#servicetax

Explore tagged Tumblr posts

Link

#bestcreditcards#businesscreditcard#businesscreditcards#CreditCard#creditcardincometax#creditcardincometaxnotice#creditcardpoints#creditcardservicetax#creditcardtax#CreditCards#CreditCardsOfferingTaxService#earnedincometaxcredit#hdfcbankcreditcard#hdfccreditcard#incometaxnoticeoncreditcardusage#incometaxoncreditcard#incometaxoncreditcardtransactions#noservicetaxoncards#servicetax#servicetaxdebitcards#taxcredit

0 notes

Text

Is Service Tax Legal? Unveiling the Truth

In the realm of taxation, the legality of service tax is a topic that frequently raises eyebrows. With this article, we delve deep into the matter, leaving no stone unturned. Let's explore the intricacies of service tax and its legal standing.

What is Service Tax?

Before we can discuss its legality, let's get a clear understanding of what service tax entails. Service tax is a consumption tax levied on services provided in a particular country. It's not a new concept; countries worldwide use it to generate revenue for public services. Essentially, service tax is a financial contribution from those who use various services.

The Legal Framework

Service Tax Acts and Regulations

In most countries, service tax has a solid legal foundation. Legislation and regulations govern its imposition and collection. These statutes specify the rates, exemptions, and procedures for service tax. Typically, the legal framework ensures that service tax collection is transparent and fair.

Compliance Requirements

Service providers are legally obligated to register for service tax and adhere to compliance requirements. This includes maintaining accurate records and filing regular returns. Failure to comply can result in legal consequences, including fines and penalties.

The Controversy

Debate Over Necessity

One of the primary reasons behind the controversy surrounding service tax's legality is the ongoing debate over its necessity. Some argue that service tax can be a burden on the average citizen, while others believe it's crucial for funding public services.

Jurisdictional Differences

Service tax laws can vary significantly from one jurisdiction to another. What's legal in one place might not be in another, adding a layer of complexity to the issue.

Service Tax Evasion

Unfortunately, service tax evasion is a harsh reality. Some individuals and businesses attempt to circumvent service tax obligations, leading to questions about its legality. Governments worldwide are continually working to combat tax evasion and ensure that service tax is collected fairly.

The Bottom Line

In conclusion, service tax, in most countries, is indeed legal. It serves as an essential source of revenue for governments, allowing them to provide necessary public services. However, its legality can be a subject of debate and varies from one jurisdiction to another. To ensure a legal and compliant stance, it is imperative for service providers and individuals to adhere to the tax laws in their respective regions.

1 note

·

View note

Text

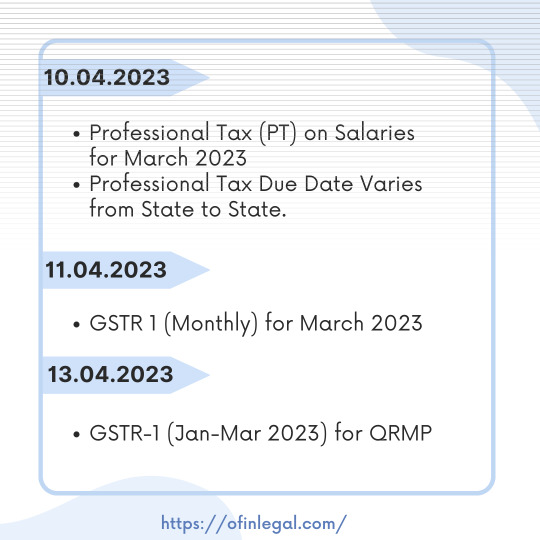

Compliance Calendar for the month of April 2023.

#compliance#compliancecalendar#incometax#TDS#tdsfiling#GST#gstr#providentfund#startupindia#startup#business#ServiceTax#april2023#ofinlegal

1 note

·

View note

Text

Get New GST Registration & GST Return Services — CAGauravShrivastava

India is gearing up to witness a major renovation to its taxation structure with the Launch of Goods and Services Tax. The implementation of GST Registration will help create a common Indian market and reduce the cascading effect of the tax on the cost of goods and services.

