that, and I’m not the first to have to weigh my life versus my finances.

In order to pay for medical costs:

53% work out payment plans with their provider. That’s probably the best option, although it ends up being one more bill to add to the list at the end of the month. I’m still paying off that $2500 hospital bill I previously mentioned.

37% have had to borrow money from family or friends

34% have increased their credit card debt

70% say they cut back spending on food, clothing, or other basic household items.

41% say they took an extra job or worked more hours.

59% say they used up most or all of their savings.

35% say they have been unable to pay for basic necessities like food, heat, or housing. (Singlecare.org)

The statistics at the bottom are exceptionally high and staggering. 70% have to cut back on basic household items/comforts in order to pay medical bills: Is it really a succesful or efficient healthcare system if you have to choose between food or medicine?

In addition to our quality of life/quality of health being impacted, I mentioned our ability to accumulate wealth, which for Millenials have proven more difficult than prior generations: According to Caroline Ratcliffe, a senior fellow at the Urban Institute who studies asset building and poverty, wealth is stagnating for younger generations compared to their parents and grandparents. For people under 40 years old: their wealth has only inched up compared to their parents in the 1980’s, and many factors affect that: Credit cards ( see prior posted article on credit card debt), Student loans ( future article) and of course medical debt:

When one in six Americans have past due medical bills on their credit report, it affects their ability to secure a good interest rate on a home or auto loan. ( PBS.org) We’re constantly told how real estate is one of the best ways to accumulate wealth, yet these unnecessary and predatory forms of debt make it harder for us to do so. A lot of these past due bills average about $600(CNBC), but when most of us have credit card bills, monthly living expenses, student loans, and living paycheck to paycheck, how easy is it to pay $600, realistically?

The additional injury to injury ( because we’re long past insults to injury), is the fact that medical care is slated to become even more expensive. It’s expected to hit $6 trillion by year 2027, and it’s already 2020!

When individuals, the federal and state government, and private business seem to share an equal balance of overall medical expenditures ( be it through medicare, the cost of employee covered insurance etc etc), why then would medical costs go up?

It goes back to the beginning of the article, where we pointed out how unchecked the healthcare industry is. Despite the fancy words and round about explanations we may get from lobbyists and those in healthcare, in addition to being gaslit by them that rising costs are unavoidable, it most certainly is avoidable.

Don't forget, compared to other countries that have comparable wealth to us, everything is more expensive here in the US, and there doesn’t seem to be a disparity in the actual quality of care. For example, the total health spending per capita is 84.8% more expensive in the US than in Canada.

In America, they perform 322 C-sections for every 1000 live births, which average a cost of $16,000. In the UK, it’s 264 C-sections per 1000 live births with an average cost of $6k.

An MRI averages about $1115 in America, yet averages to about $215 in Australia. (Singlecare.com).

These countries are comparable in wealth to us, so is affordable and universal health care really that far fetched or radical of an idea in America? Especially when it’s driving such a staggering amount of people into debt? The answer is NO. Based on the medical cost and quality in other countries, not only is it possible, but easy to make it affordable and universal. There are so many different models that are currently working that we can choose from to emulate even.

Health insurance, healthcare and pharmaceutical companies need to be governed or regulated here in the US. Otherwise, the health care system is just another player in the systemic debt traps that seem to be set for the poorer masses, and it’s a problem that’s only projected to get worse, especially for Millenials. It’s grossly affecting our overall quality of life and ability to generate wealth. These statistics show that while the sick get sicker and entrapped by debt, the healthcare industry and those at the top will benefit the most financially from our plight. This current system is neither logical, nor sustainable for the masses, the greater good, or for the economy.

What ever happened to the Hippocratic oath to do no harm?

References:

137 Million Americans are struggling with medical debt. Here’s what to know if you need some relief.

https://www.cnbc.com/2019/11/10/americans-are-drowning-in-medical-debt-what-to-know-if-you-need-help.html

2020 Medical Debt Statistics

https://www.singlecare.com/blog/medical-debt-statistics/

Millennials rack up the most Medical Debt and most frequently.

https://www.pbs.org/newshour/health/millennials-rack-up-the-most-medical-debt-and-more-frequently

Americans borrowed $88 billion to pay for healthcare last year, survey finds

https://www.nytimes.com/2019/04/02/health/americans-health-care-debt-borrowing.html

Survey: 79

million Americans have problems with Medical Bills or debt.

https://www.commonwealthfund.org/publications/newsletter-article/survey-79-million-americans-have-problems-medical-bills-or-debt

1 note

·

View note

Photo

We’re excited to be part of the Permanent Record Blog Tour!

Title: Permanent Record Author: Mary H.K. Choi Publisher: Simon & Schuster Books for Young Readers Pages: 400 Release Date: September 3, 2019 Review Copy: Digital ARC via Netgalley

Summary: From the New York Times bestselling author of Emergency Contact, which Rainbow Rowell called “smart and funny,” comes an unforgettable new romance about how social media influences relationships every day.

On paper, college dropout Pablo Rind doesn’t have a whole lot going for him. His graveyard shift at a twenty-four-hour deli in Brooklyn is a struggle. Plus, he’s up to his eyeballs in credit card debt. Never mind the state of his student loans.

Pop juggernaut Leanna Smart has enough social media followers to populate whole continents. The brand is unstoppable. She graduated from child stardom to become an international icon and her adult life is a queasy blur of private planes, step-and-repeats, aspirational hotel rooms, and strangers screaming for her just to notice them.

When Leanna and Pablo meet at 5:00 a.m. at the bodega in the dead of winter, it’s absurd to think they’d be A Thing. But as they discover who they are, who they want to be, and how to defy the deafening expectations of everyone else, Lee and Pab turn to each other. Which, of course, is when things get properly complicated.

Review: Life for Pablo is definitely taking a troubling turn. They guy has a lot going on in his life and he’s making choices that continue to multiply and exacerbate those problems. When Pablo looks at his bills and tries to think about what he’s going to do with his life, he pushes everything away and decides not to decide. He’s basically stuck and doesn’t know how to get out of his own trap. He uses his charm in an attempt to save himself over and over again when he’s not just blowing people off and treating them horribly. Some readers may not like him spite of the wattage of his charm.

