#white supremacy in banking

Explore tagged Tumblr posts

Text

The days of legally sanctioned race-based housing discrimination may be behind us, but the legacy of attitudes and practices that kept nonwhite citizens out of some neighborhoods and homeownership remains pervasive. Redlining, one of these practices, is especially notorious in U.S. real estate history.

What is redlining? Technically, it refers to lending discrimination that bases decisions on a property’s or individual’s location, without regard to other characteristics or qualifications. In a larger sense, it refers to any form of racial discrimination related to real estate.

America’s discriminatory past can still be present today with nonwhite mortgage borrowers generally getting charged higher interest rates and the persistence of neighborhood segregation. These trends can be traced in part to redlining, an official government policy dating from the 1930s, which codified racist attitudes in real estate finance and investment, and made it more difficult for nonwhites to purchase homes.

Redlining and racism in America have a long, complex and nuanced history. This article serves as a primer on the policy’s background and how it continues to affect real estate and nonwhite homeownership today. It also includes suggestions to reduce redlining’s lingering effect.

Key takeaways

Redlining refers to a real estate practice in which public and private housing industry officials and professionals designated certain neighborhoods as high-risk, largely due to racial demographics, and denied loans or backing for loans on properties in those neighborhoods.

Redlining practices were prevalent from the 1930s to the 1960s.

Ostensibly intended to reduce lender risk, redlining effectively institutionalized racial bias, making it easier to discriminate against and limit homebuying opportunities for people of color. It essentially restricted minority homeownership and investment to “risky” neighborhoods.

Though redlining is now illegal, its legacy persists, with ongoing impact on home values, homeownership and individuals’ net worth. Discrimination and inequities in housing practices and home financing still exist.

What is redlining?

Redlining — both as a term and a practice — is often cited as originating with the Federal Home Owners’ Loan Corporation (HOLC), a government agency created during the 1930s New Deal that aided homeowners who were in default on their mortgages and in foreclosure. HOLC created a system to assess the risk of lending money for mortgage loans within particular neighborhoods in 239 cities.

Color-coded maps were created and used to decide whether properties in that area were good candidates for loans and investment. The colors — from green to blue to yellow to red — indicated the lending risk level for properties. Areas outlined in red were regarded as “hazardous” (that is, high risk) — hence, the term “redlining.”

Redlined areas typically had a high concentration of African-American residents and other minorities. Historians have charged that private mortgage lenders and even the Federal Housing Administration (FHA) — created in 1934 to back, or insure, mortgages — used these maps or developed similar ones to set loan criteria, with properties in those redlined areas incurring higher interest rates or not qualifying at all. Real estate brokers often used them to segregate buyers and sellers.

“This practice was widespread and institutionalized, and it was used to discriminate against minorities and low-income communities,” says Sam Silver, a veteran Santa Clarita, Calif.-based Realtor, real estate investor and commercial lender.

The impact of redlining on the mortgage lending industry

Following World War II, the U.S. had a huge demand for housing, as many returning American servicemen and -women wanted to settle down and begin raising families. Eager to help these veterans, the FHA expanded its financing and loan-insuring efforts, essentially empowering Uncle Sam to back lenders and developers and reducing their risk when offering construction and mortgage loans.

“That lower risk to lenders resulted in lower interest rates, which granted middle-class people the ability to borrow money to purchase homes,” says Rajeh Saadeh, a real estate and civil rights attorney and a former Raritan Valley Community College adjunct professor on real estate law in Bridgewater, New Jersey. “With the new lending policies and larger potential homeowner pool, real estate developers bought huge tracts of land just outside of urban areas and developed them by building numerous homes and turning the areas into today’s suburbs.”

However, many of these new developments had restrictions stated in their covenants that prohibited African-Americans from purchasing within them. Additionally, there were areas within cities, already heavily populated by minorities, that were redlined, making them ineligible for federally backed mortgages (which effectively meant, for affordable mortgages, period). Consequently, people of color could not get loans to buy in the suburbs, nor could they borrow to purchase homes in areas in which they were concentrated.

“Redlining was part of a systemic, codified policy by the government, mortgage lenders, real estate developers and real estate agents as a bloc to deprive Black people of homeownership,” Saadeh continues. “The ramifications of this practice have been generational.”

The (official) end of redlining

During the mid-20th century, redlining predominated along the East Coast, the eastern sections of the South and the Midwest, and several West Coast metropolitan areas. Black neighborhoods and areas adjacent to them were the ones most likely to be redlined.

