#Risk Mitigation

Explore tagged Tumblr posts

Text

♡ self harm risk minimization - part two: bandaging wounds ♡

This is part two of a post about reducing risk in the event of self harm. Part one can be read here

Content is continued below

More specific content warning: description of wounds and infections, mentions of cutting and burning.

Additional disclaimer: I am not a doctor or medical professional. These are all just tips I have collected over the years & online.

Thank you for reading ♡ if there are any concerns regarding the information in this post my ask box is open, please feel free to send them so I can edit this as needed ♡

Sources used: x x

#tw sh related#cw sh mention#risk management#risk mitigation#resource#jirai#jirai girl#jirai kei#jiraiblr#jiraikei#landmine girl#landmine kei#landmine type#landmineblr#pien kei#pienblr#pien girl

203 notes

·

View notes

Text

I got sick in December. (I work with a vulnerable population so I mask anywhere indoors that is not my home, but I also spend two hours a day on trains with people who mostly aren't masked.)

I live with three other people, one of whom is immunocompromised. During the 10 days I was testing positive, and in the two days I was symptomatic but not yet testing positive, I masked (upgrading to a well-sealed Flo mask with professional filters) whenever out of my own room, and I avoided common space as much as possible. There was no way around showering in a shared bathroom, but we opened the bathroom window and put the air purifier on as high as it would go.

I was the only person in my household to test positive. Do not assume, even if you do get sick, that there's nothing left you can do to protect the people around you from getting sick.

(From Monkeys on Typewriters’ newest article.)

Really important things I wish more people kept in mind. Reducing infection risk isn’t all-or-nothing. Masking 80% of the time is better than masking 50% of the time, which is better than masking 0% of the time. Breathing in less virus is vastly preferable to breathing in more virus. Wearing a surgical mask is better than wearing no mask.

But it’s exactly because real, tangible measures to reduce infection risk exist that we should be fighting to have those measures implemented in settings like healthcare, schools, and workplaces.

6K notes

·

View notes

Text

Practical Risk Advice for Strengthening Your Business Operations

You can better optimize your business processes by anticipating and managing potential risks that might affect your success. Effective risk management measures assist you in: - Identifying threats to your business - Making contingency plans for reducing these risks - Maintaining compliance with legislation - Safeguarding your assets via adequate insurance, such as construction insurance - Developing a sustainable business culture With these actions, you can lay a foundation for long-term stability and development of your business.

Understanding Business Risks

Although every business has inherent risks, it is possible to understand these risks and navigate around potential hazards better. Risks can stem from many different sources, ranging from market fluctuations and legal liabilities to operational inefficiencies and financial uncertainties. Understanding all of these risks in a complete manner allows you to create improved strategies for countering their effects, keeping your business strong and sustainable.

Identifying Common Risks

To efficiently manage risks, begin by understanding common types that can impact your business. These might be: - Financial risks - Operational risks - Market risks - Compliance and regulatory risks - Cybersecurity threats By identifying these risks, you can prepare your business better to deal with them proactively.

Risk Assessment Techniques

Most importantly, using sound risk assessment methods is crucial to assessing your business's weaknesses. These methods enable you to rank risks according to their probability and potential effect, enabling you to use your resources effectively. Typical methods are SWOT analysis, risk matrices, and scenario analysis, which can give you important insights into your risk environment.

It is essential to use a systematic approach to risk assessment. Start by compiling information on likely threats and weaknesses in your operations. Involve the concerned members of staff to ideate and debate scenarios, and invite divergent views. Apply quantitative tools to quantify probable effects on your business, and juxtapose them with qualitative determinations to gain subtleties. Lastly, utilize construction insurance as an extra safeguard against certain risks so that you can anchor your operations in uncertain situations.

Developing a Risk Management Plan

It is important to create a risk management plan that outlines how your business will identify, assess, and respond to risks. This plan not only helps in protecting your assets and resources but also ensures a proactive approach to potential threats. Take the time to assess your operation's specific risks, engage with your team, and create a strategy that suits your business needs.

