#Fraude Ponzi

Explore tagged Tumblr posts

Text

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

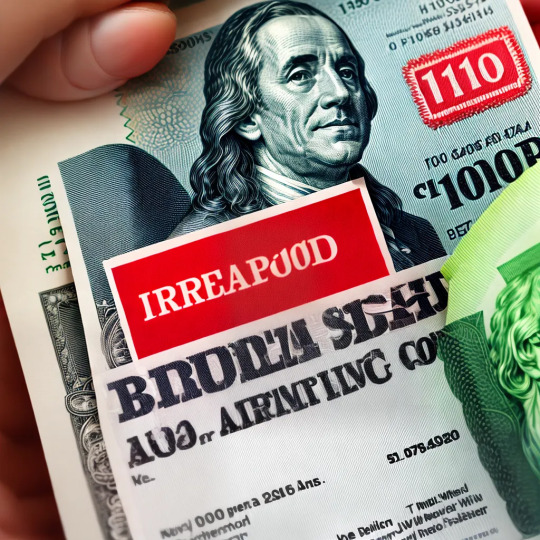

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

431 notes

·

View notes

Text

A Chatham, Ont. mother is spearheading a class action lawsuit alleging a company that collected $14 million in investments from members of her community was actually a Ponzi scheme that fed nearly a third of its funds to Ontario’s self-described ‘crypto king’ Aiden Pleterski.

“It’s definitely been overwhelming,” Emily Hime, the 31-year-old mother, told CTV News Toronto in an interview earlier this month. “The financial stress of it all, it’s impacted my family life quite significantly.”

The class action, filed at the Ontario Superior Court of Justice in May, is representing 125 people who invested with Banknote Capital Inc. after a whistleblower from the company filed a complaint to the Ontario Securities Commission in early 2023 alleging the owner pocketed investments. The lawsuit is ultimately aiming to trace and preserve assets with the goal of redistributing money to investors.

Full article

Tagging: @allthecanadianpolitics

#mine#cdnpoli#canadian news#canadian politics#canada#ontario#chatham#ponzi scheme#fraud#investments#ontario securities commission#banknote capital inc#aiden pleterski#ryan rumble#class action lawsuit#class action#legal#law

49 notes

·

View notes

Text

"Just have fun and be yourself! :)"

Okay, do you want to start a ponzi scheme?

#text#ponzi scheme#multi level marketing#pyramid scheme#fraud#crimes#please god give me a good opportunity to get away with a ponzi scheme. not for the money but the funny.

2 notes

·

View notes

Text

Investing in Cryptocurrency is Bad and Stupid

If you’ve been reading our blog for long, you probably could’ve guessed we think investing in cryptocurrency is bad and stupid.

And yeah, I considered using more expansive words like “unethical” and “speculative” instead of “bad and stupid.” Those words had precision, but lacked panache.

Our Patreon donors vote on potential article topics, and this month they wanted to read our thoughts on investing in cryptocurrency. So we get questions about it all the time! Which isn’t surprising. Relative to cash and traditional investment vehicles, crypto is new and confusing. To make matters worse, there’s so much hype surrounding it in the personal finance world that research feels like reading a data science textbook through a swarm of bees.

Mercifully, we’re not here to explain what crypto is, or how the mysterious blockchain technology works (others have done that intolerably boring work for us). Rather, we’re going to release you from caring about crypto in the first place!

Keep reading.

If you found this helpful, consider joining our Patreon.

19 notes

·

View notes

Text

Shocking! This just in: A Ponzi scheme (e.g. Crypto) was found to be duping Americans out of billions of dollars!

To which the rest of the world responded: "wah wah wah waaahh"

2 notes

·

View notes

Text

[ DJ Envy Subpoenaed For Alleged Ponzi Scheme ]

#wauln#gaming#nba 2k24#DJ envy#whairhouse real estate#the breakfast club#ponzi scheme#bet#vh1#power 105.1#iheart media#cesar pina#taylor company#flip2dao#fraud#scam#fix and flip#Rick Ross#funk master flex

2 notes

·

View notes

Text

डीबी स्टॉक कंसल्टेंसी ने पोंजी स्कीम चलाकर हजारों लोगों से ठगे 400 करोड़, सीबीआई ने किया पांच फर्जी स्कीमों का पर्दाफाश

#News डीबी स्टॉक कंसल्टेंसी ने पोंजी स्कीम चलाकर हजारों लोगों से ठगे 400 करोड़, सीबीआई ने किया पांच फर्जी स्कीमों का पर्दाफाश

