#source taxation

Explore tagged Tumblr posts

Text

Understanding Double Taxation: A Methodology To Think About What It Is

Introduction: I received the following message from: Dr. Suzanne de Treville Swiss Finance Institute Professor of Operations Management, Emeritus University of Lausanne Faculty of Business and Economics 1015 Lausanne-Dorigny Switzerland A very interesting analysis of double taxation indeed. I am reproducing this as a blog post with her kind permission. Suzanne has kindly agreed to participate in…

#citizenship taxation#double taxation#residence taxation#source taxation#Suzanne de Treville#worldwide taxation

0 notes

Text

Changes to the Tax Collection System in Revolutionary and Napoleonic France

My translation from Le prix de la gloire: Napoléon et l’argent by Pierre Branda.

This part is specifically about the reforms made to the tax collection system. Problems with taxation had been the source of many woes, so it went through major changes.

“The [tax] work of the Consulate mainly concerned the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the ‘tax slips’, to be established by municipal administrations. Their work was complex, because each year it was necessary to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of the contribution to pay. Poorly motivated (or even corrupt), the municipalities had put little care in the execution of their mission since a large part of the taxpayers had not yet received anything for their taxes of year VIII, or even of year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left outstanding). If the sending of tax matrices left something to be desired, the collection of direct contributions was hardly better. The tax collector was also not an agent of the administration: this function was assigned to any person who agreed to collect taxes with the lowest possible commission (otherwise called ‘collecte à la moins-dite’). With such a system, there were numerous inadequacies, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the profits of the collectors were most of the time too low to provide such a service; also, to compensate for their losses, they were ‘forced’ to multiply small and big cheats. In any case, in such a troubled period, letting simple individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.”

“One month after Gaudin’s appointment, on December 13, 1799, the Directorate of Direct Contributions was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely ‘in the hands of the Minister of Finance’ and in this way the taxpayer found himself in direct contact with the administration. The tax system no longer having any obstacles, the beneficial effects of such a measure did not take long to be felt. With ardor, the agents of this new administration carried out considerable work: three series of rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the ministry had not skimped on their pay (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was undoubtedly not unrelated to such success.”

“Tax reform was slower. It was not until 1804 that all tax collectors were civil servants. The consular system gradually replaced the collectors of the departments, then of the main cities and finally of all the municipalities whose tax rolls exceeded 15,000 francs. At the end of the Consulate, the entire tax administration was thus entirely dependent on the central government. Subsequently, the one in charge of indirect contributions (taxes on tobacco, alcohol or salt) created on February 25, 1804 and called the Régie des droits réunis was built on the same pyramidal and centralized model. It was the same later for customs.”

“According to Michel Bruguière, historian of public finances, ‘Napoleon and Gaudin can be considered the builders of the French tax administration. [...] They had also developed and codified the essential principles of our tax law, so profoundly derogatory from the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers’. Basically, after having clearly understood the true cause of the ‘financial wound’, Bonaparte wanted an effective, almost ‘despotic’ instrument to avoid experiencing the unfortunate fate of his predecessors. As a good soldier, he created a fiscal ‘army’ responsible for providing the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in everything that concerned public revenue. The time of the farmer generals of the Ancien Régime or the ‘second-hand’ collectors of the Directory was well and truly over. Napoleon Bonaparte, with his fierce desire to centralize power in this area as in many others, undoubtedly gave his regime the means to last.”

French:

Page 208

Page 209

Page 210

#Le prix de la gloire: Napoléon et l’argent#Le prix de la gloire#Napoléon et l’argent#napoleon#napoleonic era#napoleonic#napoleon bonaparte#19th century#first french empire#1800s#french empire#france#history#reforms#finance#economics#french revolution#frev#la révolution française#révolution française#Gaudin#tax#tax collection system#taxation#law#napoleonic code#source#french history#branda#Pierre branda

36 notes

·

View notes

Text

How to Handle Taxation on Personal Loan Forgiveness

In an ideal world, all loans would be repaid on time and without trouble. However, life sometimes throws unexpected challenges—job loss, medical emergencies, or financial downturns—that make repaying a personal loan difficult. In such cases, some lenders may offer personal loan forgiveness, where they waive a portion or the entire loan amount.

While this can offer much-needed relief, many borrowers overlook an important aspect—the tax implications of personal loan forgiveness. Let's break it down so you can handle it smartly and legally.

What is Personal Loan Forgiveness?

Personal loan forgiveness refers to a situation where a lender either partially or fully cancels your outstanding personal loan. It may occur due to financial hardship, settlement agreements, or as part of special relief schemes.

While forgiveness offers emotional and financial relief, it doesn't always mean you’re completely off the hook—especially with the tax department.

Is Forgiven Personal Loan Amount Considered Taxable?

Here’s the key question: Is the forgiven amount from a personal loan considered taxable income?

In most cases, yes.

According to Indian tax laws, if a personal loan is waived off by the lender and it is not for a capital asset (like property or vehicle), the forgiven amount may be treated as "income from other sources" and hence, taxed.

Let’s understand this in detail.

When Does Forgiven Personal Loan Become Taxable?

The tax treatment depends on why and how you took the personal loan:

Personal Loan Used for Business If you used the personal loan for business purposes and part of it gets waived, the forgiven amount may be considered business income and taxed accordingly under "profits and gains of business or profession".

Personal Loan for Personal Use If you used the personal loan for medical treatment, education, or general personal expenses and it’s forgiven, then the amount may be taxable under "income from other sources".

Personal Loan Used to Purchase Capital Asset If you used the personal loan to buy an asset like a house or car, and the loan is waived, it may not be taxed immediately. However, your cost of acquisition for the asset may be adjusted in future capital gains calculations.

Exceptions to Tax on Personal Loan Forgiveness

There are specific situations where loan forgiveness might not be taxed:

Loan from friends or family: If a personal loan is taken from friends or relatives and later forgiven, it’s not generally taxable.

Loan from employer up to a certain limit: Small loans from an employer, if forgiven, may not attract tax, provided they are within prescribed limits.

Loan settled through IBC or court: In case of insolvency or bankruptcy proceedings, forgiven personal loans may be exempt from tax, but it must be legally documented.

Real-Life Example

Imagine Raj took a personal loan of ₹4,00,000 for his wedding. Due to job loss, he negotiated a settlement with the lender who agreed to waive ₹1,50,000 of the loan.

Now, since the loan was used for personal reasons (not a capital asset), the forgiven ₹1,50,000 may be treated as taxable income and Raj will have to include it in his income tax return under “Income from Other Sources.”

How to Report Forgiven Loan Amount in ITR

If your personal loan is forgiven and it qualifies as taxable income:

Include in ITR: Report the waived amount under “Income from Other Sources.”

Add to Total Income: It gets added to your total taxable income for that financial year.

Pay Tax Accordingly: The amount will be taxed based on your slab rate.

Documents You Must Keep

When handling personal loan forgiveness and its tax implications, documentation is key. Here’s what you should keep:

Loan agreement

Settlement letter from lender

Waiver or forgiveness letter

Correspondence with lender

Purpose of the loan (proof of how you used the funds)

This documentation will help in case of an audit or if the Income Tax Department seeks clarification.

Tips to Reduce Tax Burden on Forgiven Personal Loan

If you're concerned about paying tax on a forgiven personal loan, here are a few ways to manage it wisely:

1. Prove It Was a Capital Loan

If you can prove the loan was used to buy a capital asset, the tax may be deferred to when you sell the asset (as part of capital gains calculations).

2. Settle the Loan Through Legal Channels

Settling the loan through a court-mandated insolvency process may make the forgiven amount non-taxable.

3. Consider Voluntary Repayment

Even if part of the loan is waived, voluntarily repaying it may not be legally required, but it can improve your credit score and help avoid tax complications.

4. Consult a Tax Advisor

Each case is unique. A qualified tax professional can guide you on how to treat the forgiven loan in your ITR.

Impact on Credit Score

Forgiveness or settlement of a personal loan usually affects your credit score. Even though part of the loan is waived, credit bureaus record it as “settled,” not “paid in full.”

This can:

Lower your credit score

Reduce future loan eligibility

Raise red flags for lenders

So, while you may get tax relief, your creditworthiness may take a hit.

