#bezzle

Explore tagged Tumblr posts

Text

How finfluencers destroyed the housing and lives of thousands of people

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

The crash of 2008 imparted many lessons to those of us who were only dimly aware of finance, especially the problems of complexity as a way of disguising fraud and recklessness. That was really the first lesson of 2008: "financial engineering" is mostly a way of obscuring crime behind a screen of technical jargon.

This is a vital principle to keep in mind, because obscenely well-resourced "financial engineers" are on a tireless, perennial search for opportunities to disguise fraud as innovation. As Riley Quinn says, "Any time you hear 'fintech,' substitute 'unlicensed bank'":

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

But there's another important lesson to learn from the 2008 disaster, a lesson that's as old as the South Seas Bubble: "leverage" (that is, debt) is a force multiplier for fraud. Easy credit for financial speculation turns local scams into regional crime waves; it turns regional crime into national crises; it turns national crises into destabilizing global meltdowns.

When financial speculators have easy access to credit, they "lever up" their wagers. A speculator buys your house and uses it for collateral for a loan to buy another house, then they make a bet using that house as collateral and buy a third house, and so on. This is an obviously terrible practice and lenders who extend credit on this basis end up riddling the real economy with rot – a single default in the chain can ripple up and down it and take down a whole neighborhood, town or city. Any time you see this behavior in debt markets, you should batten your hatches for the coming collapse. Unsurprisingly, this is very common in crypto speculation, where it's obscured behind the bland, unpronounceable euphemism of "re-hypothecation":

https://www.coindesk.com/consensus-magazine/2023/05/10/rehypothecation-may-be-common-in-traditional-finance-but-it-will-never-work-with-bitcoin/

Loose credit markets often originate with central banks. The dogma that holds that the only role the government has to play in tuning the economy is in setting interest rates at the Fed means the answer to a cooling economy is cranking down the prime rate, meaning that everyone earns less money on their savings and are therefore incentivized to go and risk their retirement playing at Wall Street's casino.

The "zero interest rate policy" shows what happens when this tactic is carried out for long enough. When the economy is built upon mountains of low-interest debt, when every business, every stick of physical plant, every car and every home is leveraged to the brim and cross-collateralized with one another, central bankers have to keep interest rates low. Raising them, even a little, could trigger waves of defaults and blow up the whole economy.

Holding interest rates at zero – or even flipping them to negative, so that your savings lose value every day you refuse to flush them into the finance casino – results in still more reckless betting, and that results in even more risk, which makes it even harder to put interest rates back up again.

This is a morally and economically complicated phenomenon. On the one hand, when the government provides risk-free bonds to investors (that is, when the Fed rate is over 0%), they're providing "universal basic income for people with money." If you have money, you can park it in T-Bills (Treasury bonds) and the US government will give you more money:

https://realprogressives.org/mmp-blog-34-responses/

On the other hand, while T-Bills exist and are foundational to the borrowing picture for speculators, ZIRP creates free debt for people with money – it allows for ever-greater, ever-deadlier forms of leverage, with ever-worsening consequences for turning off the tap. As 2008 forcibly reminded us, the vast mountains of complex derivatives and other forms of exotic debt only seems like an abstraction. In reality, these exotic financial instruments are directly tethered to real things in the real economy, and when the faery gold disappears, it takes down your home, your job, your community center, your schools, and your whole country's access to cancer medication:

https://www.theguardian.com/world/2012/jun/08/greek-drug-shortage-worsens

Being a billionaire automatically lowers your IQ by 30 points, as you are insulated from the consequences of your follies, lapses, prejudices and superstitions. As @[email protected] says, Elon Musk is what Howard Hughes would have turned into if he hadn't been a recluse:

https://mamot.fr/@[email protected]/112457199729198644

The same goes for financiers during periods of loose credit. Loose Fed money created an "everything bubble" that saw the prices of every asset explode, from housing to stocks, from wine to baseball cards. When every bet pays off, you win the game by betting on everything:

https://en.wikipedia.org/wiki/Everything_bubble

That meant that the ZIRPocene was an era in which ever-stupider people were given ever-larger sums of money to gamble with. This was the golden age of the "finfluencer" – a Tiktok dolt with a surefire way for you to get rich by making reckless bets that endanger the livelihoods, homes and wellbeing of your neighbors.

