#loan calculator disclaimer

Explore tagged Tumblr posts

Text

Understanding New Loan Disclaimers In The United States 2024

Have you ever dreamed of a new car, a comfortable home renovation, or finally tackling a mountain of student loans? Borrowing money can be a great way to achieve your goals, but it’s important to understand what you’re really getting into. That’s where loan disclaimers come in – they’re like a little map hidden in a treasure chest, guiding you to understand the true cost and terms of your…

View On WordPress

#access bank federal government loan disclaimer#balloon loan disclaimer#caliber home loans disclaimer#citibank loan disclaimer#commercial loan commitment disclaimers#commercial loan disclaimers#disclaimer for blank loan documents#disclaimer for business plan for bank loan#disclaimer for interest free loans#disclaimer statement for loan#disclaimer&039;s statement for loan#disclaimers bfs capital loans#disclaimers bfs loans#disclaimers for discussing business loans#disclaimers for discussing loans#employer 401k loan disclaimer#equipment loan disclaimer#flagstar loan payment disclaimer#jay farner quicken loans disclaimer#jay farner quicken loans disclaimer approval only valid#loan calculator disclaimer#loan disclaimer#loan disclaimer examples#loan disclaimers in the united states#loan term sheet disclaimer#loaner car disclaimer#loans pursuant disclaimer#nationstar mortgage llc dba mr cooper loans disclaimer#non bank loan disclaimers#opploans loan disclaimer

0 notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

194 notes

·

View notes

Note

is george and carmen’s old money style “real”, so to speak? i remember you talked about how you previously thought george had a very posh accent but it turns out he doesn’t, and i’ve seen one of carmen’s stories saying that her family struggled financially during the financial crisis and that she paid off her student loans, but every picture i see of their family (incl old pics) looks like they’re incredibly well off so im not really sure. also idk much about GR’s background

i will say they definitely play into it, but not sure if it’s more authentic or more calculated/fabricated (which there’s no problem with)

Disclaimer - I am not an aristocrat or upper class or old money in any way.

But as a British person I can say with relative certainty, neither are they.

George comes from Cambridgeshire, from what I believe is a staunchly middle class area. He doesn’t speak Queen’s English, which is by no means a foolproof way of knowing someone’s social strata but it’s a pretty strong indicator. He went to grammar school, which doesn’t always mean you can’t afford private school (I went to a grammar school because of the academics (and then got kicked out and went to private school lol)), but a lot of the time parents who can’t swing a private education for all three kids but still want their kids to achieve academically will try and get them into grammar school. I am also pretty sure I’ve read that George’s brother had to stop karting because the family couldn’t afford both of them karting. Now, karting is very expensive for the average family so that doesn’t mean the family was struggling, but in contrast, Lando has several siblings who all attended public school and were fully supported in expensive hobbies. So George’s family probably didn’t have money money. So in summation, he comes across very middle class. He has such an Eton face and he’s at every high society event going so you just assume he’s Saltburn levels but I don’t think he is. Also, might I add, he doesn’t give rich kid vibes at all. Lando does, massively. George does not. To me, anyway.

I don’t know much about Carmen’s family, I read somewhere her dad is a lawyer, which again is a pretty standard white collar profession. I can’t speak to the socioeconomic level of her family at all as I don’t know too much about Spain. What I can say is that if you’re not a UK citizen (which I presume Carmen isn’t since she only came to the UK for university and seems to have Spanish/German ancestry) university fees will be on average 20k a year, and you aren’t eligible for student finance, which is the government loan which is set at very good terms. I think it would be unusual for Carmen to take out a loan for that amount to get her degree if her family could afford to pay for it upfront.

So that’s my evidence for saying I don’t think either of them come from generational wealth.

I could go on about the pure vibes but I would probably get roasted so I won’t. Suffice it to say I think their portrayal of themselves in the old money aesthetic is a little bit of a meta commentary on that trend.

I think it’s just how they’ve branded themselves. They both have the faces for it, George very much leans into the “English gent” thing, which fits with the Mercedes brand and also the Tommy Hilfiger brand. I think it’s a case of what opportunities you get offered and then you lean into the perception to keep up with those lucrative opportunities. Nothing wrong with that at all, but it’s definitely a curate couple image, in my opinion.

3 notes

·

View notes

Text

[ad_1] A low credit score is a common reason for the rejection of loan applications or unfavourable terms. A poor score indicates a higher level of risk for the lending bank or NBFC, making it more difficult for borrowers to secure the desired loan amounts, quick approval, or even the most competitive interest rates. However, with regular CIBIL score checks, borrowers can identify areas for improvement and boost their creditworthiness. This can help increase their negotiating power and get faster loan approvals, which are especially useful when addressing emergencies like medical treatment or home/vehicle repair. Keeping this benefit at the core of its services, OneScore simplifies the credit monitoring and improvement process. Its unique mobile app enables borrowers to make better credit decisions and increase their credit scores. Upon reaching specific thresholds, customers can also apply for loans on the same OneScore app. Understanding Credit Scores This three-digit number is a summary of a user’s credit behaviour and helps lenders assess an applicant’s ability to repay borrowed funds. This score, usually ranging from 300 to 900, reflects credit history and past repayment behaviour. Four platforms provide credit score checks in India, including: TransUnion CIBIL CRIF High Mark Experian Equifax Credit Score's Impact on Loan Approval A strong credit score increases the likelihood of quick loan approval. As the score increases, borrowers can look forward to getting more affordable loan offers. On the other hand, a low score may lead to rejection or a higher interest rate with a lower loan amount. It is important to check one’s credit score before applying for a loan or credit card. This helps in assessing one’s eligibility. If borrowers see a low score, they can take time to enhance it before applying to increase their chances for a pocket-friendly loan offer. Real-world Example Consider the following example: Case A Case B Radha performed a CIBIL score check before applying for a home loan of Rs. 50 Lakhs Raj applied for the same loan with a credit score of 620, indicating higher risk Her score of 775 showed strong creditworthiness The lender imposed stricter scrutiny due to the higher risk She was classified as a low-risk borrower Approval was not immediate due to additional checks The loan was approved at an 8% interest rate for a tenure of 25 years The loan was offered at a 9.5% interest rate for the same tenure of 25 years Her EMI came to Rs. 38,591, lowering her repayment burden This increased his EMIs to Rs. 43,685, increasing his repayment burden Disclaimer: The example above and the EMI calculation are for illustration purposes only. The actual amount can vary as per the lender's policies, terms, and charges. Five Factors That Lower CIBIL Scores Here are the key reasons that may negatively impact a borrower's credit score: Delayed or skipped EMIs and credit card bills reduce the score. Days Past Due (DPD) entries indicate defaults, and even small unpaid amounts can have a negative impact. Applying for multiple loans or credit cards within a short time increases hard enquiries, signalling credit-hungry behaviour. Rejections further reduce the score. Mistakes like incorrect details, duplicate accounts, or false loan records can lower the score. Regularly checking and raising disputes helps correct them. Using over 30% of the total credit limit (on a credit card) can hurt the score. Even with timely payments, high CUR lowers creditworthiness.

