#gst filing services in Chennai

Explore tagged Tumblr posts

Text

How does the best tax planning company in Chennai benefit investors

Partnering with the best tax planning company in Chennai, like Fairmoves, can significantly ease your financial life. For investors, this means access to professional help. They provide you with such specialized services, helping you make informed decisions that could lead to increased savings and better investment returns. This allows you to focus on your financial goals with the assurance that your tax planning is in capable hands. So you can potentially free up more capital for your investment portfolio and secure your financial future.

For More Information visit : https://www.fairmoves.in/tax-consultant-in-chennai.php

#tax planning services in Chennai#best tax planning company in Chennai#tax on capital gains from mutual funds in Chennai#gst filing services in Chennai#GST Audit advisor in Chennai#tax filing consultants in Chennai#tax filing advisor in Chennai#income tax filing consultant in Chennai#tax consultant in Chennai#gst return filing online in Chennai#Tax preparation services in chennai#Income tax filing assistance in chennai

0 notes

Text

#Company Registration in Chennai#Business Name Registration in Chennai#Company Formation in Chennai#Register Company Name in Chennai#Company Setup in Chennai#Income Tax Fillings in Chennai#Zero Tax Return in Chennai#Income Refund in Chennai#Clear Tax Filing in Chennai#Incometax Returns in Chennai#GST filing in Chennai#GST return filing services in Chennai#Annual GST return in Chennai#Business GST filing in Chennai#GST filing services in Chennai

0 notes

Text

A Deep Dive into GST and Taxation in India

Unraveling GST

The Goods and Services Tax (GST) is a revolutionary reform in India’s indirect tax system. It has replaced numerous indirect taxes, such as excise duty, VAT, and services tax. This comprehensive, multi-stage, destination-based tax is levied on every value addition.

The Multi-Stage Nature of GST

An item undergoes multiple change-of-hands along its supply chain: from manufacture to the final sale to the consumer. The stages include:

Purchase of raw materials

Production or manufacture

Warehousing of finished goods

Selling to wholesalers

Sale of the product to the retailers

Selling to the end consumers

GST is levied on each of these stages, making it a multi-stage tax.

Value Addition and GST

Consider a manufacturer who makes biscuits. They buy flour, sugar, and other materials. The value of the inputs increases when the sugar and flour are mixed and baked into biscuits. GST is levied on these value additions, i.e., the monetary value added at each stage to achieve the final sale to the end customer.

Destination-Based Taxation

Let’s consider goods manufactured in Maharashtra and sold to the final consumer in Karnataka. Since GST is levied at the point of consumption, the entire tax revenue will go to Karnataka and not Maharashtra.

The Evolution of GST in India

The journey of GST in India began in the year 2000 when a committee was set up to draft the law. It took 17 years for the Law to evolve. In 2017, the GST Bill was passed in the Lok Sabha and Rajya Sabha. On 1st July 2017, the GST Law came into force.

The Impact of GST

GST has simplified the tax regime and enhanced the ease of doing business in India. It is a comprehensive tax system that has subsumed almost all the indirect taxes except a few state taxes. By levying the tax at the point of consumption, GST has ensured a fair distribution of tax revenues among states.

Conclusion

GST has brought about a significant change in the Indian taxation system. It has simplified the tax structure, making it easier for businesses to comply. Moreover, it has ensured a fair distribution of tax revenues among states. As India continues to grow and evolve, GST will play a crucial role in shaping the country’s economic landscape.

#gst#gst history#efiletax#business#gst services#gst filing chennai#gst filing#gst india#taxes#income tax

0 notes

Text

Can I Sell Online Without GST? GST Requirements for E-commerce

In 2024, the trend of e-commerce has transformed the way people shop and businesses operate online. Whether you're selling groceries, electronic items, or running a full-fledged online store, the question of GST (Goods and Services Tax) often arises. GST is a consumption tax levied on the supply of goods and services in Chennai, Tamilnadu designed to replace various indirect taxes.

What is GST?

GST is a comprehensive indirect tax on online store, sale, and consumption of goods and services throughout India, aimed at simplifying the tax structure on consumers. It is mandatory for businesses whose turnover exceeds specified thresholds to register under GST and comply with its regulations.

You Need GST for Selling Online on Shocals

The requirement for GST registration depends primarily on your turnover and the category of your business. Here are some key points to consider for GST:

Threshold Limits: As of the latest information available, businesses with an aggregate turnover exceeding Rs. 40 lakhs (Rs. 10 lakhs for northeastern states) in a financial year must register for GST. This turnover includes all taxable supplies, exempt supplies, exports of goods and services, and inter-state supplies.

Inter-state Tamilnadu Sales: If you are selling goods or services to customers in different states, you are likely to exceed the turnover threshold sooner. GST registration is mandatory for businesses making inter-state supplies, regardless of turnover.

Mandatory Registration: Even if your turnover is below the threshold, you may choose to voluntarily register for GST. This can be beneficial for claiming input tax credits on purchases and improving your business credibility.