Redlining as a sanctioned government practice ended with the passage of the Fair Housing Act in 1968, which specifically prohibits racial discrimination in the housing industry and among professionals engaged in renting, buying, selling and financing residential properties. The Act’s protections were extended by the Equal Credit Opportunity Act (1974) and the Community Reinvestment Act (1977).

The Department of Housing and Urban Development (HUD) — specifically, its Office of Fair Housing and Equal Opportunity (FHEO) — investigates reports of redlining. For example, prompted by a complaint filed by the non-profit National Community Reinvestment Coalition, HUD has been examining whether several branches of HSBC Bank USA engaged in discriminatory lending practices in Black and Hispanic neighborhoods in six U.S. metropolitan areas from 2018-2021, HSBC recently disclosed in its Form 10-Q for the second quarter 2023.

Bankrate insights

In October 2021, the Department of Justice announced its Combatting Redlining Initiative, working in partnership with the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency. It has reached seven major settlements with financial institutions to date, resulting in over $80 million in loans, investments and subsidies to communities of color.

How does redlining affect real estate today?

The practice of redlining has significantly impacted real estate over the decades in several ways:

Redlining has arguably led to continued racial segregation in cities and neighborhoods. Recent research shows that almost all formerly redlined zones in America remain disproportionately Black.

Redlined areas are associated with a long-term decline in homeownership, home values and credit scores among minorities, all of which continue today.

Formerly redlined areas tend to have older housing stock and command lower rents; these less-valuable assets contribute to the racial wealth gap.

Redlining curbed the economic development of minority neighborhoods, miring many of these areas in poverty due to a lack of access to loans for business development. After 30-plus years of underinvestment, many nonwhite neighborhoods continue to be seen as risky for investors and developers.

Other effects of redlining include the exclusion of minority communities from key resources within urban areas, such as health care, educational facilities and employment opportunities.

Today, 11 million Americans live in formerly redlined areas, estimates Kareem Saleh, founder/CEO of FairPlay AI, a Los Angeles-based organization that works to mitigate the effects of algorithmic bias in lending. He says about half of these people reside in 10 cities: Baltimore, Boston, Chicago, Detroit, Los Angeles, Milwaukee, New York City, Philadelphia, San Francisco and San Diego.

“Redlining shut generations of Black and Brown homebuyers out of the market. And when members of these communities did overcome the barriers to purchasing homes, redlining diminished their capacity to generate wealth from the purchase,” says Saleh. “To this day, redlining has depressed property values of homes owned in minority communities. The enduring legacy of redlining is that it has blocked generations of persons of color from accessing a pathway to economic empowerment.”

“Also, due to redlining, African-Americans who couldn’t qualify for government-backed mortgages were forced to pay higher interest rates. Higher interest rates translate to higher mortgage payments, making it difficult for minorities to afford homes,” Elizabeth Whitman, a real estate attorney and real estate broker in Potomac, Maryland, says. “Since redlining made it more expensive to obtain a mortgage, housing wasn’t as easy to sell and home prices got suppressed in redlined areas.”

Data from FairPlay AI’s recent “State of Mortgage Fairness Report” indicate that equality in mortgage lending is little better today for many nonwhite groups than it was 30 years ago — or it has improved very slowly. For example, in 1990, Black mortgage applicants obtained loan approvals at 78.4 percent of the rate of White applicants; in 2019 that figure remained virtually unchanged — though it did rise to 84.4 percent in 2021.

Although there’s no official federal risk map anymore, most financial institutions do their own risk assessments. Unfortunately, bias can still enter into these assessments.

“Lenders can use algorithms and big data to determine the creditworthiness of a borrower, which can lead to discrimination based on race and ethnicity. Also, some real estate agents may steer clients away from certain neighborhoods based on their racial makeup,” Silver points out.

With the rise of credit rating agencies and their ubiquity, how do we know it’s a fair system? I don’t think, at my core, that African-Americans are predisposed to be poorer and less financially secure. — Rob Roseformer executive director of the Cook County Land Bank Authority in Chicago

Insurance companies have also used redlining practices to limit access to comprehensive homeowners policies. And the home appraisal industry has also employed redlining maps when valuing properties, which has further repressed housing values in African-American neighborhoods, according to Whitman.

Furthermore, a 2020 National Fair Housing Alliance study revealed that Black and Hispanic/Latino renters were more likely to be shown and offered fewer properties than White renters.