His central plan is avoidance or distraction. This is true with debts, decisions, and in relationships. I felt for the guy though. At one point he ponders about how unfit young people are to make life changing decisions like college majors. Brains aren’t even completely developed when most people are starting college and choosing their life path. Young people are asked to make huge decisions with lifetime ramifications when some of them are simply not ready yet. Pab cannot figure things out and in the meantime his looming debt is just making every single thing more stressful.

The kid is bright though and his word play and repartee had me laughing even in the midst of his often cringey decision making. The conversations between Leanna and Pablo are especially entertaining. Leanna can also make some sketchy decisions and both of them managed to show their humanity and individuality. They’re coming of age in a bumbling sort of way which makes the whole story more endearing than annoying for me. Pab is also talented when it comes to making and choosing snacks. I definitely wanted to give some of those a try.

I really appreciated the look into Pab and his relationships with his parents. His mother is Korean and his father is Pakistani. They live their lives in two very different ways, but they both want good things for their children. Pab thinks he knows what his parents think and why, but there have been misunderstandings between them for a long time. His little brother is also a lot of fun. He adds yet another interesting perspective. He is quite precocious and enterprising. The two siblings really care for each other and that relationship was a highlight for me even though it wasn’t a huge part of the story.

Though much of this story is outside my lived experience, the book was very relatable as Pab questions his future and gets bogged down in mistakes. Even his failure to simply ask for guidance or help was almost too realistic for me. I’ve been there more times than I’d like to admit.

Recommendation: Get it as soon as you can especially if you enjoy your contemporary novels with a bit of romance, a dash of social media drama, friendship and family complications, and interesting snack ideas. Pab and Leanna will likely inspire laughter as well as introspection.

Blog Tour Schedule

August 26th – Vicky Who Reads

August 27th – Adventures of a Book Junkie

August 28th – Utopia State of Mind

August 29th – Read by Tiffany

August 30th – Rich in Color

August 31st – Your Tita Kate

September 2nd – Books on Pointe

September 3rd – Andi’s ABCs

September 4th – Book Scents

September 5th – Twirling Pages

September 6th – Bookshelves & Paperbacks

September 9th – YA Bibliophile

September 10th – Mary Had A Little Book Blog

September 11th – Chasing Faerytales

September 12th – Nicole’s Novel Reads

September 13th – Mel to the Any

Mary H.K. Choi is a writer for The New York Times, GQ, Wired, and The Atlantic. She has written comics for Marvel and DC, as well as a collection of essays called Oh, Never Mind. Her debut novel Emergency Contact was a New York Times bestseller. She is the host of Hey, Cool Job!, a podcast about jobs and Hey, Cool Life!, a podcast about mental health and creativity. Mary grew up in Hong Kong and Texas and now lives in New York. Follow her on Twitter @ChoitotheWorld.

5 notes

·

View notes

Text

The Apparent Wisdom of Bernie Sanders

Well, this probably should have been a direct message to @politijohn, but they took out their comment section. Hoo-rah. Well, might as well say my thoughts.

On January 8th of Current Year + 4 (or 2019), President hopeful Bernie Sanders had tweeted the following:

There's no crisis at the border. President Trump, you want to talk about crises?

-30 million Americans have no health insurance

-Climate change threatens our planet

-Half of older Americans have no retirement savings

-40 million are dealing with outrageous student debt

Well, let's start with the obvious. The Left has been going on about "illegal immigrants internment camps" for the last several months, so by the rhetoric of your own side you're wrong: you DO think there's a crisis at the border. Not to mention the situation that happened on November 26th, when South American migrants rushed the border wall despite the fact that they were being processed for entry anyway.

These people had pushed women and children to the front to use as physical and emotional shields. Nothing moves people's hearts and not their heads like the headline "Children tear gassed at the border." Moreover, let's say we stopped protecting our border. Let the economic migrants in. Do you think those numbers you provided will go down? Or up? "75 million children dealing with student loan debt, nearly half undocumented." Got the right kind of ring to it, eh?

Mentioning student debt, let's talk about that next. College is useless. If everyone has a degree, they become fundamentally useless. But an employer will look at an applicant funny if they didn't get a college degree. Yes, if you're poor and don't want to rack up student loan debt you'll never pay off, you'll be locked out of some jobs that are completely unattached to the high school level "required courses" you had to take to get a bachelor's degree.

Yes I dropped out of college. I have a wife I need to provide for. I have retirement that needs funding (the sooner one starts the better). I have time intensive hobbies; animation, game design, writing, drawing. I refuse to have a debt that's more than a thousand times what I make in a month and grows at the rate of 20%. You want good schooling, go to trade school. It's what I'm going to do once I have some time for it.

Also, college is expensive because the government will pay tuition for a percentage of students. It's why the price has increased a hundred fold over the past 30 years.

Speaking of things that can only be blamed on the choice of the individual, retirement. I'm poor as balls. Because I don't use credit cards, I spend months scraping together funds for something like a game console. But I take $50 out of my biweekly check and set it away in a 401k. I also work Lyft, and half my monthly earnings from that go into a Roth IRA. Now I just keep stashing for the next 40 years and I'll retire on time to a sizeable nest egg.

Besides, Mr. Sanders and @politijohn, the government already tried to fix this problem with Social Security. Which I pay into every month. And will never see a penny of, as that social program is crumbling away over the next ten, twenty years. So thanks for that.

Health insurance. Oh boy the things I have to say about health insurance. Why doesn't the government allow private companies into the health market? Did you know you can't look up how much an x-ray will set you back? An ultrasound? A blood test? Why can't we open it up to a wider market? Competition, more efficient and cheaper products, and I can look around at the prices of everything.

I can make the fucking payments to a place of medical practice, my wife's health is the most important thing to me. I've taken her to a small office already this year, when she was nearly bed ridden because of the stress her job placed on her. I could handle the cost, cause I save up money. I am not a child and the state is not my fucking mother.

