#Tax Compliance

Explore tagged Tumblr posts

Text

📢 What is a Tax Return and Why is It Essential?

Filing a tax return isn’t just a legal obligation – it’s a key financial responsibility. Whether you're a business owner or an individual, submitting your tax return ensures compliance with regulations and helps you avoid penalties.

🔹 Why is filing a tax return important? ✔ Avoid penalties: Late or missing tax returns result in fines. ✔ Access tax exemptions: Proper filing can reduce your tax liability. ✔ Prevent arbitrary tax assessments: Filing ensures your taxes are calculated fairly. ✔ Build financial credibility: Essential for business loans and contracts.

📌 Did you know that missing the deadline can lead to financial restrictions or even legal consequences? Stay compliant and manage your taxes wisely!

3 notes

·

View notes

Text

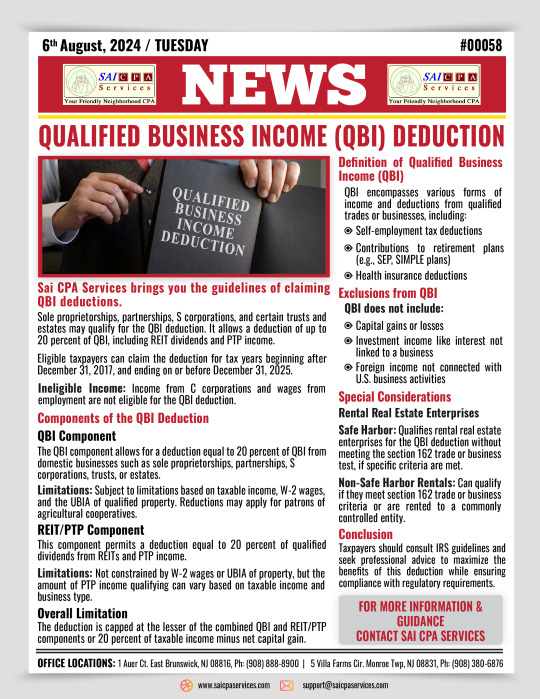

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#financial services#irs#tax debt#audit#tax compliance#peace of mind#business growth#cpa#new jeresy#accounting#bookeeping#financial planning#BusinessForecasting#financial statements#strategic planning#representation#news#breaking news

2 notes

·

View notes

Text

#taxes#tax services#tax season#april 15th#tax#income tax#pay your taxes#tax consultant#tax compliance#tax credits#tax corporations

3 notes

·

View notes

Text

Income Tax Return Filing & GST Consultant in Mumbai – Expert Tax Solutions

Mastering Tax Compliance: A Complete Guide to Income Tax Return Filing and Choosing the Best GST Consultant in Mumbai

Tax compliance is a crucial responsibility for individuals and businesses alike. Whether it's filing income tax returns or ensuring smooth Goods and Services Tax (GST) compliance, handling tax matters correctly can save you from penalties and legal complications.

If you're unsure how to go about Income tax return filing or need professional guidance from an expert GST consultant in Mumbai, this blog is your ultimate guide.

In this detailed blog, we’ll cover everything from the basics of income tax filing to the benefits of hiring a GST consultant. Let’s get started!

What is Income Tax Return Filing?

Income Tax Return (ITR) filing is the process of reporting your income, expenses, tax deductions, and tax payments to the Income Tax Department. This ensures transparency and compliance with tax laws.

Who Needs to File an Income Tax Return?

Salaried Employees – If your annual income exceeds the basic exemption limit, you must file ITR.

Business Owners & Freelancers – Self-employed individuals must report income and expenses.

Companies & Corporations – All registered businesses must file tax returns, regardless of profit or loss.

Individuals with Foreign Income – NRIs and residents with overseas assets need to file returns.

People Claiming Tax Refunds – If excess TDS has been deducted, you can claim a refund via ITR filing.

Why is Filing ITR Important?

Avoid Penalties – Late filing attracts fines and interest charges.

Loan & Credit Card Approvals – Banks require ITR documents for loan applications.

Visa Applications – Some embassies ask for ITR proof during visa processing.

Claiming Refunds – If you’ve paid more tax than required, you can claim a refund.

Legal Compliance – Non-filing may invite scrutiny and penalties from tax authorities.