A balanced mix of secured and unsecured loans strengthens the credit profile. Relying only on one type of credit may slightly impact the score. Apart from these reasons, not having any experience with credit is also detrimental to building a score. The OneScore Advantage While these strategies can help users increase their credit score, these tips are not personalised. This can raise questions as to which exact credit-related behaviour can boost a user’s score. Here’s where the customised insights offered by the OneScore App offer users a novel solution. Users can not only check their score and credit report from CIBIL and Experian, but also get tailored recommendations. For instance, say a user has two credit cards and is using card A more than B, thus increasing the credit utilisation ratio of Card A. In such cases, the OneScore App will advise her to use Card B more and Card A less to boost her credit score. In this way, OneScore makes users more aware of responsible credit habits such as: Limiting Multiple Loan Applications Increasing a Credit Card’s Credit Limit Strategically Keeping Credit Utilisation Low Paying Dues on Time Clearing Credit Card Bills in Full by the Payment Date Incorporating these tips over time can help anyone achieve a good credit score. This improves loan eligibility and helps one secure funds at better borrowing terms. Apart from offering users the freedom to monitor their credit score online for free for their lifetime, OneScore has other useful tools and features: Its Score Planner makes it easy for users to target a specific credit score and work towards it in a chosen timeframe It lists all credit accounts (be it loans or credit cards) and sends payment reminders for timely repayment It helps users identify and report fraud to ensure fake loans in their name do not bring their scores down The OneScore App thus simplifies the process of staying aware of one’s credit health and improving it over time. However, it also goes one step further. Once a user’s credit score reaches the threshold of 730, they can check their personal loan offer to meet any life goal or address a financial emergency. Following a completely digital application process and without any added documentation, users can get funds up to Rs. 5 Lakhs quickly and at competitive rates of interest. Now, everyone can take control of their creditworthiness and get easy access to funds by downloading the OneScore App. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

[ad_1] A low credit score is a common reason for the rejection of loan applications or unfavourable terms. A poor score indicates a higher level of risk for the lending bank or NBFC, making it more difficult for borrowers to secure the desired loan amounts, quick approval, or even the most competitive interest rates. However, with regular CIBIL score checks, borrowers can identify areas for improvement and boost their creditworthiness. This can help increase their negotiating power and get faster loan approvals, which are especially useful when addressing emergencies like medical treatment or home/vehicle repair. Keeping this benefit at the core of its services, OneScore simplifies the credit monitoring and improvement process. Its unique mobile app enables borrowers to make better credit decisions and increase their credit scores. Upon reaching specific thresholds, customers can also apply for loans on the same OneScore app. Understanding Credit Scores This three-digit number is a summary of a user’s credit behaviour and helps lenders assess an applicant’s ability to repay borrowed funds. This score, usually ranging from 300 to 900, reflects credit history and past repayment behaviour. Four platforms provide credit score checks in India, including: TransUnion CIBIL CRIF High Mark Experian Equifax Credit Score's Impact on Loan Approval A strong credit score increases the likelihood of quick loan approval. As the score increases, borrowers can look forward to getting more affordable loan offers. On the other hand, a low score may lead to rejection or a higher interest rate with a lower loan amount. It is important to check one’s credit score before applying for a loan or credit card. This helps in assessing one’s eligibility. If borrowers see a low score, they can take time to enhance it before applying to increase their chances for a pocket-friendly loan offer. Real-world Example Consider the following example: Case A Case B Radha performed a CIBIL score check before applying for a home loan of Rs. 50 Lakhs Raj applied for the same loan with a credit score of 620, indicating higher risk Her score of 775 showed strong creditworthiness The lender imposed stricter scrutiny due to the higher risk She was classified as a low-risk borrower Approval was not immediate due to additional checks The loan was approved at an 8% interest rate for a tenure of 25 years The loan was offered at a 9.5% interest rate for the same tenure of 25 years Her EMI came to Rs. 38,591, lowering her repayment burden This increased his EMIs to Rs. 43,685, increasing his repayment burden Disclaimer: The example above and the EMI calculation are for illustration purposes only. The actual amount can vary as per the lender's policies, terms, and charges. Five Factors That Lower CIBIL Scores Here are the key reasons that may negatively impact a borrower's credit score: Delayed or skipped EMIs and credit card bills reduce the score. Days Past Due (DPD) entries indicate defaults, and even small unpaid amounts can have a negative impact. Applying for multiple loans or credit cards within a short time increases hard enquiries, signalling credit-hungry behaviour. Rejections further reduce the score. Mistakes like incorrect details, duplicate accounts, or false loan records can lower the score. Regularly checking and raising disputes helps correct them. Using over 30% of the total credit limit (on a credit card) can hurt the score. Even with timely payments, high CUR lowers creditworthiness.

A balanced mix of secured and unsecured loans strengthens the credit profile. Relying only on one type of credit may slightly impact the score. Apart from these reasons, not having any experience with credit is also detrimental to building a score. The OneScore Advantage While these strategies can help users increase their credit score, these tips are not personalised. This can raise questions as to which exact credit-related behaviour can boost a user’s score. Here’s where the customised insights offered by the OneScore App offer users a novel solution. Users can not only check their score and credit report from CIBIL and Experian, but also get tailored recommendations. For instance, say a user has two credit cards and is using card A more than B, thus increasing the credit utilisation ratio of Card A. In such cases, the OneScore App will advise her to use Card B more and Card A less to boost her credit score. In this way, OneScore makes users more aware of responsible credit habits such as: Limiting Multiple Loan Applications Increasing a Credit Card’s Credit Limit Strategically Keeping Credit Utilisation Low Paying Dues on Time Clearing Credit Card Bills in Full by the Payment Date Incorporating these tips over time can help anyone achieve a good credit score. This improves loan eligibility and helps one secure funds at better borrowing terms. Apart from offering users the freedom to monitor their credit score online for free for their lifetime, OneScore has other useful tools and features: Its Score Planner makes it easy for users to target a specific credit score and work towards it in a chosen timeframe It lists all credit accounts (be it loans or credit cards) and sends payment reminders for timely repayment It helps users identify and report fraud to ensure fake loans in their name do not bring their scores down The OneScore App thus simplifies the process of staying aware of one’s credit health and improving it over time. However, it also goes one step further. Once a user’s credit score reaches the threshold of 730, they can check their personal loan offer to meet any life goal or address a financial emergency. Following a completely digital application process and without any added documentation, users can get funds up to Rs. 5 Lakhs quickly and at competitive rates of interest. Now, everyone can take control of their creditworthiness and get easy access to funds by downloading the OneScore App. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

