#online tax services

Explore tagged Tumblr posts

Text

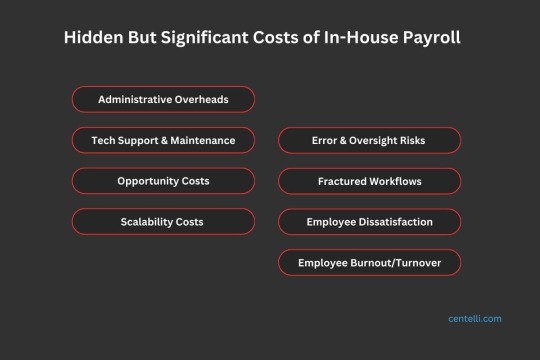

Know the Hidden Cost of Doing Payroll In-House

The cost of doing payroll in-house can be much higher than you might realize. While expenses such as payroll staff salaries, software, and office supplies are apparent, they’re just the top layer!

Beneath this surface, numerous hidden costs—both tangible and intangible—can quickly add up. These can include mounting overheads, inefficient workflows, compliance risks, workload stress leading to employee burnout, and more.

Identifying these hidden costs allows you to accurately assess:

How efficient and effective your payroll department is.

What needs to be improved, and what should your course of action be?

Is it becoming increasingly expensive?

So, should you continue managing payroll in-house or explore outsourced payroll option? Well, it’s entirely up to you, but having the full picture helps!

Continue reading to reveal the hidden layers of in-house payroll management costs…

The True Cost of In-House Payroll Is Higher Than You Think

When managing a payroll process, some costs may not be fully perceived or understood. While these costs might not be immediately obvious, their impact can significantly affect the overall financial and operational health of your business.

Consider these key hidden or less obvious costs for a comprehensive evaluation of what you’re truly spending on your in-house payroll processes:

1. Opportunity Cost of Time Spent on Payroll Tasks

Managing your payroll in-house means dedicating significant time to routine and tedious tasks such as data entry, salary calculations, and tax computation. This diverts your HRM team’s valuable time away from more strategic activities like talent acquisition, employee engagement, and performance optimization.

2. Data Update, Error Correction, and Reconciliation Costs

Payroll errors, such as miscalculated deductions or missed deadlines, can cost you dear. The financial and resource burden of correcting these mistakes and reconciling discrepancies can be significant. Additionally, it is crucial to update your data regularly; otherwise, inefficiencies may disrupt your payroll and cash flow cycle.

3. Payroll Compliance Risk and Regulatory Costs

Keeping up with prevailing payroll compliance requirements and regulations incurs additional costs. You need knowledgeable people to handle your payroll process and internal audits. Failure to ensure compliance can attract inspections from authorities, resulting in penalties and fines.

So, your team must stay updated on compliance to avoid legal troubles.

4. Salary Software/System Maintenance Expenditure

Beyond the initial investment in payroll software and systems, you also face ongoing costs for updates, security measures, and infrastructure support. These expenses are often not anticipated in advance, which can cause discomfort eventually as they quickly accumulate.

5. Internal Payroll Staffing and Training Expenses

Pre-trained payroll experts come at a high cost due to rising wage demands. On the other hand, training new talent involves additional expenditures, time, and resource allocation. Furthermore, continuously upskilling staff on updates to payroll software, systems, and compliance regulations is both time-consuming and costly.

6. Staff Benefits Administration Expenses

Employee benefits management involves tasks such as handling health insurance, retirement plans, paid time off, and other benefits. Managing all these tasks internally—enrolment, eligibility verification, claims processing, and reporting—is complex and resource-intensive. It requires significant costs for personnel, software, and training.

7. Tax Deduction at Source (TDS) Return Filing Costs

Accurate payroll tax preparation and filing are crucial to avoid significant costs related to errors, penalties, and audits. Payroll taxes involve complex calculations, numerous forms, and strict deadlines. Even minor mistakes can result in hefty fines, interest charges, and the need for costly legal assistance.

8. Spendings on Employee Data Security

This is one painful cost of doing payroll in-house that you would definitely want to avoid, right?