Finfluencers are dolts, but they're also dangerous. Writing for The American Prospect, the always-amazing Maureen Tkacik describes how a small clutch of passive-income-brainworm gurus created a financial weapon of mass destruction, buying swathes of apartment buildings and then destroying them, ruining the lives of their tenants, and their investors:

https://prospect.org/infrastructure/housing/2024-05-22-hell-underwater-landlord/

Tcacik's main characters are Matt Picheny, Brent Ritchie and Koteswar “Jay” Gajavelli, who ran a scheme to flip apartment buildings, primarily in Houston, America's fastest growing metro, which also boasts some of America's weakest protections for tenants. These finance bros worked through Gajavelli's company Applesway Investment Group, which levered up his investors' money with massive loans from Arbor Realty Trust, who also originated loans to many other speculators and flippers.

For investors, the scheme was a classic heads-I-win/tails-you-lose: Gajavelli paid himself a percentage of the price of every building he bought, a percentage of monthly rental income, and a percentage of the resale price. This is typical of the "syndicating" sector, which raised $111 billion on this basis:

https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3

Gajavelli and co bought up whole swathes of Houston and other cities, apartment blocks both modest and luxurious, including buildings that had already been looted by previous speculators. As interest rates crept up and the payments for the adjustable-rate loans supporting these investments exploded, Gajavell's Applesway and its subsidiary LLCs started to stiff their suppliers. Garbage collection dwindled, then ceased. Water outages became common – first weekly, then daily. Community rooms and pools shuttered. Lawns grew to waist-high gardens of weeds, fouled with mounds of fossil dogshit. Crime ran rampant, including murders. Buildings filled with rats and bedbugs. Ceilings caved in. Toilets backed up. Hallways filled with raw sewage:

https://pluralistic.net/timberridge

Meanwhile, the value of these buildings was plummeting, and not just because of their terrible condition – the whole market was cooling off, in part thanks to those same interest-rate hikes. Because the loans were daisy-chained, problems with a single building threatened every building in the portfolio – and there were problems with a lot more than one building.

This ruination wasn't limited to Gajavelli's holdings. Arbor lent to multiple finfluencer grifters, providing the leverage for every Tiktok dolt to ruin a neighborhood of their choosing. Arbor's founder, the "flamboyant" Ivan Kaufman, is associated with a long list of bizarre pop-culture and financial freak incidents. These have somehow eclipsed his scandals, involving – you guessed it – buying up apartment buildings and turning them into dangerous slums. Two of his buildings in Hyattsville, MD accumulated 2,162 violations in less than three years.

Arbor graduated from owning slums to creating them, lending out money to grifters via a "crowdfunding" platform that rooked retail investors into the scam, taking advantage of Obama-era deregulation of "qualified investor" restrictions to sucker unsophisticated savers into handing over money that was funneled to dolts like Gajavelli. Arbor ran the loosest book in town, originating mortgages that wouldn't pass the (relatively lax) criteria of Fannie Mae and Freddie Mac. This created an ever-enlarging pool of apartments run by dolts, without the benefit of federal insurance. As one short-seller's report on Arbor put it, they were the origin of an epidemic of "Slumlord Millionaires":

https://viceroyresearch.org/wp-content/uploads/2023/11/Arbor-Slumlord-Millionaires-Jan-8-2023.pdf

The private equity grift is hard to understand from the outside, because it appears that a bunch of sober-sided, responsible institutions lose out big when PE firms default on their loans. But the story of the Slumlord Millionaires shows how such a scam could be durable over such long timescales: remember that the "syndicating" sector pays itself giant amounts of money whether it wins or loses. The consider that they finance this with investor capital from "crowdfunding" platforms that rope in naive investors. The owners of these crowdfunding platforms are conduits for the money to make the loans to make the bets – but it's not their money. Quite the contrary: they get a fee on every loan they originate, and a share of the interest payments, but they're not on the hook for loans that default. Heads they win, tails we lose.

