#FiatCurrency

Explore tagged Tumblr posts

Text

Goldback or dollar? Discover why fiat currency could cost you in 2025 and how goldbacks stand the test of time. Protect your wealth!

2 notes

·

View notes

Text

Bitcoin's Role in Times of Financial Crisis: A Beacon of Hope in Turbulent Times

Introduction: Setting the Stage

Imagine this: the economy is unraveling, inflation is soaring, and banks are teetering on the edge of collapse. We've seen this story before. Each time the financial world is shaken, the average person is often left to pick up the pieces. In moments like these, people look for safety. Gold has often been a refuge in times of economic uncertainty, but today, a new kind of "digital gold" has entered the scene—Bitcoin.

Bitcoin isn't just another speculative asset; it's a new form of money created for the very purpose of facing crises like the ones that leave economies in shambles. But how does Bitcoin really function during times of financial turmoil? And why do people increasingly turn to it when traditional systems let them down? Let’s explore.

Historical Context of Financial Crises

The world has witnessed countless financial crises. From the Great Depression to the 2008 Great Recession, from the hyperinflation of Zimbabwe to the recent collapse of banks—economic disasters are not anomalies, they’re almost predictable. These crises share common traits: a loss of trust in financial institutions, erosion of the value of fiat currency, and people scrambling for alternatives to preserve their wealth.

Take the 2008 Great Recession. Banks gambled with people's money, and when they lost, governments stepped in to bail them out, leaving regular folks to face the consequences. It was amidst this backdrop that Bitcoin emerged—a system immune to human manipulation, with no central authority to dilute its value or make decisions in secret.

Bitcoin's Emergence During the 2008 Crisis

Bitcoin was created in response to the failures of traditional finance. Satoshi Nakamoto, the mysterious creator of Bitcoin, embedded a message in the very first block, known as the Genesis Block: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." This wasn’t just a timestamp; it was a clear statement of intent.

Bitcoin aimed to be different—a currency free from the whims of governments, banks, and those who had lost the trust of the public. Its birth was a direct reaction to a broken system, offering an alternative that promised financial freedom, transparency, and true ownership.

Bitcoin's Unique Qualities as a Crisis Hedge

What makes Bitcoin uniquely suited for times of financial crisis? Let’s break down the key qualities:

Decentralization: Bitcoin has no central authority. No government or institution can control its issuance or manipulate its value to serve their own interests. It belongs to the people, run by a network of nodes and miners spread across the globe.

Fixed Supply: Unlike fiat currencies that can be printed at will—as central banks often do in response to crises—Bitcoin has a cap of 21 million coins. This scarcity is fundamental to its value, acting as a hedge against the rampant money printing that often leads to inflation.

Portability and Accessibility: Bitcoin isn’t tied to any one country, and it doesn’t require a physical footprint. It is accessible 24/7, unlike banks that can close, restrict access, or freeze assets during turbulent times. Bitcoin gives people control over their wealth, regardless of where they are or what’s happening around them.

Real Examples of Bitcoin as a Safe Haven

We’ve seen Bitcoin being used as a safe haven asset in various crises:

Venezuela and Argentina: In hyperinflationary economies where local currency loses value rapidly, Bitcoin has provided a crucial way for people to preserve their purchasing power. Venezuelans, for instance, turned to Bitcoin as the bolivar crumbled, finding in it a stable store of value relative to their national currency.

Cyprus Bail-In (2013): In 2013, the Cypriot government froze citizens’ bank accounts and implemented a "bail-in," using their deposits to rescue failing banks. In that same year, Bitcoin’s price saw a surge as people began realizing the power of holding an asset that couldn’t be confiscated by any government.

Recent Banking Concerns (Silicon Valley Bank Collapse): More recently, during times of banking uncertainty, Bitcoin again saw an uptick in interest. People are slowly waking up to the idea that having your wealth in a system controlled by others isn’t always safe. Bitcoin offers an alternative—one where individuals have complete control.

