#Inflation (Major economic factor)

Explore tagged Tumblr posts

Text

Budget 2025: A Game Changer for Indian Real Estate? Key Expectations & Market Impact

Will This Budget Unlock Growth, Affordability, and Investment in Real Estate?

As India gears up for Union Budget 2025, the real estate sector is on high alert, anticipating policy shifts that could redefine housing affordability, taxation benefits, and infrastructure expansion. With the industry contributing nearly 7% to the GDP and projected to reach $1 trillion by 2030, real estate stakeholders—homebuyers, investors, and developers—are eyeing reforms that can boost demand, streamline regulations, and fuel long-term growth.

From tax breaks for homebuyers to incentives for green real estate, this year’s budget could be a make-or-break moment for the property market. Here’s what the industry is hoping for:

1. Affordable Housing: Bigger Incentives, Bigger Opportunities

One of the biggest expectations from Budget 2025 is an aggressive push for affordable housing, a segment that remains a key government priority. With the Pradhan Mantri Awas Yojana (PMAY) in full swing, developers and buyers alike are looking for:

✅ Extension of PMAY Benefits – Increased funding and subsidies for first-time homebuyers under Credit Linked Subsidy Scheme (CLSS). ✅ Higher Tax Deductions – Raising the Section 80EEA benefit (currently ₹1.5 lakh) to ₹2.5 lakh to help middle-income buyers. ✅ Lower GST on Under-Construction Properties – Reducing the current 5% GST (without ITC) to 3% or reinstating input tax credit (ITC) for builders to cut costs.

These moves could enhance affordability, improve sales volumes, and strengthen India’s housing demand.

2. Tax Benefits: More Savings for Homebuyers & Developers

Industry players have long demanded higher tax exemptions to boost liquidity and sales. Key tax-related expectations from Budget 2025 include:

📌 Increase in Home Loan Interest Deduction – Raising the Section 24(b) limit from ₹2 lakh to ₹5 lakh can make home loans more attractive. 📌 Relaxation in Capital Gains Tax – Expanding Section 54 exemptions to encourage reinvestment in real estate. 📌 GST Input Tax Credit (ITC) for Developers – Allowing builders to claim ITC can reduce project costs and make homes more affordable.

A well-balanced tax regime could encourage new home purchases, attract more investors, and drive fresh capital into the sector.

3. Infrastructure & Urban Expansion: Driving Real Estate Growth

Real estate thrives on strong infrastructure, and this budget is expected to boost metro expansions, smart city projects, and expressway networks. Experts are calling for:

🏗️ More Funding for Smart Cities & Urban Development – Expanding beyond metros to Tier 2 & Tier 3 cities. 🚆 Increased Connectivity Through Highways & Metro Rail – Unlocking new investment zones for real estate growth. 🏢 SEZ Reforms & Commercial Hubs – Making it easier to develop and sell properties in Special Economic Zones.

With India’s urbanization rate growing at 2.3% annually, these measures could expand real estate demand beyond metro cities.

4. REITs, Co-Living & Rental Housing: Unlocking the Next Big Market

The rental housing sector and Real Estate Investment Trusts (REITs) are emerging as game-changers, and Budget 2025 could further boost these markets with:

💼 Tax Incentives for REIT Investors – Offering capital gains tax exemptions or tax-free dividends to increase retail participation. 🏘️ Rental Housing & Co-Living Support – Special incentives for rental housing projects, student housing, and senior living. 📊 New Rental Housing Policy – Making it easier for private players to set up and manage large-scale rental properties.

With millennials and Gen Z preferring rental options, a structured rental housing framework could increase affordability and expand investment opportunities.

5. Stamp Duty & Registration Charges: A Much-Needed Rationalization

One of the biggest roadblocks in real estate transactions is high stamp duty and registration charges, which vary across states. The sector is hoping for:

📉 Reduction in Stamp Duty for First-Time Buyers – A centralized reduction policy to increase home sales. 🏡 Tax Deduction on Stamp Duty Costs – Making stamp duty partially deductible under income tax laws to improve affordability.

These measures could significantly lower property acquisition costs and encourage more real estate transactions.

6. Green Real Estate & Sustainable Development

Sustainability is the future, and Budget 2025 is expected to encourage eco-friendly real estate practices by:

🌱 Tax Benefits for Green Buildings – Reduced GST and subsidies for energy-efficient and sustainable real estate projects. ⚡ Incentives for Solar & Renewable Energy in Housing – Subsidies for solar power, rainwater harvesting, and energy-efficient homes. 🏗️ Higher Floor Space Index (FSI) for Green Certified Projects – Allowing eco-friendly buildings to have higher permissible construction limits.

With climate change concerns rising, incentivizing green real estate can attract global investors and ensure long-term sustainability.

Final Thoughts: Will Budget 2025 Be a Game Changer?

The Union Budget 2025 has the potential to revolutionize the real estate sector by focusing on affordability, infrastructure expansion, taxation benefits, and sustainable development.

For homebuyers, tax relaxations and lower interest rates could make homeownership easier. For developers, GST simplifications and incentives could reduce costs and increase profitability. For investors, REIT incentives and rental housing policies could unlock new income streams.

A progressive and real-estate-friendly budget could fuel industry growth, attract foreign investments, and make housing more accessible for millions of Indians. All eyes are now on the finance ministry—will Budget 2025 deliver the much-needed boost? Only time will tell. 🚀

#IndianEconomy (Context)#EconomicGrowth (Key concern)#FiscalPolicy (Government's approach)#FinancialPlanning (Impact on individuals)#BudgetAnalysis (For expert commentary)#BudgetUpdates (For news and announcements)#GDP (Gross Domestic Product - important metric)#Inflation (Major economic factor)#Sectors (Choose those relevant to your content):#AgricultureBudget (For farming and rural issues)#HealthcareBudget (For health and medical spending)#EducationBudget (For schools and universities)#InfrastructureBudget (For roads#railways#etc.)#DefenceBudget (For military spending)#RuralDevelopment (Focus on rural areas)#ITsector (For technology and related industries)#RealEstateBudget (For property and housing)#Manufacturing (For industrial sector)#EnergyBudget (For power and renewables)#Taxes & Reforms:#TaxReforms (Expected changes)#GST (Goods and Services Tax)#DirectTaxes (Income tax#corporate tax)#IndirectTaxes (Sales tax#excise duty)#Subsidies (Government support programs)#Expectations & Predictions:

0 notes

Text

we can all look back on and laugh at this when im wrong, but it seems like social media in its current incarnation is dying an undignified and overdue death. it turns out throwing all of humanity into one room and expecting everyone to develop a single ethos was beyond insane conceptually and the artists who built their following on social media are probably in a tail spin right now. people jumping to bluesky are insane lol. did you forget jack dorsey is the idiot who got us into this mess in the first place. why would you choose to subject yourself to this shit again. for what purpose?

the stock answer i got was that "for discoverability/audience" and if that's true thats a problem. i've been hollerin about this to anyone who would listen prior to this but the customer base of twitter (and all social media) is its advertisers. they have not been shy from the start about that fact because its the only way they generate income, as far as i know. YOU (the user) are the product. YOU (still the user) are also what draws people to the site. there is not a social media website on earth that has figured out that making a good website (which would require hiring and paying for quality labor over an extended period of time) is more likely to result in economic success than exclusively courting the businesses whose interest is in making the website worse to use with ads. at no point were our interests ever a factor.

in fact, imo, the number of people following you is not an accurate representational sample of your audience. the reasonable assumption you should make is that the vast majority of numbers involved with any website (esp those with a vested interest in showing off big numbers to VC investors or advertising execs) are inflated or just outright fake. the numbers exist solely to drive you insane and make awful people happy. the numbers cause you and everyone around you to start spontaneously spawning myths about a beast called "the algorithm" that possesses the incredible traits of being both something you can game for success or blame for your failures. it coerces you into enacting out nonsense superstitions to try to counteract or appease it in the hopes of, let's be honest, breaking it big and going viral. this way, you, the creator, do not have to do the hard work of building up a rapport with an audience. none of this goes anything but adds more numbers for the ceos to look at and nod approvingly or disapprovingly at.

the people running the world today are, without exaggeration, cartoon villains. they are deeply stupid, devoid of empathy, and open about their intent to do deeply evil acts in order to further their economic interests. trying to derive some kind of financial benefit from the creations of these unapologetic losers was always bound to be a wasted effort. the best thing i can say about twitter, a website i was banned from countless times and returned to out of stubborn desire, was that i got to make some great jokes with friends and cause some chaos lol. letting people know i have a web comic was always a secondary function once the realization of what social media was turning out to be set in like 7 years ago. any artist who insists that you have to do this or that on this or that social media site is trying to drag you down into the quagmire of online numbers poisoning.

run away!!! children heed my advice!!! the joy of creation does not lie on a path that encourages you to cater to the lowest common denominators while casting your net. just fucking have fun with it. if its not fun then it wont even be fun to do financially anyway. and isnt that, like. the point.