Ponzi Scheme Scam: सीबीआई ने बीके मुताबिक एक बड़ी धोखाधड़ी का पर्दाफाश किया है जिसमें आरोपियों ने डीबी स्टॉक कंसल्टेंसी के माध्यम से पोंजी स्कीम चलाकर हजारों निवेशकों को ठगा. इन आरोपियों पर 400 करोड़ रुपये से ज्यादा की धोखाधड़ी का आरोप है. सीबीआई ने इस मामले में 14 अक्टूबर 2024 को जांच अपने हाथ में ली थी और अब तक कई आरोपी पकड़े जा चुके हैं. आरोपियों ने पांच फर्जी स्कीमों में निवेश के नाम पर…

0 notes

Text

Co-Founder of FutureNet Crypto Scheme Arrested in Montenegro

Montenegrin police have arrested Roman Ziemian, co-founder of the fraudulent crypto scheme FutureNet, which caused losses estimated at $21 million. Ziemian, living under a false identity in Podgorica, is wanted by South Korea and Poland for fraud, theft, and money laundering. He faces life imprisonment in South Korea. The High Court in Podgorica will decide on his extradition. FutureNet, launched in 2018, was marketed as a multi-level marketing business but has since been exposed as a financial pyramid scheme.

#Roman Ziemian#FutureNet#Crypto Fraud#Ponzi Scheme#Pyramid Scheme#Extradition#Montenegro#South Korea#Poland#Money Laundering#Cryptocurrency#Financial Crime

1 note

·

View note

Text

#Florida Business Lawyer#Business Litigation Lawyer In Coral Springs#Florida Cryptocurrency Lawyer#Investment Fraud Lawyer In Coral Springs#Florida Ponzi Scheme Fraud Lawyer#Malpractice Lawyer In Coral Springs#Florida Class Action Lawsuits Lawyer#Coral Springs Whistleblower Lawyer#Phone Sim Swaps Lawyer

0 notes

Text

The Lies of Lou Pearlman

Lou Pearlman (1954-2016) would be turning 80 years old today had he not died (appropriately) in prison several years ago. Pearlman was indeed a show biz figure, though that’s not why we note his existence here today. The bands he managed were about as far from my personal taste as you can possibly imagine. But there are numerous other points of interest about this repellent man’s life that seemed…

View On WordPress

1 note

·

View note

Text

Investing in Deception: How Friendship, Love, and Ambition Fueled a $150,000 Scam

This is a story I find deeply triggering, one that I’ve struggled to tell. But in reliving it, there are lessons to be learned about the perils of misplaced trust and the high cost of blind loyalty. It’s a story of deception, ambition, and heartbreak — a cautionary tale about the dark side of supporting friends in their entrepreneurial dreams. For the sake of privacy, names have been changed to protect the innocent.

It was the spring of 2019 when my long-time friend, *Lauryn, came to me with a business opportunity. Lauryn and I had been close for over 15 years, our bond forged in the trenches of grad school and solidified by shared life experiences. When she pitched her idea to me, I didn’t hesitate to listen. She was more than a friend — she was my sister, and I was eager to see her succeed.

Lauryn had been through a lot. Two years earlier, she lost her husband, becoming a single mother to two young children at just 39. As a widow, she faced challenges that would have broken many, but Lauryn was resilient. She was rebuilding her life, and I was invested in her success. That’s why, when she approached me about reviving her wellness business, I was all in.

Lauryn was no novice in the health and wellness industry. She had owned a natural body care line, taught fitness classes, and dreamed of opening her own wellness center. She was knowledgeable, passionate, and ready to take her business to the next level. So, when she met Zacharia Ali — a financier, businessman, and investor — at our local LA Fitness, she believed it was a divine connection.

All Smoke and Mirrors

Zac was everything Lauryn needed at that moment — a businessman with a wealth of experience, or so it seemed. He offered her intimacy, mentorship, and guidance. Lauryn fell for him, both as a romantic partner and mentor. Zac carried himself with an air of authority, his words laced with the promise of success and prosperity. He spoke of his business accolades and widespread connections. He informed her that he was divorced, had sadly lost a child in a car accident, and had moved to the area for a fresh start. He was a practicing Muslim from a prominent family in Philadelphia. He was well-connected and had successfully launched many companies, and now he wanted to do the same for Lauryn.

The First Red Flag: Trust, but Verify

When Lauryn introduced me to Zac, I was initially impressed. He spoke with authority about entrepreneurship, investing, and the importance of ownership in the Black community. He even attended my birthday party, where we discussed his ventures in South America, the Middle East, and the African diaspora. Over time, Zac and I exchanged messages about business opportunities, and he seemed genuinely invested in our shared goals.

