#investor capitalism

Explore tagged Tumblr posts

Text

Eldritch cult takes over a major corporation. Refers to the Outer Gods as "The Shareholders." None of the old employees notice anything is any different.

265 notes

·

View notes

Text

A short video talking about the origins of shareholder/investor capitalism, and how it's completely fucked us all over :)

youtube

it doesn't matter how much you tell tumblr that all their silly and bad features don't work and you hate them because they're not for you. they're jingling keys to dangle in front of venture capitalists, the most gullible motherfuckers on earth, so they will keep pouring money into the giant money pit that is this website. this is also why all social media websites add features pretty much

#shareholder capitalism#investor capitalism#jack welch#tumblr#fuck tumblr's new format#social media#internet#Youtube

15K notes

·

View notes

Text

I think it's so funny that people are behaving as though all the Disco Elysium spiritual successors are effectively equivalent.

Cause Dark Math's press releases are all along the lines of "We're making a super cool edgy detective RPG. It's gonna be just like Disco Elysium, except with less words and more bullets, because who likes reading, am I right? Anyways, it's gonna be sooo cool and way more fun than Disco Elysium 😎"

And Longdue has said "uhhh yeah we're not really ready to talk about specifics yet. There's probably gonna be some weird psychological dream stuff going on. Idk. It's gonna be fun trust us"

Meanwhile Summer Eternal has hardly done any interviews, and if you read their manifesto and blog entries they're all like "Capitalism and insatiable corporate greed have irrevocably damaged the infant medium of video games. Workers in our field are treated as commodities at best and entirely disposable at worst. We intend to do everything in our power to create an uncompromised, complete, and unapologetic work of art, or we will do down trying. This isn't about making the next Elysium, this is about making something entirely new and revolutionary."

#disco elyisum#za/um#dark math#xxx nightshift#summer eternal#longdue#on one end we have “very clearly cynical cashgrab made by investors and tech bros to capitalize of Elysium's success”#on the other end we have “genuinely revolutionary worker-owned co-op that could blow the industry wide open if successful”#and in the middle we have “idk dude we're just trying to make a game. stop asking us questions.”#it's hard to get a proper read on Longdue so far but it seems like so far they're a pretty run-of-the-mill studio#not as actively shitty and annoying as dark math but nothing special. just a regular middlingly evil investor-owned corp

397 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

443 notes

·

View notes

Text

One bit of context: this was on an earnings call, which is essentially a long string of promises and pleas from a public company to investors (specifically, investment managers and analysts). Firms won't lie on an earnings call, but they'll also spin anything that's obviously bad as a potential positive.

For instance:

"If strikes run longer than next month, we're going to get hundreds of millions of dollars in cash savings! And, erm, we might lose a bit of earnings."

Any time someone is clear on the upside ("several $100 million") and vague on the downside ("some incremental downside"), they're not lying to you, but they are hiding something.

youtube

5K notes

·

View notes

Text

How finfluencers destroyed the housing and lives of thousands of people

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

The crash of 2008 imparted many lessons to those of us who were only dimly aware of finance, especially the problems of complexity as a way of disguising fraud and recklessness. That was really the first lesson of 2008: "financial engineering" is mostly a way of obscuring crime behind a screen of technical jargon.

This is a vital principle to keep in mind, because obscenely well-resourced "financial engineers" are on a tireless, perennial search for opportunities to disguise fraud as innovation. As Riley Quinn says, "Any time you hear 'fintech,' substitute 'unlicensed bank'":

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

But there's another important lesson to learn from the 2008 disaster, a lesson that's as old as the South Seas Bubble: "leverage" (that is, debt) is a force multiplier for fraud. Easy credit for financial speculation turns local scams into regional crime waves; it turns regional crime into national crises; it turns national crises into destabilizing global meltdowns.