Step-by-Step Guide to Income Tax Return Filing

Filing an Income tax return filing has become easier with online platforms. Here’s how you can do it:

Step 1: Gather Necessary Documents

PAN Card and Aadhaar Card

Salary Slips & Form 16 (for salaried employees)

Bank Statements

Investment & Deduction Proofs (PPF, LIC, Mutual Funds)

TDS Certificates

Step 2: Select the Right ITR Form

Different forms cater to different taxpayers. For instance:

ITR-1: Salaried individuals with income up to ₹50 lakh

ITR-3: Business owners and professionals

ITR-4: Presumptive income scheme filers

Step 3: Calculate Your Taxable Income

Add income from all sources and subtract eligible deductions under Sections 80C, 80D, etc., to arrive at taxable income.

Step 4: Pay Outstanding Tax, If Any

If the calculated tax liability exceeds TDS, pay the balance online through the tax portal.

Step 5: File & Verify Your ITR

Submit the return via the e-filing portal and verify it using Aadhaar OTP, net banking, or by sending a signed ITR-V copy to the Income Tax Department.

Step 6: Keep Acknowledgment for Future Reference

Download the acknowledgment receipt (ITR-V) for documentation.

Understanding GST and the Need for a GST Consultant in Mumbai

Goods and Services Tax (GST) has streamlined India’s tax system by replacing multiple indirect taxes. However, GST compliance is complex, making it essential for businesses to seek guidance from a GST consultant in Mumbai.

Who Needs a GST Consultant?

Startups & New Businesses – To ensure correct GST registration.

E-commerce Sellers – GST rules for online businesses can be tricky.

Exporters & Importers – Special GST provisions apply to international trade.

Businesses with High Transactions – Regular GST compliance is needed.

Companies Facing GST Audits – Expert assistance is crucial to handle audits and notices.

Benefits of Hiring a GST Consultant

✅ Error-Free GST Registration & Filing – Avoid mistakes in your GST compliance. ✅ Timely GST Returns – Delays can lead to penalties, so timely filing is essential. ✅ Tax Optimization – Maximize your input tax credit (ITC) to reduce tax liability. ✅ Handling GST Audits & Notices – Get professional assistance in case of tax scrutiny. ✅ Peace of Mind – Focus on business while experts handle your tax compliance.

Common GST Services Offered by Consultants

A GST consultant in Mumbai provides:

GST registration and filing

Monthly and annual return preparation

GST reconciliation and audits

GST refunds and ITC claims

Compliance with e-invoicing and e-way bills

Common Mistakes to Avoid in Tax Compliance

Income Tax Filing Mistakes

❌ Failing to report all income sources ❌ Selecting the wrong ITR form ❌ Forgetting to verify the ITR ❌ Missing tax deductions ❌ Not linking PAN with Aadhaar

GST Filing Mistakes

❌ Delayed GST registration ❌ Incorrect GST classification and rates ❌ Errors in filing GST returns ❌ Missing ITC claims ❌ Failing to respond to GST notices

Seeking expert help for Income tax return filing and hiring a professional GST consultant in Mumbai can prevent these issues.

Why Choose Jadhav & Associates for Your Tax Needs?

Jadhav & Associates is a reputed name in tax consultancy, offering expert guidance in Income tax return filing and GST consultant in Mumbai.

Why Work with Jadhav & Associates?

✅ Expertise in Income Tax & GST Compliance ✅ Seamless ITR & GST Return Filing ✅ Customized Tax Solutions for Businesses & Individuals ✅ Affordable & Transparent Pricing ✅ Proven Track Record of Accuracy & Compliance

Whether you need assistance with Income tax return filing or require an expert GST consultant in Mumbai, Jadhav & Associates can help ensure hassle-free compliance.

Conclusion: Stay Compliant & Maximize Savings with Expert Tax Assistance

Filing your ITR and staying compliant with GST regulations is essential to avoid legal troubles and maximize tax benefits. By working with tax experts, you can save time, minimize errors, and ensure seamless compliance.

If you’re looking for professional Income tax return filing services or need guidance from a reliable GST consultant in Mumbai, get in touch with Jadhav & Associates today!

Take control of your taxes and enjoy peace of mind with expert guidance.

