#Gold GST Rate

Explore tagged Tumblr posts

Text

GST on Gold: Effects of Gold GST Rate in India 2024

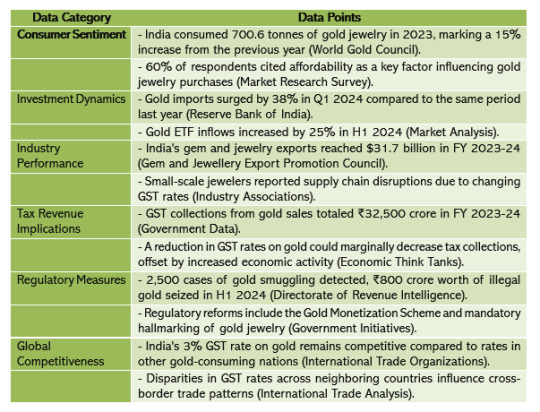

In 2024, the effects of the Goods and Services Tax (GST) rate on gold continue to resonate throughout India's economy, impacting various stakeholders from consumers to industry players. Let's delve into the implications of the gold GST rate and how it shapes the landscape of the precious metal market:

Consumer Sentiment: The GST rate directly influences the final price of gold for consumers. A lower GST rate makes gold more affordable, encouraging higher demand for jewelry, coins, and bullion among consumers. Conversely, a higher GST rate may deter purchases, particularly among price-sensitive buyers, impacting consumer sentiment and spending patterns.

Investment Dynamics: Gold is revered as a traditional investment asset and a hedge against economic uncertainties. The GST rate affects its attractiveness as an investment avenue. A lower GST rate enhances the appeal of gold investments, attracting investors seeking portfolio diversification and wealth preservation. Conversely, a higher GST rate may prompt investors to explore alternative investment options with potentially higher returns.

Industry Performance: The gold industry, encompassing miners, refiners, jewelers, and retailers, is intricately linked to the prevailing GST rate. A lower GST rate spurs demand for gold jewelry and ornaments, benefiting jewelers and retailers. However, fluctuating GST rates can disrupt supply chains, inventory management, and pricing strategies within the industry, posing challenges for stakeholders.

Tax Revenue Implications: The GST rate on gold significantly contributes to government tax revenues. While a lower GST rate stimulates demand and economic activity in the gold sector, it may lead to a reduction in tax collections. Conversely, a higher GST rate boosts government revenues but could dampen consumer spending and industry growth, necessitating a delicate balance between revenue generation and economic stimulus.

Regulatory Measures: Policymakers continuously monitor and adjust the gold GST rate to achieve broader economic objectives, address inflationary pressures, and ensure fiscal sustainability. Changes in the GST rate are often accompanied by regulatory measures aimed at curbing illicit activities such as smuggling and tax evasion, thereby safeguarding government revenue and market integrity.

Global Competitiveness: The GST rate on gold in India is juxtaposed with rates in other countries, influencing international competitiveness and trade dynamics. Disparities in GST rates between nations can incentivize cross-border trade, impacting domestic markets and necessitating policy responses to maintain a level playing field for industry participants.

In summary, the GST rate on gold in India is a critical determinant of consumer behavior, investment trends, industry dynamics, and government revenues. As policymakers navigate economic challenges and strive to foster growth, they must calibrate the gold GST rate judiciously, balancing the interests of stakeholders while ensuring fiscal prudence and regulatory effectiveness, you need the advice of experts such as efiletax Indeed.

#GST on Gold#Gold GST Rate#Gold GST Rate in India 2024#efiletax#taxes#gst services#gst filing chennai#gst update india#india gst#gold#gst filing

0 notes

Text

Indirect Tax

Recent changes in Indirect Tax

Indirect taxes are taxes that are assessed by Government on goods and services, rather than on individualities or businesses directly. These taxes are collected by businesses from consumer when they buy goods or services, and also remitted to the government. Indirect taxes are often referred to as consumption taxes because they are based on consumption of goods and services rather than income or wealth. Indirect taxes can take many forms, including sales taxes, value-added taxes (VAT), excise taxes, and tariffs.

During the Union Budget of 2023 “Amrit Kaal”, It was the very first time when the indirect tax proposals were presented before the direct tax proposals. In the Proposal of indirect tax Presented in the Union Budget of 2023 there were 4 major changes which caught the attention of the citizens.

Following are the 4 major changes:

Customs Perspective: In the Union Budget, to promote the ‘Make in India’ campaign and give to a boost to domestic manufacturing and enhance exports, the government and our FM has proposed few changes in the rate of import duties. The import duties on electric chimneys and cigarettes will now be more expensive, while on the other hand import of gold, silver, platinum, coin, etc., will be cheaper. Also, some exemption has been proposed towards goods or machinery used for manufacturing of lithium-ion battery.

GST Returns To Be Filed Within Three Years: GSTR 1, GSTR 3B and GSTR 9and GSTR 9C would now be restricted for filing, post expiry of three years from the due date of filing of the relevant GST return. Until now, there was no threshold on time for filing GST return and any taxpayer could file belated returns along with interest and late fees. However, going forward, in future these dates have been locked so as to have clarity on the timelines for litigation.

Widening of Scope of OIDAR: The Online Information and Database Access and Retrieval (OIDAR) services were brought under the tax bracket in the service tax regime and subsequently, in the GST regime. However, due to some exceptions in OIDAR and non-taxable online recipient, multiple services were escaping tax. In order to remove those exceptions, the Budget proposes to amend both the definitions and make OIDAR a wider segment for taxability purpose.

Taxability of High Sea Sales and Out-And-Out Sales: Out-and-out sales and high-sea sales were inserted in schedule III of the CGST Act, 2017 with effect from Feb. 1, 2019. However, the GST authorities were demanding GST from July 1, 2017 to Jan. 31, 2019. So to clarify this ambiguity and confusion, the budget has stated that such insertion will be with retrospective effect from July 1, 2017. This is a relief for taxpayers who are undergoing a litigation on these aspects. However, if the taxpayer has already paid the taxes for such period on the specified sales, the Budget has clearly specified that no refund of such tax can be claimed.

Although there are other changes as well but from Tax perspective the above 4 are major changes.

2 notes

·

View notes

Text

Buy Gold Bullion: A Practical Guide for Smart Investors

In an age where market volatility is the norm, more Australians are seeking stability through tangible assets. Among these, gold bullion continues to stand out as a preferred choice. For those looking to buy gold Melbourne, understanding the basics of bullion investing is essential.

Why Gold Bullion Still Matters

Gold has historically maintained its value during financial downturns. Unlike fiat currencies, which are susceptible to inflation, gold retains intrinsic worth. This makes gold bullion a powerful hedge against economic uncertainty.

Experts agree that gold serves as a store of value over the long term. "In times of financial distress, gold remains a reliable form of wealth preservation," says Jason Lawton, a Melbourne-based financial analyst.

Understanding Gold Bullion

Gold bullion refers to physical gold in the form of bars or coins, typically produced by government mints or accredited private refiners. It is valued primarily for its metal content rather than numismatic (collectible) value.

There are two main forms:

Gold Bars: Usually come in weights ranging from 1 gram to 1 kilogram.

Gold Coins: Often minted in 1 oz denominations; popular options include the Australian Kangaroo and the Canadian Maple Leaf.

Each type offers different advantages depending on your investment goals and storage options.

How to Buy Gold in Melbourne

Melbourne offers a variety of reputable bullion dealers, both physical storefronts and online platforms. When seeking to buy gold Melbourne investors should consider the following:

Dealer Accreditation: Look for dealers affiliated with the LBMA (London Bullion Market Association) or government mints.

Buyback Policy: A clear, transparent repurchase option is a good sign of a trustworthy dealer.