Selling on Shocals Partners

If you are selling through popular Shocals Partners, you need to understand the policies regarding GST compliance. It requires sellers to provide GSTIN (GST Identification Number) during registration and ensure compliance with GST laws.

Steps to Register for GST

If you decide to register for GST, here's a brief overview of the registration process:

Prepare Documents: Keep your PAN (Permanent Account Number), proof of business registration, identity and address proof, bank account details, and business address proof.

Online Registration: Visit the GST portal (www.gst.gov.in) and fill out the registration form with required details. Upload scanned copies of documents as specified.

Verification: After submission, your application will be verified by the GST authorities. Once approved, you will receive your GSTIN and other credentials.

Benefits of GST Registration

While GST compliance involves maintaining proper accounting records and filing periodic returns, it offers several advantages:

Input Tax Credit: You can claim credit for GST paid on your business purchases, thereby reducing your overall tax liability.

Legal Compliance: Avoid penalties and legal repercussions by operating within the GST framework.

Business Expansion: Facilitates smoother inter-state and international sales, enhancing business opportunities.

Conclusion

In conclusion, while small businesses and startups may initially wonder if they can sell online without GST, understanding the thresholds and benefits of GST registration is crucial. Compliance not only ensures legal adherence but also opens avenues for business growth and competitiveness in the digital marketplace. Whether you're a budding entrepreneur or an established seller, staying informed about GST requirements will help you navigate the e-commerce landscape more effectively.

For more details please visit - https://partner.shocals.com/

2 notes

·

View notes

Text

ERP Trends in Chennai: What Local Businesses Need to Know in 2025 As Chennai continues to evolve into a major business and tech hub, Enterprise Resource Planning systems are becoming essential for local businesses aiming to streamline operations and stay competitive. In 2025, several key ERP trends are shaping the way companies in Chennai adopt and use these systems.

Cloud-First ERP Adoption More Chennai-based businesses are shifting to cloud-based ERP solutions. Cloud platforms offer scalability, lower upfront costs, and easier remote access—ideal for companies in manufacturing, logistics, and services that require flexibility and real-time collaboration.

AI & Automation Integration AI-powered features are being embedded into ERP systems to automate repetitive tasks, improve forecasting, and enhance decision-making. In Chennai’s competitive SME sector, this trend helps businesses reduce manual errors and boost productivity.

Localized Solutions for Compliance With frequent changes in GST, tax filing, and local labor laws, businesses are turning to ERP providers that offer localized compliance features.

Mobile ERP for On-the-Go Access As mobile usage continues to grow, especially among field service teams and warehouse managers, mobile-friendly ERP systems are in demand. Chennai businesses are embracing mobile ERP for inventory tracking, reporting, and real-time approvals.

Industry-Specific ERP Customizations From automotive manufacturing to textile exports, companies in Chennai are opting for ERP systems that cater specifically to their industry workflows. This trend reduces implementation time and maximizes ROI.

Conclusion Partnering with a forward-thinking ERP software company in Chennai that understands the region’s unique challenges and industries is key to future growth.

1 note

·

View note

Text

Tally Software Service In Chennai

Tally Software Service in Chennai – A Complete Guide for Businesses

In today’s fast-moving business world, managing accounts and financial data is very important. Tally software is one of the best tools available for this. It is used by businesses of all sizes to handle accounting, GST, inventory, payroll, and more. If you are a business owner in Chennai looking to make your accounting simple and accurate, then using a good Tally Software Service in Chennai can be the best decision for you.

What is Tally Software?

Tally is accounting software that helps businesses keep track of their financial transactions. It is easy to use and very powerful. With Tally, you can manage your books of accounts, create invoices, generate GST reports, monitor stock, and process payroll — all in one place. It saves time and reduces mistakes.

The latest version of Tally in TallyPrime, which is more user-friendly and flexible than earlier versions. TallyPrime helps you make faster decisions by showing clear business reports and summaries.

Why Do You Need Tally Software Service?

Just buying the Tally software is not enough. You need support to install, set up, and maintain it. This is where Tally Software Service in Chennai becomes helpful. A Tally service provider gives you full support, updates, training, and customization based on your business needs.

Benefits of Tally Software Service in Chennai

Here are some of the key advantages:

1. Expert Installation and Setup

A trained team can install Tally software properly on your systems and configure it according to your business model. Whether you run a shop, a trading company, or a manufacturing unit, experts can set up Tally to suit your needs.

2. Training and Support

Many business owners and employees may not know how to use Tally in the beginning. A local Tally Software Service in Chennai will offer training to your staff. They will teach you how to create vouchers, manage stock, file GST returns, and generate reports.

4. Tally Upgrades and AMC (Annual Maintenance Contract)

Tally software keeps updating to include new features and improvements. A Tally service provider in Chennai will help you upgrade your software easily. You can also sign an AMC with them so they take care of regular maintenance and any problems that come up.

5. GST Support

GST compliance is one of the most important features of Tally. Your Tally service provider will help you with GST setup, GST return filing, and error-free reports.

