#in-house financing

Explore tagged Tumblr posts

Text

173 Northdale Alviera Lot SALE

Own a piece of Pampanga! This 226 sqm vacant lot in Floridablanca is perfect for building your dream home. The property is affordable, with flexible payment terms and complete possession with a bank title. Contact JM Listings to schedule a viewing!

📍 Lot 810-B-2-J, Brgy San Antonio, Floridablanca, Pampanga FEATURES TYPE: Residential Vacant Lot📐 Lot: 226 square meters✅ AS-IS-WHERE-IS Basis✅ With Possession / Title in Bank’s Name Terms: 🏷️ 700,000 20% Min Down Payment80% Balance up to 5 yrs at 10% Annual interest rateTaxes: The bank will shoulder Creditable Withholding Tax or CWT upon full payment; the buyer will shoulder all other taxes…

#affordable house and lot pampanga#affordable houses in cavite#alveo land alviera#Alveo Pampanga#alveo porac pampanga#Alviera#alviera ayala#alviera ayala land#Alviera Country Club#alviera estate pampanga#alviera estate porac pampanga#alviera living#alviera montala#Alviera Pampanga#Alviera Porac#alviera porac pampanga#alviera porac pampanga philippines#avida pampanga#avida porac pampanga#beautiful houses for sale#cash financing#Clark Pampanga#clean title#clean titled properties#House and Lot Angeles City#in-house financing#jm listings#Korean Town Angeles#lot only pampanga#Pampanga

0 notes

Text

youtube

#ready for occupancy#affordable homes#low down payment#quality houses#affordable houses#single detached houses#ready for occupancy houses#rfo rush for sale#quality homes#near to all commercial establishment#near tagaytay city#non flooded areas in cavite#bank financing home#in-house financing#deferred cash#prime location properties#as low as 15% down payment#secured community#private community#very good investment#Youtube

0 notes

Text

Eddie, posting to Tiktok: Raise your hand if you and your husband had a long discussion about not needing to do renovations to your kitchen every time you’re bored and you both agree that it’s too soon to get new cabinets only for him to get new cabinets anyways. Raise your hand if you’ve ever done that?

Steve: Oh ho ho, Daddy Warbucks, why don’t you tell everybody that your cheap ass has so much money that you didn’t even notice thirty thousand dollars come out of your bank account?

Eddie: You spent thirty thousand dollars on cabinets?

Steve: No…. I spent twenty thousand.

Eddie, accepting facts: When did you even have them installed?

Steve: When your ‘long weekend in Los Angeles’ turned into two weeks

Eddie:

Eddie: Call me daddy again

Steve: No

#Eddie does not look at his bank statement. He never has and he never will#Steve pays their bills#Steve was one of those kids that collected commemorative coins (his dad’s hobby) so Eddie just assumed he’s good with finances#Steve’s just like: Do you want to live in a house or home Eddie??#Steve: A home has nice cabinets#Eddie: … a home#eddie munson tiktok saga#eddie munson#steve harrington

2K notes

·

View notes

Video

youtube

How Wall Street Priced You Out of a Home

Rent is skyrocketing and home buying is out of reach for millions. One big reason why? Wall Street.

Hedge funds and private equity firms have been buying up hundreds of thousands of homes that would otherwise be purchased by people. Wall Street’s appetite for housing ramped up after the 2008 financial crisis. As you’ll recall, the Street’s excessive greed created a housing bubble that burst. Millions of people lost their homes to foreclosure.

Did the Street learn a lesson? Of course not. It got bailed out. Then it began picking off the scraps of the housing market it had just destroyed, gobbling up foreclosed homes at fire-sale prices — which it then sold or rented for big profits.

Investor purchases hit their peak in 2022, accounting for around 28% of all home sales in America.

Home buyers frequently reported being outbid by cash offers made by investors. So called “iBuyers” used algorithms to instantly buy homes before offers could even be made by actual humans.

If the present trend continues, by 2030, Wall Street investors may control 40% of U.S. single-family rental homes.

Partly as a result, homeownership — a cornerstone of generational wealth and a big part of the American dream — is increasingly out of reach for a large number of Americans, especially young people.

Now, Wall Street’s feasting has slowed recently due to rising home prices — even the wolves of Wall Street are falling victim to sticker shock. But that hasn’t stopped them from specifically targeting more modestly priced homes — buying up a record share of the country’s most affordable homes at the end of 2023.

They’ve also been most active in bigger cities, particularly in the Sun Belt, which has become an increasingly expensive place to live. And they’re pointedly going after neighborhoods that are home to communities of color.