And then we come to climate change. That's the one I feel most shaky about. Yeah, I think that the Earth is going through a greenhouse phase. The release of excess carbon into the atmosphere causing uv rays to become trapped makes decent sense to me. On the other hand, consensus is not science. I don't care what percentage of scientists agree, science is a pursuit of reality and not a democracy. And the government regulations that put the boot to the head of every small business owner, oof. Not to mention the yellow vest protests in France. You know, cause the leader of France decided to up the taxes on the poor- I mean, increase the tax on gas that will definitely end with people using other, more eco-friendly means of transportation. Definitely.

#politics#history#feminism#oppression#bernie sanders#yellow jacket protests#protests#america#france#border#immigration#retirement#money#college#fucking tuition#trump#emmanuel macron

1 note

·

View note

Text

3 Reasons New Grads Would Need Life Insurance: Do They Apply to You?

“Should I get life insurance?” is a common question many of us ask when enrolling in work benefits, especially if it’s the first time.

The answer is that it depends, but for many new graduates entering the workforce, life insurance is important to consider. If you are a new grad and your employer offers subsidized life insurance, definitely take advantage of it. It’s free (or almost free) coverage that can provide financial support for those who have been investing in your future, should something unexpected happen to you.

However, life insurance coverage through work is often only a few times your annual salary and may not be enough to cover your needs.

Here are a few scenarios where getting a basic term life policy of your own makes sense:

1. You Want to Avoid Saddling Your Parents with Student Debt

If you have a private student loan and your parents were co-signers on that loan, they may get stuck paying off your debt if you unexpectedly pass away. No one likes to think about that happening �� and hopefully you have a long, full life ahead of you — but term life insurance can help make sure parents won’t be burdened by unexpected debt if something happens to their adult children. Many federal student loans are forgiven if the graduate passes away, but private loans don’t follow the same protocol. So check on any student loan debt obligations that might fall to your parents, and consider getting some term life insurance so they can pay off that debt if you’re no longer around to do so.

You can get a small life insurance policy through Ladder to cover what you need now, and the best part is that you can increase or decrease your coverage as your financial needs change. Paid down your loans in half the time you expected? Drop your coverage by half with just a few taps in the app and watch your premium go down by the same amount.

2. You are Responsible for the Financial Security of Others

Coming out of college and grad school, many graduates have a lot of credit card debt, in addition to student debt. If you have a spouse or children to provide for, aging parents to care for, or a mortgage you are paying down, it’s important to make sure your dependents can be financially self-sufficient if something happens to you. Being able to maintain a consistent standard of living and being with the community can make a huge difference when your family is recovering from a tragic event. Look at the life insurance coverage you get from work and see if you need additional coverage to make sure your loved ones would have enough financial support.

An additional benefit of independent/additional life coverage? As long as you are within the term of the policy, it can stay with you no matter where you go, providing a financial safety net. If you leave a job, get laid off, or take time between jobs to travel, the life insurance you had through work will no longer be in effect. But if you have additional life insurance that you own independently, you can rest easy during these lulls knowing there’s a financial safety net for your people.

3. You Realize Getting Life Insurance Early is a Smart Financial Move

The beauty of term life insurance is the price stays fixed once you get a policy. So if you get a policy when you are young and super healthy, your rates will be lower than if you wait until you are in the throes of “adulting” (spouse, kids, house, mortgage). Furthermore, if you develop a chronic illness or disability in later years and have not gotten life insurance before that happens, your premiums may be much more expensive. You may even be uninsurable when you try to get life insurance, which is not ideal when you have a family who depends on you financially.

If you get a policy while in your twenties, your monthly premiums can be much more affordable and budget-friendly because you are likely young and healthy. And you’ll still be paying the same low price 20–30 years from now, depending on the term you choose. For many people, they find their monthly insurance premiums are equivalent to the cost of buying a few cups of specialty coffee a month. So imagine the cost savings you can rack up over time, if you lock in a low rate when you are younger, versus paying a pretty penny if you wait until you are older.

At the end of the day, deciding whether or not you need a basic term life insurance policy comes down to how much debt you need to cover, how much financial support you want your loved ones to have if something happens to you, and the financial legacy you want to create.

Credits: Liana Corwin

Date: June 9, 2021

Source: https://finance.yahoo.com/news/3-reasons-grads-life-insurance-151426037.html

0 notes

Text

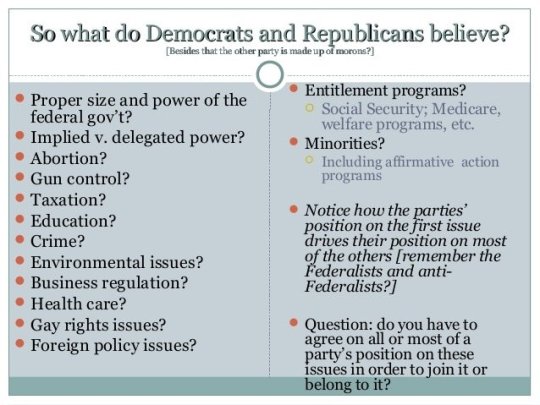

What Do Republicans Believe About Education

New Post has been published on https://www.patriotsnet.com/what-do-republicans-believe-about-education/

What Do Republicans Believe About Education

Energy Issues And The Environment

Majority Of Republicans Believe Education Is BAD For America

There have always been clashes between the parties on the issues of energy and the environment. Democrats believe in restricting drilling for oil or other avenues of fossil fuels to protect the environment while Republicans favor expanded drilling to produce more energy at a lower cost to consumers. Democrats will push and support with tax dollars alternative energy solutions while the Republicans favor allowing the market to decide which forms of energy are practical.

Where Do Democrats And Republicans Stand On The Issue Of Healthcare

The chasm between the parties approach to providing healthcare to Americans couldnt be more vast. Simply put, Democrats have had some form of healthcare reform on their agenda for nearly a century. Republicans not so much. They feel that the status quo is just fine. At the core is a philosophical disagreement about the role of government. Democrats believe that government should be responsible for the people in some ways, and Republicans believe that the less government, the better. In the current climate, this boils down to Democrats wanting to retain, improve, and expand the ACA, and Republicans working overtime to repeal it with no replacement.

