#taxreturns

Explore tagged Tumblr posts

Text

How to Get the Most Out of Your HMRC Self Assessment Tax Return and Save Money

Filing your HMRC self assessment tax return can seem like a daunting task, especially if you're not familiar with the system or have never filed one before. However, with a bit of knowledge and careful planning, you can not only make the process smoother but also ensure you get the most out of your tax return—saving money in the process. Whether you're a freelancer, a non-resident property owner, or an investor, understanding how to leverage the HMRC self assessment tax return system can help you maximize your tax benefits.

In this blog, we’ll explore everything you need to know to make the most out of your HMRC self assessment tax return, including common mistakes to avoid, tips for saving money, and how the SA109 form plays a role, especially for non-UK residents.

What is an HMRC Self Assessment Tax Return?

The HMRC self assessment tax return is a form used by individuals to report their income to Her Majesty's Revenue and Customs (HMRC) and calculate the amount of tax they owe. While many employees have their taxes deducted automatically through PAYE (Pay As You Earn), self-employed individuals, landlords, and those with additional income must file a HMRC self assessment tax return to ensure they are paying the correct amount of tax.

Whether you’re claiming tax reliefs, reporting income from rental properties, or simply want to ensure you’re compliant with UK tax laws, the HMRC self assessment tax return is the tool that helps HMRC assess how much tax you should be paying.

Understanding the Key Forms: SA109 and Non-UK Resident Tax Return

When filling out your HMRC self assessment tax return, it’s essential to understand the forms required. One important form for certain individuals is the SA109 form. If you are a non-UK resident, you will need to complete this form along with your HMRC self assessment tax return.

The SA109 form is specifically for individuals who need to declare their residency status. Non-residents, for instance, will need to fill out this form to indicate that they are not residing in the UK but still have UK-based income. This form helps HMRC determine your tax liability based on your residency status, ensuring you’re only taxed on your UK income.

If you're a non-UK resident, the non UK resident tax return process may also involve additional forms and calculations. In some cases, you may be eligible for tax relief or exemptions based on international treaties or your specific situation.

Step-by-Step Guide to Completing Your HMRC Self Assessment Tax Return

Now that you know the importance of the HMRC self assessment tax return, let’s dive into the process itself. Here’s a step-by-step guide to help you through:

1. Register for Self-Assessment (if you haven’t already)

Before you can submit your HMRC self assessment tax return, you need to register with HMRC. This step is essential for self-employed individuals, landlords, or those with additional income outside of regular employment.

For non-UK residents: You’ll need to register your non-UK resident tax return with HMRC to declare your UK income.

Self-employed individuals: Register as a sole trader or business owner to file your self-assessment.

Once registered, you will receive a Unique Taxpayer Reference (UTR) number, which is necessary for completing your HMRC self assessment tax return.

2. Collect All Necessary Documents

To complete your HMRC self assessment tax return, you’ll need to gather several key documents. These may include:

Income statements: Salary, rental income, self-employment earnings, or dividends from UK investments.

Receipts for business expenses: Keep track of receipts for anything you’ve bought related to your business or profession.

SA109: If you're a non-UK resident, this form is essential for declaring your residency status.

P60/P45: If you were employed during the tax year, your employer should have provided these forms detailing your earnings and tax paid.

Bank statements: For self-employed individuals or landlords, bank statements can be essential for providing proof of income.

3. Fill Out the HMRC Self Assessment Tax Return

Once you have all the required documents, you can begin completing your HMRC self assessment tax return. If you’re filing online, HMRC’s digital platform will guide you through the process step by step.

Section 1: Personal Information: Include your name, address, and UTR number.

Section 2: Income: Here, you’ll report all your income sources, such as employment income, rental income, or business earnings.

Section 3: Deductions and Allowances: Claim any tax reliefs or deductions you’re entitled to. For example, as a non-UK resident, you might be eligible for allowances on rental property income or income from foreign sources.

Section 4: Completing the SA109: As a non-UK resident, you will need to fill in the SA109 to confirm your residency status and outline any applicable tax treaties that might reduce your UK tax bill.