1K notes

·

View notes

Text

The despair goes deeper. Almost a quarter of renters report skipping meals to make their monthly rent payments. The expiration of pandemic-era tenant protections and rental assistance programs—which Biden and congressional Democrats did nothing to prevent—has caused evictions to spike back to pre-Covid levels. Homelessness is at an all-time high. Wider economic discontent can also be connected to housing. An astonishing 75 percent of swing-state voters said housing costs were the most stressful economic issue for their families, and nearly two-thirds said housing unaffordability made them feel negatively about the economy. Rent remains the single largest factor keeping inflation high, accounting for half the overall increase in inflation as recently as September.

It's too damn high

55 notes

·

View notes

Text

The Clean Energy Revolution Is Unstoppable. (Wall Street Journal)

Surprising essay published by the Wall Street Journal. Actually, two surprises. The first is an assertion that the fossil fuel industry is parading to its death, regardless of the current trump mania, while the renewables industry is marching toward success due to dramatic decreases in cost. The second surprise is that the essay is published in the Wall Street Journal, which we all know can be a biblical equivalent for the right wing. But be careful with that right wing label: today's right wing (e.g., MAGA) or the traditional conservative republican right wing, which is more aligned with saving money and making money and avoiding political headwinds.

Here's the entire essay. I rarely post a complete essay, but this one made me happy and feel good, and right now I/we damn well need to learn something to make us happy and feel good.

Since Donald Trump’s election, clean energy stocks have plummeted, major banks have pulled out of a U.N.-sponsored “net zero” climate alliance, and BP announced it is spinning off its offshore wind business to refocus on oil and gas. Markets and companies seem to be betting that Trump’s promises to stop or reverse the clean energy transition and “drill, baby, drill” will be successful.

But this bet is wrong. The clean energy revolution is being driven by fundamental technological and economic forces that are too strong to stop. Trump’s policies can marginally slow progress in the U.S. and harm the competitiveness of American companies, but they cannot halt the fundamental dynamics of technological change or save a fossil fuel industry that will inevitably shrink dramatically in the next two decades.

Our research shows that once new technologies become established their patterns in terms of cost are surprisingly predictable. They generally follow one of three patterns.

The first is a pattern where costs are volatile over days, months and years but relatively flat over longer time frames. It applies to resources extracted from the earth, like minerals and fossil fuels. The price of oil, for instance, fluctuates in response to economic and political events such as recessions, OPEC actions or Russia’s invasion of Ukraine. But coal, oil and natural gas cost roughly the same today as they did a century ago, adjusted for inflation. One reason is that even though the technology for extracting fossil fuels improves over time, the resources get harder and harder to extract as the quality of deposits declines.

There is a second group of technologies whose costs are also largely flat over time. For example, hydropower, whose technology can’t be mass produced because each dam is different, now costs about the same as it did 50 years ago. Nuclear power costs have also been relatively flat globally since its first commercial use in 1956, although in the U.S. nuclear costs have increased by about a factor of three. The reasons for U.S. cost increases include a lack of standardized designs, growing construction costs, increased regulatory burdens, supply-chain constraints and worker shortages.

A third group of technologies experience predictable long-term declines in cost and increases in performance. Computer processors are the classic example. In 1965, Gordon Moore, then the head of Intel, noticed that the density of electrical components in integrated circuits was growing at a rate of about 40% a year. He predicted this trend would continue, and Moore’s Law has held true for 60 years, enabling companies and investors to accurately forecast the cost and speed of computers many decades ahead.

Clean energy technologies such as solar, wind and batteries all follow this pattern but at different rates. Since 1990, the cost of wind power has dropped by about 4% a year, solar energy by 12% a year and lithium-ion batteries by about 12% a year. Like semiconductors, each of these technologies can be mass produced. They also benefit from advances and economies of scale in related sectors: solar photovoltaic systems from semiconductor manufacturing, wind from aerospace and batteries from consumer electronics.

Solar energy is 10,000 times cheaper today than when it was first used in the U.S.’s Vanguard satellite in 1958. Using a measure of cost that accounts for reliability and flexibility on the grid, the International Energy Agency (IEA) calculates that electricity from solar power with battery storage is less expensive today than electricity from new coal-fired plants in India and new gas-fired plants in the U.S. We project that by 2050 solar energy will cost a tenth of what it does today, making it far cheaper than any other source of energy.

At the same time, barriers to large-scale clean energy use keep tumbling, thanks to advances in energy storage and better grid and demand management. And innovations are enabling the electrification of industrial processes with enormous efficiency gains.

The falling price of clean energy has accelerated its adoption. The growth of new technologies, from railroads to mobile phones, follows what is called an S-curve. When a technology is new, it grows exponentially, but its share is tiny, so in absolute terms its growth looks almost flat. As exponential growth continues, however, its share suddenly becomes large, making its absolute growth large too, until the market eventually becomes saturated and growth starts to flatten. The result is an S-shaped adoption curve.

The energy provided by solar has been growing by about 30% a year for several decades. In theory, if this rate continues for just one more decade, solar power with battery storage could supply all the world’s energy needs by about 2035. In reality, growth will probably slow down as the technology reaches the saturation phase in its S-curve. Still, based on historical growth and its likely S-curve pattern, we can predict that renewables, along with pre-existing hydropower and nuclear power, will largely displace fossil fuels by about 2050.

For decades the IEA and others have consistently overestimated the future costs of renewable energy and underestimated future rates of deployment, often by orders of magnitude. The underlying problem is a lack of awareness that technological change is not linear but exponential: A new technology is small for a long time, and then it suddenly takes over. In 2000, about 95% of American households had a landline telephone. Few would have forecast that by 2023, 75% of U.S. adults would have no landline, only a mobile phone. In just two decades, a massive, century-old industry virtually disappeared.

If all of this is true, is there any need for government support for clean energy? Many believe that we should just let the free market alone sort out which energy sources are best. But that would be a mistake.

History shows that technology transitions often need a kick-start from government. This can take the form of support for basic and high-risk research, purchases that help new technologies reach scale, investment in infrastructure and policies that create stability for private capital. Such government actions have played a critical role in virtually every technological transition, from railroads to automobiles to the internet.

In 2021-22, Congress passed the bipartisan CHIPS Act and Infrastructure Act, plus the Biden administration’s Inflation Reduction Act (IRA), all of which provided significant funding to accelerate the development of the America’s clean energy industry. Trump has pledged to end that support. The new administration has halted disbursements of $50 billion in already approved clean energy loans and put $280 billion in loan requests under review.

The legality of halting a congressionally mandated program will be challenged in court, but in any case, the IRA horse is well on its way out of the barn. About $61 billion of direct IRA funding has already been spent. IRA tax credits have already attracted $215 billion in new clean energy investment and could be worth $350 billion over the next three years.

