#Personal loan without income proof

Explore tagged Tumblr posts

Text

Top 10 Smart Ways to Use a Personal Loan to Improve Your Life

In today’s fast-moving world, financial flexibility is crucial. A personal loan offers a powerful solution for those looking to manage their finances more effectively. Whether it’s an unexpected emergency or a planned life event, a personal loan can bridge the gap between your needs and available funds. But what if you could go beyond just emergencies and use a personal loan to strategically improve your life? Here are ten smart ways you can use a personal loan to create a stronger, more secure future.

1. Consolidate High-Interest Debt

One of the smartest uses of a personal loan is to consolidate multiple high-interest debts. If you have several credit card balances, personal debts, or payday loans, merging them into one personal loan can simplify your finances and potentially lower your overall interest rate. With one manageable monthly payment, it becomes easier to stay organized and pay off your debts faster.

2. Finance a Major Life Event

Life’s biggest moments, like weddings, milestone birthdays, or the birth of a child, often come with hefty price tags. A personal loan can help you fund these events without emptying your savings or maxing out your credit cards. Instead of postponing important celebrations, a well-planned personal loan lets you enjoy life's milestones while managing repayment comfortably.

3. Cover Emergency Expenses

Emergencies are unpredictable — medical bills, urgent car repairs, or sudden home damages can wreak havoc on your finances. Having quick access to a personal loan during such times provides peace of mind. It allows you to handle the situation promptly without draining your emergency savings or going into panic mode.

4. Renovate Your Home

Your home is an investment, and upgrading it can increase its value significantly. Whether it's remodeling a kitchen, upgrading a bathroom, or making energy-efficient improvements, a personal loan can fund these projects. Unlike home equity loans, a personal loan doesn't require you to use your house as collateral, offering more flexibility and speed.

5. Start or Expand a Business

Dreaming of starting your own venture or expanding an existing one? A personal loan can provide the initial capital to kickstart your ideas. From setting up a website to purchasing inventory or marketing your services, small businesses can benefit greatly from the financial boost a personal loan offers.

6. Invest in Education

Education is one of the best investments you can make. If you or your family member needs funds for tuition, certification programs, or skill development courses, a personal loan can be a practical option. Unlike education-specific loans, a personal loan offers flexible terms, quicker approvals, and can be used for a wide range of educational purposes.

7. Pay for Medical Procedures

Beyond emergencies, there are elective medical procedures, dental work, or cosmetic surgeries that can be financially demanding. A personal loan enables you to prioritize your health or wellness goals without compromising on quality. You can choose the right doctor or procedure without being limited by immediate cash constraints.

8. Take a Dream Vacation

Travel broadens the mind, but often shrinks the wallet. A dream vacation with family or friends is priceless, but costs can pile up quickly. A personal loan can make your dream trip a reality without disrupting your regular budget. Whether it's a honeymoon, a solo trip across Europe, or a luxury cruise, a well-structured personal loan can help you enjoy the experience stress-free.

9. Buy Big-Ticket Items

Sometimes you need to purchase essential high-value items like a new laptop, home appliances, or furniture. Instead of burning your savings or relying on costly store financing options, a personal loan offers a smarter, lower-interest alternative to fund big purchases.

10. Build or Improve Your Credit Score

Surprisingly, a personal loan can be an effective tool to build or repair your credit score. If you make timely payments, it demonstrates your financial responsibility to credit bureaus. Moreover, if you use a personal loan to pay off credit card balances, it can improve your credit utilization ratio — one of the most important factors in credit scoring.

How to Maximize the Benefits of a Personal Loan

Simply getting a personal loan isn’t enough; using it wisely is key. Here are a few strategies to get the most from your personal loan:

1. Compare Lenders Carefully

Interest rates and fees can vary widely across banks, NBFCs, and online platforms. Always compare multiple offers before committing to a personal loan. Check the Annual Percentage Rate (APR), processing fees, prepayment charges, and hidden costs to make an informed decision.

2. Borrow Only What You Need

While it might be tempting to borrow more, stick to the exact amount you require. A larger personal loan means higher repayments and more interest over time. Responsible borrowing ensures you can manage the loan comfortably.

3. Choose the Right Tenure

Personal loan tenure affects both your EMI and the total interest paid. Shorter terms have higher EMIs but save on interest, while longer terms lower your monthly burden but increase total interest costs. Choose a balance that suits your cash flow.

4. Read the Fine Print

Before signing any personal loan agreement, go through all the terms and conditions thoroughly. Understand your repayment schedule, penalties for late payment, and policies on foreclosure or part-prepayment.

Common Mistakes to Avoid When Taking a Personal Loan

Even though a personal loan is a handy financial tool, mistakes can make it a burden. Here's what you should avoid:

Ignoring the True Cost: Some lenders offer low monthly EMIs but hide hefty processing fees or insurance charges. Always calculate the total repayment amount.

Missing Payments: Late payments hurt your credit score and invite penalties. Set up auto-debit mandates to avoid missing EMIs.

Applying with Multiple Lenders Simultaneously: Too many loan applications in a short time can negatively impact your credit score. Use online loan aggregators to check eligibility without multiple hard inquiries.

Over-borrowing: Never take a larger personal loan just because you are eligible for it. Always align borrowing with your repayment capacity.

Final Thoughts

A personal loan can be a game-changer when used smartly. Whether you want to consolidate debt, finance personal growth, or seize new opportunities, a personal loan provides the necessary financial agility. However, responsible borrowing, thorough research, and strategic planning are key to truly benefiting from it.