Final Thoughts

Personal loan forgiveness is a financial relief, but it comes with taxation strings attached. Many borrowers wrongly assume that once a loan is waived, they’re completely free. However, the taxman may see the waived amount as income and tax it accordingly.

To avoid surprises:

Understand the tax implications based on loan usage

Maintain proper documentation

File taxes accurately

Consult experts when in doubt

Being proactive and informed is the key to handling taxation on personal loan forgiveness efficiently.

Frequently Asked Questions (FAQs)

Q1: Will the entire forgiven personal loan amount be taxed? A: Yes, unless it qualifies as an exemption (used for capital assets or forgiven via legal insolvency).

Q2: Do I have to mention forgiven loans in my ITR? A: Yes, if taxable. It must be declared under “Income from Other Sources.”

Q3: Can loan forgiveness affect my eligibility for future loans? A: Yes, especially if marked “settled” by credit bureaus.

Conclusion

Loan forgiveness can be a blessing in difficult times. But don’t let it become a tax burden due to lack of awareness. Stay informed, keep records, and consult professionals when needed. That’s how you turn a tough situation into a financially manageable one—with confidence and clarity.

For more insights on personal loans, fraud prevention, and financial planning, stay tuned to Fincrif.com—your reliable guide to smarter borrowing.

#loan apps#nbfc personal loan#fincrif#finance#personal loan online#personal loans#bank#personal loan#loan services#personal laon#personal loan forgiveness#personal loan taxation#is personal loan forgiveness taxable#tax on personal loan#forgiven personal loan income tax#how to report forgiven loan in ITR#personal loan tax implications#personal loan waiver tax#personal loan settlement tax rules#taxable income from personal loan#personal loan used for business#capital asset loan forgiveness#personal loan for personal use tax#income from other sources loan#loan waiver income tax India#ITR personal loan forgiveness#personal loan debt settlement#credit score after personal loan forgiveness#personal loan legal settlement tax

0 notes

Text

teach please me — tutor!reader x soccer player!rafe

reader's life is meticulously planned, from high school to becoming president of the country—she knows exactly where she's headed and every step to get there. but her airtight plan hits a snag when the principal ropes her into tutoring rafe cameron, the school’s star soccer player, who’s failing algebra and at risk of being benched next season. the team needs him on the field, and reader needs the principal’s glowing recommendation to secure her spot at her dream school. balancing her ambitious goals with rafe’s chaotic charm might just throw her perfectly crafted plan off track.

word count — 6.1 chapter index — prev. chap. — next chap. masterlist

nineteen

saturday, march 1st

"okay, ready?" ivy’s voice broke the quiet of the library, her sharp gaze narrowing as she held up the next flashcard. you nodded, settling your hands neatly in your lap, trying to shake off the tension in your shoulders.

"main causes of the american revolution?" she asked, her tone brisk but encouraging.

"taxation without representation, british military presence, proclamation of 1763, and acts like the stamp act and tea act," you rattled off, your voice low but steady. she gave a quick nod, flipping to the next card with a satisfied mutter.

"what was the significance of the monroe doctrine?"

"it stated that european powers should not interfere in the western hemisphere and established u.s. influence in the americas," you answered, nodding slightly as if to confirm your own words. ivy hummed in approval, her eyes scanning the card before moving on.

"what triggered the united states’ entry into world war one?" she asked, her voice laced with expectation.

you opened your mouth, ready to reply, but the answer danced just out of reach. blinking, you sifted through your mental notes, coming up blank. "the…" you hesitated, brows furrowing as you scrambled to connect the dots. "the sinking of the lusitania?" you ventured, your voice tinged with uncertainty.

ivy nodded, her expression urging you on.

"oh!" the memory clicked into place. "the unrestricted submarine warfare by germany and the zimmerman telegram!" you finished with a triumphant grin.

"ten out of ten," ivy whispered, punching the air subtly in celebration.

"moreee! i need to get this information printed into my brain," you pleaded, leaning forward with an exaggerated look.

ivy gave you a pointed look, crossing her arms. "we’ve been at this since one, and it’s almost six," she said, the corners of her mouth twitching upward in a laugh. "i think we could both use a break."

“fine,” you reluctantly agree.

she stood, grabbing her bottle off the table. "i’m gonna refill this. we’ll pick it back up in five, okay?"

you sighed but nodded, watching as she walked toward the water fountain. the moment she was out of sight, you slid your notebook aside and switched over to your imessage conversation with rafe, your lips curving into a soft smile as you read over his last message.

a couple of seconds after you send your last text, your phone lights up with a facetime call from rafe. the ringing feels louder in the quiet library, and you scramble to answer before ivy—or worse, the librarian—shoots you a glare. the call connects, and the screen fills with rafe sitting in his car, the faint golden light of the setting sun casting a warm glow over his sharp features. he’s fiddling with his phone, adjusting it against the dashboard, the camera wobbling slightly before he settles it.

“—coming back?” a voice crackles faintly in the background, pulling rafe’s attention toward his window. his brow furrows, lips twitching in a mix of amusement and confusion.

“dude, you sound drunk,” rafe says with a laugh, shaking his head as he adjusts his seatbelt. his smile tugs at the corner of his lips, easy and familiar.

“i didn’t drink!” the voice protests indignantly, and rafe’s face twists with exaggerated disbelief as he glances toward the source.

“kelce,” he drawls, his tone dripping with mockery, “you had four corona lights.”

“there’s alcohol in corona lights?” kelce’s voice is so genuinely confused that you can’t help but snort quietly, covering your mouth to stifle the sound.

rafe hears it and turns to the camera, his grin widening at the sight of you laughing. his gaze lingers for a beat longer before he shakes his head and looks back at kelce. “kelce, back up. i’m about to drive off, and i actually can’t deal with you right now.”

“i thought they called it ‘light’ because there’s no alcohol in it!” kelce yells, his tone insistent, and rafe groans, dragging a hand down his face.

“you’re an idiot,” rafe mutters, throwing the car into reverse as kelce finally stumbles out of the way.

“are you sure he should be in our grade?” you tease, watching as rafe navigates out of the parking lot, the golden hour light catching in his hair and softening the edges of his jawline.

“no,” rafe deadpans, his eyes flicking toward the camera briefly. “i’m really not.”

your grin widens as you reach up to undo your claw clip, letting your hair fall loose around your shoulders. you shake it out slightly, the strands catching the soft light spilling through the windows. rafe’s gaze flickers back to the screen for a split second, his expression softening as his eyes follow the motion, but he quickly refocuses on the road ahead.

“what are you craving?” he asks casually, one hand resting on the steering wheel, the other draped over the gear shift.

“what’s around?” you counter, leaning back in your chair, your voice playful as you tuck a strand of hair behind your ear.

his eyes narrow slightly, his lips pressing into a stubborn line. “what are you craving?” he repeats, his tone insistent, though there’s a hint of amusement dancing in his expression.

“fine,” you relent with an exaggerated sigh, though a smile creeps onto your face. “chipotle? like, a bowl with rice, guac, chicken...” you lean your chin on your hand, practically drooling at the thought.

rafe hums, glancing at the GPS on his dash. “there’s one close. i could grab it and be at the library in, like, half an hour—assuming they don’t take forever.”

“perfect,” you murmur, already mentally calculating how much more studying you and ivy could squeeze in before the food arrived.

a few quiet moments pass, the hum of the car filling the space before rafe leans back in his seat at a red light. “so,” he starts, his voice casual but with a note of deliberation. “i was just with the boys, and they wanna come by mine later. my dad got this new grill, and they’re all obsessed with trying it out. my parents are gone for the weekend, and the girls are coming, too. you should come.”

the suggestion hangs in the air for a moment, and your chest tightens, a swirl of emotions tumbling through you. you hadn’t talked about the bonfire yet—the memory of him with adriana still lingered, raw and unresolved, and the image of their lips together was one you couldn’t quite shake, but you stupidly had been pushing it aside. you didn’t want to have this stupid conversation, didn’t want to risk anything breaking this beautiful little bubble you were both in. surely, there was an explanation—there had to be. so, just ask him.

maybe they used to have a thing? you honestly didn't really like to think about it all because the image alone upset you but if they did have a thing, it was probably over. right?

and the new girl every day thing had to be made up though the valentine's day letters did stir something up in you.

rafe was so gentle, so soft, so loving and caring. he could never treat girls as disposable as cora made it out to be.