In other words, these crooks are intermediaries – they're platforms. When you're on the customer side of the platform, it's easy to think that your misery benefits the sellers on the platform's other side. For example, it's easy to believe that as your Facebook feed becomes enshittified with ads, that advertisers are the beneficiaries of this enshittification.

But the reason you're seeing so many ads in your feed is that Facebook is also ripping off advertisers: charging them more, spending less to police ad-fraud, being sloppier with ad-targeting. If you're not paying for the product, you're the product. But if you are paying for the product? You're still the product:

https://pluralistic.net/2021/01/04/how-to-truth/#adfraud

In the same way: the private equity slumlord who raises your rent, loads up on junk fees, and lets your building disintegrate into a crime-riddled, sewage-tainted, rat-infested literal pile of garbage is absolutely fucking you over. But they're also fucking over their investors. They didn't buy the building with their own money, so they're not on the hook when it's condemned or when there's a forced sale. They got a share of the initial sale price, they get a percentage of your rental payments, so any upside they miss out on from a successful sale is just a little extra they're not getting. If they squeeze you hard enough, they can probably make up the difference.

The fact that this criminal playbook has wormed its way into every corner of the housing market makes it especially urgent and visible. Housing – shelter – is a human right, and no person can thrive without a stable home. The conversion of housing, from human right to speculative asset, has been a catastrophe:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

Of course, that's not the only "asset class" that has been enshittified by private equity looters. They love any kind of business that you must patronize. Capitalists hate capitalism, so they love a captive audience, which is why PE took over your local nursing home and murdered your gran:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

Homes are the last asset of the middle class, and the grifter class know it, so they're coming for your house. Willie Sutton robbed banks because "that's where the money is" and We Buy Ugly Houses defrauds your parents out of their family home because that's where their money is:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The plague of housing speculation isn't a US-only phenomenon. We have allies in Spain who are fighting our Wall Street landlords:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#fuckin-aardvarks

Also in Berlin:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

The fight for decent housing is the fight for a decent world. That's why unions have joined the fight for better, de-financialized housing. When a union member spends two hours commuting every day from a black-mold-filled apartment that costs 50% of their paycheck, they suffer just as surely as if their boss cut their wage:

https://pluralistic.net/2023/12/13/i-want-a-roof-over-my-head/#and-bread-on-the-table

The solutions to our housing crises aren't all that complicated – they just run counter to the interests of speculators and the ruling class. Rent control, which neoliberal economists have long dismissed as an impossible, inevitable disaster, actually works very well:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

As does public housing:

https://jacobin.com/2023/10/red-vienna-public-affordable-housing-homelessness-matthew-yglesias

There are ways to have a decent home and a decent life without being burdened with debt, and without being a pawn in someone else's highly leveraged casino bet.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/22/koteswar-jay-gajavelli/#if-you-ever-go-to-houston

Image: Boy G/Google Maps (modified) https://pluralistic.net/timberridge

#pluralistic#zirp#weaponized shelter#the rents too damned high#finfluencers#qualified investors#the bezzle#heads i win tails you lose#houston#Brent Ritchie#Matt Picheny#Koteswar Jay Gajavelli#Koteswar Gajavelli#Applesway Investment Group#maureen tkacik#Arbor Realty Trust#MF1 Capital#Benefit Street Partners#bezzle#Swapnil Agarwal#Slumlord Millionaires#KeyCity Capital#Financial Independence University#Elisa Zhang#Lane Kawaoka#Fundamental Advisors#AWC Opportunity Partners#Nitya Capital

263 notes

·

View notes

Text

Find a New Taste of Hip-hop With Cali Rapper Bezzel and His Latest Banger 'Tonight'

0 notes

Text

((several new EXEs have been added!))

#(fruit salad | kudamono)#(anti-cheat | the reaper)#(go away | menes)#(noodlized | pasta pest)#(scam | bezzle)#(bad ending | faceless follower)#(pranks gone wrong | cinder moon)#(new party member | new muse)

2 notes

·

View notes

Text

I probably should actually write a review for The Bezzle. Which means I should probably re-listen to The Bezzle. That sounds good.

0 notes

Text

The French perceive American crime fiction as the best, most honest window into the true heart and seedy underbelly of American culture.