How Far Apart Are Democrats And Republicans On School Reform

Reddit

Americans are more polarized than at any point in recent history.; On issue after issueabortion, the Affordable Care Act, or just about anything else Democrats stand on one side and Republicans stand on the other. It can be difficult for leaders to build consensus around policy when the two sides each have their own base of support.; But is the public so divided over school issues?;;;;;

Last year, Education Next conducted a poll asking Americans about 17 education issues.; On eight of these issues, there is no evidence that parties differ.; Democrats are no more or less supportive than Republicans when it comes to universal vouchers, vouchers for students in failing schools, tax credits for donations to scholarship programs for private schools, higher pay for teachers in hard to staff subjects, higher pay for teachers in hard to staff schools, and awarding tenure on the basis of student performance.;

There are differences on other issuesincreasing spending, raising teacher pay, government funded universal preschool, government funded preschool for low income families, charter schools, vouchers for low-income families, merit pay, tenure, and Common Corebut these differences hardly pit the parties in opposing corners of the ring.; In only one case does the majority from one party oppose the majority from the other.; Nearly three-fourths of Democrats favor more spending on public schools, and 54 percent of Republicans oppose it.;;;;;;;;;

Recommended Reading: How Many States Are Controlled By Republicans

Federal Government In Education

The Republican Party believes in doing away entirely with federal loans. College tuition, and its consequential debt, is rising uncontrollably. At this point, it is rising far above the rate of inflation. College debt in America, as of 2012, had exceeded the amount of credit card debt. Republicans believe federal loans exacerbate this problem by their lack of transparency, and the fact that they are often more expensive than private loans. For these reasons, republicans believe that the federal government should no longer issue student loans. Greater private sector participation in loans would drive tuition costs down. The party believes that the federal government should, however, serve as an insurance guarantor for private sector loans.

Crime And Capital Punishment

Republicans generally believe in harsher penalties when someone has committed a crime, including for selling illegal drugs. They also generally favor capital punishment and back a system with many layers to ensure the proper punishment has been meted out. Democrats are more progressive in their views, believing that crimes do not involve violence, such as selling drugs, should have lighter penalties and rehabilitation. They are also against capital punishment in any form.

You May Like: How Many Democrats And Republicans Are In The House

Do The Republicans Even Believe In Democracy Anymore

They pay lip service to it, but they actively try to undermine its institutions.

By Michael Tomasky

Contributing Opinion Writer

A number of observers, myself included, have written pieces in recent years arguing that the Republican Party is no longer simply trying to compete with and defeat the Democratic Party on a level playing field. Today, rather than simply playing the game, the Republicans are simultaneously trying to rig the games rules so that they never lose.

The aggressive gerrymandering, which the Supreme Court just declared to be a matter beyond its purview; the voter suppression schemes; the dubious proposals that havent gone anywhere yet like trying to award presidential electoral votes by congressional district rather than by state, a scheme that Republicans in five states considered after the 2012 election and that is still discussed: These are not ideas aimed at invigorating democracy. They are hatched and executed for the express purpose of essentially fixing elections.

We have been brought up to believe that American political parties are the same that they are similar creatures with similar traits and similar ways of behaving. Political science spent decades teaching us this. The idea that one party has become so radically different from the other, despite mountains of evidence, is a tough sell.

Or is there?

So were not there right now. But we may well be on the way, and its abundantly clear who wants to take us there.

For Teachers The Agenda Includes Bonuses And Tax Credits

To reward teachers who are highly effective, Republican lawmakers have proposed directing $50 million of the states $13.5 billion public education budget toward bonuses. They believe it is the biggest step the state can take to directly increase teacher pay set by local districts.

They deserve it, said Sen. Paul Lundeen, R-Monument and a bill sponsor. The reality is all teachers deserve more pay, but the teachers who are doing a great job are the first ones we should be getting more pay to.

Teacher pay is determined by local school districts, and bonuses offer the state a way to add more dollars to their compensation. Lundeen said 47% of Colorados public school teachers are currently rated as highly effective. Senate Democrats defeated legislation to this effect a year ago.

Republicans are also eager to draw more top-notch teachers into Colorados struggling schools through financial incentives included in a separate bill sponsored by Sen. Kevin Priola, R-Henderson, and Rep. Bri Buentello, D-Pueblo.

The state, Priola said, should at a minimum hold them harmless financially for doing the right thing and using their excellent skills to teach the kids that really need help closing the achievement gap.

Every teacher across this state invests in their students, not only with their time and with their energy and with their heart and their soul, but those teachers also spend dollars, Lundeen said. They pay for supplies to support the students in their classroom.

Read Also: How Many Republicans Are In The 116th Congress

Shift To Community Colleges And Technical Institutions

The first step is to acknowledge the need for change when the status quo is not working. New systems of learning are needed to compete with traditional four-year colleges: expanded community colleges and technical institutions, private training schools,online universities, life-long learning, and work-based learning in the private sector. New models for acquiring advanced skills will be ever more important in the rapidly changing economy of the 21st century, especially in science, technology,engineering, and math. Public policy should address all these challenges and to make accessible to everyone the emerging alternatives, with their lower cost degrees, to traditional college attendance.

Sign Up For Daily News

Republicans and Democrats Explained! What is the Difference?

Stay informed with WPR’s email newsletter.

Rep. Evan Goyke, D-Milwaukee, said there was no excuse for underfunding schools at a time when the state budget was sitting on a roughly $2 billion projected surplus.

“We have the money,” Goyke said. “We have the money to make the investments we need.”

As part of the GOP proposal, Republicans would also set aside $350 million in Wisconsin’s budget stabilization fund, commonly referred to as the state’s “rainy day fund.” While Republicans indicated that the funding could eventually go toward schools, there would be no limits on how a future governor and Legislature could spend the money.

“The money’s going to stay there,” said Sen. Duey Stroebel, R-Saukville. “It’s a safe place to put it.”

You May Like: What Caused Republicans To Gain Power In Congress In 1938

Senator Jim Inhofe Republican Of Oklahoma

Incoming chairman of the Senate committee on the environment and public works

Inhofe is the poster boy for Republican climate change denialism, not only for his stridency on the issue but because he is the once and future leader of the key Senate committee on environmental policy. Inhofe will be able to lead the committee for two years before running up against term limits . This time around, Inhofes committee is expected to focus on transportation and infrastructure bills.