Hire now ➡️➡️ https://bit.ly/2V2hygk

#business consulting services#online company registration#income tax return filing#new gst registration#private limited company registration#company registration#itr filing#gst registartion#gst filing#accounting services#charteredaccountant#servicetax#servicetaxreturn#accountant#delhi#indirapuram#vaishali#vasundhara#cagauravsrivastava#noida

1 note

·

View note

Link

#works contract service#servicetax#service#workscontract#workscontractservice#workscontractservices#cestat#customs#exice#taxscan#taxnews

0 notes

Link

Goods and Service Tax Singapore, If you are looking for the same then you must have to visit AcraaplusCpa Pte Ltd. They are the top leading Accounting Firm in the Singapore region.

0 notes

Text

0 notes

Text

31 दिसंबर के पहले जरूर निपटा लें ये चार काम, वरना नए साल में करना पड़ेगा परेशानियों का सामना

चैतन्य भारत न्यूज नई दिल्ली. साल 2019 के खत्म होने में अब कुछ ही दिन रह गए हैं। ऐसे कई काम हैं जो आपको साल के खत्म होने से पहले पूरे करने होंगे। यदि आप यह काम 31 दिसंबर से पहले नहीं निपटाएंगे तो परेशानी में भी पड़ सकते हैं। ये जरुरी काम बैंक, आयकर, एटीएम, पैन कार्ड से जुड़े हैं। आइए जानते हैं वो कौन-से ऐसे जरुरी काम है जो आपको 31 दिसंबर से पहले निपटाना जरुरी है। (adsbygoogle = window.adsbygoogle || ).push({}); SBI का ATM डेबिट कार्ड यदि आपका अकाउंट स्टेट बैंक ऑफ इंडिया (SBI) में है और आप भी एटीएम-डेबिट कार्ड का इस्तेमाल करते हैं तो आपको सतर्क रहने की जरुरत है। एसबीआई बैंक ने अपने आधिकारिक ट्वीटर अकाउंट पर पोस्ट कर कहा है कि, 'ग्राहक अपने पुराने मैग्नेटिक एटीएम-डेबिट कार्ड को बदलवा लें। ग्राहकों को यह काम 31 दिसंबर 2019 तक करना है क्योंकि वह नए साल से अपने पुराने एटीएम-डेबिट कार्ड से पैसे नहीं निकाल पाएंगे।' PAN कार्ड हो सकता है रद्द यदि आपने अब तक अपने स्थायी खाता संख्या (पैन कार्ड) को आधार से नहीं जोड़ा है तो आपके पास 31 दिसंबर तक का समय है। आयकर विभाग ने आधिकारिक सूचना जारी कर यह जानकारी दी है। विभाग ने कहा है कि, 'बेहतर कल के लिए इनकम टैक्स से जुड़ी सेवाओं का लाभ लेने को पैन को आधार से जोड़ने का काम 31 दिसंबर, 2019 तक पूरा कर लें।' साथ ही सूचना में यह भी कहा गया है कि पैन कार्ड को आधार कार्ड से जोड़ना अनिवार्य है। अगर आपने ऐसा नहीं किया तो आपका पैन कार्ड रद्द हो जाएगा। साथ ही 1 जनवरी 2020 से आप आयकर, निवेश या लोन आदि से जुड़ा कोई भी काम नहीं कर पाएंगे, जब तक आप पैन को आधार से लिंक नहीं करते। ITR फाइल करने का आखिरी मौका यदि आपने अब तक 2018-2019 की इनकम टैक्स रिटर्न फाइल नहीं की है तो आपके पास 31 दिसंबर तक का मौका है। 31 दिसंबर तक लेट फीस के साथ आप एक बार फिर इसे फाइल कर सकते हैं। अभी लेट फीस की राशि 5,000 रुपए तक है, लेकिन यदि 31 दिसंबर तक भी आप आईटीआर फाइल करने से चूक गए तो इसके बाद और 31 मार्च, 2020 से पहले इनकम टैक्स रिटर्न फाइल करने पर आपको 10,000 रुपए जुर्माना देना होगा। निपटा लें ये विवाद यदि आप किसी सर्विस टैक्स या एक्साइज ड्यूटी से संबंधित विवाद से जुड़े हैं तो बेहतर होगा कि 31 दिसंबर 2019 से पहले इसके समाधान के लिए आप रजिस्ट्रेशन करा लें। बता दें ऐसे विवादों का निपटारा करने के लिए वित्त मंत्रालय ने इस स्कीम को शुरू किया था, जिसकी अंतिम तारीख 31 दिसंबर 2019 है। ये भी पढ़े... अगर नहीं किया ITR फाइल तो आपके पास 31 दिसंबर तक है मौका, वरना 10 हजार देना होगा जुर्माना 31 मार्च 2019 से पहले आधार से लिंक कराएं पैन कार्ड, नहीं तो आएंगी ये दिक्कतें आपके नजदीकी कौन से ATM में है पैसा? इस मोबाइल ऐप के जरिए 2 मिनट में लगा सकते हैं पता Read the full article