Dollar-Cost Averaging: A Simple Strategy for Uncertain Times

One of the biggest hurdles for people looking to get into Bitcoin is its infamous volatility. This is where Dollar-Cost Averaging (DCA) comes in—a simple yet effective strategy that makes Bitcoin accessible to anyone.

What is DCA? DCA involves investing a fixed amount of money in Bitcoin at regular intervals (e.g., weekly or monthly), regardless of the price. Whether Bitcoin is up or down, you keep investing the same amount.

Why DCA Works Well for Bitcoin:

Mitigating Volatility: Bitcoin’s price can be unpredictable, but DCA helps to average out the highs and lows. Instead of trying to time the market—which even experts struggle with—you gradually accumulate Bitcoin over time, reducing the impact of its swings.

Making Bitcoin Accessible: You don’t need to be wealthy to start accumulating Bitcoin. Even a small amount like $20 a week can add up over time, building a safety net that could one day protect you from economic turmoil.

Examples of DCA Success: Someone who started DCA-ing into Bitcoin during the peak of 2017’s bull run would still be significantly up today. The key is consistency and a long-term view. In times of crisis, DCA can be a powerful way to build a hedge, step by step, without taking on overwhelming risk.

Challenges and Criticisms

It would be disingenuous not to mention Bitcoin's challenges. Its volatility is real, and for some, this is a reason to be hesitant. But it’s crucial to understand that Bitcoin is still a young asset, evolving in a world that’s just beginning to understand its potential.

For those looking at Bitcoin as a hedge against traditional financial instability, the strategy isn't about short-term gains. It's about adopting a different mindset—one focused on time in the market, not timing the market. Volatility is less intimidating when viewed through a long-term lens.

Why Bitcoin is Different from Gold

Bitcoin has often been called "digital gold." While both assets serve as stores of value, Bitcoin has some distinct advantages. Unlike gold, Bitcoin is digital and easily portable. You can carry millions of dollars worth of Bitcoin on a USB-sized hardware wallet or even just in your memory if needed. Bitcoin is also much easier to divide. You can send someone a few dollars' worth instantly, whereas gold needs to be physically divided or tokenized to achieve that same flexibility.

Perhaps most importantly, Bitcoin is resistant to seizure. Throughout history, gold has been confiscated by governments. Bitcoin, on the other hand, can be stored with no physical footprint, making it far harder to seize if managed correctly.

Conclusion: A Modern Solution for Modern Problems

Financial crises are not going away. They are a byproduct of a flawed system that prioritizes short-term solutions over long-term stability. Bitcoin was built as a response to these very issues. It offers an alternative that’s built on transparency, ownership, and the promise of true financial sovereignty.

If you’re looking for a way to protect yourself from the next inevitable crisis, Bitcoin stands as a beacon of hope. And you don’t need to jump in all at once. Start small, consider using Dollar-Cost Averaging, and build a position over time. Bitcoin could be the life raft you need when the storm inevitably comes—a modern solution for modern problems, providing hope and resilience in a world of uncertainty.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FinancialCrisis#DigitalGold#EconomicUncertainty#CryptoResilience#SafeHavenAsset#BitcoinHistory#FinancialFreedom#DecentralizedFinance#DCA#InvestingInBitcoin#CryptoEducation#BitcoinVsFiat#SoundMoney#FutureOfFinance#BlockchainTechnology#Hyperinflation#EconomicCollapse#CrisisInvesting#BitcoinHedge#StoreOfValue#FiatCurrency#BitcoinSovereignty#BitcoinStandard#AlternativeFinance#cryptocurrency#financial empowerment#finance#globaleconomy#blockchain

2 notes

·

View notes

Text

Fiat money is a perpetual wage theft machine.