#Income Tax Return Filing#GST Consultant in Mumbai#Tax Filing Services#GST Return Filing#Income Tax Consultant#Tax Consultant Mumbai#ITR Filing Online#GST Registration#Business Tax Solutions#Tax Compliance

0 notes

Text

Below the Tax Limit: Why Filing ITR is a Must, Even If You Don’t Pay Taxes

” Why filing an Income Tax Return (ITR) is beneficial, even if your income is below the taxable limit. Learn about tax refunds, financial stability, visa processing, and more. Stay compliant and unlock hidden advantages with this comprehensive guide to ITR filing for low-income earners.” Understanding the importance of filing an Income Tax Return (ITR) is crucial, even if your income falls below…

#filing ITR#financial stability#government schemes#Income Tax Return#ITR filing online#low income tax#Tax Benefits#tax compliance#tax refund#visa processing

0 notes

Text

UK Introduces Tax Avoidance Whistleblower Scheme

In a significant move to bolster its anti-fraud enforcement and crack down on tax avoidance and tax evasion, the United Kingdom has announced the launch of a new whistleblower reward scheme. This groundbreaking initiative, overseen by HM Revenue & Customs (HMRC), is modeled after the highly successful tax whistleblower program in the United States, offering substantial financial incentives for…

#First Tier Tax Tribunal#HMRC#HMRC enforcement#hmrc investigation#HMRC Investigations#HMRC Policy#HMRC Tax Assessment#HMRC Tax Disputes#reporting tax fraud#Tax Avoidance#tax avoidance whistleblower#tax compliance#tax dispute solicitors#Tax Evasion#Tax Fraud#Tax Gap#tax whistleblower scheme#UK tax law#Unpaid Tax#VAT#whistleblower reward

0 notes

Text

Exploring the new tax incentives for startups introduced in the 2025 Budget. This would include an analysis of the reduced tax rates, tax holidays, and the government’s efforts to foster entrepreneurship and innovation.

In this article, we will explore the key features of the 2025 tax reforms, the opportunities they present for startups, and the challenges that come with implementing these changes. By gaining a clearer understanding of the new tax landscape, startups can make informed decisions that will help them scale and succeed in a competitive market.

Key Features of the New Tax Regime for Startups

The new tax measures introduced in the 2025 Budget focus on making the startup ecosystem more competitive globally. Here are the main highlights:

Lower Corporate Tax Rate

15% Tax Rate for New Startups A major component of the 2025 tax regime is the introduction of a reduced 15% corporate tax rate for new startups in the first 5 years of operation. Previously, this rate was available only for specific sectors or businesses fulfilling certain conditions. The 2025 change broadens this to include more startups, helping them retain more earnings to reinvest in growth.

Eligibility Criteria To qualify, startups must have been incorporated after a certain date (specified by the government). This offers substantial savings for those who are in the early stages of their journey.

Tax Holidays and Exemptions

Tax Holiday for the First 5 Years: Startups incorporated after the 2025 Budget will be eligible for a tax holiday for the first 5 years of their operations, with no minimum tax liability. This is an extension of previous measures that allowed startups to focus on growth and innovation without the immediate pressure of corporate tax.

Carry Forward of Losses: In a bid to help startups focus on growth, the government has extended the ability for startups to carry forward losses even if they haven’t made a profit in the first 10 years of operation. This enables them to offset losses against future profits, reducing tax liabilities in subsequent years.

Easier Compliance and Filing Process

Simplified Compliance: The government has made provisions for simplified tax filings, reducing the compliance burden on new entrepreneurs. With a focus on digital platforms and AI-based systems, the process of submitting returns and managing records will be streamlined.

Reduction in Tax Audits: For qualifying startups, the threshold for mandatory tax audits has been raised, reducing the burden of audits in the initial years of business. This will allow young businesses to focus on their core operations without the distraction of frequent audits.

Enhanced Depreciation on Equipment and Infrastructure

Startups investing in equipment, infrastructure, and technology will be able to claim higher depreciation rates, leading to reduced taxable income. This provision is particularly helpful for technology-driven startups and those in sectors that require significant capital expenditure, such as manufacturing or renewable energy.

#Tax Compliance#New Tax Regime#Startups#2025 tax reforms#2025 Budget#Corporate Tax Rate#Tax Rate#Tax Audits#uja global advisory

1 note

·

View note

Text

Mastering GST: A Guide for Plastic Surgeons & Dermatologists

Stay ahead with our Mastering GST crash course designed for plastic surgeons and dermatologists. Understand GST compliance, tax benefits, and financial planning specific to the medical industry. Enroll now at Elegance Vidhyalay and take control of your taxation strategies!