Zac became more than just Lauryn’s romantic partner and mentor; he became a central figure in our budding business venture. He offered to use his extensive network to help Lauryn relaunch her brand, promising to turn it into an international success. The plan was ambitious but enticing: we would create a line of CBD-infused skincare products, tapping into the booming wellness market. I was hesitant but hopeful. Lauryn’s trust in him reassured me. In hindsight, I should have let Lauryn and Zac work together without getting involved.

Despite my initial reservations, I convinced myself that Zac’s impressive background and Lauryn’s enthusiasm were enough to move forward. I researched Zac’s company, Zar Capital, and found nothing alarming — just websites and social media endorsements that aligned with his stories. But I ignored the small voice inside that urged caution.

The Second Red Flag: If It Sounds Too Good to Be True, It Probably Is

Despite my initial excitement, a nagging voice in the back of my mind urged caution. I researched Zac and his company, Zar Capital. His online presence seemed legitimate — impressive even. His website detailed his supposed business ventures in South America, the Middle East, and across the African diaspora. But beyond the polished surface, something felt off.

Still, Lauryn was convinced. Zac had become her rock, helping her navigate the complexities of business and life after loss. She believed in him, and because I believed in her, I put my doubts aside. Under Zac’s guidance, we formed a business partnership: Lauryn would hold 50% of the company, Zac 30%, and I would take a 20% stake. It seemed like a fair arrangement, and over the next few months, Lauryn and I made substantial investments via wire transfer, totaling $110,000. We were instructed to send the money to a Navy Federal account for GC Worldwide under the umbrella of Zac’s businesses, CBD Switch Holding Corp and Zar Capital.

Another Red Flag: All New Opportunities Are Not Good Opportunities — The Moringa Mirage

As if the CBD venture wasn’t enough, Zac presented me with another investment opportunity: a business centered around the Moringa plant in Ethiopia. He pitched it as low-risk, with the potential for high returns and the added appeal of supporting Black businesses in Africa. He presented me with diagrams, mocks, financials, a business plan, and extensive research. I invested $40,000, and we formed a company called the Moringa Cartel. Through documented email presentations, Zac promised to establish operations in Ghana, help with the business plan, and set up the website. I was excited about the prospects, but the excitement was short-lived.

Trust Your Gut

Once the money was sent and the paperwork signed, unease set in. I noticed discrepancies, like the fact that our business was registered in Nevada, even though we were all based in the Mid-Atlantic region. I decided to dig deeper, using the state of Nevada’s business portal, Silver Flume. What I found left me reeling: only the company formed between Lauryn, Zac, and me existed as a domestic corporation. My name wasn’t listed anywhere, and neither was Zac’s. Lauryn was the sole officer of the company. As for the Moringa Cartel, it was nothing more than a name reservation that had expired three months after its formation. On paper, my $100,000 investment had vanished into thin air.

“All Skinfolk Ain’t Kinfolk”

The pandemic hit, bringing unforeseen challenges. Despite this, I consistently reached out to Zac for updates. I pleaded with Lauryn to help, assuming her closer relationship with Zac might yield answers. But her relationship with Zac had soured, and she informed me that her new venture with a national television show prevented her from pursuing any legal action for at least a year. I was on my own.

I demanded that Zac dissolve my participation in the business and return my funds. His response was vague, promising to return the money once his partner returned from overseas. But days turned into weeks, and I received nothing but silence. Then, instead of the money, I received a cease-and-desist letter — a blatant attempt to intimidate me. My attorney dismissed it as legally invalid, but the damage was done. I realized too late that I should have involved legal counsel from the start.

Desperate, I contacted the Prince George’s County Financial Crimes Division and met with a detective. Lauryn accompanied me, providing proof of her own financial losses. The detective initially suspected she and Zac were working together to scam me, but her evidence showed otherwise. Still, the State’s Attorney’s office couldn’t help; our losses, though significant to us, didn’t meet the threshold for prosecution.

The Aftermath

The full scope of Zac’s betrayal came to light when I discovered another woman who had fallen victim to his schemes. Through social media, I connected with a young lady on Facebook who had also been scammed by Zac. Her story mirrored Lauryn’s — she, too, had trusted him, invested in his ventures, and been left with nothing but broken promises. She had been physically and romantically involved. The end result was a broken heart and $60,000 poorer. Her story was both devastating and validating. We were not alone, but that did little to ease the pain.

In total, I had invested $100,000 — $60,000 in the CBD skincare line and $40,000 in the Moringa Cartel. But the financial loss was just one part of the devastation. The betrayal cut deeper. Lauryn, the sister I had trusted implicitly, had unknowingly led me into the arms of a predator. Zac had exploited her vulnerability, using our friendship as a tool to manipulate and deceive.