But it seems likely that Inhofe will devote some energy to blocking the regulation of carbon emissions. We think this because on 12 November he told the Washington Post: As we enter a new Congress, I will do everything in my power to rein in and shed light on the EPAs unchecked regulations.

Inhofe has climate change the greatest hoax ever perpetrated on the American people, has said God, not humans, controls the weather, and has denied climate change in many other ways.

Gop Education Budget Would Spend $14b Less Than Evers On Schools

Thursday, May 27, 2021, 5:30pm

Republicans who run the Legislature’s budget committee parted dramatically with Gov. Tony Evers Thursday, passing a K-12 education budget that would spend $1.4 billion less than the governor asked for.

The roughly $150 million they would spend, which includes $128 million in state tax funding,;is hundreds of millions less than the increase they supported just two years ago, and it comes at a time when state government’s budget is as flush as it’s been in decades.

It also comes at a time when Wisconsin schools are receiving more federal funding than ever before through three coronavirus relief packages, a total of $2.6 billion that Republicans say reduces the need to spend state funds on schools.

“We would be so remiss if we did not account for that money as we move forward,” said Rep. Tony Kurtz, R-Wonewoc. “To me, this is a no-brainer.”

At the same time, the GOP education plan raised the prospect that Wisconsin might not qualify for the federal funds.;That’s because one of the conditions of receiving the federal money is that states maintain the amount they spend on education as a percentage of their overall budgets. As of Thursday, the budget crafted by Wisconsin Republicans would fall short.

“You’re not going to get it,” Sen. Jon Erpenbach, D-West Point, told Republicans. “One side of the aisle is not being honest here.”

In largely setting aside the governor’s proposal, Republicans rejected key pillars of Evers’ education budget.

Also Check: Leader Of The Radical Republicans

In Favour Of A Constitutional Monarchy

Not inherently undemocratic: Opponents of the republican movement argue that the current system is still democratic as the Government and MPs of Parliament are elected by universal suffrage and as the Crown acts only on the advice of the Parliament, the people still hold power. Monarchy only refers to how the head of state is chosen and not how the Government is chosen. It is only undemocratic if the monarchy holds meaningful power, which it currently does not as government rests with Parliament.

Safeguards the constitutional rights of the individual: The British constitutional system sets limits on Parliament and separates the executive from direct control over the police and courts. Constitutionalists argue that this is because contracts with the monarch such as the Magna Carta, the , the Act of Settlement and the Acts of Union place obligations on the state and confirm its citizens as sovereign beings. These obligations are re-affirmed at every monarch’s coronation. These obligations, whilst at the same time placing limits on the power of the judiciary and the police, also confirm those rights which are intrinsically part of British and especially English culture. Examples are Common Law, the particular status of ancient practices, jury trials, legal precedent, protection against non-judicial seizure and the right to protest.

What Is A Republican Republican Definition

April 11, 2014 By RepublicanViews.org

This article fully answers what a Republican is and gives the definition of a Republican in a fair, unbiased, and well-researched way. To start the article we list out the definition of a Republican, then we cover the Republican Partys core beliefs, then we list out the Republican Partys beliefs on all the major issues.

The Definition of a Republican:;a member of the Republican party of the U.S.

Source Merriam-Webster Dictionary

Also Check: When Did The Republican And Democratic Parties Switch Ideologies

History Of The Democratic Party

The party can trace its roots all the way back to Thomas Jefferson when they were known as Jeffersons Republicans and they strongly opposed the Federalist Party and their nationalist views. The Democrats adopted the donkey as their symbol due to Andrew Jackson who was publicly nicknamed jackass because of his popular position of let the people rule. The Democratic National Committee was officially created in 1848. During the civil war a rift grew within the party between those who supported slavery and those who opposed it. This deep division led to the creation of a new Democratic party, the one we now know today.

What Is Critical Race Theory And Why Do Republicans Want To Ban It In Schools

The latest front in the culture wars over how U.S. students should learn history and civics is the concept of critical race theory, an intellectual tool set for examining systemic racism. With roots in academia, the framework has become a flash point as Republican officials across the country seek to prevent it from being taught in schools.

In reality, there is no consensus on whether or how much critical race theory informs schools heightened focus on race. Most teachers do not use the term critical race theory with students, and they generally do not ask them to read the work of legal scholars who use that framework.

Some lessons and anti-racism efforts, however, reflect foundational themes of critical race theory, particularly that racism in the United States is systemic. The New York Timess landmark 1619 Project, which addresses slaverys role in shaping the nation, also has an associated school curriculum.

At least five Republican-led state legislatures have passed bans on critical race theory or related topics in recent months, and conservatives in roughly nine other states are pressing for similar measures. Some teachers have said they worry that the legislation will have a chilling effect on robust conversations, or could even put their jobs at risk, at a time when the nation is embroiled in a reckoning on race relations.

Read Also: Did Trump Say Republicans Are Stupid

America Should Deport Illegal Immigrants

Republicans believe that illegal immigrants, no matter the reason they are in this country, should be forcibly removed from the U.S. Although illegal immigrants are often motivated to come to the U.S. by companies who hire them, Republicans generally believe that the focus of the law should be on the illegal immigrants and not on the corporations that hire them.

Likely Voters Want Continued Government Funding For Teenage Pregnancy Prevention Programs Rutgers Researcher Finds

ASU Democrats vs Republicans: Federal Standards & Initiatives

Democrats and Republicans disagree on many policies but not on sex education for teenagers, a Rutgers-led national survey finds.

The study, published in the journal;Sex Education,;surveyed close to 1,000 likely voters who identified as Democrats or Republicans. The findings show a strong majority of them support sex education within schools and the continued funding by the government for teenage pregnancy prevention programs that include information about both abstinence and contraception.

“Sex education remains a vital component to reducing unintended teenage pregnancies and sexually transmitted diseases among young people as well as providing young people with the information and skills they need to build healthy relationships,” said professor Leslie M. Kantor, chair of the department of urban-global public health at the;Rutgers School of Public Health. Recent attempts by the government to shift funding away from evidence-based pregnancy prevention programs and back to abstinence-only-until- marriage-approaches are out of alignment with what likely voters want.