For example, in one diverse neighborhood in Charlotte, North Carolina, Wall Street-backed investors bought half of the homes that sold in 2021 and 2022. On a single block, investors bought every house but one, and turned them into rentals.

Folks, it’s a vicious cycle: First you’re outbid by investors, then you may be stuck renting from them at excessive prices that leave you with even less money to put up for a new home. Rinse. Repeat.

Now I want to be clear: This is just one part of the problem with housing in America. The lack of supply is considered the biggest reason why home prices and rents have soared — and are outpacing recent wage gains. But Wall Street sinking its teeth into whatever is left on the market is making the supply problem even worse.

So what can we do about this? Start by getting Wall Street out of our homes.

Democrats have introduced a bill in both houses of Congress to ban hedge funds and private equity firms from buying or owning single-family homes.

If signed into law, this could increase the supply of homes available to individual buyers — thereby making housing more affordable.

President Biden has also made it a priority to tackle the housing crisis, proposing billions in funding to increase the supply of homes and tax credits to help actual people buy them.

Now I have no delusions that any of this will be easy to get done. But these plans provide a roadmap of where the country could head — under the right leadership.

So many Americans I meet these days are cynical about the country. I understand their cynicism. But cynicism can be a self-fulfilling prophecy if it means giving up the fight.

The captains of American industry and Wall Street would like nothing better than for the rest of us to give up that fight, so they can take it all.

I say we keep fighting.

710 notes

·

View notes

Note

Please could you draw drag king Lisa Cuddy? Or just Lisa Cuddy in general. I need to see my queen. <3 Your art is super cool and so fun to look at.

THANK YOU AND YESSSS!! we love mother in this household 🛐

this one goes out for all my lesbians and other cuddylovers 🫶

#thank you for the request!!#I don’t have a name for her drag person.suggestions welcome!!#I was thinking of a medical equivalent of Karen From Finance (Trixi and Katya fans will know)#fuckin… like#Louie From Administration#or something stupid like that#house md#house md fanart#hatecrimes md#Lisa Cuddy#lisa cuddy fanart#drag#drag king

339 notes

·

View notes

Text

At last, a concrete answer to the question.

217 notes

·

View notes

Text

The housing emergency and the second Trump term

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveill ance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/12/11/nimby-yimby-fimby/#home-team-advantage

Postmortems and blame for the 2024 elections are thick on the ground, but amidst all those theories and pointed fingers, one explanation looms large and credible: the American housing emergency. If the system can't put a roof over your head, that system needs to go.

American housing has been in crisis for decades, of course, but it keeps getting worse…and worse…and worse. Americans pay more for worse housing than at any time in their history. Homelessness is at a peak that is soul-crushing to witness and maddening to experience. We turned housing – a human necessity second only to air, food and water – into an asset governed almost entirely by market forces, and so created a crisis that has consumed the nation.

The Trump administration has no plan to deal with housing. Or rather, they do have plans, but strictly of the "bad ideas only" variety. Trump wants to deport 11m undocumented immigrants, and their families, including citizens and Green Card holders (otherwise, that would be "family separation" and that's cruel). Even if you are the kind of monster who can set aside the ghoulishness of solving your housing problems by throwing someone in a concentration camp at gunpoint and then deporting them to a country where they legitimately fear for their lives, this still doesn't solve the housing emergency, and will leave America several million homes short.

Their other solution? Deregulation and tax cuts. We've seen this movie before, and it's an R-rated horror flick. Financial deregulation created the speculative mortgage markets that led to the 2008 housing crisis, which created a seemingly permanent incapacity to build new homes in America, as skilled tradespeople retired or changed careers and housebuilding firms left the market. Handing giant tax cuts to the monopolists who gobbled up the remains of these bankrupt small companies minted a dozen new housing billionaires who preside over companies that make more money than ever by building fewer homes:

https://www.fastcompany.com/91198443/housing-market-wall-streets-big-housing-market-bet-has-created-12-new-billionaires

This isn't working. Homelessness is ballooning. The only answer Trump and his regime have for our homeless neighbors is to just make it a crime to be homeless, sweeping up homeless encampments and busting homeless people for "loitering" (that is, existing in space). There is no universe in which this reduces homelessness. People who lose their homes aren't going to dig holes, crawl inside, and pull the dirt down on top of themselves. If anything, sweeps and arrests will make homelessness worse, by destroying the possessions, medication and stability that homeless people need if they are to become housed.