When chosen wisely, a personal loan is not just a liability; it becomes a stepping stone to achieving bigger dreams. At Fincrif.com, we help you find the best personal loan options with minimal hassle and maximum benefits. Take the first step toward a better financial future today!

#finance#loan apps#nbfc personal loan#fincrif#personal loan online#personal loans#bank#loan services#personal laon#personal loan#Personal loan#Best personal loan#Instant personal loan#Personal loan eligibility#Low interest personal loan#Online personal loan#Personal loan application#Personal loan for salaried individuals#Personal loan without collateral#Personal loan for self-employed#Personal loan EMI calculator#Pre-approved personal loan#Personal loan for bad credit#Quick personal loan approval#Personal loan interest rates#Personal loan for debt consolidation#Personal loan with flexible tenure#Personal loan without income proof#Compare personal loan offers#Personal loan for home renovation

0 notes

Text

Get Instant Personal Loan Online – Fast & Easy Approval Apply for an instant personal loan online with quick approval and minimal paperwork. Get fast funds for any need with flexible repayment options.

0 notes

Text

Unlocking Financial Aid: Securing Personal Loans with No Income Proof

Applying for a Personal Loan can be challenging, primarily if you can’t provide proof of income. This predicament is common among self-employed individuals, fresh hires, or those with an irregular income source. However, getting a Personal Loan without income proof isn’t impossible. This guide will walk you through the process, helping you understand how you can navigate the complexities and make informed decisions.

0 notes

Text

How To Get a Personal Loan Without Proof of Income: A Comprehensive Guide

Personal loans are a popular financing option for various needs, from unexpected expenses to home improvements to debt consolidation. However, many lenders require proof of income to qualify for a personal loan, which can be a barrier for some borrowers. Fortunately, there are ways to get a personal loan without income proof. Here’s a comprehensive guide to help you get the best personal loan…

View On WordPress

0 notes

Text

Personal Loans are an essential financial tool for many people in India. They can be used for a wide variety of purposes, from financing a wedding to covering unexpected medical expenses. However, getting approved for a Personal Loan without income proof can be challenging for many people, especially when it happens to be an essential prerequisite for most lenders.

0 notes

Text

No Salary Slip? No Problem! Apply for Instant Loan Online Without Documents in 2025

Struggling to get a loan due to low income, no salary slip, or poor credit score? You’re not alone.

In today’s fast-paced world, financial emergencies don’t wait. Whether it's a medical bill, urgent travel, or rent payment, people often need instant cash loans in 1 hour in India without the hassle of paperwork. However, traditional banks demand documents, proof of income, and a good CIBIL score.

What if we told you that in 2025, there are real solutions to get instant approval loans online without any salary slips, CIBIL checks, or even detailed income proofs?

Let’s explore India’s best no-verification loan apps that are helping thousands of users like you get money in minutes – stress-free.

Why Do People Look for Instant Loans Without Documents?

Many salaried individuals, freelancers, or small business owners often face these challenges:

No salary slip or bank statement

Low or no credit score (CIBIL)

No ITR or formal income proof

Need for urgent funds (within 1 hour)

That’s where instant loans without a salary slip and no-proof personal loan apps step in.

These apps leverage AI-powered credit engines, alternative data, and KYC to offer instant loan disbursal in minutes – even to first-time borrowers with no formal documents.

Who Can Apply?

You can apply personal loan online instantly if you meet the following:

Age: 18+ years

Basic KYC: PAN + Aadhaar

Bank account for loan disbursal

Mobile number linked to Aadhaar

Basic repayment capacity (even gig work/freelancing)

Top No-Verification Loan Apps in India (2025)

Here’s a list of trusted apps where you can get an instant loan without documents or a CIBIL check:

Most of these apps offer quick cash loans without income proof, helping even those with bad credit get personal loan approval.

How to Apply for a Loan Without Income Proof or CIBIL Check?

Here’s a step-by-step guide for an easy personal loan application online in India:

Download the App (Investkraft, KreditBee, CASHe, etc.)

Complete eKYC – Aadhaar + PAN verification

Enter Basic Details – Employment type, monthly income (self-declared)

Bank Account Link – To receive disbursal

Loan Offer & Approval – Instant approval in most cases

Get Funds – Loan disbursal in minutes to your bank or wallet

That’s it! No need to upload salary slips, bank statements, or wait for long approvals.

Real-Life Scenario: How Ramesh Got ₹20,000 in 15 Minutes

I work part-time and earn ₹12,000 monthly. No ITR, no salary slip. I had a sudden health expense and tried KreditBee. I just uploaded my Aadhaar, PAN, and filled in basic info. ₹20,000 was credited to my account in under 15 minutes. Zero paperwork, no credit check!

— Ramesh, 21, Delhi

Is It Safe to Borrow from No-Proof Loan Apps?

Yes, but choose only RBI-registered NBFC-backed apps. Read reviews, verify data encryption policies, and ensure they don’t ask for unnecessary permissions.

Avoid shady apps that:

Demand advance payments

Call your contacts

Threaten legal action

Stick to reputed names like KreditBee, CASHe, and PaySense for a trusted instant loan without a credit score check in India.

Common Myths Busted

Top 5 FAQs – Instant Personal Loans Without Documents in India

1. Can I get a loan without a CIBIL or a salary slip?

Yes. Many apps allow a loan without a salary slip or a bank statement using KYC and alternate data.