“you could bring ivy,” he adds, his voice softening, his gaze hopeful. “i’ll drive her home after, and maybe you could sleep over?”

his words are casual, but the implication lingers in the space between you. you’d been waiting for the right occasion to finally have sex and his parents not being home? that seemed like the perfect time and place. your heart races. the idea of staying over—of finally taking that step—sends a rush of heat to your cheeks, but at the same time, you can’t ignore the nagging voice in the back of your head urging you to bring up the bonfire first.

you nod slowly, “can we—“

“bring me where?” ivy’s voice cuts through your words. you glance up to see her standing behind you, her curious gaze flicking between you and the phone.

“oh,” you say quickly, trying to gather your thoughts. “rafe’s hosting this small thing at his house, and he asked if you’d want to come.”

ivy slides into the seat beside you, resting her head on your shoulder so her face pops into the frame. “what kind of thing?” she asks, her question clearly directed at rafe.

"a..barbecue but it's not outside—alcohol, but you don't have to drink—ultra casual friends thing. i can drop you off at home too." rafe explains, his voice steady but warm.

ivy hesitates for a moment, her brow furrowing slightly before she relaxes with a shrug. “why not? i’ve never been to that kind of thing,” she says lightly, her tone curious.

she turns to you, raising an eyebrow. “we can go, right?”

you glance between her and rafe, feeling the weight of their gazes. finally, you nod, a small smile playing on your lips. “yeah, we can go. rafe’s bringing us chipotle first,” you add, your tone brightening.

ivy’s eyes light up as she leans toward the phone. “wait, don’t joke with me. are you really getting us food?”

rafe chuckles, his voice warm and teasing. “yeah. what do you want?”

“hold on, i need my phone!” ivy scrambles, rummaging through her bag, and you laugh, shaking your head. “she has a very specific chipotle order,” you explain, already typing it out. “it’s easier if i just text it to you.”

rafe smirks, clearly entertained, but he doesn’t argue. a few minutes later, after you send the details, you’re subjected to twenty-eight excruciating minutes of ivy glancing toward the hallway every few seconds, her anticipation palpable. yes, you counted.

when rafe finally walks in, bags in hand, ivy practically leaps out of her seat. “you’re god-sent,” she declares dramatically, clutching the food like it’s a lifeline before digging in with record speed. you can’t help but laugh, your chest warming at the sight of her excitement and rafe’s quiet amusement.

rafe strolled over to you, his hands extended, palms up. you tilted your head, curious, before slipping your hands into his. his grip was warm and steady as he pulled you to your feet, and before you could say anything, he looped your arms around his neck. his hands settled lightly on your waist, and then he dipped his head to kiss you. it was slow and gentle, the kind of kiss that left you dizzy, though you fought to keep yourself grounded, sighing softly against his lips as he pulled you deeper into the moment.

“missed you, baby.” he murmured, his voice low and warm as he pulled back just enough that your breaths mingled between you.

“i missed you,” you echoed, your voice barely above a whisper before you pressed a quick kiss to the tip of his nose. his grin was soft but immediate, the corners of his mouth twitching upward as his hands slid lower to steady you.

“thanks for the food,” you said, glancing briefly toward ivy, who was blissfully absorbed in her chipotle bowl, completely oblivious to the exchange.

rafe followed your gaze, chuckling under his breath. “no need to thank me.” he stepped back and dropped into the chair you’d been sitting in, only to tug you down onto his knee.

you settled against him, adjusting slightly to get comfortable. “you always tell me not to thank you,” you said with mock exasperation, tilting your head to look at him. “that’s really rude, you know? who doesn’t say thank you?”

he pulled a bag from beside his chair and started unpacking it, his movements casual. “you don’t need to thank me for things that go without saying,” he replied simply, not looking up.

you hummed thoughtfully, the familiar spark of debate flaring in your chest. “i get what you’re saying, but i think some things do need acknowledgment. like, i agree there are certain actions that people do in relationships—whether romantic, familial, or platonic—that don’t need constant recognition. but still, a little appreciation never hurts. like when my parents put food on the table—it’s their job, sure, but i still say thank you because it shows I value their effort. it’s about gratitude, not obligation.”

rafe placed your bowl in front of you, a fork and napkin neatly folded beside it. “i get that,” he said, leaning back slightly as you dug into your food. “but i think a lot of things are just part of being in someone’s life. like, it’s not a task or a burden for me to do something for you. it’s automatic—like brushing my teeth. you don’t thank someone for brushing their teeth, do you? it’s just… normal.”

you chewed slowly, considering his point, before shifting on his knee to face him better. the bowl rested on your lap as you studied his expression. “that’s an interesting perspective,” you said finally, nodding a little. “but i’m still going to say thank you.”

his lips curved into a soft smirk as he raked his fingers through his hair. “and i’m still going to tell you not to.”

you rolled your eyes playfully but couldn’t fight the smile tugging at your lips. picking up the flashcards from the table, you plopped them into his hands. “fine, if you won’t accept my thanks, you can at least make yourself useful. quiz me.”

rafe huffed dramatically as he fanned through the colorful cards. “wow, i’m really just a tool to you, huh?”

from across the table, ivy piped up between bites of her food, her voice dripping with dry humor. “not just a tool, also a bank card.”

rafe’s laughter was immediate, shaking his head as he glanced at you.

“okay,” he said, flipping to the first card with a grin. “what was the purpose of the patriot act?”

you don’t linger too long at the library—just long enough for you and ivy to finish your food. once the bowls are empty and the conversation fades, rafe gathers you both and drives you home so you can drop off your bags and check in with your parents. the plan is simple: tell them you’re sleeping over at ivy’s, grab a few essentials, and head out again.

once inside, you catch a whiff of the lingering chipotle smell on your clothes, and it’s enough to make you grimace. after a quick change into fresh, comfortable clothes, and brushing your teeth to erase the last traces of cilantro-lime rice, you’re back in rafe’s car.

he’s quiet when you slide into the passenger seat, his head down as he types something on his phone. the faint glow illuminates a frown etched into his features. you buckle your seatbelt and glance at him, concern stirring. “you okay?” you ask softly.

he doesn’t look up or respond, his focus still glued to his screen.

“rafe?” you try again, your voice a little firmer this time. his head snaps up, eyes meeting yours as if pulled from deep thought.

“hmm?” he hums, blinking.

“are you okay?” you repeat, studying him closely.

he exhales, the frown softening but not entirely disappearing. “yeah,” he says quietly, slipping his phone onto the console. “just… haven’t heard much from sarah lately. i’ve been trying to get ahold of her.”

you nod, your hand brushing against his arm in a small, reassuring gesture. “i’m sure she’s fine. maybe reach out to your aunt in the morning, just to check in? but it’s probably nothing to worry about.”

his lips quirk into a faint smile as he nods. “yeah, you’re probably right. i’ll text her tomorrow.”

ivy clambers into the back seat, breaking the moment, and soon rafe is pulling out of your driveway. the car hums softly, the headlights cutting through the dark as ivy peppers rafe with questions about anything and everything that pops into her head. her curiosity is endless.

you smile faintly at their banter, but your mind drifts, your fingers fidgeting with the edge of your sleeve. it wasn’t fear—not exactly—but the thought of being around rafe’s friends again brought a weight to your chest. the last time had ended badly, leaving you walking home alone in the dark, tears blurring your vision.

time had passed since that night, though, and things were different now. rafe had been nothing but perfect—kind, attentive, funny, the kind of person who made your heart skip and your stomach flutter. your parents adored him, your friends approved, and he had done nothing to make you doubt his feelings. it should be fine. everything should be fine. but still, a flicker of unease clung to you.

you’d talk to him tonight, when everyone left. that was the only quiet moment you’d get.

“you okay?” ivy’s voice broke through your thoughts as you approached rafe’s front door.

you glanced at her, startled, and nodded quickly. “yeah, of course. why?”

she studied you for a moment, her brow furrowed. “you just seem a little… nervous.”

“nope, not nervous,” you said with a forced smile, shaking your head as if to convince yourself as much as her.

she didn’t press further, but the shadow of doubt lingered in her eyes as you both stepped inside behind rafe.

the faint murmur of voices floated from the living room, punctuated by occasional laughter, as you crossed the foyer. the sound made your stomach tighten, but you squared your shoulders and followed rafe’s lead, determined to make it through the evening.

