#Financial regulations

Explore tagged Tumblr posts

Text

Regulatory Environment of Financial Institutions.

Financial regulations are laws and rules that govern financial institutions. Regulations of financial institutions focus on providing stability to the financial system, fair competition, consumer protection, and prevention and reduction of financial crimes. By the mid-1970s, the global financial system witnessed market-oriented reforms that led to liberalization in the financial system, such as the reduction of interest rate controls, removal of investment restrictions on financial institutions and a line of business restrictions, and control on international capital movements. The modern trend observed is that financial sector regulation is moving toward a greater cross-sector integration of financial supervision. In 1998, the adoption of the Basel Accord, which required international banks to attain an 8% capital adequacy ratio was a major significant milestone in banking regulations. The collapse of the global financial system that led to the global crisis can be attributed to the systemic failure of financial regulation. Basel I defined bank capital and bank capital ratio based on two-tier systems. The Basel II framework consisted of Part 1, the scope of application and three pillars, the first one being minimum capital requirements, the second one a supervisory review process, and the third pillar is market discipline. The Basel III framework prepared new capital and liquidity requirements for banks.

Learn more about Regulatory Environment of Financial Institutions related to the publication - Strategies of Banks and Other Financial Institutions: Theories and Cases.

#Financial regulations#Regulations of financial institutions#financial security#financial industry#financial markets#financial risk management#bank capital ratio#Basel Accord#interest rate controls#international capital movements#banking system#4 december#sustainable development goals#international day of banks

2 notes

·

View notes

Text

Report on the cryptoasset ecosystem in Latin America and the Caribbean, by the University of Cambridge

This report offers a balanced analysis of the opportunities, and challenges, caused by the many moving parts of the cryptoasset ecosystem in Latin America and the Caribbean. I am happy to have contributed to this as one of the co-authors. I found it particularly interesting how some countries want to lead in the adoption of cryptoassets while others want to be more cautious. The countries that lead believe in their ability to regulate cryptoassets and manage any risks that emerge. They want to have first mover advantage. Other countries do not believe being an early, enthusiastic, adopter is worth the risks, and prefer to wait until the industry and the regulation mature. Both approaches are valid, but in both strategies it is important to follow developments closely. This is where this report can be helpful in gaining insights into this sector’s development, market trends, challenges and opportunities, as well as regulation.

The cryptoasset sector has grown across Latin America and the Caribbean in recent years and this expansion has led to increased employment opportunities. Some cryptoasset firms are now full-service fintech providers. The regulatory views on digital assets have shifted, with around a third of public sector respondents being more positive towards cryptoassets. The private sector participants are also more positive now, and they collaborate more with regulators through innovation hubs and sandboxes. The private sector respondents also see growth opportunities in DeFi services and onboarding corporate clients.

However, there are also challenges to address with the most important one being the lack of regulatory clarity. Public sector respondents believe they need more expertise in cryptoassets.

Reference

Proskalovich R., Jack C., Zarifis A., Serralde D.M., Vershinina P., Naidoo S., Njoki D., Pernice I., Herrera D. & Sarmiento J. (2023) ‘Cryptoasset ecosystem in Latin America and the Caribbean’, University of Cambridge – Cambridge Center for Alternative Finance (CCAF). Available from: https://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/crypotasset-ecosystem-in-latin-america-and-the-caribbean/

#bitcoin#cryptoasset#cryptocurrency#cryptomining#decentralised finance#ethereum#financial regulations

2 notes

·

View notes

Text

Former Cork-based Deloitte executive fails in bid to halt criminal prosecution

In the complex realm of financial regulations and legal agreements, the case of Brian Murphy, a former senior audit partner at Deloitte, has stirred significant debate and legal scrutiny. Mr. Murphy finds himself entangled in a legal battle concerning alleged tax offences, despite asserting his belief that he was shielded from criminal prosecution.

The saga began with a summons issued by the Director of Public Prosecutions (DPP) in February 2014, relating to an alleged VAT refund claim during Mr. Murphy's tenure as a director of a company. Subsequently, in October 2015, further allegations surfaced regarding tax returns spanning from 2008 to 2012, prompting the DPP to seek criminal summons against him.