4. Claim All Available Tax Reliefs

One of the most effective ways to reduce your tax liability when filing your HMRC self assessment tax return is by claiming all available tax reliefs. Some common ones include:

Marriage Allowance: If you’re married or in a civil partnership, you may be eligible to transfer a portion of your personal allowance to your partner.

Property Tax Relief: If you’re a landlord, you can deduct allowable expenses from your rental income, such as repairs, maintenance, and mortgage interest.

Self-Employed Allowances: For self-employed individuals, you can claim expenses for business-related purchases, including office supplies, travel, and professional fees.

5. Double-Check for Mistakes

Before submitting your HMRC self assessment tax return, take time to carefully review your entries. Double-check all income amounts, claimable deductions, and residency status. Mistakes on your HMRC self assessment tax return can lead to penalties or delays in processing.

6. Submit Your Return and Pay Your Taxes

After completing your HMRC self assessment tax return, you can submit it electronically through HMRC’s online portal. Be sure to pay any taxes owed by the deadline to avoid late fees and penalties. If you are due a refund, HMRC will process this as soon as your return is accepted.

Tips for Saving Money on Your HMRC Self Assessment Tax Return

Filing your HMRC self assessment tax return is your opportunity to take advantage of various tax-saving opportunities. Here are some tips to help you save money:

Maximize Allowable Expenses: Whether you’re self-employed or a landlord, be sure to claim every allowable expense. This will reduce your taxable income and, consequently, your tax bill.

Use the Marriage Allowance: If you qualify, transferring some of your personal allowance to your partner can reduce your overall tax liability.

Claim Tax Relief for Charitable Donations: If you made donations to charity during the tax year, you may be able to claim tax relief on those donations through Gift Aid.

Consider Pension Contributions: Increasing your pension contributions not only secures your future but can also reduce your tax bill in the present.

The Importance of the SA109 for Non-UK Residents

If you’re a non-UK resident, the SA109 form is crucial to ensuring that your HMRC self assessment tax return accurately reflects your status. By completing the SA109, you’re informing HMRC that you do not reside in the UK but still have income that may be subject to UK tax.

The SA109 also helps to ensure that you’re only taxed on your UK income and that you may be eligible for exemptions based on your residency status. For example, if you’re a resident of a country with a double taxation agreement with the UK, the SA109 form can help reduce or eliminate your UK tax liability.

Conclusion

Filing your HMRC self assessment tax return doesn’t have to be stressful. By understanding the process, using the correct forms like SA109 for non-residents, and claiming all available tax reliefs, you can ensure that your tax return is both accurate and beneficial. Additionally, by staying organized and filing your return online, you can minimize the risk of mistakes and ensure timely submission.

Remember, the key to getting the most out of your HMRC self assessment tax return is careful planning, attention to detail, and utilizing all available allowances. Whether you’re self-employed, a landlord, or a non-UK resident, these strategies will help you save money and reduce your tax liability.

FAQs

Q1: What is the SA109 form, and do I need it? The SA109 form is a declaration of residency status for non-UK residents. If you live abroad and have UK-based income, you need to complete this form as part of your HMRC self assessment tax return.

Q2: Can I file my HMRC self assessment tax return online? Yes, you can file your HMRC self assessment tax return online through HMRC’s digital platform. This is the most convenient and efficient way to submit your return.

Q3: How can I reduce my tax bill when filing my HMRC self assessment tax return? To reduce your tax bill, maximize your allowable expenses, claim all available reliefs like the Marriage Allowance, and consider contributing to your pension or making charitable donations.

Q4: What happens if I make a mistake on my HMRC self assessment tax return? If you make a mistake, HMRC may issue a penalty, and you could end up paying more tax than you owe. It's important to double-check your return for accuracy before submission.

Q5: How do I pay any taxes owed after submitting my HMRC self assessment tax return? After submitting your HMRC self assessment tax return, HMRC will issue a tax bill. You can pay this online through their secure portal or via other available payment methods. Be sure to meet the deadline to avoid late fees.

#SA109#TaxSavings#TaxAccountant#Finance#Taxd#TaxFiling#TaxReturns#TaxdUK#FinancialPlanning#TaxSeason#Tax#UKTaxSelfAssessment#TaxationServices#TaxReturnOnline#FinancialServices

2 notes

·

View notes

Text

An open letter to the U.S. Congress

Oppose any riders that attack the IRS or ban the implementation of Direct File!

