#Tax services

Explore tagged Tumblr posts

Text

#taxes#tax services#tax season#april 15th#tax#income tax#pay your taxes#tax consultant#tax compliance#tax credits#tax corporations

3 notes

·

View notes

Text

Know about the 5 strategies when filing for the dissolution to save taxes.

1 note

·

View note

Text

KGT Applications offers tailored business solutions. We design custom tools to automate tax processes, streamline operations and enhance efficiency to ensure tax compliance and business growth. With a comprehensive suite of enterprise software, businesses can optimize their processes and reach their maximum potential. Contact KGT Applications today!

#tax services#sap consulting services#business automation#business solutions#process management#Enterprise software

3 notes

·

View notes

Text

GST services Singapore

K.M.Ho & Co. offers Business financial audit, GST services Singapore, Public Accounting audit, GST accounting, Tax filing and return services with our top-rated audit firm for handling your business issues in Singapore at reliable prices.

#Business financial audit#Accounting audit#Audit firm singapore#Audit and tax services#Business audit#Tax audit services#Tax audit#Accounting audit services#Accounting audit firms#Tax services#Tax filing services#Tax return services#Public accountant singapore#Public accounting firm singapore#Accounting services singapore#Accounting firm services#GST accounting services#GST filing singapore#GST services singapore#GST return services

2 notes

·

View notes

Text

GST Consultants in Delhi

Conquering the Labyrinth: Navigating GST with Legalntax, Your Expert GST Consultants in Delhi The Goods and Services Tax (GST) has revolutionized the Indian tax landscape, but its complexities can often leave businesses feeling lost in a labyrinth. Fear not, intrepid entrepreneurs! Legalntax, your trusted GST consultants in Delhi, are here to guide you through every twist and turn.

Why Choose Legalntax as Your GST Guide in Delhi? With a team of seasoned chartered accountants and tax specialists, Legalntax possesses the expertise and experience to handle all your GST needs. We're not just number crunchers; we're your strategic partners, providing comprehensive GST solutions tailored to your unique business.

Our Services:

GST Registration: We'll ensure smooth and hassle-free registration, helping you navigate the intricacies of online and offline procedures. GST Return Filing: Leave the complexities of return filing to us. We'll ensure accuracy and timely submission, minimizing the risk of penalties. GST Compliance: Stay compliant with ever-evolving GST regulations. Our proactive approach keeps you informed and updated, avoiding compliance pitfalls. GST Audits and Assessments: Face audits with confidence. We'll represent you with expertise and ensure smooth resolution of any discrepancies. GST Litigation: In case of disputes, our legal team will fight for your rights, protecting your business from unnecessary burdens. GST Advisory: We're your sounding board. Seek expert advice on optimizing your GST strategy, minimizing tax liabilities, and maximizing profitability. Beyond Technical Expertise:

Legalntax goes beyond just crunching numbers. We understand that GST compliance can be a significant burden on businesses. That's why we focus on simplifying the process, making it transparent and understandable for you. We provide regular updates and guidance on the latest GST developments, empowering you to make informed decisions. Our Commitment to Your Success: At Legalntax, your success is our priority. We're invested in your business, working alongside you to minimize tax liabilities, optimize compliance costs, and achieve long-term growth. We offer competitive rates and flexible packages to cater to your specific needs and budget. Ready to Conquer the GST Labyrinth with Confidence? Don't let GST compliance become a roadblock to your business success. Choose Legalntax, your trusted GST consultants in Delhi, and navigate the complexities with ease. Contact us today for a free consultation! Remember, with Legalntax as your guide, the GST labyrinth transforms into a path to success. We hope this blog post effectively positions Legalntax as the premier choice for GST consultancy in Delhi. By highlighting your comprehensive services, expert team, and commitment to client success, you can attract businesses seeking reliable and trustworthy guidance through the intricacies of GST. Here are some additional tips to enhance your blog post: Include compelling success stories or testimonials from satisfied clients. Share valuable insights and practical tips on managing GST compliance effectively. Offer downloadable resources like GST checklists or ebooks. Optimize your blog post for search engines by including relevant keywords and phrases. Promote your blog post on social media and other online platforms to reach a wider audience. By implementing these suggestions, you can create a blog that not only informs and educates potential clients but also positions Legalntax as the go-to GST consultants in Delhi.