When financial speculators have easy access to credit, they "lever up" their wagers. A speculator buys your house and uses it for collateral for a loan to buy another house, then they make a bet using that house as collateral and buy a third house, and so on. This is an obviously terrible practice and lenders who extend credit on this basis end up riddling the real economy with rot – a single default in the chain can ripple up and down it and take down a whole neighborhood, town or city. Any time you see this behavior in debt markets, you should batten your hatches for the coming collapse. Unsurprisingly, this is very common in crypto speculation, where it's obscured behind the bland, unpronounceable euphemism of "re-hypothecation":

https://www.coindesk.com/consensus-magazine/2023/05/10/rehypothecation-may-be-common-in-traditional-finance-but-it-will-never-work-with-bitcoin/

Loose credit markets often originate with central banks. The dogma that holds that the only role the government has to play in tuning the economy is in setting interest rates at the Fed means the answer to a cooling economy is cranking down the prime rate, meaning that everyone earns less money on their savings and are therefore incentivized to go and risk their retirement playing at Wall Street's casino.

The "zero interest rate policy" shows what happens when this tactic is carried out for long enough. When the economy is built upon mountains of low-interest debt, when every business, every stick of physical plant, every car and every home is leveraged to the brim and cross-collateralized with one another, central bankers have to keep interest rates low. Raising them, even a little, could trigger waves of defaults and blow up the whole economy.

Holding interest rates at zero – or even flipping them to negative, so that your savings lose value every day you refuse to flush them into the finance casino – results in still more reckless betting, and that results in even more risk, which makes it even harder to put interest rates back up again.

This is a morally and economically complicated phenomenon. On the one hand, when the government provides risk-free bonds to investors (that is, when the Fed rate is over 0%), they're providing "universal basic income for people with money." If you have money, you can park it in T-Bills (Treasury bonds) and the US government will give you more money:

https://realprogressives.org/mmp-blog-34-responses/

On the other hand, while T-Bills exist and are foundational to the borrowing picture for speculators, ZIRP creates free debt for people with money – it allows for ever-greater, ever-deadlier forms of leverage, with ever-worsening consequences for turning off the tap. As 2008 forcibly reminded us, the vast mountains of complex derivatives and other forms of exotic debt only seems like an abstraction. In reality, these exotic financial instruments are directly tethered to real things in the real economy, and when the faery gold disappears, it takes down your home, your job, your community center, your schools, and your whole country's access to cancer medication:

https://www.theguardian.com/world/2012/jun/08/greek-drug-shortage-worsens

Being a billionaire automatically lowers your IQ by 30 points, as you are insulated from the consequences of your follies, lapses, prejudices and superstitions. As @[email protected] says, Elon Musk is what Howard Hughes would have turned into if he hadn't been a recluse:

https://mamot.fr/@[email protected]/112457199729198644

The same goes for financiers during periods of loose credit. Loose Fed money created an "everything bubble" that saw the prices of every asset explode, from housing to stocks, from wine to baseball cards. When every bet pays off, you win the game by betting on everything:

https://en.wikipedia.org/wiki/Everything_bubble

That meant that the ZIRPocene was an era in which ever-stupider people were given ever-larger sums of money to gamble with. This was the golden age of the "finfluencer" – a Tiktok dolt with a surefire way for you to get rich by making reckless bets that endanger the livelihoods, homes and wellbeing of your neighbors.

Finfluencers are dolts, but they're also dangerous. Writing for The American Prospect, the always-amazing Maureen Tkacik describes how a small clutch of passive-income-brainworm gurus created a financial weapon of mass destruction, buying swathes of apartment buildings and then destroying them, ruining the lives of their tenants, and their investors:

https://prospect.org/infrastructure/housing/2024-05-22-hell-underwater-landlord/

Tcacik's main characters are Matt Picheny, Brent Ritchie and Koteswar “Jay” Gajavelli, who ran a scheme to flip apartment buildings, primarily in Houston, America's fastest growing metro, which also boasts some of America's weakest protections for tenants. These finance bros worked through Gajavelli's company Applesway Investment Group, which levered up his investors' money with massive loans from Arbor Realty Trust, who also originated loans to many other speculators and flippers.