#Fiat money is a perpetual wage theft machine.#fiat money#fiatcurrency#fiatc#fiat 500#fiat#money#wage theft#extortion#exploitation#exploitative#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

0 notes

Text

Bitcoin vs. Fiat Currency: A Comparative Analysis by Simplyfy

Explore the contrasting aspects of Bitcoin and fiat forex with this specified evaluation from Simplyfy. Understand the advantages and challenges related to every kind of money, their advent processes, administration methods, and their roles in the world economy. This comparative learning will furnish you with a clear perception of the future of economic transactions and the upward thrust of digital currencies. Read more;https://simplyfynews.com/bitcoin-vs-fiat-currency-a-comparative-analysis/

1 note

·

View note

Text

🚀 Discover One Trading: Your Gateway to the Future of Trading!

🌐 Platform Overview:

Trade seamlessly with One Trading, your European crypto-assets exchange, offering a comprehensive platform for both beginners and professionals. Here's what sets us apart:

✅ Regulated Excellence:

Experience the safety and security of a fully regulated platform. One Trading is headquartered and regulated in the EU, upholding the highest regulatory standards.

✨ Trade in Size, Zero Commissions:

Trade up to €10M in any asset with low slippage and fees as low as 0% based on trading volumes. Enjoy the freedom of trading without commission charges!

🌈 Multi-Assets Convenience:

Seamlessly fund your account with EUR, GBP, CHF, or crypto. One Trading provides a multi-asset trading platform for ultimate flexibility.

💡 Advanced Features:

Instant Trade: Trade anywhere, anytime on desktop or mobile.

Large Asset Selection: Choose from 100+ pairs between crypto-assets and fiat.

RFQ via Electronic OTC: Enjoy a fully automated request for a quote trading experience.

📈 Platform Highlights:

User-Friendly Interface: Intuitive design for both newcomers and experienced traders.

Secure Access: Real-time and secure access with advanced order types, charting tools, and more.

📅 What's Next on Our Roadmap:

Q1 - Q4, 2023: Exciting upgrades, partnerships, and the launch of instant trading. Be part of our journey towards becoming the fastest crypto exchange for retail and institutional clients.

⏩ 👉 Follow us on Social Media:

Connect with us on Twitter, Discord, LinkedIn, Instagram, Telegram, TikTok, YouTube, and Reddit. Stay updated with the latest news and developments from One Trading!

🔗 Explore more:

Learn more about One Trading, formerly known as Bitpanda Pro, and how we're revolutionizing the crypto trading landscape.

🌐 Language Options:

Select your preferred language - English 🇬🇧, Italiano 🇮🇹, Deutsch 🇩🇪, Français 🇫🇷.

📧 Support and Contact:

For any inquiries or support, visit our FAQ section or reach out to us through our support channels. One Trading is here to empower your crypto journey!

#OneTrading#CryptoExchange#TradingPlatform#RegulatedTrading#ZeroCommissions#MultiAssetTrading#AdvancedFeatures#CryptoAssets#FiatCurrency#InstantTrade#OTCTrading#UserFriendlyInterface#SecureAccess#PlatformHighlights#Roadmap2023#CryptoNews

0 notes

Text

#fiatcurrency#money#centralization#quoteoftheday#dailyquotesforyou#decentralization#defi#freemarkets#austrianeconomics#privacy#voluntaryism#freedom#liberty#libertarianism#libertarian#anarchocapitalism#crypto#cryptocurrency#btc#wealth#freespeech#revolutionary#decentralized#financialfreedom#thorchain#thorchainrune#decentralizedliquidity#decentralizedexchange#trending#wisdom

0 notes

Text

Hong Kong Chamber of Commerce Proposes Yuan-Backed Stablecoin: Boosting Asian Trade