0 notes

Text

Tax compliance plays a critical role in maintaining smooth employer-employee relationships. When businesses fail to comply with tax laws, they often struggle with financial constraints, leading to delayed salary payments or disputes. Employees who do not receive their rightful wages may take legal action, which can further complicate matters for businesses.

Understanding the connection between tax compliance and salary disputes is crucial for both employers and employees to avoid legal complications.

#legal#legal services#tax#legal notice#legal notice section#legal notice for non payment of salary#legal notice to company for not paying salary#cheque bounce notice#cheque bounce notice period#Tax Compliance

0 notes

Text

Why Every Business Needs a Payroll Expert for Hassle-Free Salary Processing

In today’s fast-paced business world, managing payroll efficiently is crucial for every organization. Whether you run a small startup or a large corporation, ensuring timely and accurate salary processing is essential to maintain employee satisfaction and regulatory compliance. This is where a Payroll Expert comes into play.

At Ignite HCM, we understand the complexities of payroll management and how it can impact business operations. A Payroll Expert is not just responsible for paying employees; they ensure accuracy, compliance, and efficiency in the entire payroll process. In this blog, we’ll explore why every business needs a Payroll Expert and how they can help streamline salary processing seamlessly.

What is a Payroll Expert?

A Payroll Expert is a professional responsible for managing payroll functions, ensuring accurate salary calculations, handling tax deductions, maintaining compliance with labor laws, and overseeing employee benefits. They play a vital role in ensuring that payroll runs smoothly, reducing the risk of errors that could lead to financial and legal issues.

At Ignite HCM, we believe that an experienced Payroll Expert can transform payroll operations by introducing efficiency, accuracy, and compliance, helping businesses focus on growth rather than administrative burdens.

Key Reasons Every Business Needs a Payroll Expert

1. Accuracy in Payroll Processing

One of the biggest challenges in payroll management is ensuring accuracy. Incorrect salary calculations can lead to employee dissatisfaction and financial penalties. A Payroll Expert ensures that:

Salaries are calculated accurately based on working hours, overtime, bonuses, and deductions.

Taxes and deductions are computed correctly to comply with federal and state regulations.

Payroll records are maintained accurately to prevent discrepancies.

By leveraging advanced payroll solutions like those offered by Ignite HCM, businesses can automate payroll calculations while a Payroll Expert oversees the process to ensure precision.

2. Compliance with Tax and Labor Laws

Tax laws and labor regulations are constantly evolving. Businesses must stay updated with the latest changes to avoid legal complications. A Payroll Expert ensures that:

Payroll taxes are calculated and filed correctly to avoid penalties.

Employee benefits, deductions, and contributions are compliant with labor laws.

Overtime pay, minimum wage laws, and other labor regulations are followed.

With Ignite HCM’s payroll management solutions, businesses can stay compliant without the stress of navigating complex legal requirements.

3. Time and Cost Efficiency

Handling payroll in-house without expertise can be time-consuming and costly. Business owners and HR teams often spend hours managing payroll, diverting attention from core business activities. A Payroll Expert can:

Reduce payroll processing time with efficient workflows.

Minimize payroll errors that could lead to costly penalties.

Optimize payroll processes to ensure smooth and timely salary disbursements.

By integrating Ignite HCM’s payroll services, businesses can save valuable time and resources while ensuring payroll accuracy.

4. Seamless Salary Disbursement

Employees expect timely salary payments. Delayed payments can lead to dissatisfaction and lower morale. A Payroll Expert ensures:

Payroll is processed on schedule to avoid payment delays.

Direct deposits and other payment methods are managed efficiently.

Payroll records are maintained to resolve any discrepancies quickly.

Ignite HCM offers automated payroll systems that enable businesses to process payments effortlessly while a Payroll Expert ensures everything runs smoothly.

5. Handling Employee Benefits and Deductions

A comprehensive payroll system includes not just salaries but also employee benefits, deductions, and contributions. A Payroll Expert manages:

Employee health insurance, retirement plans, and other benefits.

Tax deductions such as social security, Medicare, and federal/state taxes.

Voluntary deductions such as loan repayments, union dues, and charity donations.

Ignite HCM’s payroll solutions ensure that all deductions are handled accurately while maintaining compliance with company policies and regulations.