“Planned Parenthoods mission includes providing sex education programs and resources that teach teens to make healthy, informed choices,” said Nicole Levitz, Director of Digital Products at;Planned Parenthood Federation of America;and a co-author of the study. “This study validates that most likely voters want comprehensive sex education for middle and high school students.

Recommended Reading: What Is The Pin The Republicans Are Wearing

No Federal College Loans; Just Insure Private Loans

Federal student aid is on an unsustainable path, and efforts should be taken to provide families with greater transparency and the information they need to make prudent choices about a student’s future: completion rates, repayment rates, future earnings,and other factors that may affect their decisions. The federal government should not be in the business of originating student loans; however, it should serve as an insurance guarantor for the private sector as they offer loans to students.Private sector participation in student financing should be welcomed. Any regulation that drives tuition costs higher must be reevaluated to balance its worth against its negative impact on students and their parents.

The Founders Studied History

The Founders studied the history of governments. They were very interested in what they read about the government of the Roman Republic. It was located in what is now the country of Italy. The Roman Republic existed more than 2,000 years before our nation began.

The Founders liked what they read about the Roman Republic. They learned some important ideas from their study of the government of ancient Rome. They used some of these ideas when they created our government.

You May Like: Democrats Switched Platforms

Recommended Reading: Why Are Republicans Wearing Blue Ties

0 notes

Text

Something I May Need to Stop Doing...

I'll be venting in this post, but this is about the desire to move out of a desperate want for change right now even though such a move is not meant to be.

On occasion, I go onto zillow's website and check out houses around Pittsburgh out of curiosity just to see what houses are going for what price in what kind of condition. I've noticed something incredibly enticing: there are some houses going for under $100,000 and are technically livable. It's just got flaking/chipping paint, may need new rugs, and other general clean-ups. The only "major" thing I wanna do to any of these houses falling under this criteria is the fact that I feel more comfortable with a tin roof.

These houses that I find are within city limits, most of these houses I've shown an interest in are close to sidewalks. This means if I were to move into one of these houses, then I'd have a chance to properly commute!

Ah, but why exactly am I making this post? What is it that I'm venting about? And what did I mean earlier when I said "not meant to be?"

Back in 2014 (autumn, specifically), my husband and I had to move out of our apartment in downtown Pittsburgh to my parents' farm in Ohio. Two reasons made us do this: one was the skyrocketing rent prices when HUD sold our building, causing rent to go from $539/mo to $720/mo. My husband worked at a casino, and was making $10/hr, so when rent prices went up like mad, we really began to struggle to survive. The other thing was bedbugs. The building manager laughed at our discomfort and said, "What do you expect me to do about it? Where would everyone go for the building to be treated?" Like, you're a shit manager if you haven't come up with those contingency plans.

Paying $720/mo for a bedbug-infested apartment (bedbugs are fucking hard to get rid of) and living in a constant state of itchy breakout made us decide it was time to move in with my parents. Because we literally could not afford to live anywhere else, and our student loan debt fucked up our credit scores, so we couldn't even get a house (and we were looking for one at the time!).

We used to think living on this farm was temporary until reality set in, that there is absolutely no possible way for us to make it on our own now. My husband has ADHD and anxiety and is still struggling to practice to get his driver's license (it's hard when my dad is a major source of my husband's stress; my dad's an asshole and gets worse by the year), and I'm Autistic, so I can't hold down a regular job, and nothing else is hiring.

In terms of getting a job for me at all, either I'd have to go to school for my special interest for the job (ecology, entomology, and/or paleontology) or I'd rather work in a library.

Welp, college is far too expensive for me to pay out of pocket, and my already existing student loan debt is barring me from getting any sort of financial aid to go back to school at all. As far as the library is concerned? Remember when I said my husband is currently struggling to practice for his license? (He doesn't get much practice because my dad is a stressful asshole that makes my husband have a horrible headache and anxiety after he drives). We have 2 vehicles, one my mom uses to get to work, and the other my dad uses to take my husband to work as well as do errands in like grocery shopping and shit like that.

I can't get a ride.

Can't ride a bicycle, either. It's definitely not safe (I live in America, if you couldn't tell). My parents' farm is deep within one of the back roads with one of the properties on this road being an oil rig. The oil workers drive like assholes, not caring what animal they hit, speeding through here. There are dirtbikes and four-wheelers that speed through here, too. There's no room for 2 vehicles to pass one another, and nothing but pure fucking hill the moment you step off the side of the road. I literally cannot bike here.

But let's pretend I got onto one of the main roads on either end of our road. It's even worse! And STILL no room for bicyclists! This goes for fucking miles until you reach a residential area! Except for a nearby little village-town that has the closest library branch. It's the village my husband grew up in, but there's a lot of sketchy turns, corners, and again, no room for bicycles. This includes main roads.

With all this in mind, I actually considered the possibility of moving to that village, because the village itself is actually safe enough to bike ride in. The problem is: I'm not guaranteed to get a job at the library at all. I tried getting a job as a library clerk at the Carnegie Library in Pittsburgh, got interviewed and everything, and didn't get the job for whatever reason. In fact, I'm not guaranteed a job at all at any library branch, regardless of the neighborhood. So moving to such an area depending on the chance of being hired there is not worth it.

Such a village is actually rather unfriendly, and that goes for a lot of communities here on this side of Ohio. You'd think this was one of the southern states from its people and what flags they fly.

So why not Pittsburgh? Why not move there if we could?

Well, I thought about it. It has all the perks I could expect such as public transportation, somewhat safer bicycling areas to commute to school and work, and more importantly: THINGS TO DO.

Living in the middle of nowhere blows when you want to, on your own without relying on someone to drive you, go and do something, such as buying fabric or art supplies for future projects, or going to the library, or anything, really! Yeah, I do want to garden, but I don't have the means to do that on a damn farm (long, frustrating story that made me stop believing my parents' promises).