Ending the tax credits would be politically difficult, since the top 10 states for clean energy jobs include Texas, Florida, Michigan, Ohio, North Carolina and Pennsylvania—all critical states for Republicans. Trump may find himself fighting Republican governors and members of Congress to make those cuts.

It is more likely that Trump and Congress will take actions that are politically easier, such as ending consumer subsidies for electric vehicles or refusing to issue permits for offshore wind projects. The impact of these policy changes would be mainly to harm U.S. competitiveness. By reducing support for private investment and public infrastructure, raising hurdles for permits and slapping on tariffs, the U.S. will simply drive clean-energy investment to competitors in Europe and China.

Meanwhile, Trump’s promises of a fossil fuel renaissance ring hollow. U.S. oil and gas production is already at record levels, and with softening global prices, producers and investors are increasingly cautious about committing capital to expand U.S. production.

The energy transition is a one-way ticket. As the asset base shifts to clean energy technologies, large segments of fossil fuel demand will permanently disappear. Very few consumers who buy an electric vehicle will go back to fossil-fuel cars. Once utilities build cheap renewables and storage, they won’t go back to expensive coal plants. If the S-curves of clean energy continue on their paths, the fossil fuel sector will likely shrink to a niche industry supplying petrochemicals for plastics by around 2050.

For U.S. policymakers, supporting clean energy isn’t about climate change. It is about maintaining American economic leadership. The U.S. invented most clean-energy technologies and has world-beating capabilities in them. Thanks to smart policies and a risk-taking private sector, it has led every major technological transition of the 20th century. It should lead this one too.

16 notes

·

View notes

Text

On Tuesday morning, five days after Hurricane Helene ripped through Boone, North Carolina, David Marlett was on his way to the campus of Appalachian State University. The managing director of the university’s Brantley Risk & Insurance Center, Marlett was planning to spend the day working with his colleagues to help students and community members understand their insurance policies and file claims in the wake of the storm. He didn’t sound hopeful. “I’m dreading it,” he said. “So many people are just not going to have coverage.”

Helene made landfall southeast of Tallahassee, Florida, last week with winds up to 140 miles per hour, downing trees and bringing record-breaking storm surges to areas along the Gulf Coast before charging up through Georgia. But perhaps its most shocking impacts have been on inland North Carolina, where it first started raining while the storm was still over Mexico. At least 57 people are dead in Buncombe County in the west of the state alone. Communities like Boone received dozens of inches of rainfall despite being hundreds of miles from the coast. Waters rose in main streets, sinkholes and mudslides wreaked havoc, and major roads were blocked, flooded, or degraded by the storm.

Now, there’s a good chance that many homeowners in North Carolina won’t see any payouts from their insurance companies—even if they have policies they thought were comprehensive.

“The property insurance market for homes was already a patchwork system that really doesn’t make a lot of sense,” Marlett says. “Now you’re adding in the last couple of years of economic uncertainty, inflation, climate change, population migration—it’s just an unbelievably bad combination happening all at once.”

For North Carolinians, the issue right now has to do with what, exactly, private insurance is on the hook for when it comes to a storm. An average homeowner policy covers damage from wind, but private homeowners’ insurance plans in the US do not cover flooding. Instead, homeowners in areas at risk of flooding usually purchase plans from the National Flood Insurance Program (NFIP).

The way a hurricane wreaks havoc on a state is a crucial deciding factor for insurers’ wallets. Hurricane Ian, which hit Florida as a category 4 storm with some of the highest wind speeds on record, caused $63 billion in private insurance claims. In contrast, the bulk of the $17 billion in damage caused by 2018’s Hurricane Florence, which tore up the North Carolina coast, was water damage, not wind; as a result, private insurers largely avoided picking up the check for that disaster.

This breakout of flood insurance from home policies dates back to the 1940s, says Donald Hornstein, a law professor at the University of North Carolina and a member of the board of directors of the North Carolina Insurance Underwriting Association. Private insurance companies decided that they did not have enough data to be able to accurately predict flooding and therefore could not insure it. “In some ways, that calculation of 50 years ago is still the calculation insurers make today,” he says.

While the NFIP, which was created in the late 1960s, provides virtually the only backup against flood damage, the program is saddled with debt and has become a political hot potato. (Project 2025, for instance, recommends phasing out the program entirely and replacing it with private options.) Part of the problem with the NFIP is low uptake. Across the country, FEMA statistics show that just 4 percent of homeowners have flood insurance. Some areas hit by Helene in Appalachia, initial statistics show, have less than 2.5 percent of homeowners signed up for the federal program.

“Even in coastal areas, not many people buy that, much less here in the mountains,” Marlett says. “People have never seemed to fully understand that flood is a separate policy.”

Flooding is not unprecedented in the mountains of North Carolina: Hurricane Ivan swept through Appalachia in 2004, and flash floods from rivers are not unheard of. Purchasing flood insurance is mandatory with a government-backed mortgage in some areas of the country, based on flood zones set by FEMA. But the data is based on extremely outdated floodplain maps that have not taken the most recent climate science on record rainfall into account.

“The biggest non-secret in Washington for decades is how hopelessly out of date these flood maps are,” Hornstein says.

Even if water wasn’t the cause of destruction for some homeowners in North Carolina, the storm’s disastrous mudslides—another risk supercharged by climate change—may not be covered either. Many home insurance policies have carve-outs for what are known as “earth movements,” which includes landslides, sinkholes, and earthquakes. In some states, like California, insurers are mandated to offer additional earthquake insurance, and homeowners can purchase private additional policies that cover earth movements. But in a state like North Carolina, where earthquake risk is extremely low, homeowners may not even know that such policies exist.

It’s also been a tough few years for the insurance industry across the country. A New York Times analysis from May showed that homeowners’ insurers lost money in 18 states in 2023—up from eight states in 2013—largely thanks to expensive disasters like hurricanes and wildfires. Payouts are increasingly costing insurers more than they are getting in premiums. Homeowners are seeing their policies jump as a result: According to statistics compiled by insurance comparison shopping site Insurify, the average annual cost of home insurance climbed nearly 20 percent between 2021 and 2023. In Florida, which has the highest insurance costs in the country, the average homeowner paid over $10,000 a year in 2023—more than $8,600 above the national rate.

Florida has made headlines in recent months as ground zero for the climate-change insurance crisis. More than 30 insurance companies have either fully or partially pulled out of Florida over the past few years, including big names like Farmers’ and AAA, after mounting losses from repeated major hurricanes like 2022’s Ian, the most expensive natural disaster in the state’s history. Florida’s insurer of last resort, now saddled with risk from multiple homeowners, has proposed a rate increase of 14 percent, set to go into effect next year.

In comparison, North Carolina’s insurance market looks pretty good. No insurers have exited the state since 2008, while homeowners pay an average of $2,100 per year—high, but avoiding the sky-high rates of states like Florida, California, and Texas.

“What traditionally has happened is that there’s a rate increase every few years of 8 to 9 percent for homeowner’s insurance,” says Hornstein. “That has kept the market stable, especially when it comes to the coast.”

But as natural disasters of all kinds mount, it’s tough to see a way forward for insurance business as usual. The NFIP is undergoing a series of changes to update the way it calculates rates for flood insurance—but it faces political minefields in potentially expanding the number of homeowners mandated to buy policies. What’s more, many homeowners are seeing the prices for their flood insurance rise as the NFIP adjusts its rates for existing floodplains using new climate models.

Many experts agree that the private market needs to reflect in some way the true cost of living in a disaster-prone area: in other words, it should be more expensive for people to move to a city where it’s more likely your house will be wiped off the map by a storm. The cost of climate change does not seem to be a deterrent in Florida, one of the fastest-growing states in the country, where coastal regions like Panama City, Jacksonville, and Port St. Lucie are booming. (Some research suggests that the mere existence of the NFIP shielded policyholders from the true costs of living in flood-prone areas.)