"rafe! there you are, i seriously need—" kiara's voice echoed down the stairs but stopped abruptly when her eyes landed on you and ivy. her surprised expression melted into a wide, welcoming smile. "hey! you came!" she exclaimed, practically skipping down the last few steps.

jj was close behind her, bounding down the stairs like a golden retriever before leaping onto rafe’s back in a chaotic greeting. rafe stumbled forward slightly, muttering something about jj needing a leash, but you were too focused on kiara approaching you and ivy.

"hey, kiara," you said warmly, gesturing toward your friend. "this is ivy."

ivy offered a polite smile and a small wave. "hi, nice to meet you."

"i’m kiara," she said, grinning at the both of you. "so glad you came." without missing a beat, she looped an arm through yours and started tugging you forward. jj threw a quick, cheerful “hi” your way before he and rafe disappeared behind the corner.

"since you don’t drink, i got you something special!" kiara announced with an excited sparkle in her eyes. she practically beamed as she gestured toward the kitchen island, where cleo and pope were deep in the throes of concocting something that resembled a science experiment more than a drink.

pope held up a glass, swirling it like a sommelier, while cleo smirked beside him, her fingers busy mixing something else.

"look!" kiara reached for a six-pack of sleek, colorful cans and held them up like a prized trophy. you stared at them, blinking in confusion.

"they’re virgin mojitos!" she said proudly, her voice practically dripping with enthusiasm.

it clicked a moment later, and you couldn’t help but smile. "so, i can kind of pretend i’m drinking the same as you guys? how thoughtful!" you laugh and kiara nods.

"of course! no one gets left out here," she said with a grin.

pope had already grabbed one of the cans, cracking it open with a flourish and pouring its contents into a glass. he added some questionable-looking ingredients from the assortment on the counter, finishing it off with a dramatic sprinkle of sugar.

"boom!" pope declared, sliding the drink toward you. "virgin cocktails à la cleo and pope. tell me that’s not perfection."

with cautious determination, you took a small sip. immediately, your face scrunched up as the overpowering sweetness hit you. you squeezed your eyes shut, trying to swallow without gagging.

"oh my god," you croaked, handing the glass to ivy, who was already laughing at your reaction.

ivy hesitated, then took a brave sip herself. the second the liquid touched her tongue, her eyes went wide, and she practically spat it back into the glass. "oh, god! what is that? did you dump an entire bag of sugar in here?"

pope and cleo were doubled over with laughter, clearly amused by your suffering.

as ivy hunted for water, muttering something about "instant diabetes," john b strolled into the kitchen, eyebrow raised. "guys, seriously? already throwing up?"

ivy, still laughing through her sputtering, waved him off as she grabbed a glass of water. "i think i just shaved ten years off my life," she mumbled dramatically, taking long gulps.

cleo crossed her arms, looking offended. "you two clearly don’t appreciate our craftsmanship."

"yeah," pope added, nodding in agreement. "this is an art form."

you glanced at kiara, who was biting her lip to hold back laughter. your shared look was enough to set both of you off.

you weave through the place, scanning for rafe in the sea of familiar faces, but he’s nowhere in sight. a few steps in, you collide with jj, his lazy grin revealing he's had more than just a few drinks. "hello," he greets, his voice light and teasing.

"hi," you reply, smiling politely, though his glassy eyes and slight sway make you wonder if he’s entirely steady on his feet.

you glance back to see him watching pope and cleo, who are hunched over the kitchen counter, laughing as they concoct a drink that looks less like a cocktail and more like a dare. jj turns back to you, ignoring your question entirely. "looking for rafe?" he asks, his tone casual.

"yeah," you nod, and his grin widens.

"i’ll take you to him." before you can protest, he drapes an arm over your shoulder, steering you toward the garden.

outside, the air is cooler, and the faint glow of string lights illuminates the yard. rafe stands by the grill with topper and cora. topper is manning the grill, flipping meat with practiced ease, while cora plates the freshly cooked food. rafe, on the other hand, leans casually against the table, contributing absolutely nothing.

"rafe! i brought you a peace offering," jj announces with exaggerated theatrics, gripping your shoulders and nudging you forward.

"peace offering?" you echo, a soft laugh escaping your lips as you glance between jj and rafe.

rafe’s brows lift as he looks at you, his lips twitching into a smirk. "oh, yes. a peace offering because jackson here threw up on my carpet yesterday," he says dryly.

jj lets out an indignant noise, ducking as rafe chucks a nearby towel at his head. "dude! i cleaned it up, and you love me, so stop holding grudges and just forgive me already."

jj moves toward the table, hand reaching for a freshly grilled sausage, but cora smacks his fingers without missing a beat. "it just came off the grill, idiot. you’ll burn yourself."

"you didn’t clean it up," topper chimes in, laughing. "you wiped it. there’s a difference. he’s gonna have to get the carpet professionally cleaned."

"and who’s paying for that?" rafe asks, his tone pointed as he slides an arm around your waist.

jj shrugs, lips pressing together in mock thought. "your rich-ass parents," he answers shamelessly.

"or yours," rafe counters, raising a brow.

jj grimaces, shoving a piece of sausage into his mouth before mumbling, "my dad hasn’t given me a dime since i took his lambo for that little joyride."

"you didn’t even crash it. what’s the issue?" kelce’s voice cuts in as he steps out from the house, joining the growing group.

their conversation continues, laughter and banter spilling into the cool night air. but your focus shifts, the voices fading into the background. you can feel cora’s eyes on you, her gaze heavy and assessing. instead of meeting her stare, you focus on the comforting warmth of rafe beside you, the way his chest rumbles when he laughs, the scent of his cologne grounding you. you twist one of his fingers absently, letting the small act ease your nerves.

after a few moments, you lean closer to rafe. "i’m gonna go get a drink," you murmur softly.

his attention snaps to you, his blue eyes searching yours. "you good?" he asks, concern flickering across his face.

you nod quickly, offering him a reassuring smile. "uh-huh. you want anything?"

"whatever beer’s in the fridge," he replies, and you nod, brushing a kiss against his cheek before heading back toward the house.

as you step inside, the warmth and noise envelop you again, and your gaze lands on adriana making her entrance. she glides through with a confidence that borders on arrogance, her knowing smile is a little unsettling and when she catches your eye, her expression twists into something mocking, though she doesn’t say a word. instead, she brushes past you, heading straight for the garden—and for rafe.

you bite the inside of your cheek, willing yourself to shake off the unease bubbling in your chest. moving toward the kitchen, you find ivy perched at the island, her laughter mingling with the chatter of kiara, cleo, pope, and john b.

you rest your chin on ivy’s shoulder, your voice soft as you ask, "you good?"

she turns to you, her smile bright and reassuring. "very good. you?"

the question is simple, but the answer feels anything but. you hesitate, searching for the right words, though none seem to fit. "yeah," you say finally, forcing a smile. it’s what you should say because nothing is wrong. but deep down, something feels off. something you can’t quite place.

the whole evening, you kept waiting for something to go wrong. you could feel it hovering like a storm cloud, an almost tangible weight pressing on your chest. but nothing happened. cora and adriana barely acknowledged you, and rafe’s friends were as welcoming and warm as the first time you’d met them. you ate, you laughed, and for a moment, you almost believed the night could stay perfect.

but then you glanced at the clock—nine p.m.—and instinctively reached for your phone, only to realize it wasn’t in your pocket. you patted the other one, frowning as the absence unsettled you. rafe, ever attentive, noticed immediately.

“do you know where my phone is?” you asked him, voice light despite the knot forming in your stomach.

he paused, thoughtful. “in your jacket? jackets are on my bed upstairs. want me to grab it?”

you shook your head quickly, forcing a smile. “no, that’s okay.” before he could respond, you were already moving, eager to retrieve it yourself.

the familiar grey door to his room was ajar, and inside, a mountain of jackets sprawled across his bed. you rifled through them, finally locating yours. slipping your phone from the pocket, you glanced at the screen. just a couple of messages—school group chats and your mom wishing you a good night.

you were still typing a reply to your mom when you turned and gasped, startled to find yourself face-to-face with adriana.