The Hong Kong Chamber of Commerce is advocating for the issuance of a stablecoin backed by the Chinese yuan. This digital currency will be accessible to companies engaging with mainland China and other Asian nations. In a bid to become leading hubs for blockchain industry development, Hong Kong is competing with Singapore and London. In April 2023, Hong Kong authorities urged the city's banking sector to cater to cryptocurrency companies. Removing restrictions on interactions with businesses focused on digital currencies will foster more robust industry growth in the region. The Hong Kong General Chamber of Commerce (HKGCC) proposes launching a stablecoin pegged to the yuan or a basket of fiat currencies, including the Hong Kong dollar and the US dollar, as highlighted by the organization's press service. The HKGCC's stablecoin initiative is suggested for inclusion in Hong Kong's budget program. While city authorities do not oppose this initiative, they propose consulting with experts and blockchain companies. In December, HKMA Chief Eddie Yue suggested that stablecoins could serve as a bridge between the crypto sphere and the traditional finance market. Read the full article

#blockchainindustry#budgetprogram#ChamberofCommerce#Chineseyuan#consultations#cryptocurrencycompanies#digitalcurrency#fiatcurrencies#HKGCC#HKMA#HongKong#London#Singapore#stablecoin

0 notes

Text

SOME VERY GOOD POINTS ABOUT TRANSACTING BUSINESS IN SILVER AFTER THE COLLAPSE AND POSSIBLE GOVERNMENT CONFISCATION OF MONEY WITH USA ON IT !!!

https://youtu.be/Vzr0fNPu7Eo?si=eg-EuK0Q-kl-_Y3A

##CRIMINAL #GOVERNMENT #BIDEN #MOB #REGIME #ECONOMIC #COLLAPSE #MONEY #TRANSACTIONS #SILVER #FIATCURRENCY #CONFISCATION #FIGHT #AMERICA #USA #NOW

0 notes

Text

Fiat currencies are crashing! Gold is surging! 💰 It's becoming obvious as to why central banks are hoarding gold. Find out more on the latest morning check-in! 🔥

#dollar#economy#gold#money#news#silver#bitcoin#trump#GoldVsFiat#GoldInvestment#FiatCurrency#TradeWar#EconomicCollapse

0 notes

Text

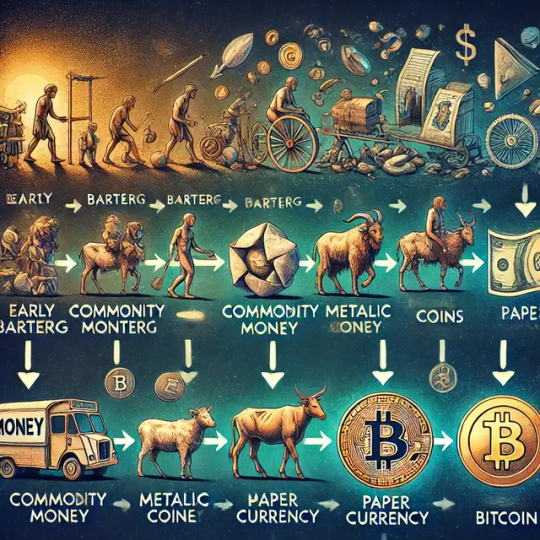

The Evolution of Money: From Barter to Bitcoin

Money has always been an essential part of human society, serving as a tool for exchange, value storage, and facilitating trade. From the early days of barter systems to the modern era of digital currencies, money has evolved in fascinating ways. In this post, we will explore the history of money—from the simple barter systems to the rise of Bitcoin as a potential solution for today's monetary challenges.

1. Barter System In the earliest days of human society, people used a barter system to trade goods and services directly. If someone had surplus grain and needed a tool, they would find someone who had that tool and was in need of grain. While this system worked on a small scale, it had significant limitations. The "coincidence of wants" problem made it impractical—both parties had to want what the other had, and this was often not the case. As societies grew more complex, a more efficient system was needed.

2. Emergence of Commodity Money To overcome the inefficiencies of barter, societies began using commodity money—items that had intrinsic value and were widely accepted in trade. Items like shells, cattle, and metals became mediums of exchange. Commodity money solved the "coincidence of wants" issue and allowed for more standardized trade. However, challenges persisted, such as portability, divisibility, and the ability to assess value consistently.