Mr. Murphy vehemently denies any wrongdoing, basing his defense on an agreement he claims was reached with Revenue in August 2015. According to him, this agreement, made within the context of civil proceedings, included provisions that would shield him from prosecution as long as he complied with a settlement payment plan.

Adding to the complexity are alleged oral representations made to Mr. Murphy by a legal executive acting on behalf of solicitors representing Revenue. These representations, he argues, reinforced his belief that he would not face criminal prosecution.

However, the High Court's ruling in May of the previous year dealt a blow to Mr. Murphy's hopes, affirming that he could indeed be prosecuted for the alleged tax offences. Despite his legitimate expectations based on agreements and representations, the court's decision sets a precedent that emphasizes the primacy of legal process and obligations.

As the legal proceedings unfold, the case of Brian Murphy underscores the intricate interplay between contractual agreements, oral representations, and the authority of legal institutions in matters of taxation and criminal prosecution.

A FORMER senior audit partner at financial services giant Deloitte has lost an appeal against a High Court ruling that he can be criminally prosecuted for alleged tax offences, despite arguing he had a legitimate expectation that he would not be prosecuted. In May of last year, the High Court ruled that Brian Murphy, a qualified accountant and former audit partner with the finance firm Deloitte who brought proceedings against the Revenue Commissioners and the Director of Public Prosecutions, could be prosecuted.

In February 2014, the DPP issued a summons against Mr Murphy in relation to an alleged offence concerning a VAT refund claim on behalf of a company of which Mr Murphy had been a director.

In October 2015, the DPP further applied to have a criminal summons issued against Mr Murphy in relation to alleged offences regarding tax returns between 2008 and 2012.

Mr Murphy, of Carrigaline, Co Cork denies any criminal wrongdoing.

Mr Murphy claimed that a criminal prosecution would breach the terms of an agreement between him and Revenue in August 2015 in the context of certain civil proceedings which he claims meant that he would avoid prosecution if he adhered to a settlement payment plan.

Mr Murphy had further relied on certain oral representations he claimed were made to him on behalf of a legal executive working for solicitors acting for Revenue that he would not be prosecuted.

The appellant claimed his prosecution would amount to a breach of his ‘legitimate expectation’.

Legitimate expectation is a legal principle which may apply where a public body leads a person to believe a particular state of affairs to be undertaken and that person acts to his detriment in reliance on their representation.

Dismissing the 2022 application Mr Justice Garrett Simons said Mr Murphy had not established the grounds for his claim of the breach of his legitimate expectation.

Mr Justice Simons said the agreement between Revenue and Mr Murphy was reached in 2015 following a separate decision in 2014 made by the DPP to issue a criminal summons against him.

That summons related to an alleged offence concerning a VAT refund claim on behalf of a company of which Mr Murphy had been a director.

Mr Murphy then entered into talks with Revenue to also discharge other unrelated arrears of tax before coming to an agreement on payments in August 2015.

He undertook to make monthly payments of €4,000 from August 2015 to December 2018 to settle the outstanding taxes. In addition, Mr Murphy offered to make annual lump sum payments ranging between €20,000 and €75,000.

The judge found that the 2015 agreement did not amount to a representation that the DPP would not pursue criminal proceedings against the appellant.

Mr Justice Simons said that if there was an element in the agreement to prevent criminal prosecution it was “inconceivable that this would not have been expressly recorded in its terms”.

Mr Murphy appealed and his lawyers submitted that the judge did not adequately analyse a series of communications between Revenue and Mr Murphy before the signing of the settlement.

At the Court of Appeal, Mr Justice George Birmingham said Mr Murphy had been “anxious” to enter into a settlement agreement with Revenue that could allow him to keep working in order to make his payments but to also enter into a “highly desirable” agreement that would “preclude criminal proceedings already instituted or any further proceedings”.

“On the other hand, the position of the Revenue Commissioners was that they were not going to commit themselves to non-prosecution or to preclude other means of enforcement,” said Mr Justice Birmingham.