“adriana, hi.” your voice wavered as you took a step back, your heart hammering in your chest.”

“hey, teach.” she smiled and took a strand of your hair, flicking it between her fingers. “isn’t he great with his fingers?”

you frowned. “what?” the word barely escaped your lips before they continued.

“didn’t i tell you next time, it’d be you?” cora mused, from behind her, her usual saccharine smile firmly in place. "right as always."

“listen,” you started, trying to keep your voice steady as you shifted to step past them, “i don’t want any problems with either of you. if there’s a problem with rafe, you should really just talk to him.” the words felt forced, but you hoped they’d end this confrontation.

cora chuckled, the sound low and condescending. “there is no problem with rafe,” she said breezily. “that’s what we’re trying to tell you. no girl has ever had any complaints.”

“this says as much,” adriana chimed in, and your stomach dropped as you turned to see her holding a stack of letters. valentine’s day letters. rafe’s valentine’s day letters.

your chest tightened painfully. “those are just crushes,” you said quickly, your voice firmer now. “they don’t mean anything.”

“really?” cora tilted her head, her brows arching in mock curiosity. “well, i’m curious.”

you had no interest in entertaining their games, so you moved to leave, muttering, “okay, you two have fun. i’m gonna go.”

but adriana grabbed your arm, pulling you back with a laugh that grated against your nerves. “no, no, hold on, teach!” she sang, flipping open one of the letters with deliberate glee.

“this one’s good,” she began, her voice dripping with amusement. she cleared her throat. “‘rafey, the other night was so fun. i left you a little gift in your sock drawer. same time, next friday? love, lexi.’”

next friday? had he really been seeing girls while he was seeing you?

your breath caught as cora, with a sickening familiarity, moved to the dresser. she opened the drawer without hesitation, rummaging through the neatly folded socks until she produced something bright red.

“and would you look at that?” cora said, holding up a pair of red lace panties. “pretty sexy.”

“wait, those are actually cute,” adriana giggled, inspecting them like they were a trophy. “wonder where she got them.”

you stared at the fabric dangling from her fingers, the blood draining from your face. this had to be manipulation. some twisted attempt to mess with you. but then, why did he have those panties?

cora snatched another letter, her grin widening. “okay, another one! ‘remember our beach day? you said you love me. can’t stop thinking about you. happy valentine’s day. s.’”

you felt a sharp sting behind your eyes, and when cora turned to you, her expression almost pitying, the first tear slipped free. you aggressively wiped it away.

“she’s so sweet! isn’t she sweet?” she taunted, and her gaze made something inside you snap.

you clutched your jacket tightly, desperate to leave, but adriana wasn’t finished. “hold on, teach!” she laughed, grabbing yet another letter. “this one’s even better! ‘i still remember when you took my v-card in the back of your car—‘“

no no no.

no.

your heart strings pulled tightly and you stopped listening. you shoved past adriana, the world around you blurring as tears filled your vision.

you felt a hand grip your arm and tug you back. “hey?” cora’s ‘concerned’ face, “we’re just trying to help you. i’m a girl’s girl, y/n. i just don’t want to see you get hurt since clearly you aren’t smart enough to see through him yourself.”

you tugged your arm away and behind you, their laughter echoed like a cruel melody. “how sad,” adriana laughed, her voice chasing you down the hallway as your chest heaved with silent, choked sobs.

you rush down the stairs, the sound of your footsteps muffled by the pounding in your ears. tears blur your vision, and the lump in your throat feels like it’s choking you. you don’t stop, you can’t stop. your heart is in free fall, shattering with every breath. you dart past rafe's friends, kiara's concerned look, topper saying something you don't quite catch, their faces a blur, until you find ivy.

her eyes meet yours instantly, wide with concern, like she can sense the storm inside you. “i’m gonna go,” you manage to choke out, your voice trembling. before you can say another word, she’s at your side, her hand brushing against your arm. “y/n?”

rafe is suddenly there too, his brows furrowed, confusion etched into his face. “y/n, baby?” his voice is soft but urgent, and when he reaches for your wrist, you yank it away, shaking your head violently.

“what's wrong, talk to me?” he pleads, moving to block your path. his blue eyes are frantic, clouded with worry, the same eyes you adored only minutes ago. now all you could think about was how you sat in his car, the same car he used to bring you to the retirement home, the one he used to pick you up and take you to school, the one where you'd laughed the most you'd ever laughed and you'd kissed him over and over. the same car you'd given him your first freaking blowjob in was the same car he used to take some girl's virginity and who knows who else's? yours was next. clearly.

“please, just let me g-go.” your voice cracks, trembling with barely-contained sobs as you try to push past him because the thoughts of 'next friday' won't leave you. the picture of him with another girl right after your seeing you or even right before. who knows?

rafe doesn’t let up. his hands find your arms, his grip firm but careful, his touch begging you to stay. “what happened? y/n, please—please talk to me,” he implores, his voice breaking as he tries to steady you, to calm you and it feels like such bullshit, it all feels like a slap in the face and it feels like being deceived and betrayed and you can’t think, don’t care about all the eyes on you, watching you cry—you can’t care because you have this ugly picture playing in your head of him sleeping with girls after touching you and kissing you and him telling a girl he loves her and that girl isn’t you. that girl is not you. it was never you. it all sort of becomes clear. this illusion, dream-like state that you refused to burst out of because of how blissful it felt was really just that, a far-fetched dream.

“don’t touch me! stop!” you cry, your voice rising, panic taking over.

adriana’s voice slices through the tension like a blade, smooth and cruel. “you should leave her alone, rafe. i think she’s had enough.”

his head snaps toward her, his body stiffening. “what? what did you say to her? what the fuck did you two do?” his voice is sharp, his tone teetering on the edge of fury as he glares at adriana and cora.

cora shrugs, her smile dripping with feigned innocence. “we? we didn’t say anything to her. your many, many conquests, though? they were a lot more talkative.”

you watch as the words register, as rafe freezes, his anger shifting to something like dread. his gaze swings back to you, wide and pleading. “you read the letters?” he whispers.

you don’t answer. the tears in your eyes say enough. they won’t stop, pouring down your cheeks as you stare at him, your chest heaving with sobs you can’t control. his momentary hesitation gives you just enough time to slip out of his grasp, to make a desperate break for the door.

“no! no, wait—” his voice is desperate, and his hand finds your wrist again, pulling you into his chest. his grip trembles as much as his voice. “it’s not true—” he stammers, then falters. “well, it’s—i swear, i promise, the moment this became real, the moment i realised you didn't just see me as a friend, i was yours. you know me,” he pleads, his words rushing together, his forehead pressing against yours in a futile attempt to anchor you. “look at me, baby. look at me. you know me.” he begs.

you don’t wipe the tears away. there’s no point. they fall faster than you can stop them, burning hot trails down your cheeks. “is that you? a new girl every couple of days? you—” your voice cracks, broken and raw, “you told a girl you love her?"” the words feel like poison on your tongue, and you pray, beg silently for him to deny it, to give you anything to make this nightmare go away.

“you took another girl’s virginity… in your car?” the words taste bitter on your tongue, your voice breaking on the last syllable. your chest is so tight it hurts to breathe.

you try to pull away from him, to rip yourself from his grasp, but his fingers cling desperately to you. the nausea rises so violently you think you might actually throw up.

rafe’s head shakes frantically, his own eyes filling with tears, the panic setting in. “i don’t—i don’t have the best track record, i know that! but you—you brought out the best in me. i know i fucked up, i know the shit i did wasn’t okay, but i’m sorry,” he pleads, his voice cracking under the weight of his guilt.

you barely hear him. your pulse is roaring in your ears, your vision blurring with tears.

“do you remember her name?” you whisper. your voice is so quiet, so fragile, but it cuts through the air like a blade.

his breath catches. his whole body goes still, like he doesn’t understand the question. his blue eyes dart across your face, searching desperately for something—an out, an answer, a way to fix this.

“what…?” his voice is hoarse.

you swallow back a sob, forcing yourself to meet his gaze. “you were her first,” you repeat, and your voice is deadly soft now. “do you even remember her name?”

the silence that follows is unbearable.

he doesn’t speak. doesn’t even breathe for three whole seconds.

and that’s all it takes.

your stomach lurches. a cold, sickening wave crashes over you, and suddenly his hands on you feel wrong, like they’re scorching your skin, leaving burns behind.