2. How fast can I get the loan amount?

You can receive funds within 5 to 30 minutes, depending on the app and verification speed.

3. Is my low CIBIL score a problem?

No. Several platforms specialize in offering loans without a credit score check in India or to low-CIBIL borrowers.

4. Which is the best app for quick cash without income proof?

KreditBee and TrueBalance are top-rated for quick cash loans without income proof.

5. Do I need a job to get a personal loan?

Not always. Some apps offer loans to freelancers, students, and self-declared income earners.

Final Thoughts – Raise Instant Funds Without Hassle in 2025

In 2025, getting instant personal loans without income proof, CIBIL score, or documents is no longer be a dream. With the rise of AI-driven loan platforms, users across India can now meet urgent needs without fear of rejection.

Whether you're looking to apply personal loan online instantly, get an instant cash loan in 1 hour in India, or use a no proof personal loan app, the options are many – and very real.

Choose your app wisely. Stick to trusted names. Borrow only what you need. And enjoy the freedom of instant funds without paperwork.

#Get instant approval loan online#apply personal loan online instantly#instant cash loan in 1 hour in India#insta loan app without salary slip#bad credit personal loan approval guaranteed#loan without salary slip or bank statement#easy personal loan apply online India#instant loan disbursal in minutes#get instant loan without documents#quick cash loan without income proof#no proof personal loan apps#loan without credit score check in India

0 notes

Text

The Future Scope of an MBA in Finance

The Future Scope of an MBA in Finance The Future Scope of an MBA in Finance Are you considering pursuing an MBA in finance? If so, you may be wondering about the future scope of this degree. In today’s rapidly evolving business landscape, it’s essential to understand how this qualification can benefit you in the long run. The Growing Demand for Finance Professionals Finance is a critical…

View On WordPress

#best loan app#finance professionals#future scope#instant loan#instant loan app#instant loan app without income proof#instant personal loan#instant personal loan app#instant personal loan online without income proof#loan#loan app#MBA in finance#new loan app#The Future Scope of an MBA in Finance

0 notes

Text

Cash Advance in Quebec: Fast Financial Relief for Short-Term Needs

For Quebec residents needing quick cash to cover unexpected expenses, a cash advance can offer fast access to funds. This short-term financial solution is designed to help manage urgent costs like medical bills, car repairs, or utility bills, providing you with immediate cash when you need it most.

Here’s what you need to know about cash advances in Quebec, including how they work, requirements, benefits, and some important considerations before you apply.

What Is a Cash Advance?

A cash advance is a short-term loan that provides immediate funds, usually repaid on your next payday or within a few weeks. In Quebec, cash advances are often offered by payday lenders and online loan providers, making them accessible and convenient for those facing temporary cash flow issues.

How Does a Cash Advance Work?

Application: You can apply online or at a cash advance location in Quebec. The application typically requires basic information like your ID, proof of income, and bank details.

Approval Process: Cash advances don’t usually require a credit check, so approvals are quick, often within minutes.

Funding: Once approved, the funds are sent to your bank account, sometimes within hours through e-Transfer or direct deposit.

Repayment: The loan amount plus any fees is usually due on your next payday. Some lenders may offer flexible repayment options for a slightly longer term.

Benefits of Cash Advances in Quebec

Quick Access to Funds: Cash advances are ideal for emergencies, as they provide immediate funds without lengthy approval times.

No Credit Check Needed: Most cash advance providers don’t perform a credit check, making them accessible to people with low credit scores.

Flexible Usage: You can use a cash advance for a wide range of expenses, from car repairs to last-minute travel.

Easy Online Applications: Many Quebec lenders offer online applications, allowing you to apply from the comfort of your home.

Requirements for Getting a Cash Advance in Quebec

To qualify for a cash advance, lenders generally require:

Proof of Income: Regular income, such as employment income, government benefits, or pension funds.

Canadian Bank Account: A bank account for direct deposit and repayments.

Government-Issued ID: Proof of identity and Quebec residency.

Contact Information: A valid phone number and email address.

Things to Consider Before Taking a Cash Advance

While cash advances provide immediate financial relief, there are a few important considerations:

High Fees and Interest: Cash advances often come with high fees. In Quebec, payday lenders can charge up to $15 per $100 borrowed, which can add up quickly.

Short Repayment Period: Repayment is typically due on your next payday, which can be challenging if you don’t have enough cash flow to cover the loan.

Risk of a Debt Cycle: Repeatedly relying on cash advances may lead to a cycle of debt. Borrow only what you need and plan to repay on time.

Tips for Using a Cash Advance Responsibly

Borrow Only When Necessary: Use a cash advance only for urgent expenses that can’t be postponed.

Budget for Repayment: Make sure you’ll have sufficient funds to repay the loan on time to avoid additional fees.

Explore Other Options First: If possible, consider alternatives like personal loans, borrowing from family or friends, or using a credit card cash advance if it’s more affordable.

Understand the Terms: Be clear on the fees, interest rate, and repayment schedule before agreeing to the loan.

Alternatives to Cash Advances in Quebec

Credit Union Loans: Many credit unions in Quebec offer short-term loans at lower interest rates than payday lenders.

Installment Loans: These loans allow for longer repayment periods and may offer better terms than cash advances for those who qualify.

Credit Card Cash Advance: While credit card cash advances have high interest, they might still be cheaper than payday loans if paid off quickly.