The judge said that Revenue had “articulated clearly” to Mr Murphy that their position would be without prejudice to any other enforcement action or prosecution and had stated that this position be “clearly stated” throughout the settlement document.

However, the draft agreement furnished to Mr Murphy had no mention of a “without prejudice” clause. “It was silent on the issue,” said Mr Justice Birmingham. Mr Murphy then signed the document and claimed that the absence of any mention of prosecution meant he had achieved his objective based on previous discussions with Revenue.

“I am quite unable to conclude that the absence of a ‘without prejudice’ clause amounts to an unambiguous and unequivocal representation to the effect that there would be no prosecutions,” said the judge.

Mr Justice Birmingham said that if Mr Murphy’s position regarding any clause was correct then the “prosecution, which had already been launched, would be halted and that the investigation which was at an advanced stage, would also be halted”.

The judge said that if the appellant was correct then it would have meant that even if underpayment of tax during other years, or other irregularities came to light, then “enforcement would be prohibited”.

“I am bound to say that I regard this as an extraordinary proposition. I cannot believe there was any representation to that effect and most certainly I cannot believe there was any representation that was unambiguous and unequivocal,” said the judge, who stressed that the document was “silent” on the matter.

“Nobody who was facing a prosecution and then found that threat lifted would allow the appearance of the threat to remain in place for a day longer than necessary,” he said, adding that Mr Murphy would have “moved immediately” to have them struck out.

Mr Justice Birmingham said the trial judge properly assessed the case and “he was fully entitled to reject the claim, whether formulated in terms of legitimate expectation, or contract, or some cross between the two”.

Mr Justice Birmingham then dismissed the appeal.

#Taxation#Legal Proceedings#Financial Regulations#Criminal Prosecution#Deloitte#Revenue Commissioners#High Court#Legal Agreements#VAT Refund#Compliance

1 note

·

View note

Text

Countering Money Laundering: New Comprehensive AML Initiative Takes Aim at Financial Threats

In a world where financial crime continues to evolve, combating money laundering has become paramount. Governments and international organizations have devised stringent anti-money laundering (AML) regulations to safeguard the global financial system. Now, a cutting-edge two-day course has emerged, designed to empower professionals with the knowledge and tools needed to reduce risks and enhance AML compliance.

Money laundering represents a significant menace to the stability of the global economy. To tackle this multifaceted issue, governments and international bodies have introduced AML regulations spanning various sectors such as banking, gaming, real estate, legal, and accounting services. Amid this backdrop, a newly launched course on international anti-money laundering regulations and best practices is set to equip professionals with the latest insights.

The two-day program delves deeply into the latest AML developments, with a particular emphasis on the Financial Action Task Force (FATF) recommendations and the European Union's 5th and 6th AML directives, among other international regulations. Attendees will gain comprehensive insights into various facets of compliance, including risk assessments, customer due diligence (CDD), enhanced due diligence (EDD), and transaction monitoring.

Led by experienced trainers, the course employs real-world case studies, interactive discussions, and practical exercises to empower participants with the skills and knowledge required to effectively manage money laundering risks within their organizations. Furthermore, it takes a proactive approach by addressing the risks associated with digital assets, sanctions, and real-world money laundering scandals spanning diverse industries, such as banking, gambling, real estate, law, accounting, and more.

Attendees will not only learn to stay compliant with AML regulations but also discover best practices for mitigating risks effectively. Through a blend of lectures, case studies, and interactive exercises, participants will master the art of conducting AML risk assessments, implementing due diligence procedures, and crafting AML compliance programs aligned with regulatory expectations.

Staying attuned to the ever-changing AML landscape is crucial. This course ensures professionals are well-versed in the latest trends and emerging threats in the world of AML. It also explores innovative strategies to remain one step ahead of potential financial crimes.

Whether one serves as a compliance officer, risk manager, or business leader, this workshop promises to endow individuals with the knowledge and skills required to navigate the intricate realm of AML compliance. The ultimate goal is to foster a safer and more secure global financial system, fortified against the scourge of money laundering.

Participants can anticipate gaining expertise in various critical domains, including understanding the global landscape of money laundering and terrorist financing. This involves appreciating the pivotal role played by AML compliance in mitigating these threats.