Storage Options: Some dealers offer insured vault storage; others provide discreet delivery services.

Local Insight

A recent buyer in Melbourne shared this insight:

"Purchasing gold bullion from a local dealer gave me peace of mind. I appreciated the ability to inspect the gold before finalising the transaction." — Daniel M., St Kilda resident

Frequently Asked Questions (FAQs)

Q: Is gold bullion subject to GST in Australia? A: No. Investment-grade bullion is exempt from GST if it meets purity requirements (99.5% for gold).

Q: Can I store gold at home? A: Yes, but it’s recommended to use a secure safe and inform your insurer.

Q: How do I know the gold is authentic? A: Always request a certificate of authenticity and buy only from accredited dealers.

Q: What's the difference between gold bullion and jewellery? A: Jewellery includes design and labour costs, while bullion reflects only the gold content value.

Market Trends to Watch

Gold prices are influenced by various global factors including geopolitical tension, inflation rates, and currency strength. With inflationary pressures remaining a concern, many analysts project a strong outlook for gold in 2025.

"We're seeing a resurgence of interest in physical assets," notes economic strategist Leila Chen. "Those looking to buy gold in Melbourne are part of a broader movement toward wealth preservation."

Final Thoughts

Whether you're a seasoned investor or just beginning to diversify your portfolio, buy gold Australia is a step toward financial resilience. Melbourne residents benefit from access to established dealers, knowledgeable advisors, and transparent market practices.

0 notes

Text

Online Accounting Software for Jewellery: Best Solutions for Financial Management

Managing a jewellery business involves handling high-value transactions, tracking inventory, and ensuring tax compliance. Traditional bookkeeping methods can be time-consuming and prone to errors. That’s why online accounting software for jewellery is a game-changer—it automates financial processes, simplifies tax filing, and provides real-time financial insights.

In this article, we’ll explore the best online accounting software for jewellery businesses, helping you choose the right solution to streamline operations and boost profitability.

Why Jewellery Businesses Need Online Accounting Software?

Jewellers deal with precious metals, fluctuating prices, and customer transactions daily. Using cloud-based accounting software ensures:

✅ 24/7 Access to Financial Data – Manage accounts anytime, anywhere. ✅ Automated GST & Tax Compliance – Generate tax reports and file returns effortlessly. ✅ Real-Time Inventory & Expense Tracking – Sync financial data with stock management. ✅ Secure Cloud Storage – Prevent data loss with automatic backups. ✅ Faster Billing & Invoicing – Generate invoices instantly and reduce manual work.

Top 5 Online Accounting Software for Jewellery Businesses

1. QuickBooks Online – Best for Cloud-Based Accounting

QuickBooks is a widely used jewellery accounting software that provides secure, cloud-based financial management. It’s ideal for jewellers looking for an easy-to-use, automated accounting system.

🔹 Key Features: ✔️ Multi-device access for on-the-go accounting ✔️ Automated invoicing and expense tracking ✔️ Bank reconciliation & financial reporting

2. Xero – Best for Multi-Store Jewellery Businesses

Xero offers real-time financial tracking and seamless integration with POS and inventory software, making it perfect for jewellery businesses with multiple locations.

🔹 Key Features: ✔️ Online invoice management with auto-reminders ✔️ Multi-currency transactions for global businesses ✔️ Secure cloud backup & mobile access

3. Marg ERP Cloud – Best for GST & Tax Compliance

Marg ERP provides cloud-based accounting for jewellers with built-in GST billing and stock management, ensuring seamless financial operations.

🔹 Key Features: ✔️ GST-compliant invoicing & tax return filing ✔️ Karigar (goldsmith) account tracking ✔️ Gold & silver rate updates with automatic pricing adjustments

#JewelleryAccountingSoftware#OnlineAccountingSoftware#JewelleryBusiness#AccountingSoftwareForJewellers#JewelleryManagement#CloudAccounting#SmallBusinessAccounting

0 notes

Text

Which judiciary coaching in Delhi is the most cost-effective?

When seeking cost-effective judiciary coaching in Delhi, it's essential to balance affordability with the quality of education. Below is a curated list of the top five institutes known for their reasonable fees and commendable coaching services:

1. Plutus Law

Plutus Law is a renowned coaching institute that offers comprehensive courses for judiciary aspirants. While specific details about their judiciary coaching fees are not readily available, their reputation for providing quality education at competitive rates makes them a noteworthy option.

2. Kautilya IAS

A subsidiary of Plutus IAS, Kautilya IAS specializes in judiciary coaching. They offer various courses tailored to different preparation needs:

Integrated Course: Spanning 12-18 months, this course is priced at ₹1,20,000 plus 18% GST for English medium and ₹1,10,000 plus 18% GST for Hindi medium.

Crash Course: Designed for rapid preparation over 3 months, this course costs ₹60,000 plus 18% GST.

These structured programs aim to provide in-depth knowledge and exam readiness.

See Also: Best Judiciary Services Coaching in Delhi

3. Knowledge Nation Law Centre

Ranked among the top judiciary coaching centers in Delhi, Knowledge Nation Law Centre is renowned for its excellent coaching and guidance, which has helped many aspirants secure top ranks in various competitive examinations. The institute offers comprehensive course material and practice tests, with experienced faculty providing individual attention to each student.

4. Ambition Law Institute

Ambition Law Institute is one of the most sought-after coaching institutes for judiciary and PCS-J exams in Delhi. The institute is known for its experienced and knowledgeable faculty, well-researched course material, and intensive mock tests.

5. Juris Academy

Juris Academy is an organization of gold-medalist law specialists who intend to provide world-class law education. The academy has achieved the National Education Excellence Award continuously in 2016 and 2017.

When choosing a judiciary coaching institute, it's crucial to consider factors beyond just the fee structure. Evaluate the quality of faculty, course materials, success rates, and student reviews to ensure a well-rounded preparation experience. Visiting the institutes, attending demo classes, and interacting with current students can provide valuable insights to make an informed decision.

0 notes

Text

Where to Buy or Rent High-Performance Printers on the Gold Coast

In today's fast-paced business environment, having access to reliable and efficient printing solutions is crucial. For businesses located on the Gold Coast, finding the right printer—whether for purchase or rent—can significantly impact productivity and operational efficiency. This guide explores the top options for acquiring high-performance printers on the Gold Coast, emphasizing the importance of selecting the right solution to meet your business needs.

Understanding Your Printing Needs

Before diving into where to acquire a printer, it's essential to assess your specific requirements:

Volume of Printing: Determine the average number of pages your business prints monthly. High-volume environments may benefit from robust, multifunction printers.

Functionality: Consider whether you need additional features such as scanning, copying, faxing, or duplex printing.

Budget Constraints: Decide between purchasing a printer outright or opting for rental or lease agreements based on your financial planning.

Environmental Considerations: With a growing emphasis on sustainability, eco-friendly printing solutions can reduce energy consumption and waste.

Top Providers for Printers on the Gold Coast

Several reputable providers cater to businesses seeking high-performance printers on the Gold Coast. Here are some notable options:

1. BBC Digital

BBC Digital offers a comprehensive range of multifunction printers suitable for various business needs. Their offerings include both color and black & white devices, with options to rent, lease, or purchase outright. The Canon IR ADV DX series, for instance, boasts features like high-speed duplex scanning and customizable paper capacities, making it ideal for dynamic office environments.

2. Photocopier Hire

Specializing in flexible rental and hire solutions, Photocopier Hire provides both new and refurbished printers from top brands. They emphasize hassle-free integration, offering services like network setup and ongoing maintenance. Their transparent pricing structures and all-inclusive service agreements ensure businesses can manage printing needs without unexpected costs.