“no, please—please, baby, don’t—” rafe’s voice is raw, wrecked. he reaches for you again, his hands desperate, his entire body pleading, but you stumble back, chest heaving, tears slipping down your face in hot, relentless streams.

he chokes on a breath. his whole face is crumbling, his own tears spilling over now, but you can’t bear to look at him. you can’t breathe around the ache in your chest, around the betrayal weighing down your limbs like lead.

“oh, god..” you shake your head, wrenching yourself out of his arms. “no, please, please.” he tries to pull you close, tries to get you to look at him. “baby—“

“no. no, please, stop. let me go,” you beg him, your voice shaking as you push him away, desperate to escape.

“no, y/n, please—please don’t go,” he begs, his hands reaching for you again, trembling with desperation. “i’m so sorry. i swear, i swear on everything, i’m not that person anymore. i can't lose you. you know me!”

but you can’t listen. you can’t hear another word, not when your heart is breaking like this. the air feels too heavy, the walls too close, and all you know is that you need to get out of this house.

you yank the front door open, but your escape halts when you see her—sarah cameron, standing there with a suitcase in hand. even through the haze of your tears, you recognize her.

“sur…prise,” she says hesitantly, her eyes darting between you, rafe, and the onlookers scattered around the foyer. the scene before her—a girl sobbing uncontrollably, rafe pleading, their friends frozen in stunned silence—leaves her wide-eyed and unsure.

you only look at her for a fleeting moment before stepping past her, out into the cold night. rafe’s voice carries after you, cracking with disbelief. “sarah?”

ivy’s hand slips into yours as she catches up, her grip warm and grounding. you squeeze it tightly, the tears still flowing, unstoppable and endless, as you walk away.

chapter index — prev. chap. — next chap.

a.n — um ya.. what IM surprised abt is that she was gonna let him hit it when he hasnt even made it official..? girl? standardsss??

taglist — @rafeysworldim19 @my-name-is-baby @pogueprincesa @fveapplestall @chalametlover444 @slutglimreqpers @uarmyhopeworldwide @junxe3 @bakuhoethotski @kinderwh0r3 @wintercrows @magicalflowerstranger @bigjuli444 @singlethreadofivy @stylestarkey

let me know if you'd like to be added to the taglist & interact with post to remain tagged <3

#rich jj maybank bc my boy suffered enough in the real show#novawrites#teachme#soccerplayer!rafe#tutor!reader#rafe cameron#rafe cameron x reader#rafe x you#fluff#angst#rafe obx#rafe x reader#rafe cameron x female reader#rafe cameron x you#rafe cameron imagine#rafe fic#rafe cameron fanfiction#rafe outer banks#eventual virginity loss#rafe cameron fluff#john b routledge#pope heyward#kiara carrera#sarah cameron#outer banks#obx#dividers by cafekitsune

292 notes

·

View notes

Text

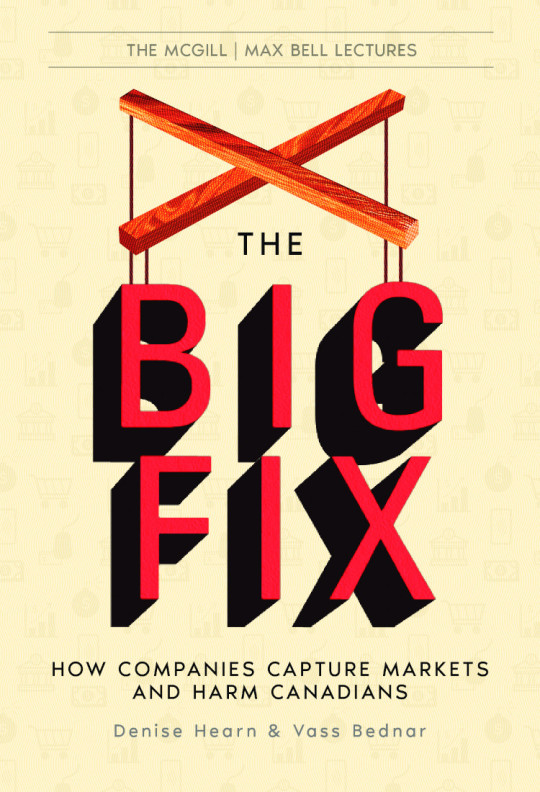

Denise Hearn and Vass Bednar’s “The Big Fix”

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/12/05/ted-rogers-is-a-dope/#galen-weston-is-even-worse

The Canadian national identity involves a lot of sneering at the US, but when it comes to oligarchy, Canada makes America look positively amateurish.

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/12/05/ted-rogers-is-a-dope/#galen-weston-is-even-worse

Canada's monopolists may be big fish in a small pond, but holy moly are they big, compared to the size of that pond. In their new book, The Big Fix: How Companies Capture Markets and Harm Canadians, Denise Hearn and Vass Bednar lay bare the price-gouging, policy-corrupting ripoff machines that run the Great White North:

https://sutherlandhousebooks.com/product/the-big-fix/

From telecoms to groceries to pharmacies to the resource sector, Canada is a playground for a handful of supremely powerful men from dynastic families, who have bought their way to dominance, consuming small businesses by the hundreds and periodically merging with one another.

Hearn and Bednar tell this story and explain all the ways that Canadian firms use their market power to reduce quality, raise prices, abuse workers and starve suppliers, even as they capture the government and the regulators who are supposed to be overseeing them.

The odd thing is that Canada has been in the antitrust game for a long time: Canada passed its first antitrust law in 1889, a year before the USA got around to inaugurating its trustbusting era with the passage of the Sherman Act. But despite this early start, Canada's ultra-rich have successfully used the threat of American corporate juggernauts to defend the idea of Made-in-Canada monopolies, as homegrown King Kongs that will keep the nation safe from Yankee Godzillas.

Canada's Competition Bureau is underfunded and underpowered. In its entire history, the agency has never prevented a merger – not even once. This set the stage for Canada's dominant businesses to become many-tentacled conglomerates, like Canadian Tire, which owns Mark's Work Warehouse, Helly Hansen, SportChek, Nevada Bob's Golf, The Fitness Source, Party City, and, of course, a bank.

A surprising number of Canadian conglomerates end up turning into banks: Loblaw has a bank. So does Rogers. Why do these corrupt, price-gouging companies all go into "financial services?" As Hearn and Bednar explain, owning a bank is the key to financialization, with the company's finances disappearing into a black box that absorbs taxation attempts and liabilities like a black hole eating a solar system.

Of course, the neat packaging up of vast swathes of Canada's economy into these financialized and inscrutable mega-firms makes them awfully convenient acquisition targets for US and offshore private equity firms. When the Competition Bureau (inevitably) fails to block those acquisitions, whole chunks of the Canadian economy disappear into foreign hands.

This is a short book, but it's packed with a lot of easily digested detail about how these scams work: how monopolies use cross-subsidies (when one profitable business is used to prop up an unprofitable business in order to kill potential competitors) and market power to rip Canadians off and screw workers.

But the title of the book is The Big Fix, so it's not all doom and gloom. Hearn and Bednar note that Canadians and their elected reps are getting sick of this shit, and a bill to substantially beefed up Canadian competition law passed Parliament unanimously last year.

This is part of a wave of antitrust fever that's sweeping the world's governments, notably the US under Biden, where antitrust enforcers did more in the past four years than their predecessors accomplished over the previous 40 years.

Hearn and Bednar propose a follow-on agenda for Canadian lawmakers and bureaucrats: they call for a "whole of government" approach to dismantling Canada's monopolies, whereby each ministry would be charged with combing through its enabling legislation to find latent powers that could be mobilized against monopolies, and then using those powers.

The authors freely admit that this is an American import, modeled on Biden's July 2021 Executive Order on monopolies, which set out 72 action items for different parts of the administration, virtually all of which were accomplished:

https://www.eff.org/deeplinks/2021/08/party-its-1979-og-antitrust-back-baby

What the authors don't mention is that this plan was actually cooked up by a Canadian: Columbia law professor Tim Wu, who served in the White House as Biden's tech antitrust czar, and who grew up in Toronto (we've known each other since elementary school!).

