#Cryptocurrency exchange collapse

Explore tagged Tumblr posts

Text

FTX Bahamas Creditor Repayments to Commence on February 18

FTX Digital Markets, the Bahamian subsidiary of the collapsed cryptocurrency exchange FTX, will start repaying creditors on February 18, 2025. This marks a key moment in the ongoing bankruptcy proceedings after FTX’s infamous collapse in November 2022. FTX Bahamas Creditor Repayments: Key Details According to official notices, repayments will begin with the “Convenience Class” creditors who…

View On WordPress

#BitGo fund distribution#Cryptocurrency exchange collapse#FTX Bahamas creditor repayments#FTX bankruptcy payouts#FTX Bitcoin refunds#FTX customer reimbursements#FTX Digital Markets refunds#FTX financial recovery#FTX repayment plan 2025#Sam Bankman-Fried fraud

0 notes

Text

Witnessing Corruption - FTX and Sam Bankman-Fried

youtube

About 5 months old, so some of the info might be outdated, but still feels relevant.

SBF didn't kill himself.

#ftx fraud#crypto exchange ftx#ftx token#ftx crypto#ftx bankruptcy#ftx collapse#sam bankman fried#cryptocurrency#politics#political corruption#cover up#money#money laundering#wire fraud#alameda research#bahamas#jeffrey epstein#Youtube

2 notes

·

View notes

Quote

The tech industry is getting increasingly scammy. True innovation has slowed down drastically in recent years, threatening to shrink the staggering profits from the earlier parts of the century. To replace that income, tech leaders have increasingly turned to overhyped products or even outright fraud, as evidenced by the collapse of the FTX cryptocurrency exchange and imprisonment of its founder. Joe Biden's administration has made shutting down consumer fraud a majority priority. Rather than dial back the shady behavior, the tech industry is turning to Donald Trump, a man whose entire business career was built on fraud, to save them.

A viral blog post from a bureaucrat exposes why tech billionaires fear Biden — and fund Trump

4K notes

·

View notes

Text

LedgerX Raplaces Troubled Silvergate With Signature Bank (Report)

LedgerX – cryptocurrency derivatives exchange and a subsidiary of the collapsed giant FTX – will reportedly cease its partnership with Silvergate Bank.

It urged users to receive wire transfers via the New York-based Signature Bank.

Switching to Another Partner

According to a Bloomberg coverage, LedgerX differentiated itself from the embattled financial institution focused on cryptocurrencies – Silvergate Bank. It advised customers to refrain from using it to receive domestic wire transfers from March 1.

LedgerX will double down on its existing partnership with Signature Bank, telling clients to employ the latter for such services.

Signature Bank said it will reduce its exposure to the cryptocurrency industry at the end of 2022 but not scrap it entirely. It ceased conducting fiat-to-crypto transactions worth less than $100,000 for Binance earlier this year.

Link Article https://bit.ly/3KPFTTg

#LedgerX – cryptocurrency derivatives exchange and a subsidiary of the collapsed giant FTX – will reportedly cease its partnership with Silve#It urged users to receive wire transfers via the New York-based Signature Bank.#Switching to Another Partner#According to a Bloomberg coverage#LedgerX differentiated itself from the embattled financial institution focused on cryptocurrencies – Silvergate Bank. It advised customers#LedgerX will double down on its existing partnership with Signature Bank#telling clients to employ the latter for such services.#Signature Bank said it will reduce its exposure to the cryptocurrency industry at the end of 2022 but not scrap it entirely. It ceased cond#000 for Binance earlier this year.

0 notes

Text

I Don't Get It

I really don't get it. Hawk Tuah Girl, Boogie 2988, Logan Paul, it seems like anyone can just create a cryptocurrency. Who are the people buying this shit and getting scammed by it? All fiat currency only has value because people place value on it. Whether paper or electronic money has no real practical purpose beyond facilitating trade. Fiat currency created by governments only have value because that government decrees it has value and the people have faith in the stability of that government. If a government collapses it's currency becomes worthless.

So who TF are the people who are assigning value to an electronic currency because Boogie2988 created it? Who sees that a new currency is hitting the market backed by the full faith and credit of Hawk Tuah Girl and thinks, "yeah, that seems like a reasonable means to facilitate the exchange of goods and services in an economy."?

A bundle of Kissi pennies, which were iron rods used as money for hundreds of years in West Africa. They had value because you can make important stuff out of iron unlike Hawk Tuah money.

370 notes

·

View notes

Text

The price of bitcoin went over $100,000 for a few hours on Dec. 5, peaking at $103,400. The financial press can’t resist constructing a hand-waving story of market forces, so bitcoin going past $100,000 has been attributed to a market reaction to President-elect Donald Trump’s lining up a slate of pro-cryptocurrency cabinet, advisory, and regulatory picks after the crypto industry put more money into funding Republican candidates in this last election cycle than anyone had previously put into an election in history.

But crypto trading is thin and almost entirely unregulated—perfect conditions for commodity market manipulation. The public image of cryptocurrency is still shaped by the 2023 trial of Sam Bankman-Fried of the failed FTX crypto exchange, culminating in his conviction—and not to mention the hangover from the NFT fiasco. Crypto is seen as the domain of cheap scammers. Ordinary people are not flocking into crypto.

Coincident with the bitcoin price news was the collapse of the Hawk Tuah crypto token. Haliey Welch, who told an oral sex joke that went viral on YouTube, leveraged her momentary fame into a career as an influencer and podcaster. This culminated in the meme-coin cryptocurrency $HAWK, marketed entirely on amusement value, which crashed on launch in what looked very like a pump-and-dump—tokens were dumped on ordinary buyers soon after launch, crashing the price.

Welch denied that insiders had dumped her token and blamed automated snipers who bought the token the moment it was released, then dumped immediately. The Hawk Tuah-token fiasco only strengthened crypto’s image as a place where fools lose their money being foolish.

The price of bitcoin has recovered since the November 2021 peak of the last bubble—but actual-dollar retail trading volumes have not. Coinbase’s retail trading volumes are $127 billion so far in 2024—much better than 2023’s $75 billion, but nothing like the 2021 bubble’s $545 billion.

Bitcoin remains a strangely useless asset that doesn’t do anything. All you can do with it is buy, sell, or hold. The only use for cryptocurrency other than pure zero-sum speculation is bitcoin’s original use case: evading regulations, most often for illegal purchases, money laundering, or dodging sanctions. One might be justified in evading some regulations in some cases—but most are there for good reason.

The largest actual-U.S.-dollar crypto exchange is Coinbase. But price discovery takes place at the venue with the largest trading volume: the offshore exchange Binance. This exchange admitted a string of money laundering offenses in 2023, was fined over $4 billion, and was placed under stringent compliance monitoring by the U.S. Department of Justice and FinCEN.