3. Metallic Coins and Standardization The introduction of metallic coins marked a significant leap forward. Coins made from precious metals like gold, silver, and copper had inherent value and could be easily transported and traded. Standardization played a key role—authorities like kings and governments minted coins to certify their value, providing public trust in the monetary system. Metallic coins facilitated commerce and expanded trade networks, but they also required oversight and protection from debasement or counterfeiting.

4. Paper Money and Government Backing To address the practicality of carrying large quantities of coins, societies transitioned to using paper money. Initially, these paper notes acted as promissory notes that represented a claim on a specific amount of gold or silver stored by a bank. Central banking systems were established to manage these reserves, and eventually, governments began issuing paper currency backed by their promise of value. This emergence of government-backed fiat currency allowed for much greater flexibility and convenience in managing the money supply.

5. The Gold Standard and Its Demise For much of the 19th and early 20th centuries, many countries adhered to the gold standard, where paper money was directly linked to a fixed amount of gold. This system aimed to stabilize currencies and prevent excessive inflation. However, during the Great Depression in 1933, the U.S. government made owning significant amounts of gold illegal and confiscated gold holdings from citizens to stabilize the economy and provide more control over the money supply. By the early 1970s, the gold standard was completely abandoned, and fiat currency—money not backed by any physical commodity—became the global norm.

6. The Fiat Era and Modern Challenges Fiat currency, backed solely by the trust and authority of governments, allowed countries to control their monetary policies and react to economic challenges. However, there are notable downsides. Governments can print more money to fund expenditures, leading to inflation. In recent years, countries worldwide have been printing money at an unprecedented rate, leading to a compounding effect that reduces the purchasing power of their currencies. This widespread money printing not only creates inflation but also contributes to economic instability. Due to the interconnected nature of the global economy, these actions often have ripple effects, creating financial uncertainty and challenges for individuals worldwide.

7. The Advent of Bitcoin Bitcoin emerged in 2009 as a response to the perceived failings of the traditional monetary system. It introduced a digital, decentralized alternative to traditional forms of money. Bitcoin is built on a peer-to-peer network that operates without the need for intermediaries like banks. Its limited supply of 21 million coins ensures scarcity, and its transparent, decentralized ledger—the blockchain—addresses many of the issues related to trust and inflation. Bitcoin represents a bold step forward in the evolution of money, one that resists censorship, preserves value, and operates independently of centralized authorities.

8. Comparison: Bitcoin vs. Fiat Currency Bitcoin offers key advantages over fiat currency. Unlike fiat, which can be printed at will, Bitcoin's supply is fixed and predictable. Its decentralized nature makes it resistant to censorship and government intervention. While fiat currency benefits governments by allowing them to control economic policy, Bitcoin's transparent and decentralized framework empowers individuals and offers a new level of financial sovereignty.

Conclusion The evolution of money has been shaped by humanity's ongoing quest for convenience, fairness, and stability. From barter systems to commodity money, metallic coins, paper currency, and now digital assets, each stage reflects our changing needs. Bitcoin represents the next step in this evolution, offering a solution to the challenges of fiat currency—such as inflation, centralization, and lack of transparency. As the world continues to change, it's worth considering whether Bitcoin might be the foundation for a more resilient and fair financial system in the future.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#EvolutionOfMoney#HistoryOfMoney#BarterToBitcoin#Bitcoin#Cryptocurrency#FinancialHistory#DigitalCurrency#MoneyMatters#EconomicHistory#FiatCurrency#GoldStandard#CommodityMoney#FutureOfMoney#Blockchain#FinancialEducation#Decentralization#MoneyEvolution#BitcoinRevolution#SoundMoney#UnpluggedFinancial#financial experts#finance#financial empowerment#financial education#globaleconomy#unplugged financial

3 notes

·

View notes

Text

Bitcoin Hits Record High in Yen Terms, Reflecting Stress on Japan's Fiat Currency

Fiat currencies like the U.S. dollar, Japanese yen, euro, and others are not backed by a hard asset. Their value is subjective, depending on market perceptions. Bitcoin's ongoing rally indicates weak sentiment for the yen among major fiat currencies. The leading cryptocurrency recently reached a new record high of 7.9 million yen in Tokyo, while its dollar-denominated price is still 32% below the previous record high. The Federal Reserve and other central banks have raised interest rates to combat inflation, but the Bank of Japan has kept rates at zero and printed more fiat money.