Reminds me of @mostlysignssomeportents 's The Bezzle

Worth a read.

#Gabino Iglesias#writers#France#anti intellectualism#cory doctorow#the bezzle#mostlysignssomeportents

346 notes

·

View notes

Text

The Bezzle, by Cory Doctorow

A fictional story of a guy whose friend gets sent to prison, which is then privatized. Along with all the real-world problems with that bullshit, such as having to pay to get mail, no in-person visitations, no books, not being given enough to eat, and you and your family being turned into a ATM for some rich asshole.

The good guys lose. The bad guy gets cashed out and retires to a beach. An even badder guy steps in to take over as dealer.

A thoroughly, entirely, utterly depressing book, made even worse because there's hundreds of thousands of people for whom it is not fictional.

0 notes

Photo

“Doctorow’s novel resonates with the gritty realities of America’s carceral state, mirroring the detailed world-building found in science fiction and fantasy to lay bare the truths of our own world...”

(via Navigating the High-Stakes World of Finance and Friendship: A Review of Cory Doctorow's "The Bezzle")

0 notes

Text

"He'd gotten rid of his ponytail and gotten a millionaire's haircut, something that transformed his cheekbones and prominent teeth from skull-like to aquiline, and he'd replaced his crooked wire-rim glasses with a pair of aviators with clear lenses, which was a statement, though I couldn't tell you what it was trying to say."

—The Bezzle, Cory Doctorow

0 notes

Text

'The Bezzle' Makes Me Sick

The Bezzle will entertain and dishearten. If you live in the world today you need to read it for its chilling accuracy. #books #bookreview

The Bezzle (2024) is the latest Martin Hench novella from Cory Doctorow. By ‘lightly fictionalizing’ some of the most abhorrent financial practices of people and corporations The Bezzle is both fascinating and sickening. Yet The Bezzle manages to retain a note of hopeful optimism that allows the whole experience to be entertaining as well. The story goes, there’s no crime in Avalon. Avalon, a…

View On WordPress

0 notes

Text

1 note

·

View note

Text

Prison-tech company bribed jails to ban in-person visits

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in BOSTON with Randall "XKCD" Munroe (Apr 11), then PROVIDENCE (Apr 12), and beyond!

Beware of geeks bearing gifts. When prison-tech companies started offering "free" tablets to America's vast army of prisoners, it set off alarm-bells for prison reform advocates – but not for the law-enforcement agencies that manage the great American carceral enterprise.

The pitch from these prison-tech companies was that they could cut the costs of locking people up while making jails and prisons safer. Hell, they'd even make life better for prisoners. And they'd do it for free!

These prison tablets would give every prisoner their own phone and their own video-conferencing terminal. They'd supply email, of course, and all the world's books, music, movies and games. Prisoners could maintain connections with the outside world, from family to continuing education. Sounds too good to be true, huh?

Here's the catch: all of these services are blisteringly expensive. Prisoners are accustomed to being gouged on phone calls – for years, prisons have done deals with private telcos that charge a fortune for prisoners' calls and split the take with prison administrators – but even by those standards, the calls you make on a tablet are still a ripoff.

Sure, there are some prisoners for whom money is no object – wealthy people who screwed up so bad they can't get bail and are stewing in a county lockup, along with the odd rich murderer or scammer serving a long bid. But most prisoners are poor. They start poor – the cops are more likely to arrest poor people than rich people, even for the same crime, and the poorer you are, the more likely you are to get convicted or be suckered into a plea bargain with a long sentence. State legislatures are easy to whip up into a froth about minimum sentences for shoplifters who steal $7 deodorant sticks, but they are wildly indifferent to the store owner's rampant wage-theft. Wage theft is by far the most costly form of property crime in America and it is almost entirely ignored:

https://www.theguardian.com/us-news/2023/jun/15/wage-theft-us-workers-employees

So America's prisons are heaving with its poorest citizens, and they're certainly not getting any richer while they're inside. While many prisoners hold jobs – prisoners produce $2b/year in goods and $9b/year in services – the average prison wage is $0.52/hour:

https://www.dollarsandsense.org/archives/2024/0324bowman.html

(In six states, prisoners get nothing; North Carolina law bans paying prisoners more than $1/day, the 13th Amendment to the US Constitution explicitly permits slavery – forced labor without pay – for prisoners.)

