#UnpluggedFinancial

Explore tagged Tumblr posts

Text

Conscious Currency: What Bitcoin Teaches Us About Value and Awareness

What if your entire perception of value—of time, work, even self-worth—was built on a lie? What if the very money in your pocket was the root of a fog that clouds everything you see, touch, and believe in? This isn’t a conspiracy theory. It’s a reality too many people never stop to question. Because when you’re born inside a system, you rarely pause to consider that the system itself might be broken.

Fiat currency is a masterpiece of illusion. It pretends to be stable, but it erodes. It acts like a store of value, yet silently leaks your time and energy through inflation. The dollar doesn’t just lose value—it steals clarity. It convinces you to chase numbers on a screen while the real wealth—your attention, your freedom, your future—is siphoned away.

And then along comes Bitcoin. Not as a quick fix or a get-rich scheme, but as a new way of seeing. A peer-to-peer, decentralized protocol of truth that doesn’t ask for permission, doesn’t lie, and doesn’t inflate. It simply is. A tool with the power to change your relationship with value, because it’s the first form of money that operates like a mirror—reflecting back the truth of your actions, your time, your priorities.

Bitcoin is the red pill. The deeper you understand it, the more it reshapes how you see the world. Once you truly see Bitcoin through the eyes of its creator—once you grasp the elegance, the honesty, the intent—you can use that lens to look at everything else. And when you do, you realize just how broken everything really is.

You start to see how inflation props up empires and devours savings. How debt is sold as freedom. How institutions feed off confusion. How most of society is sprinting on a treadmill powered by lies.

But Bitcoin doesn’t just fix money. It fixes your perception. It shows you that value is not what they told you it was. It’s not dollars or titles or trends. Value is rooted in time, energy, and trust. And once you can see that, you stop playing their game. You start playing your own.

Bitcoin is conscious currency. It’s value with awareness baked in. It doesn’t just upgrade your wallet—it upgrades your worldview.

Because at the end of the day, this isn’t about digital coins. It’s about digital clarity. It’s about realizing that you were never broken—your money was. And now, for the first time, you have a choice.

Tick tock. Next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#ConsciousCurrency#FiatIsBroken#BitcoinRevolution#FinancialAwakening#SoundMoney#DigitalClarity#MoneyTruth#DecentralizedFuture#EconomicPhilosophy#WakeUp#BitcoinStandard#RedPillMoney#EndTheFed#ValueAwareness#UnpluggedFinancial#TheFutureIsBitcoin#TickTockNextBlock#FreedomThroughBitcoin#cryptocurrency#digitalcurrency#finance#globaleconomy#financial education#financial experts#financial empowerment#unplugged financial#blockchain

2 notes

·

View notes

Text

The Bitcoin Mindset: How Learning About BTC Changes the Way You See Everything

Most people think Bitcoin is just an investment, a get-rich-quick scheme, or digital money for tech nerds. But those of us who have really gone down the rabbit hole know better. Bitcoin isn’t just a new form of money—it’s a lens that completely rewires how you see the world.

Understanding Bitcoin forces you to question everything—from the way governments operate, to how money is created, to the very nature of personal sovereignty. And once you see the truth, there’s no going back.

Money: The Greatest Illusion Ever Sold

Before Bitcoin, most people—including myself—never really questioned money. It was just… there. You worked for it, saved it, spent it, and that was the end of the story. But Bitcoin forces you to dig deeper:

Why does money lose value over time?

Who controls it, and who benefits from that control?

Why is it that no matter how hard people work, they seem to be getting poorer?

The answers to these questions aren’t comfortable. The fiat system is built on debt, inflation, and control—and it’s rigged against the average person. Governments print money endlessly, diluting its value while wages stagnate. The entire system is a slow-motion theft of purchasing power, masked as “economic policy.”

Bitcoin shatters this illusion. It shows us that money can be fixed, that it can be scarce, and that it can be outside the control of any government or corporation. Once you understand that, your relationship with money changes forever.

Government: The Business of Control

Bitcoin also exposes how much power governments derive from controlling money. The ability to print unlimited currency gives them absolute authority over economies, wars, and policies. And when that power is threatened, they don’t respond kindly.

Why do you think governments have spent years trying to discredit or regulate Bitcoin? Because it strips them of financial dominance. A world where people store their wealth in Bitcoin is a world where governments can’t just inflate away your savings or freeze your accounts on a whim.

Bitcoin forces you to ask:

How much of my wealth is actually mine?

What happens when governments decide I can’t spend my own money?

If my money is controlled by someone else, am I truly free?

And here’s the reality—without self-sovereign money, your freedom is an illusion. Bitcoin gives people the option to exit the traditional system and take back control.

Personal Sovereignty: The Ultimate Awakening

This is where Bitcoin takes things to another level. Once you realize that you don’t need banks or governments to manage your wealth, you start applying that same logic to everything else in life.

Bitcoiners tend to: ✅ Question mainstream narratives ✅ Seek truth over convenience ✅ Value privacy, independence, and self-reliance ✅ Think in terms of long-term conviction over short-term gains

It’s not just about money. It’s about how you see the world. Once you start questioning money, you start questioning everything—education, healthcare, politics, history, media. You realize that so much of what we’re told is designed to benefit those in power, not the average person.

Bitcoiners aren’t just investors—we are critical thinkers, builders, and disruptors. We are the ones opting out of a broken system and creating a better one.

The Red Pill Moment

For me, Bitcoin wasn’t just a financial discovery—it was a mental shift. It changed how I saw my work, my time, my future. It made me realize that true wealth isn’t just about money—it’s about freedom.

And once you see it, you can’t unsee it.

Tick Tock, Next Block

Bitcoin isn’t just fixing money. It’s fixing minds. It’s creating a new generation of people who are done with the lies, the manipulation, and the endless cycle of financial slavery.

If you haven’t had your “aha” moment yet, keep digging. Question everything. Learn the history of money, understand the mechanics of inflation, and see for yourself why Bitcoin is the future.

The world is waking up. Are you?

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#BitcoinAwakening#BitcoinMindset#FinancialFreedom#Decentralization#CryptoRevolution#FixTheMoney#OrangePill#SovereignIndividual#SoundMoney#DigitalGold#FiatIsTheProblem#HardMoney#MoneyRevolution#EconomicFreedom#UnpluggedFinancial#WakeUp#QuestionEverything#TickTockNextBlock#blockchain#digitalcurrency#financial experts#finance#financial empowerment#financial education#globaleconomy#unplugged financial#cryptocurrency

3 notes

·

View notes

Text

Wake Up Neo: The Bitcoin Rabbit Hole & Breaking Free From the Matrix

Have you ever felt it? That nagging sensation in the back of your mind, like something in this world doesn’t add up? You work harder, you save more, you play by the rules—yet, somehow, it never seems to be enough. Prices go up, your paycheck doesn’t stretch as far, and no matter how much you grind, financial freedom always seems just out of reach.