Redlining’s ongoing legacy

Even without conscious bias, the legacy of redlining — and its impact on the accumulation of assets and wealth — can put nonwhite loan applicants at a disadvantage to a disproportionate degree. For example, studies consistently show that Black borrowers generally have lower credit scores today, even when other factors like education and income are controlled for. Credit scores, along with net worth and income, are of course a key factor in determining mortgage eligibility and terms.

As a result, it remains more difficult for Black borrowers to qualify for mortgages — and more expensive for those who do, because they’re usually charged higher interest rates. Other minorities are also much more likely to pay a higher interest rate than their White counterparts.

Because home appraisals look at past property value trends in neighborhoods, they reinforce the discrimination redlining codified by keeping real estate prices lower in historically Black neighborhoods. That, in turn, makes lenders assume they’re taking on more risk when they extend financing in those areas.

“The single-greatest barrier in helping to break out of these neighborhoods is the current appraisal process,” says Rob Rose, former executive director of the Cook County Land Bank Authority in Chicago. “The appraisers are trying to do the best that they can within the parameters that they’re given, but it’s a broken system and industry that’s built on a faulty foundation.”

African-American homeowners pay hundreds of dollars more per year in mortgage interest, mortgage insurance premiums and other fees than White homeowners — amounting to $13,464 over the life of their loan, according to “The Unequal Costs of Black Homeownership,” a 2020 study by MIT’s Golub Center for Finance and Policy.

What can be done to reduce the impact of redlining?

The current housing financing system is built on the foundations that redlining left in place. To decrease the effects of redlining and its legacy, it’s essential to address the underlying biases that led to these practices.

“This can be done through Fair Housing education and training of real estate professionals, increased enforcement of Fair Housing laws, and investment in communities that have been historically redlined,” suggests Silver.

Others insist that the public and private sectors need to play a bigger role in combating prejudice and discrimination.

“Federal regulators likely will continue to put pressure on financial institutions and other stakeholders in the mortgage ecosystem to root out bias,” says Saleh. “The Department of Justice’s Combatting Redlining Initiative shows the government’s commitment to supervisory oversight. There are also policy and regulatory moves, such as the recent push by regulators encouraging lenders to use Special Purpose Credit Programs — lending programs specifically dedicated to remedying past discrimination. Similarly, various federal task forces have been actively addressing historical biases and discriminatory practices in the appraisal industry.”

Also, financial institutions could adjust their underwriting practices and algorithms to better evaluate nonwhite loan applicants, and help level the playing field for them. For example, in late 2022, Fannie Mae announced it had adjusted its automated Desktop Underwriter system — widely used by bank loan officers — to consider bank account balances for applicants who lack credit scores. Fannie and its fellow mortgage-market player, Freddie Mac, now may also consider rent payments as part of borrowers’ credit histories.

Such efforts won’t eradicate the effects of redlining overnight, of course. But they can be a start towards helping more people towards a key piece of the American Dream.

If you believe you are the victim of redlining or another sort of housing discrimination, you have rights under the Fair Housing Act. You can file an online complaint with or phone the U.S. Department of Housing and Urban Development at (800) 669-9777. Additionally, you can report the matter to your local private Fair Housing center or contact the National Fair Housing Alliance.

#What is redlining? A look at the history of racism in American real estate#redlining#Racial disparities in homeownership#white supremacy in banking#american hate