Who Can Use Tally Software?

Tally is useful for almost every business type. Here are some examples:

Retail Shops: For billing, stock management, and GST returns.

Wholesalers and Distributors: To handle inventory and track receivables.

No matter what industry you are in, Tally can be customized to fit your needs.

How to Choose the Best Tally Software Service in Chennai?

With many companies offering Tally services, you need to choose the right one. Here are some tips:

Check Experience: Choose a service provider with many years of experience in Tally support.

Customer Reviews: Look for good customer feedback and testimonials.

Final Thoughts

Tally is an essential tool for every modern business. It makes accounting simple, fast, and error-free. But to get the best out of it, you need reliable support. Choosing a good Tally Software Service in Chennai ensures that you get expert help whenever you need it. From setup to training and from troubleshooting to updates, they can take care of everything. This way, you can focus more on growing your business and less on accounting problems.

0 notes

Text

💻 𝗘𝘅𝗽𝗲𝗿𝗶𝗲𝗻𝗰𝗶𝗻𝗴 𝗕𝗹𝘂𝗲 𝗦𝗰𝗿𝗲𝗲𝗻 𝗘𝗿𝗿𝗼𝗿𝘀 𝗼𝗻 𝗬𝗼𝘂𝗿 𝗛𝗣 𝗟𝗮𝗽𝘁𝗼𝗽? 𝗪𝗲 𝗖𝗮𝗻 𝗛𝗲𝗹𝗽!

Is your HP laptop stuck on a blue screen, also known as the Blue Screen of Death (BSOD)? Don’t worry! 𝗥𝗮𝗺𝗶𝗻𝗳𝗼𝘁𝗲𝗰𝗵 𝗟𝗮𝗽𝘁𝗼𝗽 𝗦𝗲𝗿𝘃𝗶𝗰𝗲 𝗖𝗵𝗲𝗻𝗻𝗮𝗶 𝗣𝘃𝘁 𝗟𝘁𝗱-𝗚𝘂𝗱𝘂𝘃𝗮𝗻𝗰𝗵𝗲𝗿𝘆 specializes in diagnosing and fixing blue screen errors to get your device back up and running smoothly.

🔧 𝗖𝗼𝗺𝗺𝗼𝗻 𝗖𝗮𝘂𝘀𝗲𝘀 𝗼𝗳 𝗕𝗹𝘂𝗲 𝗦𝗰𝗿𝗲𝗲𝗻 𝗘𝗿𝗿𝗼𝗿𝘀:

Driver Issues: Outdated or incompatible drivers causing system crashes

Hardware Failures: Problems with RAM, hard drives, or other components

Corrupted Files: Damaged system files disrupting normal operation

Overheating: Excessive heat affecting performance and stability

Malware and Viruses: Harmful software causing system instability

💻 𝗢𝘂𝗿 𝗕𝗹𝘂𝗲 𝗦𝗰𝗿𝗲𝗲𝗻 𝗘𝗿𝗿𝗼𝗿 𝗥𝗲𝗽𝗮𝗶𝗿 𝗦𝗲𝗿𝘃𝗶𝗰𝗲𝘀 𝗜𝗻𝗰𝗹𝘂𝗱𝗲:

Comprehensive Diagnostics to Identify the Root Cause

Driver Updates and Reinstallations

Hardware Testing and Replacement

System File Repair and Restoration

Malware Removal and Protection Solutions

💡 𝗪𝗵𝘆 𝗖𝗵𝗼𝗼𝘀𝗲 𝗥𝗮𝗺𝗶𝗻𝗳𝗼𝘁𝗲𝗰𝗵 𝗟𝗮𝗽𝘁𝗼𝗽 𝗦𝗲𝗿𝘃𝗶𝗰𝗲 𝗖𝗵𝗲𝗻𝗻𝗮𝗶 𝗣𝘃𝘁 𝗟𝘁𝗱-𝗚𝘂𝗱𝘂𝘃𝗮𝗻𝗰𝗵𝗲𝗿𝘆?

Experienced Technicians: Skilled in HP laptop repairs

Quality Service: Fast, reliable repairs with customer satisfaction guaranteed

Genuine Parts: Use of high-quality components for replacements

Friendly Support: Committed to helping you understand and resolve your issues

📌𝗥𝗮𝗺𝗶𝗻𝗳𝗼𝘁𝗲𝗰𝗵 𝗟𝗮𝗽𝘁𝗼𝗽 𝗦𝗲𝗿𝘃𝗶𝗰𝗲 𝗖𝗵𝗲𝗻𝗻𝗮𝗶 𝗣𝘃𝘁 𝗟𝘁𝗱-𝗚𝘂𝗱𝘂𝘃𝗮𝗻𝗰𝗵𝗲𝗿𝘆

👉No 94 ,1 st Floor, Gst road ,Guduvanchery Chennai,Tamil Nadu 603202

Landmark : Near Chellamani & Co

☎️ Ph : 9841983638

0 notes

Text

5 Legal Benefits of a Virtual Office Address in Chennai

In the era of digital businesses, startups, and remote work, the traditional concept of a physical office is rapidly evolving. For entrepreneurs and professionals looking to establish a legitimate business presence without the financial burden of renting a full-fledged commercial space, virtual offices offer a practical and legally sound alternative.