10. Payroll Scalability and Associated Costs

As your business grows, payroll management becomes increasingly complex. Scaling payroll operations demands additional resources, time, and expertise, which can impact operational efficiency. Hiring new employees, expanding to new locations, or adjusting payroll structures also becomes cost intensive.

11. Impact of Payroll Inefficiencies on Business Reputation

Frequent payroll errors or delays can harm employee satisfaction and morale and can also damage your company’s reputation over the long term. This impact extends beyond your employees, potentially tarnishing your brand image with external stakeholders.

The cost of reputational damage can lead to lower employee trust, reduced customer confidence, and a loss of business. No business owner would want this!

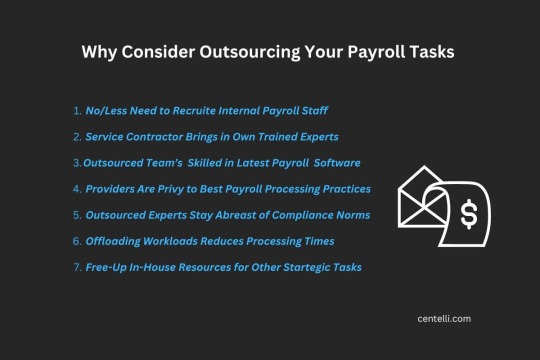

Mitigating the Financial Burdens of In-House Payroll Management Via Outsourcing

While managing payroll in-house offers complete control over data and processes, it requires substantial resources, expertise, and constant maintenance, which means significant capital and costs.

Hiring a professional payroll outsourcing service, in contrast, offers a strategic opportunity to avoid the hassle and mitigate (or even reduce) the hidden costs associated with in-house payroll processes.

Here’s how?

a. Enhance Internal HR Team Efficiency

Or you could even opt for partial outsourcing to relieve your internal payroll team of heavy workloads.

b. Improve Payroll Compliance

Payroll service providers employ experts who are adept at navigating the complex and frequently changing landscape of payroll tax laws and labour regulations. Their expertise helps mitigate compliance issues and avoid costly penalties, enhancing your business’s compliance and reputation.

c. Easily Scale Your Processes

Unlike internal payroll management, which may require additional hires and resources as your company grows, outsourcing offers a highly flexible solution. Most payroll providers can seamlessly adapt to your evolving needs, whether hiring new employees, expanding to new locations, or adjusting payroll structures.

d. Streamline Overall Payroll OPEX

Outsourcing streamlines your payroll operations by eliminating direct expenses, such as salaries and benefits for internal payroll staff. Additionally, it alleviates intangible pressures on internal HR teams, helping prevent burnout. Payroll providers often leverage economies of scale to offer more cost-effective solutions.

End Note on Effective Cost of Doing Payroll In-House

The actual cost of doing payroll internally extends beyond just salaries and infrastructure. Recognizing those hidden and sometimes overlooked expenses is key to understanding how they strain your internal payroll setup.

Outsourcing payroll could be a more cost-effective option. It’s always a great time to review your payroll processes and consider outsourcing to make the most of your resources and cut down on hidden costs.

You can reach out to us to book a free consultation with us to learn how we can help you save up to 35-65% in costs.

#Payroll Management Services#Payroll Services#payroll tax services#Tax services#Online tax services#Payroll tax Preperations

0 notes

Text

For Long-Term Growth, Make the Most of Your Business Tax Plan

We offer business tax planning, tax support services, assistance with CRA communications, and corporate tax filing. From the simplest personal tax returns to the most complex ones, our Online tax services are ready to work with you to ensure that any taxes due are minimized and your refund is maximized. The tax laws set forth by the Revenue Agency are updated and modified annually. Nonetheless, our team stays up to date on these advancements and ensures that, while preparing your individual tax return, the most recent laws are considered and adhered to.

Our Approach

We neither require nor offer appointments for personal tax returns. We employ a unique intake form instead, which saves you time that would otherwise be spent in our office by eliminating the guesswork out of filing your return.