Community Assistance Programs: For essential expenses, check if any local resources or assistance programs in Quebec can help.

Frequently Asked Questions (FAQs)

1. Can I get a cash advance with no credit check in Quebec?Yes, most cash advance lenders don’t require a credit check, focusing instead on your income and ability to repay.

2. How much can I borrow with a cash advance?Cash advance amounts typically range from $100 to $1,500, depending on your income and the lender’s policies.

3. How quickly can I receive the funds?Many lenders offer same-day or next-day funding, particularly if you apply online.

4. Are cash advances expensive?Yes, cash advances come with high fees due to their short-term nature. In Quebec, the maximum fee allowed is $15 per $100 borrowed.

5. What happens if I can’t repay my cash advance on time?If you’re unable to repay on time, contact your lender. Many lenders offer extensions, but they usually come with additional fees. Avoid defaulting, as it could negatively impact your financial situation.

Cash advances in Quebec provide a quick financial solution for short-term needs, but they come at a cost. While they can help in emergencies, it’s essential to borrow responsibly, considering both the repayment terms and potential alternatives. By planning carefully, a cash advance can provide the immediate relief you need without compromising your financial stability.

3 notes

·

View notes

Text

Direct Lender - Traditional Loan Solution - Short Term Loans UK

When you need a little cash advance to cover bills that come up in between two paychecks, short term loans UK direct lender are the most popular financial choice. Many people on salaries struggle to control their monthly expenses due to their fixed income. They have to get some money quickly, but they're not sure where to apply for a short term loans UK. Landlords have rigorous financing terms and conditions. Forget about it and go for the online short term loans direct lenders that provide enough funding with less paperwork.

Several payday lending companies in the United Kingdom are collaborating with numerous lenders. To swiftly and simply locate short term loans UK direct lender, you must go online. With so many lenders in this fiercely competitive lending industry, you have to choose one. You now need to begin filling out an application form that is straightforward and free of charge, including all the required details. The lender will securely deposit the funds into your bank account after this process is complete and may make an instant decision regarding approval. Tough procedures like faxing and copious documentation don't exist with this media.

A short term loans direct lenders require standard requirements to be met. By the time you are 18, you ought to be an adult. You possess a valid UK residency proof that is at least half a year old. In order to receive the applicable funds in your bank account via direct deposit, you must be employed or self-employed with a monthly income of at least £750 and maintain an open checking account.

All of these requirements help you, in spite of your poor credit history; locate the ideal cash bargain on short term loans UK direct lender and short term direct lenders for persons receiving benefits. If you have adverse credit factors—arrears, foreclosure, late payments, missed payments, judgments from country courts, individual voluntary agreements, defaults, insolvency, or low credit scores—you are eligible to apply for a loan at any time without worrying about a credit check because there isn't one required.

There are occasions when you suddenly find yourself short on cash and without a debit card. To receive 100% approval for a short term loans UK, you must proceed. In lieu of the provided financing, you can obtain an amount between £100 and £2500 without providing collateral. A brief repayment time of two to four weeks is provided by this financing. Additionally, you are allowed to use the funds to pay off any number of bills, including those for groceries, power, unintentional medical charges, credit card debt, and other expenses.

Are you trying to find more about same day loans UK? Learn why we provide same day loans online and why they are prohibited. Payday loans from Payday Quid are far more equitable, adaptable, and responsible. Applying for a same day loan with us is simple, and as a new client, you could get a loan quickly and easily, with amounts ranging from £100 to £2500.

https://paydayquid.co.uk/

5 notes

·

View notes

Text

Short Term Cash Loans: The Best Cash Support

Have you been already exhausted coping lot loan formalities for availing the money in United Kingdom? Don’t worry! Here you are advised to apply for short term cash loans is the best one solution helping you solving miscellaneous financial needs such as paying for medical bills, electricity bills, grocery store bills, child’s school or tuition fees, repairing of car and so forth.

Despite your bad credit history, you can always obtain cash support with short term cash loans. Many lenders are willing to give you the money without requiring credit verification. You therefore have bad credit factors, such as bankruptcy, insolvency, foreclosure, arrears, late payments, CCJs, and so on.

There are short term loans UK direct lender that range in size from £100 to £1,000. The incredible thing is that you may take advantage of the loan mentioned here without having to worry about having to pledge assets as security. This makes it possible for tenants and non-homeowners alike to benefit greatly from the loan. With this money in your possession, you can promptly and simply handle unforeseen expenses. This must be returned within two to four weeks.

Remember that you must meet certain requirements, like being at least eighteen years old, a resident of the United Kingdom, working a regular job that pays at least £1000, and having an open bank account. You can apply for a short term loans UK direct lender as soon as feasible, 24/7. To get your application verified, you must fill out the online form and submit it. On the day of application, the loan is approved and deposited into your account.

Why Apply for a Loan Without Security?

There are many causes for which a person could require a short term loans UK. This kind of loan is helpful for debt consolidation or for funding large expenditures.

The following are a few typical explanations for requesting a short term loan:

Combining debt with high interest rates

Unexpected maintenance or crises

Settling medical debt

Paying for required house repairs

Taking out a short term loans UK for expensive items like electronics or trips can sound alluring. It is not advised to do this. Debt that is not needed might put a strain on your budget and harm your financial stability.

It is usually advisable to save money in advance if you wish to purchase expensive goods or activities. It is advised to use short term loans UK for emergencies. Or other inescapable financial requirements, such as loans for debt consolidation.