7 notes

·

View notes

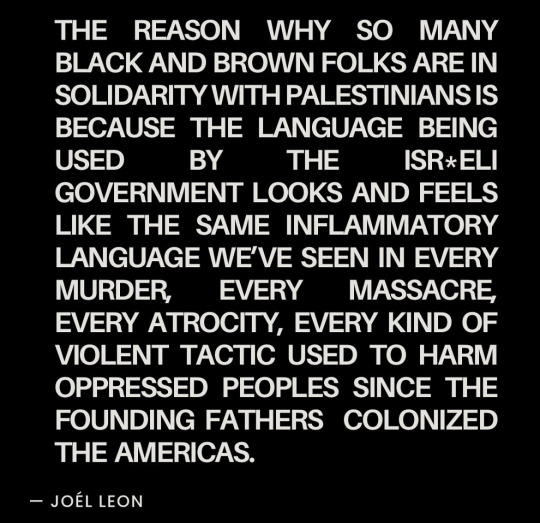

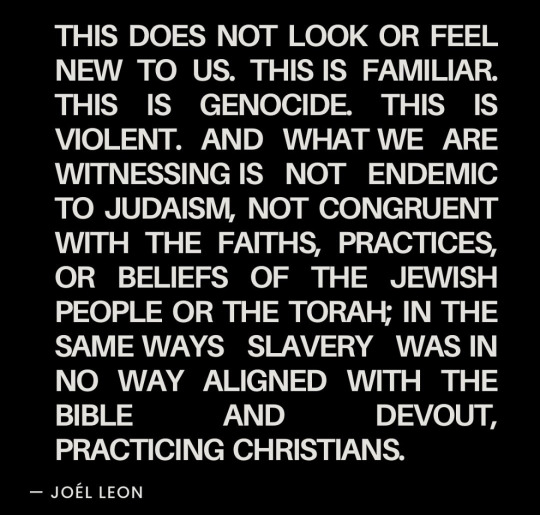

Text

#palestine#free palestine#gaza#free gaza#jerusalem#west bank#rafah#egypt#lebanon#yemen#middle east#human rights#united nations#unrwa#politics#resistance#violent resistance#freedom#freedom fighters#hamas#us politics#america#colonialism#imperialism#white supremacy#racism#islamophobia#biden#genocide joe

109 notes

·

View notes

Text

#threads#threads app#social justice#current events#free palestine#gaza#free gaza#palestine#gaza strip#gaza genocide#gazaunderattack#save gaza#anti zionisim#fuck israel#palestine 🇵🇸#from the river to the sea palestine will be free#freepalastine🇵🇸#free palastine#stand with gaza#gazaunderfire#important#west bank#middle east#settler colonialism#fuck imperialism#human rights#fuck white supremacy

39 notes

·

View notes

Text

What the fuck is ""foreign aid"" and """upliftment""""??? Bitch you owe us trillions in reparations???

#it's like if someone kept coming into your house and stealing all you stuff#selling them and then generously giving you 'loans' from the profits because you have no money to eat and charging you interest#everything you own you're stealing off our blood sweat and tears#sending the bombs and then giving the victims 'aid money'. death is too good for you#colonialism#western imperialism#IMF#World Bank#climate justice#reparations#indigenous rights#decolonization#colonization#white supremacy#knee of huss

18 notes

·

View notes

Text

“Patriarchy hurts men too,” okay, does white supremacy hurt whites too?

Does capitalism hurt the bourgeoisie?

Does colonialism hurt the colonists?

#I know the answer to the last one#men will choose to fly to another country#shoot the people who live there#then cry about having PTSD#and people will actually feel bad for them#you flew to another country to shoot the people who live there like you could have just NOT done any of that#why can’t it be enough that male supremacy hurts females?#capitalism#white supremacy#politics#can you imagine a member of the#bourgeoisie#saying it’s really hard being expected to extract the#surplus value of their workers labour#feminism#that movie#cherry#with#tom holland#where being a soldier#made him rob banks when he got home

10 notes

·

View notes

Text

#joél leon#free palestine#signal boost#free gaza#gaza strip#west bank#white supremacy 101#revisionist history#bigotry#colonialism#imperialism#crimes against humanity#history#current events#war crimes#genocide#ethnic cleansing#solidarity with palestine

27 notes

·

View notes

Text

Bad Faith by Israelis

By the way, it's not "anti-Semitism", it's just "anti-Assholism" and some Jews are blessed with it too. Let's not conflate and make this racial. Only Israelis racialize here, and it's because they don't consider Palestinians - or anyone, apparently - as equal to them. Newsflash: you're terrorists and sociopaths first, Mr Netanyahu & IDF. Nothing to write home about.

#palestine#palestinians#free gaza#free palestine#israeli apartheid#genocide#ethnic cleansing#white supremacy#gaza invasion#west bank#israeli occupation#child murder#war crimes#the hague#icj#icc#justice#justice for palestine#united nations#anti asshole

12 notes

·

View notes

Text

Azealia’s IG story a few days ago praising Nicki Minaj’s Pink Friday era

8 notes

·

View notes

Video

youtube

Black bank manager says arrest was motivated by race

#racial profiling#Black Men Matter#Black LIves Matter#banking#banking while Black#working while Black#Working in a Bank while Black#Black bank manager says arrest was motivated by race#racism#american hate#white supremacy#systemic racism