Setting Objectives and Priorities

Having clear objectives and priorities is the key to a successful risk management plan. Identify what you want to accomplish and determine the risks that have the greatest impact on your business. Having clarity will enable you to allocate resources effectively and concentrate on risk areas that are aligned with your strategic objectives.

Implementing Risk Mitigation Strategies

Risk mitigation strategy management is a process of dealing with risks that have been identified. Begin by analyzing your existing processes and seeking methods to minimize exposure. You may want to explore alternatives like purchasing construction insurance, improving employee training programs, or replacing equipment. Continuously review and monitor these strategies to keep them effective and modify them accordingly.

An effective risk mitigation plan is not merely about removing risks but also about reducing their impact on your operations. Involvement of employees at all levels to create a risk-aware culture and solicit ideas for improvement. Leverage technology to automate processes and establish redundancy mechanisms to account for interruptions. Lastly, review your plans regularly to respond to changes in the operating environment so your operations remain agile and ready for unexpected problems.

Strengthening Operational Resilience

Certain strategies can assist you in bolstering your operational resilience. Prioritize adaptability, training for employees, and strong communication channels. By doing so, you can ensure that your business is ready to handle unforeseen disruptions and recover quickly from them.

Building a Crisis Management Framework

Development of framework should assist you in managing any possible crisis effectively. Identify key risks and develop clear response protocols. Define roles and responsibilities, perform regular drills, and inculcate a culture of openness and ongoing improvement within your organization.

Increasing Supply Chain Security

The success of your operations heavily relies on supply chain integrity. Adopt security protocols to detect weaknesses and prevent risks. Diversify suppliers, perform routine checks, and invest in monitoring and data analysis technology to have a more secure supply chain.

Supply chain security management demands that you be proactive. Work with suppliers to develop best practices and have open communication about potential threats. Use construction insurance to cover against financial loss due to supply chain disruption. By building relationships and constantly evaluating vulnerabilities, you can develop a responsive supply chain that resists economic changes and operational disruptions.

Using Technology for Risk Management

To make your business operations stronger, it is essential to utilize technology for efficient risk management. By implementing advanced tools, you can detect possible threats and manage them in advance. Adopting digital solutions not only makes data more accurate but also simplifies communication and decision-making procedures. Make investments in technology aligned with your business objectives to enhance efficiency and minimize risks.

Automation and Data Analytics

Automation helps to limit the scope of human error and bring in more efficiency in operations. With automated processes in place, you can deal with mundane tasks with accuracy, so your team has the time to work on strategic projects. Analytics tools provide you with an ability to compare trends, anticipate problems, and make sound decisions based on real-time data.

Cybersecurity Measures

Utilizing effective cybersecurity measures is vital for protecting your business from digital threats. Integrating firewalls, encryption, and robust authentication protocols can significantly reduce vulnerabilities. Regularly updating software and conducting vulnerability assessments will also help to safeguard sensitive data, ensuring compliance and maintaining your reputation.

Initiatives like employee training and incident response planning are part of an effective cybersecurity strategy. Train your staff to identify phishing attacks and other types of cyber attacks. Get cyber insurance to manage financial exposure due to data breaches. Proactive cybersecurity protects not only your property but also generates trust with your partners and clients.

Inviting Employees on Board for Risk Awareness

All staff members have an important part to play in finding and reducing risks within your business. By involving them in risk awareness, you promote an active approach where everyone is responsible for safety and compliance. Inspire open dialogue, give frequent updates on potential risks, and engage your staff in discussions and activities regarding risk management. Together, all of this can make your business activities stronger and ultimately lead to improved outcomes.

Training and Development Programs

Creating ongoing development and training programs is needed for increasing your team's risk awareness. You should offer seminars and workshops on risk management rules and methods in your line of business. Emphasize experiential case studies, role-playing situations, and simulations to force learning home. Arm your employees with information on how to identify possible hazards and respond correctly, thus minimizing exposure to risks in your company.