If your personal income situation is complex involves a business, investments, or other non-basic circumstance, we will discuss whether you need to make an appointment. You can use our secure client portal to electronically transmit your personal tax information to us at any time, or during regular office hours. Get in touch with our office by phone or email so we can assist you with setting up an account. In order to optimize your return, our online tax services will review your personal information, seek clarification where needed, and work with you. You may put your trust in us and know that your case will be handled with care and consideration. It is both advantageous and sometimes required that you notify us of changes in your personal circumstances, such as the birth of a child, a change in marital status, a new employment, or a side business. Send us a note so we can make sure this information is taken into account when completing your tax return and attach it to your file. All personal tax returns are filed online, with the exception of those that are over five years past due or in specific additional circumstances when filing on paper is required by the CRA. Since we have no control over these situations, we must submit our tax returns in compliance with CRA regulations.

We cannot file your tax return unless you sign the T183 Information Return for Electronic Filing of an Individual's Income Tax and Benefit Return. We advise against signing your tax return if there are any items about which you are still unsure or if the information does not satisfy you. The process of making changes to an already submitted return is significantly more involved and costly than it is for an unfiled return. Once we receive payment for our invoice, we send you the tax return, which you can peruse at your convenience at our office or at home.

0 notes

Text

sawyer was sick over the weekend so we got some blood tests done and it turns out she is diabetic, she stayed at the vet a couple of nights, it was really strange to be alone in my room those nights. i spend more time with her than anybody. then we were supposed to pick her up thursday morning and they said to come in the evening instead because her glucose was v low. the vet asked me to find a glucose sensor to bring with me that evening, it was a public holiday so i had to find a pharmacy that was actually open. when we went to get her we waited 90 minutes and the sensor was being weird so they said come back later. finally brought her back home at 11pm and the sensor still wasn't working, had to go buy another sensor and bring her back this morning to switch them out, had to leave her there for a few hours so they could switch them and make sure the new one worked, then come back in the afternoon. i've had like no sleep at all this week, its a miracle i kept my eyes open to get training to give her insulin. she's so much better since she came home, even though she's not stabilised yet she very clearly feels heaps better ❤ it was such a relief to have her sleeping on my bed again last night. i was still up all night because i felt like i needed to keep an eye on her because i didn't have the monitor. we'll be in and out a lot over the next couple of weeks while they fine tune her dosage and monitor her levels.

#i want to know when i get a break#had planed to use this week to catch up on the prof development course i enrolled in months ago that started the day before nonna passed#i hoped it would be a chance to really apply my mind to something because i feel like my brain is utterly degenerated#after the time i took off this week for this i won't be able to do any of it before it closes i'll just have to download the modules#and read them in my own time without doing any activities/participating in discussions#have to keep canceling my dental check up because things keep coming up#i've also spent the last few weeks trying to link my online tax account to my government services account but it says all my info is wrong#no matter what i give them#what do i need to do#my life updates are so miserable. i delete so many of the posts i start because they just depress me#i deleted two earlier this week#feel like i need to get something out so i keep coming back to try#i still haven't asked hr about whether we have that counselling service thing because i keep forgetting bc i always have so much to catch u#on#i'll try to remember to do it next week#tp

9 notes

·

View notes

Text

Our ITR Filing Plan Starting from for salaried person rs749 but now we offer only rs 499 , offer valid only 21 july 2024 so hurry up file your ITR with taxring Why choose taxring read Description Click here to choose the plan that suits you best! https://taxring.com/service/top-plan…

File your ITR with TaxRing and enjoy:

- Easy and quick filing process - Expert assistance from our team of CAs - Maximum refund guaranteed - Filing for last 3 years' returns - Tax planning and consultation - Refund claims and follow-up

Don't wait, file your ITR now and avoid unnecessary penalties and fees!

whatsapp now - +91 9711296343

Visit us - https://taxring.com

#itr filing#taxring#income tax#taxation#itr#taxes#taxation services#itr filing last date#itr filing for fy 2023-24#income tax filing#income tax calculator#income tax department#income tax return#income tax notice#file itr#capital gain#file itr for salaried#file itr for business#itr filing online#return filing

2 notes

·

View notes

Text

Navigating the Landscape of Tax Preparation and Bookkeeping Services- A Guide to Choosing the Best Agencies