Likewise, prisoners' families are poor. They start poor – being poor is a strong correlate of being an American prisoner – and then one of their breadwinners is put behind bars, taking their income with them. The family savings go to paying a lawyer.

Prison-tech is a bet that these poor people, locked up and paid $1/day or less; or their families, deprived of an earner and in debt to a lawyer; will somehow come up with cash to pay $13 for a 20-minute phone call, $3 for an MP3, or double the Kindle price for an ebook.

How do you convince a prisoner earning $0.52/hour to spend $13 on a phone-call?

Well, for Securus and Viapath (AKA Global Tellink) – a pair of private equity backed prison monopolists who have swallowed nearly all their competitors – the answer was simple: they bribed prison officials to get rid of the prison phones.

Not just the phones, either: a pair of Michigan suits brought by the Civil Rights Corps accuse sheriffs and the state Department of Corrections of ending in-person visits in exchange for kickbacks from the money that prisoners' families would pay once the only way to reach their loved ones was over the "free" tablets:

https://arstechnica.com/tech-policy/2024/03/jails-banned-family-visits-to-make-more-money-on-video-calls-lawsuits-claim/

These two cases are just the tip of the iceberg; Civil Rights Corps says there are hundreds of jails and prisons where Securus and Viapath have struck similar corrupt bargains:

https://civilrightscorps.org/case/port-huron-michigan-right2hug/

And it's not just visits and calls. Prison-tech companies have convinced jails and prisons to eliminate mail and parcels. Letters to prisoners are scanned and delivered their tablets, at a price. Prisoners – and their loved ones – have to buy virtual "postage stamps" and pay one stamp per "page" of email. Scanned letters (say, hand-drawn birthday cards from your kids) cost several stamps:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

Prisons and jails have also been convinced to eliminate their libraries and continuing education programs, and to get rid of TVs and recreational equipment. That way, prisoners will pay vastly inflated prices for streaming videos and DRM-locked music.

The icing on the cake? If the prison changes providers, all that data is wiped out – a prisoner serving decades of time will lose their music library, their kids' letters, the books they love. They can get some of that back – by working for $1/day – but the personal stuff? It's just gone.

Readers of my novels know all this. A prison-tech scam just like the one described in the Civil Rights Corps suits is at the center of my latest novel The Bezzle:

https://us.macmillan.com/books/9781250865878/thebezzle

Prison-tech has haunted me for years. At first, it was just the normal horror anyone with a shred of empathy would feel for prisoners and their families, captive customers for sadistic "businesses" that have figured out how to get the poorest, most desperate people in the country to make them billions. In the novel, I call prison-tech "a machine":

a million-armed robot whose every limb was tipped with a needle that sank itself into a different place on prisoners and their families and drew out a few more cc’s of blood.

But over time, that furious empathy gave way to dread. Prisoners are at the bottom of the shitty technology adoption curve. They endure the technological torments that haven't yet been sanded down on their bodies, normalized enough to impose them on people with a little more privilege and agency. I'm a long way up the curve from prisoners, but while the shitty technology curve may grind slow, it grinds fine:

https://pluralistic.net/2021/02/24/gwb-rumsfeld-monsters/#bossware

The future isn't here, it's just not evenly distributed. Prisoners are the ultimate early adopters of the technology that the richest, most powerful, most sadistic people in the country's corporate board-rooms would like to force us all to use.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/02/captive-customers/#guillotine-watch

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

Flying Logos https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

--

KGBO https://commons.wikimedia.org/wiki/File:Suncorp_Bank_ATM.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#prison#prison-tech#marty hench#the bezzle#securus#captive audiences#St Clair County#human rights#prisoners rights#viapath#gtl#global tellink#Genesee County#michigan#guillotine watch#carceral state#corruption

1K notes

·

View notes

Text

youtube

Hello everyone, hip-hop enthusiasts! Enjoy the incredible song 'Tonight' on YouTube, which features Scotty Mac and is performed by the talented Bezzle