Home Loan Affordability Using Income

Alright, so you’re earning an X amount of money every month and you want to know if you can afford that dream house of yours? Well, calculating affordability only based on income is a job half done, hence here’s a piece on how to accurately calculate the affordability of a house.

But, since we’re here, let’s dance!

Total Income

Okay, first things first. You need to calculate how much is your total family income. Include all income sources here like taking weekend classes, any kind of freelance jobs, or income from second jobs as well. If your spouse is earning or a parent as well, then include that. Basically, all the people who are going to be invested in the new house.

Total Expenses

Now, minus the total expenditure. This should include any existing EMIs, insurance premiums, SIPs (that you can’t stop), grocery expenses, education expenditure, et al. All of those things that take money away from you, should be included here. Another aspect that you need to consider is your Future Expenses. Maybe your kid wants to go to Stanford or you feel like you should own an MG Hector because your colleague thinks that a new house deserves a new car. Does a parent need to undergo major surgery, or is one of your kids getting married within the next 2 years? What if there’s damage due to natural disaster, vehicle damage, job loss and God knows what can happen. What if a deadly virus breaks out, locks down an entire country, and crashes the economy! Would you be able to sustain yourself given that you would have an additional liability of monthly EMIs? Therefore, remember to have a Safety Net where you park money for your emergencies and unavoidable expenses. A general rule of thumb says to have at least 6 months of total expenses as a safety net amount. Apart from this, also have about 1% of the gross house price for emergency house repairs, maintenance, and enhancements.

Let’s suppose the following

Net family income – Rs. 50,000

Total Monthly Expenses – Rs. Rs. 20,000

Net cash in hand – Rs. 30,000

Now, you’re ready and you know how much EMI you can afford to pay.

Suppose you can afford to pay Rs.26,000 (approx.) EMI per month @ 8.5%. How much money can you afford to borrow? Rs.30,00,000!

Okay, let’s say you’re going to be borrowing 80% of the total house cost. So, 30,00,000 is 80% of which number? Rs.37,50,000 (Borrowed amount ÷ 80%). That’s the maximum value of the house that you can afford. And hey, don’t be flattered by my math skills here. I’ll be honest. I used this nifty EMI calculator to get all the answers. Just one disclaimer here – I’ve assumed loan tenure to be of 20 years because that’s the usual tenure that most people go for. But you can change that as well.

0 notes

Text

10 Essential Tips for Beginner Real Estate Investors

Real estate investment has long been a proven avenue for wealth creation, offering tremendous opportunities for Real Estate Investors. But success requires knowledge and strategy.

But, the dynamic nature of the real estate market demands careful planning and understanding. In this fast-paced environment, beginners need a roadmap for success. In this blog, we’ll distill key insights from “10 Essential Tips for Beginner Real Estate Investors” to guide you through the dynamic market.

1. Start with a Clear Investment Strategy:

Define goals, assess risk, and create a strategy aligning with your objectives. Residential or commercial? Long-term rentals or short-term flips? A clear plan guides decisions and maintains focus.

2. Research Local Real Estate Markets:

Each location has unique market trends. Research property values, rental rates, and vacancy rates to identify growth potential and make informed investment choices.

3. Analyze Investment Potential:

Conduct a financial analysis considering cash flow, ROI, property taxes, insurance, maintenance costs, and rental income. A detailed assessment determines a property’s worth.

4. Build a Reliable Network:

Connect with real estate agents, managers, lenders, and fellow investors. Networking provides valuable insights, partnership opportunities, and access to off-market deals.

5. Secure Adequate Financing:

Understand financing options—traditional mortgages, private lenders, or partnerships. Calculate your budget, assess borrowing capacity, and build a solid credit profile for favorable loan terms.

6. Perform Due Diligence:

Thoroughly inspect properties, review documents, and engage professionals to identify risks. Diligence minimizes unforeseen issues and protects investments.

7. Mitigate Risk with Diversification:

Spread investments across property types, locations, or strategies to reduce risk. Diversification safeguards against market volatility and potential losses.

8. Stay Informed and Adapt:

Constantly educate yourself on industry trends, regulatory changes, and economic factors. Be adaptable and proactive to make informed decisions.

9. Leverage Technology and Data:

Utilize online platforms, data analytics, and real estate investment software for efficient research, analysis, and property management.

10. Learn from Mistakes:

Embrace mistakes as learning opportunities. Reflect, analyze, and adjust strategies. Surround yourself with mentors for guidance along your investment journey.

Conclusion:

Real estate investment demands careful planning, research, and adaptability. These 10 essential tips provide a strong foundation for success. Define your strategy, conduct market research, analyze potential investments, build a network, secure financing, perform due diligence, diversify, stay informed, leverage technology, and learn from mistakes. With these insights, confidently navigate the dynamic real estate market and unlock lucrative opportunities.

Ready to get financing for your deal? Connect with us. We are your real estate investment partner.

Disclaimer: The information provided in this blog post is for informational and educational purposes only. It is not intended as investment, financial, or legal advice. Always consult with a qualified professional for personalized advice tailored to your specific financial situation and goals. Please see our Terms of Use for further information.

#property investment uk#real estate investing#investment#investment portal#property listing uk#eggsinvest#investors

0 notes

Text

Are Solar Panels a Ripoff?

Solar panels are a great way to reduce your energy bills. They also help the environment. However, homeowners should be wary of shady salespeople and make sure they understand their state’s laws on incentives.

Scams in solar energy can include posing as state or utility representatives, making inflated claims of rebates and savings, and pushing solar leases or PPAs (power purchase agreements). These scams are a huge risk to consumers.

