#stock market Trading and investment

Explore tagged Tumblr posts

Text

Leading Trading Academy School in India

Are you searching for trading academy school for learn to stock market? In the thriving financial markets, necessary for individuals seeking to become experts at stock market trading and investing. Artha Shastra Gurukul stands out as the undisputed leader, offering a Vedic way of investing that sets it apart from the rest. As we analyse the qualities of the best trading academy school in India, you will learn how this institution prepares its students for success by using traditional methods with modern approaches.

The Vedic Way of Investing:

Wetake a unique approach to trading and investmentthe course of study incorporates the traditional expertise of the Vedic way. The ancient texts of India contain profound insights into wealth management and financial prosperity, which form the foundation of the academy's teachings. By blending these age-old principles with contemporary market strategies, students gain a holistic understanding of the financial world.

Comprehensive Education:

The academy offers a detailed range of courses designed to cater to individuals at various stages of their trading and investment journey. Whether you are a beginner or an experienced trader, theyhave a program tailored to your needs. From understanding the basics of the stock market trading and investment to mastering advanced trading techniques, the academy covers it all.

Skilled Administrator:

We have an excellent team of trainers who are extremely skilled and highly educated. These experts bring years of practical experience to the classroom, ensuring that students receive realworld insights and guidance. They are dedicated to nurturing the next generation of successful traders and investors.

Modern Technology:

It's important to stay modern with the latest technological advances in the fast-paced world of finance. Theyprovide its students with access to cutting-edge tools and software used by industry professionals. This hands-on experience equips students with the skills needed to navigate today's digital trading landscape effectively.

Practical Learning:

Webelieve in learning by doing. The academy offers a simulated trading environment where students can apply their knowledge in realtime. This practical experience helps them build confidence and refine their trading strategies without risking real capital.

Community and Support:

Joining Artha Shastra Gurukul means becoming part of a supportive community of like-minded individuals. The academy fosters an environment where students can collaborate, share insights, and grow together. Regular workshops, webinars, and networking events further enhance this sense of community.

Weare not just a trading academy it's a transformative experience that combines ancient wisdom with modern expertise to create the best trading academy school in India. Join withus and unlock the path to financial success through the Vedic way of investing.

#Best Trading Academy#Vedic Way Of Investing#Best Trading Academy School In India#stock market Trading and investment

0 notes

Text

land of the free free if you have money only.

#tiktok ban#tiktok#corrupt politicians#republicans#republican lies#trump#meta#meta stock#politics#greed#gop#gop hypocrisy#conservatives#trump administration#fuck the gop#investing stocks#stock market#stock trading

24 notes

·

View notes

Text

Hey everyine great news! My drop shiopping courses have been enough of a scusess tbat the

33 slurp juices remain. Your mission is to eliminate all of them before they can combine with an astro ape and mint a new astro ape

NFT game is back on! And there’s even better news!!!

Just ship a dead rat to 38.89679° N, 77.03601° W for a big surprise!!! Send me a pic of the surprise and you’ll even get a jared leto joker nft valued at 10 million billion dogecoin on us!!!

But hurry! This once in a lifetime opportunity is going away flr goot in just [function.timne+1]!!! Be sure to get in on the ground floor because forget the moon, we’re going all the way to freaking mars!!!

Did YOU seee the hiddem nessage??? Be sure to read the post thoroughly for any clues you might have missed!!!

#to the moon#nft#bitcoin#blockchain#crypto#cryptocurrency#web 3.0#binance#cryptocurreny trading#investment advice#retirement planning#stocks#stock market#cryptocurrency trading#cryptocurrency investment#might blaze this later idk

126 notes

·

View notes

Text

Want to learn how to invest?

ATTENTION CITIZENS OF BITCH NATION.

Our beloved comrade, Dumpster Doggy aka Amanda Holden, is teaching an investing workshop starting THIS SUNDAY, FEB 4. Dumpster Doggy designed this workshop as your first step toward financial freedom, and it is perfect for beginners and those who just want to understand the reasoning and mechanics behind investing.

This workshop is for you if you:

Have debt — yes, you should consider investing even if you have debt now

Don't know where to start

Want to be certain that your educational foundation is absolutely solid

Understand that investing is the key to building wealth, and know that a paycheck alone is not wealth

Don't want to work forever

Want your money to start working for you

Know that you just need to get started—no matter how small the dollar amount!