920 so far! Help us get to 1,000 signers!

Filing our taxes online should be free and easy. I’m excited to be able to use the IRS’s new Direct File tax filing system. But I understand that some members of Congress are attempting to attach a rider to must-pass government funding legislation that would ban the IRS from implementing Direct File. I urge you to vote against any riders that attack the IRS or ban the implementation of Direct File. Investments in the IRS are already paying off: the agency is cracking down on wealthy and corporate tax cheats, processing tax returns more quickly, and answering more taxpayer questions with fewer delays. Direct File is an investment in the American people. Please allow the IRS to put our needs ahead of the greed of TurboTax and H&R Block.

▶ Created on February 26 by Jess Craven

📱 Text SIGN PRGORX to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PRGORX#resistbot#petition#OpenLetter#Congress#IRS#DirectFile#TaxFiling#GovernmentFunding#TaxReturns#Taxpayers#TaxCheats#Investments#AmericanPeople#TurboTax#HRBlock#FreeFiling#TaxSystem#Legislation#Riders#Opposition#Implementation#TaxPreparation#TaxAssistance#TaxPolicies#TaxCompliance#GovernmentSpending#FinancialServices#TaxCode

2 notes

·

View notes

Text

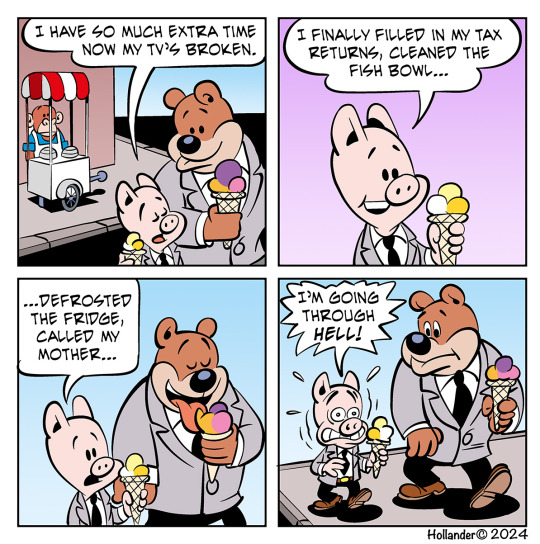

Idling

#comic#comics#webcomic#webcomics#webcomicupdate#comicstrip#funnycomic#joke#funny#comicartwork#cartoonist#artwork#idle#taxreturns#taxes

2 notes

·

View notes

Text

🍁📑 Maple Tax Consultancy: Your guide to seamless tax management! With a focus on individual and business tax services, we're committed to tailored solutions, optimizing deductions, and strategic planning. Our expertise spans IRS representation, state-specific tax laws, and empowering educational resources. Let's unravel the complexities of taxes together!

#TaxSolutions#StrategicPlanning#FinancialEmpowerment#TaxConsulting#FinancialGuidance#TaxExperts#Taxation#IRS#FinanceTips#TaxAdvice#FinancialManagement#TaxStrategies#BusinessFinance#TaxReturns#TaxSeason#PersonalTaxes#TaxHelp#FinancialPlanning#EstateTaxes#TaxProfessionals#IRSRepresentation#TaxCompliance#InvestmentPlanning#FinancialServices#tumblr

2 notes

·

View notes

Text

Get Expert Help with Your Tax Returns!

Struggling with tax filing? Aone Outsourcing offers professional tax return services to ensure accuracy and maximize your refunds. Our experts handle all paperwork, deductions, and compliance, saving you time and stress. Affordable, reliable, and hassle-free—let us simplify your tax process!

1 note

·

View note

Text

At Syriac CPA Tax & Accounting Services Inc., we specialize in strategic tax planning and compliance assurance to help you minimize liabilities and maximize savings. Let our experienced team guide you through the complexities of tax regulations, ensuring your financial success.

Optimize Your Finances with Expert Tax Consulting Services!