That’s because you were never meant to win.

Welcome to the Matrix.

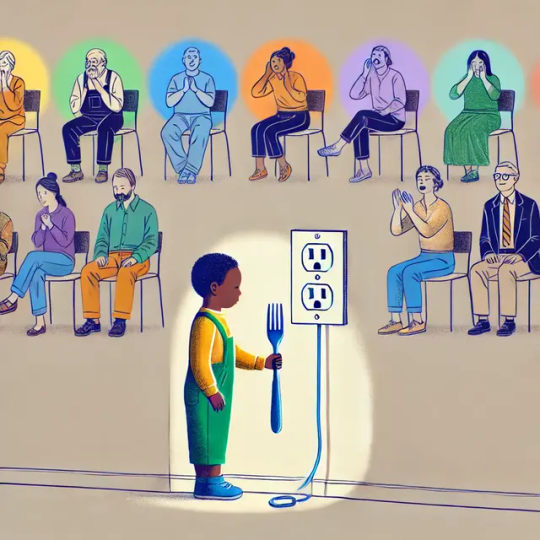

The Illusion of Freedom

From the moment we are born, we are plugged into a system designed to extract our energy. We are handed a script: go to school, get a degree, take out loans, get a job, pay taxes, buy a house, work until you're 65, and then—maybe—you’ll get to enjoy life. But by then, you’re too old, too tired, and too drained from a lifetime of servitude.

The system doesn’t just run on money. It runs on you. Your time. Your effort. Your productivity. And the cruelest trick of all? The very currency you earn in exchange for your labor is constantly being devalued.

Inflation isn’t an accident. It’s not some unfortunate byproduct of bad economic policy. Inflation is the system working exactly as intended. Governments print more money, your purchasing power shrinks, and the cycle continues. They tell you 2% inflation is “healthy,” but for who? Certainly not for you. You are the battery, drained year after year, kept just comfortable enough to stay obedient but never free enough to escape.

The Agents of the Fiat System

In The Matrix, the agents are everywhere, enforcing the rules of the system. In our world, they take a different form. The central banks, the politicians, the financial media—all of them exist to keep the illusion intact.

Central banks print money out of thin air, diluting the value of what you worked for. Politicians promise solutions while only ever increasing the national debt, making each dollar weaker. The financial media tells you everything is fine, distracting you with nonsense while your savings quietly erode. And the schools? They never teach you how money actually works—because if they did, the whole illusion would shatter.

They want you in debt. They want you relying on them. They need you to believe that there is no alternative.

But there is.

Bitcoin: The Red Pill

Somewhere deep inside, you’ve always known something was wrong. You just didn’t know what the alternative looked like—until now.

Bitcoin is decentralized. No rulers. No central bank. No government printing it into oblivion.

Bitcoin is scarce. Only 21 million will ever exist. No inflation. No dilution. No theft by the hidden hand of monetary policy.

Bitcoin is uncensorable. No bank can freeze it. No government can confiscate it. No corporation can deplatform you from it.

Bitcoin is the red pill.

Once you see it, you can’t unsee it. You realize that fiat is the real scam. That the stock market, the housing market, the entire financial system is just a house of cards, propped up by artificial money and endless debt. That the only way to win is to exit the game entirely.

Escaping the Matrix

Waking up isn’t enough. You have to act. You have to unplug. And that means taking control of your financial future before it’s too late.

The first step? Start stacking sats. The fiat system wants you to believe you need to be rich to invest. That’s another lie. With Bitcoin, you can start with $5, $10, whatever you can afford. The key is to start.

Next, take back your sovereignty. Get your Bitcoin off exchanges. Own your keys. Custody is control, and control is freedom.

Then, educate yourself. Read the Bitcoin Standard, listen to podcasts, follow those who have already broken free. The more you learn, the more obvious the scam becomes.

Finally, reduce your dependence on the system. Get out of unnecessary debt. Stop trading your time for a paycheck that loses value by the second. Find ways to earn in Bitcoin, transact in Bitcoin, and build a future that isn’t dictated by the whims of a central bank.

And most importantly? Spread the signal. Help others wake up before the system tightens its grip. Because make no mistake—CBDCs are coming. More surveillance is coming. More control is coming. The Matrix doesn’t like losing its prisoners.

But you don’t have to be one of them.

The Choice is Yours

Most people will never wake up. They’ll keep running on the treadmill, trading their lives away for an illusion. They’ll cling to the belief that the system is fair, that it’s just bad luck keeping them from financial freedom. They’ll blame inflation on corporations, on supply chains, on everything except the source: the money printer itself.

But not you.

You have a choice. You can take the blue pill—close this article, keep scrolling, and forget everything you just read.

Or you can take the red pill. You can start stacking, learning, and taking back control. You can unplug from the fiat system and step into a world where your time is yours again.

Wake up, Neo. The Matrix is crumbling. And Bitcoin is your way out.

Tick Tock. Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#TheMatrix#RedPill#FinancialFreedom#FiatSlavery#WakeUpNeo#BitcoinRabbitHole#SoundMoney#Decentralization#OptOut#MoneyRevolution#Hyperbitcoinization#UnpluggedFinancial#Sovereignty#TickTockNextBlock#blockchain#financial education#finance#globaleconomy#unplugged financial#financial experts#financial empowerment#cryptocurrency#digitalcurrency

2 notes

·

View notes

Text

Good morning, everyone!

Today, I want to reflect on something that has been on my mind lately: the concept of resilience in both the financial world and in our personal lives. We all know that the world can be unpredictable. Economies shift, technologies evolve, and life throws us unexpected challenges. But it's during these times of uncertainty that our capacity for resilience is truly tested.

Bitcoin has always been a symbol of resilience to me. It was born out of a financial crisis and has endured skepticism, regulatory challenges, and countless attempts to undermine it. And yet, here we are—Bitcoin is still standing, stronger than ever, and more relevant than it's ever been. It reminds us that there is strength in decentralization, in transparency, and in the collective belief that something better can exist beyond the traditional systems we've grown accustomed to.