Chennai, with its booming IT sector, robust infrastructure, and business-friendly ecosystem, is fast becoming a preferred destination for setting up new enterprises. In this article, we explore the five major legal benefits of using a virtual office address in Chennai, and how this smart solution can help your business maintain full compliance with minimal overhead.

1. Legally Valid for Business Registration

One of the primary legal advantages of using a virtual office address is that it qualifies as a legitimate registered business address. In India, the Ministry of Corporate Affairs (MCA) requires every business to declare a registered office address for incorporation. Similarly, if you're setting up a sole proprietorship or partnership firm, local authorities mandate an address for issuing licenses or trade permissions.

A professionally managed virtual office in a commercial zone meets all the documentation requirements:

No Objection Certificate (NOC) from the space provider

Rent Agreement between the virtual office provider and your business

Utility Bill (such as electricity or water bill) as proof of premises

These documents are essential when incorporating your company, obtaining a Shop & Establishment license, or applying for MSME/Udyam registration.

Why it matters legally: Using a residential address, or an address not authorized for commercial activity, can lead to rejection of your registration application or even penalties under the Companies Act. A virtual office eliminates this risk while keeping your compliance in check.

2. Supports GST Registration and Compliance

If your business is supplying taxable goods or services, it is mandatory to register for Goods and Services Tax (GST). GST registration requires the submission of valid address proof documents—something virtual office providers are well-equipped to deliver.

In Chennai, several virtual office services offer dedicated GST registration support by providing:

Latest utility bills

Legally stamped rent agreements

Signed NOCs from the owner

Additionally, many offer signage facilities or limited access to their premises, which becomes helpful if the GST officer conducts a physical verification.

Legal advantage: Attempting to register with an invalid address or incomplete documentation can delay your GST approval or result in legal complications, including notices under GST regulations. A compliant virtual office streamlines the entire process and gives your business a lawful GST presence.

3. Protects Privacy While Maintaining Legal Identity

A less obvious but crucial legal benefit is privacy protection. When registering your business, your registered office address becomes part of public records. For freelancers, consultants, or solopreneurs who work from home, using their residential address exposes personal information online.

A virtual office address solves this by offering a legally recognized commercial address that appears on:

ROC filings (Registrar of Companies)

Public business directories

Invoices and contracts

Legal and statutory correspondence

This setup ensures your home address remains confidential, yet your business retains a legitimate identity in the eyes of the law.

Why this is important: In today’s digital environment, protecting personal data is not only a matter of preference but often a legal requirement under data privacy regulations. Virtual offices offer a compliant alternative while shielding you from unwanted attention or data misuse.

4. Compliant with Licensing and Regulatory Approvals

Many industries in India require additional licenses or sector-specific approvals, depending on the nature of operations. Whether you're applying for an FSSAI license, Import Export Code (IEC), or a Shops & Establishments Certificate, a virtual office address can be used as the principal place of business—provided it is commercially zoned.

Chennai’s virtual office providers are often located in areas approved for commercial activity, such as:

Teynampet

Guindy

Anna Salai

Nungambakkam

OMR (Old Mahabalipuram Road)

This zoning compliance is critical because authorities may reject applications if the address is located in a residential area not sanctioned for business use.

Legal benefit: By using a compliant virtual address, your business avoids delays, rejections, or revocation of licenses. This is particularly useful when scaling into e-commerce, food delivery, import/export, or regulated services.

5. Accepted for Legal Notices and Government Communication

Another significant legal perk is that your virtual office address is recognized for receiving official legal correspondence, notices, and communication from government departments.

As per the Companies Act and other statutory laws, all communication—including legal notices, tax letters, and compliance audits—will be sent to the registered office address. A virtual office ensures:

Mail and courier handling with notification systems

Forwarding of official documents to your designated contact

In some plans, scanning and emailing of legal communication

This feature not only keeps you compliant but also ensures you never miss important updates from the Registrar of Companies, GST authorities, or municipal bodies.

Why this matters: Failing to receive or respond to legal notices can result in serious consequences—penalties, fines, or even cancellation of licenses. A virtual office provides a structured and professional solution to stay legally connected at all times.

Additional Legal Considerations When Using a Virtual Office

While virtual offices offer immense legal benefits, it’s important to understand certain boundaries and best practices to stay fully compliant:

1. Avoid Misrepresentation

You should clearly state your business type and location on official documents. Do not mislead customers or authorities by claiming the virtual office as your operational headquarters if you don't conduct operations there.

2. Use a Reputable Provider

Not all virtual offices are created equal. Ensure your provider offers legally valid documents and has a clean track record. Verify their registration and ask for sample agreements before committing.