Not to mention, I still have friends in Pittsburgh, If I wanna see them, they don't have to drive an hour and 45 minutes (and that's if they have a car) to visit. I got 2 friends here in the area, and they're busy with their work's demanding schedules. When we do hang out, Cards Against Humanity, Uno, and D&D can only do so much until it gets old and boring and you wanna do something else that isn't hanging out at a dead mall. There is truly nothing to do here. Pittsburgh has the museums, libraries, parks, and far more interesting establishments to lurk in.

So again: why not Pittsburgh?

Because that city has changed and is still changing compared to when I was last there. My regular watering hole (The Beehive) is no more. There are neighborhoods being gentrified (meaning I'm not guaranteed to keep my home even if I pay it off). Businesses are closing, meaning people will be losing their jobs, and some of the other places hiring (like libraries) are not guaranteed to hire me, especially when I haven't had a job since 2010.

There's also my cat to consider; she gets stressed at the sound of a lawn-mower (I don't blame her). She wouldn't be able to handle the sounds of the city. Unless we found a place not too close to downtown, such a move is a no-go.

I've daydreamed about living in Pittsburgh again. I'm homesick for Pittsburgh. I've realized only recently that that city was my home. Not this farm, not even the house I grew up in. I felt like a person who didn't have to rely on people for rides and such. It's the only place where I've truly lived on my own and enjoyed it.

I've actually considered moving out of this country and found that even more impossible. No matter which country you pick, no matter what language you learn, not only do you have to pay for your things to be shipped, for your plane ticket for a one-way trip, or whatever you need to become a citizen there, you still have to pay at least $2,000 to revoke your American citizenship or else you will be forced to pay American taxes despite never setting foot on American soil ever again.

Thanks to capitalism, America has made it fucking impossible for the average person to leave for good. If you are born here, you are financially enslaved here unless you're wealthy enough to leave.

So... What's the plan?

Well, for now: not much. The pandemic has set plans back a bit, but my parents have a lien on the house thanks to my private student loans my mom was bullied and forced into co-signing for. She... I guess?... is almost done paying them off? I don't know. My parents don't like communicating need-to-know info with me and then get mad when I don't absorb it through osmosis. Once the lien is taken off the house, mom wants to move north to be near her sister, and she said she'll try finding a farm for sale near Kent State so it'll be an easier commute (be it by bicycle or by car). My intention is to enroll there to be able to get a job as an ecologist (focus in entomology, specializing in arachnology) with a minor in paleontology.

Once I've gotten that all taken care of (as well as my husband going back to school for what he wants), we move to the pacific northwest, mainly just north of Seattle somewhere.

I hate Ohio. I hate running into people I've gone to school with that I try to avoid (more like I see them, but they don't recognize me? At least I hope not?). I hate this place so much. I hate this climate, being near people I don't want just randomly showing the fuck up. And what's the use of living near family when they don't want to bother visiting you? I hate hearing my mom tell me so-and-so that I obviously want nothing to do with told her to tell me they said hi. I'm tired of fearing I'll run into someone that abused me in the past because now they're back in the fucking area again apparently.

I've got my fingers crossed that something is gonna give and college to some level (community college?) will be free for residents or something. It'll give me a chance to go back to school for something close to what I wanna do so I can maybe get a job? Completing something at a community college would at least make it easier for me to get enrolled at a university.

My husband and I picked Seattle (or close to Seattle) for its climate. It's (usually) not blistering hot every goddamn year, and it's not horribly cold thanks to the mountain range (I'm quite cold-intolerant). We both enjoy overcast weather and rain. We'd rather take our chances with volcanoes than earthquakes or hurricanes in areas where these things are guaranteed to happen yet nobody ruling these areas wants to invest in infrastructure that helps stand a chance against them. Seattle also has a nice combination of city and wilderness side-by-side. Not much of that with Pittsburgh.

If I was forced to only move to Pittsburgh and no other city, I wouldn't mind, especially since I'm more familiar with Pittsburgh than I am with anything in my current local area (because I had to travel on foot instead of relying on a car to get to places!). Fuck, my mom wouldn't even let me do anything by myself out of the yard when we lived in the village I grew up in because she was a paranoid fuck and by the time I JUST STARTED gaining independence for having a bike and bicycling to the post office everyday, we moved to this farm.

Oh, this isn't a roof over my head I should be thankful for. My parents got screwed. Our water is full of iron and calcium that no filter can fix, so we constantly have plumbing problems, the post and internet connections are questionable at best, we get ant infestations from 2 species EVERY YEAR, all for a farm my mom wanted for horses she always wanted and eventually got but has little next to no energy to spend the time she wants with them and she refuses to admit her age has a lot to do with it on top of her working so she sits in the living room on THREE DIFFERENT DEVICES sucking up bandwidth to religiously watch every fucking livestream of a country singer she likes (and complains if she's missing it for any reason!), scroll through Facebook, and play a fucking shitty app game!

Our internet out here? The physical equipment is outdated (copper wires instead of fiber-optic cables) because the fucking company doesn't wanna spend the money to upgrade it.

So instead, we're stuck here, with my husband losing his sanity bit by bit by the day at his shitty retail job (every other available job offering would be worse in this area) and I sit here and hope that maybe, JUST MAYBE, I could start gardening soon.

I miss Pittsburgh. I really do. But despite all of its benefits it would give me and my husband if we moved back, I don't think it will happen.

In the off-chance that we don't move north, that my dad's assholery intensifies and he decides to remain here (he has to legally agree to sell this house in order for my mom to move north; dad's reasons keep fucking changing), Pittsburgh is a nice back-up plan. Pitt University actually has the major I'd want to go back to school for, as well as what my husband wants to go back to school for, and we'd already be familiar with the city and what to expect of it. However, we're aiming higher, and hoping to move to the pacific northwest, instead.

But I think to avoid losing my sanity, I should stop daydreaming about a future that may never be.

Fingers crossed!

0 notes

Note

I will never understand why all these middle income people think they're more like millionaires and billionaires when the only difference between them and poor people is 3-6months of lost wages.

I've got a friend like this that worked since she was sixteen and spent very little and didn't go to college except one year so doesnt have massive college debt. She always saved up her income tax money.