#TaxConsulting#TaxPlanning#TaxServices#TaxHelp#TaxSeason#IncomeTax#TaxAdvice#TaxPreparation#TaxTips#TaxExperts#TaxFiling#AccountingServices#TaxAdvisor#Taxation#TaxProfessional#TaxRefund#Taxes#BusinessTax#TaxReturns#Accountant#TaxSolutions#TaxConsultant#TaxPreparer#FinancialPlanning#TaxAssistance#Bookkeeping#Accounting#TaxPrep

0 notes

Text

Tax Returns | Insight Business Solutions

Insight Business Solutions is a reputable firm of tax accountants, providing expert tax returns for individuals and businesses alike …

0 notes

Text

At Syriac CPA Tax & Accounting Services Inc., we specialize in strategic tax planning and compliance assurance to help you minimize liabilities and maximize savings. Let our experienced team guide you through the complexities of tax regulations, ensuring your financial success.

🔍💼 Optimize Your Finances with Expert Tax Consulting Services! 💼🔍

#TaxConsulting#TaxPlanning#TaxServices#TaxHelp#TaxSeason#IncomeTax#TaxAdvice#TaxPreparation#TaxTips#TaxExperts#TaxFiling#AccountingServices#TaxAdvisor#Taxation#TaxProfessional#TaxRefund#Taxes#BusinessTax#TaxReturns#Accountant#TaxSolutions#TaxConsultant#TaxPreparer#FinancialPlanning#TaxAssistance#Bookkeeping#Accounting#TaxPrep

0 notes

Text

#auditing#accounts#charteredaccountant#tax#vat#consultancy#advisory#incometaxreturns#incometax#auditing firm in Oman#audit company in Muscat#audit firm in Muscat#accountant#finance#businessowner#taxtime#payroll#taxreturns#payrollservices#accounting#vatfiling

0 notes

Photo

Did you know your tax returns can be reviewed, even if someone besides us prepared them? We can often find mistakes made by software or other preparers -- and amend your return for a more favorable outcome. Did you leave money on the table? Schedule a time today for a complimentary review of your last tax return. https://www.afitonline.com/appointments

#TaxReturns#TaxReview#TaxMistakes#AmendYourReturn#MaximizeRefund#TaxPreparation#FinancialAdvice#TaxSavings#TaxPlanning#IRSHelp#TaxSoftware#ExpertTaxAdvice#GetYourMoneyBack#TaxConsultation#HiddenDeductions#TaxSeason2023#AffordableTaxHelp#ClientFocused#ScheduleYourReview#FinancialWellness#MoneyMatters#ProfessionalTaxService#PeaceOfMind#FreeConsultation#TaxStrategy#LeaveNoMoneyBehind#OptimizeYourTaxes#TaxExperts#TaxReturnReview#AfitOnline

0 notes

Text

From Confused to Confident: Mastering Self Assessment Tax Returns in 2025

Filing your self assessment tax returns can feel overwhelming — especially with changing rules, complex forms, and the risk of errors. Whether you're a UK resident, a non-resident earning UK income, or someone navigating HMRC’s system for the first time, understanding the process is crucial.

With the right guidance, you can move from feeling confused to confident when filing your self assessment tax returns in 2025. In this guide, we’ll walk you through the process, highlight key tips, and explain how tools like the UK tax resident calculator can simplify your filing — especially if you’re submitting a tax return for non resident status.

1. What Are Self Assessment Tax Returns?

A self assessment tax return is HMRC's system for collecting income tax that hasn’t been automatically deducted from your salary, pension, or savings.

Who Needs to File a Self Assessment Tax Return?

✅ Self-Employed Individuals ✅ Freelancers and Contractors ✅ Landlords Earning Rental Income ✅ Company Directors (not paid through PAYE) ✅ High Earners (earning over £100,000 annually) ✅ Non-Residents with UK Income

If you’re unsure whether you need to file, HMRC offers a UK tax resident calculator that helps determine your residency status — a crucial factor in whether your income is taxable in the UK.

2. Key Changes to Self Assessment Tax Returns in 2025

Tax regulations evolve, and 2025 introduces several updates that may affect how you file:

1. Digital by Default

HMRC continues its “Making Tax Digital” initiative, encouraging individuals to file their self assessment tax returns online.

Paper submissions are still accepted but are slower and risk higher error rates.

2. Stricter Penalties for Late Filings

Penalties for late filing now start at £100 immediately after the deadline, with increasing fines for prolonged delays.