3. Keep Records Updated

If you change your virtual office address, notify relevant authorities promptly—MCA, GST, banks, and licensing bodies. Keeping outdated records can lead to non-compliance issues.

Use Case: How a Freelancer Registered Legally Using a Virtual Office in Chennai

Ravi, a freelance UX designer, wanted to register as a sole proprietor and obtain a GST number to work with corporate clients. Renting a commercial space was out of his budget. Instead, he opted for a virtual office located in T Nagar.

With the virtual office provider’s help, he obtained:

A legally binding rent agreement

NOC from the property owner

Utility bill as address proof

He successfully registered his sole proprietorship with the Chennai municipal authorities, acquired GST registration, and even used the address on his website and invoices.

Today, Ravi operates remotely but maintains a legally recognized business presence, protecting his privacy and enhancing his credibility—all without stepping into a traditional office.

Final Thoughts

For remote-first entrepreneurs, freelancers, and startups in Chennai, the benefits of using a virtual office go beyond just cost savings or image enhancement. The legal advantages they offer are substantial and often critical to the success and sustainability of your business.

From enabling official company registration and GST compliance to protecting your privacy and ensuring you're reachable for legal correspondence, a virtual office lays the groundwork for a legally sound business operation.

With a virtual office in Chennai, you can confidently establish your legal footprint in one of India’s top business cities—without being tied to a traditional workspace.

0 notes

Text

Customs Brokerage: The Key to Hassle-Free International Trade

In the world of international shipping, clearing customs can be one of the most complex and time-consuming parts of the supply chain. That’s where customs brokerage services come in—helping businesses navigate the rules, regulations, and paperwork that govern the movement of goods across borders.

If you're an importer or exporter searching for the best customs brokerage service in India, understanding what these services offer and how to choose the right one is critical for smooth, timely, and compliant international trade.

What is Customs Brokerage?

Customs brokerage is the process of facilitating the import or export of goods through a country’s customs authorities. Licensed customs brokers ensure that all documentation is complete, duties and taxes are calculated correctly, and goods are cleared in accordance with the latest regulations.

Key Services Provided by a Customs Broker

Filing import/export documentation

Classification of goods under the correct HS code

Payment of customs duties and GST

Liaising with Indian Customs, DGFT, and port authorities

Compliance with import/export regulations and restrictions

Handling bonded warehouse documentation

Why You Need a Customs Brokerage Service

Navigating customs clearance is not just about paperwork—errors or non-compliance can lead to fines, shipment delays, or even confiscation of goods.

Here’s how customs brokers add value:

Save Time: Avoid delays with accurate filing and documentation

Avoid Penalties: Ensure full compliance with current laws

Peace of Mind: Let experts handle interactions with customs officers

Faster Clearance: Brokers streamline the process for quick release

Cost Efficiency: Optimize duties through correct tariff classifications

🇮🇳 Finding the Best Customs Brokerage Service in India

India's import-export landscape is dynamic, and regulations often change. Choosing the best customs brokerage service in India means partnering with professionals who have the expertise and local knowledge to handle your specific industry requirements.

What to Look For:

Government licensing and compliance certifications (CHA license)

Experience with your type of cargo or industry

Presence at key ports and airports

Integration with freight forwarding or warehousing services

Proactive communication and real-time shipment updates

Transparent pricing without hidden charges

Top Customs Brokerage Companies in India

Some of the most trusted names in Indian customs clearance include:

DHL Global Forwarding India

Blue Dart Express Ltd.

Allcargo Logistics

DB Schenker India

Jeena & Company

Skyways Group

Kuehne + Nagel India

Total Transport Systems Ltd.

These companies have experienced customs clearance agents and provide end-to-end logistics support, making them leading contenders for the best customs brokerage service in India.

Real-World Impact of Good Customs Brokerage

A pharmaceutical firm avoids spoilage of temperature-sensitive imports through expedited customs clearance.

An electronics company saves lakhs in duties through correct HS code classification.

A textile exporter increases turnaround by using bonded warehousing combined with swift document filing.

Customs at India’s Key Ports & Airports

Top Indian entry/exit points include:

JNPT (Nhava Sheva), Mumbai

Chennai Port

Mundra Port

Delhi IGI Airport

Bangalore Kempegowda Airport

Kolkata Port

The best customs brokers in India maintain a strong presence at these gateways to expedite shipment processing.

Final Thoughts

In a complex and competitive global market, customs clearance can make or break a shipment. Partnering with the best customs brokerage service in India ensures your goods move quickly, safely, and in full compliance with the law.

Whether you're importing raw materials or exporting finished products, a trusted customs broker is your silent but essential partner in success.

0 notes

Text

What’s Included in a Full Solar Panel Installation in Chennai?

When you get a quote for solar, do you know what’s actually included? Let’s break down the full package you should expect with a proper solar panel installation in Chennai — so you avoid hidden costs.