Typically, you have to check a few boxes in order to be eligible for a short term loans direct lenders. For example, you require a consistent source of income, ideally from a job. You must provide proof of your address and that your income exceeds your expenses, or that you can afford to take out a loan and repay the balance over time in equal installments. You must have a bank account that you may use to make payments on your personal loan when you apply online.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Can a Homemaker Apply for a Personal Loan?

Introduction

A personal loan is often a go-to financial solution for individuals needing urgent funds. However, one common question is whether a homemaker can apply for a personal loan without a fixed income source. While banks and NBFCs typically offer personal loans to salaried and self-employed individuals, homemakers have options too.

This guide explores how homemakers can secure a personal loan, eligibility criteria, required documents, and the best lenders offering financial support.

Can Homemakers Apply for a Personal Loan?

Yes, homemakers can apply for a personal loan, but since they do not have a regular income, they may need to explore alternative ways to qualify. Many lenders allow homemakers to apply for a loan with the help of a co-applicant, collateral, or proof of alternative income sources.

Ways a Homemaker Can Get a Personal Loan

1. Apply with a Co-Applicant or Guarantor

A homemaker can apply for a personal loan with a co-applicant (such as a spouse or a working family member). The co-applicant’s income and credit score will determine the loan approval and interest rate.

2. Opt for a Secured Personal Loan

Many financial institutions offer secured personal loans against assets like gold, fixed deposits, or property. If a homemaker has valuable assets, they can pledge them to get a loan with lower interest rates.

3. Show an Alternative Income Source

If a homemaker earns from freelance work, tutoring, rental income, or a home-based business, they can present these income sources as proof of financial stability.

4. Apply for Special Personal Loan Schemes

Certain banks and NBFCs have special personal loan schemes for women and homemakers, offering easier eligibility terms and lower interest rates.

Eligibility Criteria for Homemakers Applying for a Personal Loan

CriteriaRequirementsAge18 - 65 yearsCredit Score650+ (if applicable)Income SourceCo-applicant’s income, secured assets, or alternative incomeEmployment StatusHomemaker with financial backingLoan Amount₹50,000 - ₹50 lakh (varies by lender)Repayment Tenure12 months - 5 years

Best Personal Loan Providers for Homemakers

If you’re a homemaker looking for a personal loan, consider these trusted lenders:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

InCred Personal Loan

Documents Required for a Homemaker to Apply for a Personal Loan

KYC Documents: Aadhaar Card, PAN Card, Voter ID

Income Proof: Co-applicant’s salary slips, bank statements, rental income, or alternative earnings proof

Collateral Proof: If applying for a secured loan

Address Proof: Utility bill, rental agreement, passport

Pros and Cons of a Personal Loan for Homemakers

Pros:

✔️ Financial independence for homemakers ✔️ Quick loan approval with a co-applicant or collateral ✔️ No restrictions on loan usage ✔️ Special schemes available for women borrowers

Cons:

❌ Higher interest rates for unsecured loans ❌ Requires a strong co-applicant or asset for approval ❌ Loan rejection risk if credit history is weak

Tips to Improve Loan Approval Chances for Homemakers

✔️ Maintain a good credit score if you have a credit card or past loan history. ✔️ Opt for a loan amount that suits your repayment capability. ✔️ Consider applying with an earning spouse or family member. ✔️ Explore secured loan options for better interest rates. ✔️ Compare lenders to get the best personal loan deal.

Conclusion

Homemakers can apply for a personal loan through various means, including co-applicants, secured loans, or proof of alternative income. While banks and NBFCs may have strict criteria, many lenders offer customized loan schemes for homemakers to achieve financial independence.

For the best personal loan options, explore:

Personal Loan Options

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

InCred Personal Loan

By selecting the right loan type and preparing the necessary documents, homemakers can access financial assistance and meet their personal or family-related needs smoothly.

#personal loan#loan apps#bank#fincrif#personal loan online#loan services#nbfc personal loan#personal loans#finance#personal laon#Personal loan#Personal loan for homemakers#Personal loan without income proof#Best loans for homemakers#Personal loan for housewives#Loan for non-working women#How to get a personal loan as a homemaker#Can a housewife apply for a personal loan without a job?#Best banks offering personal loans for homemakers#Personal loan eligibility for homemakers in India#How to secure a loan without a salary slip

0 notes

Text

0 notes

Text

What I really don't understand about housing is that it's treated like a business and not something humans need to live. It's inhumane.

The US constitution says we have the right to life, liberty, and pursuit of happiness. You know what's required for those things? A place to live. Homelessness in itself is unconstitutional. And don't we all agree that everyone deserves a place to sleep? Don't we all agree that we don't want people on the streets?

Banks and landlords should not decide whether or not someone has a place to live.

Let's think about it this way.

This is the reality for a lot of people.

You owe money to your past landlord? Even if they lied about the circumstances? Sorry, no one can rent to you now because that money is more important than your & your kids' safety and going homeless. They "can't help it", they need their "business" to prosper, not you. They're not gonna get their money paid back any faster – in fact, now you have MORE expenses & it'll be a slower process.

Maybe the company that owns the place is worth millions and they won't be hurting at all without the money. Doesn't matter. You're going to be punished since you couldn't help make them richer. Their lives matter more than yours, sorry.