For investors, the scheme was a classic heads-I-win/tails-you-lose: Gajavelli paid himself a percentage of the price of every building he bought, a percentage of monthly rental income, and a percentage of the resale price. This is typical of the "syndicating" sector, which raised $111 billion on this basis:

https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3

Gajavelli and co bought up whole swathes of Houston and other cities, apartment blocks both modest and luxurious, including buildings that had already been looted by previous speculators. As interest rates crept up and the payments for the adjustable-rate loans supporting these investments exploded, Gajavell's Applesway and its subsidiary LLCs started to stiff their suppliers. Garbage collection dwindled, then ceased. Water outages became common – first weekly, then daily. Community rooms and pools shuttered. Lawns grew to waist-high gardens of weeds, fouled with mounds of fossil dogshit. Crime ran rampant, including murders. Buildings filled with rats and bedbugs. Ceilings caved in. Toilets backed up. Hallways filled with raw sewage:

https://pluralistic.net/timberridge

Meanwhile, the value of these buildings was plummeting, and not just because of their terrible condition – the whole market was cooling off, in part thanks to those same interest-rate hikes. Because the loans were daisy-chained, problems with a single building threatened every building in the portfolio – and there were problems with a lot more than one building.

This ruination wasn't limited to Gajavelli's holdings. Arbor lent to multiple finfluencer grifters, providing the leverage for every Tiktok dolt to ruin a neighborhood of their choosing. Arbor's founder, the "flamboyant" Ivan Kaufman, is associated with a long list of bizarre pop-culture and financial freak incidents. These have somehow eclipsed his scandals, involving – you guessed it – buying up apartment buildings and turning them into dangerous slums. Two of his buildings in Hyattsville, MD accumulated 2,162 violations in less than three years.

Arbor graduated from owning slums to creating them, lending out money to grifters via a "crowdfunding" platform that rooked retail investors into the scam, taking advantage of Obama-era deregulation of "qualified investor" restrictions to sucker unsophisticated savers into handing over money that was funneled to dolts like Gajavelli. Arbor ran the loosest book in town, originating mortgages that wouldn't pass the (relatively lax) criteria of Fannie Mae and Freddie Mac. This created an ever-enlarging pool of apartments run by dolts, without the benefit of federal insurance. As one short-seller's report on Arbor put it, they were the origin of an epidemic of "Slumlord Millionaires":

https://viceroyresearch.org/wp-content/uploads/2023/11/Arbor-Slumlord-Millionaires-Jan-8-2023.pdf

The private equity grift is hard to understand from the outside, because it appears that a bunch of sober-sided, responsible institutions lose out big when PE firms default on their loans. But the story of the Slumlord Millionaires shows how such a scam could be durable over such long timescales: remember that the "syndicating" sector pays itself giant amounts of money whether it wins or loses. The consider that they finance this with investor capital from "crowdfunding" platforms that rope in naive investors. The owners of these crowdfunding platforms are conduits for the money to make the loans to make the bets – but it's not their money. Quite the contrary: they get a fee on every loan they originate, and a share of the interest payments, but they're not on the hook for loans that default. Heads they win, tails we lose.

In other words, these crooks are intermediaries – they're platforms. When you're on the customer side of the platform, it's easy to think that your misery benefits the sellers on the platform's other side. For example, it's easy to believe that as your Facebook feed becomes enshittified with ads, that advertisers are the beneficiaries of this enshittification.

But the reason you're seeing so many ads in your feed is that Facebook is also ripping off advertisers: charging them more, spending less to police ad-fraud, being sloppier with ad-targeting. If you're not paying for the product, you're the product. But if you are paying for the product? You're still the product:

https://pluralistic.net/2021/01/04/how-to-truth/#adfraud

In the same way: the private equity slumlord who raises your rent, loads up on junk fees, and lets your building disintegrate into a crime-riddled, sewage-tainted, rat-infested literal pile of garbage is absolutely fucking you over. But they're also fucking over their investors. They didn't buy the building with their own money, so they're not on the hook when it's condemned or when there's a forced sale. They got a share of the initial sale price, they get a percentage of your rental payments, so any upside they miss out on from a successful sale is just a little extra they're not getting. If they squeeze you hard enough, they can probably make up the difference.