1. Core System Components

Every complete setup should include:

Solar Panels – Mono/poly, MNRE-approved

Inverter – On-grid, hybrid, or off-grid

Mounting Structure – Galvanized or aluminum

DCDB & ACDB – Protection boxes

Wiring & Conduits – For safe and clean installation

👉 See what affects pricing: Solar Panel Price in Chennai

2. Services That Must Be Covered

Site assessment

System design and layout

Net metering application

Subsidy filing (if applicable)

Installation and commissioning

Basic training to use the system

👉 Explore service flow: Solar Panel Installation in Chennai

3. What You Should Clarify Before Finalizing

Does the price include GST?

Are metering and TANGEDCO charges covered?

Is transportation free?

Is the warranty printed in writing?

4. Add-ons (Optional but Useful)

WiFi/App-based monitoring

Battery backup (for power cuts)

Anti-theft panel locks

Custom roof elevation frames

HelioStrom offers add-ons as part of a personalized package to suit your rooftop and usage.

Final Thoughts

Don’t fall for “cheap” quotes that skip essential components. A complete solar panel installation in Chennai should cover panels, hardware, safety, net metering, and service — all under one clear cost. With HelioStrom, what you see is what you get.

0 notes

Text

Auditors and Accountants

https://www.aska1.com/single-business-category/auditors-and-accountants/

🔍 Trusted Auditors & Accountants Near You! 📊 Need help managing your books or ensuring compliance? Our expert auditors and accountants offer reliable, accurate financial services tailored to your business needs.

✅ Tax Filing ✅ Internal Audits ✅ GST & TDS ✅ Bookkeeping ✅ Financial Planning

📍 Serving businesses across Chennai with professional expertise and a personal touch.

📞 Contact us today to keep your finances stress-free!

#AuditorsInChennai #AccountingExperts #TaxFilingServices #FinancialAudit #BusinessCompliance #BookkeepingServices #GSTReturn #ChennaiAccountants

0 notes

Text

How Does GST Audit Advisor in Chennai Prevent Filing Errors?

If you run a business, you already know how important it is to stay on top of financial regulations. But one area that often creates confusion is GST filing. Dealing with GST returns can feel like walking through a maze, especially when you’re trying to do everything right to avoid penalties. Whether you’re a small business owner or an investor trying to maintain clean books. This is why more and more businesses are opting for GST filing services in Chennai to stay worry-free. Having expert support means fewer errors and better compliance.

But even if you're getting help, understanding the basics and common mistakes in GST filing can give you a clearer view of your financials. In this article, we’ll walk you through the most common errors people make while filing GST returns and how to avoid them.

1. Manual Data Entry Errors

Let’s face it: Typing numbers manually always leaves room for mistakes. A small typo in GSTIN, invoice amount, or date can create major problems. These errors can trigger notices or rejections during audits. Always double-check your entries or use digital accounting tools to reduce the chances of these errors.

2. Confusion with Tax Slabs

Every product or service is taxed under a specific GST slab. If you don’t apply the correct rate, it can lead to underpayment or overpayment of tax. This can result in a mismatch when the department cross-verifies your returns, leading to delays or penalties. Always refer to the HSN (Harmonised System of Nomenclature) codes and GST slab list before filing.

3. Skipping NIL Returns

Just because you didn’t make any sales in a particular month doesn’t mean you can skip the GST return. Many investors and startups make this mistake. You must file a NIL return to stay compliant, even when there’s no activity. Ignoring this can attract fines and freeze your GSTIN.

4. Zero-Rated vs Nil-Rated Confusion

Zero-rated supplies (like exports) and nil-rated supplies (like certain essential goods) are not the same. Be sure to understand this distinction clearly before filing your returns.

If you find these processes overwhelming, it might be time to get help from a GST Audit advisor in Chennai. They can help review your filing practices and make sure you're not missing anything important.

5. Incorrect Reverse Charge Filing

Some transactions fall under the Reverse Charge Mechanism (RCM), where the buyer pays the GST instead of the seller. Failing to identify and declare these transactions correctly can lead to interest and penalties. Always check whether a transaction falls under RCM and file it accordingly.

6. Misclassification under GST Heads

Many businesses end up paying GST under the wrong tax heads — CGST, SGST, or IGST. This mistake can affect your returns and lead to notices or demands from the tax department. Knowing which tax head applies to each transaction type is key to staying compliant.

7. Documentation and Bookkeeping Gaps

Maintaining clean and organized records is a must. Inadequate documentation can make audits a nightmare. Make sure to save every invoice, payment proof, and ledger detail. Good documentation helps not just during audits but also while claiming ITC and preparing financial reports.

Conclusion

Whether you're a business owner or an investor, understanding the basics of GST compliance is crucial. It’s not just about avoiding fines, it’s also about building trust, keeping your operations smooth, and staying stress-free during audits. A little help can go a long way for your business or investment portfolio to grow without unnecessary hiccups.