Now you're either couch hopping, living out of your car, or out on the streets. You have to find a way to pay back your landlord instead of saving up for another place. Now let's say you're on disability like I am, or in between jobs. You're having trouble getting someone to hire you or getting on any assistance because you no longer have a mailing address. You only have a few hundred bucks per MONTH to survive off of.

Maybe your landlord agrees to do a payment plan, but now you have to choose between having food & your other bills paid for or paying them a minimum $150-$200 a month, that they want delivered to them in person every time. Now you assume someone will rent to you because you have proof that you're paying it off, but you're losing money on application fees because they still won't work with you. You have to somehow come up with the money for the applications, a down payment, and first month's rent while also paying back your previous landlord in the off chance that someone MIGHT rent to you after you've already blown $300 on application fees.

Your landlord made the decision to make you homeless.

"Well they have to add that stuff to their rental record!" that record is only kept to work with other landlords to make sure that no one can have a place to live unless they're profitable. They're contributing to that system.

"But landlords need a way to make money too!" Here's a tip: find a real job. Owning something and receiving passive income from it is not a job. Your tenants are busting their asses at their real jobs just for you to take 1/3 of their income so you can live comfortably knowing that other people's labor is paying your bills.

EVERY HUMAN DESERVES THE RIGHT TO A PLACE TO LIVE.

Landlords are a class of people that should NOT EXIST. There is no reason we need a person that stands between us and owning a house – just to tell us what we can and can't do in the place we're paying for.

"But I can't afford a mortgage and need to rent!"

You're already paying off your landlord's mortgage and MORE. The housing market is the way it is because landlords drove the prices up. And this is where it's the bank's fault as well. You can't save up for a down payment because you're paying off someone else's mortgage; you can't get approved for a home loan because with the price of housing you have to be able to qualify for a larger amount than before, or maybe you happened to have one or two unexpected life events that lowered your credit score. The banks decide that their profit is more important than human lives, too.

The vast majority of us are only a couple of missed paychecks away from homelessness.

We can't keep complaining about homelessness while ignoring the root cause of the issue.

#.bdo#homelessness#im real salty about having to live w my mom#bc the property managers claimed they had to replace the entire carpet for my cat peeing in one spot#i owe 1100#i lost my housing assistance because of it#ALAB

6 notes

·

View notes

Text

Jhatpat loan

Jhatpat Loan from Al Khair Bank is designed for individuals needing quick, hassle-free financial assistance. “Jhatpat” means “instant” or “quick” in Hindi, and these loans are structured for rapid approval and disbursement, making them ideal for emergencies, urgent expenses, or short-term needs.

Key Features Interest-Free: All Jhatpat Loans are Sharia-compliant, meaning they are provided without any interest, adhering to ethical Islamic banking principles.

Swift Processing: The application process is streamlined for fast approval, with minimal documentation and quick disbursal of funds, often within a few business days.

Flexible Use: Loans can be used for personal needs, medical emergencies, education, business, or home repairs.

Transparent and Ethical: No hidden charges or unfair lending practices; all terms are clearly communicated.

Eligibility Criteria Age between 21 and 60 years

Stable source of income (salaried or self-employed)

Good credit history

Valid identification and address proof

Application Process Choose Loan Type: Select the loan that matches your needs-personal, business, education, or home loan.

Check Eligibility: Ensure you meet the age, income, and credit requirements.

Gather Documents: Prepare ID proof, address proof, income proof, and recent bank statements.

Apply Online or Offline: Submit your application through the Al Khair Bank website or visit a branch.

Verification & Approval: The bank reviews your application and verifies your documents for a swift decision.

Disbursement: Upon approval, funds are transferred directly to your bank account.

Why Choose Jhatpat Loan from Al Khair Bank?

Quick Approval and Disbursement

0% Interest, Sharia-Compliant

Flexible Repayment Options

User-Friendly Application Process

Trusted and Ethical Banking Partner

Jhatpat Loan is an ideal solution for anyone seeking fast, ethical, and interest-free financial support with minimal paperwork and maximum transparency.

#personal loans for students#al-khair bank loan details#al-khair bank loan online apply#al khair islamic bank#Al Khair Credit Society#al khair bank#jhatpat loan#0 interest loans

0 notes

Text

Personal Loan Without Guarantor: How to Apply and Get Approved Quickly

Personal loans have become a lifeline for many individuals facing financial crunches. Whether it's for medical emergencies, home renovations, or debt consolidation, a personal loan can offer the financial relief you need. However, many people shy away from applying for a loan because they believe they need to offer collateral or a guarantor. This article will break down the process of applying for a personal loan with no guarantor or collateral, providing you with step-by-step guidance to get a Quick Approval Personal Loan without the usual requirements.

What is a Personal Loan Without a Guarantor or Collateral?

A personal loan without collateral or a guarantor is an unsecured loan. Unlike secured loans, where you need to pledge an asset (like your home or car) or get someone to co-sign, this type of loan does not require any form of security. It’s based entirely on your creditworthiness, income, and repayment capacity. For those who have limited assets or cannot rely on a guarantor, this is the perfect option.

Why Choose a Personal Loan Without Collateral or Guarantor?

No Risk to Assets: Since there’s no collateral involved, you don’t risk losing any of your valuable assets, such as your home or car.

Faster Processing: These loans typically have a quicker approval process because there’s no need for property evaluation or third-party approval.

Flexibility in Usage: Personal loans are versatile. You can use the funds for a variety of purposes, such as medical bills, travel, or home renovation.