Developing a Risk-Informed Culture

Once you have developed good training procedures, you must develop a risk-conscious culture in your organization. Make your employees speak up regarding risk management concerns and ideas. Reward and recognize risk-reducing behaviors that are proactive. Make risk awareness a part of your core values and day-to-day operations and incorporate it into performance reviews. This helps instill a sense of responsibility in your employees and ultimately makes your business more robust.

It is essential to focus on transparency and communication regarding risks. Reporting incidents can create learning opportunities for staff. The development of a non-punitive strategy for reporting problems can also increase engagement. When you cultivate an environment where everybody feels respected in their contribution, your organization gains from the variety of thinking on risk management. Think of having particular practices like regular safety meetings or an anonymous feedback system, which can be used to reinforce construction insurance elements and make sure everyone stays involved in the risk management process.

Monitoring and Reviewing Risk Management Practices

In contrast to static methods, efficient risk management necessitates you constantly watching and reviewing your practices. Constant reviews and checks will assist you in detecting any new threats and guarantee that your strategies are efficient. Having a routine checkup of monitoring also enables you to update your approaches in light of shifting business environments so that your operations are efficiently smooth.

Regular Audits and Assessments

In addition to continuous monitoring, regular audits and assessments are essential. These drills enable you to assess the effectiveness of your risk management measures and give you feedback on areas for improvement. Make it a point to conduct these audits at least once a year, or more often if conditions require.

Continuous Improvement Strategies

There must be continuous improvement strategies in any good risk management plan. You must retest your processes consistently, learn from your past history, and adapt to new emerging risks in your business. Feedback from your audit and employees should guide you into innovating within your operations.

Risk management practices are assessed by you to give you a treasure trove of information. Having feedback loops in place enables you to streamline strategies, improve employee training, and invest in tools such as construction insurance. Foster an open culture where employees are not afraid to voice concerns, so that your business successfully adapts to new challenges and risks head-on.

To conclude

Therefore, putting practical risk advice into practice can effectively fortify your business operations. Pay attention to these important strategies: - Determine potential risks and their impact. - Create a full-fledged risk management plan. - Adhere to regulations and standards, such as construction insurance. - Monitor and revise your risk management methods on a regular basis. Through these measures, you can increase the resilience of your business and protect your assets from unexpected adversity.

0 notes

Text

on the one hand, i love reading, writing, and thinking about planning. i've realized that risk mitigation has really become a driving philosophy in my life and a part of my personality.

on the other hand, i really hate reading about planning things that i know how to do but i don't do anyway. financial planning especially, but historically this would have included schoolwork as well. like yeah i know how budgets work. i understand that you can preallocate money to various things, and you can even mitigate risks (yay!) by expecting the unexpected ahead of time. but at the end of the day it comes down to hitting that "place order" button and i'll be darned if that ain't just the hardest thing to quit.

0 notes

Text

Security Failover Technology Redefining the Very Essence of ICS and OT Resilience

Security failover safeguards critical operations, minimizing downtime and protecting against cyberattacks targeting Industrial Control Systems ICS and Operational Technology OT environments. Robust failover mechanisms ensure continuous protection against cyber threats, reinforcing the resilience of ICS and OT networks. In a constantly evolving digital landscape, organizations must shift to a proactive cybersecurity approach.

How Security Failover Enhances ICS and OT Resilience

Rapid Recovery Salvador Technologies offers 30 second recovery, enabling swift restoration of operations in case of failures or attacks.

Air gapping for Business Continuity Ensuring uninterrupted critical processes and services with a widely recognized 3 2 1 organizational backup, recovery, and operational continuity plan.

Redundancy Implementing redundant systems and components to provide backup capabilities using boot from the Salvador Technologies unit.

Risk Mitigation using Software Agent Reducing the potential impact of cyber incidents on operations by installing the agent, which takes less than a minute to install.

