#accounting services

Explore tagged Tumblr posts

Text

GST Registration Services in Delhi by SC Bhagat & Co.

Navigating the complexities of GST registration can be challenging for businesses. If you're looking for expert GST Registration Services in Delhi, SC Bhagat & Co. is your trusted partner. With years of experience and a dedicated team of professionals, we ensure a seamless GST registration process for businesses of all sizes.

Why Choose SC Bhagat & Co. for GST Registration in Delhi?

SC Bhagat & Co. is a leading tax and accounting firm, offering comprehensive GST solutions to individuals, startups, and enterprises. Our team of experts simplifies the GST registration process and ensures compliance with all legal requirements.

Our Key GST Services

GST Registration & Compliance

New GST Registration

GST Amendments & Modifications

GST Cancellation & Revocation

Filing of GST Returns

GST Advisory & Consultancy

GST Impact Analysis

Input Tax Credit (ITC) Planning

GST Rate Classification

Compliance Management

GST Return Filing & Compliance

Monthly, Quarterly & Annual GST Returns

GSTR-1, GSTR-3B, and GSTR-9 Filing

Reconciliation of GST Data

GST Audit & Assessment

GST Litigation & Representation

Assistance in GST Notices & Appeals

GST Refund Processing

Representation before GST Authorities

Advisory on Anti-Profiteering Laws

Benefits of GST Registration for Your Business

Legal Recognition: Get a valid GSTIN for your business operations.

Tax Benefits: Avail input tax credit and reduce tax liabilities.

Expand Business Reach: Register under GST to operate across India.

Compliance & Credibility: Build a strong financial reputation.

Avoid Penalties: Stay compliant and avoid legal complications.

Why Businesses Trust SC Bhagat & Co.?

Experienced Tax Experts: In-depth knowledge of GST laws and regulations.

Hassle-Free Process: Quick and easy GST registration with minimal documentation.

Affordable Pricing: Transparent and cost-effective service packages.

Dedicated Support: Personalized assistance for all GST-related queries.

Get in Touch with SC Bhagat & Co.

Looking for GST Registration Services in Delhi? SC Bhagat & Co. is here to assist you with all your GST needs. Let us handle your GST compliance while you focus on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#tax consultancy services in delhi#direct tax consultancy services in delhi#taxationservices

5 notes

·

View notes

Text

2 notes

·

View notes

Text

Why Accurate Financial Statements Matter for Your Business

Accurate financial statements are the backbone of any successful business, providing insights into your company’s financial health and guiding decision-making. At SAI CPA Services, we offer expert financial statement preparation, ensuring your records are precise and reliable.

Why Accurate Financial Statements Matter

Accurate financial statements allow businesses to plan for the future, meet regulatory requirements, and demonstrate financial stability. Here’s how our services benefit your business:

Informed Decision-Making: Our financial statement services give you a clear understanding of your revenue, expenses, and overall financial position, enabling you to make informed business decisions.

Investor Confidence: Lenders and investors rely on accurate financial statements to evaluate your business’s health. A professionally prepared statement adds credibility and trust.

Regulatory Compliance: We ensure that your financial statements comply with all necessary accounting standards and regulations, avoiding penalties and ensuring transparency in your operations.

How SAI CPA Services Can Help

At SAI CPA Services, we provide accurate and detailed financial statements to help your business stay on track. Our team ensures that your financial records are up-to-date, reliable, and compliant.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#SAICPAServices#financial statements#business growth#financial services#accounting#accounting services#cpa#new jeresy#investor confidence#regulatory compliance services

2 notes

·

View notes

Photo

5 posts!