7 notes

·

View notes

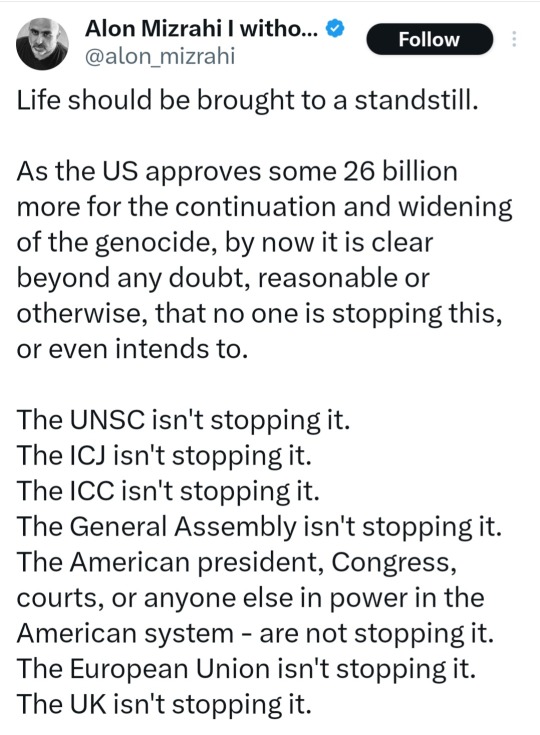

Text

#palestine#gaza#free palestine#free gaza#jerusalem#west bank#rafah#egypt#lebanon#yemen#middle east#human rights#united nations#politics#iran#america#israel#united kingdom#germany#france#western politics#the west#white supremacy

88 notes

·

View notes

Text

AL.com: Alabama bank slammed for Robert E. Lee, MLK holiday sign: ‘Pull your money out’

Alabama and Mississippi are the only two states in the union to recognize Martin Luther King Jr. and Robert E. Lee on the same day. Every year, notices reminding bank customers, teachers and post office visitors of the joint holiday on the third Monday in January draw confusion.

This year, Alabama celebrates the holiday Monday, January 16, 2023.

More recently, a photo of an Alabama-based bank commemorating the Confederate general alongside King has gone viral online.

“This office will be closed Monday, January 16 in observance of Robert E. Lee and Martin Luther King, Jr.,” a flyer read outside of a CB&S Bank, according to a photo posted to Reddit Wednesday.

CB&S Bank is headquartered in Russellville and serves dozens of locations across Alabama, Mississippi and Tennessee. It is unclear when and at which location the photo was taken, and efforts by AL.com to reach CEO Mike Ross were not immediately successful.

“If you live in Alabama you should pull your money out of [CB&S Bank] immediately,” Brock Boone, a civil rights attorney, said in a tweet Wednesday evening. “Unless you think Black Americans should be slaves.”

Martin Luther King, Jr.’s birthday is recognized nationally on the third Monday of January. For decades, Alabama has officially observed the birthday of Lee, a Confederate general born on Jan. 19, 1807 in Virginia, alongside the slain civil rights leader.

Read more: Renaming of Robert E. Lee, Jefferson Davis schools will be first to test Alabama monuments law

Only Alabama and Mississippi combine a holiday honoring Lee and King, though Alabama lists Lee’s name second to King’s in its most recent calendar. Other states, including Florida and Tennessee, set aside a day for Lee but do not combine it with the King holiday and state offices remain open.

Previous efforts to end the joint holiday, including a 2020 bill that would give Lee his own day in October, have failed in the Alabama Legislature. Southern states began celebrating days honoring Lee and other Confederate leaders in the late 1800s.

“Martin Luther King, Jr. and Robert E. Lee were two men with totally different agendas, beliefs and goals,” Sen. Vivian Figures, the author of the bill, told AL.com at the time. “To separate them as individual holidays is the right thing to do.”

Read more: Alabama lawmaker wants to separate King, Robert E. Lee holidays

Alabama also recognizes Confederate Memorial Day on April 24 and Jefferson Davis’ Birthday on June 5. Rosa Parks Day, on December 1, is commemoration on.

Juneteenth, a federal holiday recognizing the end of slavery, was recognized statewide in 2022. The legislature must still decide if it will become a permanent state holiday.

#Alabama#white supremacy#loosers of the confederacy#white ignorance#Civil Rights#US Laws#MLK Jr Birthday Federal Holiday#Alabama bank slammed for Robert E. Lee#MLK holiday sign: ‘Pull your money out’.