Convenience: With the rise of digital banking, you can apply for an Online Personal Loan Application Process and get the funds disbursed to your bank account in no time.

How to Apply for a Personal Loan with No Guarantor or Collateral?

The process of applying for an unsecured personal loan is straightforward, but it’s important to understand the eligibility criteria, required documents, and the application steps.

1. Check Your Eligibility

Before applying, you need to ensure that you meet the basic eligibility criteria. Typically, lenders will check the following:

Age: Most lenders require you to be between 21 and 58 years old.

Income: A steady source of income is crucial. Lenders generally prefer individuals with a monthly income of at least ₹20,000-30,000.

Credit Score: While you don’t need collateral or a guarantor, a good credit score (750 or above) increases your chances of approval for an Instant Cash Loan Disbursal.

Employment Status: You must be either salaried or self-employed. Some lenders may have additional criteria based on your profession or employer.

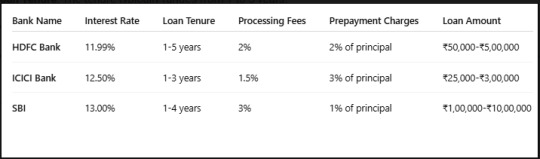

2. Compare Lenders and Loan Offers

It’s crucial to compare different personal loan offers before making a decision. Look for key features such as:

Interest Rates: Personal loans without collateral tend to have higher interest rates compared to secured loans.

Loan Tenure: The tenure typically ranges from 1 to 5 years.

Processing Fees: Some lenders charge processing fees, which could impact the total loan cost.

Prepayment Charges: In case you plan to pay off your loan early, it’s essential to check if there are any prepayment penalties.

You can use comparison tables to easily assess which lender offers the best deal for you.

3. Gather Required Documents

Though you don’t need a guarantor or collateral, you’ll still need to provide certain documents for verification:

Identity Proof: Aadhar card, passport, voter ID, or driver’s license.

Address Proof: Utility bills, Aadhar card, passport, or rental agreement.

Income Proof: Salary slips, bank statements, or IT returns (if self-employed).

Photographs: Passport-sized photos for identity verification.

4. Complete the Online Personal Loan Application Process

Many lenders now offer the ability to apply online. The Online Personal Loan Application Process is simple and quick. You’ll need to fill out an application form, upload your documents, and submit it for processing. Once your loan is processed, you’ll receive an Instant Personal Loan Approval (provided you meet the eligibility criteria).

5. Wait for Approval and Loan Disbursal

Once your application is approved, the lender will process the loan and disburse the funds into your bank account. This could take anywhere from a few hours to a couple of days, depending on the lender. With some lenders offering Fast Insta Loan Approval, you can get the money in your account within the same day or the next.

Key Factors to Consider When Applying for an Unsecured Personal Loan

Interest Rates: Be sure to understand the interest rate and how it will affect your EMIs.

Repayment Flexibility: Choose a lender that offers flexible repayment options.

Loan Limitations: Understand the maximum and minimum loan amounts.

Hidden Fees: Look for hidden fees or charges that could add up during the loan tenure.

Benefits of Taking an Instant Personal Loan with No Guarantor or Collateral

No Risk of Losing Assets: As mentioned earlier, there’s no collateral required, so you won’t risk losing valuable assets like your home or car.

Faster Access to Funds: The application process is much quicker, and many lenders offer Instant Cash Loan Disbursal, ensuring you get funds when you need them the most.

No Need for a Guarantor: You can apply independently without needing someone else to co-sign the loan, making the process more private and straightforward.

Flexible Loan Usage: Personal loans can be used for almost any purpose—medical expenses, home repairs, education fees, and more.

Quick Processing with Minimal Documentation: With minimal paperwork and quick processing times, you can have your loan approved in no time.

5 Frequently Asked Questions (FAQs)

1. Can I get a personal loan with no CIBIL score?

While having no CIBIL score may reduce your chances of approval, some lenders may still offer a personal loan without CIBIL. However, you may face higher interest rates and stricter eligibility criteria. It’s best to check with individual lenders.

2. What is the interest rate on a personal loan with no collateral?

Interest rates on unsecured personal loans are generally higher than those on secured loans. Typically, rates range from 11% to 24% depending on your credit score and the lender's policies.

3. How long does it take to get approved for an unsecured personal loan?

The approval time can vary from lender to lender, but with Fast Insta Loan Approval, you may receive approval within a few hours. Disbursement can take anywhere from a few hours to a couple of days.

4. Do I need a guarantor for a personal loan without collateral?

No, a personal loan without collateral does not require a guarantor. The loan is approved based on your creditworthiness and financial situation.

5. What if I miss a payment on my personal loan?

Missing a payment can affect your credit score negatively. Lenders may charge late payment fees, and repeated missed payments could lead to legal action or the loan being sent to collections.

In conclusion, applying for a personal loan with no guarantor or collateral is entirely possible and often a quick and convenient solution to financial challenges. By following the outlined steps, comparing lenders, and ensuring you meet eligibility requirements, you can secure the funds you need without risking your assets or involving a third party.