Asheville, at the heart of Buncombe County, was once hailed as a climate haven safe from disasters; the city is now reeling in the wake of Helene. For many homeowners, small business owners, and renters in western North Carolina, the damage from Helene will be life-changing. FEMA payouts may bring, at best, only a fraction of what a home would be worth. Auto insurance generally covers all types of damage, including flooding—a small bright spot of relief, but not enough to offset the loss of a family’s main asset.

“People at the coast, at some point after the nth storm, they start to get the message,” Hornstein says. “But for people in the western part of the state, this is just Armageddon. And you can certainly forgive them for not having before appreciated the fine points of these impenetrable contracts.”

Marlett says that there are models for insurance that are designed to better withstand the challenges of climate change. New Zealand, for instance, offers policies that cover all types of damage that could happen to your house; while these policies are increasingly tailored price-wise to different types of risk, there’s no chance a homeowner would experience a climate disaster not covered by their existing policies. But it’s hard, he says, to see the US system getting the wholesale overhaul it needs, given how long the piecemeal system has been in place.

“I sound so pessimistic,” he said. “I’m normally an optimistic person.”

30 notes

·

View notes

Text

Positives about Joe Biden and Negatives about Donald Trump

Positives about Joe Biden

Over the years, Joe Biden has demonstrated an evolution on key issues. Notably, on criminal justice, he has moved far from his much-criticized "tough-on-crime" position of the 1990s. His proposed policies aim to reduce incarceration, address disparities in the justice system, and rehabilitate released prisoners .

Accomplishments: Throughout his extensive political career, Joe Biden has dedicated himself to serving the American people. As a U.S. Senator and Vice President alongside Barack Obama, he has been involved in various initiatives and policies aimed at fighting for Americans .

Leadership and Resilience: Despite facing challenges and uncertainties, President Biden has demonstrated resilience and leadership. His administration has achieved significant milestones, such as the passage of the infrastructure bill, which had been a longstanding goal for previous administrations.

Public Perception: Joe Biden's favorability ratings have been relatively positive, with a net favorability rating of +9 points in recent high-quality live interview polls. His favorability rating is above his unfavorable rating in almost all polls, reflecting a generally positive public perception .

Health and Vigor: Despite facing health challenges, including testing positive for COVID-19, President Biden has shown vigor and determination in fulfilling his duties as the head of state.

Likability and Personal Conduct: According to a Pew Research Center study, voters are more likely to view Joe Biden as warm and likeable compared to Donald Trump. A larger percentage of voters give Biden warm ratings, with about one-in-three voters expressing intensely positive feelings about him .

Accomplishments: President Biden has outperformed Trump on various fronts, including inequality, green spending, and crime. His third year in office was marked by an economy that remained resilient despite challenges like inflation and surging borrowing costs.

Personal Qualities: Despite a decline in public impressions of Biden's personal qualities, he is still perceived as able to manage government effectively. Additionally, a significant percentage of voters believe that Biden cares about the needs of ordinary people.

In summary: Joe Biden's presidency has been considered highly positive due to several key factors. His administration managed to implement significant legislation aimed at economic recovery, infrastructure development, and climate change mitigation. Biden also re-established international alliances and restored a sense of stability and decorum to the presidency. His efforts in addressing the COVID-19 pandemic, including successful vaccination campaigns, were pivotal in saving lives and reviving the economy.

Negatives about Donald Trump

Donald Trump's presidency has been marked by various controversies and criticisms, as evidenced by a range of factors and public opinion.

Worker Safety and Health: The Trump administration has been criticized for disregarding negative impacts on worker safety and health, such as proposing rules that could endanger young workers and patients.

Handling of Race Relations: Trump received negative marks for his handling of race relations, with a majority of adults expressing concerns about his approach and the divisions along racial, ethnic, and partisan lines.

COVID-19 Response: Trump's legacy has been defined by the controversial handling of the COVID-19 pandemic, with widespread criticism of his administration's response to the crisis.

Controversial Statements and Actions: Throughout his political career, Trump has been associated with a series of controversial statements and actions, including derogatory remarks about immigrants and divisive rhetoric.

Erosion of Democratic Institutions: Trump has been criticized for questioning the legitimacy of democratic institutions, including the free press, federal judiciary, and the electoral process, leading to concerns about the erosion of democratic norms.

Tax and Financial Practices: Trump's financial practices, including tax-related issues and potential conflicts of interest, have been the subject of scrutiny and criticism.

Policy Priorities: Critics argue that Trump's policy priorities have favored corporations and the wealthiest few at the expense of other segments of the population.

Public Perception: Public opinion reflects stronger negative views on the potential downsides of a Trump presidency, with concerns about his personality traits, views on immigration, and the economy.

In summary, Donald Trump's presidency has been marked by a range of controversies and criticisms, including concerns about worker safety, race relations, the COVID-19 response, controversial statements, erosion of democratic institutions, financial practices, policy priorities, and public perception. These factors have contributed to a complex and divisive public perception of his presidency.

#politics#donald trump#joe biden#potus#scotus#heritage foundation#trump#democracy#democrats#republicans#please vote#vote blue#get out the vote#vote biden#vote democrat#vote blue to save democracy

27 notes

·

View notes

Text

Large-scale renewable energy is an unlikely success story in sub-Saharan Africa.

As our new work shows, between 2013 and 2023, the installed capacity in wind and solar photovoltaic (PV) energy in the region increased by a factor of 16. And that excludes South Africa, which has installed capacity in wind and solar PV energy of approximately 9,000 MW – higher than all the rest of the sub-Saharan region combined.

This is a remarkable feat. From almost zero in 2010, to around 200 MW in 2013 and then 3,500 MW in 2023, with additional capacity under construction in 2025, utility-scale projects are being developed, financed, built and connected to the grid in nearly all sub-Saharan African countries. This has happened despite major challenges, including conflict, political turmoil, the COVID-19 pandemic, ballooning inflation and public debt.

Efforts thus far have not accomplished enough, with too many people and economies still lacking access to electricity. But this does not make the achievements any less significant, especially when we consider how difficult it is to finance even one moderately sized project in countries where the energy system as a whole is not financially viable for investments. The fact that progress continues despite this monumental barrier is impressive.

What are the secrets that underpin this accomplishment?

4 notes

·

View notes

Text

We have been seeing numerous stories in the media about how people support Donald Trump because he did such a great job with the economy. Obviously, people can believe whatever they want about the world, but it is worth reminding people what the world actually looked like when Trump left office (kicking and screaming) and Biden stepped into the White House.

Trump’s Legacy: Mass Unemployment

The economy had largely shut down in the spring of 2020 because of the pandemic. It was still very far from fully reopening at the point of the transition.

In January of 2021, the unemployment rate was 6.4 percent, up from 3.5 percent before the pandemic hit at the start of the year. A more striking figure than the unemployment rate was the employment rate, the percentage of the population that was working. This had fallen from 61.1 percent to 57.4 percent, a level that was lower than the low point of the Great Recession.

The number of people employed in January of 2021 was nearly 8 million people below what it had been before the pandemic. We see the same story if we look at the measure of jobs in the Bureau of Labor Statistics establishment survey. The number of jobs was down by more than 9.4 million from the pre-pandemic level.

We were also not on a clear path toward regaining these jobs rapidly. The economy actually lost 268,000 jobs in December of 2020. The average rate of job creation in the last three months of the Trump administration was just 163,000.

What the World Looked Like When Donald Trump Left Office

In the fourth quarter of 2020 the economy was still being shaped in a very big way by the pandemic. Most of the closures mandated at the start of the pandemic had been lifted, but most people were not conducting their lives as if the pandemic had gone away. We can see this very clearly in the consumption data.