#5 posts#tumblr milestone#binjoyauditors#accounting services#Audit Firm In Dubai#chartered accountant

2 notes

·

View notes

Text

We are a leading financial services firm based in Thrissur, dedicated to providing our clients with the best financial solutions to meet their diverse needs. Our primary services include mutual fund distribution, insurance agency, and loans syndication. Our team of experts is highly skilled and experienced in handling all types of financial services. We are committed to delivering the best-in-class services to our clients and ensuring their financial goals are met with the utmost professionalism and expertise. At Neelsaj Financial Services Private Limited, we understand that every client is unique, and their financial requirements vary. Hence, we offer personalized services that are tailored to meet their specific needs. We ensure that our clients receive the highest level of support and assistance throughout their financial journey. Our core values include integrity, transparency, and customer-centricity. We believe in building long-term relationships with our clients and providing them with the best financial solutions that are aligned with their goals. Thank you for choosing Neelsaj Financial Services Private Limited as your trusted financial partner. We look forward to serving you with the best financial solutions and excellent service.

.

.

.

.

2 notes

·

View notes

Text

Top Audit Firm in Qatar | Accounting and Bookkeeping

Discover GSPU, your trusted audit and accounting firm in Qatar! Our experienced professionals offer tailored financial solutions, innovative strategies, and expert guidance to help your business thrive. Get in touch today to streamline your financial processes and drive growth with confidence.

#accounting#taxes#success#startup#tax#tax accountant#property taxes#audit#taxation#taxcompliance#bookkeeping#accounting services#business growth#services#finance#business consulting#outsourced cfo services#corporatefinance#cybersecurity#excise tax

3 notes

·

View notes

Text

Singapore Accounting

When it comes to money, accuracy, and compliance are essential, and Singapore Accounting Services is your trustworthy partner. Our smooth and efficient financial system excels in bookkeeping, creating, and filing financial reports. We have experience negotiating Singapore's intricate financial regulations and are dedicated to supporting you every step of the way.

2 notes

·

View notes

Text

Doshi Outsourcing is proud to introduce itself as a trusted outsourcing partner, offering comprehensive accounting and bookkeeping solutions in the UK. With their expertise and dedication, they aim to simplify financial processes, ensuring businesses can focus on growth and success. Explore their services for efficient financial management.

#accounts outsourcing#outsourcing accounting#outsourced accounting#accounting services#Accounting Outsourcing#accounting companies#accountant outsourcing#outsource accounting#offshoring accounting#outsourced accountant

2 notes

·

View notes

Text

#accounting firms#bookkeeping#bookkeeping firm#small business bookkeeping#financial management#bookkeeping solutions#accounting services#accountingservices

4 notes

·

View notes

Text

GST Registration Services Provider in Delhi by SC Bhagat & Co.

In today’s dynamic business landscape, GST registration is a crucial step for any business operating in India. If you are looking for a reliable GST Registration Services Provider in Delhi, SC Bhagat & Co. offers expert assistance to ensure a smooth and hassle-free registration process.

Why is GST Registration Important?

GST (Goods and Services Tax) is a unified tax system that has replaced multiple indirect taxes in India. Every business with an annual turnover exceeding ₹40 lakh (₹10 lakh for special category states) must register for GST. Even businesses below this threshold can opt for voluntary registration to avail benefits like input tax credit and improved compliance.

Services Offered by SC Bhagat & Co.

SC Bhagat & Co. specializes in providing end-to-end GST solutions, ensuring that businesses remain compliant with tax regulations. Our services include:

GST Registration

Assistance in preparing and submitting GST registration applications

Obtaining GST Identification Number (GSTIN)

Handling queries from tax authorities

GST Return Filing

Monthly, quarterly, and annual GST return filing

Ensuring timely and accurate compliance to avoid penalties

GST Advisory Services

Expert consultation on GST applicability and exemptions

Guidance on tax planning and input tax credit claims

GST Audit & Compliance

Regular audits to identify compliance gaps

Representation before tax authorities in case of disputes

GST Cancellation & Amendments

Assistance in cancellation of GST registration if business operations cease

Support for modifications in GST registration details

Why Choose SC Bhagat & Co.?

With years of experience and a team of skilled professionals, SC Bhagat & Co. ensures that businesses comply with GST regulations seamlessly. Our commitment to accuracy, transparency, and customer satisfaction makes us the preferred GST registration services provider in Delhi.