They’re a great investment

If you are solar panels a ripoff ? Make sure to research the industry and technology thoroughly. This will help you avoid scams and pitfalls. Moreover, it will help you understand how to calculate your overall solar savings. This is a complex calculation, which requires determining upfront costs of the system less all available federal investment tax credits and state/local rebates. It also includes loan fees and interest.

It is important to remember that solar energy is a long-term investment. Although it can reduce your electricity bills and cut your carbon footprint, you should be aware that it can take years before you get a return on your investment.

In order to avoid scams, be sure to compare quotes from multiple companies and consider the Better Business Bureau and your state consumer protection agency. Lastly, avoid solar companies that offer leases instead of purchasing. These types of contracts are difficult to back out of and do not provide the same tax breaks as a purchase.

They’re a ripoff

The solar energy industry has exploded in popularity, offering homeowners an opportunity to produce clean, renewable energy and save money. However, the boom has also given rise to scammers and shady companies.

Many scams in the solar energy sector involve misleading or false claims. Some are reminiscent of old-fashioned door-to-door scams, while others are more modern contracting shams. Regardless of how they are conducted, these scams often violate state consumer protection laws.

Homeowners should be especially wary of ads and posts that promise free solar panels. These claims are usually based on PPAs or solar leases, which don’t provide ownership of the solar system and exclude homeowners from federal and state incentive programs and rebates. In addition, they may be offered with a grace period or $0 down, but consumers should understand that these deals will still cost them in the long run. It’s also important to keep in mind that solar systems do not work only in sunny weather. Sunlight reaches the Earth’s surface on cloudy, rainy, and snowy days, too.

They’re a scam

While solar energy is a great investment, there are scammers who take advantage of people eager to adopt this new technology. These sham companies masquerade as reputable businesses, and use aggressive sales tactics to close a deal. They make false promises and misrepresent state and federal incentives. In addition, they may charge exorbitant prices and impose long-term contracts that are difficult to back out of.

The scammers may be after your personal information or claim they have a special government program that will reimburse your upfront costs for installing solar panels on your home. These ads are usually displayed on Facebook and are accompanied by an official-looking disclaimer. Some even feature a “solar expert” or a celebrity endorsement.

These shams can cause a significant financial loss for the consumer. They also hurt the solar industry and jeopardize a clean energy future. To avoid these problems, be careful when choosing a company and check with the Better Business Bureau and your local consumer protection agency.

They’re not a ripoff

Solar tech panels extract value over time and can be a great investment for homeowners. Whether it’s the energy they provide or the financial security of having power in an outage, solar panels are worth the initial upfront costs and can pay for themselves over a decade in most cases. Homeowners can also save even more on their electricity bills by evaluating local energy prices and incentives.

However, the solar industry can be prone to inexperienced salespeople who make misleading claims. These false or deceptive claims can lead to consumers being misled and overpaying for solar power. Consumers should be wary of companies that offer PPAs or solar leases and should always read their contract carefully. Any misrepresentations should be reported to the Federal Trade Commission. These false claims not only hurt individual consumers but the entire industry as well. They also jeopardize a clean energy future for all Americans. The good news is that these scams are easy to spot and avoid if you know what to look out for.

0 notes

Text

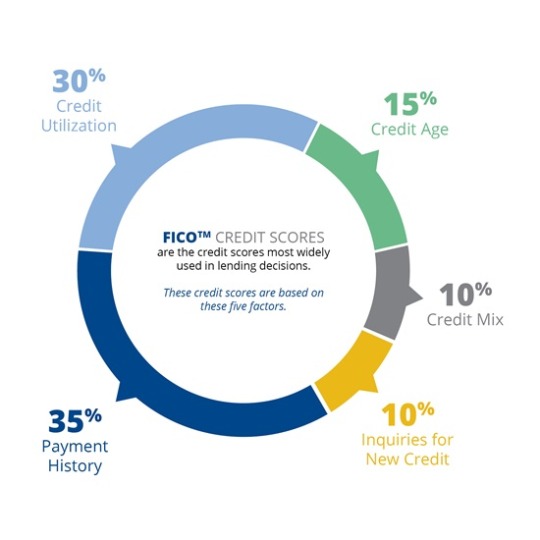

Credit Scores

Disclaimer: Some of this advice may not be immediately applicable to people who are struggling financially.

On the other hand, if you are responsible with money & lucky, your credit score will pretty much take care of itself.

I just don't want anyone to be accidentally lowering their credit score because they don't know the "rules of the game."

.......................................................................................................................

Dos:

--Pay off all your debt owed every single month - car loan, mortgage and yes credit card. (It's a common falsehood that carrying a credit card balance helps your score, it only does harm plus wastes your money on interest.)

--Keep your credit card spending below 30% of your official spending limit for that card; lower% is even better.

--For an credit card bill above the 30%, pay your balance before the "statement date" and don't wait until the due date.

--If you get a significant raise or other financial boon, contact your credit card company to request a raise to your spending limit.

--Focus on your FICO credit score, and don't worry about any other credit score calculators.

--Avoid "hard inquiries" into your credit unless you expect to be approved for an imminent large purchase (vehicles, rental/mortgage, etc.)

--Only take out credit if you know you won't abuse it. A "thin file" is better than a file full of financial red flags.

Don'ts:

--Cancel your oldest credit card. Keep it going, set it up to autopay a small monthly bill (netflix, water, or the like)

--Apply for new credit cards unless you really need them. The hard credit check, the newness of the credit line, any overdue payments, and any spending near that card's credit limit can ALL harm your credit score.

--Expect a credit score change to change immediately or directly due to increased income or increased savings. Those factors are not a part of your credit score (though of course if you budget that money well, your credit score will eventually reflect your better financial stability).

--Fuss if your credit score is 740 instead of 850; 740 is the low end of the "perfect" range, you'll be approved for basically anything.

--Worry if your starting credit score is below 740. Nothing is wrong and you are not being penalized. Credit scores include 5 components: payment history, amounts owed, length of credit history, credit mix - these will all improve over time if you don't miss payments. The 5th component, new credit, may be lowering your score when you open your first credit line, but this too will fade with time (as long as you don't quickly open additional credit lines).

How to find your credit score for free from trusted sources: 1) Check with your bank or credit union.

2) Request your score through these three companies only: Experian, TransUnion, and Equifax. 3) use Consumer Financial Protection Bureau links:

(Note that you may have slightly different FICO credit scores across different financial websites, this is normal.)