#tax planning services in Chennai#best tax planning company in Chennai#tax on capital gains from mutual funds in Chennai#gst filing services in Chennai#GST Audit advisor in Chennai#tax filing consultants in Chennai#tax filing advisor in Chennai#income tax filing consultant in Chennai#tax consultant in Chennai#gst return filing online in Chennai#Tax preparation services in chennai#Income tax filing assistance in chennai

0 notes

Text

#Company Registration in Chennai#Business Name Registration in Chennai#Company Formation in Chennai#Register Company Name in Chennai#Company Setup in Chennai#Income Tax Fillings in Chennai#Zero Tax Return in Chennai#Income Refund in Chennai#Clear Tax Filing in Chennai#Incometax Returns in Chennai#GST filing in Chennai#GST return filing services in Chennai#Annual GST return in Chennai#Business GST filing in Chennai#GST filing services in Chennai

0 notes

Text

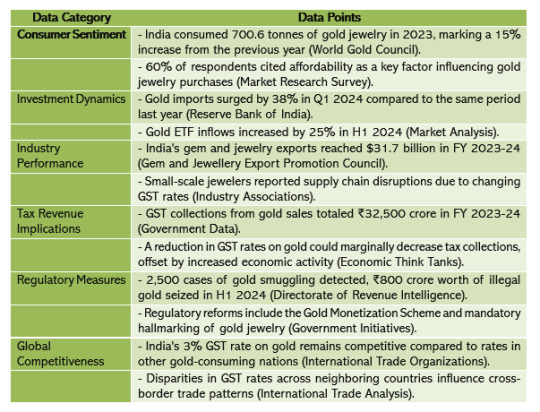

GST on Gold: Effects of Gold GST Rate in India 2024

In 2024, the effects of the Goods and Services Tax (GST) rate on gold continue to resonate throughout India's economy, impacting various stakeholders from consumers to industry players. Let's delve into the implications of the gold GST rate and how it shapes the landscape of the precious metal market:

Consumer Sentiment: The GST rate directly influences the final price of gold for consumers. A lower GST rate makes gold more affordable, encouraging higher demand for jewelry, coins, and bullion among consumers. Conversely, a higher GST rate may deter purchases, particularly among price-sensitive buyers, impacting consumer sentiment and spending patterns.

Investment Dynamics: Gold is revered as a traditional investment asset and a hedge against economic uncertainties. The GST rate affects its attractiveness as an investment avenue. A lower GST rate enhances the appeal of gold investments, attracting investors seeking portfolio diversification and wealth preservation. Conversely, a higher GST rate may prompt investors to explore alternative investment options with potentially higher returns.

Industry Performance: The gold industry, encompassing miners, refiners, jewelers, and retailers, is intricately linked to the prevailing GST rate. A lower GST rate spurs demand for gold jewelry and ornaments, benefiting jewelers and retailers. However, fluctuating GST rates can disrupt supply chains, inventory management, and pricing strategies within the industry, posing challenges for stakeholders.

Tax Revenue Implications: The GST rate on gold significantly contributes to government tax revenues. While a lower GST rate stimulates demand and economic activity in the gold sector, it may lead to a reduction in tax collections. Conversely, a higher GST rate boosts government revenues but could dampen consumer spending and industry growth, necessitating a delicate balance between revenue generation and economic stimulus.

Regulatory Measures: Policymakers continuously monitor and adjust the gold GST rate to achieve broader economic objectives, address inflationary pressures, and ensure fiscal sustainability. Changes in the GST rate are often accompanied by regulatory measures aimed at curbing illicit activities such as smuggling and tax evasion, thereby safeguarding government revenue and market integrity.

Global Competitiveness: The GST rate on gold in India is juxtaposed with rates in other countries, influencing international competitiveness and trade dynamics. Disparities in GST rates between nations can incentivize cross-border trade, impacting domestic markets and necessitating policy responses to maintain a level playing field for industry participants.

In summary, the GST rate on gold in India is a critical determinant of consumer behavior, investment trends, industry dynamics, and government revenues. As policymakers navigate economic challenges and strive to foster growth, they must calibrate the gold GST rate judiciously, balancing the interests of stakeholders while ensuring fiscal prudence and regulatory effectiveness, you need the advice of experts such as efiletax Indeed.

#GST on Gold#Gold GST Rate#Gold GST Rate in India 2024#efiletax#taxes#gst services#gst filing chennai#gst update india#india gst#gold#gst filing

0 notes

Text

Billing software in chennai

Running a business means juggling multiple responsibilities—sales, inventory, customer relationships, and of course, getting paid on time. Whether you're a small business owner, a freelancer, or managing a retail store, having a reliable billing software can make a huge difference.

Let’s explore why billing software is no longer a luxury, but a must-have tool for modern businesses.

🔹 What is Billing Software?

Billing software is a digital tool that helps businesses:

Generate invoices

Track payments

Manage customer records

Apply taxes (like GST)

Send payment reminders

Generate financial reports

Some billing software also includes inventory, accounting, and POS (Point of Sale) features, making it an all-in-one solution.

