#venture capital

Explore tagged Tumblr posts

Text

146 notes

·

View notes

Text

#cartoons#cartoon#comics#comic#venture capital#capitalism#anti capitalist#washington capitals#capitalist hell#capitalist dystopia#capitalist bullshit#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#class war#slavery#wage slavery#chattel slavery#money#fuck the police#fuck the patriarchy

272 notes

·

View notes

Text

One founder told me that many investors don’t really understand this space, and that they’re often drawn to the sexiest, most revolutionary technology, rather than more incremental improvements and business models that are already proven, like lower-tech greenhouses. It’s also hard to make money selling baby greens rather than a high price-point item like cannabis—or even just more expensive produce, like berries. “Is it worth spending $20 million on a cutting-edge system when you’re producing objects that might get $1 or $2 in the marketplace? That’s the problem,” says Stein, the Penn State business professor. (As a growing number of indoor farms have started selling branded greens, the competition is also making it harder to get placement in grocery stores.) If companies look to make more money by charging a large premium for a box of greens, there’s a relatively limited group of consumers willing to pay more for salad.

226 notes

·

View notes

Text

#longevity#technology#life extension#venture capital

12 notes

·

View notes

Text

2.4.25 SubscribePodcast.com

I have filmed thousands of videos and podcasts over the past 4 years. I will be temporarily shutting down all Clubhouse & X Recordings for the next few days; however, I may live stream some Elon Musk X Spaces. I will be editing all Youtube Accounts and consolidating branding, playlists, and links. My complete Youtube To-Do list is below:

Add the following to all YT videos in Subscribe Now:

Descriptions with URL, X URL, Youtube URL, Keywords, eMail, instagram url

Update Gallery Pics on Top 1000 Videos

Cancel TUMBLR domains

Create 100 Shorts a day of Poetry

Simply YT account names: PoetryNow PoetryZen PoetZen ZenPoetry ZenNow TaoZenNow

Update SubscribePodcast.com (on Apple phone?)

Create 100 New Playlists and ad all Videos to new PL's

Add automatic chapters to all live streams and shorts

Post all YT videos to Subscribe Podcast

Create a new Tumblr Website (domain) - Publish top 100 YT vids,

Publish 100 Poems / Hypnosis

Renew Subscribe Podcast URL - Follow Now Podcast

Go through all Phones & Consolidate Names / Playlists - Direct to

Subscribe Podcast (use Desktop & 50 Edits)

STOP ALL CONTENT CREATION & JUST CREATE BRAND 15 SECOND SHORTS

STOP USING CLUBHOUSE COMPLETELY till ALL YT accounts are consolidated & Content is on Tumblr(s)

Add related Videos to all videos

Change Short(s) Thumbnails on Cell Phones

Update Categories on All Videos

Add ALL Instagram handles into ALL YT videos as well

Change UN on IG to new Tumblr Domains (SubscribePodcast)

Open BuyMeCoffee SubscribePodcast account and add to Tumblr Description

#podcast#youtube#subscribe podcast#creator#videos#movies#films#youtube shorts#poetry#poems#documentary#podcasts#startups#venture capital#content creator#hypnosis#philosophy#communication

7 notes

·

View notes

Text

Focus On: Africa's Venture Capital landscape

youtube

3 notes

·

View notes

Text

How Things Work: If the coop model can succeed in Minneapolis, that would significantly undermine the power of Uber and Lyft's threats to pull out of other cities in the future. Do you interact directly with those companies at all? Do they view you as a threat? Do they try to actively hold you back, or do they mostly leave you alone? What's your message to regular people about why they should use you, rather than those ubiquitous apps?

Forman: We're somewhere between the "first they ignore you" and "then they laugh at you" phases. People should use us because on average, we're a little cheaper than Uber, and drivers make 10% above the minimum wage. And it's worker-owned. We're building lasting power in this industry in a democratic, worker-controlled organization.

How Things Work: For people who can see the logic of a driver's cooperative, what's the best way to help—in Minneapolis, and also in cities that don't have such a thing yet?

Forman: For people who want to help—please download the app and share it with friends. We just created a new feature where you can see how many drivers and riders have been recruited in your area, and you can easily share the app with a QR code and other tools. Also, we certainly need funds to get this done. If you can, donate a bit to the effort to build a co-op in Minneapolis.

#article#how things work#ride share#co-op#worker owned#labor vs capital#capital vs labor#venture capital#labor movement#minneapolis#technology#tech

14 notes

·

View notes

Text

Ko-Fi prompt from @dirigibird:

I've been looking at investment options but I don't want to be messing around too much with the stock market, and a co-worker suggested exchange traded funds. Would love to know your opinions!