Much like Bitcoin, each of us has the ability to endure, adapt, and grow in the face of adversity. Whether it's about finances, personal struggles, or trying to make the world a better place—resilience is the key. Let's take a moment today to think about the ways we can build our own resilience. Maybe it's learning a new skill, deepening our understanding of financial sovereignty, or just having the courage to take one more step forward, even when the path isn't clear.

I think it's also important to recognize that resilience is not just an individual endeavor—it's a collective one. When we come together as a community, we amplify each other's strength. Bitcoin itself is a perfect example of this—it's a network built on the contributions of millions of people around the world. Each node, each miner, each holder plays a role in securing the network and making it stronger. In the same way, we can uplift one another in our personal journeys. We can share knowledge, support each other through difficult times, and celebrate each other's victories, no matter how small. Resilience thrives in an environment of mutual support and shared purpose.

So, let's ask ourselves: How can we contribute to the resilience of our communities? How can we use our knowledge, our skills, and our experiences to help others stand firm when times get tough? Maybe it's as simple as sharing what we know about financial independence, or maybe it's about being there for a friend who's struggling. Every small action counts, and collectively, they can make a huge difference.

And just as Bitcoin has shown us that there's an alternative to the broken financial systems we've inherited, we too can create alternatives in our own lives. We don't have to accept the status quo if it doesn't serve us. We can build new habits, new systems, and new ways of thinking that align with our values and our vision for the future. This is the essence of resilience—not just enduring the world as it is, but actively shaping it into something better.

Remember, resilience isn't about avoiding the storm—it's about learning how to dance in the rain. Let's keep moving forward, together, knowing that every challenge is an opportunity to grow stronger, both individually and collectively.

Stay strong, stay curious, and as always, stay unplugged.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Resilience#FinancialFreedom#Bitcoin#CryptoCommunity#Decentralization#OvercomingChallenges#FinancialRevolution#StayStrong#UnpluggedThoughts#FutureOfFinance#Sovereignty#CommunitySupport#Motivation#Inspiration#StormsAndSunshine#DanceInTheRain#AlternativeFinance#BuildingTogether#StayCurious#UnpluggedFinancial#financial education#financial experts#digitalcurrency#blockchain#finance#unplugged financial#financial empowerment#cryptocurrency#globaleconomy

4 notes

·

View notes

Text

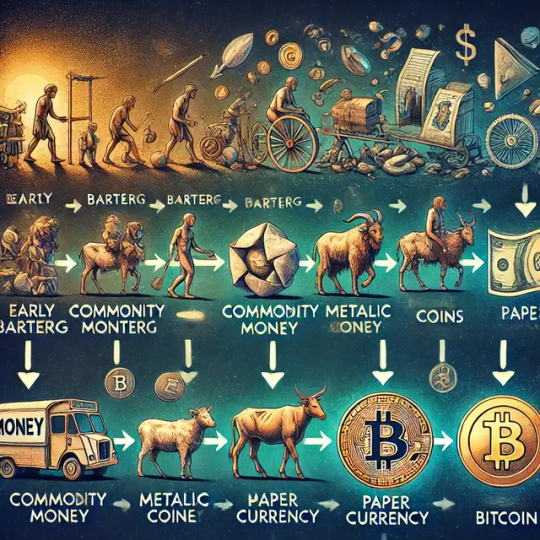

The Evolution of Money: From Barter to Bitcoin

Money has always been an essential part of human society, serving as a tool for exchange, value storage, and facilitating trade. From the early days of barter systems to the modern era of digital currencies, money has evolved in fascinating ways. In this post, we will explore the history of money—from the simple barter systems to the rise of Bitcoin as a potential solution for today's monetary challenges.

1. Barter System In the earliest days of human society, people used a barter system to trade goods and services directly. If someone had surplus grain and needed a tool, they would find someone who had that tool and was in need of grain. While this system worked on a small scale, it had significant limitations. The "coincidence of wants" problem made it impractical—both parties had to want what the other had, and this was often not the case. As societies grew more complex, a more efficient system was needed.

2. Emergence of Commodity Money To overcome the inefficiencies of barter, societies began using commodity money—items that had intrinsic value and were widely accepted in trade. Items like shells, cattle, and metals became mediums of exchange. Commodity money solved the "coincidence of wants" issue and allowed for more standardized trade. However, challenges persisted, such as portability, divisibility, and the ability to assess value consistently.

3. Metallic Coins and Standardization The introduction of metallic coins marked a significant leap forward. Coins made from precious metals like gold, silver, and copper had inherent value and could be easily transported and traded. Standardization played a key role—authorities like kings and governments minted coins to certify their value, providing public trust in the monetary system. Metallic coins facilitated commerce and expanded trade networks, but they also required oversight and protection from debasement or counterfeiting.

4. Paper Money and Government Backing To address the practicality of carrying large quantities of coins, societies transitioned to using paper money. Initially, these paper notes acted as promissory notes that represented a claim on a specific amount of gold or silver stored by a bank. Central banking systems were established to manage these reserves, and eventually, governments began issuing paper currency backed by their promise of value. This emergence of government-backed fiat currency allowed for much greater flexibility and convenience in managing the money supply.

5. The Gold Standard and Its Demise For much of the 19th and early 20th centuries, many countries adhered to the gold standard, where paper money was directly linked to a fixed amount of gold. This system aimed to stabilize currencies and prevent excessive inflation. However, during the Great Depression in 1933, the U.S. government made owning significant amounts of gold illegal and confiscated gold holdings from citizens to stabilize the economy and provide more control over the money supply. By the early 1970s, the gold standard was completely abandoned, and fiat currency—money not backed by any physical commodity—became the global norm.

6. The Fiat Era and Modern Challenges Fiat currency, backed solely by the trust and authority of governments, allowed countries to control their monetary policies and react to economic challenges. However, there are notable downsides. Governments can print more money to fund expenditures, leading to inflation. In recent years, countries worldwide have been printing money at an unprecedented rate, leading to a compounding effect that reduces the purchasing power of their currencies. This widespread money printing not only creates inflation but also contributes to economic instability. Due to the interconnected nature of the global economy, these actions often have ripple effects, creating financial uncertainty and challenges for individuals worldwide.

7. The Advent of Bitcoin Bitcoin emerged in 2009 as a response to the perceived failings of the traditional monetary system. It introduced a digital, decentralized alternative to traditional forms of money. Bitcoin is built on a peer-to-peer network that operates without the need for intermediaries like banks. Its limited supply of 21 million coins ensures scarcity, and its transparent, decentralized ledger—the blockchain—addresses many of the issues related to trust and inflation. Bitcoin represents a bold step forward in the evolution of money, one that resists censorship, preserves value, and operates independently of centralized authorities.