Sources

#credit score#fico#npr#npr life kit#cfpb#equifax#transunion#experian#personal finance#financial awareness#financial literacy#what they should have taught in high school#credit cards#credit history#credit utilization

0 notes

Text

Minimum credit score requirements for business loans

In today's economy, having access to capital is essential for the success of any business. Whether you are starting a new business or looking to expand an existing one, obtaining a loan is often necessary. However, the ability to obtain a loan is heavily dependent on your credit score. In this article, we will discuss the minimum credit score requirements for business loans. We will also discuss why credit score is important for obtaining a loan, and tips for improving your credit score.

What is a credit score?

A credit score is a numerical representation of a person or business's creditworthiness. It is calculated based on various factors such as payment history, credit utilisation, credit history, and types of credit used. Credit scores range from 300 to 850, with higher scores indicating better creditworthiness.

Why credit score is important for business loans

Lenders use credit scores to determine the likelihood of a borrower repaying a loan. A high credit score indicates that the borrower is responsible with credit and is likely to repay the loan on time. A low credit score, on the other hand, indicates that the borrower may be a higher risk and may have difficulty repaying the loan. To learn more about how to negotiate for business loans in India, here are some effective tips you must keep in mind.

Additionally, credit score also affects the terms and interest rates of a business loan. Borrowers with higher credit scores are more likely to receive favourable loan terms and lower interest rates. Conversely, borrowers with lower credit scores may be offered less favourable loan terms and higher interest rates.

Minimum credit score requirements for business loans

The minimum credit score requirements for business loans vary depending on the type of loan and lender. Here are some general guidelines:

SBA loan requirements

SBA 7(a) loans: Minimum credit score of 640

SBA 504 loans: Minimum credit score of 680

SBA microloans: Minimum credit score between 620-640

Traditional bank loan requirements

Minimum credit score of 640 for most small business loans

Minimum credit score of 680 for larger loans or lines of credit

Alternative lender loan requirements

Credit score requirements may vary by lender. However, there are chances that some alternative lenders may be more willing to work with borrowers with lower credit scores. Still, a minimum of 500 score is required to qualify the loan requirement.

Note- While these are the minimum credit score requirements, lenders may also consider other factors such as business revenue, time in business, and collateral when making lending decisions.

Improving your credit score

If your credit score is below the minimum requirements for a business loan, there are steps you can take to improve it. Here are some tips:

Pay bills on time: Payment history is the most important factor in determining your credit score. Late payments can have a negative impact on your credit score, so ensure to pay all bills on time.

Keep credit utilisation low: Credit utilisation is the amount of credit you are using compared to your credit limit. Keeping your it below 30% can help improve your credit score.

Monitor your credit: Regularly monitoring your credit can help you catch errors or fraudulent activity and address them promptly.

Build credit history: Having a longer credit history can improve your credit score. If you don't have a credit history, consider opening a credit card or taking out a small loan.

Work with a credit counselor: If you are struggling to improve your credit score, consider working with a credit counselor who can provide guidance and support.

Disclaimer: Please be aware that the information presented in this article may be based on available knowledge and resources at the time of writing, and may not be comprehensive or current. It is advisable for readers to independently verify the details before making any decisions based on the information provided.

0 notes

Text

Ya that one isn't going to hit too many people, doesn't make leaving any easier.

The payroll tax increase to cover the mishandling of the unemployment system during covid felt kinda fake to me, I hadn't heard it yet at least but.

*disclaimer, I'm unfamiliar with this source but mediabias fact check and all sides list them as center right with no failed fact checks in the last 5 years so I'm good with that personally*

Chef Andrew Gruel, who owns and runs Calico Fish House in Huntington Beach, took to X to explain his recent experience paying his workers in a post that has since garnered over 16 million views.

“We just ran payroll. The payroll taxes were 2K higher than calculated. We called the payroll company,” said Gruel. “They explained (in summary) that California has a budget shortfall, and the federal government wants money back that it lent California for UI that it 'lost.' They are making up for it by having business owners pay it.”

While the state was responsible for the management of lockdown-era unemployment benefits, business owners are footing the bill.

“California gave out billions in unemployment during COVID, much of which was fraudulent,” said Assemblyman Bill Essayli, R-Corona, on X in response to Gruel. “Now businesses are left to pick up the tab. Newsom could have paid off the deficit, but he elected to give out $5 billion in healthcare coverage to illegal immigrants instead.

Oklahoma Gov. Kevin Stitt used the opportunity to encourage businesses to abandon California and its taxes and seek lower taxes elsewhere.

“Crazy…payroll tax hikes to cover up government spending in California,” said Stitt on X. “Oklahoma is open for business. Come to a state where you’re not on the hook for the state’s financial mismanagement.

The California Budget and Policy Center, a left-of-center think tank, said in an October report that the state does not raise enough money to pay for current unemployment benefits, let alone pay down the $21 billion in unemployment benefit debt to the federal government.

ECT, carrying on as well

California, New York, and the US Virgin Islands are the only jurisdictions subject to the payroll tax increases. Connecticut and Illinois had taken on debt and were subject to payroll tax increases but have since paid back their outstanding loans, while the Virgin Islands have had an outstanding balance since 2010. ___________________

I imagine spiking our minimum wage did a number on the backwards slide we've done with all that money too.

Also never look up how much money has gone both missing and unspent that was earmarked for our homeless situation here.

I'm really hoping they start to go hard after the people that defrauded the system, because this isn't fair to the business owners.

134 notes

·

View notes

Text

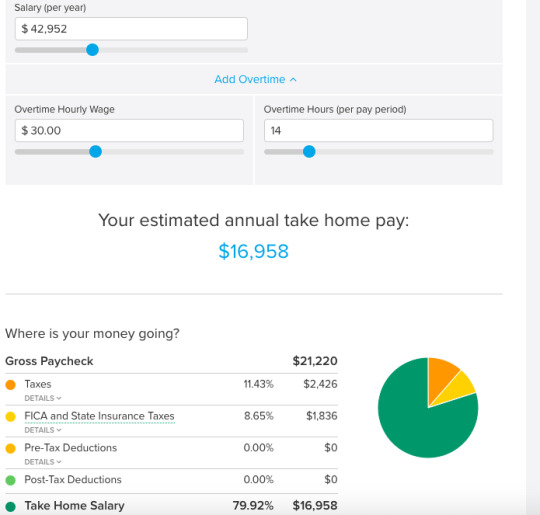

Why The Gang Became Robbers

CW: Discussions of Poverty and Money

So, it’s somewhat theorized that the gang started stealing because of financial reasons. There’s actually some allusions to this in the movie itself, with them planning to stop stealing after the heist they were eventually caught for, them seeming to live in the shop, Johnny’s clothes seeming to be hand-me-downs (his dad’s jacket, a shirt that’s a few sizes too big with worn out sleeves, well worn-too large jeans), and mostly using walkie talkies instead of their phones (data is expensive). I started to wonder how deep in debt they actually were sooo... I did some calculations.