Tax preparation and bookkeeping are integral parts of running a successful business. However, for many entrepreneurs and business owners, these tasks can be daunting and time-consuming. That's where professional services come in handy. In cities like Perth, Brisbane, Sydney, Melbourne, Adelaide, and NSW, agencies like Account Cloud offer comprehensive tax preparation and bookkeeping services to alleviate the burden on businesses. But with so many options available, how do you choose the best agency for your needs? Here's a guide to help you navigate the landscape:

1. Assess Your Needs: Before you start your search for a tax preparation and bookkeeping service agency, it's essential to assess your needs. Determine the scope of services you require, such as tax filing, payroll processing, financial reporting, or general bookkeeping. Understanding your requirements will help you narrow down your options and find agencies that specialize in the services you need.

2. Experience and Expertise: When entrusting your financial matters to a third-party agency, it's crucial to ensure they have the necessary experience and expertise. Look for agencies with a proven track record in tax preparation and bookkeeping services. Consider factors such as the number of years in business, client testimonials, and the qualifications of their team members.

3. Industry Specialization: Different industries have unique tax and accounting requirements. Whether you're in retail, hospitality, healthcare, or any other sector, consider choosing an agency that specializes in serving businesses similar to yours. Industry-specific knowledge can ensure compliance with relevant regulations and optimize tax strategies tailored to your business.

4. Technology and Innovation: The accounting landscape is continually evolving, with advancements in technology reshaping how financial tasks are performed. Seek out agencies that embrace technology and leverage innovative solutions to streamline processes and enhance accuracy. Cloud-based accounting platforms, automation tools, and data analytics can significantly improve efficiency and decision-making.

5. Communication and Accessibility: Effective communication is key to a successful partnership with a tax preparation and bookkeeping agency. Choose an agency that prioritizes clear and transparent communication, keeping you informed about your financial status and any regulatory changes that may affect your business. Additionally, consider their accessibility and responsiveness to inquiries or concerns.

6. Compliance and Security: Compliance with tax laws and regulations is non-negotiable when it comes to financial matters. Ensure that the agency you choose adheres to the highest standards of compliance and stays updated with the latest regulatory changes. Moreover, prioritize security measures to protect sensitive financial information against unauthorized access or data breaches.

7. Scalability and Flexibility: As your business grows, your accounting needs may evolve as well. Select a tax preparation and bookkeeping agency that can scale its services according to your business growth. Whether you're a small startup or a large enterprise, flexibility in service offerings and pricing structures ensures that you receive tailored solutions aligned with your current and future needs.

8. Cost and Value: While cost is undoubtedly a factor in the decision-making process, it's essential to consider the value proposition offered by the agency. Instead of solely focusing on the lowest price, evaluate the services, expertise, and support provided in relation to the cost. A higher upfront investment in quality services can often yield long-term benefits and cost savings through improved financial management.

Choosing the best tax preparation and bookkeeping services agency requires careful consideration of various factors, including your specific needs, the agency's experience and expertise, industry specialization, technology adoption, communication practices, compliance standards, scalability, and cost-effectiveness. By conducting thorough research and due diligence, you can find a trusted partner like Account Cloud to handle your financial affairs efficiently, allowing you to focus on growing your business with peace of mind.

#Bookkeeping Services Melbourne#Bookkeeping Services Brisbane#Bookkeeping Services Perth#Perth Bookkeeping Services#Adelaide Bookkeeping Services#Online Bookkeeping and Accounting Perth#Online Bookkeeping Services Melbourne#Small Business Bookkeeping Services Brisbane#Small Business Bookkeeping Services Sydney#Small Business Bookkeeping Services Perth#Small Business Bookkeeping Services NSW#Premier Tax and Bookkeeping Adelaide#Tax and Accounting Services Brisbane#Tax and Accounting Services Sydney#Tax and Accounting Services Perth#Personal Tax Accountant Brisbane

3 notes

·

View notes

Text

Bookkeeping Company in Denver

Aqtoro is the best Bookkeeping Company in Denver that understands the needs and concerns of businesses as the accounting needs of every firm are unique, and accordingly, our experts provide the right online bookkeeping services to businesses in Denver.