8. Comparison: Bitcoin vs. Fiat Currency Bitcoin offers key advantages over fiat currency. Unlike fiat, which can be printed at will, Bitcoin's supply is fixed and predictable. Its decentralized nature makes it resistant to censorship and government intervention. While fiat currency benefits governments by allowing them to control economic policy, Bitcoin's transparent and decentralized framework empowers individuals and offers a new level of financial sovereignty.

Conclusion The evolution of money has been shaped by humanity's ongoing quest for convenience, fairness, and stability. From barter systems to commodity money, metallic coins, paper currency, and now digital assets, each stage reflects our changing needs. Bitcoin represents the next step in this evolution, offering a solution to the challenges of fiat currency—such as inflation, centralization, and lack of transparency. As the world continues to change, it's worth considering whether Bitcoin might be the foundation for a more resilient and fair financial system in the future.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#EvolutionOfMoney#HistoryOfMoney#BarterToBitcoin#Bitcoin#Cryptocurrency#FinancialHistory#DigitalCurrency#MoneyMatters#EconomicHistory#FiatCurrency#GoldStandard#CommodityMoney#FutureOfMoney#Blockchain#FinancialEducation#Decentralization#MoneyEvolution#BitcoinRevolution#SoundMoney#UnpluggedFinancial#financial experts#finance#financial empowerment#financial education#globaleconomy#unplugged financial

3 notes

·

View notes

Text

Unplugged Financial: Why Now is the Time to Educate Ourselves on Bitcoin

In a world where traditional financial systems are showing significant vulnerabilities and uncertainty is ever-present, one term continues to rise in relevance: Bitcoin. However, let’s be honest—most people still don’t truly understand what Bitcoin represents or why it matters. This gap in understanding keeps many tethered to a financial structure that is steadily losing its effectiveness. Now is the time to break free. Now is the time to educate ourselves.

Why Now? The Collapse of Trust in Traditional Finance

Banks were once considered symbols of stability and trust, but recent years have painted a different picture. The 2008 financial crisis shattered the illusion of invulnerability, and since then, central banks have doubled down on policies that disempower the average individual—such as printing trillions of dollars, leading to inflation and the erosion of purchasing power. In 2023, we witnessed bank failures that sent shockwaves throughout the economy, causing many to question: if these institutions can collapse so suddenly, where can we place our trust?

Bitcoin, with its fixed supply and decentralized design, offers an alternative. Unlike fiat currencies, which can be printed without limit, Bitcoin operates on principles of scarcity—there will only ever be 21 million coins. It is transparent, incorruptible, and free from government manipulation. But for Bitcoin to be a viable option for individuals, understanding it is crucial—and that requires education.

The Knowledge Gap: From Mystery to Empowerment

For many people, Bitcoin remains an enigma. It is often labeled as “digital gold” but is still clouded by misconceptions—frequently dismissed as too complex, overly speculative, or just a passing trend. This lack of understanding is the primary obstacle. Learning about Bitcoin is not merely about grasping a new form of currency; it is about reclaiming control, gaining financial literacy, and empowering oneself in the face of a system designed to limit our options.

When you begin to explore Bitcoin, you enter a rabbit hole of interconnected topics—from economics and cryptography to energy consumption and financial sovereignty. This intellectual journey enhances your critical thinking as you evaluate diverse perspectives, analyze intricate information, and form your own conclusions. By demystifying how Bitcoin functions—from understanding the blockchain to using practical tools like wallets and the Lightning Network—we can close this knowledge gap.

For the first time in human history, as one financial system collapses, we have another ready to step in and fill the void. Bitcoin provides a new foundation—one that is decentralized, transparent, and accessible to all. It is time to disconnect from outdated narratives that keep us reliant on centralized power structures. Education fosters empowerment, and empowered individuals make informed decisions for themselves and their families.

Bitcoin Education: A Practical Approach

The journey to understanding Bitcoin begins with small, intentional steps. There is a wealth of resources available—podcasts, articles, documentaries, and beginner guides. You don’t need to become a technical expert; you just need to start somewhere. Break down myths by uncovering the facts. Unplugged Financial is here to support you on this journey—through articles, videos, and thought-provoking discussions.

Consider the kind of world we want to create for future generations. Do we want our children to inherit a financial system plagued by endless debt, failing banks, and depreciating currencies? Or do we want to offer them financial sovereignty, a means to save and accumulate wealth without fearing the decisions of centralized authorities? The answer depends on what we do today—starting with education.

Take Action Today

The world is changing rapidly. As financial landscapes evolve, we can either remain passive and hope for stability or take proactive steps to secure our futures. Bitcoin is more than a currency; it is a movement towards a fairer, more transparent financial system. But it all begins with knowledge. Now is the time to disconnect from outdated ideas, dive deeper, and learn how Bitcoin can positively impact your life.

Are you ready to take control of your financial future? Start today. Read, listen, question everything—and together, let’s build a better tomorrow.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FinancialEducation#CryptoRevolution#DecentralizedFinance#BitcoinStandard#FiatCollapse#FinancialFreedom#BlockchainTechnology#DigitalGold#Cryptocurrency#EconomicSovereignty#MoneyRevolution#UnpluggedFinancial#BitcoinAwareness#FinancialFuture#financial empowerment#finance#globaleconomy#digitalcurrency#blockchain#financial experts#financial education#unplugged financial

2 notes

·

View notes

Text

How Bitcoin Redefines Trust in Global Trade

For centuries, trust has been a cornerstone of global trade. Whether trading across borders or within nations, businesses have historically relied on governments, banks, and institutions to act as intermediaries, providing the necessary oversight and guarantees that transactions would be honored. But as our world becomes more digital and interconnected, the limitations and inefficiencies of these traditional systems are becoming increasingly evident. Enter Bitcoin—a decentralized currency that is fundamentally transforming the very nature of trust in global trade.

The Role of Trust in Traditional Trade

In the current global trade system, trust is largely built on central authorities—governments, central banks, and financial institutions. These intermediaries ensure stability, enforce contracts, and manage currencies. While this system has worked to some extent, it’s fraught with problems: corruption, inefficiencies, inflation, and geopolitical risks. For example, trade disputes can escalate into economic sanctions or currency manipulation, which can cripple businesses. Trust in these institutions can falter, and when it does, the global economy feels the effects.

Moreover, relying on the USD as the global reserve currency has its drawbacks. The USD's value fluctuates based on the policies of the U.S. government, including money printing, interest rate changes, and other interventions. This introduces volatility into global markets and trade relationships, often to the detriment of smaller, emerging economies.