The fact that this criminal playbook has wormed its way into every corner of the housing market makes it especially urgent and visible. Housing – shelter – is a human right, and no person can thrive without a stable home. The conversion of housing, from human right to speculative asset, has been a catastrophe:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

Of course, that's not the only "asset class" that has been enshittified by private equity looters. They love any kind of business that you must patronize. Capitalists hate capitalism, so they love a captive audience, which is why PE took over your local nursing home and murdered your gran:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

Homes are the last asset of the middle class, and the grifter class know it, so they're coming for your house. Willie Sutton robbed banks because "that's where the money is" and We Buy Ugly Houses defrauds your parents out of their family home because that's where their money is:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The plague of housing speculation isn't a US-only phenomenon. We have allies in Spain who are fighting our Wall Street landlords:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#fuckin-aardvarks

Also in Berlin:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

The fight for decent housing is the fight for a decent world. That's why unions have joined the fight for better, de-financialized housing. When a union member spends two hours commuting every day from a black-mold-filled apartment that costs 50% of their paycheck, they suffer just as surely as if their boss cut their wage:

https://pluralistic.net/2023/12/13/i-want-a-roof-over-my-head/#and-bread-on-the-table

The solutions to our housing crises aren't all that complicated – they just run counter to the interests of speculators and the ruling class. Rent control, which neoliberal economists have long dismissed as an impossible, inevitable disaster, actually works very well:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

As does public housing:

https://jacobin.com/2023/10/red-vienna-public-affordable-housing-homelessness-matthew-yglesias

There are ways to have a decent home and a decent life without being burdened with debt, and without being a pawn in someone else's highly leveraged casino bet.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/22/koteswar-jay-gajavelli/#if-you-ever-go-to-houston

Image: Boy G/Google Maps (modified) https://pluralistic.net/timberridge

#pluralistic#zirp#weaponized shelter#the rents too damned high#finfluencers#qualified investors#the bezzle#heads i win tails you lose#houston#Brent Ritchie#Matt Picheny#Koteswar Jay Gajavelli#Koteswar Gajavelli#Applesway Investment Group#maureen tkacik#Arbor Realty Trust#MF1 Capital#Benefit Street Partners#bezzle#Swapnil Agarwal#Slumlord Millionaires#KeyCity Capital#Financial Independence University#Elisa Zhang#Lane Kawaoka#Fundamental Advisors#AWC Opportunity Partners#Nitya Capital

263 notes

·

View notes

Text

Where is the lie?

#Where is the lie?#scalpers#scalper#investors#exploitation#exploitative#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#anti capitalism#late stage capitalism#fuck capitalism#capitalist hell#eat the rich#eat the fucking rich#class war#materialism#dialectical materialism#anti capitalist#capitalist dystopia#capitalist bullshit#capitalist realism#capitalist society

44 notes

·

View notes

Text

Feel like I shouldn't have to say this and I'm mostly just preaching to the choir but housing should not be an investment opportunity. Living, breathing humans reside in that house. You're disgusting if you're a landlord, even more so if you have your tenants live in dangerous conditions. If you're gonna own the property, it's your responsibility for maintenance. Point-blank and I don't wanna hear anyone tell me otherwise.

#capitalism#anti capitalism#anti capitalists be like#capitalist hell#late stage capitalism#capitalist dystopia#investment#real estate investing#investors

44 notes

·

View notes

Text

Y’all. If you think that the evils of big business starts and ends with the CEOs bloated salaries, you’re missing a wholeeeeeee lot.

#like are the CEOS evil but come on you gotta know#there is wealth above the studio CEOs#I know that’s hard to remember bc the CEOs are so over paid#but yeah#anyway fuck capitalism#the CEOs AND the investors

52 notes

·

View notes

Text

Capitalism is the best economic system for ensuring that resources are distributed according to what society needs most.