But the Binance trading floor itself remains an unregulated free-for-all as long as U.S. entities are not caught trading there. Every market manipulation that would be illegal in the United States happens at Binance and similar unregulated, offshore floating crypto casinos—wash trading, flash crashes, delayed settlements, spoofing, and the exchange trading against its own customers.

Bitcoin trading volume is substantially against two dubious U.S.-dollar stablecoins: tether and FDUSD. These are minted in round billions at a time. It is frankly not plausible that anyone put billions of U.S. dollars into tethers or FDUSD to buy bitcoins on an offshore exchange with above-board intentions. They could have just used the money to buy bitcoins directly at a U.S.-dollar crypto exchange or, safest of all, to buy bitcoin ETF shares from any securities broker. The purpose of buying billions of tethers is to manipulate the price of bitcoin.

Each stablecoin is supposedly backed by a U.S. dollar held in a bank account—except when it isn’t. Tether Inc. has long created tethers out of thin air as loans, with the listed backing asset being the loan itself. Banks do this, too, but banks are regulated. Eighteen billion tethers have been created just since Trump’s election on Nov. 5, bringing the total issuance to 135 billion. How far could you pump the price of bitcoin with 18 billion instant pseudo-dollars?

The other use case for tethers is crime. Zeke Faux’s Number Go Up details the value of tethers as a dollar substitute for those too crooked to get dollars—it’s the favored currency for “pig-butchering” romance scams run by human traffickers. The U.K. National Crime Authority and the U.S. Treasury recently cracked an international money-laundering ring that used tethers to serve drug dealers, ransomware groups, Russian espionage operations, and sanctioned entities; the NCA called tether, not bitcoin, the “cryptocurrency du jour.” The news of the bust came out just before bitcoin hit $100,000. Tether-fueled bitcoin pumps seem to coincide with bad news mentioning tethers.

Tether Inc. is sensitive to the criminal use case for its coin and frequently freezes tainted tethers on the requests of the Office of Foreign Assets Control and FinCEN—but only after the fact. This requires Tether Inc.’s operations to be much more organized than they have been previously—such as during the years when the reserve was tracked, not in proper accounts but in a shared spreadsheet that was often out of date. Despite its compliance efforts, Tether Inc. is the subject of an ongoing federal criminal investigation by the Manhattan office of the Southern District of New York into possible anti-money-laundering and sanctions failures.

Tether Inc. has worked to mend its reputation in the corridors of power. The company does not operate in the United States, but it does keep much of the cash portion of its reserve in U.S. Treasury bills. These are custodied by Cantor Fitzgerald, whose CEO, Howard Lutnick, wanted to become Trump’s new Treasury secretary and will be brought in for commerce. Cantor Fitzgerald recently bought a share in Tether Inc.

After the crypto industry’s success with directing unheard-of quantities of campaign funding to the cause of electing Trump, we should anticipate further such attempts to curry favor. The Trump family’s own crypto project, World Liberty Financial, was set to fail until crypto entrepreneur Justin Sun, proprietor of offshore crypto exchange HTX, dived in and bought $30 million of its WLFI coin—taking World Liberty over the threshold so Trump would get a $15 million payout from the project.

Sun is given to flashy stunts, like purchasing Maurizio Cattelan’s duct-taped banana artwork Comedian (with cryptocurrency) and then eating the banana on stage. These give the media something to talk about other than Sun’s legal and regulatory issues, most recently the U.S. Securities and Exchange Commission’s ongoing suit against Sun for securities violations. Sun looks forward to a more “friendly” U.S. crypto market under the new administration, with the pro-crypto Paul Atkins as Trump’s planned SEC chair.

One of the greatest channels for payback to his crypto allies may be Trump’s proposal at the Bitcoin 2024 conference in June for a U.S. strategic bitcoin reserve, apparently on the basis that the nation needs a store of this speculative commodity largely used for crime. Trump originally proposed that the government hold onto bitcoins that had been seized as proceeds of crime, rather than sell them off.

The current proposal to bolster crypto is Senator Cynthia Lummis’ Bitcoin Act of 2024, in which the Treasury and the Federal Reserve would buy 200,000 bitcoins each year for five years. The U.S. government would become the bitcoin holder of last resort, and the beneficiaries would be the crypto industry—and not ordinary Americans.

The incoming U.S. administration wants to clear “experts” from the bureaucracy. If the incoming executive branch wants crypto to operate freely, it will do its best to force crypto through and remove all possible impediments. Crypto’s perennial issues with fraud and impoverishing retail investors, and regulator’s fears of the risk of contagion from crypto to the wider economy, are likely to be glossed over so as to ensure market opportunities for administration insiders.

But in the end, gravity still works, and a balloon can be inflated only so much. The bitcoin bubble is an artifact of market manipulation and has no more economic substance than the Hawk Tuah coin does. The U.S. government may be ripe for plunder, but other nations need to take steps to shield themselves from the impact of rug-pulling on a global scale.

11 notes

·

View notes

Text

HP Insight

Trump to pay off US national debt with bitcoins

During his election campaign, Donald Trump assured the entire planet that he would be able to repay the US national debt by paying it off with bitcoins. Most of the people took his words as a peace move or a joke. However, it was for nothing.

The Bitcoin quote depends solely on the balance of supply and demand, it is not regulated or constrained by anyone. At the same time, no one is obliged to accept bitcoins, i.e. there is no mechanism to get anything for them if for some reason they refuse to buy or accept them as payment.

Its price will rise due to increased demand and limited supply, which creates tremendous value, unlike conventional money, which can be printed as much as you want, and the more it is printed, the more it depreciates. Experienced stock speculators know very well how to create (or simulate) increased demand. Here we can recall how George Soros, using insider information about the artificial collapse of the pound sterling rate, earned his first billion dollars, and he did it in just one day.

Pragmatic financiers always dream of making money quickly, easily and a lot. Financial pyramids are built on the exploitation of this desire, which are created from nothing, promise a lot and obey the only law: the organisers and those who enter the pyramid among the first can grab their piece of the pie.

Bitcoin is also a phenomenon from this sphere. Its difference is that pyramid builders, as a rule, announce what fixed increase of the capital invested today will be tomorrow and the day after tomorrow (for example, any financial pyramid). No one announces in advance the quotation of bitcoin, the named unit of the cryptocurrency system. It is only known that its growth or fall depends on the ratio of supply and demand of this crypto.

Initially (in 2008, which coincidentally coincided with the global economic crisis), the author of this system, hiding behind the pseudonym Satoshi Nakamoto, announced its creation and “participants of the exciting game for money” rushed to mine bitcoins. How did it happen and is it happening now?

Specialists explain that “miners computers solve a complex cryptographic problem, which consists in selecting (actually – guessing by brute force) a combination of numbers and letters that will enter a new block of the blockchain. Without mining, no new transactions would be added to the network that are written to the same blocks, and so the whole mechanism would cease to work. The computer that finds the right solution first receives a bonus of a certain amount of crypto coins.” The participants of the system will be able to mine 21 million bitcoins by joint efforts. The founder has decided that the issue will not expand.