Compliance Adherence Meeting regulatory requirements for system availability and security.

By leveraging advanced security failover technology, organizations can enhance ICS and OT resilience, ensuring business continuity and protecting critical operations from cyber threats.

Explore how security failover can redefine your cybersecurity strategy with this exclusive whitepaper.

0 notes

Text

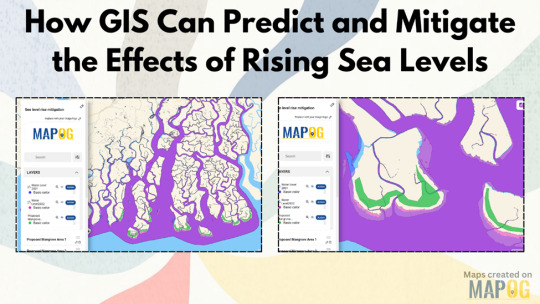

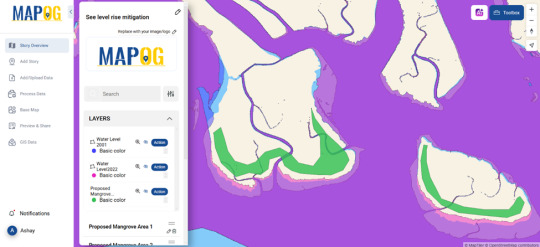

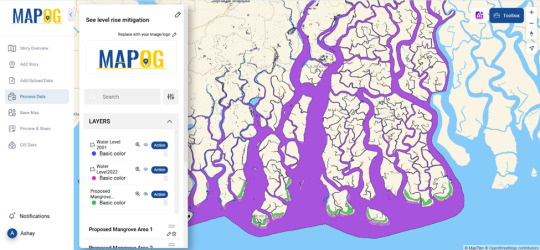

How GIS Can Predict and Mitigate the Effects of Rising Sea Levels?

Rising sea levels pose a serious threat to coastal communities, ecosystems, and infrastructure worldwide. Geographic Information Systems (GIS) provide a powerful way to analyze, predict, and mitigate these impacts using real-time spatial data and advanced mapping techniques.

Understanding the Threat: What GIS Reveals About Rising Waters

GIS allows scientists and policymakers to visualize past and present water levels to predict future risks. By analyzing historical water level data—such as from 2001 and 2022—GIS can create accurate models to identify areas at high risk of flooding. This helps in forecasting potential damage and preparing preventive measures.

Using GIS for Risk Assessment and Mitigation

Mapping Vulnerable Zones GIS overlays different datasets, such as elevation models, climate data, and urban development, to pinpoint the most vulnerable regions. This helps authorities focus on high-risk coastal areas that need urgent intervention.

Proposing Natural Solutions One effective mitigation strategy is mangrove restoration. Mangroves act as natural barriers, reducing coastal erosion and absorbing excess water during storms. By using GIS tools to map potential mangrove plantation sites, we can strategically enhance these natural defenses.

Urban Planning and Infrastructure Resilience City planners can use GIS simulations to design flood-resistant infrastructure, such as elevated roads, drainage systems, and protective sea walls. Identifying evacuation routes and emergency shelters also becomes more efficient through GIS mapping.

How GIS Tools Help in Real-Time Decision Making

Platforms with interactive mapping capabilities enable researchers and policymakers to update their models as new data becomes available. For instance, some GIS platforms allow users to upload historical water level data, create proposed mitigation zones, and analyze changes over time—all within an intuitive mapping interface.

If you're working on coastal resilience planning, exploring GIS-based platforms can help visualize and implement effective mitigation strategies. Platforms like MAPOG allow users to overlay water level data, draw mitigation zones with “Add polygon” tool, and create interactive maps that aid in decision-making and see how mapping can be a game-changer in combating rising sea levels.

Final Thoughts

Rising sea levels require proactive solutions, and GIS plays a crucial role in understanding and mitigating this challenge. From data-driven predictions to ecosystem-based solutions, GIS empowers decision-makers with the insights they need to protect vulnerable communities.