#Bookkeeping and Accounting Services For Small Business in Denver#Accounting and Bookkeeping Services in Denver#payroll & bookkeeping services in denver#Bookkeeping Company in Denver#Online Bookkeeping in Denver#Bookkeeping and Tax Services Denver#Local Bookkeeping Services Denver

3 notes

·

View notes

Text

Website : https://en.intertaxtrade.com

Intertaxtrade, established in the Netherlands, excels in facilitating international business and assisting individuals in Europe with integrated solutions in tax, finance, and legal aspects. Registered with the Chamber of Commerce, they offer services like company management in the Netherlands, Dutch company accounting, tax intermediation, international tax planning, business law consulting, EU trademark and intellectual property registration, international trade advice, and GDPR compliance. Their expertise in financial and accounting services ensures clients have a clear financial overview, aiding in business success.

Facebook : https://www.facebook.com/intertaxtrade

Instagram : https://www.instagram.com/intertaxtrade/

Linkedin : https://www.linkedin.com/in/ramosbrandao/

Keywords: company registration netherlands legal advice online comprehensive financial planning financial planning consultancy international business services international business expansion strategies gdpr compliance solutions international trade consulting european investment opportunities gdpr compliance consulting services in depth financial analysis gdpr compliance assistance cross border tax solutions netherlands business environment european union business law dutch accounting services tax intermediation solutions international tax planning advice eu trademark registration services investment guidance online business law consultancy corporate tax services netherlands financial analysis experts business immigration support startup legal assistance online european market entry consulting international financial reporting services business strategy netherlands tax authority communication support international business law expertise dutch commercial law advice global business strategy services european business consulting online international business services platform expert legal advice online efficient company registration netherlands reliable dutch accounting services strategic tax intermediation proactive international tax planning eu trademark registration support tailored investment guidance specialized business law consultancy dynamic international trade consulting holistic corporate tax services netherlands streamlined business immigration support online startup legal assistance strategic international business expansion european market entry planning innovative cross border tax solutions navigating the netherlands business environment european union business law insights accurate international financial reporting proven business strategy netherlands exclusive european investment opportunities seamless tax authority communication in depth dutch commercial law advice comprehensive global business strategy proactive european business consulting one stop international business services personalized financial planning solutions expert legal advice for businesses quick company registration in netherlands trustworthy dutch accounting services strategic tax intermediation solutions innovative international tax planning efficient eu trademark registration tailored investment guidance online business law consultancy expertise comprehensive corporate tax services netherlands thorough financial analysis support streamlined business immigration assistance navigating netherlands business environment european union business law guidance international financial reporting accuracy business strategy for netherlands market european investment opportunities insights efficient tax authority communication international business law excellence dutch commercial law proficiency global business strategy implementation european business consulting excellence comprehensive international business services proactive financial planning strategies expert legal advice on international matters

#company registration netherlands#legal advice online#comprehensive financial planning#financial planning consultancy#international business services#international business expansion strategies#gdpr compliance solutions#international trade consulting#european investment opportunities#gdpr compliance consulting services#in depth financial analysis#gdpr compliance assistance#cross border tax solutions#netherlands business environment#european union business law#dutch accounting services#tax intermediation solutions#international tax planning advice#eu trademark registration services#investment guidance online#business law consultancy

4 notes

·

View notes

Text

25 ways to be a little more punk in 2025

Cut fast fashion - buy used, learn to mend and/or make your own clothes, buy fewer clothes less often so you can save up for ethically made quality

Cancel subscriptions - relearn how to pirate media, spend $10/month buying a digital album from a small artist instead of on Spotify, stream on free services since the paid ones make you watch ads anyway

Green your community - there's lots of ways to do this, like seedbombing or joining a community garden or organizing neighborhood trash pickups

Be kind - stop to give directions, check on stopped cars, smile at kids, let people cut you in line, offer to get stuff off the high shelf, hold the door, ask people if they're okay

Intervene - learn bystander intervention techniques and be prepared to use them, even if it feels awkward

Get closer to your food - grow it yourself, can and preserve it, buy from a farmstand, learn where it's from, go fishing, make it from scratch, learn a new ingredient

Use opensource software - try LibreOffice, try Reaper, learn Linux, use a free Photoshop clone. The next time an app tries to force you to pay, look to see if there's an opensource alternative

Make less trash - start a compost, be mindful of packaging, find another use for that plastic, make it a challenge for yourself!