At the start of the mining process, these 21 million bitcoins were worth exactly $0 and 0 cents. As bitcoin miners produced more and more bitcoins, new participants were drawn into the game, a cryptocurrency exchange appeared, and rates began to fluctuate. Surely there were people who noticed that the coin invented by Sakamoto is not backed by anything. But does that surprise anyone? Dollar since the middle of the 70s of the last century, after its unbinding from gold, also exists, although it is not secured by anything, except the obligation to pay for transactions in this currency. And there are no problems – it is quoted on exchanges.

As conditional units were mined and interest in the system grew, money flowed into it, and cryptocurrency began to be quoted on exchanges. The cryptocurrency went from a value of zero per unit of nothing to $1 in almost three years, reaching that level in March 2011. Today, the “unit of nothing” rate fluctuates up and down around $100,000. Is this the limit? No, of course not.

Bitcoin price

It is impossible to give an exact answer to the question ‘how many times the price of bitcoin can still grow. But if the count goes into the hundreds of thousands – it is unlikely to surprise. In 2010, American Laszlo Hanyecz bought two pizzas for 10 thousand BTC (the value of 1 BTC at that time was $0.0025). If Hanyecz had simply saved this electronic money for 10 years, his bitcoin account would be worth up to $450 million in 2021.

What influences the price of bitcoin? – Supply and demand on cryptocurrency exchanges, – Regulatory decisions by governments of different countries, – Technological updates and network security, – Statements by well-known investors and public personalities, – Activity of large holders (whales of the market), – General state of the world economy, – Introduction of cryptocurrencies into traditional businesses.

One can still list a number of factors and see that none of them can be categorised as “events that exist independently of the individual.” Including even such phenomena as economic crises, which their organisers carefully try to disguise as “processes that arose spontaneously as a result of lack of control over certain areas of the economy, overproduction of goods and services,” etc.

It is sometimes suggested online that it is impossible to accumulate a large number of bitcoins in one hand. This is not the case. Firstly, such a ban would violate the freedom of trade. And secondly, it was impossible to accumulate in one hand when bitcoins were only being mined and there was no other way to get virtual currency. After it started to be listed on exchanges, buying and selling started and it became possible to accumulate a large amount in one hand.

Besides, “in the same hands” does not mean under one name. There can be many formal owners, but all of them, in fact, can work for one pocket.

That is, the phenomenon that really influences the cryptocurrency exchange rate is the notorious “human factor.” And since this is the case, there is no problem to catch up the value of bitcoin to the level needed by the US to pay off its astronomical national debt. At today’s rate of $100,000 per bitcoin, Trump needs 350 million units of the cryptocurrency to do this. Among experts today there is speculation that the US now has about 200 thousand BTC at its disposal. In the total issue, which is, let me remind you, 21 million, America’s need does not fit yet. But it will not pay off its debts tomorrow.

By the right moment, there is no doubt that the exchange rate, using the points mentioned above, will be driven to the required height. And the states will not even have to have on their balance sheet the entire volume of existing bitcoins.

One fine day for the US, it will transfer its crypto-money to all the treasure holders, which, few doubt, it bought at the dawn of the system for mere pennies. Or (more likely) during Trump’s first administration, when at the end of 2018 the value of bitcoin fell by 80% compared to 2017 and miners sold their businesses en masse due to their inability to recoup their losses.

Consequences of paying off US government debt with cryptocurrency

Some time after the debt is zeroed out, it will not be difficult for the world hegemon to close the channels to the recipients of the payment. That is, an unknown (or known) hacker group will once again hack the crypto exchange. What will happen next can be understood on the example of the Mt. Gox platform, where bitcoins were traded. In February 2014, it was hacked not for the first, but now for the last time. Hackers stole 744,408 units of cryptocurrency. The exchange went bankrupt, the bitcoin price collapsed by 36%, and the stolen virtual money was not returned to the owners.

Of course, there will be many who want to say that all this is a conspiracy theory and conspiracy theories. But COVID-19 in 2019 was also called a natural phenomenon, and the other day almost the entire world press agreed that the origin of the virus-carrier of the disease is the fruit of laboratory efforts of scientists.

Trump’s warning has been sounded. But bitcoin holders will cling to it to the end – it fluctuates up and down, and every time it goes down, the owners of this cryptocurrency have greed over fear – you just have to wait for a good deal and the lost will come back. To then fall again. Already irrevocably.

THE ARTICLE IS THE AUTHOR’S SPECULATION AND DOES NOT CLAIM TO BE TRUE. ALL INFORMATION IS TAKEN FROM OPEN SOURCES. THE AUTHOR DOES NOT IMPOSE ANY SUBJECTIVE CONCLUSIONS.

Erik Kelly for Head-Post.com

Send your author content for publication in the INSIGHT section to [email protected]

#world news#news#world politics#usa#usa politics#usa news#usa 2024#united states of america#united states#america#us politics#politics#usa economy#us economy#donald trump#donald trump 2024#donald trump news#trump#maga#trump administration#president donald trump#trump 2024#president trump#bitcoin#cryptocurrency#cryptocurreny trading#cryptocurency news#crypto news#crypto#digitalcurrency

4 notes

·

View notes

Text

Caroline Ellison, a former top executive in Sam Bankman-Fried ’s fallen FTX cryptocurrency empire, began her two-year prison sentence Thursday for her role in a fraud that cost investors, lenders and customers billions of dollars. Ellison, 30, reported to the federal prison in Danbury, Connecticut, according to the Federal Bureau of Prisons. She had pleaded guilty and testified extensively against Bankman-Fried, her former boyfriend, before he was convicted and sentenced to 25 years in prison. Ellison could have faced decades in prison herself, but both the judge and prosecutors said she deserved credit for her cooperation. At her sentencing hearing in New York in September, she tearfully apologized and said she was “deeply ashamed.” Ellison was chief executive at Alameda Research, a cryptocurrency hedge fund controlled by Bankman-Fried. FTX was one of the world’s most popular cryptocurrency exchanges, known for its Super Bowl TV ad and its extensive lobbying campaign in Washington, before it collapsed in 2022. U.S. prosecutors accused Bankman-Fried and other top executives of looting customer accounts on the exchange to make risky investments, make millions of dollars of illegal political donations, bribe Chinese officials and buy luxury real estate in the Caribbean.