6. Data Security and Confidentiality

Payroll information is highly sensitive and must be protected from unauthorized access. A Payroll Expert ensures:

Secure handling of employee salary details, tax records, and banking information.

Compliance with data protection laws to prevent data breaches.

Implementation of secure payroll systems to prevent fraud or identity theft.

Ignite HCM provides secure payroll solutions, ensuring that all payroll data remains confidential and protected from cyber threats.

7. Expertise in Payroll Software and Automation

Modern businesses rely on payroll software to streamline salary processing. A Payroll Expert:

Understands how to use payroll software effectively.

Automates payroll tasks to reduce manual errors.

Ensures integration with other HR and accounting systems.

With Ignite HCM’s cutting-edge payroll technology, businesses can automate payroll processing while leveraging the expertise of a Payroll Expert to oversee operations.

8. Reducing Payroll-Related Risks

Payroll errors can lead to serious consequences, including lawsuits, penalties, and employee dissatisfaction. A Payroll Expert helps mitigate risks by:

Ensuring payroll accuracy to prevent disputes.

Keeping records updated to comply with audits and regulations.

Addressing payroll-related concerns before they escalate into major issues.

Ignite HCM’s payroll management solutions provide businesses with the assurance that payroll operations are handled efficiently and risk-free.

How Ignite HCM Can Help Your Business with Payroll Management

At Ignite HCM, we specialize in providing comprehensive payroll solutions tailored to your business needs. Our team of Payroll Experts ensures that your payroll operations run smoothly, accurately, and in compliance with regulations. Here’s how we can help:

✔ Advanced Payroll Automation

We offer state-of-the-art payroll automation systems that eliminate manual errors, ensuring accurate and timely salary processing.

✔ Compliance Assurance

Our Payroll Experts stay updated with the latest tax and labor laws, ensuring that your business remains compliant at all times.

✔ Secure Payroll Processing

With robust security measures in place, we protect your payroll data from cyber threats and unauthorized access.

✔ Employee Self-Service Portals

We provide user-friendly employee self-service portals where employees can access their pay slips, tax forms, and benefits information.

✔ Personalized Payroll Solutions

Whether you need payroll management for a small business or a large enterprise, our solutions are tailored to meet your unique requirements.

Final Thoughts

A Payroll Expert is an invaluable asset to any business, ensuring that salary processing is seamless, accurate, and compliant with regulations. By partnering with Ignite HCM, businesses can simplify payroll operations, reduce administrative burdens, and ensure employee satisfaction with timely and accurate salary payments.

If you’re looking for a reliable payroll solution, Ignite HCM has the expertise and technology to transform your payroll management. Contact us today to learn more about how we can help your business thrive with hassle-free payroll processing.

For more info Contact us: +1 301-674-8033 or Email : [email protected]

#Payroll Expert#Payroll Management#HR and Payroll#Payroll Solutions#Payroll Processing#Business Finance#Tax Compliance#Employee Payroll#HR Technology#Payroll Services

0 notes

Text

Expert Accounting Companies Melbourne Businesses Trust for Financial Success

Strong financial management drives business growth, compliance, and profitability. Partnering with experienced accounting companies Melbourne ensures accurate reporting, effective risk management, and strategic financial planning. Whether handling tax obligations, improving cash flow, or managing risks, expert accountants keep businesses financially stable and ready for future challenges.

Why Work with Leading Accounting Companies Melbourne?

Managing finances without professional support leads to costly errors and missed opportunities. Skilled accounting companies Melbourne help businesses navigate tax complexities, improve operational efficiency, and strengthen financial decision-making.

Top services include:

Tax compliance and planning to reduce liabilities

Financial reporting for accurate business insights

Bookkeeping to maintain clean financial records

Business advisory to drive long-term success

Walker Wayland Advantage delivers tailored financial solutions that support businesses in achieving stability and growth.

Strengthen Business Security with Risk Advisory Services Melbourne

Every business faces financial, operational, and regulatory risks. Ignoring these risks leads to losses, compliance issues, and reputational damage. Professional risk advisory services Melbourne help businesses identify, assess, and manage risks before they become serious problems.

Key benefits of expert risk advisory services Melbourne include:

Fraud prevention and internal control improvements

Compliance with Australian financial regulations

Cybersecurity risk assessment and data protection

Strategic risk management for long-term business stability

A proactive risk management strategy strengthens financial security and ensures smooth business operations.