Bitcoin as a Trustless System

Bitcoin offers a radically different approach. Built on blockchain technology, Bitcoin eliminates the need for intermediaries. Instead of relying on a centralized authority to verify and approve transactions, Bitcoin operates through a decentralized network where transactions are publicly recorded and verified by code. This concept of "trustless" transactions means that participants don't need to rely on a central authority to validate their exchanges.

By removing the need for middlemen, Bitcoin reduces transaction costs, increases transparency, and provides a level of security that is nearly impossible to breach. This decentralization also means that no single entity—government or financial institution—can manipulate the currency for its own gain, making it a more stable and reliable form of value transfer in global trade.

Decentralization and Its Impact on Global Trade

The decentralized nature of Bitcoin is already reshaping trade by enabling peer-to-peer transactions across borders. With no central authority dictating terms or controlling the flow of money, individuals and businesses can transact directly, quickly, and securely. This is particularly important in emerging markets, where trust in financial institutions is often low or nonexistent.

For example, in countries experiencing hyperinflation or economic instability, Bitcoin provides a way for businesses to engage in global trade without relying on a failing national currency. It also opens doors for the unbanked—those who don't have access to traditional financial services—to participate in the global economy.

Real-World Applications of Bitcoin in Trade

We are already seeing Bitcoin’s impact on global trade in various sectors. Cross-border payments and remittances have become faster, cheaper, and more secure through Bitcoin. Companies are starting to use Bitcoin as part of their supply chains or as a payment option to mitigate currency risk and reduce reliance on traditional banking systems.

Countries like El Salvador have already embraced Bitcoin as legal tender, providing a real-world experiment in how Bitcoin can drive economic activity and improve trade relations. As more countries and companies adopt Bitcoin, we will likely see this trend continue and grow.

The Future of Trade in a Bitcoin Economy

As Bitcoin adoption grows, the future of global trade could be vastly different from what we see today. With Bitcoin’s fixed supply and decentralized network, trade will no longer be subject to the whims of central banks or governments. Transactions will be faster, more secure, and far less costly, leading to an overall more efficient global marketplace.

More importantly, trust will no longer be placed in fallible institutions but in technology and code. This shift could open up global trade to new participants, especially those in countries with unstable currencies or restrictive financial regulations.

The Market with Bitcoin as a Denominator

One of the most profound changes Bitcoin could bring to global trade is how markets behave with a true hard asset like Bitcoin as the denominator, compared to the USD. Currently, the USD's value is constantly influenced by inflation, monetary policy, and the actions of the U.S. government. This introduces distortions in pricing across global markets.

In contrast, Bitcoin’s fixed supply means there’s no central authority devaluing the currency by printing more of it. The market would adjust based on real supply and demand dynamics, leading to more stable and predictable pricing. Goods, services, and assets would be priced more accurately, free from the distortions caused by inflation or interest rate changes. Essentially, a Bitcoin standard could allow for a freer, more transparent market, where prices reflect true value, not manipulated fiat prices.

With a hard asset like Bitcoin as the global standard, we could see a deflationary effect over time, where the purchasing power of Bitcoin increases. This would encourage savings and long-term thinking, reshaping how businesses plan and execute global trade strategies.

Conclusion

Bitcoin is poised to redefine the trust model in global trade. By decentralizing trust and removing intermediaries, Bitcoin enables faster, more secure, and transparent transactions across borders. It also shifts the foundation of global trade from government-controlled currencies to a decentralized, hard asset that is beyond manipulation. The shift to a Bitcoin-denominated world will challenge the status quo, but the benefits it offers—stability, fairness, and efficiency—are too great to ignore.

As we move closer to a Bitcoin standard, the future of global trade will be built on truth, not fiat manipulation, ushering in a new era of financial sovereignty and fairness.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#CryptoRevolution#GlobalTrade#Decentralization#BlockchainTechnology#FinancialFreedom#SoundMoney#TrustlessSystem#PeerToPeer#DigitalCurrency#EconomicChange#HardMoney#USDvsBitcoin#BitcoinEconomy#FutureOfFinance#TransparencyInTrade#FiatToBitcoin#FinancialSovereignty#CryptoFuture#UnpluggedFinancial#financial empowerment#financial experts#globaleconomy#finance#unplugged financial#cryptocurrency#financial education#blockchain

3 notes

·

View notes

Text

youtube

Video Title: How Bitcoin Transformed My Life: A Journey to Financial Freedom

Description for Tumblr:

Hey everyone, welcome to Unplugged Financial! 🌟 In my latest video, I dive deep into my personal journey with Bitcoin and how it has completely transformed my life. If you're curious about Bitcoin or looking for inspiration to improve your financial situation, this video is for you! 📈💰

What You'll Discover:

My early financial struggles and how Bitcoin helped me break free from the paycheck-to-paycheck cycle.

How learning about Bitcoin led to a profound understanding of money, inflation, and the financial system.

The practical steps I took to improve my financial habits and build a safety net.

Tips and advice for anyone starting their own Bitcoin journey.

Key Highlights:

Educating yourself about Bitcoin and doing your own research to build conviction in your choices.

Starting small with manageable investments and increasing your exposure as you become more comfortable.

Securing your Bitcoin investments with reputable wallets.

Staying informed about the latest developments in the cryptocurrency space.

Call to Action:

I'd love to hear your thoughts and experiences! Drop a comment and let’s chat. If you find this video helpful, please follow my blog for more content on financial freedom and Bitcoin. Let's embark on this journey together and unlock the potential of Bitcoin. Thanks for watching! 🙌

#Bitcoin#Crypto#Cryptocurrency#FinancialFreedom#BitcoinJourney#Investing#PersonalFinance#DigitalCurrency#BitcoinSuccess#CryptoEducation#BitcoinCommunity#UnpluggedFinancial#MoneyManagement#InvestInBitcoin#FinancialAwakening#BitcoinInvestment#CryptoLife#FinancialLiteracy#BitcoinTransformation#Blockchain#CryptoInvesting#BitcoinEducation#WealthBuilding#BitcoinRevolution#financial experts#unplugged financial#globaleconomy#financial empowerment#financial education#finance

4 notes

·

View notes

Text

youtube

The Evolution of Money: From Barter to Bitcoin

Description:

Are you ready to explore the fascinating journey of money? In this video, we delve deep into the history of money, tracing its evolution from ancient barter systems to the cutting-edge world of Bitcoin. 🌍💰

🔍 What You'll Learn:

Barter Systems: Discover how early civilizations exchanged goods and services before the invention of money.