3. Copier Choice

Copier Choice allows businesses to compare quotes for multifunction printers on the Gold Coast. They offer options to lease, rent, or buy A4 and A3 printers from top suppliers, enabling businesses to find tailored solutions that align with their operational requirements and budgetary constraints.

4. Global Document Solutions

Global Document Solutions stands out by offering competitive leasing options, guaranteeing to beat any printer lease price with rates as low as $15.00 + GST per week. Their instant leasing quotes and commitment to affordability make them a noteworthy option for businesses seeking cost-effective solutions.

5. Document Solutions Australia

For businesses prioritizing sustainability, Document Solutions Australia partners with EPSON to provide eco-friendly printing solutions. EPSON's EcoTank printers, for example, are designed to reduce energy consumption and minimize waste, aligning with green business practices.

Making the Right Choice

When deciding where to buy or rent a high-performance printer on the Gold Coast, consider the following factors:

Service Agreements: Ensure the provider offers comprehensive service and maintenance plans to minimize downtime.

Flexibility: Opt for providers that offer flexible terms, allowing you to upgrade or adjust your printing solutions as your business evolves.

Support: Reliable customer support is essential for addressing any technical issues promptly.

By thoroughly assessing your business's printing needs and exploring the offerings of these reputable providers, you can secure a high-performance printer that enhances productivity and aligns with your operational goals on the Gold Coast.

0 notes

Text

How to Get a Personal Loan If You Are a Freelancer Without Income Proof

Introduction

For freelancers, managing finances can be challenging due to fluctuating income and lack of formal salary slips. Unlike salaried employees, freelancers often struggle to secure a personal loan because they lack traditional income proof such as salary slips or Form 16. However, getting a personal loan as a freelancer is not impossible. With the right approach, alternative documentation, and proper planning, freelancers can access loans to manage their financial needs.

In this guide, we will explore ways freelancers can secure a personal loan even without conventional income proof, along with expert tips to improve their loan eligibility.

1. Understanding Personal Loan Eligibility for Freelancers

Freelancers do not have a fixed salary, but many lenders offer loans based on their financial stability. Here are key factors lenders consider:

A. Credit Score

A high credit score (750 or above) increases the chances of loan approval. Lenders use credit history to assess repayment behavior.

B. Bank Statements

A steady flow of income reflected in bank statements (past 6-12 months) can serve as proof of financial stability.

C. Tax Returns

If freelancers file ITR (Income Tax Returns) regularly, it acts as an alternative income proof, increasing credibility.

D. Work Experience & Stability

Lenders may assess freelance work history, project stability, and client contracts to determine repayment capacity.

E. Existing Debts & Liabilities

A low debt-to-income ratio (DTI) improves eligibility, indicating that the borrower can manage additional loan repayments.

2. Best Alternatives to Traditional Income Proof for Freelancers

If you do not have a salary slip or employment letter, you can still present the following documents to strengthen your loan application:

A. Bank Statements

Freelancers should provide bank statements for the last 6-12 months, showing consistent income from multiple sources.

B. Income Tax Returns (ITR)

Filing ITR for the past two years helps prove financial stability and income consistency.

C. Client Invoices & Contracts

Lenders may consider invoices, work contracts, or payment receipts from long-term clients as proof of regular income.

D. Proof of Business Operations

If a freelancer operates under a registered business name, documents like GST registration, business license, or website proof can support the loan application.

E. Collateral or Guarantor

If freelancers struggle with unsecured loans, they can opt for a secured personal loan using gold, fixed deposits (FDs), or property as collateral. Alternatively, a co-applicant with a stable income can enhance approval chances.

3. Best Personal Loan Options for Freelancers Without Income Proof

Some financial institutions and NBFCs offer tailored personal loans for freelancers. Here are the top options:

A. HDFC Bank Personal Loan

✅ Loan Amount: ₹50,000 – ₹40 lakh ✅ Interest Rate: 10.50% - 21.00% p.a. ✅ Tenure: 1 – 5 years ✅ Requires bank statements & credit score check

B. ICICI Bank Insta Personal Loan

✅ Loan Amount: ₹50,000 – ₹25 lakh ✅ Interest Rate: 10.75% - 19.00% p.a. ✅ Instant loan approval for existing customers with strong banking history

C. Bajaj Finserv Flexi Loan

✅ Loan Amount: ₹50,000 – ₹35 lakh ✅ Interest Rate: 11.50% - 18.00% p.a. ✅ Flexible withdrawal and repayment options ✅ Requires strong credit score & banking transactions

D. Tata Capital Personal Loan

✅ Loan Amount: ₹75,000 – ₹25 lakh ✅ Interest Rate: 10.99% - 18.00% p.a. ✅ Offers relaxed eligibility for self-employed professionals

E. Indiabulls Dhani Personal Loan

✅ Loan Amount: ₹5,000 – ₹15 lakh ✅ Interest Rate: 12.00% - 24.00% p.a. ✅ 100% digital process, no physical paperwork

4. Tips to Improve Loan Approval Chances for Freelancers

A. Maintain a High Credit Score

Pay all existing EMIs and credit card bills on time.

Keep your credit utilization ratio below 30%.

B. Show Consistent Income

Deposit all earnings into a single bank account for better financial tracking.

Avoid cash transactions and use digital payments for transparent income records.

C. Choose the Right Loan Amount

Avoid applying for high loan amounts beyond repayment capacity.

Use a personal loan EMI calculator to estimate monthly payments.

D. Opt for NBFCs or Digital Lenders

Some NBFCs and fintech lenders have relaxed eligibility criteria for freelancers.

Look for lenders offering instant loans with minimal documentation.

E. Add a Guarantor or Co-Borrower

A co-applicant with a stable income increases loan approval chances.

Choose a family member or close friend with a high credit score.

F. Apply for a Secured Loan

Offer collateral like gold, FD, or property to reduce the lender's risk.

Secured loans have lower interest rates and higher approval rates.

5. Mistakes to Avoid When Applying for a Personal Loan as a Freelancer

❌ Applying for Multiple Loans at Once – Too many loan applications can lower your credit score. ❌ Not Checking Loan Terms & Hidden Charges – Always read the fine print before signing the loan agreement. ❌ Ignoring Processing Fees – Some lenders charge high processing fees (1% - 3%), increasing loan costs. ❌ Providing False Information – Any discrepancy in documents can lead to rejection and blacklist from lenders. ❌ Skipping Credit Report Checks – Ensure your CIBIL or Experian score is accurate before applying.

Conclusion

While freelancers may face challenges in securing a personal loan without traditional income proof, they can still qualify by showcasing alternative financial stability. Maintaining a high credit score, providing bank statements, filing ITRs, and opting for the right lenders can significantly improve loan approval chances.

If you are a freelancer looking for the best personal loan options, compare multiple lenders and choose one that aligns with your financial needs.

For expert financial advice and exclusive personal loan deals, visit www.fincrif.com today!

#finance#personal loan online#fincrif#personal loans#personal loan#loan apps#nbfc personal loan#bank#loan services#personal laon#Personal loan#Freelancer loan#Personal loan without income proof#Self-employed loan#Unsecured personal loan#Instant loan for freelancers#Personal loan for self-employed#Best loan options for freelancers#Freelancer loan eligibility#No income proof loan#How to get a personal loan as a freelancer?#Best personal loan options without salary slip#Can freelancers get loans without ITR?#Personal loan for gig workers and consultants#How to improve loan approval chances as a freelancer?

0 notes

Text

Step - by - Step Guide to BIS Certififaction | Expert Insights from Standphill India

BIS certification is crucial for businesses in India to ensure product quality, safety, and compliance with Indian standards. The certification, issued by the Bureau of Indian Standards (BIS), is mandatory for many products before they can be sold in India.