#aadharcard#aadharpancard#exciseduty#pancard#PANकार्ड#sbi#sbiatm#sbidebitcard#servicetax#आयकर#आयकरविभाग#इनकमटैक्सरिटर्न#एक्साइजड्यूटी#एटीएम#पैनकार्ड#बैंक#सर्विसटैक्स

0 notes

Photo

Effective September 01, 2019, the Minister under S. 34(3), Service Tax Act 2018 (#Act807) exempted the following services prescriped under First Schedule, the Service Tax Regulations 2018, as below. 1. Freight forwarder - logistics management services; 2. Inbound tour packages by travel agents - tourism management services; 3. Amusement park services; 4. Coin Operated Laundry Machine (#COLM) - cleaning services. #taxation #tax #servicetax #custom #sst #servicetaxact #malaysiatax #logistics #tourism #cleaning Ref.: Service Tax Policy No. 1/2019 https://mysst.customs.gov.my/assets/document/Annoucement/ServiceTaxPolicy_12019.pdf (at Royal Malaysia Customs Putrajaya) https://www.instagram.com/p/B2F9eiQngPA/?igshid=1ewv30mq47mve

#act807#colm#taxation#tax#servicetax#custom#sst#servicetaxact#malaysiatax#logistics#tourism#cleaning

0 notes

Photo

Free USA Tax PowerPoint Template http://www.freetemplatestheme.com/free-usa-tax-powerpoint-template.html #usa #tax #usaflag #incometax #servicetax #revenue #taxation #freepptpresentation #freepptthemes #freepowerpointtemplate https://www.instagram.com/p/BzIp28JgU08/?igshid=laorgssvw0t4

#usa#tax#usaflag#incometax#servicetax#revenue#taxation#freepptpresentation#freepptthemes#freepowerpointtemplate