3 notes

·

View notes

Photo

Wall Street Journal ponders: did diversity cause the collapse of Silicon Valley Bank? In a Wall Street Journal op-ed titled "Who Killed Silicon Valley Bank?" Andy Kessler writes: Was there regulatory failure? Perhaps. SVB was regulated like a bank but looked more like a money-market fund. Then there's this: In its proxy statement, SVB notes that besides 91% of their board being independent and 45% women, they also have "1 Black," "1 LGBTQ+" and "2 Veterans." — Read the rest https://boingboing.net/2023/03/14/wall-street-journal-ponders-did-diversity-cause-the-collapse-of-silicon-valley-bank.html

#Post#diverse oligarchy#diversity#diversity equity inclusion#economics#financial crisis#financial news#Silicon Valley Bank#wall street journal#white supremacy#Thom Dunn#Boing Boing

2 notes

·

View notes

Text

As Netanyahu visits the US, Israelis keep killing...

“The US administration must be well aware that the region is on the verge of an explosion as a result of the Israeli persistence in killing, destruction, and theft of land, and the American administration must intervene immediately to stop this Israeli madness..."

#palestine#israeli apartheid#israeli occupation#illegal settlements#free palestine#usa#palestinians#settler colonialism#idf terrorists#right wing extremism#white supremacy#west bank#gaza#jenin#benjamin netanyahu

2 notes

·

View notes

Text

Cul disponible hummmmm 😋😋😋💦💦💦💦💦💦😊😊😊😊😊

#interracial#black supremacy#bbc#black and white#blacked#black superiority#little cock#cocufiage#small penis problems#sperm bank#humiliation sissy

17 notes

·

View notes

Text

youtube

Aired March 1, 2024

Rich Siegel, a Jewish man from New Jersey, US, protested an upcoming synagogue event selling off homes in illegal West Bank settlements during a City Council meeting on February 27.

#israel#am yisrael chai#jumblr#Rich Siegel#jew#jewish#west bank#new jeresy#history#white history#genocide#ceasefire#ceasfire now#jews for palestine#jews for peace#jews for ceasefire#us history#world history#white supremacy#Youtube

0 notes

Text

I will not be voting for Trump, ever. But I also won’t be voting for Biden again. Not only has he failed to follow through on his campaign promises, but he is ACTIVELY committing war crimes and funding a genocide against the Palestinians. And for what? Oil. Money. Greed. Power. Colonialism, racism, islamophobia. All of it.

Voting for someone who is causing harm and death is wrong. Period. There is no lesser of two evils here, there is only evil and corruption. It’s not about who can do better, it’s about who has wronged both American citizens and citizens across the globe.

Biden could’ve written an executive order for student debt forgiveness (a campaign promise) and he didn’t. What did he write one for? Sending aid to Israel. On top of the $3.8 billion the US government sends them annually. Further, there is a bill to be passed that will send more than $14 billion — all with no constraints. A blank check for Israel to use how the see fit, and we all know what they intend to do with it. All of this funding, tax dollars — money being made by the working class and paid to the government to be put back into our system — is being used to kill innocent humans. Men. Women. Children, half of Palestine’s population.

Voting for Biden is not voting for the lesser of two evils.

Voting for Biden is voting for genocide. For murder. For the deaths of innocent people who are pleading and begging every day for someone to see them, hear them, help them.

If you vote for Biden, remember the faces of the children that were burned and murdered by his bombs. Of the women who have miscarriages due to poor health, stress, terror that their bodies feel. Of the fathers who spend their days digging through the rubble of their homes and neighborhoods to find their children. Of the families and lineages that have been eradicated from this world.

I will not mince my words to be kind or sensitive. I hope they haunt you if you vote for Biden.

"Biden is funding a literal genocide!"

Yeah - and so will Trump. Like, if you don't vote for Biden, Trump will win, and he will continue to send aid to Israel - in fact, he will likely send MORE aid to Israel. That's the reality of the world we live in.

And, to be honest, any US president will support Israel. Because the USA is Israel's ally. That's how foreign policy works.

So who do you prefer?

Biden, who has helped lgbtq rights, reproductive rights, infrastructure, the environment, lowered medication costs, supported unions, and done MANY good, progressive things,

Or Trump, who we already know is awful. Who we already know will destroy any human rights Biden managed to gain. Who will not help the environment. Who will not help trans people, or immigrants, or women.

Because those are your two choices. And if you think they're the same, you are dangerous to all marginalized people.

#palestine#pro palestine#fuck isreal#anti zionisim#fuck biden#butcher biden#from the river to the sea palestine will be free#❤️🖤🤍💚#save gaza#save west bank#save palestine#save the children#anti colonialism#anti white supremacy

22K notes

·

View notes