As the leading BIS consulting services company in Delhi, Standphill India simplifies the entire certification process, helping businesses achieve compliance efficiently. This guide provides a step-by-step breakdown of obtaining BIS certification.

What is BIS Certification and Why is It Mandatory?

BIS certification ensures that products adhere to Indian safety and quality standards. It is required for a wide range of products, including electronics, consumer goods, industrial products, and jewelry.

Failure to comply with BIS regulations can lead to penalties, product recalls, or bans from the Indian market. Standphill India assists businesses in navigating these requirements for a hassle-free certification process.

Reference: BIS Certified Products List

Types of BIS Certification Schemes

Different products require different BIS certification types. The major schemes include:

ISI Mark Certification – For industrial and consumer products

Compulsory Registration Scheme (CRS) – For electronics and IT goods

Foreign Manufacturers Certification Scheme (FMCS) – For international companies selling in India

Hallmarking Scheme – For gold and silver jewelry

Reference: BIS Certification Types

Step 1: Determine If Your Product Needs BIS Certification

Not all products require BIS certification. To verify if your product is included:

Visit the official BIS website and search for your product category.

Consult with Standphill India experts to determine the correct certification for your product.

Reference: Check BIS Product List

Step 2: Product Testing in a BIS-Approved Laboratory

All products requiring BIS certification must undergo testing in a BIS-accredited laboratory. The process includes:

Testing against Indian Standards (IS codes)

Receiving a test report, which is mandatory for BIS certification

Ensuring compliance with safety, durability, and quality standards

Reference: BIS Lab Recognition Services

Step 3: Submitting the BIS Application with Expert Help

Filing a BIS application requires precise documentation and submission through the Manak Online BIS portal. The steps include:

Registering on Manak Online

Completing Form V (ISI Mark) or Form VI (CRS Registration)

Uploading required documents:

Company registration certificate (GST, PAN, etc.)

Product test report from a BIS-approved lab

Manufacturing process details

Factory layout & quality control documentation

Paying the application fee

Reference: Manak Online BIS Portal

Step 4: BIS Factory Inspection (For ISI Mark & FMCS)

For ISI Mark and FMCS certification, BIS officials inspect the manufacturing facility to verify:

Production processes

Testing equipment & quality control measures

Compliance with BIS standards

Standphill India ensures businesses are well-prepared for inspections, increasing approval success rates.

Reference: BIS Inspection & Audits

Step 5: BIS Certificate Approval & Timeline

After meeting all requirements, BIS officials review the application and grant certification. The approval timeline depends on the certification type:

ISI Mark Certification: 30-90 days (includes factory inspection)

CRS Registration: 20-30 days (no factory inspection required)

FMCS Certification: Up to 6 months

Reference: BIS Certification Process

Step 6: Post-Certification Compliance & Renewal

BIS certification remains valid for 1-2 years, after which businesses must:

Renew certification through annual audits

Maintain ongoing compliance with BIS standards

Be prepared for random market surveillance by BIS officials

Standphill India offers post-certification support to ensure continuous compliance.

Reference: BIS Compliance & Renewal

Why Choose Standphill India for BIS Certification?

With over 20 years of experience and 400+ successful certifications, Standphill India is the best BIS consulting services company in Delhi. Our services include:

Personalized Consultation – Identifying the right certification for your product

End-to-End Support – Handling documentation, testing, and certification approval

Faster Approvals – Avoiding delays and rejections with expert guidance

Post-Certification Assistance – Compliance monitoring, audits & renewals

Get Expert Help Today

BIS certification is essential for businesses aiming to sell safe, high-quality products in India. Standphill India streamlines the process, ensuring a smooth experience from start to finish.

Avoid compliance risks and delays. Let our experts handle your BIS certification process efficiently.

Book a Free Consultation with Standphill India

#BISCertification#ProductCompliance#QualityStandards#BestConsultingServicesCompanyInDelhi#BISRegistration#ManufacturingStandards#ConsumerSafety#IndianMarketApproval#BusinessCompliance#StandphillIndia

0 notes

Text

Bridal to Everyday Wear – Jewellery Designed Just for You

Gold is a precious good whose price varies daily according to the market. In case you would wish to know what the current gold rate is in Anjugramam, being current in a bid to make an optimal decision for buying or investing is of utmost importance. Gold prices fluctuate depending on various factors that involve global moves, foreign exchange rate fluctuations, and also the local demand.

A number of deciding factors determine the gold price in Anjugramam:

International Market Trends—Local rates track international gold prices directly.

Exchange Rates of Currency - The value of the Indian Rupee against the US Dollar dictates gold prices.

Inflation & Economic Environment - Increasing inflation has a penchant to drive gold prices up.

Demand & Supply - Excess demand during wedding and festival seasons has a tendency to push the price up.

Government Policies & Taxes - GST and import duty impact the final price of gold.

Gold Purity & Price Variations

Prices of gold in Anjugramam differ with purity levels:

24K Gold (99.9% pure) - Best for investment.

22K Gold (91.6% pure) - Mostly used in jewellery.

18K & 14K Gold - Alloys are mixed with it, used for designer jewellery.

Where to See the Current Gold Rate in Anjugramam?

To remain current on the current gold rate in Anjugramam, you may:

Visit your local jewellery shops for daily rate information.

Log in to the internet to determine live gold rates.

Monitor news of finance to watch market directions.

Purchase Gold at the Ideal Price in Anjugramam

When investing in or purchasing ornaments made of gold, compare costs and purchase them from genuine jewellers only. Opt for hallmark certification to analyse purity and originality.

Get Up-to-date with Gold Rates

Gold prices fluctuate, and therefore it is advisable to refer to recent prices before making a purchase. Be adequately informed, compare rates, and invest wisely.

Conclusion

Gold prices vary daily, and therefore it is necessary to stay updated before buying or investing. Always take reference from the latest gold Rate in Anjugramam from reliable sources and well-known jewellers. Check purity with hallmark-approved gold and compare For the latest gold rate in Anjugramam, visit your local jewellery shop or see authentic online websites today!

#best jewellery shop#bridaljewellery#best jewelry stores#diamondjewellery#goldjewellery#handcraftedjewellery#jewellerydesigns#jewellerylovers#jewelleryshop#luxuryjewellery

1 note

·

View note

Text

Businessman who brought UAE investors facing several cases

Samaan Lateef Srinagar, April 24 A Dubai-based businessman has decided to invest in Kashmir months after investigative agencies carried out multiple raids against him in Jammu. To lure the investment from the UAE, the J&K administration projected Kashmir to an…

Srinagar, April 24

A Dubai-based businessman has decided to invest in Kashmir months after investigative agencies carried out multiple raids against him in Jammu. To lure the investment from the UAE, the J&K administration projected Kashmir to an Emirati delegation as the safest place to do business and cited its lowest share in crime rates. It even showed that the BJP-ruled Haryana, Uttar Pradesh and Gujarat topped the crime chart.

Bal Krishen Rathore, a Dubai-based Jammu-origin businessman, who brought a 36-member Emirati business delegation to Kashmir last month, has long been a target of different investigative agencies.

In the run-up to the abrogation of Article 370, GST intelligence officials conducted searches at Safa Valley, a project of Rathore’s 8 Boundaries Builders Private Limited in Jammu and slapped him with a penalty of Rs 4.5 crore for tax evasion.

In September 2019, the J&K Anti-Corruption Bureau (ACB) initiated another probe against Rathore for illegal constructions and encroachment upon state land as well as the sale of flats meant for economically weaker sections.