Commodity Money: Understand the role of items like gold, silver, and other commodities in trade and their intrinsic value.

The Birth of Coins: Learn about the first coins, their origins, and how they revolutionized trade and commerce.

The Rise of Paper Money: Explore the transition from metal coins to paper currency and the impact on economies worldwide.

Fiat Currency: Dive into the concept of fiat money, its advantages, and its role in modern economies.

The Digital Revolution: Uncover the emergence of digital currencies, the rise of Bitcoin, and how they are reshaping the financial landscape.

✨ Why Watch This Video?

Gain a comprehensive understanding of the history of money.

Learn about the key milestones that have shaped our current financial systems.

Discover how Bitcoin and other cryptocurrencies are poised to transform the future of money.

Join us on this enlightening journey through time and witness the remarkable evolution of money! Don't forget to like, subscribe, and hit the notification bell to stay updated with all our latest content. 🚀

#MoneyEvolution#HistoryOfMoney#Bitcoin#Cryptocurrency#FinancialRevolution#FiatCurrency#DigitalCurrency#EconomicHistory#BarterSystem#GoldStandard#PaperMoney#CryptoEducation#FinancialFreedom#UnpluggedFinancial#MoneyMatters#FinancialLiteracy#financial experts#globaleconomy#unplugged financial#blockchain#financial empowerment#financial education#finance#Youtube

3 notes

·

View notes

Text

youtube

Will Trump Buy Bitcoin as a US Treasury Reserve Asset? - Unplugged Financial

Could Bitcoin be on the verge of a historic breakthrough? Join us at Unplugged Financial as we explore the explosive possibility of Donald Trump endorsing Bitcoin as a US Treasury reserve asset.

🔍 In this video, we analyze the potential impact of Trump's support on the price of Bitcoin and the broader financial landscape. We delve into the reasons why this move could send Bitcoin prices skyrocketing and what it means for the future of digital currencies.

✨ What you can expect:

Trump's Influence: Understand how Trump's endorsement could reshape public and institutional perception of Bitcoin.

Economic Analysis: Explore the financial implications of Bitcoin becoming a US Treasury reserve asset.

Market Predictions: Get insights into how this potential move could drive Bitcoin's price to new heights.

Strategic Opportunities: Learn how to position yourself to benefit from this potential game-changing development.

🚀 Whether you're a seasoned Bitcoin enthusiast, a curious observer, or an investor looking for strategic insights, this video will provide you with a comprehensive analysis of what could be one of the most significant events in Bitcoin's history.

👍 Like, subscribe, and hit the notification bell to join our community and stay updated with all our latest content. Let's explore the future of Bitcoin together!

#Bitcoin#CryptoNews#Trump#BitcoinPrice#USTreasury#FinancialRevolution#DigitalCurrency#CryptoAnalysis#BitcoinInvesting#MarketPredictions#UnpluggedFinancial#BitcoinFuture#CryptoEconomy#StrategicInvesting#FinancialFreedom#BitcoinEndorsement#EconomicImpact#cryptocurrency#blockchain#finance#unplugged financial#globaleconomy#financial education#financial empowerment#financial experts#Youtube

3 notes

·

View notes

Text

The Bitcoin Bombshell: Analyzing Trump's Hypothetical Move to Make BTC a Treasury Reserve Asset

In the ever-evolving landscape of finance and politics, few scenarios could send shockwaves through the global economy quite like a major policy shift involving Bitcoin. Picture this: Former President Donald Trump announces his intention to advocate for Bitcoin as a US Treasury reserve asset. While purely hypothetical, such a declaration could potentially catapult Bitcoin's price to unprecedented heights and reshape the financial world as we know it. In this blog post, we'll dive deep into the implications of this speculative yet fascinating prospect, exploring why it could lead to a parabolic surge in Bitcoin's value and what it might mean for the future of global finance.

The Power of Political Influence on Markets

Historical precedent shows us that statements from high-profile political figures can significantly impact markets and investor sentiment. Trump, with his substantial following and controversial yet influential persona, has demonstrated the ability to move markets with mere tweets. If he were to endorse Bitcoin as a treasury reserve asset, it would mark a seismic shift in the perception of cryptocurrencies, potentially cementing Bitcoin's status as a legitimate and mainstream financial asset.

Historical Context: From Gold Standard to Digital Gold

To grasp the magnitude of this hypothetical move, let's revisit history. The US once used gold as a treasury reserve asset to back its currency, a system known as the gold standard. This approach solidified gold's status as a valuable and stable asset for decades. A similar endorsement of Bitcoin could position it as "digital gold" for the 21st century, potentially offering a hedge against inflation and economic uncertainty in the digital age.

The Mechanics of a Potential Parabolic Price Surge

Supply and Demand Dynamics: Bitcoin's fixed supply cap of 21 million coins is fundamental to its value proposition. An announcement of this magnitude would likely trigger an unprecedented surge in demand from retail and institutional investors alike, colliding with Bitcoin's limited supply and potentially driving prices to new all-time highs.

Market Psychology and FOMO: The fear of missing out (FOMO) is a powerful force in financial markets. As news of Trump's endorsement would spread, investors might rush to acquire Bitcoin, creating a self-reinforcing cycle of buying pressure and price appreciation.

Institutional Adoption Acceleration: Many institutions have been cautiously observing Bitcoin, hesitant due to regulatory uncertainties. A move like this could be interpreted as a green light for widespread adoption, potentially leading to significant capital inflows from hedge funds, corporations, and even sovereign wealth funds.

Economic and Geopolitical Implications

Impact on the US Dollar: Holding Bitcoin as a reserve asset could potentially strengthen the US dollar by diversifying the country's reserves and providing a hedge against inflation. However, it could also challenge the dollar's status as the world's primary reserve currency.

Global Ripple Effects: Other nations might feel compelled to follow suit, fearing economic disadvantage. This could spark a global race to accumulate Bitcoin, further driving up its price and integrating it deeper into the global financial system.

Regulatory Challenges: Such a move would likely face significant legal and regulatory hurdles. It would require changes to existing laws and could face opposition from traditional financial institutions and some policymakers.

Environmental Considerations

It's important to address the environmental concerns often associated with Bitcoin mining. Any move to make Bitcoin a reserve asset would likely intensify debates about its energy consumption and carbon footprint. This could potentially lead to increased investment in renewable energy sources for mining operations.