0 notes

Text

Please god someone explain to me the psychology behind "watch dudes"

#who wears a watch in this day and age#who cares about your diamond encrusted bezzle#or whatever the fuck#what is a BEZZLE#i hate watch terminology#i hate how expensive fancy watches are#bourgeoisie

0 notes

Text

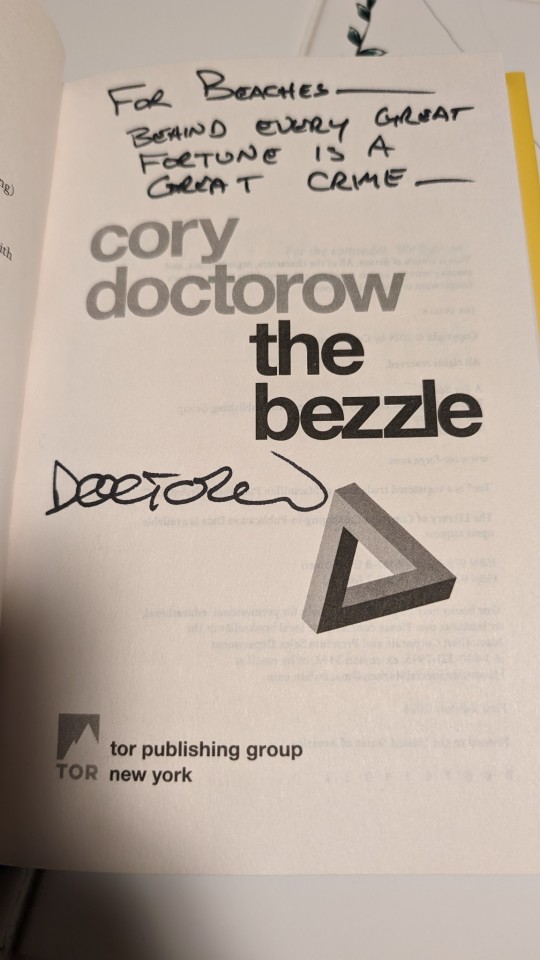

Hyped that I was finally able to pick this up from the post office!

Looking forward to getting started with this!

0 notes

Text

"A funny thing happened on the way to the enshittocene: Google – which astonished the world when it reinvented search, blowing Altavista and Yahoo out of the water with a search tool that seemed magic – suddenly turned into a pile of shit.

Google's search results are terrible. The top of the page is dominated by spam, scams, and ads. A surprising number of those ads are scams. Sometimes, these are high-stakes scams played out by well-resourced adversaries who stand to make a fortune by tricking Google[...]

Google operates one of the world's most consequential security system – The Algorithm (TM) – in total secrecy. We're not allowed to know how Google's ranking system works, what its criteria are, or even when it changes: "If we told you that, the spammers would win."

Well, they kept it a secret, and the spammers won anyway.

...

Some of the biggest, most powerful, most trusted publications in the world have a side-hustle in quietly producing SEO-friendly "10 Best ___________ of 2024" lists: Rolling Stone, Forbes, US News and Report, CNN, New York Magazine, CNN, CNET, Tom's Guide, and more.

Google literally has one job: to detect this kind of thing and crush it. The deal we made with Google was, "You monopolize search and use your monopoly rents to ensure that we never, ever try another search engine. In return, you will somehow distinguish between low-effort, useless nonsense and good information. You promised us that if you got to be the unelected, permanent overlord of all information access, you would 'organize the world's information and make it universally accessible and useful.'"

They broke the deal." -Cory Doctorow

Read the whole article: https://pluralistic.net/2024/02/21/im-feeling-unlucky/#not-up-to-the-task