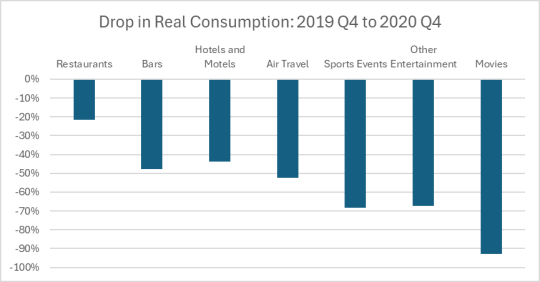

Source: Bureau of Economic Analysis and author’s calculations.

The figure above shows the falloff in consumption between the fourth quarter of 2019 and the fourth quarter of 2020 in some of the areas hardest hit by the pandemic. While overall consumption was down just 0.8 percent, there has been an enormous shift from services to goods.

Inflation-adjusted spending at restaurants was down by 21.5 percent, and much of this spending went for picking up food rather than sit-down meals. Spending at bars was down 47.7 percent. Spending at hotels and motels was down by 43.8 percent as people had hugely cut back travel. Air travel was down 52.4 percent.

Spending on football games, baseball games, and sports events was down by 68.3 percent. Spending on live concerts and other entertainment was down a bit less, at 67.4 percent. And movie going was down 92.7 percent.

The Story of Cheap Gas

Donald Trump and his supporters have often boasted about the cheap gas we had when he was in office. This is true. Gas prices did fall below $2.00 a gallon in the spring of 2020 when the economy was largely shut down, although they had risen above $2.30 a gallon by the time Trump left office. The cause of low prices was hardly a secret, demand in the U.S. and around the world had collapsed. In the fourth quarter of 2020 gas consumption was still 12.5 percent below where it had been before the pandemic.

In fact, gas prices likely would have been even lower in this period if not for Trump’s actions, which he boasted about at the time. Trump claimed to have worked a deal with Russia and OPEC to slash production and keep gas prices from falling further. The sharp cutbacks in production were a major factor in the high prices when the economy began to normalize after President Biden came into office since oil production cannot be instantly restarted.

The End of the Trump Economy Was a Sad Story

Donald Trump handed President Biden an incredibly damaged economy at the start of 2021. People can rightfully say that the problems were due to the pandemic, not Trump’s mismanagement, but the impact of the pandemic did not end on January 21. The problems associated with the pandemic were the main reason the United States, like every other wealthy country, suffered a major bout of inflation in 2021 and 2022.

It is often said that people don’t care about causes, they just care about results. This is entirely plausible, but the results in the last year of the Trump administration were truly horrible by almost any measure.

It may be the case that people are more willing to forgive Trump for the damage the pandemic did to the economy than Biden, but that is not an explanation based on the reality in people’s lives, or “lived experience” to use the fashionable term.

That would mean that for some reason people recognize and forgive Trump for the difficult circumstances he faced as a result of the pandemic, but they don’t with Biden. It would be worth asking why that could be the case.

27 notes

·

View notes

Text

US Dollar Index Decline Could Propel Bitcoin Price to All-Time High in 2025

A Drop in the US Dollar Index Signals a Bullish Bitcoin Price Surge Toward New All-Time Highs. The recent decline in the US Dollar Index (DXY) is fueling speculations that Bitcoin (BTC) could soon reach a new all-time high. The connection between the US Dollar Index and the performance of Bitcoin has been evident in previous market cycles, and analysts are increasingly optimistic about the cryptocurrency's trajectory in 2025.

The US Dollar Index (DXY), which measures the value of the US dollar against a basket of other currencies, has fallen significantly in recent weeks. This movement has piqued the interest of crypto professionals, including Jamie Coutts, Chief Crypto Analyst at Real Vision. Coutts recently highlighted historical trends that show that large losses in the DXY are frequently followed by significant increases in the price of Bitcoin. According to Coutts, when the DXY falls by more than 2%, Bitcoin tends to rally with an average gain of 31.6%, a trend with a remarkable 94% success record over the next 90 days. Also Read: tokenized-assets-hit-50b-projected-to-reach-2t-by-2030/ This observation is not based solely on assumption. Coutts' backtest indicated that if the DXY fell more than 2.5%, Bitcoin gained an average of 37%, with 100% of these occurrences yielding positive returns. The recent slide in the US Dollar Index follows a similar pattern, prompting many to anticipate that Bitcoin will reach new all-time highs by May 2025. The inverse association between the US Dollar Index and Bitcoin is not a recent phenomena. When the US currency falls, investors typically flock to alternative assets, such as Bitcoin, as a store of value. This trend has been most visible during times of economic instability and rising inflation, when traditional dollar-based investments lose appeal. Bitcoin's price has already shown strong upward momentum in the early months of 2025, and present conditions indicate that the trend may continue. Analysts believe that the combination of the US Dollar Index's slide and Bitcoin's increased institutional adoption could pave the way for a new all-time high. In addition to macroeconomic concerns, strong technical indicators indicate to a bright future for Bitcoin. Bitcoin has been steadily rising, breaching major resistance levels and gaining new attention from both retail and institutional investors. These factors, together with the possibility of continuing weakness in the US dollar, indicate that Bitcoin may soon achieve a new all-time high, maybe exceeding $100,000. As we approach 2025, investors will need to regularly monitor the US Dollar Index. If the DXY continues its downward trend, Bitcoin may be well-positioned for a massive price surge, reaching new highs and paving the way for more optimistic market circumstances. The next few months could be important for Bitcoin, with many believing that the cryptocurrency could break past prior price boundaries and reach new all-time highs. To summarise, the decrease in the US Dollar Index provides a unique opportunity for Bitcoin to prosper. If past tendencies hold true, Bitcoin may soon reach an all-time high, ushering in a new period of bullish momentum for the leading cryptocurrency. Read the full article

#2025BitcoinPredictions#All-TimeHigh#Bitcoin#bitcoinforecast#Bitcoinprice#BTCPriceSurge#CryptoAnalysis#cryptocurrency#MarketTrends#USDollar#USDollarIndex

2 notes

·

View notes

Text

Sterling Heights: A Growing Suburban Hub in Michigan

Sterling Heights, Michigan, is a city that continues to evolve, with steady population growth, rising incomes, and a shifting demographic landscape. As the fourth-largest city in Michigan, it plays a significant role in Macomb County’s urban development, offering a mix of residential stability, economic opportunities, and strategic infrastructure.

By analyzing population trends, housing shifts, and income changes from 2014 to 2019, we can better understand Sterling Heights’ strengths and challenges as it moves toward 2040. Compared to its neighboring cities—Warren, Troy, and Clinton Township—Sterling Heights presents a unique case of economic resilience and suburban expansion.

A Brief History of Sterling Heights

Originally a rural farming community, Sterling Heights transitioned into a suburban city during the post-World War II era, as Detroit residents moved to the suburbs. Incorporated as a city in 1968, it quickly became a key player in southeast Michigan’s economy, benefiting from its proximity to Detroit and the automotive industry.

Strategically located along the Clinton River, with access to major highways (I-75, I-94, and I-696), Sterling Heights has become a desirable destination for both residents and businesses. Today, its continued growth suggests an attractive housing market and strong economic foundation.

Sterling Heights vs. Neighboring Cities: Key Demographic Trends (2014-2019)

1️⃣ Population Growth: A City on the Rise

Unlike nearby Warren and Clinton Township, which saw population declines, Sterling Heights experienced a slight population increase, growing by 700 residents (0.53%) between 2014 and 2019.

📈 Troy also grew (by 1.16%), but unlike Sterling Heights, it saw a drop in housing units. This suggests that while Troy remains attractive, it may face challenges in expanding its housing capacity.

📉 Warren and Clinton Township both lost residents, indicating possible suburban migration trends or economic challenges affecting these communities.

2️⃣ Housing & Household Trends: Expanding Options for Residents

🏠 Sterling Heights increased both housing units (+1.49%) and total households (+3.49%), aligning with Macomb County’s overall housing expansion.

📉 Warren and Clinton Township, however, experienced a loss in housing units and households, suggesting possible declining demand or aging housing stock.