Expert Opinions

Dr. Saifedean Ammous, economist and author of "The Bitcoin Standard," states: "While the scenario is hypothetical, it underscores Bitcoin's potential as a neutral, global reserve asset in a world of competing national currencies."

On the other hand, Nobel laureate economist Paul Krugman cautions: "The volatility of Bitcoin makes it a risky choice for national reserves. It could introduce unprecedented instability into the global financial system."

Impact on Other Cryptocurrencies

A Bitcoin-focused treasury reserve policy could have mixed effects on other cryptocurrencies. While it might lend credibility to the broader crypto market, it could also concentrate investment in Bitcoin at the expense of other digital assets.

Conclusion: Navigating the Potential Financial Revolution

While the idea of Trump advocating for Bitcoin as a US Treasury reserve asset remains speculative, exploring this scenario highlights the growing influence and potential of Bitcoin in the global financial landscape. Such a move could indeed send Bitcoin's price on a parabolic trajectory, fueled by increased demand, institutional adoption, and geopolitical dynamics.

However, it's crucial to approach this hypothetical scenario with a balanced perspective. The potential benefits in terms of financial innovation and hedging against inflation must be weighed against regulatory challenges, environmental concerns, and the potential for increased market volatility.

As the world of cryptocurrencies continues to evolve at a rapid pace, staying informed and critically evaluating new developments is more important than ever. Whether this scenario comes to pass or not, it's clear that Bitcoin and blockchain technology will play a significant role in shaping the future of global finance.

Call to Action

Stay ahead of the curve in the ever-changing world of cryptocurrency and finance. Subscribe to my blog and YouTube channel, Unplugged Financial, for regular insights, expert analyses, and in-depth discussions on the future of money. Together, let's navigate the potential financial revolution that lies ahead.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#BTC#FinancialRevolution#DigitalGold#Trump#TreasuryReserve#GlobalFinance#Investing#Blockchain#CryptoMarket#EconomicShift#InflationHedge#DigitalCurrency#FinancialFuture#UnpluggedFinancial#financial empowerment#unplugged financial#globaleconomy#financial experts#financial education#finance

3 notes

·

View notes

Text

How to Vet Crypto Services: Ensuring Safety and Reliability

In the ever-evolving world of cryptocurrencies, ensuring the safety and reliability of the services you use is paramount. With numerous platforms and services popping up, it's easy to fall prey to scams or unreliable providers. This guide will help you navigate the process of vetting crypto services to safeguard your investments.

Understand the Service

First, identify the type of service you're evaluating. Is it an exchange, a wallet, a DeFi platform, or another kind of service? Each type has its own set of standards and requirements. Research the service's reputation by looking for reviews and feedback from reputable sources. Platforms like Reddit, Twitter, and specialized crypto forums can provide insights into the experiences of other users. A reliable service will be transparent about its team, location, and regulatory status. Check the "About Us" section on their website and verify the information provided.

Security Measures

Ensure the service employs up-to-date encryption and robust security protocols. This includes secure SSL connections and advanced security measures to protect your data. Two-Factor Authentication (2FA) should be a standard feature for any credible service, adding an extra layer of security to your account. For exchanges, verify that they store the majority of funds in cold storage, significantly reducing the risk of hacks.

Regulation and Compliance

Check if the service is licensed and regulated by relevant authorities. Regulatory compliance is a strong indicator of a service's legitimacy. Know Your Customer (KYC) and Anti-Money Laundering (AML) policies are essential for regulatory compliance. These policies help prevent fraudulent activities and ensure the service is operating within legal boundaries.

User Experience and Customer Support

The platform should be user-friendly and intuitive. A complex interface can lead to mistakes and a poor user experience. Test the responsiveness and helpfulness of their customer service. A reliable service will offer prompt and effective support.

Financial Stability

Research the service’s financial backers and funding sources. Well-funded services with reputable backers are generally more reliable. Some services offer insurance for user funds in case of breaches. This added security can provide peace of mind.

Community Feedback

Engage with the community on platforms like Reddit, Twitter, and specialized crypto forums. Community feedback can provide valuable insights into the reliability of the service. Review sites like Trustpilot or industry-specific review sites can offer additional perspectives on the service's performance.

Red Flags to Watch Out For

Be wary of services that withhold crucial information. Transparency is key to building trust. Avoid services that promise guaranteed returns or seem too good to be true. These are often signs of scams. Pay attention to any negative news or past incidents involving the service. A history of issues can be a major red flag.

Conclusion

Vetting crypto services is a critical step in safeguarding your investments. By conducting thorough research and being vigilant about potential red flags, you can avoid unreliable providers and make informed decisions.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Let’s learn about the Bitcoin Revolution together. Your financial freedom starts now!

#CryptoSafety#VettingCryptoServices#CryptoSecurity#Bitcoin#CryptoTips#FinancialFreedom#Blockchain#CryptoEducation#CryptoCommunity#CryptoInvesting#DigitalCurrency#CryptoRegulation#CryptoNews#CryptoAdvice#UnpluggedFinancial#financial education#financial empowerment#financial experts#cryptocurrency#finance#globaleconomy

3 notes

·

View notes

Text

The Role of Bitcoin in Financial Independence

In today’s rapidly evolving world, where financial systems are increasingly centralized and controlled, the concept of financial independence has never been more vital. Many are turning to Bitcoin as a path to achieve this independence. But how exactly can Bitcoin help us break free from traditional financial constraints? Let’s dive into the key ways Bitcoin can empower us and why it might be the revolutionary choice you need.

1. Decentralization and Control

Imagine a world where your money is truly your own. One of Bitcoin’s most revolutionary aspects is its decentralized nature. Unlike traditional currencies, which are controlled by central banks and governments, Bitcoin operates on a peer-to-peer network. No single entity has control over the Bitcoin network, making it resilient to censorship and manipulation.

For you, this decentralization means more control over your finances. You’re no longer reliant on banks or financial institutions to access or transfer your money. This autonomy ensures your assets are safeguarded from institutional failures, government interventions, or political instability. It’s financial freedom in its purest form.

2. Protection Against Inflation

Inflation is a silent thief, eroding the purchasing power of your hard-earned money over time. With central banks worldwide printing money at unprecedented rates, the risk of inflation looms large.

Bitcoin, with its fixed supply of 21 million coins, offers a robust hedge against inflation. Its scarcity ensures it cannot be devalued by government actions. Unlike fiat currencies, which can be inflated away, Bitcoin’s value is preserved by its limited supply. This makes it an attractive store of value in an era of rampant money printing and economic uncertainty.