LEGALLY NECESSARY DISCLAIMER: I am not a licensed financial advisor, and it is illegal for me to advise anyone on investment in securities like stocks. My commentary here is merely opinion, not financial advice, and I urge you to not make any decisions with regards to securities investments based on my opinions, or without consulting a licensed advisor. I am also going to be talking this all over from an American POV, which means some of these things may not apply elsewhere.

So instead of letting you know what to pick or how to organize your securities, I'm going to go through the definitions of what various investment funds are, how they compare functionally, and maybe rant about how I disagree with the stock market on a fundamental ethical level if I have word count left over.

If you want more information, and are okay with jargon, I'd suggest hitting up investopedia. That is where I will be double-checking most of my information for this one.

I also encourage folks who know more about the stock market specifically to jump in! I like to think I'm good at research and explaining things, but I'm still liable to make mistakes.

Mutual Funds: A mutual fund is a pool of money and resources from multiple individuals (often vast numbers of people, actually) being put together and managed as a group by investment specialists. The primary appeal of these is that the money is professionally managed, but not personally so; it gives smaller investors access to professional money managers that they would not have access to on their own, at cheaper rates than if they tried to hire one for just their own assets. The secondary appeal is that, due to the sheer number of people, and thus capital, that is being invested at once, the money can be invested in a wide variety of industries, and is generally more stable than investing in just one company or industry. Low risk, low reward, but overall at least mostly reliable. Retirement plans are often invested in mutual funds by employer choice, through companies like Fidelity or John Hancock.

Hedge Funds: A hedge fund is a high risk, high reward mutual fund. Investors are generally wealthy, and have the room and safety to lose large amounts of money on an investment that has no promise of success, especially since money cannot be withdrawn at will, but must remain in the fund for a period of time following investment. It gets its name from "hedging your bets," as part of the strategy is to invest in the opposition of the fund's focus in order to ensure that there is a backup plan to salvage at least some money if the main plan backfires. Other strategies are also on the riskier side, often planning to take advantage of ongoing events like buyouts, mergers, incumbent bankruptcy, and shorting stocks (that's the one that caused the gamestop incident).

Private Equity: Private equity is... a nightmare that got its own incredibly good Hasan Minhaj episode of Patriot Act, so if you've got 20 minutes, an interest in comedically-delivered, easily-digestible, Real Information, and an internet connection, take a watch of that one. (If it's not available on YouTube in your country, it's originally from Netflix, or you can probably access it by VPN.) Private equity companies are effectively hedge funds that purchase entire companies, rebuild them in one way or another, and then sell them at (hopefully) a profit. Very often, the companies purchased by private equity are very negatively impacted, especially if the private equity group is a Vulture Fund. Sometimes, it's by taking it apart to sell off; sometimes it's by just bleeding it for cash until there's nothing left. Sometimes, it's taking over a hospital and overcharging the patients while also abusing the staff! (Glaucomflecken has a lot of videos on the topic of private equity in the medical industry, check him out.)

Venture Capital: In contrast to private equity, which purchases more mature companies, venture capital is focused on startups, or small businesses that have growth potential. These are the kinds of hedge funds that are like a whole group that you'd see some random tv character calling an Angel Investor (they're not actually the same thing, but they overlap by a lot). I'd hesitantly call these less ethically dubious than private equity, but I'm still suspicious.

And finally, to answer your question on what ETFs are and how they fit into the above.

Exchange Traded Funds: ETFs are... sort of like a mutual fund. Sort of. You are, to some extent, pooling your money... ish.

An ETF is like a stock that is made out of partial stocks. So instead of paying $100 for stock A, and not getting stocks B/C/D that all cost the same, you buy $100 of the ETF, which is $25 each of stocks A/B/C/D. You are getting a quarter of a unit of stock, which isn't normally an option, but because you are purchasing through an ETF that officially already bought those Whole stocks, you can now purchase the partial stocks through them.

They buy the whole stocks, then they resell you mixes of those stocks. They still officially own the whole stocks themselves, but you now own parts of the stocks. Basically, you own "stock" in a company that owns stock in other companies, and in that process you own partial stocks in those other companies.

I'm going to re-explain this using fruit.