I was left with nothing — no money, no business, and no means of contacting Zac. Emails bounced back, texts went unread, and calls went straight to voicemail. I had been swindled out of $100,000, and there was no way to recover it. Heartbroken, Lauryn had lost $50,000 and wanted nothing more to do with the situation.

Lessons Learned

Looking back, the signs were there. But I ignored them, blinded by the desire to support a friend in need and the allure of a promising business opportunity. I’ve since learned the hard way that when something seems too good to be true, it usually is. In the end, I had to come to terms with the trauma of losing everything because I let my desire to help a friend cloud my judgment. I was emotionally invested in Lauryn’s well-being, but I failed to do my due diligence on Zac. I trusted blindly and paid a heavy price.

Conclusion

In the end, the story isn’t just about a lost investment or a failed business venture. It’s about the importance of critical thinking, the danger of blind loyalty, and the painful reality that not everyone who enters your life has good intentions. I was betrayed by a man I barely knew, but also by my own willingness to believe in the impossible.

Let this be a reminder: Protect your dreams but protect your heart and your wallet even more. This experience has left me scarred, but it has also made me wiser. I share this story not to shame myself or Lauryn, but to warn others. In the world of business, and in life, there are those who will prey on your goodwill and ambition. The best defense is vigilance — ask questions, trust your instincts, and never let excitement cloud your judgment.

#Zacharia Ali#Fraud#Scammer#Business Scam#Investment fraud#CBD Switch#Zar Capital#South Africa#Ghana#Maryland#nevada#Africa#Moringa#investment#Charles County#DC#Black Rose#GC Worldwide#Jerrid Douglas#MLM#ponzi scheme#financial#money matters#la fitness#hustler

0 notes

Text

https://www.agweb.com/news/business/crop-gangsters-million-dollar-farm-ponzi-collapses-under-flood-fish

0 notes

Text

Fun fact "getting into stealing stamps" is a reasonably accurate description of how Charles Ponzi came up with his infamous Scheme! (He didn't invent the pyramid scheme first but he did go off with it.)

[ID: a screengrab of a reblog from @nico-the-overlord, tagged "ohhh sealing not stealing stamps".]

Me to a friend: oh yeah I got into sealing stamps because of an ASMR video. I like that kind of video anyway, molten stuff -- glass blowing, lava, wax, resin casting, sugar sculpture, it's interesting.

Friend: Maybe you should get into glassblowing!

Me: ...I have an entire hashtag dedicated to ways I have injured myself. Maybe sealing wax should be as molten as I'm allowed to get.

420 notes

·

View notes

Text

A maior FRAUDE da história: como GOVERNOS e BANCOS drenam o SEU DINHEIRO 1.2

A maior FRAUDE da história: como GOVERNOS e BANCOS drenam o SEU DINHEIRO – Area Bitcoin. 20 mar 2024 in: AICARR – 2024 abr 01 00:00 – Como começou a fraude fiat 02:03 – Como surgiram os primeiros bancos 04:01 – Bancos viraram parte do Estado: surgimento dos Bancos Centrais 04:57 – Confisco é roubo regulado 06:25 – Como os EUA se tornaram a maior economia do mundo 07:55 – Fim do lastro do…

View On WordPress

#A árvore que dava dinheiro. “Sera´?”# A maior FRAUDE da história: como GOVERNOS e BANCOS drenam o SEU DINHEIRO# A maior FRAUDE da história: como GOVERNOS e BANCOS drenam o SEU DINHEIRO - Area Bitcoin# altos retornos financeiros# Charles Ponzi italiano primeiro esquema Ponzi# Confisco é roubo regulado# crise de hiperinflação. Jornal DCI# década 1920 Estados Unidos# dólar $$ real rs euro moeda iene# emissão de moedas Money dinheiro em espécie# escândalos financeiros# esquema Ponzi de Bernard Madoff#��EUA maior economia do mundo# Fim do lastro do dinheiro# Imprimir dinheiro é fraude# Imprimir dinheiro é um crime contra a humanidade# inflação descontrolada# Lehman Brothers# Marina Souza - Rabisco da História# máquina de roubo silenciosa# primeiros bancos# Roubo via diluição e arrecadação# surgimento dos Bancos Centrais# tipo de fraude financeira investidores# VÍDEO fraude fiat#Tags:inflação#Wall Street

1 note

·

View note

Text

#Florida Business Lawyer#Business Litigation Lawyer In Coral Springs#Florida Cryptocurrency Lawyer#Investment Fraud Lawyer In Coral Springs#Florida Ponzi Scheme Fraud Lawyer#Malpractice Lawyer In Coral Springs#Florida Class Action Lawsuits Lawyer#Coral Springs Whistleblower Lawyer#Phone Sim Swaps Lawyer

0 notes

Text

0 notes