3. Enhanced Guidance for Non-Residents

HMRC now provides clearer instructions for those filing a tax return for non resident status, reducing the risk of overpayment.

3. How to Determine Your Residency Status with the UK Tax Resident Calculator

Residency status plays a major role in your tax obligations. If you live abroad but earn UK income, your residency status will determine how much tax you pay.

Using the UK Tax Resident Calculator

The UK tax resident calculator helps assess your status based on key factors:

✅ Number of days spent in the UK during the tax year ✅ Your primary home’s location ✅ Ties to the UK (e.g., family, employment, or property)

Why Is This Important?

If you qualify as a non-resident, you may only be taxed on your UK-sourced income — potentially reducing your overall tax liability. This is crucial when filing a tax return for non resident status.

4. Step-by-Step Guide to Filing Self Assessment Tax Returns

Follow these steps to confidently file your self assessment tax returns in 2025:

Step 1: Register for Self Assessment

First-time filers must register with HMRC.

After registration, you’ll receive a Unique Taxpayer Reference (UTR) — required for filing.

Step 2: Gather Your Financial Information

Ensure you have: ✅ P60/P45 (employment income) ✅ Bank statements (for interest earned) ✅ Rental income records (if you’re a landlord) ✅ Foreign income details (for a tax return for non resident) ✅ Expense receipts (to claim deductions)

Step 3: Use the UK Tax Resident Calculator

Before filing, use the UK tax resident calculator to confirm your residency status and determine which income sources must be reported.

Step 4: Complete Your Self Assessment Online

Log into your HMRC account.

Follow the guided steps, ensuring you declare all income streams, allowable expenses, and deductions.

Step 5: Claim Allowances and Deductions

Key deductions that reduce your tax bill include: ✅ Mortgage interest (for landlords) ✅ Business expenses (for self-employed individuals) ✅ Charitable donations ✅ Pension contributions

Step 6: Submit Your Tax Return and Payment

The filing deadline is 31 January 2026 for online submissions.

Payments must also be made by this deadline to avoid penalties.

5. Special Considerations for Non-Residents

If you’re filing a tax return for non resident status, be aware of these key points:

✅ Declare UK-Sourced Income Only: Non-residents are typically taxed only on UK earnings, not global income. ✅ Claim Double Taxation Relief: If you’re taxed abroad, you may qualify for relief to avoid paying tax twice. ✅ NRLS Registration: Non-resident landlords should register for the Non-Resident Landlord Scheme (NRLS) to prevent tax deductions at source.

Using the UK tax resident calculator ensures you accurately determine your status and avoid paying unnecessary tax.

6. Common Mistakes to Avoid When Filing Self Assessment Tax Returns

Even seasoned filers can make costly mistakes. Here are some pitfalls to watch out for:

❌ Missing the Deadline: The deadline for online filing is 31 January 2026. Late submissions can lead to fines starting at £100. ❌ Forgetting to Declare Side Income: Income from side jobs, freelance work, or investments must be reported. ❌ Failing to Claim Deductions: Missing out on eligible expenses could mean overpaying tax. ❌ Incorrect Residency Status: Misjudging your status using the UK tax resident calculator can result in overpayment or fines. ❌ Incomplete Records: Always keep proof of income, expenses, and deductions for at least 5 years in case of HMRC inquiries.

7. Why Using Tax Software Can Make Filing Easier

Tax software can simplify filing your self assessment tax returns and ensure you meet deadlines while maximizing deductions.

Benefits of Tax Software:

✅ Step-by-Step Guidance: Ensures you don’t miss key entries. ✅ Automatic Calculations: Reduces errors and ensures accurate totals. ✅ Integrated UK Tax Resident Calculator: Helps determine if you should file a tax return for non resident status. ✅ Faster Refunds: Submitting online speeds up refund processing.

Popular platforms like TaxCalc, GoSimpleTax, and Taxfiler provide comprehensive support for UK residents and non-residents alike.

Conclusion

Filing your self assessment tax returns in 2025 doesn’t have to be stressful. By understanding key changes, using tools like the UK tax resident calculator, and staying informed about non-resident tax rules, you can file with confidence.

Whether you’re a freelancer, landlord, or expat handling a tax return for non resident status, following the right steps will ensure accuracy and potentially boost your refund.