Imagine you can buy apples, oranges, melons, grapes, etc. You can also buy fruit cups. You can only buy the individual fruits in big batches or you can pool your money with a few other people, hand it to a chef. The chef will decide which fruits look like they'll taste the best by lunch time, buy a bunch of those fruit pallets with your combined money, and plan out the best possible fruit salad for you to share with a bunch of people once lunch rolls around.

You could also buy a fruit cup. You don't have a lot of control over what's already in the fruit cup, but there are a few different mixes available--that one has strawberries, but that one over there uses kiwi, and the other one that way has pineapple--and you can pick which mix you want. It's a pretty small fruit cup, and it's predesigned, but you can choose the one you want without having to pool money with everyone else. You just first have to let someone else design the fruit cups you choose from, and you don't know which ones are probably going to survive the best to lunch time unless you ask a chef (which defeats the purpose of buying a fruit cup instead of pooling your money, and asking the chef costs money).

That's the ETF. The ETF is the fruit cup.

The upside is that you can now just track the prices of your fruit cup, instead of tracking the prices of four different fruits, and so if the price of one fruit drops, you can just... let the other three buoy it.

Of course, in the real world, there are more than just four stocks involved in an ETF. This part of the Investopedia article lists a few examples, and they're usually themed and involve anywhere from 30 (DOW Jones) to thousands (Russell) of shares by stock type, or by commodity/industry. So with the ETF, you can invest in an entire industry, like technology, and just keep track of that single "stock" in the industry game.

They do cost less in brokerage/management fees than regular mutual funds, and they have a slightly lower liquidity (slower to cash out). There also exist actively managed ETFs, which are basically mutual funds for ETFs. You are paying the chef to buy you premade fruit cups.

(Prompt me on ko-fi!)

#economics#stock market#etfs#etf#mutual funds#hedge funds#venture capital#private equity#capitalism#phoenix talks#ko fi#ko fi prompts#economics prompts

51 notes

·

View notes

Text

9 notes

·

View notes

Text

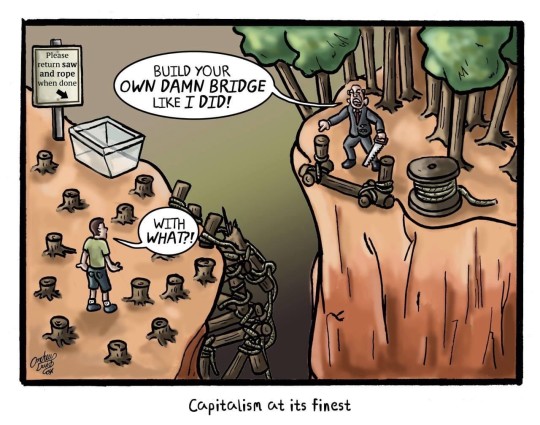

Capitalism is the best economic system for ensuring that resources are distributed according to what society needs most.

38 notes

·

View notes

Text

VP candidate JD Vance, who has worked as a Venture Capitalist, says immigration is to blame for high housing costs, and not Venture Capitalists buying up all the houses. Later this week, Vance is expected to release a statement saying water is not to blame for wetness.

- written by me for tonight's This Week This Week in LA, you can come see it.

#los angeles#la#satire#joke#funny#comedy#sketch#sketch comedy#comedy writer#writer#screeenwriter#screenwriting#jd vance#vance#housing#venture capital#us politics#politics#political

4 notes

·

View notes

Text

Wage theft…modern tech style!

#Wage theft…modern tech style!#comics#comic#cartoons#cartoon#memes#meme#wage theft#venture capital#exploitation#exploitative#eat the rich#eat the fucking rich#class war#antiwork#anti slavery#anti capitalism#antiauthoritarian#antinazi#fuck work#antifascist#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese

49 notes

·

View notes

Text

Investment Options in India: Diversify Your Portfolio in 2024

Diversification is a fundamental principle of investing, essential for managing risk and optimizing returns. In 2024, as investors navigate an ever-changing economic landscape, diversifying their portfolios becomes even more critical. India, with its vibrant economy, diverse markets, and growth potential, offers a plethora of investment options for both domestic and international investors. In this comprehensive guide, we explore various investment avenues in India in 2024, from traditional options like stocks and real estate to emerging opportunities in startups and alternative assets.

1. Equities: Investing in the Stock Market

Investing in equities remains one of the most popular ways to participate in India's economic growth story. The Indian stock market, represented by indices such as the Nifty 50 and Sensex, offers ample opportunities for investors to capitalize on the country's booming sectors and emerging companies.

- Blue-Chip Stocks: Invest in established companies with a proven track record of performance and stability.