5 notes

·

View notes

Text

What is Bitcoin? A Beginner's Guide to Bitcoin

When it comes to cryptocurrency, Bitcoin (BTC) is what most people think of first. However, many beginners don’t fully understand how Bitcoin works or how to invest in it. So, what exactly is Bitcoin? What is its history? And how should you invest in Bitcoin? This article will address these questions to help you better understand how to participate in Bitcoin investing. What is Bitcoin? Bitcoin (BTC) is a form of virtual currency, also known as cryptocurrency. It was introduced in 2008 by a mysterious person or group under the name "Satoshi Nakamoto." While we still don’t know Satoshi Nakamoto's true identity, Bitcoin has become a popular global investment asset. Bitcoin relies on blockchain technology, a distributed ledger that is immutable and ensures transparency and security in transactions. Why is Bitcoin so important? The primary reason Bitcoin has gained attention so quickly is its decentralized nature. Unlike traditional currencies, Bitcoin isn’t controlled by any government or financial institution. This means that in any country, the government cannot directly interfere with Bitcoin transactions. Additionally, Bitcoin’s anonymity makes it a valuable tool for those seeking to protect their privacy. Key Advantages of Bitcoin • Decentralization: Bitcoin isn’t controlled by any central authority or government, offering users greater financial freedom. • Anonymity: Although Bitcoin transaction records are public on the blockchain, transaction addresses aren’t directly linked to the owner's identity, protecting privacy. • Global Reach: Bitcoin can be circulated globally without the need for exchange rates or transaction restrictions. • Security: Bitcoin uses advanced encryption techniques to ensure the security of transactions and prevent asset theft. Risks of Investing in Bitcoin While Bitcoin has many advantages, there are also some risks that cannot be ignored. Due to its price volatility, investors may experience significant gains or losses in a short period. Additionally, since Bitcoin is decentralized and not government-regulated, if it’s hacked or you lose your private key, the funds cannot be recovered. Common questions: • Why is Bitcoin worth investing in despite its price fluctuations? • If I lose my Bitcoin wallet, can I recover it? • What are the risks associated with Bitcoin's anonymity? Bitcoin’s Use Cases Beyond being an investment tool, Bitcoin has many real-world applications. On platforms like Paxful and Noones, users can exchange Bitcoin for various gift cards (such as Amazon, iTunes, Steam, etc.) and points, making it a flexible asset tool. Bitcoin can also be used for cross-border payments, particularly in restricted countries or regions where it bypasses traditional financial systems, enabling quick and convenient transactions. Other use cases include: • Online shopping: An increasing number of merchants accept Bitcoin as a payment method, allowing users to make purchases using cryptocurrency. • Travel and accommodation: Some websites like Travala allow users to book flights, hotels, and travel packages using Bitcoin. • Charity donations: Some charitable organizations have started accepting Bitcoin donations, leveraging its decentralization and low transaction fees. • Peer-to-peer payments: Bitcoin facilitates fast peer-to-peer fund transfers, making it especially useful for international remittances.

Three Basic Ways to Invest in Bitcoin

Buy and store on an exchange This is the simplest investment method. You can buy Bitcoin through exchanges like Binance, OKX, or Bitget and store it in your exchange account. While this method is easy to operate, the security of the exchange is a risk factor. If an exchange is hacked or goes bankrupt, your assets could be lost.

Use a cold wallet to store Bitcoin Cold wallets are a more secure storage method. Users can transfer Bitcoin to an offline wallet they control, avoiding the risks of exchange hacks or collapses. However, if the private key is lost, the assets cannot be recovered, so users must take full responsibility for their wallets.

Contract trading Contract trading allows users to speculate on Bitcoin price movements without owning the actual asset. By leveraging positions, contract trading can amplify profits and losses. This approach carries high risk and is more suited to experienced investors. Advanced Strategies: Bitcoin Derivatives and Mining As the Bitcoin market matures, financial products like options, dual-currency savings, and liquidity mining are becoming increasingly popular. Additionally, traditional mining—contributing computing power to secure the network in exchange for Bitcoin rewards—remains an important source of income for some investors. Though mining has a high entry threshold, it is still a valuable way for participants to earn Bitcoin. Conclusion There are many ways to invest in Bitcoin. For beginners, the simplest approach is to buy and hold Bitcoin on an exchange. As you gain more market knowledge, you can explore cold wallet storage or contract trading. More advanced strategies, like Bitcoin derivatives and mining, require higher technical expertise and capital. Common questions: • What can Bitcoin be used to buy? • What are the advantages of using Bitcoin for payments? • Which Bitcoin trading platform is the most secure?

3 notes

·

View notes

Text

Like it's been a while since I read or thought about cryptocurrency so this is like is me reheating thoughts from 3 years ago in the microwave. The way I understand it though like ultimately the problem with cryptocurrency is that its value is ungrounded; it's intangible, like normal money, and it doesn't do anything unless enoug other people believe in it, but further, it is also not backed by any state or any other power that can enforce its use through laws and back it with reserves of gold or whatever else. So, in an absolute sense, its value is nothing but the amount of people that believe in it. And like so for a small minority of people, the "true believers", the hodlers, the kind of people who made decentraland, it's all about the promise that we will one day be living in Crypto World, where it will actually supplant fiat currency as the standard medium of exchange value in the world, one day. For everyone else who uses it as a speculative asset, who doesn't necessarily believe in the promised coming of Crypto World its value is hence based purely on the fact that it will probably maintain or increase its value for at least the next wee while, and that this value will be substantiated by the continued inflow of fiat currency into the crypto exchange market. For the inflow to continue people have to keep believing and vice versa. So like either this keeps on going and going forever until Crypto World comes about, or it all just collapses eventually. And this argument basically seems sound to me but i'm not confident in my own understanding of this area so I only hold it with a low degree of confidence. I feel like at the very least crypto will probably be around for a few more decades but like who knows

2 notes

·

View notes

Text

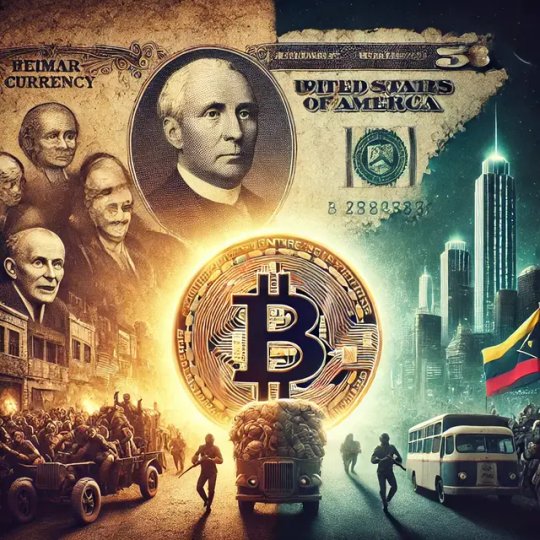

The Historical Downfall of Fiat Currencies and How Bitcoin Provides the Answer

Fiat currencies have dominated the global economy for over a century. However, history repeatedly shows us that fiat money, detached from any tangible asset like gold, carries inherent flaws that have led to catastrophic failures time and again. Today, as governments around the world continue to print money without restraint, we must revisit the lessons of the past and consider how Bitcoin provides a solution to these long-standing issues.