--------------------------

Disclaimer: All of these were based of the average costs of everything in the state of California (Calatonia is based on LA and San Francisco). There were some generosity here in debt calculations including giving them a good credit score when they applied for the loan and assuming they had only been in the states 7 years. Oh and that they had a bit money when they came to the US.

----------------------------------------------------

Debts

The Garage Itself

Building Price: $2,250,00

Down Payment (20%): $450,000

30-Year Fixed Loan Plan with Interest of 5.395%

Credit Score (I’m trying to help them out here): 729

Annual Property Tax: $28,125

Annual Home Insurance: $7,875

Monthly Payment: $13,102

Annual Total Building Payments: $193,224

Plus Other Expenses (calculated from average 2 person household costs)

Food, Water, Electricity: $24,475.8

Health Insurance: $0

Car Insurance: $0

----------------------------------------------------

Now, the total mortgage would be around 4.62708 million when calculating in 7 years of interest rates. And if we look at the average yearly income of a mechanic in California...

Yeah, Marcus is only taking home around $16,958 dollars per year, and that’s being generous with both rates and overtime. So, without even factoring in the debt, as well as assuming that Stan and Barry are not included in their household income, the Taylor family is almost $2,000 dollars below the Californian poverty line.

Now, let’s take a look at their plan here. We know that the gold shipment they were planning on stealing in Sing 1 was around 25 million dollars worth. Well, that would clearly pay off their entire mortgage, as well as probably help Stan and Barry with whatever financial issues they might be facing. It would also give them a good cushion for a few years going forward, preventing them from going into debt easily again.

With the seven years of payments totaling $599,844, and assuming that they have stolen at least $2.163,677 to pay towards the debt before, in Sing 1, they only owe a much more reasonable $1,863,559.

And while that is still a lot, if a rich person, say an old musical theatre star, wanted to guarantee that the performers at their old theatre troupe wouldn’t be falling onto a bad path, they could pay that off much easier than the full mortgage.

So, in conclusion, Johnny and his family, stolen money included in this, are still some of the poorest characters in all of Sing. They probably didn’t want to steal in the first place either, judging by how they were planning on stopping after the flubbed heist anyway. They were just desperate. they needed money, and clearly the garage plus whatever side jobs Johnny could have potentially had were not enough.

I believe that the main reason we don’t see them still stealing in Sing 2 is that their debts were paid off, more than likely by Nana Noodleman as she’s the only one with that amount of money lying around. This allowed them to begin working again without a immediate threat of debt, and with the money Johnny’s bringing in from the theatre, the family is probably in a bit better shape.

#sing#sing 2#sing johnny#sing marcus#sing stan (only mentioned)#sing barry (only mentioned)#sing nana noodleman (only mentioned)#this is a theory#you do not have to accept it as canon#i'm sorry if the math is off i tried#i was alway a reading and history kid#nana definitely helped buster johnny and ash out after the first movie#because theres literally no way the theatre could have turned that large of a profit that fast#this puts Johnny as the second poorest after Buster in sing 1 and the second after Nooshy in Sing 2#by my calculations at least

18 notes

·

View notes

Text

The Fact About New Home Construction in Palm Beach That No One Is Suggesting

We may also help decide on local builders, negotiate the very best deal, and streamline the Construct method, all without charge for you

Expanding industrial parks in Palm Coast bring on a perceptible advancement previously 10 years. With An array of selections for recreation, buying and residing, Palm Coastline features the most exciting living possibilities to people who desire to settle below. The put has been specified since the speediest escalating metropolitan area and has observed a huge increase in the population in the final several years.

K. Hovnanian Homes may well keep or use details that you simply provide. Any information and facts submitted won't be offered to 3rd get-togethers.

youtube

Residents of West Palm Beach, Florida know there's no superior place on Earth to get in touch with home. Persons of any age and all walks of life are proud to phone West Palm Beach their home as it is a location with so many things to offer.

When you are at a Business or shared community, it is possible to request the network administrator to run a scan through the community trying to find misconfigured or infected devices.

All other emblems revealed and not owned by PulteGroup, Inc. and/or its affiliates are classified as the assets of their respective proprietors.

House taxes, homeowner’s insurance policies and HOA expenses are estimates only. Actual amounts for house taxes, homeowner’s insurance plan and HOA service fees may be higher and are matter to alter on occasion. A flood insurance plan may very well be demanded depending on the place from the home. The home finance loan calculator is for informational and illustrative applications only. That you are inspired to hunt advice from a lender of one's selecting for details, stipulations certain in your recent condition.

If you're someone that enjoys spending more often than not in mother nature’s lap and enjoy the sand, Sunshine and The ocean, Palm Coast is the best spot for you. Palm Coastline is heaven for that beach bums.

The enjoyment in no way finishes in Palm Beach County. With a variety of aquatic attractions and pursuits for The complete family members, That is everyday living at its best.

Disclaimer: Faculty attendance zone boundaries are provided by Pitney Bowes and therefore are subject to vary. Test Along with the relevant university district before creating a choice according to these boundaries.

... but For several, It can be overwhelming. At Cresswind Palm Beach at Westlake, We've got a straightforward recipe to uncover the proper Local community, Establish your perfect home new home builders in palm beach and revel in a lifetime. Our new home professionals enable you to take advantage of fantastic choices so you're able to Stay improved, lengthier. Timetable Your Tour

The metropolitan spot including West Palm Beach is among the most popular while in the U.S. for home building, so there are several home style and construction corporations. Before you end up picking a home builder in West Palm Beach, make certain the contractor:

Facts is delivered exclusively for buyers' own, non-commercial use and might not be employed for any purpose apart from discovering future properties shoppers may well have an interest in buying

One of The united states’s primary homebuilders and a Fortune 500 corporation, Lennar has experienced the privilege of assisting more than a million families transfer into the subsequent phase of lifestyle by using a new home.