37 notes

·

View notes

Text

Top investors in space in India

Why Venture Capitalists Are Betting Big on India’s Space Sector

A Thriving Ecosystem of Space Startups: India’s space ecosystem is no longer limited to government-run entities like the Indian Space Research Organisation (ISRO). Today, a surge of innovative space startups are taking the stage, offering cutting-edge solutions in satellite technology, launch services, space data analytics, and more. Companies like Skyroot Aerospace, Agnikul Cosmos, and Pixxel lead the charge, each carving out a unique niche. These startups are pushing the boundaries of what’s possible, driving investor interest with the potential for high returns in a relatively untapped market.

Strong Government Support and Policy Reforms: One of the key reasons behind the surge in space venture capital in India is the proactive stance taken by the Indian government. Recent policy reforms have opened the doors for private players to participate in space activities, previously dominated by ISRO. Establishing IN-SPACe (Indian National Space Promotion and Authorization Center) is a significant step, providing a regulatory framework that encourages private sector involvement. Such government support has given investors in space in India the confidence to back ambitious projects, knowing there’s a clear path for private ventures.

Cost-Effective Innovation as a Competitive Edge: India’s reputation for cost-effective innovation is another major attraction for investors. Launching satellites at a fraction of the cost compared to global competitors has positioned India as a hub for affordable space technology. This competitive edge not only allows Indian space startups to thrive domestically but also makes them attractive on the international stage. Investors are keen to support companies that can deliver world-class technology with lower capital outlays, reducing investment risks while promising impressive returns.

Global Interest in Indian Talent and Expertise: India’s space sector is not just about affordability; it’s about world-class talent. The country boasts a deep pool of highly skilled engineers, scientists, and entrepreneurs with expertise in aerospace and technology. This talent pool has been instrumental in driving innovation and attracting global attention. International investors are increasingly looking to partner with Indian space startups, recognizing the country’s unique blend of technical prowess and entrepreneurial spirit.

A Growing Market for Space-Based Services: The market for space-based services, including satellite communications, Earth observation, and data analytics, is expanding rapidly. In India, this growth is driven by rising demand from industries such as agriculture, telecommunications, logistics, and defense. With space technology playing a crucial role in optimizing these sectors, investors see an opportunity to capitalize on the potential for domestic and international applications. Space-based services represent a lucrative market, attracting space venture capital in India to back startups that can cater to these needs.

Strategic Partnerships and Collaborations: Indian space startups are not working in isolation; they are forming strategic partnerships with global companies and space agencies. Collaborations with NASA, ESA (European Space Agency), and private companies have opened up new opportunities for technology sharing, funding, and market access. These partnerships have also strengthened investor confidence, as they reduce risks and validate the technology being developed by Indian companies. For investors in space in India, such collaborations signal a promising future, driving more venture capital into the sector.

A New Era of Commercial Space Exploration: The idea of commercial space exploration, once confined to science fiction, is now becoming a reality. From reusable rockets to satellite constellations, Indian space startups are exploring new frontiers that were once considered out of reach. This new era of commercial space exploration has piqued the interest of venture capitalists who see the potential for profitable exits through IPOs, acquisitions, and global partnerships. With private space missions no longer just a dream, space venture capital in India is ready to fuel the next big leap.

Encouraging Signs from Successful Fundraising Rounds: The confidence in India’s space sector is evident from the successful fundraising rounds by leading space startups. Companies like Skyroot Aerospace and Agnikul Cosmos have secured millions in funding from top-tier venture capital firms. These funding rounds not only provide the necessary resources for scaling but also act as a signal to other investors that the Indian space market is mature and ready for high-stakes investment. The momentum created by these early successes is a clear indicator of why investors in space in India are increasingly willing to place their bets.