📉 Troy had fewer housing units but saw an increase in households, indicating a shift toward higher occupancy rates or more multi-family housing options.

3️⃣ Median Income: Economic Strength Despite Inflation

💰 Sterling Heights showed the highest median income growth, rising from $59,011 in 2014 to $67,238 in 2019 (a 13.95% increase). Adjusted for inflation, the real increase was 5.89%.

📉 Warren, Troy, and Clinton Township all saw income declines when inflation was factored in, indicating regional economic challenges.

📈 Macomb County as a whole saw a strong 27.65% income increase (18.68% inflation-adjusted), suggesting that Sterling Heights is contributing significantly to the county’s overall economic resilience.

Who’s Moving In & Who’s Moving Out? Analyzing Age Trends

🔹 Young adults (20-24) decreased by 30.4%, possibly due to college attendance or job relocation. 🔹 The 25-34 age group grew by 16.5%, suggesting Sterling Heights is attracting young professionals. 🔹 The 35-54 age group declined, indicating that some middle-aged professionals may be relocating. 🔹 Older residents (55-59) increased significantly, likely due to aging Baby Boomers.

📉 The slight decrease in the oldest age groups suggests that Sterling Heights may need more senior-friendly amenities and healthcare options to retain aging residents.

What’s Next for Sterling Heights? Projections for 2040

Using three forecasting methods, projections for Sterling Heights’ 2040 population suggest continued modest growth:

✅ SEMCOG Projection: 140,404 residents ✅ Average Annual Absolute Change (AAAC): 140,791 residents ✅ Growth Share Method: 139,485 residents

📌 The AAAC method aligns best with regional trends, reinforcing Sterling Heights’ steady expansion.

What This Means for Urban Planning & Policy

As Sterling Heights continues to evolve, urban planners must address key demographic trends to ensure sustainable, inclusive growth.

🏡 Housing Diversity is Key – With more young professionals and smaller households, the city should prioritize affordable, mixed-use housing options to meet future demand.

💼 Sustaining Economic Growth – Policies should support local businesses, attract new industries, and enhance job opportunities to maintain income growth and economic resilience.

👵 Senior-Friendly Infrastructure – Expanding healthcare, accessible housing, and public transit could help retain aging residents and maintain community stability.

📊 Smart Growth Strategies – Continued data-driven planning can help Sterling Heights manage growth effectively while ensuring it remains an attractive place to live and work.

Final Thoughts: Sterling Heights as a Model for Sustainable Suburban Growth

Sterling Heights has positioned itself as one of Michigan’s strongest suburban communities, balancing economic development, housing expansion, and demographic shifts. While challenges remain—such as retaining younger residents and addressing income disparities—its steady growth and economic resilience set it apart from neighboring cities.

As we look toward 2040, the city has an opportunity to build on its strengths, ensuring that growth is inclusive, sustainable, and beneficial for all residents.

2 notes

·

View notes

Text

Why Crypto Market Is Down Today: Is FOMC Meeting 2025 the Reason?

The crypto market is down today, and many experts believe the upcoming FOMC Meeting 2025 could be a major factor behind the decline. Investors are reacting cautiously to potential decisions on interest rates, inflation control, and monetary policy, which can significantly impact risk assets like cryptocurrencies. Market uncertainty often leads to volatility, with traders adjusting their positions in anticipation of economic shifts. To know more- Crypto crash

3 notes

·

View notes

Text

Our inflation was caused by external factors (namely covid wrecking supply lines and a major oil producer getting sanctioned for declaring war on a major global breadbasket) not by Biden era economic policy, and we are currently on our way out of said inflationary period with a soft landing. Do you realize how impressive that is? For the most part, the only way to escape an inflationary period is to plunge the economy into recession, and we're on our way out of it with unemployment at a record low.

No, "Bidenomics" is not causing inflation.

4 notes

·

View notes

Text

Christian Pax at Vox:

Is Donald Trump on track to win a historic share of voters of color in November’s presidential election? On the surface, it’s one of the most confounding questions of the Trump years in American politics. Trump — and the Republican Party in his thrall — has embraced anti-immigrant policies and proposals, peddled racist stereotypes, and demonized immigrants. So why does it look like he might win over and hold the support of greater numbers of nonwhite voters than the Republican Party of years past? In poll after poll, he’s hitting or exceeding the levels of support he received in 2020 from Latino and Hispanic voters. He’s primed to make inroads among Asian American voters, whose Democratic loyalty has gradually been declining over the last few election cycles. And the numbers he’s posting with Black voters suggest the largest racial realignment in an election since the signing of the Civil Rights Act in 1964.

There are a plethora of explanations for this shift, but first, some points of clarification. The pro-Trump shift is concentrated among Hispanic and Latino voters, though it has appeared to be spreading to parts of the Black and Asian American electorate. Second, things have changed since Vice President Kamala Harris took over the Democratic ticket in late July. Polling confirms that Harris has posted significant improvements among nonwhite voters, young voters, Democrats, and suburban voters. In other words, Harris has managed to revive the party’s standing with its base, suggesting that a part of Trump’s gains were due to unique problems that Biden had with these groups of voters. Thus, it’s not entirely clear to what extent this great racial realignment, as some have described the Trump-era phenomenon, will manifest itself in November.

[...]

Why? Putting aside environmental factors and shifts in the American electorate that are happening independent of the candidates, there are a few theories to explain how Trump has uniquely weakened political polarization along the lines of race and ethnicity. 1) Trump has successfully associated himself with a message of economic nostalgia, heightening nonwhite Americans’ memories of the pre-Covid economy in contrast to the period of inflation we’re now exiting. 2) Trump and his campaign have also zeroed in specifically on outreach and messaging to nonwhite men as part of their larger focus on appealing to male voters. 3) Trump and his party have taken advantage of a confluence of social factors, including messaging on immigration and cultural issues, to shore up support from conservative voters of color who have traditionally voted for Democrats or not voted at all.

[...]

Theory 1: Effective campaigning on the economy

Trump’s loudest message — the one that gets the most headlines — is his bombastic attacks on immigrants and his pledge to conduct mass deportations. His most successful appeal to voters, though, which he has held on to despite an improving economy under Biden, is economic. Trump claims to have presided over a time of broad and magnificent prosperity, arguing that there was a Trump economic renaissance before Biden bungled it. That pitch doesn’t comport with reality, but it may be resonating with voters who disproportionately prioritize economic concerns in casting their votes, particularly Latino and Asian American voters. Polling suggests that voters at large remember the Trump-era economy fondly and view Trump’s policies more favorably than Biden’s. Black and Latino voters in particular may have more negative memories about Biden and Democrats’ economic stewardship because they experienced worse rates of inflation than white Americans and Asian Americans did during 2021 and 2022.

[...]

Theory 2: Direct appeals to nonwhite men

The political realignment of women voters has been one of the major stories of 2024; the gender gap in American politics exploded in 2016, took a break in 2020, and seems like it’s about to be historic in 2024, with a huge pro-Democrat shift among women. At the same time, though, the rightward drift of men, including men of color, is a quiet undercurrent that may end up explaining what happened if Trump wins in November. Plenty of theories have been raised in the past about what kind of appeal Trump might have specifically to men and to men of color: Does his businessman persona resonate with upwardly mobile, financially aspirational men? Is there a “macho” appeal there for Hispanic men? Could his gritty, outsider, everyman posturing and brash rhetoric resonate with Black and Latino men, particularly those living in traditionally Democratic cities?

[...]

Theory 3: Championing conservative social issues

Trump and the GOP may also have found the right social issues to emphasize and campaign on in order to exploit some of the cultural divides between conservative and moderate nonwhite voters, and liberal white voters who also make up part of the Democratic base (in addition to liberal nonwhite voters). In 2021 and 2022, that looked like fearmongering on gender identity and crime, playing up concerns over affirmative action, and campaigning on the overturning of Roe v Wade. In 2023 and 2024, the Trump focus has shifted strongly toward immigration, an issue that has divided the Democratic coalition as hostility toward immigration has grown. That’s true even for Latino and Hispanic voters — long seen as being the voting group most amenable to a pro-immigrant, Democratic message — and it’s being used as a wedge issue by Republicans among Black voters as well.