Know that education must be your foundation and that investing without knowledge is dangerous

Have a workplace retirement account

Don't have a workplace retirement account

The course costs $15. We wouldn't recommend something paid like this if we didn't believe in it, so this endorsement does NOT come lightly. Amanda is one of our ride-or-dies, and she left Wall Street so she could teach investing through a feminist lens.

But if $15 is too rich for your blood, we are offering Amanda's course FOR FREE to our Patreon donors. Sign up at the $5 level or higher and it's yours ($15-$5=$10 SAVINGS HOLY CANNOLI). We'll have the information for Patreon donors up tomorrow.

Lastly, if you can't make it live, you'll still get a recording of the workshop. So don't worry if you're not available this Sunday. Ok here are those links again:

Investing for Freedom Workshop with Dumpster Doggy

Bitches Get Riches Patreon for free access to workshop

#investing#stock market#how to invest#how to invest in the stock market#stocks#trading stocks#investors#investments#personal finance#money#money advice#money tips#making money#investing stocks#stockmarket

117 notes

·

View notes

Text

❄️☕️

Go follow : StocksOnWatch ( YouTube)

#coffee#iced coffee#selfie#snapchat#foot feddish#feetfinder#bored#beautiful stoner#investing stocks#stock market#stock trading

37 notes

·

View notes

Text

Time to take this office apart ft my needy little helper I won't miss much about this office, but I will definitely miss the stunning view and the breathtaking sunrises I had every morning. I haven't decided whereabouts my office will be going in my new house yet but I'm looking forward to switching things up and creating my brand new trading den ⚫.

#forexmarket#forextrading#forexstrategy#forex#bitcoin#free usdt#cryptocurrency#cryptonews#crypto#stock market#stock trading#investment#learnsomethingneweveryday#learn forex trading

39 notes

·

View notes

Text

me when:...

#original character#artists on tumblr#digital art#illustration#art#meme#stonks#stock market#stock trading#investment#investors#evil stonks#super villain#president#original characters#my art#evil oc#villian oc#villian#OC: Booker#shit post

18 notes

·

View notes

Text

Then it’s real…

#Then it’s real…#pirates of the caribbean#pirates of the caribbean meme#memes#meme#taxes#tax#stocks#stock market#stock trading#investing stocks#stock#wall street#wall streeet journal#wall st#wall st.#stock management software#capitalism#exploitation#exploitative#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

20 notes

·

View notes

Video

youtube

Metal Stock to focus

#youtube#investment#investors#invest#kingdom of saudi arabia#united kingdom#india#vedanta#nseindia#bse sensex#indian stock market#economic affair#nifty50#algo trading#bilateral

7 notes

·

View notes

Text

My bf is doing some stuff w stock investing i dont get it. Arent they like a scam?

5 notes

·

View notes

Text

What's your take on NVIDIA's rise?

#nvidia has soared to new heights, becoming one of the world's most valuable companies! Their innovations in AI are transforming industries.

#finance#stock market#learnandearn#investment#educate yourself#investing stocks#stock trading#nvidia#finance news

12 notes

·

View notes

Text

So recently I've found myself gaining an interest in the stock market. Anyone have any suggestions on investing for beginners or recommendations of youtubers who delve into this?

41 notes

·

View notes

Text

youtube

Benzinga Interviews NVSTly: The Future of Social Investing

Join Benzinga as they sit down with NVSTly, the cutting-edge platform revolutionizing social trading and investing. In this exclusive interview, NVSTly shares insights on empowering retail traders, fostering transparency, and building a thriving community for investors of all levels. Discover how NVSTly is shaping the future of trading with innovative features, real-time trade tracking, and global collaboration.

Join NVSTly:

Website: nvstly.com

Mobile App: Available on Google Play and App Store

Discord Community: Join Now

#crypto#cryptocurrency#finance#fintech#forex#futures#investing#investors#stock market#startup#business#Youtube#stocks#nasdaq#financial#investing stocks#investment#blockchain#personal finance#finances#economy#economic#forextrading#forex market#futures trading#stock trading#markets#invest#awards#award winning

2 notes

·

View notes

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

11 notes

·

View notes

Text

Money Is Fake and GameStop Is King: What Happened When Reddit and a Meme Stock Tanked Hedge Funds

Like this article? Join our Patreon!