Wu's plan has been field tested. It worked. It was exciting and effective. There's something weirdly fitting about finding the answer to Canada's monopoly problems coming from America, but only because a Canadian had to go there to find a receptive audience for it.

The Big Fix is a fantastic primer on the uniquely Canadian monopoly problem, a fast read that transcends being a mere economics primer or history lesson. It's a book that will fire you up, make you angry, make you determined, and explain what comes next.

161 notes

·

View notes

Photo

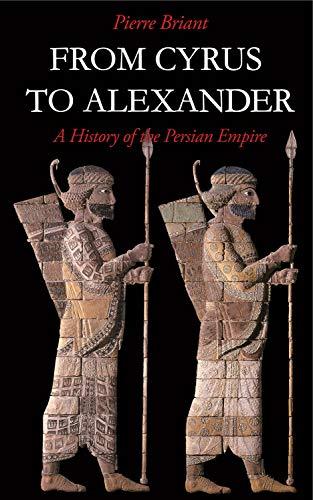

From Cyrus to Alexander: A History of the Persian Empire

"From Cyrus to Alexander" by Pierre Briant offers a detailed history of the Persian Empire, focusing on its administration, culture, and military. Briant highlights Persia’s innovations in governance and its tolerant, multicultural approach. The book challenges traditional Greek-centric views, presenting Persia as a complex and influential empire with a lasting historical legacy.

Pierre Briant’s From Cyrus to Alexander: A History of the Persian Empire is widely considered the definitive modern history of the Persian Empire. The book covers its origins under Cyrus the Great through its conquest by Alexander the Great. Originally published in French as Histoire de l’Empire Perse in 1996, the English translation made this monumental work accessible to a wider audience, expanding its influence in Near Eastern studies, ancient history, and comparative empires.

Briant’s book stands out for its focus on presenting the Persian Empire as an autonomous civilization rather than through the perspective of its Greek rivals. Historically, much of what Western scholars knew about the Persian Empire came from Greek sources like Herodotus, who often cast Persia as a monolithic enemy. By situating Persia at the center of its own narrative and making extensive use of archaeological findings, inscriptions, and administrative records, Briant counters this Eurocentric bias and offers a view of Persia as a sophisticated, multiethnic empire that left a significant legacy of governance, culture, and trade.

Briant structures the book in a way that mirrors the breadth of the Persian Empire, dedicating each section to a different aspect of the empire’s history, politics, economy, society, and culture. The organisation of the book reflects his emphasis on a systemic, comprehensive examination of the empire.

The early chapters detail Cyrus the Great’s conquests and policies of tolerance, which established a stable, expansive empire. Briant also examines governance, highlighting the balance between central control and local autonomy, the role of satraps, and the unifying use of Aramaic as an administrative lingua franca. Moreover, he analyses the Persian military apparatus, from its elite units like the Immortals to the logistical organisation enabling vast mobilizations by the Persians. He contextualises major conflicts, including the Persian Wars as part of a strategy to stabilize borders and secure valuable territories, rather than dominate all of Greece.

The book also dedicates significant attention to the Persian economy, exploring the empire’s agrarian base, trade networks, and taxation system. He shows how Persia’s economic policies were designed to support both the imperial treasury and local economies, creating a sustainable model that contributed to the empire’s longevity. The culture and religion section highlights Persia’s promotion of cultural integration and religious diversity. Briant shows how Persian art blended regional styles to symbolize royal authority and examines how Zoroastrian traditions coexisted with support for local religions, fostering loyalty among subjects.

One of Briant’s central arguments is that the Persian Empire’s strength lay in its policy of tolerance and inclusion. By allowing conquered peoples to retain their religious practices, local laws, and leaders, the Persians created a sense of allegiance that went beyond military domination. He also highlights the Persian administrative system as a model for later empires, like the Roman and Islamic. Innovations such as standardized taxation, the Royal Road, and an organised postal system enabled centralised yet flexible governance. His analysis of satrapies shows how Persia balanced regional autonomy with loyalty to central authority.

The book repositions the Persian Empire within a global context, highlighting its role in economic and cultural exchange across Asia and the Mediterranean. Through trade and diplomacy with regions like Egypt and Greece, Persia facilitated the flow of ideas and technologies, serving as a prototype for managing diverse populations and complex trade networks.

From Cyrus to Alexander is widely praised for its depth but critiqued for its daunting length and scholarly density. While excelling in its analysis of Persian administration and politics, it offers limited insight into the daily lives of ordinary Persians, focusing more on imperial strategies than social and cultural history.

This monumental work offers a detailed and balanced account of the Persian Empire, redefining its role in world history. Briant’s focus on understanding Persia on its own terms provides valuable insights into its governance, economy, and cultural integration, making it an essential resource for ancient Near Eastern studies.

Continue reading...

82 notes

·

View notes

Text

Washington state Democrats accidentally leaked a document entitled “2025 Revenue Options” describing how they plan to hunt down citizens for additional taxes. An email containing the document and an accompanying PowerPoint presentation was sent to everyone in the Senate and entail exactly how they will wordsmith their way into extorting the people. “Do say: ‘Pay what they owe’ — but Don’t say: “Tax the rich” or “pay their fair share” because “taxes aren’t a punishment,” the graph read.

The proposal includes an 11% tax on firearms and ammunition. Storage units would be reclassified as RENTALS and seen as retail transactions. Amid the cost of living crisis exacerbated by shelter costs, these politicians believe that citizens should pay more in property taxes.

“Avoid centering the tax or talking in vague terms about ‘the economy’ or ‘education,’” the document states, instead opting to use positive connotations such as “providing,” “ensuring,” and “funding.” These lawmakers note that they must “identify the villain” who is preventing “progress.” That villain is the government, but the government needs to pin your woes on another source to create division. “We can ensure that extremely wealthy Washingtonians are taxed on their assets just like middle-class families are already taxed on theirs,” the slide reads.

The leaked document assures that this common rhetoric is intended to blind the masses into believing that tax hikes will not affect them but the dreaded “rich” who do not pay their “fair share.” In truth, no amount of taxation could ever be enough for the government as it spends perpetually with no plan to “pay their fair share” of debt.

Smart money has been fleeing blue states for this precise reason. Amazon’s Jeff Bezos notably fled Washington state for Florida, reportedly saving $1 billion on taxes alone. He moved his parents out of the state as well to avoid the death tax, which is among the highest in the nation at 20%. Governor Jay Inslee is wrapping up his term by insisting on a “wealth tax.”

The state is expected to face a $16 billion revenue deficit over the next four years and believes a 1% levy on the wealthiest residents could generate $3.4 billion over that time period. Businesses generating over $1 million annually would be in a new tax category called “service and other activities” and would be required to pay a 20% surcharge from October 2025 to December 2026. Come January 2027, successful businesses would be punished with a 10% tax. Why would anyone choose to conduct business in a state that punishes success? Innovators are not going to begin their businesses under these conditions and established companies will simply leave.

“Let’s be clear: there is a deficit ahead, but it’s caused by overspending, not by a recession or a drop in revenue,” Gildon said in a statement. “When the cost of doing business goes up, consumers feel it too. His budget would make living in Washington even less affordable.”

The state failed to manage its finances properly, and that burden now falls on the people. We see the same problem emerge at the local and federal levels. Governments feel entitled to YOUR money. Rather than correcting the root issue of spending and misallocated funds, governments believe the people they govern will foot the bill. The rhetoric is always the same as they insist they are “progressing” society by punishing the greedy and vilified rich. In truth, everyone suffers as a result of government mismanagement.

58 notes

·

View notes

Note

Sorry if this is not the kind of ask you want to get but several people in this post argued about the benefit of legalizing prostitution and it sounds very convincing? What do you think? https://www.tumblr.com/prismatic-bell/757101438415601664/i-still-remember-learning-the-following-factoid?source=share

Hi! This is exactly the sort of ask I like to get!

So, I think the reason why this sounds convincing is because they are partially correct. However, the third individual is wrong on a very crucial part, which I will explain.

---

Policies regarding prostitution range from full legalization (all related activities are legal and incorporated into the legitimate economy) to full criminalization (all related activities are illegal and exist only in an underground economy).