Though it was seen as a gaffe, Trump’s “black jobs” comment during the first presidential debate got to this tension — the idea of migrants taking jobs, resources, and opportunities from non-white citizens. Florida Republican Rep. Byron Donalds, one of Trump’s go-to Black surrogates, explained the argument to me like this: “If you’re a Black man, Hispanic man, white man, you’re working hard every day, and the money you earn doesn’t go as far. That hurts your family, that hurts your kids. So they look at this situation, this immigration problem. People are saying, ‘Wait a minute. Why are illegal aliens getting food, getting shelter, getting an education, while my family and my child is struggling. It’s not right, and it’s not fair.’” And for Asian American voters, now the fastest growing ethnic segment of the electorate, immigration is also becoming a wedge issue, Zarsadiaz told me. “This feeling, ‘I’ve waited my turn, I waited my time’ — there’s long been Latino and Asian American immigrants who have felt this way. The assumption has long been that if you’re an immigrant, you must be very liberal on immigration, and that’s definitely not the case,” Zarsadiaz said. “Some of the staunchest critics of immigration, especially on amnesty or Dreamers, are immigrants themselves, and with Asian Americans that’s an issue that has been drawing more voters to Trump and Trumpism — those immigrant voters who feel like they’re being wronged.” Democrats are now moderating on immigration, but only after years of moving left. And that shift left has been true on a range of issues, contributing to another part of this theory of Trump’s gains: that Democrats have pushed conservative or moderate nonwhite Americans away as they embraced beliefs more popular with white, college-educated, and suburban voters. The political scientist Ruy Teixeira and Republican pollster Patrick Ruffini have been theorizing for a while now that a disjuncture over social issues in general — and Trump’s seizure of these issues — has complicated the idea that Democrats would benefit from greater numbers and rates of participation from nonwhite America. It may explain why conservative and moderate voters of color, who may have voted for Democrats in the past, are now realigning with the Republican Party.

[...]

There are signs that some of this shift may be happening independently of Trump. It could be a product of the growing diversification of America, upward mobility and changing understandings of class, and growing educational divides. For example, as rates of immigration change and the share of US-born Latino and Asian Americans grows, their partisan loyalties may continue to change. Those born closer to the immigrant experience may have had more of a willingness to back the party seen as more welcoming of immigrants, but as generations get further away from that experience, racial and ethnic identity may become less of a factor in the development of political thinking.

Concepts of racial identity and memory are also changing — younger Black Americans, for example, have less of a tie to the Civil Rights era — potentially contributing to less strong political polarization among Black and Latino people in the US independently of any given candidate — and creating more persuadable voters in future elections. At the same time, younger generations are increasingly identifying as independents or outside of the two-party paradigm — a change in loyalty that stands to hurt Democrats first, since Democrats tend to do better with younger voters.

Vox explores how Donald Trump made inroads with a portion of the POC vote this election: young men of color.

#Donald Trump#Race#2024 Election Polls#2024 Elections#2024 Presidential Election#Immigration#Conservatism#Gender Gap#Economy

3 notes

·

View notes

Text

Topics: health care, monopoly

In a recent article for Tikkun, Dr. Arnold Relman argued that the versions of health care reform currently proposed by “progressives” all primarily involve financing health care and expanding coverage to the uninsured rather than addressing the way current models of service delivery make it so expensive. Editing out all the pro forma tut-tutting of “private markets,” the substance that’s left is considerable:

What are those inflationary forces? . . . [M]ost important among them are the incentives in the payment and organization of medical care that cause physicians, hospitals and other medical care facilities to focus at least as much on income and profit as on meeting the needs of patients. . . . The incentives in such a system reward and stimulate the delivery of more services. That is why medical expenditures in the U.S. are so much higher than in any other country, and are rising more rapidly. . . . Physicians, who supply the services, control most of the decisions to use medical resources. . . . The economic incentives in the medical market are attracting the great majority of physicians into specialty practice, and these incentives, combined with the continued introduction of new and more expensive technology, are a major factor in causing inflation of medical expenditures. Physicians and ambulatory care and diagnostic facilities are largely paid on a piecework basis for each item of service provided.

As a health care worker, I have personally witnessed this kind of mutual log-rolling between specialists and the never-ending addition of tests to the bill without any explanation to the patient. The patient simply lies in bed and watches an endless parade of unknown doctors poking their heads in the door for a microsecond, along with an endless series of lab techs drawing body fluids for one test after another that’s “been ordered,” with no further explanation. The post-discharge avalanche of bills includes duns from two or three dozen doctors, most of whom the patient couldn’t pick out of a police lineup. It’s the same kind of quid pro quo that takes place in academia, with professors assigning each other’s (extremely expensive and copyrighted) texts and systematically citing each other’s works in order to game their stats in the Social Sciences Citation Index. (I was also a grad assistant once.) You might also consider Dilbert creator Scott Adams’s account of what happens when you pay programmers for the number of bugs they fix.

One solution to this particular problem is to have a one-to-one relationship between the patient and a general practitioner on retainer. That’s how the old “lodge practice” worked. (See David Beito’s “Lodge Doctors and the Poor,” The Freeman, May 1994).

But that’s illegal, you know. In New York City, John Muney recently introduced an updated version of lodge practice: the AMG Medical Group, which for a monthly premium of $79 and a flat office fee of $10 per visit provides a wide range of services (limited to what its own practitioners can perform in-house). But because AMG is a fixed-rate plan and doesn’t charge more for “unplanned procedures,” the New York Department of Insurance considers it an unlicensed insurance policy. Muney may agree, unwillingly, to a settlement arranged by his lawyer in which he charges more for unplanned procedures like treatment for a sudden ear infection. So the State is forcing a modern-day lodge practitioner to charge more, thereby keeping the medical and insurance cartels happy—all in the name of “protecting the public.” How’s that for irony?

Regarding expensive machinery, I wonder how much of the cost is embedded rent on patents or regulatorily mandated overhead. I’ll bet if you removed all the legal barriers that prevent a bunch of open-source hardware hackers from reverse-engineering a homebrew version of it, you could get an MRI machine with a twentyfold reduction in cost. I know that’s the case in an area I’m more familiar with: micromanufacturing technology. For example, the RepRap—a homebrew, open-source 3-D printer—costs roughly $500 in materials to make, compared to tens of thousands for proprietary commercial versions.

More generally, the system is racked by artificial scarcity, as editor Sheldon Richman observed in an interview a few months back. For example, licensing systems limit the number of practitioners and arbitrarily impose levels of educational overhead beyond the requirements of the procedures actually being performed.

Libertarians sometimes—and rightly—use “grocery insurance” as an analogy to explain medical price inflation: If there were such a thing as grocery insurance, with low deductibles, to provide third-party payments at the checkout register, people would be buying a lot more rib-eye and porterhouse steaks and a lot less hamburger.

The problem is we’ve got a regulatory system that outlaws hamburger and compels you to buy porterhouse if you’re going to buy anything at all. It’s a multiple-tier finance system with one tier of service. Dental hygienists can’t set up independent teeth-cleaning practices in most states, and nurse-practitioners are required to operate under a physician’s “supervision” (when he’s out golfing). No matter how simple and straightforward the procedure, you can’t hire someone who’s adequately trained just to perform the service you need; you’ve got to pay amortization on a full med school education and residency.