How do you think GIS can improve coastal resilience in your region? Let us know in the comments!

#mapog#sea level rise#risk mitigation#gis#mapping#spatial analysis#data visualization#water mitigation#climate change mitigation

0 notes

Text

Risk Mitigation Through Multi-Factor Authentication

Enhance security with multi-factor authentication (MFA)! This case study explores how a leading enterprise mitigated risks and strengthened data protection through advanced MFA solutions. By implementing robust authentication protocols, they reduced fraud, improved compliance, and safeguarded sensitive information. Discover how MFA can secure your business against cyber threats.

0 notes

Text

Uncertainty can derail even the most promising projects, leading to delays and missed opportunities. In this insightful article, we explore how ambiguity hampers progress and introduce effective methods to overcome it, ensuring your projects stay on track and achieve their goals.

0 notes

Text

Is the "Risk Management Course" Worth the Investment? A Real-World Review

Is the “Risk Management Course” Worth the Investment? A Real-World Review 🧐 In today’s unpredictable world, “risk management” isn’t just a buzzword – it’s a crucial skill for anyone in business, project management, finance, or even just navigating everyday life! So, when I came across the “Risk Management Course” (let’s just call it “RMC” for short), I was intrigued. Could this online course…

#business risk management#career development#decision making#financial risk management#online learning#online risk management course#professional skills#project risk management#risk analysis#risk assessment#risk management#risk management certification#risk management course#risk management training#risk mitigation#self-paced learning

0 notes

Text

Five Global Trends in Business and Society in 2025 – 2 – Asrar Qureshi’s Blog Post #1064

#Asrar Qureshi#Blogpost1064#economic crisis#Geopolitical Crises#Gobal Trends 2025#Impact on Business#Pharma Veterans#Risk Assessment#Risk Management#Risk Mitigation#Sanctions#Trade Wars

0 notes

Text

How Tax Planning Can Mitigate Risk During Economic Uncertainty?

A lot of surveys are regularly carried out in order to keep the tax planning strategies smooth. It is the duty of the Government of a nation to ensure efficient & reliable taxing strategies to the general public. Risk planning in taxation is an essential part to avoid unnecessary losses in the financial management. During uncertain economic situations the financial aspect can take a toll on the revenue strategies of a nation. The matter can escalate upto global standards increasing the financial instability in a nation. This article is a guide on mitigating risk during economically uncertain situations. Read on.

The Link Between Economic Uncertainty and Business Risk

Economic uncertainty can stem from various sources, including political shifts, fluctuating interest rates, changing trade policies, or market volatility. These unpredictable factors create risks that can destabilize even the most robust business models. Companies may face challenges such as:

Fluctuating Revenue: Sales cycles can become unpredictable, especially in sectors highly dependent on consumer spending.

Supply Chain Disruptions: Global supply chains may face interruptions, driving up costs and reducing profitability.

Changing Tax Regulations: Governments often adjust tax laws during periods of economic stress to stimulate growth or manage fiscal challenges, which can complicate budgeting and financial forecasting.

Cash Flow Constraints: In uncertain times, businesses may find themselves short on cash as customer payments slow down and unexpected expenses arise.

In these situations, tax planning becomes an essential tool for mitigating risk. A proactive tax strategy helps businesses maintain liquidity, optimize financial outcomes, and prepare for the long-term effects of macroeconomic shifts.

How Tax Planning Mitigates Risk in Uncertain Times

Effective tax planning is all about making informed decisions that maximize the financial health of your business while minimizing the potential risks from external volatility. Here are some key ways the planning can help businesses during uncertain economic times:

1. Optimizing Cash Flow Through Tax Deferral Strategies

During periods of economic uncertainty, maintaining a steady cash flow is crucial. Tax deferral strategies allow businesses to delay tax payments, which can provide immediate liquidity. This is particularly useful for businesses facing cash flow difficulties due to declining revenues or unexpected expenditures.