Take Control of Your Finances Today

Choosing the right accounting companies Melbourne provides businesses with expert financial guidance and strategic insights. Whether improving tax efficiency, enhancing financial reporting, or implementing risk advisory services Melbourne, Walker Wayland Advantage delivers customised solutions that help businesses stay ahead.

Get in touch today and take the next step toward financial security and business success.

Source

0 notes

Text

Expert CIS Returns Outsourcing Services for Accountants & Firms

Struggling with CIS returns compliance? Our expert CIS Returns Outsourcing Services help accountants and firms manage Construction Industry Scheme (CIS) returns efficiently. Ensure timely submissions, accuracy, and compliance while reducing workload. Let our professionals handle the complexities so you can focus on growing your practice.

#CIS Returns Outsourcing Services#Expert CIS Returns Services#CIS Returns Services#Professional CIS Returns Services#Accounting Outsourcing#Tax Compliance#Accountants

0 notes

Text

Expert Legal Services for NRIs – Hassle-Free Solutions!

From property disputes to legal documentation, we provide expert guidance to ensure smooth legal processes for NRIs in India.

#NRI legal assistance#property disputes#legal consultation#document verification#real estate law#power of attorney#court representation#tax compliance#legal advisory#hassle-free solutions

0 notes

Text

The Zakat, Tax and Customs Authority (ZATCA) in Saudi Arabia has set the compliance deadline for Wave 20 to 𝐎𝐜𝐭𝐨𝐛𝐞𝐫 𝟑𝟏, 𝟐𝟎𝟐𝟓. Businesses must integrate their invoicing systems with 𝐙𝐀𝐓𝐂𝐀’𝐬 𝐅𝐀𝐓𝐎𝐎𝐑𝐀 platform for real-time validation.

JRS Dynamics Info Solutions - Microsoft Solutions Partner, we specialize in seamless 𝐙𝐀𝐓𝐂𝐀 𝐏𝐡𝐚𝐬𝐞 𝟐 integration with 𝐌𝐢𝐜𝐫𝐨𝐬𝐨𝐟𝐭 𝐃𝐲𝐧𝐚𝐦𝐢𝐜𝐬 𝟑𝟔𝟓 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐂𝐞𝐧𝐭𝐫𝐚𝐥, ensuring your business stays 𝟏𝟎𝟎% 𝐜𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭.

💼 Avoid penalties, business disruptions, and invoice processing delays! 𝐒𝐭𝐚𝐲 𝐚𝐡𝐞𝐚𝐝 𝐨𝐟 𝐜𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞—𝐚𝐜𝐭 𝐧𝐨𝐰.

👉 𝐑𝐞𝐚𝐝 𝐨𝐮𝐫 𝐥𝐚𝐭𝐞𝐬𝐭 𝐛𝐥𝐨𝐠: https://jrsdynamics.com/zatca-phase-2-integration/

👉🏻 Get Your FREE Demo Today!

📧 𝐄𝐦𝐚𝐢𝐥: [email protected] 🌐 𝐕𝐢𝐬𝐢𝐭: www.jrsdynamics.com

#ZATCA#EInvoicing#SaudiArabia#KSA#Business Central#Tax Compliance#ZATCA Integration#Wave 20#FATOORA#ZATCA Implementation#ERP#Business Solutions#Digital Transformation#JRS Dynamics#Dynamics 365#Microsoft Dynamics 365#Software Company#Microsoft Partner

1 note

·

View note

Text

Navigating the complexities of business tax laws is one of the most critical responsibilities for business owners. Tax compliance ensures that your operations remain lawful while avoiding costly penalties or disruptions.

0 notes

Text

Presumptive Taxation vs. Regular Tax: Which One is Right for You?

“Everything about presumptive taxation, including Sections 44AD, 44ADA, and 44AE. Learn how this simplified tax system benefits small businesses, reduces compliance burdens, and offers lower tax rates.” Presumptive taxation is a simplified tax scheme designed to ease the compliance burden on small businesses and professionals. This system allows eligible taxpayers to declare income at a fixed…

#lower tax rates#presumed income#presumptive taxation#Section 44AD#Section 44ADA#Section 44AE#simplified tax system#small business taxation#tax compliance#tax filing for freelancers

0 notes