2 notes

·

View notes

Text

The Case for a 30 Year Mortgage

Disclaimer: I am not a mortgage lender, accountant, or financial advisor. I’m a professional real estate consultant that is passionate about the subject and likes to think outside the box. I, in no way, recommend you make investment or lending decisions based off the content of this writing. It is intended only to open your mind to other possibilities, which I strongly advise discussing with your mortgage, tax and financial professional.

So you’re shopping for a mortgage. You’ve saved, and researched, and the conventional wisdom says “if you can, get a 15 year mortgage!”

After all, you’ll save thousands in interest via the shorter life of the loan, and you’ll be mortgage free sooner! Plus, interest rates are typically lower for 15 year notes, saving you even more, right?

This advice isn’t necessarily wrong, and, as I often tell my clients, real estate isn’t always black and white. There are many ways to leverage it to your advantage, and this topic is no different. So today, I’m making the case for a 30 year mortgage over its 15 year counterpart. I’ll lay out the reasons I often advise that my clients explore this strategy with their mortgage lenders and financial advisors prior to securing a mortgage loan, along with some real-world examples. I’ll also examine the strategy from the perspective of a typical buyer, as well as a real estate investor.

Let’s dig in. First, let me lay out the typical case FOR the 15 year mortgage, before I examine the alternative:

Interest Savings

This is the obvious one, and so I’ll start here.

Because interest is paid monthly, for the life of the loan. It stands to reason that when comparing two loans, with the same principal balance and interest rate (more on this in a moment), but with one having half as many payments during its life than the other, the one with the shorter life will net significant interest savings.

For example, let’s say we have two loans with a principal balance of 100K at 3% interest. One is spread over 360 payments (30 years) and the other 180 (15 year). I ran an amortization and below is the summary:

30 Year Note:

Interest paid over life of loan: $51,777

Monthly principal and interest payment: $421

15 Year Note:

Interest paid over life of loan: $24,304

Monthly principal and interest payment: $690

On first examination, you’ll see that with the 15 year note, you are saving $27,473 in interest over the 30 year option, while borrowing the same amount of money, which is excellent. Because you are condensing the principal into a shorter time period, your monthly P&I comes in about $269 higher. Granted, you’re paying off the same principal balance, so this isn’t an added cost per se, but it is a larger monthly obligation (more on that later).

Lower Interest Rate

Historically, 15 year notes have carried a lower interest rate than their 30 year counterparts. The difference varies, but often this is in the ball park of .5-1%. If we adjusted the interest rate for the 15 year note on the example above to 2.5%, the scenario now looks like this:

15 Year Note:

Interest paid over life of loan: $20,022

Monthly principal and interest payment: $667

Now, you’re saving $31,755 for an increased monthly obligation of only $246 during its repayment period. Nice!

Shorter Repayment Period

Now I’ll be captain obvious for a moment. 15 years is half as much time as 30 years. Who doesn’t like to be debt free? Aside from saving money, the obvious appeal to a 15 year mortgage is being mortgage free sooner.

OK…. I know what you may be thinking; a 15 year mortgage sounds great – I’m sold! But, wait. Here is where you can get creative. Let’s get to the meat of the topic:

The Case for a 30 Year Mortgage

Opportunity Cost

Remember this one from your college finance class? Investopedia defines opportunity cost as “the forgone benefit that would have been derived by an option not chosen.” In the example above, we came to the mathematical conclusion that the 15 year note would save you approximately $31,755 over the loan’s life, with an increased payment obligation of $246 for those 15 years. Imagine you went with the 30 year note and instead invested that $246 monthly at an average rate of return of 7%, which is achievable (remember, the stock market historically averages around 10%). At the end of 15 years, your side investment would be worth approximately $78,000. At this point in your 30 year mortgage, the loan payoff would be approximately $61,000, meaning you could take your investment profits and pay off your 30 year mortgage at year 15, having spent the exact same amount monthly for the past 15 years as the 15 year note, and be left with a profit of $17,000.

Now, of course, I’m generalizing here. There will be some taxes on your investment earnings, reducing that profit some. But, with the right investment, perhaps you achieved a rate of return higher than 7%.

You see where I’m going with this.

You leveraged a 30 year note to achieve a lower total mortgage payment, invested the difference, paid the note off at year 15, and made additional money on your investment, besting the 15 year mortgage by thousands of dollars to your advantage and still becoming mortgage free in the same amount of time. Cool, right?

Yes, this strategy takes discipline, assumes some risk, and is just one simplified example of how you could capitalize on this. Most importantly, it still leaves you with flexibility, should times get tough.

Payment Flexibility

2020 is a perfect example of why payment flexibility during times of financial stress and uncertainty is worth its weight in gold (or mortgage interest savings). Imagine you bought a house in 2019. Times were good, your job was secure, and the 15 year mortgage seemed like a no brainer for the interest savings over time. Then, the unthinkable happened. Fast forward one year and the COVID-19 pandemic has cost you your job. You picked up new work where you could, but it’s at a fraction of your previous earnings. Suddenly, the last thing on your mind is the potential of savings over decades, or being mortgage free in another 14 years. Your focus is now undoubtedly on paying the mortgage next month, avoiding foreclosure, and keeping a roof over your family’s head. While no one hopes for this situation, it is the sad reality for thousands, if not millions of families affected by the pandemic. That extra $246 a month could be the difference between paying the mortgage at all, or the electric bill, or even groceries and basics, and you might be glad for the lower payment, if you had chosen it.

The 30 year note gives you flexibility to use that money other ways when you need it most. And while we’re on the subject of flexibility, here’s another interesting tidbit to note – if your income recovers and times are better, you can still shorten that 30 year mortgage and save thousands on interest, all without refinancing! How? I’m glad you asked. It’s EASY.

Ever heard of a pre-payment penalty? If you’re a Baby Boomer, or maybe even Generation X, you may have. If you’re a Millennial or Generation Y, you probably haven’t. That’s because they largely don’t exist anymore. A pre-payment penalty is a fee some lenders charge if you pay some or all of mortgage obligation early. It’s supposed to incentivize you to pay the principal back slowly so that the lender doesn’t lose out on collecting all of that glorious interest. The fact that they are largely extinct means you can dial up your principal payments when times are good in order to shorten your mortgage and save on interest.