2 notes

·

View notes

Text

Unravelling VAT Dynamics: A Comprehensive Handbook on Registration Services in the UAE

Welcome to Goviin VAT Registration Services – a collective of qualified and knowledgeable accountants, auditors, and tax advisors committed to empowering you to take control of your finances and propel your business towards greater heights. Our comprehensive suite of services caters to clients spanning across the UAE. Whether you require seasoned bookkeeping services or proficient tax preparation for your business, rest assured that Goviin VAT Registration Services has the expertise to meet your needs and ensure financial success.

Value Added Tax (VAT) serves as a consumption tax, intricately woven into the economic fabric, impacting the supply of goods and services. This rate applies to a wide array of goods and services, with specific categories enjoying zero-rated or exempt status.

VAT Registration Services:

Engaging professional VAT registration services is a prudent choice for businesses navigating the complexities of compliance. These services streamline the registration process, ensuring accurate submission of required documents and adherence to the Federal Tax Authority (FTA) guidelines.

Key Steps in VAT Registration:

Assessment of Eligibility

Document Preparation

Online Registration Portal

Effectively managing VAT tax registration services in the UAE is pivotal for businesses operating in the region. Professional assistance not only simplifies the registration process but also ensures ongoing compliance with VAT regulations. As the UAE continues to evolve as a global business destination, staying informed and seeking expert guidance becomes paramount for businesses aiming to thrive in this dynamic marketplace.

2 notes

·

View notes

Text

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/ https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ (908) 380-6876

1 Auer Ct, East Brunswick, New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

IRS Tax Preparer

We have a list of IRS-enrolled agents who can provide professional tax preparation for your needs. Find a tax office near you today by searching the IRS enrolled agent list.

For best information please visit our website - https://www.enrolledagent.com/ Address - 100 Church Street, 8th floor, New York, NY, United States, 10007 Phone - +1 8552224368 Email - [email protected]

#Enrolled Agent#Enrolled Agent Near Me#Tax Services#EA Tax Preparer#EA Tax Preparer Near Me#IRS Free Filing Program#Enrolled Agent Lookup#List of Enrolled Agents#find enrolled agent

2 notes

·

View notes

Text

youtube

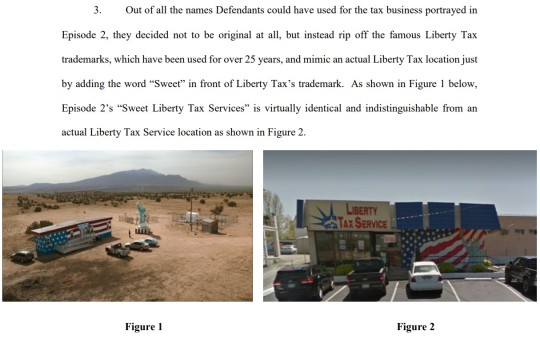

Better Call Saul was SUED IN REAL LIFE by an actual tax company! 👨🏻⚖️

#better call saul#bcs#breaking bad#brba#tv#tv show#tv shows#tv series#did you know#trivia#tv trivia#fun fact#fun facts#sued#lawsuit#liberty tax#taxes#tax preparation#tax services#true story#Youtube

3 notes

·

View notes

Text

Bookkeeping for Startups: Basics and Tips

Starting a new business is an exciting time, but it can also be overwhelming. There are so many things to think about, from marketing and sales to product development and customer service. In the midst of all of this, it's easy to overlook the importance of bookkeeping.

However, bookkeeping is essential for any business, regardless of its size. It's the foundation for managing your finances, making informed decisions, and complying with tax laws.

If you're a startup, you may be wondering where to start with bookkeeping. Here are some basic tips:

Understand the importance of bookkeeping. Bookkeeping is more than just keeping track of your income and expenses. It's also about providing you with insights into your business's financial health. By keeping accurate records, you can track your cash flow, identify areas where you can save money, and make informed decisions about your business's future.

Set up a system for organizing your financial documents. This will make it easier for you to track your transactions and prepare your financial statements. You can use a simple spreadsheet or a more sophisticated accounting software program.

Choose a bookkeeping method. There are two main types of bookkeeping methods: cash basis and accrual basis. Cash basis accounting records transactions when cash is received or paid. Accrual basis accounting records transactions when they occur, regardless of when cash is received or paid. The method you choose will depend on your business's needs.

Track your income and expenses. This is the most important aspect of bookkeeping. You need to track all of your income and expenses, no matter how small. This will help you to stay on top of your finances and identify areas where you can save money.