For instance, tax deferral through retirement plan contributions or depreciation deductions can reduce taxable income and delay tax liabilities. By pushing taxes into the future, businesses can retain cash in the short term to weather the storm. Moreover, deferring taxes to a year when the economy stabilizes or when your business anticipates higher profits can also result in better overall tax positioning.

2. Leveraging Tax Credits and Incentives

Governments often introduce tax credits and incentives during economic uncertainty to encourage specific business behaviors—such as investment in research and development (R&D), hiring initiatives, or sustainability projects. Tax planning enables businesses to identify and take full advantage of these credits and deductions, reducing their overall tax burden.

For example, in the wake of the COVID-19 pandemic, businesses could leverage various relief measures such as the Employee Retention Credit (ERC) or government grants. In future uncertain periods, similar initiatives may be introduced to support businesses in adapting to new economic realities. By staying up-to-date with available credits and tax incentives, businesses can enhance profitability while mitigating risk.

3. Maximizing Losses Through Tax Loss Harvesting

During economic downturns, businesses may incur losses. Instead of letting these losses go to waste, these planning strategies such as tax loss harvesting allow businesses to offset profits from other areas. Tax loss harvesting involves selling off underperforming assets to realize capital losses, which can then be used to offset capital gains and reduce taxable income.

By strategically managing losses, companies can reduce their tax liabilities, improving their cash flow and offsetting the impact of economic downturns. This also gives businesses more flexibility to reinvest in new opportunities without the burden of excessive taxes.

4. Adapting to Changing Tax Regulations and Shifting Market Conditions

Economic uncertainty often triggers changes in tax regulations, as governments adapt their policies to meet shifting fiscal needs. Whether it’s a change in corporate tax rates, tax reforms, or new compliance rules, staying ahead of tax changes is crucial for business stability.

This planning helps businesses anticipate these changes and adjust accordingly. By working with tax advisors to stay informed about proposed reforms or new tax regulations, companies can proactively adjust their business models, investments, and operations to align with new policies. This can help businesses avoid surprises and take advantage of any favorable tax opportunities presented by these changes.

For example, if tax rates are expected to increase in the coming years, a business may accelerate certain deductions or investments to lock in current rates. Alternatively, if new tax incentives are introduced, businesses can align their operations with those incentives to maximize savings.

5. Creating Flexible and Resilient Business Structures

The structure of your business—whether it’s a sole proprietorship, partnership, corporation, or LLC—can have a profound impact on your overall tax liability. During economic uncertainty, tax planning allows business leaders to adjust their business structure to optimize tax outcomes and enhance resilience.

For example, a shift to an S-corporation or LLC may offer better tax advantages, such as avoiding double taxation and reducing self-employment taxes. On the other hand, certain organizational changes—such as establishing a holding company or creating tax-efficient subsidiaries—can protect assets and reduce overall exposure to economic risks.

By tailoring business structures and operations based on changing economic conditions and tax regulations, business leaders can mitigate risk and maximize financial efficiency, even during challenging periods.

6. Planning for Global Tax Exposure in Uncertain Markets

For businesses operating internationally, economic uncertainty can have additional layers of complexity due to changing trade policies, tariffs, or currency fluctuations. The planning becomes critical when dealing with cross-border taxation and managing global risk.

By implementing effective transfer pricing strategies, establishing tax-efficient global supply chains, and taking advantage of tax treaties, businesses can reduce their global tax exposure. This not only minimizes risk but also ensures that international operations remain profitable despite shifting economic landscapes.

Furthermore, for companies facing fluctuating exchange rates, tax planning strategies such as foreign currency hedging can help lock in favorable rates and protect profits from market volatility.

How to Build a Tax Planning Strategy for Risk Mitigation

Building a robust tax planning strategy for risk mitigation during uncertain times involves a combination of forward-thinking tactics and flexibility. Here’s how business leaders can create an effective strategy:

Work with Tax Experts: Given the complexity of tax laws and economic conditions, it’s essential to collaborate with tax advisors, accountants, and legal experts who can provide insights tailored to your business’s unique needs.