Get involved in local politics - show up at meetings for city council, the zoning commission, the park district, school boards; fight the NIMBYs that always show up and force them to focus on the things impacting the most vulnerable folks in your community

DIY > fashion - shake off the obsession with pristine presentation that you've been taught! Cut your own hair, use homemade cosmetics, exchange mani/pedis with friends, make your own jewelry, duct tape those broken headphones!

Ditch Google - Chromium browsers (which is almost all of them) are now bloated spyware, and Google search sucks now, so why not finally make the jump to Firefox and another search like DuckDuckGo? Or put the Wikipedia app on your phone and look things up there?

Forage - learn about local edible plants and how to safely and sustainably harvest them or go find fruit trees and such accessible to the public.

Volunteer - every week tutoring at the library or once a month at the humane society or twice a year serving food at the soup kitchen, you can find something that matches your availability

Help your neighbors - which means you have to meet them first and find out how you can help (including your unhoused neighbors), like elderly or disabled folks that might need help with yardwork or who that escape artist dog belongs to or whether the police have been hassling people sleeping rough

Fix stuff - the next time something breaks (a small appliance, an electronic, a piece of furniture, etc.), see if you can figure out what's wrong with it, if there are tutorials on fixing it, or if you can order a replacement part from the manufacturer instead of trashing the whole thing

Mix up your transit - find out what's walkable, try biking instead of driving, try public transit and complain to the city if it sucks, take a train instead of a plane, start a carpool at work

Engage in the arts - go see a local play, check out an art gallery or a small museum, buy art from the farmer's market

Go to the library - to check out a book or a movie or a CD, to use the computers or the printer, to find out if they have other weird rentals like a seed library or luggage, to use meeting space, to file your taxes, to take a class, to ask question

Listen local - see what's happening at local music venues or other events where local musicians will be performing, stop for buskers, find a favorite artist, and support them

Buy local - it's less convenient than online shopping or going to a big box store that sells everything, but try buying what you can from small local shops in your area

Become unmarketable - there are a lot of ways you can disrupt your online marketing surveillance, including buying less, using decoy emails, deleting or removing permissions from apps that spy on you, checking your privacy settings, not clicking advertising links, and...

Use cash - go to the bank and take out cash instead of using your credit card or e-payment for everything! It's better on small businesses and it's untraceable

Give what you can - as capitalism churns on, normal shmucks have less and less, so think about what you can give (time, money, skills, space, stuff) and how it will make the most impact

Talk about wages - with your coworkers, with your friends, while unionizing! Stop thinking about wages as a measure of your worth and talk about whether or not the bosses are paying fairly for the labor they receive

Think about wealthflow - there are a thousand little mechanisms that corporations and billionaires use to capture wealth from the lower class: fees for transactions, interest, vendor platforms, subscriptions, and more. Start thinking about where your money goes, how and where it's getting captured and removed from our class, and where you have the ability to cut off the flow and pass cash directly to your fellow working class people

36K notes

·

View notes

Text

The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman, introduces several tax reforms aimed at enhancing trade facilitation and compliance within India’s Goods and Services Tax (GST) framework. These reforms have significant implications for GST registration requirements, return filing processes and overall tax governance. Understanding these changes is crucial for businesses and individuals engaged in taxable activities. Read.

#legal#tax#legal services#gst registration#new gst registration#GST Return Filing#file gst return#tds return filing#online tds return filing#Income Tax Return Filing#company income tax return filing

0 notes

Text

When do I need to pay tax on capital gains from mutual funds in Chennai?

Capital gains tax applies when you redeem or sell your mutual funds, and the rate that applies depends on the holding period. Investors can rely on Fairmoves for expert guidance on managing tax on capital gains from mutual funds in Chennai efficiently.