- Mid and Small-Cap Stocks: Explore growth opportunities by investing in mid and small-cap companies with high growth potential.

- Sectoral Funds: Diversify your portfolio by investing in sector-specific mutual funds or exchange-traded funds (ETFs) targeting industries such as technology, healthcare, and finance.

2. Mutual Funds: Professional Fund Management

Mutual funds provide an excellent avenue for investors to access a diversified portfolio managed by professional fund managers. In India, mutual funds offer a range of options catering to different risk profiles and investment objectives.

- Equity Funds: Invest in a diversified portfolio of stocks, including large-cap, mid-cap, and small-cap companies.

- Debt Funds: Generate stable returns by investing in fixed-income securities such as government bonds, corporate bonds, and treasury bills.

- Hybrid Funds: Combine the benefits of equity and debt investments to achieve a balanced risk-return profile.

- Index Funds and ETFs: Track benchmark indices like the Nifty 50 and Sensex at a lower cost compared to actively managed funds.

3. Real Estate: Tangible Assets for Long-Term Growth

Real estate continues to be a popular investment option in India, offering the dual benefits of capital appreciation and rental income. While traditional residential and commercial properties remain attractive, investors can also explore alternative avenues such as real estate investment trusts (REITs) and real estate crowdfunding platforms.

- Residential Properties: Invest in apartments, villas, or plots of land in prime locations with high demand and potential for appreciation.

- Commercial Properties: Generate rental income by investing in office spaces, retail outlets, warehouses, and industrial properties.

- REITs: Gain exposure to a diversified portfolio of income-generating real estate assets without the hassle of direct ownership.

- Real Estate Crowdfunding: Participate in real estate projects through online platforms, pooling funds with other investors to access lucrative opportunities.

4. Startups and Venture Capital: Betting on Innovation and Entrepreneurship

India's startup ecosystem has witnessed exponential growth in recent years, fueled by a wave of innovation, entrepreneurial talent, and supportive government policies. Investing in startups and venture capital funds allows investors to participate in this dynamic ecosystem and potentially earn high returns.

- Angel Investing: Provide early-stage funding to promising startups in exchange for equity ownership, betting on their growth potential.

- Venture Capital Funds: Invest in professionally managed funds that provide capital to startups and emerging companies in exchange for equity stakes.

- Startup Accelerators and Incubators: Partner with organizations that support early-stage startups through mentorship, networking, and access to resources.

5. Alternative Assets: Diversification Beyond Traditional Investments

In addition to stocks, bonds, and real estate, investors can diversify their portfolios further by allocating capital to alternative assets. These assets offer unique risk-return profiles and can act as a hedge against market volatility.

- Gold and Precious Metals: Hedge against inflation and currency fluctuations by investing in physical gold, gold ETFs, or gold savings funds.

- Commodities: Gain exposure to commodities such as crude oil, natural gas, metals, and agricultural products through commodity futures and exchange-traded funds.

- Cryptocurrencies: Explore the emerging asset class of digital currencies like Bitcoin, Ethereum, and others, which offer the potential for high returns but come with higher volatility and risk.

Conclusion

Diversifying your investment portfolio is essential for mitigating risk, maximizing returns, and achieving long-term financial goals. In 2024, India offers a myriad of investment options across various asset classes, catering to the preferences and risk profiles of different investors.

Whether you prefer the stability of blue-chip stocks, the growth potential of startups, or the tangible assets of real estate, India provides ample opportunities to diversify your portfolio and capitalize on the country's economic growth story. By carefully assessing your investment objectives, risk tolerance, and time horizon, you can construct a well-diversified portfolio that withstands market fluctuations and delivers sustainable returns in the years to come.

This post was originally published on: Foxnangel

#best investment options in india#diversify portfolio#share market#stock market#indian stock market#mutual funds#real estate#startups in india#venture capital#foxnangel#invest in india

4 notes

·

View notes

Text

What Makes a Good Startup in the Railroad Industry?

youtube

2 notes

·

View notes

Text

Charles Baudelaire 🌺🌹 👿 🌺🌹 #3 #Poem #Poet #Poetic @Johnkitovermovie @...

youtube

14 notes

·

View notes

Text

#marc andreessen#ben horowitz#The Verge#venture capital#profiteering#politics#capitalism#republican party#donald trump#cryptocurrency#jd vance#Project 2025#artificial intelligence#taxation#a16z#photography#exploitation#federal trade commission#US Securities and Exchange Commission

3 notes

·

View notes