Conclusion: A Promising Orbit for Investment India’s space sector is on an exciting trajectory. With a favorable policy environment, a surge of innovative startups, and a proven track record of cost-effective solutions, it’s no wonder that space venture capital in India is booming. As the country continues to explore new frontiers and expand its role in global space exploration, venture capitalists are set to play a pivotal role in shaping the future. For those looking to invest in the final frontier, India’s space industry presents a unique opportunity to be part of a revolution that’s only just beginning.

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

5 Ring Road, Lajpat Nagar 4, 3rd Floor, New Delhi-110024

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india#business investors in kerala#venture capital company#semiconductor startups#semiconductor venture capital#investors in semiconductors#startup seed funding in India#deep tech venture capital#deeptech startups in india#semiconductor companies in india#saas angel investors#saas venture capital firms#saas venture capital#b2b venture capital#space venture capital in india

2 notes

·

View notes

Text

The concept of "financial independence" is inherently flawed in end-stage capitalism and features ideals which appear at anti-thesis--

Unless a person lives on a completely self-sufficient farm in the middle of nowhere and has never used a government service in their ENTIRE life, and never talked to another person before --

(and somehow got all this stuff by themself too??? How? Stealing? So many questions.. who the fuck raised them? Bears??)--

Then a person is NEVER independent, they are only ignorant of their true dependence on others across their lifetime (including bear parents)

Often tracing that issue of false beliefs back would probably label this individual as an "energy vampire" or "leech" on society as it sounds like a very "lazy" individual who is bumming off of everyone else and projecting that issue onto the working class

Looking at you "passive income investors"

Every dime of "passive income" is almost guarenteed to be a dime that can be traced back to a working class individual being exploited for undervalued labor.

9 notes

·

View notes

Text

Where to Find a $4-an-Hour Math Tutor With a Ph.D.? Overseas

Traditionally in-person services are increasingly provided from abroad

https://www.wsj.com/articles/where-to-find-a-4-an-hour-math-tutor-with-a-ph-d-overseas-b5d9afce?mod=mhp

🚫 http://www.afterschoolalliance.org/AA3PM/Concentrated_Poverty.pdf #wfh #skills #DigitalTransformation #education #edtech #Children #school #remotework #cre

🔮 https://twitter.com/mohossain/status/1645976290506186753?s=46&t=GtuOmoaTjOwevz2JidiiDQ

17 notes

·

View notes

Text

"Hey I think capitalism is bad. In particular, this specific aspect, for these reasons."

"Surely you don't mean what you just specifically said though!"

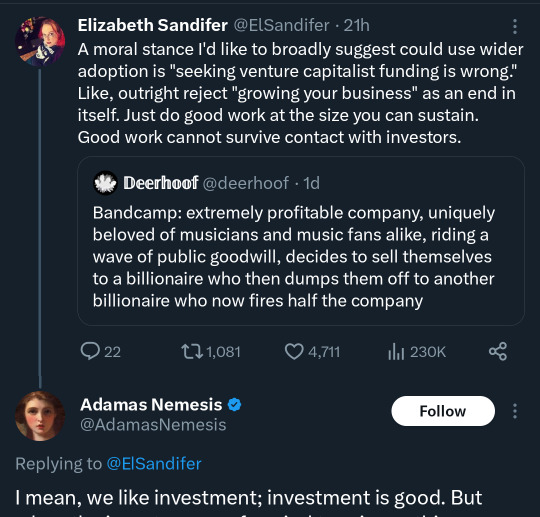

#This guy that replied has “investor” in his bio. Lol. Lmao.#bandcamp#epic games#songtradr#anti capitalism

18 notes

·

View notes

Text

youtube

Joe Rogan Experience #2190 - Peter Thiel

#quote of the day#joe rogan#peter thiel#PayPal#ceo#enterpreneur#business#money#capitalism#bank#corporate#billionaire#millionaire#inter#occupy wall street#investors#political#cia#us government#politics#new world order#conspiracy#greed#corruption#middle class#lower class#working class#social engineering#social networks#Youtube

3 notes

·

View notes