Furthermore, attendees will delve into identifying the pivotal components of an effective AML compliance program, fostering a culture of compliance within their organizations, and conducting thorough risk assessments. They will also navigate the intricate web of AML regulations and compliance requirements across diverse jurisdictions.

Staying ahead of the curve remains central to AML compliance, and this course equips participants with insights into the latest trends and emerging threats in the field. It also unveils innovative strategies to counteract these challenges.

In an increasingly digital world, understanding the unique AML risks associated with digital assets is essential. The course ensures attendees are well-versed in these risks and armed with strategies to mitigate them.

Moreover, the program caters to professionals across various industries, including finance, fintech, insurance, real estate, gambling, professional services, and law firms. It imparts specialized insights into industry-specific AML compliance requirements, enabling professionals to address risks within their respective sectors effectively.

Effective cross-functional collaboration is also emphasized as a means to promote AML compliance. Strategies for engaging with stakeholders across organizations are part of the course content. Additionally, the program underscores the importance of effective training and communication in promoting AML compliance, guiding participants in implementing training programs within their organizations.

Professionals will also learn best practices for conducting AML investigations and how to respond to regulatory inquiries and audits. By the end of the course, attendees will have a robust action plan for implementing AML compliance strategies and ongoing risk mitigation.

Networking opportunities with fellow AML professionals further enrich the learning experience, allowing for the exchange of valuable experiences and perspectives.

For those eager to enhance their AML compliance skills, here is the schedule of upcoming programs by Shasat. However, we recommend you continue to visit Shasat's website for the most up-to-date program schedules.

Anti-Money Laundering (AML) Compliance Workshop | GID 24001 | London: October 19-20, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24003 | Singapore: October 30-31, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24004 | Bermuda: September 28-29, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24005 | Las Vegas: December 18-19, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24006 | Riga: October 24-25, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24007 | Zurich: November 2-3, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24008 | Sydney: December 4-5, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24009 | Mumbai: November 6-7, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24010 | Mexico City: December 11-12, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24011 | Lagos: December 21-22, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24012 | Istanbul: November 13-14, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24013 | Manila: October 30-31, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24014 | Cyprus: October 26-27, 2023

Anti-Money Laundering (AML) Compliance Workshop | GID 24000 | Online | Available on request

For more details and to enrol in the Anti-Money Laundering (AML) Training Programs, please visit:

https://shasat.co.uk/product-category/anti-money-laundering-training-programs/

This comprehensive AML course equips professionals with the knowledge and skills needed to navigate the complex world of AML compliance effectively.

#AML#AML Compliance#Money Laundering#Financial Regulations#Risk Mitigation#Anti-Money Laundering#Financial Training#Professional Development

0 notes

Text

Mastering Accounts Payable: 15 Common Interview Questions and Expert Answers

Preparing for an Accounts Payable (AP) interview is a crucial step in securing a position in this vital finance function. To help you excel in your interview, we’ve compiled a comprehensive guide that covers the 20 most common AP interview questions, each paired with expert answers. In this article, you’ll gain valuable insights into the world of AP and enhance your chances of acing your…

View On WordPress

#Accounting#Accounting Software#Accounting Standards#Accounts Payable#Accuracy in AP#AP Interview#Cost Savings#data security#Disputed Invoices#Financial Regulations#Foreign Currency Transactions#Fraud Prevention#High Invoice Volume#Invoice Processing#Payment Methods#Tax Compliance#Urgent Payments#Vendor Onboarding#Vendor Relationships

0 notes

Text

#this came to me in a vision#i dont believe in santa but gimme emotional regulation and financial stability 🤲#actually bpd#bpd#bpd meme#bpd shit#actually borderline#rambles

319 notes

·

View notes

Text

Is an RB podium bad for F1?