3. Borderless Transactions

Imagine being able to send money to anyone, anywhere, without the usual hassles. Traditional financial systems are often hindered by borders, regulations, and intermediaries. International transfers can be slow and costly, involving multiple parties and high fees.

Bitcoin, however, allows for seamless, borderless transactions. Whether sending money to family abroad or paying for services from global vendors, Bitcoin facilitates quick and inexpensive transfers. This is especially beneficial for those in countries with restrictive financial regulations or unstable currencies.

4. Financial Inclusion

A significant portion of the world’s population remains unbanked or underbanked, lacking access to traditional financial services. This exclusion limits economic opportunities and perpetuates poverty.

Bitcoin can bridge this gap by providing a simple, accessible means of storing and transferring value. All you need is an internet connection and a digital wallet, empowering millions to participate in the global economy. For people in developing countries or areas with limited banking infrastructure, Bitcoin offers a lifeline to financial services that were previously out of reach.

5. Transparency and Security

Trust is built on transparency. Bitcoin transactions are recorded on a public ledger known as the blockchain. This transparency ensures transactions can be verified by anyone, reducing the risk of fraud.

Additionally, Bitcoin’s cryptographic security makes it extremely difficult for unauthorized parties to alter transaction data or access funds without the owner’s private keys. This security model is a stark contrast to traditional banking systems, where breaches and fraud are more common. By holding your own private keys, you have full control and responsibility over your assets, providing peace of mind in the digital age.

6. Autonomy and Privacy

In a world where financial privacy is becoming increasingly rare, Bitcoin offers a degree of anonymity. While transactions are transparent, the identities of the parties involved are not easily traceable.

This privacy can protect you from intrusive surveillance and potential misuse of personal financial data. It ensures your financial activities remain your own, free from prying eyes. This level of financial privacy is particularly important for those living under oppressive regimes or in environments where financial freedom is restricted.

7. Life-Changing Investment Potential

Incorporating Bitcoin into your investment strategy can produce life-changing results. As a relatively new and rapidly evolving asset class, Bitcoin has demonstrated substantial growth and potential for significant returns.

Early adopters of Bitcoin have seen remarkable gains, and while past performance is not indicative of future results, the continued development and adoption of Bitcoin suggest it still holds significant investment potential. By diversifying your investment portfolio with Bitcoin, you can achieve greater financial gains and secure your financial future. This potential for high returns, combined with its other benefits, makes Bitcoin an attractive addition to any investment strategy.

Conclusion

Bitcoin is more than just a digital currency; it represents a paradigm shift towards financial independence and empowerment. By offering decentralization, protection against inflation, borderless transactions, financial inclusion, transparency, security, privacy, and substantial investment potential, Bitcoin can play a crucial role in achieving financial freedom. As the world continues to evolve, embracing Bitcoin might be the key to securing your financial future in an increasingly uncertain economic landscape.

So, as you ponder your financial future, consider the revolutionary potential of Bitcoin. It might just be the game-changer you need.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Let’s learn about the Bitcoin Revolution together. Your financial freedom starts now!

#Bitcoin#FinancialIndependence#CryptoRevolution#Decentralization#DigitalCurrency#InflationHedge#BorderlessTransactions#FinancialInclusion#BlockchainTechnology#CryptoSecurity#PrivacyInFinance#InvestmentStrategy#CryptoInvesting#FutureOfFinance#UnpluggedFinancial#MoneyEvolution#CryptoEducation#FinancialFreedom#CryptoCommunity#DigitalAssets#financial education#financial empowerment#financial experts#cryptocurrency#blockchain#finance#unplugged financial#globaleconomy

3 notes

·

View notes

Text

IMF Bitcoin Strategy

The International Monetary Fund just pulled a two-faced maneuver that every Bitcoiner should be paying attention to.

On one hand, they’ve slapped El Salvador with strict conditions for a $1.4 billion Extended Fund Facility, demanding the country slam the brakes on its Bitcoin adoption. On the other hand, they’ve quietly updated their global economic framework to formally recognize Bitcoin and other digital assets as legitimate components of international finance.

So which is it, IMF? Is Bitcoin a joke? Or is it a global financial asset worthy of being tracked by over 160 nations under your freshly minted BPM7 guidelines?

Let’s start with what they’re doing to El Salvador. As part of the new loan agreement, the IMF imposed a “ceiling of 0” on new Bitcoin acquisitions by public entities. In plain English: the Salvadoran government isn’t allowed to buy a single additional sat. They’ve also ordered the liquidation of the Fidebitcoin trust and the shutdown of the Chivo wallet system—the very tools designed to empower citizens and increase financial inclusion. Oh, and they want the government to fully dox its wallet addresses and segregate user funds. Privacy? Sovereignty? Gone.

At the same time, buried in the IMF’s March 20th release of BPM7—their first major update since 2009—we find something shocking: digital assets are now officially part of the global balance sheet. Bitcoin and other tokens with no backing liabilities are classified as “non-produced nonfinancial assets.” Stablecoins are considered financial instruments. Ethereum and Solana might even count as equity-like assets. Mining and staking? Now recognized as exportable services.

This isn’t just an accounting update—it’s an ideological shift. The IMF spent years dismissing or downplaying crypto. Now it’s threading it into the DNA of global finance.

And yet, while they recognize it on paper, they restrict it in practice. That’s not progress. That’s control.

They want to put Bitcoin in a frame. Label it. Box it. Make it safe. But Bitcoin was never meant to be safe—it was meant to be free. By treating it as a capital asset and not a currency, they dilute its disruptive potential. They want Bitcoin to exist, just not in a way that threatens their monopoly on monetary policy.

The hypocrisy is staggering. El Salvador’s decision to continue stacking sats—quietly adding to their treasury despite IMF pressure—is more than a financial move. It’s a quiet act of rebellion. A sovereign flex. A signal that they won’t back down, even when pressured by the world’s financial puppet master.

Let’s be clear: the IMF knows Bitcoin isn’t going away. That’s why they’re updating their manuals. That’s why they’re slipping it into their models. But they’re also hoping to control the narrative before it controls them.

Bitcoin doesn’t need IMF recognition to succeed. It doesn’t need a line item in a spreadsheet. It needs time, blocks, and believers. The very fact that it’s being recognized at the highest levels of global finance proves the revolution is working. The fact that it’s being restricted at the same time proves the old guard is scared.

So here’s the truth: the IMF just blinked. And in doing so, they revealed that Bitcoin is no longer an outsider. It’s now a threat from the inside.

Tick tock, IMF.

Next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.