Embrace the power of preparation — start your self assessment journey today and secure your financial future!

FAQs

1. When is the deadline for filing my self assessment tax return in 2025?

The deadline for online submissions is 31 January 2026. If you’re filing by paper, the deadline is 31 October 2025.

2. How do I use the UK tax resident calculator?

Visit the official HMRC website and follow the calculator’s prompts. It evaluates your residency status based on the number of days you’ve spent in the UK and your personal ties.

3. Do non-residents need to report foreign income?

Non-residents are generally taxed only on UK-sourced income. However, if you have global earnings that fall under UK tax rules, you may still need to declare them.

4. Can I amend my self assessment tax return after submission?

Yes. You can make changes to your self assessment tax returns online up to 12 months after the filing deadline.

5. What happens if I file my tax return late?

HMRC issues an immediate £100 fine for late submissions, with additional penalties accumulating over time.

#SA109#TaxSavings#TaxAccountant#Finance#Taxd#TaxFiling#TaxReturns#TaxdUK#FinancialPlanning#TaxSeason#Tax#UKTaxSelfAssessment#TaxationServices#TaxReturnOnline#FinancialServices

1 note

·

View note

Text

The Advantages of Working with a Tax Agent in St Albans

Using a tax agent in St Albans for individual returns offers numerous advantages, including expert advice, maximised deductions, and time savings. Tax agents ensure compliance with regulations, reduce the risk of audits, and provide personalised support, making the tax process smoother and more efficient for individuals. Enjoy peace of mind and better outcomes. Know more about Top 10 Benefits Of Using A Tax Agent In St Albans For Individual Returns

0 notes

Text

Unauthorized access of tax returns on the rise at IRS

In 2023, 125 violation cases of unauthorized access of tax return data were reported, the highest since 2018 —but instances of disclosure violations remains low.

0 notes

Text

🎉 5th ANNIVERSARY CELEBRATION! 🎉 🔥 LIMITED-TIME OFFER 🔥 💥 Unlock Up to 5% OFF Until 15 Jan 2025! 💯 Why Wait? Join thousands who are already taking advantage! ⏰ Time’s Ticking! Don’t miss out on this exclusive deal—

👇 Click "Register Now" and secure your spot!

📞 +1 248-346-8856 | +1 929-481-4456 🌐 www.mapletaxconsulting.com 📍 364 E Main St Ste 1001, Middletown, DE, 19709

Follow for more Accounting &Tax Informations !! Get yourself the best Tax & Accounting firm in USA

#limitedoffer#5thanniversarysale#registernow#exclusivediscounts#savebig#timetocelebrate#dontmissout#specialoffer#mapletaxconsulting#mapletaxexperts#taxseason#tax#IRS#income#taxdeductions#taxfiling#taxfirmusa#taxrefund#usa#taxhelp#taxjourney#taxservices#mapletax#taxpreparation#savetax#accounting#financetips#businesstax#taxhelp

#usa#us taxes#taxseason#taxation#accounting#financetips#taxreturns#taxprofessionals#taxconsulting#maple tax consulting#taxadvice#financialplanning

1 note

·

View note

Text

18 lakh people were found to have not submitted taxes within the previous three years: FBR Chairman

0 notes

Text

Navigate Business Challenges Effortlessly with expert tax consultancy on the BizConsultancy App!

🚀 Simplify your business operations by connecting with our trusted consultants for the right solution. 📜 EASY TAX REGISTRATION AND FILING: Streamline your tax processes effortlessly. 💼 INCOME TAX RETURNS: File your income tax returns with confidence and accuracy. 📇 PROFESSIONAL TAX REGISTRATION: Get professional tax registration done in no time. 💰 GST REGISTRATION: Simplify GST registration with our step-by-step guidance. 💳 TDS RETURN: Hassle-free TDS return filing for your business. Let BizConsultancy App take care of your business needs so you can focus on what you do best! Download now and experience the ease! 📲✨

#businessconsultancy#taxreturns#incometax#businessadvice#businesstips#business#businessconsultant#businessconsultants#consultant#consultants#improvement#Management#experience#services#success#smallbusiness#innovation#community#solutions

0 notes