Drug patents have the same effect, increasing the cost per pill by up to 2,000 percent. They also have a perverse effect on drug development, diverting R&D money primarily into developing “me, too” drugs that tweak the formulas of drugs whose patents are about to expire just enough to allow repatenting. Drug-company propaganda about high R&D costs, as a justification for patents to recoup capital outlays, is highly misleading. A major part of the basic research for identifying therapeutic pathways is done in small biotech startups, or at taxpayer expense in university laboratories, and then bought up by big drug companies. The main expense of the drug companies is the FDA-imposed testing regimen—and most of that is not to test the version actually marketed, but to secure patent lockdown on other possible variants of the marketed version. In other words, gaming the patent system grossly inflates R&D spending.

The prescription medicine system, along with state licensing of pharmacists and Drug Enforcement Administration licensing of pharmacies, is another severe restraint on competition. At the local natural-foods cooperative I can buy foods in bulk, at a generic commodity price; even organic flour, sugar, and other items are usually cheaper than the name-brand conventional equivalent at the supermarket. Such food cooperatives have their origins in the food-buying clubs of the 1970s, which applied the principle of bulk purchasing. The pharmaceutical licensing system obviously prohibits such bulk purchasing (unless you can get a licensed pharmacist to cooperate).

I work with a nurse from a farming background who frequently buys veterinary-grade drugs to treat her family for common illnesses without paying either Big Pharma’s markup or the price of an office visit. Veterinary supply catalogs are also quite popular in the homesteading and survivalist movements, as I understand. Two years ago I had a bad case of poison ivy and made an expensive office visit to get a prescription for prednisone. The next year the poison ivy came back; I’d been weeding the same area on the edge of my garden and had exactly the same symptoms as before. But the doctor’s office refused to give me a new prescription without my first coming in for an office visit, at full price—for my own safety, of course. So I ordered prednisone from a foreign online pharmacy and got enough of the drug for half a dozen bouts of poison ivy—all for less money than that office visit would have cost me.

Of course people who resort to these kinds of measures are putting themselves at serious risk of harassment from law enforcement. But until 1914, as Sheldon Richman pointed out (“The Right to Self-Treatment,” Freedom Daily, January 1995), “adult citizens could enter a pharmacy and buy any drug they wished, from headache powders to opium.”

The main impetus to creating the licensing systems on which artificial scarcity depends came from the medical profession early in the twentieth century. As described by Richman:

Accreditation of medical schools regulated how many doctors would graduate each year. Licensing similarly metered the number of practitioners and prohibited competitors, such as nurses and paramedics, from performing services they were perfectly capable of performing. Finally, prescription laws guaranteed that people would have to see a doctor to obtain medicines they had previously been able to get on their own.

The medical licensing cartels were also the primary force behind the move to shut down lodge practice, mentioned above.

In the case of all these forms of artificial scarcity, the government creates a “honey pot” by making some forms of practice artificially lucrative. It’s only natural, under those circumstances, that health care business models gravitate to where the money is.

Health care is a classic example of what Ivan Illich, in Tools for Conviviality, called a “radical monopoly.” State-sponsored crowding out makes other, cheaper (but often more appropriate) forms of treatment less usable, and renders cheaper (but adequate) treatments artificially scarce. Artificially centralized, high-tech, and skill-intensive ways of doing things make it harder for ordinary people to translate their skills and knowledge into use-value. The State’s regulations put an artificial floor beneath overhead cost, so that there’s a markup of several hundred percent to do anything; decent, comfortable poverty becomes impossible.

A good analogy is subsidies to freeways and urban sprawl, which make our feet less usable and raise living expenses by enforcing artificial dependence on cars. Local building codes primarily reflect the influence of building contractors, so competition from low-cost unconventional techniques (T-slot and other modular designs, vernacular materials like bales and papercrete, and so on) is artificially locked out of the market. Charles Johnson described the way governments erect barriers to people meeting their own needs and make comfortable subsistence artificially costly, in the specific case of homelessness, in “Scratching By: How the Government Creates Poverty as We Know It” (The Freeman, December 2007).

The major proposals for health care “reform” that went before Congress would do little or nothing to address the institutional sources of high cost. As Jesse Walker argued at Reason.com, a 100 percent single-payer system, far from being a “radical” solution,

would still accept the institutional premises of the present medical system. Consider the typical American health care transaction. On one side of the exchange you’ll have one of an artificially limited number of providers, many of them concentrated in those enormous, faceless institutions called hospitals. On the other side, making the purchase, is not a patient but one of those enormous, faceless institutions called insurers. The insurers, some of which are actual arms of the government and some of which merely owe their customers to the government’s tax incentives and shape their coverage to fit the government’s mandates, are expected to pay all or a share of even routine medical expenses. The result is higher costs, less competition, less transparency, and, in general, a system where the consumer gets about as much autonomy and respect as the stethoscope. Radical reform would restore power to the patient. Instead, the issue on the table is whether the behemoths we answer to will be purely public or public-private partnerships. [“Obama is No Radical,” September 30, 2009]

I’m a strong advocate of cooperative models of health care finance, like the Ithaca Health Alliance (created by the same people, including Paul Glover, who created the Ithaca Hours local currency system), or the friendly societies and mutuals of the nineteenth century described by writers like Pyotr Kropotkin and E. P. Thompson. But far more important than reforming finance is reforming the way delivery of service is organized.

Consider the libertarian alternatives that might exist. A neighborhood cooperative clinic might keep a doctor of family medicine or a nurse practitioner on retainer, along the lines of the lodge-practice system. The doctor might have his med school debt and his malpractice premiums assumed by the clinic in return for accepting a reasonable upper middle-class salary.

As an alternative to arbitrarily inflated educational mandates, on the other hand, there might be many competing tiers of professional training depending on the patient’s needs and ability to pay. There might be a free-market equivalent of the Chinese “barefoot doctors.” Such practitioners might attend school for a year and learn enough to identify and treat common infectious diseases, simple traumas, and so on. For example, the “barefoot doctor” at the neighborhood cooperative clinic might listen to your chest, do a sputum culture, and give you a round of Zithro for your pneumonia; he might stitch up a laceration or set a simple fracture. His training would include recognizing cases that were clearly beyond his competence and calling in a doctor for backup when necessary. He might provide most services at the cooperative clinic, with several clinics keeping a common M.D. on retainer for more serious cases. He would be certified by a professional association or guild of his choice, chosen from among competing guilds based on its market reputation for enforcing high standards. (That’s how competing kosher certification bodies work today, without any government-defined standards). Such voluntary licensing bodies, unlike state licensing boards, would face competition—and hence, unlike state boards, would have a strong market incentive to police their memberships in order to maintain a reputation for quality.

The clinic would use generic medicines (of course, since that’s all that would exist in a free market). Since local juries or arbitration bodies would likely take a much more common-sense view of the standards for reasonable care, there would be far less pressure for expensive CYA testing and far lower malpractice premiums.

Basic care could be financed by monthly membership dues, with additional catastrophic-care insurance (cheap and with a high deductible) available to those who wanted it. The monthly dues might be as cheap as or even cheaper than Dr. Muney’s. It would be a no-frills, bare-bones system, true enough—but to the 40 million or so people who are currently uninsured, it would be a pretty damned good deal.

#health care#monopoly#us healthcare#us politics#healthcare#medicine#science#kevin karson#anarchism#anarchy#anarchist society#practical anarchy#practical anarchism#resistance#autonomy#revolution#communism#anti capitalist#anti capitalism#late stage capitalism#daily posts#libraries#leftism#social issues#anarchy works#anarchist library#survival#freedom

2 notes

·

View notes

Note

I get that there’s a multitude of factors that led to both Trump and Claudia Sheinbaum being elected at roughly the same time, but I have to wonder what caused the majority of Latino men here to vote for Trump while Sheinbaum won comfortably in Mexico.

Of course Mexico is one nation in Central/Latin America and doesn’t determine the political attitudes of Latin Americans everywhere, but I understand many theorize that the “macho” look of Trump had a hand in many Latino men voting for him. It’s just a little wild to me that a progressive woman won in Mexico when it’s been a rough election cycle for progressives generally across the globe. Perhaps it’s more of the post-Covid ire that people hold towards incumbent administrations more than anything.