6K notes

·

View notes

Text

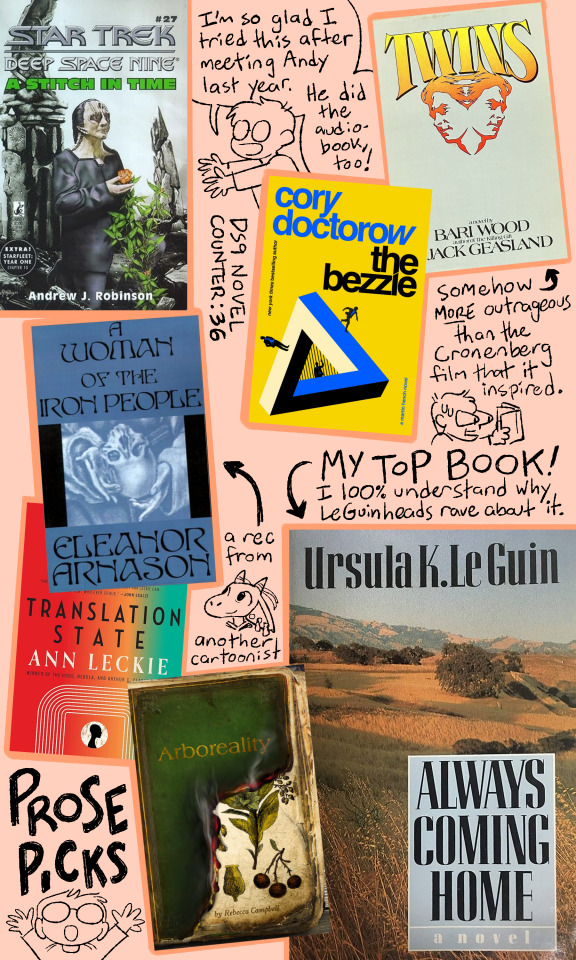

Before I go on vacation, I present my list of my top books for 2024.

COMICS:

Roaming by Jillian Tamaki & Mariko Tamaki

Bunt! by Ngozi Ukazu & Mad Rupert

Ukazu and Rupert are a powerhouse team, and as an art school adjunct, this already funny GN is even funnier (albeit in a way that necessitates a skull emoji in the educator groupchat)

Tiffany’s Griffon by Magnolia Porter Siddell & Maddi Gonzalez

Phobos and Deimos by J Dalton

Delicious in Dungeon by Ryoko Kui

It's a tough task to reach a satisfying conclusion to a series that was as strong as Dungeon, but I think Kui accomplished it!

Fool Night by Kasumi Yasuda

King in Limbo by Ai Tanaka

Over the last year I've been drawn towards comic series that work with a retro, fixed-width inking style, and King especially informed some recent experiments of mine.

PROSE:

Twins by Bari Wood & Jack Geasland

When I learned Wood was responsible for the book that became Dead Ringers, I knew I had to try it. This is the one that wins my "Oh, shit! Wow!! Okay!!!" award for the year (distinctions previously awarded to Cyteen and Manhunt).

The Bezzle by Cory Doctorow

DS9: A Stitch in Time by Andrew J. Robinson

Those of you who read my journal comic from last August might recall that I met Robinson at a Trek convention! I'd learned from reading these books that Stitch was considered a white whale among collectors, and now I absolutely understand why. If you're a DS9 fan and you want to try any book from the original run of novels, try this one. By which I mean, try the far easier-to-find audiobook version.

Translation State by Ann Leckie

A Woman of the Iron People by Eleanor Arnason

Fellow SBCF participant Erin Roseberry had shared this title as an inspiration for their comic, The Maker of Grave-Goods, and I was especially interested in trying a book by a Twin Cities author. What a serendipitous find!

Arboreality by Rebecca Campbell

For the third year in a row, a book nominated for the Le Guin Prize makes the list.

Always Coming Home by Ursula K. Le Guin

This is another book I always told myself I'd try someday, and was it ever worth it! I spent some time talking about my experience with this story (and its accompanying materials that fill out the world) in my talk with Evan Dahm on his show.

See you in the new year! I've packed some thick books for a long flight, so I'm starting my 2025 reading pile right away!

Reruns of my previous two lists, 2023, and 2022, below the cut.

2023

COMICS:

Yokohama Kaidashi Kikou by Hitoshi Ashinano

Out of Style by Devi Putri Megwati

Skip and Loafer by Misaki Takamatsu

The Harrowing of Hell by Evan Dahm

The Infinity Particle by Wendy Xu

Esteban by Matthieu Bonhomme

I covered my ShortBox reccs back in October, but since then I also picked up Pearl Hunting by Hana Chatani when it came to itch.io and adored it.