In Japan, core inflation, excluding food and energy, increased by 3.1% in 2023, eroding the purchasing power of the yen. This has led investors to seek alternative assets like bitcoin and gold, which are considered stores of value. The yen has depreciated against the dollar by 13% and against bitcoin by 6.4% this year. Unless the Bank of Japan accelerates its exit from its loose monetary policy, bitcoin may continue to trade at a premium in yen terms. Countries like Japan, Hong Kong, and Singapore, with better legal clarity for digital asset trading, may see the growth of cryptocurrencies due to persistent volatility in fiat currencies.

Overall, the ongoing rally of bitcoin reflects market perceptions, with the yen being the weakest among major fiat currencies. Inflation, the depreciation of the yen, and the continuous printing of fiat money by the Bank of Japan have pushed investors towards alternative assets like bitcoin and gold. The legal clarity in Japan, Hong Kong, and Singapore regarding digital asset trading, coupled with volatile fiat currencies, may foster the growth of cryptocurrencies in these regions. To read the original article, click here.

#bitcoin #cryptocurrency #yen #fiatcurrency

0 notes

Photo

Save your fiat currency that is losing value by the second.

7 notes

·

View notes

Text

Think about this on a larger scale. Set aside the BS propaganda you hear about how great the economy is, the consumer is resilient, the job market is robust, blah blah blah. We are a nation of debt, period. As I write this, the current tally is at $34 trillion and counting. By the time I hit the publish button in a day or two, it’ll be worse.

0 notes

Photo

I see what Satoshi did. I’m not complaining. I’m just impressed. Who walks away from fortune & fame? Someone with a small ego & a big brain. This world isn’t kind to those who set the masses free. 🤓 #fuckthebanks #fuck #the #banks #satoshi #setusfree #freefromdebt #debtfree #fiatcurrency #notmymoney #fuckrepublicans #fuckdemocrats #fight2thedeath #please #bitcoiner #bitcoiners (at Venice Beach) https://www.instagram.com/p/CJy-lOegNlp/?igshid=xfptmn4ekhud

#fuckthebanks#fuck#the#banks#satoshi#setusfree#freefromdebt#debtfree#fiatcurrency#notmymoney#fuckrepublicans#fuckdemocrats#fight2thedeath#please#bitcoiner#bitcoiners

2 notes

·

View notes

Photo

#Bitcoin $Gbtc #Blockchain $Riot #Stocks #Wallstreet #Liquidity #cryptocurrency #Fiatcurrency #Goldstandard #Cfds $Gold #Etfs #Ethereum #Banking #Financialfreedom #Finance #Business #REALESTATE #mmj $Hemp $Budz $phot $Gwph $Cgc $Nugs $Spy #Ratrace $Race https://www.instagram.com/p/B2moRcqjqaP/?igshid=l86r490noglo

#bitcoin#blockchain#stocks#wallstreet#liquidity#cryptocurrency#fiatcurrency#goldstandard#cfds#etfs#ethereum#banking#financialfreedom#finance#business#realestate#mmj#ratrace

1 note

·

View note

Text

#fiatcurrency#money#decentralization#defi#freemarkets#austrianeconomics#privacy#voluntaryism#freedom#liberty#libertarianism#libertarian#anarchocapitalism#crypto#cryptocurrency#btc#wealth#freespeech#revolutionary#decentralized#financialfreedom#thorchain#thorchainerune#decentralizedliquidity#decentralizedexchange

0 notes