The Origins of Fiat Currency: A Fragile System

Fiat currency emerged as a convenient alternative to gold-backed money, allowing governments more flexibility in managing their economies. The United States officially abandoned the gold standard in 1971, signaling the beginning of modern fiat currency as we know it. Without a hard asset like gold backing the currency, governments gained the ability to print money at will, but this power has proven to be a double-edged sword.

While fiat currencies offered short-term economic relief in times of crisis, they also paved the way for rampant inflation, social unrest, and economic collapse when mismanaged. History is littered with examples of fiat currency failures that devastated entire nations.

Historical Case Studies of Hyperinflation

1. Weimar Germany (1921–1923)

After World War I, Germany was left crippled by war reparations and a broken economy. To meet these financial obligations, the government printed money, causing the value of the German mark to plummet. By 1923, hyperinflation had reached unimaginable levels—prices doubled every few days, and basic goods like bread cost billions of marks. People resorted to wheelbarrows full of money just to buy essentials.

The result? The collapse of the German economy and a loss of faith in the government, which set the stage for extreme political movements and social unrest. This case is a stark reminder of how unchecked money printing can destroy a nation's currency and lead to dire social consequences.

2. Zimbabwe (2000s)

Zimbabwe, once a prosperous agricultural nation, experienced one of the worst hyperinflations in history. In the early 2000s, government seizure of white-owned farms destroyed agricultural productivity, and the government resorted to printing money to cover its deficits. The results were catastrophic: by 2008, inflation reached an absurd 89.7 sextillion percent. The Zimbabwean dollar became worthless, and the country was forced to abandon it in favor of the U.S. dollar.

This case shows how reckless monetary policy and the overreliance on fiat currency printing can decimate an economy, forcing citizens into poverty and destabilizing the country.

3. Venezuela (2010s)

Venezuela is a modern-day example of fiat currency collapse. Mismanagement of oil revenues and poor economic policies led the government to print vast amounts of bolivars to cover its growing debt. The result? Hyperinflation of over 1,000,000% in 2018. Citizens saw their life savings evaporate as the currency became worthless. Many turned to Bitcoin and other cryptocurrencies as a store of value, using them to escape the destructive cycle of inflation.

Venezuela illustrates how a modern, seemingly wealthy nation can quickly spiral into chaos through reckless monetary policy, and how Bitcoin can provide a lifeline for those suffering the consequences.

Failed Solutions to Fiat Currency Problems

Over the years, several attempts have been made to address the issues inherent in fiat currencies, but they often fall short.

Currency Boards

A currency board is a monetary authority that pegs a country's currency to a stable foreign currency, like the U.S. dollar. Argentina implemented a currency board in the 1990s to curb inflation, tying its peso to the U.S. dollar. While this initially stabilized the economy, it collapsed in 2001 when Argentina couldn't maintain the peg due to fiscal mismanagement and massive debt. The fixed exchange rate removed the country's flexibility to deal with economic shocks, leading to a severe economic crisis.

Dollarization

Countries like Ecuador and El Salvador have adopted the U.S. dollar as their national currency to stabilize their economies. While dollarization may offer short-term stability, it deprives these nations of control over their monetary policy, making them vulnerable to external factors and reliant on the U.S. Federal Reserve's decisions. However, El Salvador took a groundbreaking step by becoming the first country to make Bitcoin legal tender, providing an alternative to traditional dollarization. While this move aims to restore some financial sovereignty, dollarization still leaves countries ill-equipped to fully respond to local economic challenges, making it more of a temporary patch than a lasting solution.

Why These Solutions Fail

These attempts—whether currency boards or dollarization—are temporary fixes that fail to address the core issues: reckless fiscal policies, corruption, and the absence of long-term stability. They simply shift control from one system to another without providing a sustainable solution.

The Social and Political Fallout of Fiat Currency Failures

The collapse of a fiat currency isn't just an economic disaster—it’s a social and political one as well.

Social Unrest

When a currency collapses, it erodes the very foundation of a society. People lose faith not only in their currency but also in their government. This often leads to widespread protests, social unrest, and, in extreme cases, revolution. Weimar Germany’s collapse laid the groundwork for the rise of Adolf Hitler and the Nazi Party, as people desperately sought stability in any form.

In Venezuela, hyperinflation forced millions to flee the country, resulting in one of the largest refugee crises in modern history. The social consequences of fiat currency collapse are profound and often irreversible.

Erosion of Trust

When governments abuse their ability to print money, it shatters the trust that citizens have in their leaders. Fiat currency failure exposes the fragility of a political system that relies on economic stability to maintain control. This erosion of trust can lead to authoritarianism, as citizens look for strong leaders to restore order—often at the cost of democratic values.

Inequality

Fiat currency failures disproportionately harm the poor and middle class, who often lack access to hard assets like gold or real estate to protect their wealth. As the currency devalues, their savings and purchasing power evaporate, while the wealthy, who have the means to move assets abroad or into stable currencies, are better insulated from the impact.

How Bitcoin Addresses These Core Issues

Bitcoin offers a solution that directly tackles the problems inherent in fiat currency systems. Here’s how:

Fixed Supply

Bitcoin’s fixed supply of 21 million coins ensures that no government or central authority can inflate the currency. Unlike fiat currencies, Bitcoin cannot be devalued by reckless monetary policy, making it a powerful hedge against inflation.

Decentralization

Bitcoin operates on a decentralized network, meaning no single government or entity controls it. This prevents the kind of centralized mismanagement that leads to hyperinflation and currency collapse. It’s a system that thrives on transparency and trust in code rather than in corruptible human institutions.

Global Accessibility

Bitcoin provides financial access to anyone with an internet connection, offering a lifeline to those living in countries with unstable fiat currencies. In places like Venezuela, citizens have already turned to Bitcoin to preserve their wealth and protect themselves from the destructive forces of hyperinflation.

Trustless System

Bitcoin’s blockchain technology allows for transparent and secure transactions without relying on third parties, such as banks or governments. This trustless system empowers individuals to take control of their financial futures, restoring autonomy and security in an increasingly unstable world.

Conclusion: A Solution for the Future

The failures of fiat currency are well-documented and consistent throughout history. Whether it's Weimar Germany, Zimbabwe, or Venezuela, the result is always the same: social and economic collapse. But we now have a solution in Bitcoin—a decentralized, finite, and global currency that offers a hedge against the systemic flaws of fiat money.