Reconcile your bank statements. This is the process of comparing your bank statements to your bookkeeping records to make sure they match. It's an important step in ensuring the accuracy of your financial records.

Prepare financial statements. Financial statements are a summary of your business's financial performance. They include the balance sheet, income statement, and cash flow statement. You need to prepare financial statements on a regular basis to track your business's progress and make informed decisions.

Bookkeeping can seem daunting at first, but it's essential for any business. By following these tips, you can set yourself up for success with bookkeeping from the start.

Anchor text: Bookkeeping

Here are some additional tips for bookkeeping for startups:

Use cloud-based accounting software. This can make it easier to track your finances and collaborate with others.

Hire a bookkeeper or accountant. If you don't have the time or expertise to do your own bookkeeping, you can hire a professional to help you.

Stay up-to-date on tax laws. The tax laws can change frequently, so it's important to stay up-to-date so you can file your taxes correctly.

Bookkeeping is an essential part of running any business. By following these tips, you can set yourself up for success with bookkeeping from the start.

If you're a startup, don't neglect bookkeeping. It's an essential part of managing your finances and making informed decisions. By following these tips, you can set yourself up for success with bookkeeping from the start.

#bookkeeping#bookkeeper#taxpreparation#financial#income#companies#bookkeeping el paso tx#tax services

2 notes

·

View notes

Text

Get Offshore Accounting And Tax Services For Accounting Firms Are you looking for offshore services for your accounting firm? Visit Credfino.com. Their aim is to assist accounting firms, tax firms in attaining stable and reliable revenue growth, enhancing profitability, and optimizing operations via staffing solutions and business consulting. Visit their website to learn more.

#Accounting Firms#Offshore Staffing#Business Consulting#Tax firms#staffing solutions#Tax Services#Accounting Services#CPA firm#Offshore services

6 notes

·

View notes

Text

Efficient Corporate Year-End Services for Your Business – Apex Accounting

Apex Accounting offers comprehensive corporate year-end services to help businesses close their financial year with ease. Our expert team provides:

Financial Statement Preparation: Ensure accurate representation of your financial health.

Tax Planning & Filing: Maximize deductions and avoid penalties.

Compliance with Regulations: Stay up to date with all regulatory requirements.

Financial Reporting: Clear insights to guide future business decisions.

Let Apex Accounting help you streamline your year-end processes, so you can start the new year with confidence!

#accounting#financial services#bookkeeping#payroll services#dental bookkeeping#tax services#corporate tax filing

0 notes

Text

Review of “Bookkeeping: A Complete Guide to Financial Accuracy and Business Success”

If you’re looking for a thorough, well-structured guide to mastering bookkeeping for your business, this article by BHT Tax Services delivers everything you need and more. The article dives deep into the essentials of bookkeeping, explaining its critical role in maintaining financial stability and driving business growth. It’s packed with detailed explanations of core bookkeeping components, such as the chart of accounts, general ledger, and financial statements, making it an excellent resource for beginners and seasoned business owners alike.

What sets this guide apart is its practical advice. It outlines actionable best practices like separating personal and business finances, using accounting software, and reconciling accounts regularly. These tips are not only easy to implement but also crucial for keeping financial records accurate and up to date. The section on common mistakes, such as neglecting small expenses or failing to categorize transactions properly, provides valuable insights to help readers avoid costly errors.

The language is clear, concise, and professional, making complex bookkeeping concepts accessible to all readers. Whether you’re a small business owner, entrepreneur, or someone simply looking to understand bookkeeping better, this article offers a wealth of knowledge. It also subtly encourages readers to think proactively about their financial management, ensuring long-term success for their ventures.

Overall, this guide is a must-read for anyone aiming to improve their bookkeeping skills and achieve financial clarity. It’s not just informative but also empowering, leaving readers equipped to take control of their business finances. Highly recommended!

0 notes

Text

#indian corporate news#acquisory corporate news#sebi guidelines#rbi guidelines#tax services#tax department of india

0 notes

Text

Explore the best Tax Simulation Tools for Tax Practice, designed to help you master real-world tax scenarios. Access the Top Tax Software for Practical Tax Learning.

#taxes#tax services#tax solutions#billing software#software#development#technologies#saas#developer#erp

0 notes

Text

Preparing your taxes doesn't have to be a daunting task. With Virtual Tax Preparation, you can make the process simpler and easier than ever before.

0 notes