Real exemplary Bootstrap American. No disabilities, able to handle the emotional labor of retail and hospitality work. Got herself a good job as a casino dealer making 19-23 an hour after tips.

She's laid off right now without pay because of this virus. I know a few years ago she had 10k saved up. So let's say just for shirts and giggles shes got another 10k saved up by now

That's 20k. So say this virus takes a year to clear up. Shes gotta stretch that 20k for a year. That's less than 10/hr.

How the hell is she supposed to live like that? That's half her normal income, nevermind any expensive medical expenses she might have to pay for. That's her without health insurance cause she got laid off, without visin or dental insurance.

And she has an abnormal amount of savings. Not all of us have been able to save our money since age 16. We had other family members to take care of, we had medical emergencies, credit card bills, student loan payments, high interest rates because our credit scores are low. We have rents that keep getting higher, we have unexpected car maintenance issues. We live paycheck to paycheck because everything is always due every single month. Theres bill that only charges you for half a year. Rent due 12 times a year, car note due 12 times a year, car insurance due 12 times a year, electricity due 12 times a year, cell phone bill due 12 times a year.

None of those things is something we can do without in this day and age. Especially in a city like mine with nearly worthless public transit options. You know how much just those things cost me each month? 1236. You know how much I make a month? 1416.08

This doesn't count things like food, toiletries, gas, pleasure activities. This is just enough to keep a rough over my head, have lights, and get to where I need to go.

And I make almost 14 an hour! You may be wondering how that adds up to 354.02 a week. The answer to that is the humongous amount of health insurance taken out of my pretax income. Yeah. Health insurance that comes out every check but that I still have to pay copays on for the doctor. For prescriptions.

The whole system is set up for people to fail. And the sooner people that are "living within their means" realize that those at the top have been underpaying them as long as they've been underpaying those of us at the bottom. That healthcare shouldn't be privatized, that pharmaceutical companies shouldnt be allowed to charge 3000 times the price it costs to make a drug and then patent that drug for 10yrs, that they shouldnt have to work 40hrs a week just to barely have a living with a bit of savings in this age of technological advancement, that everything they've been told they have to earn is there's by birthright...the sooner we can change this country and this world for the better.

People on disability shouldn't get a stimulus check, theirs should be donated to repaying all the money they've mooched off taxpayers.

This is not the first time I’ve gotten a message like this. I always find it curious. Because if you have this attitude you are either invincible, rich, or a fool.

I used to be in this tech nerd community and there was this older fella who slowly revealed himself to be a super right wing asshat. He complained about immigrants mooching, black people mooching, poor people mooching… everybody was mooching his taxes. Meanwhile, he was 65 and working hard. Paying his own way. Doing things proper like a good American.

He was no damn moocher, that’s for sure.

Then he got sick.

He could not work anymore.

Lost his medical insurance.

His savings ran out in about 3 months.

And he became a fellow moocher.

He had to sign up for Medicare and disability.

But then he realized that wasn’t enough to live on. Boy, was he mad. ALL CAPS POSTS about how he can’t afford rent. He can’t afford food. He started posting links to his Paypal asking people to donate. He got furious at people because no one would give him money. Called us all bad people for not helping him in his time of need. He had to move to a smaller place. Sell a lot of his tech.

He was so very angry.

“I WORKED HARD.”

“I DID THINGS THE PROPER WAY.”

“I DESERVE MORE THAN THOSE MOOCHERS!”

Even after his experience, he viewed himself as different than other people trapped in the safety net. He deserved more because he had a bootstrap attitude. It didn’t occur to him that a lot of people on welfare or disability probably worked hard too. That he was no more or less deserving than them. It was sad to see his experience didn’t instill any empathy.

He’s a lost cause. But maybe you aren’t. Maybe you should think about how long you could last before you’d have to mooch. Are you set for life? If you were in an accident and unable to work ever again, would you be able to live comfortably and manage your expenses? Think about that. And think about the fact that disability pays less than minimum wage. Could you live your life on $750 per month? What changes would you have to make to accomplish that? Use your imagination and really try to put yourself in those shoes.

$1200 is not a windfall for me. It is maybe 4 months of having slightly less financial anxiety. That anxiety is a part of my life. It is inescapable and I have conceded it will always be there. It is the dread of seeing $14 in my bank account towards the end of the month and hoping I didn’t forget about an automatic payment. It’s the fear of looking in my freezer and wondering if two bags of frozen chicken nuggets are enough to last until I get my next payment.

But now I am getting $1200 and for a few months maybe I don’t have to feel some of that anxiety. I can reallocate that anxiety to the world being on fire and worrying about my dad getting sick.

But you want me to send it back?

What’s even sadder about your attitude is you are focusing on the wrong people. I’m not a moocher. I’m an insignificant financial speck in the grand scheme. I’m probably a percentage of a penny on your tax bill. But then you look at companies like Amazon who used loopholes to pay no taxes. They also got cities to subsidize offices and warehouses. So not only did they not pay taxes, we paid them for the honor of giving people low wage jobs with poor benefits and dubious working conditions.

What about our F-35 fighter jet program? For years they didn’t even work properly and they still haven’t even been used for anything and they will probably rarely be utilized because of drones. But we will spend a trillion dollars on them anyway.

What about oil subsidies? About $20 billion of our tax dollars goes to the fossil fuel industry every year. An industry that has never struggled to turn a profit. Just look at pictures of Dubai and ask yourself why we are giving them subsidies.

We give corporations billions upon billions of dollars even though they are making record profits. And then we find out they were operating so close to the edge that they can’t even last a month without us giving them billions more.

But my $750 per month makes me the moocher.

Sure.

40K notes

·

View notes

Text

6 Reasons Why You Must Never Provide Money To Friends Or Household

6 Reasons You Ought To Never Ever Lend Cash To Pals Or Family

#toc background: #f9f9f9;border: 1px solid #aaa;display: table;margin-bottom: 1em;padding: 1em;width: 350px; .toctitle font-weight: 700;text-align: center;

Content

Do You Need To Borrow Money?

Determining Whether You Need To Be Loaning Money

Do You Really Need To Invest The Money Whatsoever?

Do You Need To Borrow Money?