✅ Top Benefits of Using Billing Software

1. Faster & Professional Invoicing

No more manual templates or handwritten bills. With billing software, you can:

Create branded invoices in seconds

Customize formats with your logo and business details

Share invoices instantly via email or WhatsApp

2. GST Compliance Made Easy

Most billing software is GST-ready, helping you:

Automatically apply the right tax rates

File monthly GST returns

Generate GSTR-1, GSTR-3B reports

Perfect for Indian businesses that need to stay compliant.

3. Real-Time Payment Tracking

Keep tabs on who has paid and who hasn't. Billing software lets you:

View payment status

Send auto-reminders

Track overdue invoices

Maintain a full history of transactions

4. Inventory Integration

If you're selling physical products, many billing tools also help you manage stock:

Auto-update inventory after every sale

Set alerts for low stock

Track batch numbers or expiry dates (great for pharma or grocery)

5. Multiple Payment Options

Make it easy for customers to pay with integrated options like:

UPI

Credit/debit cards

Net banking

Wallets

Some billing software even generates QR codes right on the invoice.

6. Secure & Cloud-Based Access

Modern billing software is cloud-based, meaning:

You can access your data from any device

Your data is securely backed up

Team members can collaborate in real time

7. Detailed Reports & Analytics

Generate powerful reports such as:

Sales summary

Tax reports

Customer-wise billing

Daily/weekly income trends

This helps you make smarter business decisions.

🧾 Who Should Use Billing Software?

Billing software is perfect for:

Retail shops

Wholesalers and distributors

Service-based businesses

Freelancers and consultants

Restaurants and cafes

Salons, spas, and clinics

Manufacturing units

💡 Popular Billing Software Options in India

If you're looking to try one, here are some well-known billing software tools:

Zoho Invoice

TallyPrime

Vyapar

Marg ERP

myBillBook

Busy Accounting Software

GoFrugal

Each one has unique features and pricing, so choose based on your needs and industry.

0 notes

Text

Annual Compliance Services: What Your Business Needs to Know in 2025

As we enter 2025, staying compliant with business regulations is not just good practice—it’s essential. Whether you're a startup, a growing enterprise, or a large corporation, annual compliance services ensure that your business avoids penalties, maintains credibility, and meets all legal obligations. If you're running a company in Chennai, Solubilis offers comprehensive compliance solutions tailored to every business type and industry.

Why Is Annual Compliance Crucial?

Annual compliance includes tasks like filing Income Tax Returns, maintaining statutory registers, conducting board meetings, and submitting annual returns. Failure to comply can lead to heavy fines or disqualification of directors. That’s why businesses—from Private Limited Companies to LLPs—need reliable compliance partners.

Who Needs Annual Compliance?

1. Different Types of Business Structures

Whether you're running a Private Limited Company, a Public Limited Company, an LLP, or even a One Person Company, each structure has its unique compliance requirements. Solubilis offers specialized services to ensure you meet all ROC filing and statutory norms.

2. NBFCs and Special Entities

If you're in the financial sector operating as an NBFC or a Nidhi Company, annual compliance becomes even more critical due to RBI oversight and strict reporting norms.

3. Sole Proprietors and Partnerships

Even if you're running a Sole Proprietorship or a Partnership Firm, annual tax filing and GST compliance are essential. Additionally, Hindu Undivided Family (HUF) structures must adhere to their own tax rules.

4. Non-Profit Entities

Organizations like Section 8 Companies, Trusts, and Societies need to maintain transparency and accurate record-keeping to stay compliant with FCRA, Income Tax, and Registrar guidelines.

Intellectual Property & Other Essential Compliances

Beyond corporate filings, protecting your brand and operations is vital. Solubilis provides:

Trademark Registration

Copyright Registration

Patent Filing

Industrial Design Protection

Geographical Indication Registration

These services ensure that your intellectual assets are legally protected while staying in line with annual regulatory updates.

Industry-Specific Registrations

2025 demands a higher level of regulatory compliance, especially for export-based or food-related businesses. Solubilis also handles:

FSSAI Registration

Digital Signature Certificate (DSC)

Barcode Registration

Legal Metrology Certification

Import Export Code (IEC)

SSI/MSME Registration

APEDA Registration

AEPC Registration

Secretarial and ISO Compliance

Compliance isn’t only about filing returns. Internal corporate governance is equally important. With Secretarial Services, you can ensure board meetings, audits, and ROC filings are handled seamlessly. You can also boost your brand’s credibility with ISO Certification—a must for businesses aiming to compete globally in 2025.

Get GST Ready

With updates and stricter rules being introduced frequently, proper GST Registration and return filing is non-negotiable. Solubilis ensures smooth GST filing and audit support so your business doesn’t face disruptions or penalties.

Final Thoughts Annual compliance in 2025 is no longer just an obligation—it’s a strategy to build trust, secure funding, and scale operations. Whether you're just starting with your company registration in Chennai or managing multiple business entities, Solubilis offers end-to-end support to ensure you're 100% compliant.

0 notes