#Quick Approval Personal Loan#Online Personal Loan Application Process#Instant Cash Loan Disbursal#Fast Insta Loan Approval#Personal Loan with Bad Credit Score#Unsecured Personal Loan Without Income Verification#How to Apply for Personal Loan in India#Quick Online Personal Loan Approval#Fast Instant Loan Disbursement#Quick Access to Instant Loan Funds#No Income Proof Instant Loan#Unsecured Instant Loan Without CIBIL Score

0 notes

Text

Top Tips to Apply for Commercial Vehicle Loan Successfully

Beginning or opening a transportation-based business usually entails the purchase of commercial vehicles. Whether trucks, buses, delivery vans, or other utility cars, the expenditure can be a hefty one. That's why Commercial Vehicle Financing is available. It provides an efficient means to acquire the vehicles you require without forking over the entire sum in advance. Yet, making a successful to Apply for commercial vehicle loan involves preparation and knowledge. Here are the best tips to assist you in getting the most out of this funding opportunity.

1. Know Your Needs

Before seeking any form of financing, it is important to evaluate your particular business requirements. Do you need new vehicles, or will Used Commercial Vehicle Loans be adequate? New vehicles tend to have more substantial loan amounts and longer payment periods, whereas used vehicles might have more affordable choices. Knowing your requirements aids in choosing the correct lender and loan type that meets your business objectives.

2. Check Your Credit Score

Your creditworthiness is one of the initial things that lenders consider. If you are an individual owner or a business organization, having a good credit rating increases your likelihood of being approved. Ensure you review both your business and personal credit scores before Apply for Commercial vehicle loan. In case your score is low, take some time and raise it by settling outstanding debts or clearing any errors on your credit report before applying for Commercial Vehicle Financing.

3. Have a Clear Business Plan

Lenders want to see that you’re using the vehicle for a legitimate and profitable business purpose. Having a clear and realistic business plan helps establish your intent. It should include details about how the vehicle will be used, expected revenues, and your ability to repay the loan. For those applying for Used Commercial Vehicle Loan, emphasize how the purchase fits into your business strategy and how it offers value.

4. Familiarize Yourself with the Types of Loans Offered

There are various types of loans offered under Commercial Vehicle Financing. These are new vehicle loans, Used Commercial Vehicle Loans, lease financing, and refinancing. Ensure you know which type of loan is best for your business. Used car loans tend to have higher interest rates but lower principal balances. Knowing the terms will enable you to make a wiser choice.

5. Gather Required Documentation

To hasten your Commercial Vehicle Loan process and ensure better chances of approval, be prepared with the documents. While these may differ according to lender requirements, some common documents are:

Identity and address proof

Business registration certificates

Bank statements (generally 6–12 months back)

Income tax returns

Quotation or invoice of the vehicle

Evidence of down payment (if any)

Correct documentation portrays openness and encourages lenders to believe in your discipline in managing money.

6. Select the Appropriate Lender

All lenders are not the same when it comes to terms or Commercial Vehicle Financing expertise. They may provide more favorable terms on Used Commercial Vehicle Loans or something else for newer vehicles. Check interest rates, repayment terms, processing charges, and customer review ratings before choosing a lender. Research can result in improved terms and smooth loan processing.

7. Select Down Payment Alternatives

Most Commercial Vehicle Loan lenders will ask for a down payment. A larger down payment can lower your loan size, leading to smaller EMIs and lower interest rates. If you have the means to pay a large amount upfront, it might increase your chances of getting a loan. For second-hand vehicles, down payments are usually smaller, making Used Commercial Vehicle Loans more affordable for companies with less capital.

8. Assess Repayment Capability

Before Apply for Commercial vehicle loan, evaluate your company's capacity to repay the loan. Lenders will consider your income, cash flows, and outstanding liabilities. Select a loan term that fits your business cycles and income streams. For example, seasonal businesses can opt for longer terms with smaller monthly payments. Honesty in reporting your repayment capacity is key to preventing defaults and preserving your credit score.

9. Look for Hidden Charges

When opting for Commercial Vehicle Financing, look beyond the interest rate. Check for hidden charges such as:

Loan processing fees

Prepayment penalties

Late payment fees

Insurance and registration costs

These extra charges can add up and affect your overall cost of borrowing. Always read the loan agreement carefully and clarify any doubts before signing.

10. Explore Government Schemes and Subsidies

In most nations, the government assists small enterprises in the form of subsidies and low-interest loan programs. Such programs typically extend to Commercial Vehicle Loans, such as Used Commercial Vehicle Loans, and tend to have favorable terms compared to private lenders. Investigate such options through local banks or government portals to find out if you are eligible for any assistance.

11. Ensure Transparency and Honesty

Lenders prefer honesty. Trying to cover up financial trouble or providing counterfeit documentation can get your application turned down. Admit your income, debt, and usage of the vehicle. Providing accurate and comprehensive information not only accelerates approval but also helps to establish rapport with your lender.

12. Use a Financial Advisor

If you're new to Commercial Vehicle Financing or have complicated financials, it can be beneficial to speak with a financial advisor. Advisors can walk you through the process, assist in selecting the appropriate lender, and make sure that the terms of the loan fit your long-term business objectives. They can also help in assessing whether new or Used Commercial Vehicle Loans are better financially suited for your present situation.

Conclusion

Pursuing a Commercial Vehicle Loan needn't be a source of anxiety or confusion. With proper preparation, sound knowledge of your requirements, and stable financial records, you stand a better chance of obtaining a successful loan application. Whether you plan to opt for new models or settle for more reasonably priced Used Commercial Vehicle Loans, the secret is in making informed choices and handling finances with care.

Commercial Vehicle Financing is a powerful solution that can help you build your business and remain competitive in a changing marketplace. Use these tips, and you'll be well on your way to securing the vehicles that power your business.

0 notes