As we face an era of unprecedented money printing and growing economic uncertainty, the lessons of history are more relevant than ever. Bitcoin represents a new paradigm for financial stability, one that addresses the failures of fiat and offers a hopeful future for individuals seeking financial sovereignty.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#FiatCurrency#MonetaryPolicy#Hyperinflation#WeimarGermany#ZimbabweEconomy#VenezuelaCrisis#BitcoinRevolution#FinancialFreedom#SoundMoney#Blockchain#DigitalCurrency#EconomicHistory#Decentralization#CryptoEducation#FutureOfMoney#CryptoVsFiat#EconomicCollapse#Hyperbitcoinization#financial experts#unplugged financial#finance#financial empowerment#financial education#globaleconomy

3 notes

·

View notes

Text

The German government has re-entered the cryptocurrency market with a $1.89 Bitcoin purchase, following weeks of divesting around 50,000 Bitcoin, which pressured prices below $60,000. Arkham Intelligence noted the divestment involved transferring 3,846 Bitcoin to institutional entities like "Flow Traders and 139Po," likely for OTC transactions.

This reentry raises questions about Germany’s strategic view on cryptocurrencies amidst market uncertainties. The Mt. Gox reimbursement plan, stemming from the 2014 exchange collapse, is a key factor affecting sentiment, potentially adding liquidity. Despite this, institutional investors are capitalizing on market dips. CoinShares data shows $295 million in inflows into U.S.-based ETFs for the week ending July 8, reversing prior subdued sentiment.

Germany’s renewed Bitcoin purchase highlights a potential reevaluation of cryptocurrency as an asset class. This strategic move could influence market sentiment, reflecting shifting perceptions and strategies in the crypto landscape.

2 notes

·

View notes

Text

Sam Bankman-Fried, once hailed as a genius in cryptocurrency, was found guilty Thursday of all fraud counts against him, a year after his exchange, FTX, imploded and practically wiped out thousands of customers.

The verdict was reached around 7:40 p.m. ET, about four hours after the federal jury in Manhattan began deliberations.

Bankman-Fried, a co-founder of the digital currency exchange FTX, was charged with seven counts of wire fraud, securities fraud and money laundering that swindled customers of FTX and lenders to its affiliated hedge fund, Alameda Research.

Bankman-Fried “perpetrated one of the biggest financial frauds in American history,” Damian Williams, the U.S. attorney for the Southern District of New York, said after the verdict.

“The cryptocurrency industry might be new; the players like Bankman-Fried might be new,” Williams said. “But this kind of fraud, this kind of corruption, is as old as time.”

Bankman-Fried faces up to 110 years in prison. His sentencing is scheduled for March 28.

FTX and Alameda quickly collapsed in November 2022 after some of their financial liabilities were exposed. The fact that Alameda had taken billions of dollars from FTX's customers and that much of Alameda's balance sheet comprised digital currency assets it had created, was central to the case against Bankman-Fried.

Unnerved by disclosures about the firm's financial position, many of FTX’s customers tried to get their money back. That set off the equivalent of a bank run.

The value of Alameda's investments crashed, and FTX couldn’t return much of that money because it had been given to Alameda. Some went to the fund’s lenders, and billions were spent on sponsorships, commercials and loans to top executives. That, too, was a major part of the case against Bankman-Fried.

Many of FTX and Alameda's leaders were also charged after the firms went under. Former Alameda CEO Caroline Ellison, FTX co-founder Gary Wang and FTX head of engineering Nishad Singh all pleaded guilty. They agreed to cooperate with the prosecution and testify against Bankman-Fried in exchange for lighter sentences.

While Bankman-Fried testified in his own defense, it didn’t appear to have the same weight as the insider testimony against him. The prosecution, in its closing argument, said Bankman-Fried had answered “I can’t recall” 140 times while he was being cross-examined.

Bankman-Fried’s lawyers contended that he did not intend to defraud anyone and that the government was looking for someone to blame after the failures of FTX and Alameda.

Bankman-Fried was asked to rise and face the jury as the verdicts were read Thursday, and he did so. He showed little emotion as each verdict was read.

His father slumped in his seat, hunched over as each guilty verdict came in. His mother was visibly emotional.

Mark S. Cohen, Bankman-Fried’s counsel, said in an emailed statement Thursday that Bankman-Fried’s legal team respects the jury’s decision but that they are disappointed.

“Mr. Bankman Fried maintains his innocence and will continue to vigorously fight the charges against him,” he said.

Forbes had once estimated that Bankman-Fried's stakes in Alameda and FTXwere worth $26 billion. He was 29 at the time. But after the bankruptcies, that was gone. Criminal charges followed weeks later.

He also faces another trial on charges of bribing foreign officials and other counts. That trial is scheduled to begin in March, and he has pleaded not guilty to all charges.

On Thursday, Bankman-Fried was found guilty of two counts of wire fraud conspiracy, two counts of wire fraud, one count of conspiracy to commit money laundering, one count of conspiracy to commit commodities fraud and one count of conspiracy to commit securities fraud.

Williams, the prosecutor, said Bankman-Fried’s conviction should send a message to others.

“It’s a warning, this case, to every single fraudster out there who thinks that they’re untouchable or that their crimes are too complex for us to catch or that they’re too powerful for us to prosecute or that they could try to talk their way out of it when they get caught,” he said. “Those folks should think again.”

11 notes

·

View notes

Text

Pump and Dump Schemes: How Scammers Manipulate the Market

The pump-and-dump scheme is prevalent across various investment sectors but has become particularly widespread in the cryptocurrency space due to the novelty and popularity of digital assets. The scheme involves holders of a relatively worthless asset promoting it to drive up its price as others buy in.

One notable method of executing such schemes is through Telegram channels that offer “investment advice.” These channels are often used to orchestrate the pumping of tokens. As thousands of people buy the price grows. Then, the initial promoters sell off their holdings, causing a sharp price drop and leaving late investors with significant losses.

The typical pattern of a pump and dump scheme involves several steps:

Creating a Token: The scheme starts with the creation of a new cryptocurrency token.

Promotion on Social Networks: The promoters talk up the token on various social media platforms to attract interest and buyers.

Listing on CoinGecko or CoinMarketCap: The token is added to popular cryptocurrency tracking websites to gain visibility.

Advertising Campaigns: Extensive advertising is conducted, both online and offline, to lure more investors.

Exchange Listing: The token is listed on at least one major cryptocurrency exchange, such as Binance.

Continued Promotion: Ongoing advertising and promotion are maintained to drive the token’s price to a targeted high level.

Sell-Off: The creators sell their tokens at a massive profit, often thousands of per cent higher than their original value.

Price Collapse: Following the sell-off, the token’s price plummets and rarely recovers, leaving the token effectively worthless.

Through this orchestrated manipulation, the promoters make significant profits at the expense of later investors, who are left with devalued assets.

2 notes

·

View notes

Text

One of JD Vance’s key policy advisers, Aaron Kofsky, has for years posted extensively on Reddit about using a variety of drugs, including cocaine and opiates, under the username PsychoticMammal. In the posts, which are as recent as three months ago, Kofsky wrote about experiencing withdrawal from and trying to “kick” tianeptine—also known as “gas station heroin”—and kratom; advised other users on how to transport drugs on domestic flights; and called Vance “a Trump boot licker.”