#how would it not be a ‘genuine’ podium simply because they’re taking parts off Red Bull that is well within the regulations???#I can’t believe they’re going to make me deep throat a corporation on main like that all season long#a backmarker gets some financial backing and decides to exploit some symbiosis within legal boundaries of the sport#and suddenly it’s a problem?#and not to make this about Daniel but would this have gotten this much attention if it would have been any other driver pairings at RB?#daniel ricciardo

124 notes

·

View notes

Note

Hello, I've been paying attention to Dustborn and the only actual question I would like to make is if you see anything worth dissecting on the fact that it got tax money from the EU? Games funded by a government are very rare, so I wonder if analyzing the game from that perspective provides something interesting into game development.

Getting tax breaks and incentives from various governments is actually very common. Government investment is often a lot like scholarships to university - they have bundles of money set aside for applicants that meet certain criteria. Most governments are interested in encouraging economic activity within their borders, especially tech industry growth. Tech pays pretty well, isn't large on space, and encourages secondary growth - tech workers that move to the area will buy usually houses and spend with local businesses, leading to a positive cycle of improved economic growth for the area.

As an example of this, in 2020 the Department of Community & Economic Development of Pennsylvania offered a [tax credit] of 25% of qualified expenses for the first four years of development and 10% for each subsequent year back in 2020 to game developers who spent at least 60% of their total production costs in Pennsylvania. The politicians were hoping to encourage game developers to move to Pennsylvania and they were offering tax credits as incentive.

Similarly, the Norwegian Film Institute offers funding to [audiovisual productions that meet their criteria]:

The screenplay, or the literary work on which the screenplay is based, has originally been written in the Norwegian or Sami language

The main theme is connected to Norwegian history, culture or social conditions

The action takes place in Norway, in another EEA country (countries of the European Union [EU] plus Iceland, Liechtenstein)

The work contains significant contributions from rights holders or artists resident in Norway or in another EEA country.

Dustborn ticked enough of these boxes that the NFI agreed to fund them. It wasn't a special thing, it was government money set aside to encourage the development of Norwegian-focused cultural audio visual works. That includes video games, movies, television, or any other kind of audio visual production. Lots of smaller works, games included, find funding through programs and grants like this.

[Join us on Discord] and/or [Support us on Patreon]

Got a burning question you want answered?

Short questions: Ask a Game Dev on Twitter

Long questions: Ask a Game Dev on Tumblr

Frequent Questions: The FAQ

27 notes

·

View notes

Text

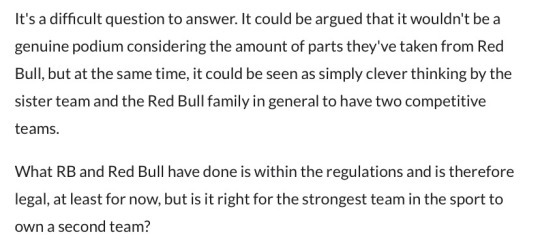

#cartoon#political cartoon#political meme#US Politics#Two Party System#Neoliberalism#Deregulation#US Political Critique#editorial#editorial cartoon#de-regulation#Cuyahoga#Love Canal#Pollution#US environmental#environment#Boeing#financial crisis#2008#political memes#relatable memes#us history#historical grievances

8 notes

·

View notes

Text

Is Bitcoin a Good Investment?

#cryptocurrency#Blockchain Technology#Decentralized Finance (DeFi)#Financial markets#Digital Assets#Investment Risks#Bitcoin Volatility#Inflation Hedge#Cryptocurrency Regulation#Bitcoin Investment

2 notes

·

View notes

Text

not to keep clowning on other peoples posts but I can't take that one seriously that's like spaced out modern poetry style and starts with

maybe real self worth

is a regulated nervous system,,,,

#babygirl that's not how that works#I can have real self worth and still have the same nervous disposition and accompanying negative health effects as a hyena#and before you get on me before 'oh you can go to therapy and do biofeedback' self worth is unrelated to the financial situation that allows#or disallows someone from accessing treatments#that's not even getting into how disabled people with dis regulated nervous systems have real self worth didjdbdisdhdhsifj#people be so fuckin stupid in the name of poetry and the bastardized capitalistic idea of mental health

5 notes

·

View notes

Text

AN OPEN LETTER to THE U.S. CONGRESS

Hold Bank Execs Financially Accountable for Mismanagement! Pass the DEPOSIT Act.