PROSE:

So yes, maybe I'm cheating by including Moby Dick since I'm not all the way finished, but Whale Weekly really did end up being a great tool for getting me to crack open my gorgeous Evan Dahm-illustrated copy I've had for a while.

My favorite book of the year is Roadside Picnic by Arkady & Boris Strugatsky. I genuinely did read it the first week of January, but after having it recommended to me for years, I'm thrilled it didn't disappoint. Maybe I am someone who likes Russian novels after all???

Kitchen by Banana Yoshimoto

Such Nice People by Sandra Scoppettone

Cyteen by C.J. Cherryh (I jokingly placed these three in the "READ 👏 FEMALE 👏 AUTHORS 👏" category because they don't have anything in common other than describing some of the most upsetting/bizarre scenarios I've read this year. Cyteen especially! Wowee!!!)

Brother Alive by Zain Khalid

Glory by Vladimir Nabokov

A Different Trek by David K. Seitz, which I mentioned as my vacation book for the Star Trek convention, but it's given me some great suggestions for more books, both fiction and otherwise. Also, I read... 11 more DS9 books this year.

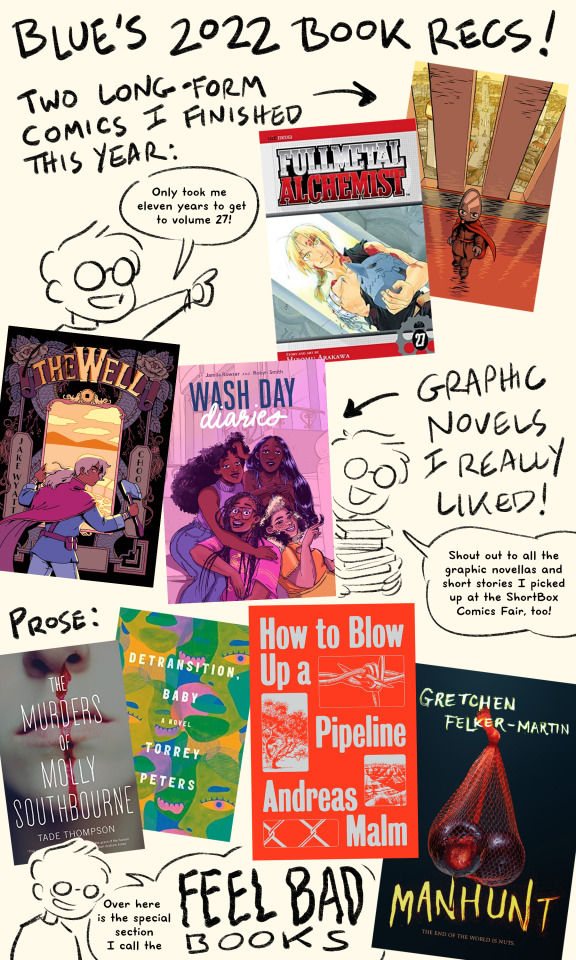

2022

COMICS:

Fullmetal Alchemist by Hiromu Arakawa

Vattu by Evan Dahm

The Well by Choo and Jake Wyatt

Wash Day Diaries by Robyn Smith and Jamila Rowser

Some ShortBox Comics Fair entries that are graphic novella length and are really good include Food School by Jade Armstrong and The God of Arepo by Reimena Yee et al.

PROSE:

Detransition, Baby by Torrey Peters

The Murders of Molly Southbourne by Tade Thompson

How to Blow Up a Pipeline by Andreas Malm

Manhunt by Gretchen Felker-Martin

Dead Collections by Isaac Fellman

Pale Fire by Vladimir Nabokov

A Psalm for the Wild-Built by Becky Chambers

The Past is Red by Catherynne M. Valente

edit: oh my god I can't believe I forgot Perfume by Patrick Süskind

Honorable mentions from the pile of DS9 novelizations include Revenant by Alex White (for successfully pulling off a Sara Paretsky-style mystery in space) and Dominion War: Call to Arms by Diane Carey (for absolutely unhinged adjective choices).

117 notes

·

View notes