Monitor Tax Changes Regularly: Stay abreast of any tax reforms or government programs that may impact your business. By monitoring tax policies, you can quickly pivot your strategy to take advantage of new opportunities or avoid potential pitfalls.

Evaluate Financial Performance Continuously: Regular financial reviews allow you to identify areas where tax planning strategies can have the most impact, such as shifting taxable income, maximizing deductions, or managing asset sales.

Diversify Revenue Streams: Economic uncertainty can affect certain sectors more than others. By diversifying revenue sources or business operations, you can reduce exposure to a single industry or market and increase overall stability.

Plan for the Long Term: While short-term measures like deferring taxes are helpful, long-term strategies—such as business restructuring, investing in R&D, or preparing for future tax increases—help build resilience that lasts beyond temporary downturns.

Conclusion

In uncertain economic times, tax planning is not just a tool for minimizing liabilities—it’s an essential risk management strategy. By optimizing cash flow, leveraging tax credits, managing losses, and adapting to regulatory changes, businesses can safeguard their financial health, mitigate risks, and remain agile in an unpredictable world. A well-crafted tax strategy not only helps mitigate immediate financial risks but also provides the flexibility and resilience needed to thrive in any economic climate.

Uncover the latest trends and insights with our articles on Visionary Vogues

0 notes

Text

Enhance your expertise in risk identification, assessment, and mitigation strategies with IGMPI's comprehensive Enterprise Risk Management course. Designed for professionals aiming to excel in risk management practices, this course offers in-depth insights into enterprise risk frameworks, compliance, and decision-making strategies. Gain practical knowledge to lead your organization through complex risk landscapes with confidence.

#Enterprise Risk Management Course#Risk Assessment#Risk Mitigation#Professional Development#IGMPI#Compliance Training#Risk Management Frameworks#Corporate Risk Strategies#Online Learning#Distance Education.

0 notes

Text

How Portfolio Management Firms Add Value to Investors

Money symbolizes dreams, stability, and heritage; it is more than simply numbers on a screen. When investors encounter the intricacies of contemporary financial markets, Portfolio Management Firms become reliable advisors, converting impersonal market data into significant financial results.

The Development of Investment Knowledge

The days of merely purchasing stocks and bonds to manage investments are long gone. By providing advanced techniques that adjust to market conditions, wealth management firms have completely changed the way that money is created.

These firms leverage decades of collective experience, combining time-tested wisdom with cutting-edge analysis to navigate volatile markets.

The Strategic Difference

Investment Portfolio management stand out for a set of core competencies that few individual investors are able to emulate:

Risk Management Expertise

Professional portfolio managers employ sophisticated risk management tools and diversification techniques that protect wealth when the market gets turbulent. They create portfolios that balance the upside potential with the downside protection. Clients can therefore sleep soundly, irrespective of the market situation.

Market Intelligence Networks

Investment portfolio management teams maintain extensive networks of analysts, researchers, and industry experts. This collective intelligence helps identify opportunities before they become obvious to the general market, providing clients with a significant competitive edge.

Systematic Decision-Making

Emotional investing often leads to poor outcomes. A wealth management firm removes emotion from the equation, implementing disciplined investment processes based on empirical research rather than market sentiment or headlines.

Technology Integration

Portfolio management companies at the top level utilize advanced software and artificial intelligence to constantly monitor markets, capturing subtle patterns and opportunities that human analysis cannot pick up. Such an advantage in technology means more targeted portfolio adjustments and better risk management.

Personalization and Agility

Every investor comes with unique goals, constraints, and preferences. Portfolio management firms excel at creating tailored investment strategies that align perfectly with individual circumstances. Whether planning for retirement, funding education, or building generational wealth, these firms craft solutions that reflect each client’s specific situation.