274 so far! Help us get to 500 signers!

I am writing to urge you to pass the Deliver Executive Profits on Seized Institutions to Taxpayers (DEPOSIT) Act that was recently introduced by Sen. Richard Blumenthal and U.S. Reps Adam Schiff (D-CA) and Mike Levin (D-CA).

This important legislation would hold executives at failed banks financially responsible for their mismanagement and prevent them from selling off shares of stock, potentially profiting from their bank failure -- like Silicon Valley Bank CEO Greg Becker might have done when he sold $3.6 million of stock shortly before the collapse of SVB.

American taxpayers shouldn’t be left holding the bag and bailing out banks while their executives are walking away with multi-million dollar compensation and bonus packages. Please respond in writing and let me know you co-sponsored this bill. Thanks!

▶ Created on March 24, 2023 by Jess Craven

📱 Text SIGN PNFKGB to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#AN OPEN LETTER to THE U.S. CONGRESS#Hold Bank Execs Financially Accountable for Mismanagement! Pass the DEPOSIT Act.#274 so far! Help us get to 500 signers!#Deliver Executive Profits on Seized Institutions to Taxpayers (DEPOSIT) Act#Sen. Richard Blumenthal#Adam Schiff#Mike Levin#Silicon Valley Bank#CEO Greg Becker#holding the bag#bailing out#multi-million dollar compensation#bonus packages#▶ Created on March 24 2023 by Jess Craven#📱 Text SIGN PNFKGB to 50409#🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409#JESSCRAVEN101#PNFKGB#resistbot#U.S. Congress#DEPOSIT Act#bank executives#financial accountability#mismanagement#legislation#accountability#taxpayer protection#banking industry#executive responsibility#financial regulation

4 notes

·

View notes

Text

Bitcoin Going Parabolic: A Closer Look at the Factors Driving the Surge

Bitcoin has been a subject of fascination and debate for over a decade. Recently, the buzz around its potential parabolic rise has reached new heights. With multiple presidential nominees proposing to make Bitcoin a strategic reserve asset and groundbreaking legislative efforts, the cryptocurrency is poised for a significant breakthrough. In this blog post, we will explore the factors contributing to Bitcoin's potential meteoric rise and what this could mean for the future of finance.

Current Market Overview

The Bitcoin market has seen remarkable stability and growth over the past year. Despite global economic uncertainties, Bitcoin's price has maintained an upward trajectory, driven by increased adoption and growing institutional interest. The market's resilience has only strengthened the belief that Bitcoin is here to stay.

Factors Driving Bitcoin's Potential Parabolic Rise

Institutional Adoption Institutional investment in Bitcoin has been one of the most significant drivers of its price surge. Companies like MicroStrategy, Tesla, and Square have made substantial Bitcoin purchases, demonstrating their confidence in its long-term value. Recently, MicroStrategy announced plans to raise $2 billion to buy more Bitcoin, adding to its already significant holdings of 226,500 BTC. This move exemplifies the growing trend of institutions recognizing Bitcoin as a hedge against inflation and economic instability.

Regulatory Developments Positive regulatory changes are also contributing to Bitcoin's upward momentum. Notably, several presidential nominees in the upcoming election have expressed their support for Bitcoin, proposing to make it a strategic reserve asset for the United States. Additionally, Senator Cynthia Lummis has introduced a groundbreaking bill to establish a U.S. Bitcoin reserve. This legislation aims to treat Bitcoin like gold or oil, strengthening the country's economy and positioning Bitcoin as a permanent national asset. Such initiatives could legitimize Bitcoin on a national level, potentially triggering a wave of similar actions from other countries.

Monetary Policy Shifts The Federal Reserve is expected to cut interest rates in September, a move that historically leads to Bitcoin price pumps. Lower interest rates often result in increased liquidity in the financial system, driving investors to seek alternative stores of value like Bitcoin. Moreover, the global M2 money supply is skyrocketing, indicating a significant increase in the amount of money in circulation. This surge in money supply can lead to inflation, further underscoring the appeal of Bitcoin as a deflationary asset.