In March 2020, the Enforcement Directorate conducted a raid at Rathore’s Jammu offices and the premises of his business associates. Under FEMA violations, the agency seized fixed deposits and sovereign gold bonds worth $3.3 million.

In January, Rathore’s Dubai-based Century Financial signed an MoU with the J&K government for making a $100M investment to set up three hotels and one commercial complex in Kashmir.

In March 2022, Rathore used his connections in the UAE to bring a 36-member delegation of Emiratis and Indian expats to Kashmir.

Reportedly out of 36, 13 were Emirati and the rest were affluent Indian expats. Ashok Kotecha of BAPS Swaminarayan Temple, Abu Dhabi, was also part of the delegation.

After the UAE delegation visited Kashmir, Lieutenant Governor Manoj Sinha had said that investment in J&K would cross Rs 70,000 crore in the next six months.

A US based investigative journalist Raqib Hameed Naik revealed the information behind the Emarti delegation.

Naik alleged authorities are “arm-twisting to force affluent Indian expats to bring investment and promote their sense of normalcy in Kashmir.”

Tax evasion, encroachment charges

In 2019, GST officials had conducted searches at Safa Valley, a project of Bal Krishen Rathore in Jammu, and slapped him with a penalty of Rs 4.5 crore for tax evasion.

The Anti-Corruption Bureau initiated another probe against Rathore for illegal constructions and encroachment upon state land.

In 2020, the ED had raided premises of Rathore and his associates, seizing FD and sovereign gold bonds worth $3.3 million.

0 notes

Text

2025 Gold Price at Dubai: Smart Shopping Tips for Ladies | Hypeladies

Gold Price at Dubai: Expert Smart Shopping Tips for Ladies to Buy in 2025

Dubai, often called the "City of Gold," has long held its position as one of the world's premier destinations for gold trading and purchases. With approximately 20% of the world's gold passing through this glittering emirate, understanding the gold price at Dubai is crucial for both investors and jewelry enthusiasts. In this comprehensive guide, we'll explore everything you need to know about navigating Dubai's golden landscape.

Understanding Gold Prices in Dubai

The fascinating world of Dubai's gold market operates on a delicate balance of global and local factors. While the international gold market sets the baseline for Dubai gold prices, several unique aspects make the emirate's pricing structure particularly attractive to buyers worldwide. How Dubai Gold Prices Are Determined ? The gold price at Dubai is primarily influenced by the international gold market, which is quoted in US dollars per ounce. However, local prices are typically displayed in Arab Emirates Dirham (AED) per gram, making it essential to understand both metrics. Here's a breakdown of the pricing structure: Base Price Components: - International market rate (spot price) - Currency exchange rates - Local market premiums - Making charges (for jewelry) What makes Dubai's gold market unique is its tax-free status and competitive pricing structure. While most global markets add significant taxes and premiums to gold purchases, Dubai maintains minimal markups, typically ranging from 0.5% to 1% above the international rate for pure gold bars. Daily Price Fluctuations in Dubai's Gold Market Gold prices in Dubai are updated multiple times throughout the trading day, reflecting real-time changes in the global market. Local dealers receive price updates through the Dubai Gold & Jewellery Group (DGJG), which helps maintain consistency across the market. In 2024, we've seen price fluctuations ranging from: - Morning trading: First update around 8:30 AM GST - Mid-day adjustments: Updates around 1:30 PM GST - Evening revisions: Final updates around 5:00 PM GST Key Market Influences: - Global economic indicators - Political events - Currency fluctuations - Local demand cycles - Tourism patterns Market Dynamics and Price Factors Several unique factors affect the gold price at Dubai: - Tourism Impact: - Peak season (November to March): Prices may include higher premiums - Off-peak season: More room for negotiation - Festival periods: Increased demand can drive up making charges - Local Market Conditions: - Wedding season demand - Religious festivals (particularly Diwali and Eid) - Regional economic stability - Local consumer confidence - Global Factors: - International gold prices - US dollar strength - Global economic conditions - Geopolitical events Recent market analysis shows that Dubai's gold prices have maintained a competitive edge over other major gold markets. For instance, in early 2025, the average markup over international prices was just 0.75%, compared to 2-3% in many Western markets.

Dubai Gold Price Calculator: Making Sense of Rates and Values

2025 Gold Price at Dubai Understanding how to calculate gold prices in Dubai is essential for making informed purchases. Whether you're interested in pure gold bars or intricate jewelry, knowing the pricing structure helps you get the best value for your investment. Understanding Gold Karats and Purity In Dubai's gold market, you'll encounter different purity levels, each affecting the final price: 24K Gold (999.9 purity) - Purest form of gold available - Used primarily in bars and coins - Price per gram serves as the base rate - No additional metals mixed in 22K Gold (916.7 purity) - Most popular for jewelry in Dubai - Approximately 91.67% pure gold - More durable than 24K - Price calculation: (24K price × 0.916) 18K Gold (750 purity) - Common in contemporary jewelry - 75% pure gold - More affordable option - Price calculation: (24K price × 0.750) Making Charges and Additional Costs Making charges significantly impact the final price of gold jewelry in Dubai. These charges vary based on: - Design Complexity: - Simple designs: 3-8% of gold value - Medium complexity: 8-15% of gold value - Intricate designs: 15-25% of gold value - Custom pieces: Can exceed 25% - Retailer Location: - Gold Souk: Generally lower making charges - Mall outlets: Higher making charges - Boutique stores: Premium charges Sample Price Calculation Formula To calculate the final price of gold jewelry in Dubai, use this formula: Final Price = (Gold weight in grams × Current gold rate × Purity percentage) + Making charges + VAT (if applicable) Example Calculation: For a 22K gold necklace weighing 20 grams with 10% making charges: - Current 24K gold rate: 220 AED/gram - Purity percentage: 0.916 (22K) - Weight: 20 grams - Making charges: 10% Base gold cost = 20 × 220 × 0.916 = 4,030.40 AED Making charges = 4,030.40 × 0.10 = 403.04 AED Final price = 4,030.40 + 403.04 = 4,433.44 AED Price Differences Between Products Understanding price variations across different gold products helps in making informed decisions: Gold Bars: - Lowest making charges (0.5-1%) - Best value for investment - Usually sold in 24K only - Available in various weights (1g to 1kg) Gold Coins: - Slightly higher premium than bars - Collectible value consideration - Popular weights: 1g, 5g, 10g, 1oz Jewelry: - Highest making charges - Design value addition - Labor costs included - Variety of purity options