For More information visit : https://www.fairmoves.in/tax-consultant-in-chennai.php

#tax planning services in Chennai#best tax planning company in Chennai#tax on capital gains from mutual funds in Chennai#gst filing services in Chennai#GST Audit advisor in Chennai#tax filing advisor in Chennai#tax filing consultants in Chennai#income tax filing consultant in Chennai#tax consultant in Chennai#gst return filing online in Chennai

0 notes

Text

Simplify Your VAT Returns with Expert Outsourcing Services!

Struggling with VAT returns? Save time, reduce errors, and ensure compliance with professional VAT returns outsourcing services. Let experts handle your VAT filings while you focus on growing your business.

#VAT Return Services#VAT Returns outsourcing Services#VAT Return online#Outsourced VAT returns services UK#VAT returns services UK#Tax Compliance#Outsourcing

0 notes

Text

#accounting#tax#Tax services#income tax#tax return#online tax services#bookkeeping#finance#outsourcing#startup#accounting softwares#offshore#freshbooks#netsuite#online business

0 notes

Text

Online Tax Services Boost Companies and Provide Relief

Online tax services save time and money, helping Calgary businesses expand. Digital tools make tax accountants' jobs easier and allow them to take on more customers.

Save Time with Automation

Online tax services automate client data collection, deduction and credit calculations, and return filing. Focus on more sophisticated customer demands by spending less time on repetitive activities and data input. Many systems can save time by pulling data from clients' bank and investment accounts.

Reduce Costs

Traditional tax prep software is more expensive than online options. A low monthly membership gives you powerful features. You may save clients’ money by charging less. Digital automation reduces paper, ink, and office supply costs.

Improve Accuracy

Errors are reduced by sophisticated algorithms that double-check. Software updates constantly with the latest tax laws and forms, and alerts advise you of any concerns. Precision and precision establish service trust.

Improve Security

Client data is protected by leading tax software's high encryption and security. Two-factor authentication, data limits, and activity logs reduce identity theft and fraud. Clients may securely share documents and interact via portals.

Get More Customers

Online presence attracts more customers. Promote your website, social media, and Yelp or Google My Business listing. Give clients an easy way to obtain tax paperwork and resources. Online ease draws techies.

Calgary tax accountants may save time and improve customer service with the correct digital tools. Look for software with automation, affordability, security, and other capabilities that enhance productivity and accelerate business growth.

Conclusion

Take your tax bill before your tax bill surprises you. Contact online tax services today to ensure you pay what you owe. Their skill allows them to identify every deduction and credit you deserve. Why give the government money that could help you? A skilled accountant is priceless. Invest in yourself and your finances. You will thank yourself next tax season.

0 notes

Text

Do you need GST filing training? We are your right stop. Learn at your own pace, with our expert-led sessions and interactive content. Our course covers everything from GST basics to advanced return filing techniques. For more information, you can call us at 7530813450.

#gst registration service#income tax certification course#partnership firm registration services#best income tax course#basic gst course#gst basic course#basic gst course online#gst filing training#best income tax preparation courses#best income tax course online

0 notes

Text

#tax preparation services in west palm beach#online e-filing services in usa#e-filing services in west palm beach#Instant Tax Refund Services in USA

0 notes

Text

How to Apply for a Thailand Business Visa: Step-by-Step Process (2025)

Thinking of working or starting a business in Thailand? You’ll need a Thailand Business Visa!

✅ Step-by-step application guide ✅ Visa requirements & document checklist ✅ Expert tips for smooth approval

📩 Let AMI Advisor handle your Visa & Work Permits Services in Thailand so you can focus on your business!

📞 Call us now: +66 (0)93 580 4536 🔗 Read more: https://ami-advisor.com

#ThailandBusinessVisa #VisaAssistanceThailand #ThailandVisa #BusinessVisaThailand #WorkInThailand #AMIAdvisor #ThaiVisaExperts

#bookkeeping services thailand#corporate services thailand#tax consultant thailand#thai business visa#thailand visa#study visa#bookkeeping#accounting software thailand#company incorporation#thailand visa online#Visa Assistance Thailand#Bookkeeping Services Thailand#Thai Business Visa#Tax Consultant Thailand#Payroll Services Thailand#Accounting Software Thailand#Expat Tax Services Thailand#Corporate Services Thailand#Financial Planning Services Thailand

0 notes