#gamestonk#gme#hedge fund#investing#r/wallstreetbets#short selling#shorting#stock market#stocks#trading stocks#Wall Street Bets

17 notes

·

View notes

Text

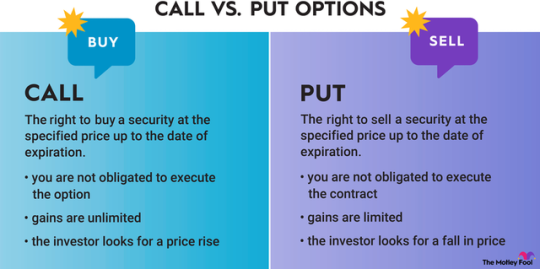

Call vs. Put Options

This guide will give you a complete rundown of call options and put options.

A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date.

That's the short summary of these options contracts. Now, let's take a closer look at how call and put options work, as well as the risks involved with options trading.

How does a call option work?

A call option is a contract tied to a stock. You pay a fee, called a premium, for the contract. That gives you the right to buy the stock at a set price, known as the strike price, at any point until the contract's expiration date.

You're not obligated to execute the option. If the price of the stock increases enough, then you can execute it or sell the contract itself for a profit. If it doesn't, then you can let the contract expire and only lose the premium you paid.

The breakeven point on a call option is the sum of the strike price and the premium. When you have a call option, you can calculate your profit or loss at any point by subtracting the current price from the breakeven point.

As an example, let's say that you're bullish on Apple (AAPL -0.54%) and it's trading at $150 per share. You buy a call option with a strike price of $170 and an expiration date six months from now. The call option costs you a premium of $15 per share. Since options contracts cover 100 shares, the total cost would be $1,500.

The breakeven point would be $185 since that's the sum of the $170 strike price and the $15 premium. If Apple reaches a price of $195, your profit would be $10 per share, which is $1,000 total. If it only goes to $175, you'd have a loss of $10 per share. Your maximum potential loss would be the $1,500 you paid for the premium.

How does a put option work?

A put option is a contract tied to a stock. You pay a premium for the contract, giving you the right to sell the stock at the strike price. You're able to execute the contract at any point until its expiration date.

If the price of the stock decreases enough, then you can sell your put option for a profit. You're not obligated to execute the contract, so if the price of the asset doesn't drop enough, you can let the contract expire.

The breakeven point on a put option is the difference between the strike price and the premium. When you have a put option, you can calculate your profit or loss at any point by subtracting the breakeven point from the current price, or by using the calculator at the bottom of this page.

To give you an example, imagine Netflix (NFLX -0.51%) trades at $500 per share. You think it's overvalued, so you buy a put option with a strike price of $450 and an expiration date three months away. The premium costs $10 per share, which is a total price of $1,000 for the contract.

The breakeven point would be $440, the difference between the $450 strike price and the $10 premium. If Netflix plummets to $400, then you're up $40 per share ($4,000 total) on your put option. If it doesn't drop below $450 at all, then you'd only be able to let the option expire and eat the cost of the premium.

Risks of call vs. put options

The risk of buying both call and put options is that they expire worthless because the stock doesn't reach the breakeven point. In that case, you lose the amount you paid for the premium.

It's also possible to sell call and put options, which means another party would pay you a premium for an options contract. Selling calls and puts is much riskier than buying them because it carries greater potential losses. If the stock price passes the breakeven point and the buyer executes the option, then you're responsible for fulfilling the contract.

The benefit of buying options is that you know from the beginning the maximum amount you can lose. This makes options safer than other types of leveraged instruments such as futures contracts.

However, options can be riskier than simply buying and selling stocks because there's a greater possibility of coming away with nothing. When investing in stocks, you only need to predict whether the stock goes up or down. For options trading, you need to predict three things correctly:

The direction the stock will move.

The amount the stock will move.

The time period of the stock movement.

If you're wrong about any of those, then the options contract will be worthless. While there's the potential for greater returns with options, they're also harder to trade successfully.

Despite the challenge of successfully trading call and put options, they provide an opportunity to amplify your returns. That can make them a valuable addition to a balanced portfolio. For investors interested in options, there are also more advanced strategies that go beyond buying calls and puts.

#kemetic dreams#call option#options#put options#money#stocks#stock market#markets#investing stocks#stock trading#nasdaq#balanced portfolio#money talk

13 notes

·

View notes