Bankrate.com has a handy calculator that you can use to see the effect of extra principal payments on your mortgage. You can find it here. Using the example we’ve been referencing throughout this post, if you were to make an extra $100 monthly principal payment, from month one, you would shorten your mortgage loan by 8 years and 2 months and save about $15,000 across the life of the loan. How’s that for flexibility?

What if you’re an Investor?

So, what if you’re an investor? Well, all the same benefits apply, and there are some additional considerations as well.

Because your tenant is generally covering the debt service, the $246 lower monthly payment for that first 15 years is passed on to you in the form of increased margin. You can do many things with it. Perhaps you could use it to pay down the principal on a higher interest mortgage loan in your portfolio (remember you can shorten your repayment period and save thousands on interest with extra principal payments), or you could invest it, either in financial instruments or additional real estate.

This last point should not be overlooked. If your goal is to continue scaling your real estate portfolio, consider that a 15 year note has a greater impact on your debt-to-income ratio and that lenders may take into account that the cash flow won’t be as strong when considering market rent. Taking this a step further, consider that, in most cases, a 20-25% down payment is required to purchase investment property, and that increased cash-flow may help you acquire more real estate faster, the cumulative effect of which should exceed any interest savings realized by the 15 year note, assuming you make wise selections.

Finally, remember that as an investor, your goal, at a very basic level, is wealth building by having someone else pay the mortgage in exchange for living in the property. If turbulent times were to cause rents to dip significantly, there is always a possibility that rents don’t cover the full debt service (not to mention taxes, insurance, vacancies, etc…) With a 15 year note, there is less margin (literally) for error, at least initially, which can make it higher risk.

Conclusion

The concepts in this article are simplified and quite condensed, which is intentional. As I was writing, I resisted the urge to spinoff on numerous tangents. Of course there are numerous other factors to consider; tax implications, investment strategy, market conditions, risk tolerance, the list goes on. All in a boundless number of combinations, which is what makes real estate both thrilling and complex.

For many, a 15 year mortgage might be an excellent selection, and I don’t want to downplay its direct benefits, but I hope reading this opened your eyes to the exciting possibilities of real estate and how all is not always as straightforward as it seems.

1 note

·

View note

Text

Debt Snowball

[DISCLAIMER] this is a VERY simplified explanation of the debt snowball method. I am a 25 year old house spouse. I dont do shit, dont know shit, and I'm not a professional money genuis. research things pls.

anyways

so let's pretend we live in a fantasy world where interest isnt real and all your debts and their payments are in neat multiples of 10

like this!

so you've got about 15k in debt spread between 2 credit cards, a car loan, and something you financed, say a computer or furniture.

the first thing you want to do is list them from largest to smallest as above. key points involve NEVER USING YOUR CREDIT CARDS OR FINANCING SHIT EVER AGAIN.

so anyways you go about your life paying those debts once a month as you do, and not accumulating more because that would make all of this pointless.

keep this up for a few months and

wow! you paid of that couch and/or computer! now you have all that money to spend on other shit right??

WRONG

that money belongs to debt #3 now. instead of one $100 payment and one $200 payment, you are now making a single $300 payment.

I forgot to take a picture of just #4 crossed out but here you go.

once you pay off one debt, that money you've been paying goes to the next one!!

that's what a snowball is, you're gathering larger and larger payments, but nothing really changes in your wallet because you were paying all that to begin with, you're just doing it smarter now!

so let's zoom into the future, Christmas 2019

you paid off that credit card! obviously before all of this started you sliced it up and closed the account, so its finally gone for good! your debts are shrinking exponentially, and it's only been a year!! you're doing so well, now let's peek at the new year

incredible!!!

last year it took you 5 months to pay off just $500, now this year it's only taken 4 to pay off $1600!

that's the power of the snowball baybee!!

so now that you only have ONE debt left, and you're putting uhh

$650 dollars a month towards it(!!), it'll be no time at all before it's gone for good!!

YOU DID IT YOU WILD BASTARD YOU ARE FUCKING DEBT FREE!!! CONGRATION!!

and you did it in TWENTY THREE months. compare with the fact that if you just paid regularly with no snowballing, it would have taken FIFTY months. (and recall here that we aren't even dealing with interest! imagine how much longer WITH it.)

now obviously theres like.. interest on things like loans and credit cards. I dont know how to calculate that shit, so if you do, go nuts, and if you dont, just consider your calculations to be a ROUGH estimate of how things will go. the principles are still the same! once the ball starts rolling, it'll obliterate everything in its path.

#op#the debt snowball is step 2 tho#step 1 is to amass an emergency fund of 1000 as fast as humanly possible.#because what use is snowballing if you get rear ended and have to use that card to pay for repairs??#(step 0 is get current and get insurance)

501 notes

·

View notes

Text

Some tax advice

We made it through another April Fool's Day, so that means that the deadline for filing last year's taxes (in the US anyway) is fast approaching.

I want you to feel some control over your finances, and knowledge is power, so let's have a little beginners lesson on Withholding, shall we?

(Disclaimer: I am not a CPA, and more importantly, I am not *your* CPA. So take this as educational material, not doctrine.)

Here's the basic idea: instead of sending you a hefty bill in April, the government keeps (withholds) a percentage of every paycheck. Then, when the year is over, you settle up. If you owe, you send more money to the government. If you overpaid, they send you a refund.

What I'd like you to understand is that a big refund just means that you gave the government a sizeable (and interest-free) loan, and now they are returning it to you.

Broadly speaking, this is not ideal. A better situation is a much smaller refund (like maybe $200) or a small bill that you pay in April. If you got a $5,000 tax refund, you should consider adjusting your withholding so that less is withheld (more for you in each paycheck) and next year's refund will be smaller.

There are plenty of good reasons to ignore this advice and continue to have lots of withholding and a large refund. For example, if your spending pattern is to burn small amounts of money (on coffee or comics or whatever), but you find it easier to save it when it comes in large chunks, then by all means, keep up with your current plan. Or if your income is wildly variable. Know your own habits, and make the decision that is right for you.

You can change your witholding at any time. Just contact your HR team (email would be fine) and tell them you want to adjust your W4 form. You can see a sample form (and helpful calculators) online. The form itself guides you (add a 1 for each kid or whatever) but you are not bound to this number. It is just a suggestion.

Try less witholding for a year, and if you don't like it, you can always change back. If you go too far (like zero witholding when you are not actually exempt) the IRS can impose penalties. But clicking it down one notch at a time will be fine.

2 notes

·

View notes