Best Time to Buy Gold in Dubai: Seasonal Guide and Market Trends

2025 Gold Price at Dubai Understanding the optimal timing for gold purchases in Dubai can lead to significant savings. Let's explore the various factors that influence pricing throughout the year and the best strategies for timing your purchase. Seasonal Price Variations Dubai's gold market experiences distinct seasonal patterns that affect prices: Peak Tourist Season (November to March) - Higher foot traffic in gold markets - Increased retail premiums - Less room for negotiation - Better selection of designs Off-Peak Season (June to September) - Lower tourist numbers - More competitive pricing - Better bargaining opportunities - Potential seasonal discounts (20-30% off making charges) Festival Impact on Gold Rates Key festivals significantly influence gold prices in Dubai: Dubai Shopping Festival (January-February) - Special promotions and discounts - Raffle draws and prizes - Reduced making charges - Limited-time offers Religious and Cultural Festivals - Diwali (October/November) - High demand period - Premium prices - Extensive new collections - Special festival designs - Eid Celebrations - Increased local buying - New collection launches - Gift-buying season - Premium pricing during Eid al-Fitr Best Days and Times to Buy Strategic timing can help secure better deals: Weekly Timing: - Monday mornings: Often see lower prices after weekend adjustments - Mid-week (Tuesday-Thursday): Stable prices - Friday: Limited trading hours - Saturday: Higher tourist traffic Daily Timing: - Early morning (8:30-10:00 AM): Fresh price updates - Mid-afternoon (2:00-4:00 PM): Usually stable prices - Evening (after 6:00 PM): Possible end-of-day adjustments Market Monitoring Tips To track gold prices effectively in Dubai: - Digital Tools: - Dubai Gold & Jewellery Group website - Gold price tracking apps - Local banking apps with gold rate features - International gold market websites - Price Alerts: - Set up notifications for price drops - Monitor weekly trends - Track currency exchange rates - Follow market news - Historical Data Analysis (2024-2025 Trends): Quarter | Average Price (AED/gram) | Market Trend Q1 2024 | 215 | Upward Q2 2024 | 220 | Stable Q3 2024 | 228 | Upward Q4 2024 | 235 | Volatile Q1 2025 | 240 | Stable Expert Buying Strategy For optimal pricing, consider this recommended approach: - Research Phase: - Monitor prices for 2-3 weeks - Compare rates across retailers - Understand current market trends - Check historical price patterns - Timing Considerations: - Avoid major festivals - Shop during off-peak tourist seasons - Consider early weekday purchases - Watch for promotional periods - Price Negotiation: - Best during quiet periods - More effective in traditional souks - Focus on making charges - Bundle purchases for better deals

Where to Buy Gold in Dubai: A Comprehensive Guide to the Best Locations

Dubai offers several renowned locations for gold shopping, each with its unique advantages and characteristics. Let's explore the most prominent gold shopping destinations in detail. Dubai Gold Souk: The Traditional Heart of Gold Trading The Dubai Gold Souk, located in Deira, stands as the city's most historic and authentic gold shopping destination. This traditional market hosts over 380 retailers, making it one of the largest gold markets globally. Key Features of Dubai Gold Souk: - Operating hours: 10:00 AM to 10:00 PM - Closed on Friday mornings - Over 10 tons of gold present at any time - Competitive prices due to high competition Notable Retailers: - Deira Gold Souk - Atlas Jewellery - Joy Alukkas - Malabar Gold & Diamonds - Kalyan Jewellers Shopping Tips: - Best for bulk purchases - Excellent bargaining opportunities - Wide variety of traditional designs - Lower making charges compared to malls Gold & Diamond Park: Modern Luxury Shopping Located on Sheikh Zayed Road, the Gold & Diamond Park offers a more contemporary shopping experience in an air-conditioned environment. Distinctive Features: - 90+ specialized retailers - Modern shopping environment - Custom design services - Manufacturing facilities on-site Benefits: - Fixed price transparency - Quality certification guaranteed - Professional service standards - Modern designs and collections Dubai Mall Gold Shops: Premium Retail Experience The Dubai Mall hosts numerous high-end jewelry retailers, offering a luxury shopping experience with international brands. Notable Features: - Location Benefits: - Central location - Premium shopping environment - International brands - Extended shopping hours - Popular Retailers: - Cartier - Tiffany & Co. - Local premium jewelers - Designer boutiques Price Comparison Across Locations: Location | Making Charges | Price Premium | Bargaining Scope Gold Souk | 4-12% | Lowest | High Gold & Diamond | 8-15% | Medium | Medium Dubai Mall | 12-25% | Highest | Low Speciality Areas and Unique Offerings Meena Bazaar: - Alternative to Gold Souk - Lower tourist traffic - Competitive prices - Specialized in Indian jewelry Satwa Gold Markets: - Local community favorite - Moderate prices - Good for small purchases - Personalized service Location-Specific Shopping Tips - Gold Souk Shopping: - Visit during weekday mornings - Compare prices across shops - Bargain confidently - Check gold purity certificates - Mall Shopping: - Best for branded jewelry - Fixed prices but seasonal sales - Premium making charges - Excellent after-sales service - Gold & Diamond Park: - Ideal for custom designs - Professional craftsmanship - Mid-range pricing - Good for engagement rings Expert Recommendations for Different Buyer Types: Buyer Type | Recommended Location | Reason Bulk Buyers | Gold Souk | Best wholesale prices Tourists | Dubai Mall | Convenient location Custom Design | Gold & Diamond Park | Specialized services Traditional | Meena Bazaar | Authentic designs Budget-conscious | Satwa Markets | Competitive pricing

Gold Investment Options in Dubai: A Strategic Guide

2025 Gold Price at Dubai Dubai's status as a global gold hub makes it an attractive destination for gold investment. Let's explore the various investment options available and how to maximize your returns. Gold Bars: The Pure Investment Choice Gold bars represent the most straightforward and cost-effective way to invest in physical gold in Dubai. Available Options: - Cast Bars: - Most economical choice - Available weights: 1g to 1kg - Lower premium over spot price - Best for long-term investment - Minted Bars: - Premium finish - Collector's value - Higher manufacturing cost - Popular sizes: 50g, 100g, 250g Price Comparison by Weight (February 2025): Weight | Cast Bar (AED) | Minted Bar (AED) | Premium 1g | 245 | 255 | 4% 10g | 2,425 | 2,475 | 2% 50g | 12,050 | 12,200 | 1.2% 100g | 24,000 | 24,200 | 0.8% 1kg | 238,000 | 239,500 | 0.6% Gold Coins: Combining Investment and Collectible Value Gold coins offer a unique combination of investment potential and numismatic value. Popular Options: - Emirates Gold Coins - Canadian Maple Leaf - American Eagle - South African Krugerrand Investment Considerations: - Advantages: - Easy to store and transport - Widely recognized - Historical value appreciation - Good liquidity - Disadvantages: - Higher premiums than bars - Storage concerns - Authentication requirements - Limited size options Storage Solutions in Dubai Secure storage is crucial for gold investments. Dubai offers several options: Bank Safe Deposit Boxes: - Annual fees: 500-2000 AED - Size variations available - Insurance included - 24/7 security Private Vault Facilities: - Enhanced security features - Flexible access hours - Higher insurance limits - More privacy Insurance Considerations Protecting your gold investment is crucial: - Insurance Types: - Basic coverage (included with storage) - Comprehensive coverage - Transportation insurance - Personal possession coverage - Coverage Costs: - 0.5-1% of gold value annually - Additional rider options - Deductible choices - Multi-year discounts Investment Strategy Tips Short-term Investment (1-2 years): - Focus on smaller denominations - Consider coins for quick sales - Monitor market actively - Maintain flexible storage options Long-term Investment (5+ years): - Larger bars for better value - Secure storage solutions - Regular market monitoring - Documentation maintenance Risk Management: - Authentication verification - Diversification across products - Regular market analysis - Professional storage solutions

Tips for Buying Gold in Dubai: Essential Guidelines and Precautions

When purchasing gold in Dubai, following proper guidelines ensures a secure and satisfactory transaction. Here's a comprehensive guide to help you make informed decisions. Authentication and Certification Verifying the authenticity of your gold purchase is crucial in Dubai's market. Read the full article

0 notes

Text

A Complete Guide to Buying Gold Jewellery Online Safely in 2025

Gold jewellery has long been a symbol of luxury, tradition, and investment. With the rise of e-commerce, purchasing gold jewellery online has become more convenient than ever. However, the fear of fraud, counterfeit products, and security risks can make many buyers hesitant. This guide will help you navigate the process of buying authentic gold jewellery online safely in 2025, ensuring you make a secure and informed purchase.

1. Verify Gold Purity and Hallmark Certification

One of the most critical aspects of buying gold jewellery online is ensuring its purity. Gold is measured in karats (K), with 24K being the purest form. However, most jewellery pieces are made from 22K, 18K, or 14K gold, depending on durability needs.