The power of investment portfolio management is especially seen during life milestones. Mark inherited his family’s estate, and this came with difficult decisions on how to protect and expand it. His portfolio management firm crafted an all-encompassing strategy that was in line with what his family intended but also properly aligned with the state of the markets currently.

Beyond Traditional Investment Management

These new-generation portfolio management companies have left mere investment choices to their good judgment. Now they coordinate all kinds of tax professionals, estate planners, and the lot to keep your investment choices coherent with any long-term objective or financial goal for that matter.

For instance, a wealth management company might arrange portfolios to reduce tax liabilities without sacrificing performance. Such advanced strategies for wealth protection often prove to be highly valuable for high-net-worth individuals dealing with complicated tax situations.

Success Measurement

The real value of portfolio management firms goes beyond the raw investment returns. Their impact is reflected in the confidence that clients have in their financial future, the preservation of wealth from one generation to the next, and the achievement of personal financial goals.

Professional portfolio managers monitor not only performance metrics but also progress toward specific client objectives. A goals-based approach ensures that investment strategies remain aligned with what truly matters to each investor.

Making the Choice

Selecting a reputable portfolio management company is among the most crucial choices an investor will ever make. The top companies have a track record of successfully navigating a range of market conditions, are open and truthful about their programs and charges, and comprehend the needs of their clients.

A portfolio management company can offer the resources, experience, and methodical procedures that can significantly alter the trajectory of investment outcomes for an investor seeking to maximize his financial future. These companies are reliable partners in creating and safeguarding money for future generations in the increasingly complicated financial environment of today.

#portfolio management#financial goals#asset allocation#investment planning#risk management#market analysis#investment strategy#diversification#wealth management#portfolio optimization#growth opportunities#financial stability#investment returns#financial planning#risk mitigation#portfolio rebalancing#investment advice#expert guidance#asset management#strategic investments

0 notes

Text

Master Risk Mitigation Strategies with IRM’s Level 2 Certification

Enhance your expertise in risk mitigation with IRM India’s Level 2 Certification. This globally recognized program provides comprehensive training in identifying, assessing, and managing risks effectively. Learn to develop robust frameworks, safeguard organizational assets, and drive informed decision-making. Whether you're a risk professional or aiming to advance in your career, this certification equips you with practical tools and insights to navigate complex business challenges. Start your journey to becoming a risk management expert today!

0 notes

Text

Predict the Future of Business Moves with Predictive AI

Advanced predictive AI tool from Langoor

Harness the power of advanced predictive AI tools to forecast trends, product ideation mitigate risks, and optimize operations. From predictive analytics to actionable strategies, Langoor.ai empowers businesses to stay ahead of the competition. Read use cases on how Predictive AI solutions can transform your business decisions with data-driven insights. Visit the website of Langoor to be learn more about predictive AI.

0 notes

Text

Empowering Business Resilience with Market Risk Management

Introduction

In the fast-paced business environment of today, managing market risks effectively is critical for long-term success. Market intelligence provides businesses with the tools needed to anticipate challenges, adapt strategies, and seize opportunities. The integration of market risk management into business operations ensures that organizations remain resilient and competitive.

The Importance of Risk Mitigation

As data becomes central to decision-making, businesses face challenges such as data misinterpretation and security risks. Market risk management addresses these concerns by offering a structured approach to assess and respond to uncertainties. Harnessing the power of data effectively safeguards organizations from potential pitfalls.

Leveraging Market Intelligence for Growth

Market intelligence transforms raw data into actionable insights, empowering businesses to navigate uncertainties. Predictive analytics forecasts potential threats, competitor analysis sharpens strategic positioning, and consumer insights ensure market relevance. Together, these elements form the foundation of a robust risk management strategy.

Conclusion

Market risk management is not just about avoiding pitfalls; it’s about unlocking opportunities for growth. With a solid foundation in market intelligence, businesses can confidently tackle challenges and secure their future in an unpredictable world.

Click here to talk to our experts

0 notes