Technological Advancements Bitcoin's underlying technology continues to evolve, enhancing its security, efficiency, and scalability. Innovations such as the Lightning Network and Taproot upgrade are making Bitcoin transactions faster and more cost-effective, further cementing its position as a superior financial instrument.

Historical Parabolic Trends in Bitcoin

Bitcoin's history is marked by several parabolic rises, each driven by different factors but sharing common themes of increased adoption and market maturation. The 2017 bull run, fueled by retail investor interest, and the 2020-2021 surge, driven by institutional adoption, provide valuable insights into the current trend. Studying these patterns helps us understand the potential trajectory of Bitcoin's price movement.

Expert Predictions and Analysis

Experts in the field of cryptocurrency are making bold predictions about Bitcoin's future. Influential figures like Michael Saylor, CEO of MicroStrategy, and Cathie Wood, CEO of ARK Invest, have forecasted Bitcoin reaching new all-time highs. Their analyses are based on Bitcoin's scarcity, growing adoption, and its role as digital gold.

Potential Challenges and Risks

While the outlook for Bitcoin is promising, it is essential to acknowledge the potential challenges and risks. Regulatory hurdles, market volatility, and technological vulnerabilities could impact Bitcoin's growth. Investors must remain vigilant and informed to navigate these challenges effectively.

Conclusion

Bitcoin's potential to go parabolic is underpinned by strong institutional support, favorable regulatory developments, and continuous technological advancements. As multiple presidential nominees propose to make Bitcoin a strategic reserve asset and Senator Lummis's groundbreaking bill aims to establish a U.S. Bitcoin reserve, the stage is set for a significant transformation in the financial landscape. With MicroStrategy's aggressive strategy to raise $2 billion for more Bitcoin purchases and the expected interest rate cuts by the Federal Reserve, the momentum is undeniable. Additionally, the skyrocketing global M2 money supply highlights the growing need for a deflationary asset like Bitcoin. Whether you're an investor, a crypto enthusiast, or a curious observer, staying informed about these developments is crucial as we witness the evolution of Bitcoin.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Crypto#Cryptocurrency#BTC#Blockchain#FinancialRevolution#DigitalGold#Investing#InstitutionalAdoption#Regulation#BitcoinNews#CryptoMarket#BitcoinPrice#BitcoinInvestment#FederalReserve#MonetaryPolicy#InterestRates#M2Supply#SenatorLummis#MicroStrategy#ParabolicRise#FinancialFreedom#financial experts#digitalcurrency#unplugged financial#globaleconomy#financial education#financial empowerment#finance

5 notes

·

View notes

Text

#2008#bankruptcy#credit default swaps#crisis#derivatives#financial collapse#fraud#government bailout#investigation#lending practices#mortgage-backed securities#regulation#regulatory failure#risky loans#Silicon Valley Bank#subprime mortgages#systemic risk#United States

11 notes

·

View notes

Text

Binance also operated in the state of Heisenbergian uncertainty, sometimes known as Malta. Malta has a substantial financial services industry, which welcomed Binance with open arms in 2018 and then pretended not to know him in 2020. This continues Malta’s proud tradition of strategic ambiguity as to whether it is an EU country or rentable skin suit for money launderers. ¿Por qué no los dos? Despite this, Binance would continue claiming to customers and other regulators for a while that it was fully authorized to do business by Malta.

Patrick McKenzie, Bits about Money

#quote#quotation#Patrick McKenzie#Bits about Money#Binance#(I put this in the tags with some trepidation)#Heisenbergian uncertainty#Malta#financial services industry#strategic ambiguity#country#skin suit#see also: Cyprus#customers#regulators#money laundering

2 notes

·

View notes

Text

Man

#perfect storm of feels bad happening#it’s still too humid for me to be comfortable like my body cannot regulate still#and it’s a traumaversary (not just. the historical one lmao)#and I have a super long day with new and difficult students#(the kids are good just what they need is more challenging)#and my financial stuff still isn’t figured out#it’s just a Lot and I wish I could have a proper break at some point#i just want to not feel like I’m being hunted for sport for a little bit

4 notes

·

View notes