Key Benefits of Choosing Us:

✔️ Quick and hassle-free registration process ✔️ Affordable and transparent pricing ✔️ Personalized consultation and support ✔️ Expert handling of GST compliance and disputes ✔️ Timely reminders for return filing

Get Started Today!

If you are a business owner looking for professional GST Registration Services in Delhi, SC Bhagat & Co. is your trusted partner. Contact us today to ensure a smooth GST registration and compliance process.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances#beauty#actors

3 notes

·

View notes

Text

Outsourcing Accounting Services is Best for Your Business

If you’re a business owner living in Dubai, there are various choices to handle your accounting and financial requirements. Outsourcing Accounting Services are among the most well-known. Each strategy comes with distinct advantages and disadvantages. Therefore, it is essential to evaluate your options before settling on one.

Introduction

A solid accounting and finance base is crucial to running an effective business. Accounting is essential to running a business successfully in Dubai, including accounting and bookkeeping, as well as tax compliance and planning. Two main methods to tackle these issues are outsourcing and internal auditing. In this article, we’ll discuss the differences between these two methods so that it is easier for you to choose the best option for your business.

Outsourcing Accounting Services in UAE

The option of hiring a person or company from a different company to complete your financial tasks is referred to as Outsourcing Accounting Services. As more businesses realize the benefits of hiring experienced accountants, this option is increasing in popularity in Dubai. Here are a few of the significant advantages of outsourcing accounting services

Savings: Recruiting external help can be less costly than acquiring internal employees, particularly for smaller businesses that have more money to pay a full-time accountant.

Access to knowledge: Outsourcing gives you access to a team of expert experts with years of experience who can handle any financial obligations.

Scalability Since outsourcing can be adaptable, you can alter the amount of assistance you receive as your business grows and evolves.

Flexibility: By outsourcing, you can focus on the main areas of your business while a different person handles the financial complexities.

Outsourcing However, it could have certain disadvantages to take into account, including:

Control loss If you contract out accounting services, you grant an individual control over your financial information. People who like to keep track of their financial information may be able to see an issue to be concerned about.

Communication issues: Working with a provider in an area with a different time zone may help communicate during outsourcing accounting services.

Localized Accounting Services in UAE

Hiring a part-time or full-time employee to handle your financial needs is known as accounting in-house. It has been used for some time & is highly sought-after by businesses regardless of size. There are a few advantages of accounting in-house:

Control The control over the financial data you store in the internal accounting department. That is a great thing for business owners worried about privacy and security.

It’s easier to communicate and collaborate with your accountant when he is in an office in the same building. That will help in ensuring the accuracy and up-to-dateness of your financial records.

Personalization When you’ve specific financial requirements, the in-house accountant could be tailored to your needs. That can be the most significant benefit.

Stability over the long term: Working with a permanent employee who understands the financial requirements and processes could help you get an accountant on staff to ensure stability for your business.

However, there could be some disadvantages to internal accounting, for instance:

Cost: Employing a full-time accountant within the company can be costly, especially for small companies that require financial resources to pay for it.

Unskilled: A company’s in-house accountant may have unrelated expertise to a reputable outsourcing firm, which could lead to mistakes or omissions in financial management.

Time and resources: Accounting in-house requires an extensive time and resources commitment, such as the hiring of new staff, the training process, and the onboarding of new employees.

Limited scaling: As your company grows, changing the level of assistance you receive could be easier if you use internal accounting. When your business grows and expands, it can lead to issues with efficiency or the need for more resources.