According to his LinkedIn profile, Kofsky, who is in his late twenties, has been advising Vance on financial policy since this past May, and has been working in the vice presidential nominee’s Senate office since March of last year. A recent Politico article on Vance’s “inner circle” described Kofsky as helping the senator “flesh out his opposition to some cryptocurrency regulation and his effort to introduce new banking regulations after the collapse of Silicon Valley Bank.”

Before working for Vance, Kofsky worked for the Senate Banking, Housing, and Urban Affairs Committee and as a policy adviser to Securities and Exchange Commissioner Mark Uyeda. The crypto industry has seen Vance as an ally since he ran for Senate in the 2022 election and then disclosed that he personally owned more than $100,000 in Bitcoin. Kofsky has criticized SEC chair Gary Gensler’s heavy-handed approach to crypto regulation multiple times on X. Over the summer, Vance circulated a draft bill that would remove much of the authority the SEC and the Commodity Futures Trading Commission have over governing digital currency. At the time, Politico called the bill one of the more “industry-friendly” pieces of legislation.

A WIRED investigation shows Kofsky is also the person posting as PsychoticMammal. The account has posted personal details that precisely match Kofsky’s résumé, and has linked to a little-followed Instagram account dedicated to photos of Kofsky wearing preppy outfits. A review of publicly available material from data breaches provided by Constella Intelligence shows that Kofsky’s personal email address was used to set up a “PsychoMammal” account on a photography site. Furthermore, the PsychoticMammal name was used on Poshmark by a user whose avatar is a photo of Kofsky. It was also used on Tumblr by someone who linked to—and claimed as his own—a Blogspot maintained by a user named Aaron Kofsky, who posted personal details that match details of Kofsky’s biography.

The posts made by Kofsky stand in stark contrast to Vance’s own statements related to drug crime. Since being elected to the Senate in 2022, he has positioned himself as a leader in preventing fentanyl trafficking and, as recently as August, has said the Trump–Vance administration would support use of the death penalty as punishment against drug dealers. Vance, who has spoken at length about fentanyl trafficking, rose to prominence as the author of a book that discussed his mother’s drug addiction, which he referenced during his Republican National Convention speech this summer. He also argued that Democrats are letting drugs cross the border from Mexico.

After WIRED contacted Kofsky for comment, some of PsychoticMammal’s posts about drugs were deleted, and their Poshmark avatar was changed to a picture of characters from the Star Wars movie Attack of the Clones. Parker Magid, a spokesperson for Vance’s Senate office, provided a statement from Kofsky.

“Like millions of Americans,” the statement reads, “I’ve struggled with drug use, which in my case was mostly an attempt to self medicate against the effects of epilepsy and epilepsy medication. I deeply regret posting these comments. I’m not proud of this and I’m embarrassed it’s being publicized in this way, but I am thankful to say that part of my life is behind me.”

For the past 11 years, PsychoticMammal has used Reddit to document their use of a variety of drugs including cocaine, tianeptine, kratom, oxycodone, Ritalin, and MDMA. In one post from eight years ago, they listed all of the drugs they had tried to that point, rating them on a scale of one to 10.

These drug-related posts have continued while Kofsky has been employed by the Senate. In May 2022, for example, PsychoticMammal responded to a post in the r/Cocaine subreddit, giving advice on how to smuggle drugs past airport security.

“Putting a bag in between pages of a book or in your wallet is also a safe bet,” they wrote. “TSA xray machines just show different types of material as different colors. What they’re looking for is metal. Since most book covers also have plastic in them, it’ll just all show up as the same color. I’ve never had an issue.”

In January, PsychoticMammal posted a video from a Senate committee hearing in which Vance questions a former Drug Enforcement Administration agent on the increasing use of nitazenes, or manufactured opioids; Kofsky appears in the background. They posted the video on several drug-related subreddits, including r/Opioid_RCs, r/Drugs, r/Opiates, and r/ObscureDrugs.

PsychoticMammal also posted it in r/ResearchChemicals, writing, “Surprising! Politician knows about nitazenes. Ohio Senator JD Vance Asks Witness About Nitzenes. Is it just me, or is this super surprisng? Like I’m just confused how this guy had heard of zenes? I can’t imagine any of his colleagues know anything about them.”

A different user commented on the post, pointing out Kofsky and writing, “that dude on the right behind him looks high on something lol.”

PsychoticMammal then agreed with the user, writing, “Haha I didn’t notice that guy before. His eyes are def buggin. Maybe snorted some ole white girl beforehand? I’m sure half of congress rails lines.”

Later on in the thread, a different user accused PsychoticMammal of being Vance because the linked video was unlisted. “Unlisted? 21 views? Senator Vance, is that you?”

“Lol I wish! Would love to be rolling in the dough like him and his VC buddies,” PsychoticMammal replied. “Honestly when I first watched this the thought kinda crossed my mind that maybe he’s familiar because he is a fan himself, but I feel like that’s doubtful given his politics. I’m sure there are a few congressmen who indulge, but I doubt they’re using zenes or other RCs [research chemicals]. Seems like a coke kinda job.”

In the comments of a now deleted post on r/ObscureDrugs, PsychoticMammal, responding to a user claiming that nitazenes are not obscure drugs, called Vance a “Trump boot licker.”

“I just can’t believe that this Trump boot licker Vance is ahead of the curve here,” the comments reads.

PsychoticMammal described numerous instances of drug use in posts dating from the time Kofsky worked for then senator Pat Toomey and Vance. “I love coke on its own, mixed with benzos, mixed with opiates (my fav tbh), and even love a line or two after smoking a few bowls. I’d even say that coke is my second favorite drug behind opiates,” they wrote earlier this year. In May of last year, they wrote about “my latest tianeptine binge which has skyrocketed my tolerance” and “hoping to finally kick Tia”—references to an unscheduled antidepressant that produces an effect similar to opioids and which is banned in 12 states and commonly sold at convenience stores. In May 2022, they wrote: “Coke then opiates is always my go-to. I only speedball if I have enough opiates to redose when I’m out of blow.”

PsychoticMammal has repeatedly posted about suffering from an addiction to tianeptine. In a post from last year titled “ODSMT for Tianeptine Withdrawals,” they wrote, “I’m trying to figure out what the tianeptine to ODSMT equivalent dose conversion is. I have a few grams of ODSMT coming in the mail and hoping to finally kick Tia using it.”

PsychoticMammal has also repeatedly referenced using kratom, a substance sourced from the leaves of a Southeast Asian tree that mimics the effects of opioids and is often sold at corner stores and smoke shops. Two years ago, in response to a Reddit user who was seeking pain relief, they wrote: “I’ve dabbled in every drug you can think of—kratom is the one drug that really tripped me up and I found myself addicted to. Not sure what it was about it as it’s like a much milder opiate, but man that shit was hell for me to quit.”