Look for BIS Hallmarking: In India, the Bureau of Indian Standards (BIS) hallmark certifies gold purity. Ensure that the jewellery you purchase has a BIS hallmark for authenticity.

Check Other Certifications: International certifications like the Assay Office Mark (UK) and the Jewellers of America certification (USA) are also indicators of quality.

Request a Purity Certificate: Reputable online jewellers provide a purity certificate, detailing gold composition and weight.

For a wide range of hallmarked gold jewellery, visit GoldSutra.

2. Choose a Reputable Online Jewellery Store

Buying from a well-established and trusted jeweller minimizes the risk of fraud. Here’s how to identify a reputable online jewellery retailer:

Check Business Credentials: Look for the company’s history, customer service reputation, and certifications.

Read Customer Reviews: Platforms like Google Reviews, Trustpilot, and social media can provide insights into other buyers' experiences.

Verify Return and Exchange Policies: A reputable seller will have a transparent return/exchange policy in case the product does not meet your expectations.

Ensure Secure Website & Payment Gateway: Always look for "https" in the website URL and check if secure payment options are available.

Explore a trusted selection of authentic gold jewellery at GoldSutra.

3. Understand Pricing and Hidden Charges

Gold prices fluctuate based on market trends, making it essential to compare prices before purchasing. Here’s what to consider:

Current Market Rate: Check the prevailing gold price before making a purchase.

Making Charges: This fee varies depending on the craftsmanship and design intricacy.

GST & Other Taxes: In India, a 3% GST is levied on gold jewellery purchases.

Shipping & Insurance Costs: Some stores may charge extra for secure shipping and insurance.

4. Secure Payment Methods & EMI Options

To ensure a safe transaction, use secure payment methods when buying gold jewellery online.

Trusted Payment Options: Opt for credit/debit cards, UPI, or net banking with fraud protection.

EMI & Financing Options: Some reputed jewellers offer easy EMI plans, making expensive purchases more affordable.

Cash on Delivery (COD) for Gold: Some retailers offer COD for added security, though it may be limited to specific locations.

5. Safe and Insured Shipping

When ordering gold jewellery online, ensure the seller provides insured and secure shipping.

Trusted Courier Services: Reliable brands use reputed logistics partners like Blue Dart, FedEx, or Malca-Amit.

Tamper-Proof Packaging: Ensure the jewellery comes in sealed and tamper-proof packaging.

Real-Time Tracking: A trustworthy retailer will offer shipment tracking for peace of mind.

Insurance Coverage: Always opt for insured delivery to protect your purchase from loss or theft.

6. Read Customer Reviews & Testimonials

Before finalizing your purchase, read customer testimonials and reviews. Real experiences help assess product quality and customer service reliability.

Check Verified Reviews: Reviews on the retailer’s website, social media, and independent platforms add credibility.

Look for High Ratings: Consistently high ratings indicate reliability and good service.

Engage in Community Forums: Online jewellery forums and social media groups can provide valuable recommendations.

7. Understand Return, Exchange, and Warranty Policies

A transparent return policy is essential when purchasing jewellery online.

Easy Return Window: Reputable sellers offer a return window (usually 7-30 days) with full refunds.

Exchange Offers: Some brands allow gold exchange for upgraded designs.

Warranty & Buyback Policies: Ensure your jewellery has a warranty against defects and a buyback option.

Conclusion

Buying gold jewellery online in 2025 is convenient and safe if you take the right precautions. From verifying hallmark certification and checking reviews to ensuring secure payments and insured delivery, following these steps will help you make a trustworthy purchase.

For a curated collection of certified gold jewellery, explore GoldSutra and shop with confidence.

By following these guidelines, you can enjoy the convenience of online gold jewellery shopping without compromising on quality or security. Happy shopping!

0 notes

Text

lakshadweep samudram package

The Lakshadweep Samudram Package is a five-day cruise that offers an immersive experience of the Lakshadweep archipelago, covering the islands of Kavaratti, Kalpeni, and Minicoy aboard the M.V. Kavaratti. This package is organized by the Society for Promotion of Nature Tourism and Sports (SPORTS), the official tourism department of Lakshadweep. Let us discuss about lakshadweep samudram package

samudram.utl.gov.in

Key Highlights of the Samudram Package:

Duration: 4 Nights and 5 Days

Islands Covered: Kavaratti, Kalpeni, and Minicoy

Accommodation: Nights are spent aboard the M.V. Kavaratti in air-conditioned cabins.

Activities: Daytime island tours include swimming, snorkeling, kayaking, and other water sports. Lunch and refreshments are provided on the islands.

Itinerary Overview:

Day 1: Departure from Kochi in the afternoon.

Day 2: Arrival at the first island (sequence varies). Activities include sightseeing, water sports, and cultural programs.

Day 3: Visit the second island with similar activities.

Day 4: Explore the third island.

Day 5: Return to Kochi by mid-morning.

Package Rates:

The package offers different classes of accommodation:

Diamond Class (First Class Cabin):

Adult: ₹37,500 (₹25,000 for transportation + ₹12,500 for tour charges) + 5% GST

Child (1 to 10 years): ₹33,000 (₹25,000 + ₹8,000) + 5% GST

Gold Class (Second Class Cabin):

Adult: ₹28,500 (₹18,000 + ₹10,500) + 5% GST

Child: ₹25,000 (₹18,000 + ₹7,000) + 5% GST

you can also watch samudram cruise for lakshadweep video in our channel.

0 notes

Text

Which Items To Buy Before Union Budget 2025?

A number of items are expected to become costlier after Union Budget 2025, but you can save money if you buy them soon

The Union Budget 2025 is one of the most awaited, as the economy seems to be facing some headwinds. There are also demands from individuals and businesses to reduce taxes. It appears that the government has to do a balancing act in this year's budget.

From the perspective of the common man, the main focus is on which items will become costlier and which will become cheaper. To help you save money, let us take a look at some items that can potentially become costlier after Union Budget 2025. So, if you place your order soon, you can save quite a bit of your hard-earned money.

Luxury goods - It is possible that GST rates could be increased for luxury items. The government needs significant funding for its infrastructure development projects and welfare programs. Increasing taxes on luxury goods can help the government to generate the required funds. Luxury goods include various items such as high-end watches, luxury cars, jewelry and precious stones, designer clothing and accessories, luxury handbags, exclusive perfumes, luxury yachts, private jets and premium electronics and gadgets.

Tobacco and cigarettes - Similar to the trend seen in previous years, prices of tobacco products and cigarettes are expected to increase after Union Budget 2025. While using tobacco is not advisable, there are millions of people who use it on a regular basis. It is also true that rising prices of tobacco have forced many people to quit using tobacco or reduce the overall consumption amount. It is up to adults to decide what their choices are going to be.

Alcohol - Just like cigarettes, alcohol products are likely to become costlier after Union Budget 2025. Consumption of alcohol has skyrocketed in India. The increase in alcohol consumption can be seen across various income groups. However, if we look at per capita figures, India ranked quite low at 98th spot in terms of alcohol consumption. But considering the rise in alcohol consumption, it is likely that India could have moved higher in per capita alcohol use in recent years.

Gold and silver - It is expected that the government will increase import duties on precious metals like gold and silver. However, jewelers and bullion sellers want the government to introduce measures that can encourage people to buy more gold. For example, there is demand to allow people to buy gold via the EMI route. Bullion traders are also demanding reduction in import duties on gold dore. This will allow them to increase their profit margin.

Mobile recharge plans - All private telecom service providers have already increased mobile recharge rates last year. As telecom service providers need to expand their 5G networks and spend on 6G infrastructure, it is possible that mobile recharge rates may see a further hike. It may not happen immediately after the Union Budget 2025, but there is a strong possibility of price hike later this year.