#accounting services#accounting firms#accountingservices#Accounting Companies in Dubai#accountingfirms

2 notes

·

View notes

Text

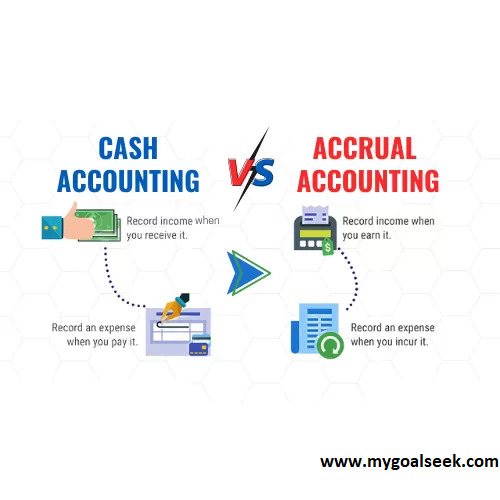

Counting on Accounting: Cash Vs Accrual Accounting

Every business is unique in its way and so are its methods of working. Depending upon the need of the business or the ease of owner they decide the way they wish to transact with customers, products, purchase, sales, and stakeholders or even with the books of account. Where there are two types of recording transactions, viz. Cash accounting and accrual accounting; businessman opts for the one that suits his objectives.

What is cash accounting?

In simple terms, recording the transaction when the cash is paid is cash accounting. Be it income or expenditure, when the cash is transacted, is the time when the transaction is recorded in the book of accounts. For example, if the x party has purchased something from y in January and has not paid any cash for the transaction done in the same month. The transaction will not be recorded. On the other hand, when the party clears the due in February, the transaction is recorded in February.

Is that suitable for your business type?

Since this is real-time cash transaction tapping, it is always the first choice, so that the cash gets tallied. But in actuality, this is more suitable for all those who deal with a limited cash business transaction. Moreover, if the business is small and mostly the type of transaction done is cash-based, this should suit your business needs.

Accrual Accounting:

In simple terms, this is the type of account where the transactions are recorded even when they are not realized in cash. This is exactly the opposite of recording the cash transaction. The income or expenditure is recorded in the book of accounts irrespective of the time frame when it has occurred. For instance, when Vendor A sells his good to B and asks him to settle his accounts to clear his dues in the weekend, B has an increase in purchasing power and hence this leverages his business. A would only record the transaction without the time or cash constraint as he is dealing with books by the accrual accounting method.

Keeping the stuff simple, cash being earned or not, the revenue is recorded as soon as the product is sold or the services are offered, ensuring that the expenditure is recorded as well.

Is that suitable for your business type?

Well, if you are dealing with huge cash transactions, or you are in macro business; it is a sure shot Yes! When you have more than certain cash transactions, it is not manageable to record them always. Hence the same is recorded in the accrual accounting pattern.

Let’s get into a sneak peek as to how cash accounting differs from accrual accounting:

If you wish to know your exact cash transaction done in a day, cash accounting shall be a great aid. Think of a moment when you recorded cash but have not paid in the expenses, will that give you the exact picture? The answer to the same is NO!. The income in cash can be recorded if done in the day whereas in accrual the expenditure and income both can be recorded, hence providing you the exact picture. Cash accounting will not provide you with a clear picture if payable and receivable are not done on the same day.

Cash is the easiest way to apply in day-to-day accounting methods, whereas accrual is a bit complex. However, GAAP and IFRS acknowledge the accrual accounting method.

The income level recorded in the cash accounting system will be less and the levels in comparison will be more in the accrual accounting system as the cash will be actual and the income will be assumed. Cash received can be part of actual cash on hand in the cash accounting system, whereas Income is not equal to cash flow. All in all, Different business has different strategies and so is the accounting system. Pick up the method that suits the need of the business.

2 notes

·

View notes

Text

Accounting Firm

Are you happy with your accounting firm? If not then risians accounting firm in Dubai is one of the best firms to hire. They have good players for accounting, bookkeeping, auditing, and tax agent which can do good care of your business finance.

2 notes

·

View notes

Text

Get Offshore Accounting And Tax Services For Accounting Firms Are you looking for offshore services for your accounting firm? Visit Credfino.com. Their aim is to assist accounting firms, tax firms in attaining stable and reliable revenue growth, enhancing profitability, and optimizing operations via staffing solutions and business consulting. Visit their website to learn more.

#Accounting Firms#Offshore Staffing#Business Consulting#Tax firms#staffing solutions#Tax Services#Accounting Services#CPA firm#Offshore services

6 notes

·

View notes