0 notes

Link

0 notes

Text

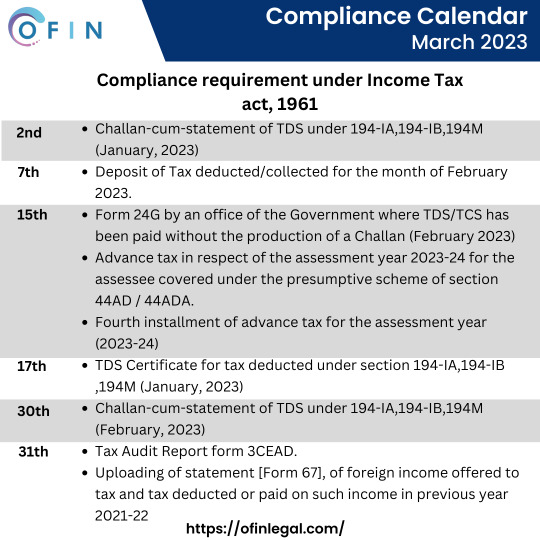

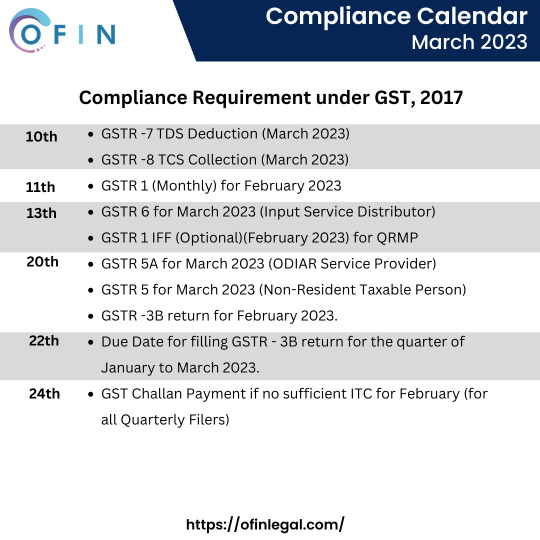

Compliance Calendar for the month of March 2023.

#compliance#compliancecalendar#incometax#TDS#tdsfiling#GST#gstr#startupindia#providentfund#ServiceTax#March2023#ofinlegal

1 note

·

View note

Text

Online GST Registration Services | cagaurav.co.in

India is adapting to observe a noteworthy remodel to its tax assessment structure with the Launch of Goods and Services Tax. The execution of GST will help make a typical Indian market and lessen the falling impact of the assessment on the expense of merchandise and enterprises. Hire now ➡️➡️ http://cagaurav.co.in/

#taxconsultant#accountingconsultants#charteredaccountant#canearme#indiacainindirapuram#cagauravsrivastava#noida#ghaziabad#vaishali#vasundhara#indirapuram#ncr#delhi#accountant#servicetaxreturn#gst#tds#gstregistration#servicetax#gstregistrationonline

0 notes

Link

Service tax could be a tax imposed by the government on services offered by the sellers. It includes transportation service, hospitality, travel, and tourism, cable operators, restaurants, etc. For More Details Check:http://pticindia.com/what-is-service-tax-and-why-should-yo…/

0 notes

Link

We are the top leading provider of services like Goods and service Tax Singapore (GST) if you are looking for the same then you must have to visit Acraaplus CPA Pte Ltd.

0 notes

Photo

DM FOR ORDER COPY... Restaurants primarily provide service and the sale undertaken in the course of rendition of service, is only incidental. Thus, according to the revenue, the provision of take-away food and drinks involves the rendition of service and the mode of sale, that is, by parcels, has no bearing in the matter.... COMMENT YOUR VIEWS.... . . . FOLLOW @blaw_basic_l_aw_areness FOLLOW @blaw_basic_l_aw_areness FOLLOW @blaw_basic_l_aw_areness . . . #service #legalservices #legalservice #takeaway #takeawayfood #delivery #deliveryservice #parcels #servicetax #tax #blawnews #taxreturns #taxcollection #taxconsultant #taxing #taxlaws #newsreporting #news #newsoftheday #newsinshort #newsupdates #breaking #newpost📸 #likeforlikes #followersinstagram #followme #follows #lawlove #lawlecture #legal (at Noida/Delhi) https://www.instagram.com/p/CPvwIK9pGVd/?utm_medium=tumblr

#service#legalservices#legalservice#takeaway#takeawayfood#delivery#deliveryservice#parcels#servicetax#tax#blawnews#taxreturns#taxcollection#taxconsultant#taxing#taxlaws#newsreporting#news#newsoftheday#newsinshort#newsupdates#breaking#newpost📸#likeforlikes#followersinstagram#followme#follows#lawlove#lawlecture#legal

0 notes