If you make your moves now, you can save on items that are expected to become costlier after Union Budget 2025. However, it is recommended that you do your own research also before spending your money.

source: newspatrolling.com

0 notes

Text

Understanding the Tax Implications of Selling Gold in Canada

When selling gold in Canada, it’s important to be aware of the tax implications that could affect your profits. Whether you’re selling gold jewelry, coins, or bullion, there are rules that govern the taxation of your sale. At 24 Gold Group Ltd., we want to ensure you understand the key considerations involved in the sale of gold and how it can impact your financial situation. In this article, we’ll break down the tax implications of selling gold in Toronto and offer insights into How To Invest In Gold In Canada.

Tax Implications of Selling Gold in Toronto

Gold is considered a commodity in Canada, and its sale can have tax consequences, depending on how it’s classified. There are a few factors to consider when selling gold in Toronto, such as the type of gold you’re selling and whether or not you’ve held it as an investment.

Capital Gains Tax on Investment Gold If you’ve held gold as an investment and sell it for a profit, the sale is typically subject to capital gains tax. This means that 50% of your profit will be taxed at your marginal tax rate. For example, if you purchased gold for $1,000 and sold it for $1,500, you would have a $500 gain, with $250 being taxable as part of your income. The good news is that gold bars, coins, and bullion are often classified as “precious metals” and are subject to specific tax treatments. The Canada Revenue Agency (CRA) may treat the sale of these assets differently from other types of personal property, so it’s crucial to track the amount of capital gains when selling gold.

GST/HST on Gold Sales In Canada, the sale of certain gold items like gold coins or bars may be exempt from the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST), depending on the type of transaction and how the gold is classified. However, if the gold is not considered investment-grade or it doesn’t meet certain criteria set by the CRA, you could be required to pay GST/HST on the sale.

Selling Jewelry vs. Investment Gold The sale of gold jewelry is treated differently than the sale of investment gold. If you sell gold jewelry for a profit, the profit may be subject to tax as a form of income. However, if you’re simply selling the jewelry at a loss or for the same value as it was purchased, you may not need to pay taxes on the transaction.

How to Invest in Gold in Canada

If you're interested in getting into gold as an investment, there are several ways you can do so in Canada. Whether you're looking to diversify your portfolio or hedge against inflation, how to invest in gold in Canada can be done through a variety of options:

Physical Gold: Buying physical gold in the form of coins or bars is one of the most direct ways to invest.

Gold ETFs: Exchange-Traded Funds (ETFs) are a popular way to invest in gold without having to own the physical commodity.

Gold Stocks: Investing in companies involved in gold mining or exploration is another way to gain exposure to gold prices.

At 24 Gold Group Ltd., we help guide individuals on how to invest in gold in Canada by providing options for purchasing physical gold or exploring investment opportunities.

Contact Us

If you’re considering selling gold or want to know more about the Tax Implications Of Selling Gold in Toronto, don’t hesitate to reach out to us. We’re here to answer your questions and help you make informed decisions about your gold investments.

Read our blog for more information on the benefits of investing in gold and the potential tax consequences you should consider.

0 notes

Text

How to Get a Personal Loan as a Self-Employed Individual

For self-employed individuals, securing a personal loan can sometimes be challenging due to irregular income streams and lack of formal employment documentation. However, with the right approach, self-employed professionals can successfully obtain a personal loan to meet their financial needs. In this guide, we’ll explore the steps, eligibility requirements, and tips to improve approval chances.

Understanding Personal Loans for Self-Employed Individuals

A personal loan is an unsecured loan that can be used for various financial needs such as business expansion, medical emergencies, education, or home renovations. Unlike salaried individuals, self-employed applicants must provide additional financial proof to assure lenders of their repayment ability.

Eligibility Criteria for a Personal Loan as a Self-Employed Individual

Lenders have specific requirements for self-employed applicants. Here are the key eligibility criteria:

Stable Income

Proof of consistent income over a period (typically 2-3 years) is required.

Bank statements and income tax returns (ITRs) help establish financial stability.

Good Credit Score

A credit score of 700 or above increases approval chances.

Timely repayment of existing loans or credit card dues strengthens creditworthiness.

Business Stability

Most lenders prefer businesses to be operational for at least 2 years.

Providing a business license or GST registration can validate the legitimacy of the business.

Low Debt-to-Income Ratio

Keeping existing financial obligations low increases approval probability.

A DTI ratio below 40% is preferable.

Documents Required for a Personal Loan as a Self-Employed Individual

To support the loan application, self-employed individuals must submit the following documents:

Identity Proof: PAN Card, Aadhaar Card, Passport, or Voter ID

Address Proof: Utility Bills, Rent Agreement, or Passport

Income Proof: Last 2-3 years’ Income Tax Returns (ITR)

Bank Statements: Last 6-12 months’ bank statements

Business Proof: GST registration, Business License, or Trade Certificate

Steps to Apply for a Personal Loan as a Self-Employed Individual

Step 1: Assess Your Financial Situation

Before applying, analyze your financial health by reviewing income, expenses, and credit score. Ensure that you meet the lender’s eligibility criteria.

Step 2: Compare Lenders

Different banks, NBFCs, and online lenders offer personal loans with varying interest rates and terms. Comparing them helps in selecting the best option.

Step 3: Check Your Loan Eligibility

Use an online personal loan eligibility calculator to estimate how much you can borrow based on your income and financial obligations.

Step 4: Gather Required Documents

Ensure all necessary documents are in order before submitting the loan application.

Step 5: Submit the Loan Application

Apply for a personal loan online through a bank, NBFC, or fintech lender. Some institutions offer instant approval and quick disbursal.

Step 6: Loan Processing & Verification

Lenders verify the provided documents, income stability, and credit score before approving the loan.

Step 7: Loan Disbursal

Upon successful verification, the loan amount is credited to the borrower’s bank account.

Tips to Increase Personal Loan Approval Chances for Self-Employed Individuals

Maintain a Strong Credit Score

Pay bills and EMIs on time to improve creditworthiness.

Show Consistent Income

Regular bank transactions and financial statements help assure lenders of financial stability.

Opt for a Lower Loan Amount

Requesting a reasonable loan amount increases approval chances.

Provide Additional Collateral (If Required)

Some lenders may offer a secured personal loan where assets like property or gold can be pledged as security.

Choose a Lender Offering Flexible Requirements

Some digital lenders specialize in loans for self-employed individuals with relaxed eligibility criteria.

Benefits of Personal Loans for Self-Employed Individuals

No Collateral Required

Unsecured personal loans do not require pledging assets.

Quick Disbursal

Online application processes ensure fast loan approvals and disbursal.

Flexible Repayment Options

Borrowers can choose a repayment tenure ranging from 12 to 60 months.

Multipurpose Usage

The loan can be used for business expansion, medical needs, home renovation, or other expenses.

Final Thoughts

Securing a personal loan as a self-employed individual is possible with the right financial planning and proper documentation. Maintaining a good credit score, showcasing stable income, and comparing different lenders can help in obtaining a loan with the best terms.

For expert financial guidance and personalized loan recommendations, visit www.fincrif.com.

#loan apps#fincrif#bank#personal loans#nbfc personal loan#personal laon#loan services#finance#personal loan online#personal loan#Personal loan#best bank for personal loan#best personal loan rates#Personal loan for self-employed#Self-employed loan eligibility#Business loan vs personal loan#Instant personal loan for self-employed#Personal loan without income proof#Personal loan interest rates#Loan approval for self-employed#Best lenders for self-employed loans#Unsecured personal loan for business owners#Personal loan without collateral

0 notes