The first thing to understand – and what the individuals in that post got right – is that full criminalization does not help the people trapped in either "voluntary" prostitution or sex trafficking victims. This stakeholder report [1] discusses various issues that result for human trafficking victims (including children) as a result of full criminalization. This is focused on trafficking victims, rather than all prostitutes, but in truth, the line between these categories is blurry at best. (There certainly isn't a reliable way for the legal system to differentiate between them.)

So, in this way, the first two individuals are correct. Arresting women and children for "selling sex" does significant harm. It also doesn't appear to be effective at reducing trafficking, child sexual exploitation, or exploitation by pimps.

---

However, each poster appears to be making the leap that because full criminalization is harmful to the vulnerable women and children in prostitution, the best alternative is full legalization or decriminalization. (To clarify between these two, consider the case of marijuana: legalized marijuana often entails taxation and other governmental involvement in the industry whereas decriminalization means it is still illegal remains but the government doesn't actively pursue people involved with marijuana.)

This assumption is erroneous.

There is well documented evidence that full legalization/decriminalization does not significantly reduce (and may increase) harm to prostituted women and children.

The alternative option, is a partial decriminalization. Specifically, decriminalizing the "supply" ("selling sex"), while maintaining criminalization of the demand ("buying sex") and third-party organization (pimps, traffickers, etc.). This option results in the most harm reduction (as endorsed by those posters!). This option is often referred to as the "Nordic Model" (as it originated in a Nordic country).

I'll expand on these points below.

---

Innumerable studies have shown that full legalization results in an increase in sex trafficking. Here is a selection:

These comparisons on several European countries find that full legalization leads to an increase in trafficking, in comparison to both full criminalization and the Nordic model. [2, 3]

This review discusses how "evidence supports the theory that legal prostitution is associated with increased trafficking." When the article was written (2009) an estimated "80% of all women in German and Dutch prostitution are trafficked". In New Zealand's largest city, "A 200-400% increase in street prostitution has been reported since prostitution was decriminalized in 2003." and "25% of those interviewed said that they entered the sex industry because it had been decriminalized". [4]

This paper highlights how "fighting sex trafficking using the criminal justice system may even be harder in the legalized prostitution sector". [5]

This EU commissioned study found that both full legalization and full decriminalization was associated with twice the number of trafficking victims as full criminalization or the Nordic model. [6]

This article discusses how legalization promotes trafficking, expands demand, increases the illegal market, increases child prostitution/trafficking, and doesn't protect the women/children in prostitution [7].

In addition:

This paper provides a thorough debunking of Amnesty International's support for decriminalization. They discuss how "the best available evidence indicates that decriminalization of prostitution would: increase sex trafficking, leave prostituted women or 'sex workers' more vulnerable to violence, and reduce access to healthcare, protection, and services." [8]

This paper's title is particularly apt: "Prostitution, Trafficking, and Cultural Amnesia: What We Must Not Know in Order To Keep the Business of Sexual Exploitation Running Smoothly". In particular, it discusses how prostitution is extremely violent, linked to prejudice, linked to trafficking, and harmful to women and society at large. [9]

This study of 150 countries finds legalization "does not help liberate victims of human trafficking" and doesn't protect victims. [10]

I have searched for any evidence that (as claimed by the third poster) that the "growth rate of trafficking in [Germany, following legalization] went down" and found ... nothing. I can't actually find any sources about the "growth rate" of trafficking in either direction. That being said, the above sources all clearly indicate that traffickers find Germany (and other countries with legalized prostitution) to be profitable (i.e., people are still being trafficked through and into Germany).

Further, while it is likely that victims find it easier to escape under a fully legalized than a fully criminalized model (as discussed above), that doesn't change the fact that more women are being trafficked in the first place. It also doesn't change the fact that there is a better alternative (i.e, the Nordic model, which retains the ability for women to escape trafficking while also reducing trafficking and the overall demand for prostitution).

To expand, many papers have provided empirical support for the Nordic model. These papers [11-15] all discuss the various advantages and disadvantageous of the different systems. Papers [13-15] all explicitly recommend the Nordic model as the best (if still flawed) option.

And here [16] is an additional discussion of both the benefits and issues (primarily implementation problems) with the Nordic model. They describe the reduction in prostitution and trafficking and positive change sin public opinion, but also discuss the additional services and protections needed to realize the full potential of this policy.

---

All in all, I actually agree that "harm reduction is always good". However, the greatest amount of harm reduction is afforded by the Nordic model. This model legalizes/decriminalizes "selling sex" while criminalizing "buying sex" and "organization" (e.g., pimps, brothels). It results in reduced demand, reduced trafficking, and reduced overall harm. Simply legalizing "sex work" is not harm reduction; on the contrary, it causes significant harm.

References under the cut:

International Women’s Human Rights Clinic, et al. Criminalization of Trafficking Victims. 2015, https://www.law.cuny.edu/wp-content/uploads/page-assets/academics/clinics/hrgj/publications/Criminalization-of-Trafficking-Victims.pdf.

Marinova, Nadejda K., and Patrick James. “The Tragedy of Human Trafficking: Competing Theories and European Evidence1: The Tragedy of Human Trafficking.” Foreign Policy Analysis, vol. 8, no. 3, July 2012, pp. 231–53. DOI.org (Crossref), https://doi.org/10.1111/j.1743-8594.2011.00162.x.

Osmanaj, Egzone. “The Impact of Legalized Prostitution on Human Trafficking.” Academic Journal of Interdisciplinary Studies, June 2014. DOI.org (Crossref), https://doi.org/10.5901/ajis.2014.v3n2p103.

Farley, Melissa. “Theory versus Reality: Commentary on Four Articles about Trafficking for Prostitution.” Women’s Studies International Forum, vol. 32, no. 4, July 2009, pp. 311–15. DOI.org (Crossref), https://doi.org/10.1016/j.wsif.2009.07.001.

Huisman, Wim, and Edward R. Kleemans. “The Challenges of Fighting Sex Trafficking in the Legalized Prostitution Market of the Netherlands.” Crime, Law and Social Change, vol. 61, no. 2, Mar. 2014, pp. 215–28. DOI.org (Crossref), https://doi.org/10.1007/s10611-013-9512-4.

Di Nicola, Andrea. The differing EU Member States’ regulations on prostitution and their cross-border implications on women’s rights. European Union, 2021.

Raymond, Janice G. "Ten reasons for not legalizing prostitution and a legal response to the demand for prostitution." Journal of Trauma Practice 2.3-4 (2004): 315-332.

Geist, Darren. (2016). Dignity: A Journal on Sexual Exploitation and Violence. Vol. 1, Issue 1, Article 6. DOI:10.23860/dignity.2016.01.01.06. Available at http://digitalcommons.uri.edu/dignity/Vol1/Iss1/6.

Farley, Melissa. "Prostitution, trafficking, and cultural amnesia: What we must not know in order to keep the business of sexual exploitation running smoothly." Yale JL & Feminism 18 (2006): 109.

Cho, Seo-young (2013) : Liberal coercion? Prostitution, human trafficking and policy, MAGKS Joint Discussion Paper Series in Economics, No. 44-2013, Philipps-University Marburg, Faculty of Business Administration and Economics, Marburg

Curiel, Angelica. Informing United States Sex Trafficking Policies: A Comparative Analysis of Sweden, the Netherlands, New Zealand, Chile, and South Korea. Diss. California State University San Marcos, 2016.

Tomlinson, Alexia, Mary Haggerty, and Caroline Rini. "A global study of prostitution policy." Wis. JL Gender, & Soc'y 37 (2022): 23.

Rowe, Kathryn, "Regulating Sex Work: United States' Policy and International Comparisons" (2018). Honors Theses. 522. https://egrove.olemiss.edu/hon_thesis/522

Tate Santana, Madison. "Trafficked in Texas: Combatting the sex-trafficking epidemic through prostitution law and sentencing reform in the lone star state." Vand. L. Rev. 71 (2018): 1739.

Joulaei, Hassan, et al. "Legalization, Decriminalization or Criminalization; Could We Introduce a Global Prescription for Prostitution (Sex Work)?." International Journal of High Risk Behaviors and Addiction 10.3 (2021).

Waltman, Max. "Sweden's prohibition of purchase of sex: The law's reasons, impact, and potential." Women's Studies International Forum. Vol. 34. No. 5. Pergamon, 2011.

123 notes

·

View notes

Text

Spinner’s End Wasn’t Poverty—It Was Privacy