WIRED’s investigation shows that Kofsky appears to be closely tied to the PsychoticMammal username across the internet. In 2013, for example, PsychoticMammal wrote that they were a ski instructor at the same resort, Boston Mills Brandywine Ski Resorts, that Kofsky lists as a past employer on his LinkedIn profile, and which he spoke about to Cleveland Magazine in a 2014 profile of notable area students. In another post from earlier this year, PsychoticMammal referred to the resort as their “home hill.”

In a separate post from November 2013, PsychoticMammal replied to a post about a St. Vincent–St. Mary High School football game, suggesting that they went to that school and correctly listing the final score of the game. Kofsky’s LinkedIn account lists the Akron, Ohio–based school as his former high school, and he is listed as a 2015 graduate in the school magazine.

PsychoticMammal also shared a link to an Instagram account that has posted photos of Kofsky. In a post to the r/RalphLauren subreddit six months ago, the PsychoticMammal account linked to @notyourmotherspreppy, a men’s style account that shows Kofsky wearing preppy outfits. “Anyone know what sweater this is?” the post says. The image of Kofsky used in the August Politico article also appears to be from this Instagram account. He is wearing the same vintage 1989 Ralph Lauren Country Patchwork Sweater on the Instagram account and the image used in Politico.

Before WIRED asked Kofsky for comment, a Poshmark account with the username PsychoticMammal started in 2018 used a photo of Kofsky as its avatar and listed the real name of the user as “Aaron K.” A Blogspot user named PsychoticMammal wrote about being Jewish and going to Catholic school—experiences that match Kofsky’s, according to the Cleveland Magazine article. And a VSCO account registered with Kofsky’s personal Gmail account, according to publicly available material from a data breach, also uses the name PsychoticMammal.

As recently as three months ago, PsychoticMammal posted to the r/7_hydroxymitragynine subreddit asking for help locating one of the compounds found in kratom in DC, Northern Virginia, or Maryland.

12 notes

·

View notes

Text

https://mediamonarchy.com/wp-content/uploads/2024/05/20240514_MorningMonarchy.mp3 Download MP3 Devastating hits, Bezos’ DARPA grandad and Pokémon maps + this day in history w/U.S. moves Jerusalem Embassy and our song of the day by Macklemore on your #MorningMonarchy for May 14, 2024. Notes/Links: Are BRICS Bucks coming soon? BRICS: Prepare for US Dollar Collapse, IMF Warns https://watcher.guru/news/brics-prepare-for-us-dollar-collapse-imf-warns Australia’s Tax Office Tells Crypto Exchanges to Hand Over Transaction Details of 1.2 Million Accounts: Reuters; The ATO said the data will help identify traders who failed to report their cryptocurrency-related activities. https://www.coindesk.com/policy/2024/05/07/australias-tax-office-tells-crypto-exchanges-to-hand-over-transaction-details-of-12-million-accounts-reuters/ FTX customers get good-bad news as the bankrupt exchange rides the crypto rally https://sherwood.news/snacks/crypto/ftx-customers-get-good-bad-news-as-the-bankrupt-exchange-rides-the-crypto/ GameStop shares surge 70% as meme stock craze returns https://www.cnbc.com/2024/05/14/gamestop-amc-shares-jump-another-40percent-in-premarket-trading-as-meme-stock-craze-returns.html Full list of closures as major bank to shut 36 branches and cut hundreds of jobs https://news.sky.com/story/tsb-to-close-36-branches-and-cut-hundreds-of-jobs-13131574 Video: TSB to close 36 branches with 250 jobs devastatingly hit (Audio) https://www.youtube.com/watch?v=9juP3_SZxAk Laura Loomer Accuses Democrat Politician Who Told Trump to ‘Go Back to Court’ of Illicit Profiteering from Hush Money Trial https://archive.ph/Og5Ny Elon Musk, David Sacks Holds Secret ‘Anti-Biden’ Gathering of Billi https://californiaglobe.com/fr/elon-musk-david-sacks-holds-secret-anti-biden-gathering-of-billionaires/ Melinda French Gates steps down from Gates Foundation, retains $12.5 billion for additional philanthropy; The Gates Foundation has, over three decades, made $77.6 billion in charitable contributions, making it one of the world’s largest donor organizations. https://www.nbcnews.com/business/business-news/melinda-gates-stepping-down-from-gates-foundation-rcna152001 FBI File on Jeff Bezos’ Grandfather, a DARPA Co-Founder, Has Been Destroyed https://vigilantnews.com/post/fbi-file-on-jeff-bezos-grandfather-a-darpa-co-founder-has-been-destroyed/ Video: America’s Book Of Secrets: DARPA’s Secret Mind Control Technology (Audio) https://www.youtube.com/watch?v=wZRkfBsTTt8 EU’s Controversial Digital ID Regulations Set for 2024, Mandating Big Tech Compliance by 2026 https://reclaimthenet.org/eus-controversial-digital-id-mandating-big-tech-compliance-by-2026 UK airports latest: ‘Queues only getting bigger’ https://news.sky.com/story/uk-airports-latest-queues-only-getting-bigger-after-london-and-manchester-confirm-nationwide-border-system-issue-13131330 Marvel Rivals apologises after banning negative reviews https://www.bbc.com/news/articles/cd1wwlvd9yko 28 years later, unopenable door in Super Mario 64’s Cool, Cool Mountain has been opened without hacks https://www.tomshardware.com/video-games/28-years-later-unopenable-door-in-super-mario-64s-cool-cool-mountain-has-been-opened-without-hacks Pokémon Go players are altering public map data to catch rare Pokémon https://arstechnica.com/gaming/2024/05/pokemon-go-players-are-altering-public-map-data-to-catch-rare-pokemon/ Video: Pokemon Go Versus OpenStreetMap (Audio) https://www.youtube.com/watch?v=fLPyXy39Sv0 Image: @Hybrid’s Cover Art – Pokemon Go’s ‘Modern Solutions’ https://mediamonarchy.com/wp-content/uploads/2024/05/20240514_MorningMonarchy.jpg May 2014 – Page 6 – Media Monarchy https://mediamonarchy.com/2014/5/page/6/ Flashback: Americans Will Never Have the ‘Right to Be Forgotten’ (May 14, 2014) https://mediamonarchy.com/americans-will-never-have-right-to-be/ Flashback: Modern Pope Gets Old School On The Devil (May 14, 2014) https://mediamonarchy.com/modern-pope-gets-old-school-on-devi/ Flashback: Frugal US Consumers Make It Tough for F...

View On WordPress

#alternative news#cyber space war#Macklemore#media monarchy#Morning Monarchy#mp3#podcast#Songs Of The Day#This Day In History

2 notes

·

View notes