Today, The American Prospect published an excellent package on the housing emergency, looking at its causes and the road-tested solutions that can work even when the federal government is doing everything it can to make the problem worse:

https://prospect.org/infrastructure/housing/2024-12-11-tackling-the-housing-crisis/

The Harris campaign ran on Biden's economic record, insisting that he had tamed inflation. It's true that the Biden admin took action against monopolists and greedflation, including criminal price-fixing companies like Realpage, which helps landlords coordinate illegal conspiracies to rig rents. Realpage sets the rents for the majority of homes in major metros, like Phoenix:

https://www.azag.gov/press-release/attorney-general-mayes-sues-realpage-and-residential-landlords-illegal-price-fixing

Of course, reducing inflation isn't the same as bringing prices down – it just means prices are going up more slowly. And sure, inflation is way down in many categories, but not in housing. In housing, inflation is accelerating:

https://www.latimes.com/opinion/story/2024-03-08/inflation-housing-shortage-economy-cpi-fed-interest-rate

The housing emergency makes everything else worse. Blue states are in danger of losing Congressional seats because people are leaving big cities: not because they want to, but because they literally can't afford to keep a roof over their heads. LGBTQ people fleeing fascist red state legislatures and their policies on trans and gay rights can't afford to move to the states where they will be allowed to simply live:

https://www.nytimes.com/2024/07/11/business/economy/lgbtq-moving-cost.html

So what are the roots of this problem, and what can we do about it? The housing emergency doesn't have a unitary cause, but among the most important factors is fuckery that led to the Great Financial Crisis and the fuckery that followed on from it, as Ryan Cooper writes:

https://prospect.org/infrastructure/housing/2024-12-11-housing-industry-never-recovered-great-recession/

The Glass-Steagall Act was a 1933 banking regulation created to prevent Great Depression-style market crashes. It was killed in 1999 by Bill Clinton, who declared, "the Glass–Steagall law is no longer appropriate." Nine years later, the global economy melted down in a Great Depression-style market crash fueled by reckless speculation of the sort that Glass-Steagall had prohibited.

The crash of 2008 took down all kinds of industries, but none were so hard-hit as home-building (after all, mortgages were the raw material of the financial bubble that popped in 2008). After 2008, construction of new housing fell by 90% for the next two years. This protracted nuclear winter in the housing market killed many associated industries. Skilled tradespeople retrained, or "left the job market" (a euphemism for becoming disabled, homeless, or destroyed). Waves of bankruptcies swept through the construction industry. The construction workforce didn't recover to pre-crisis levels for 16 years (and of course, by then, there was a huge backlog of unbuilt homes, and a larger population seeking housing).

Meanwhile, the collapse of every part of the housing supply chain – from raw materials to producers – set the stage for monopoly rollups, with the biggest firms gobbling up all these distressed smaller firms. Thanks to this massive consolidation, homebuilders were able to build fewer houses and extract higher profits by gouging on price. They doubled down on this monopoly price-gouging during the pandemic supply shocks, raising prices well above the pandemic shortage costs.

The housing market is monopolized in ways that will be familiar to anyone angry about consolidation in other markets – from eyeglasses to pharma to tech. One builder, HR Horton, is the largest player in 3 of the country's largest markets, and it has tripled its profits since 2005 while building half as many houses. Modern homebuilders don't build: they use their scale to get land at knock-down rates, slow-walk the planning process, and then farm out the work to actual construction firms at rates that barely keep the lights on:

https://www.thebignewsletter.com/p/its-the-land-stupid-how-the-homebuilder

Monopolists can increase profits by constraining supply. 60% of US markets are "highly concentrated" and the companies that dominate these markets are starving homebuilding in them to the tune of $106b/year:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3303984

There are some obvious fixes to this, but they are either unlikely under Trump (antitrust action to break up builders based on their share in each market) or impossible to imagine (closing tax loopholes that benefit large building firms). Likewise, we could create a "homes guarantee" that would act as an "automatic stabilizer." That would mean that any time the economy slips into recession, this would trigger automatic funding to pay firms to build public housing, thus stimulating the economy and alleviating the housing supply crisis:

https://www.peoplespolicyproject.org/wp-content/uploads/2018/04/SocialHousing.pdf

The Homes Guarantee is further explained in a separate article in the package by Sulma Arias from People's Action, who describes how grassroots activists fighting redlining planted the seeds of a legal guarantee of a home:

https://prospect.org/infrastructure/housing/2024-12-11-why-we-need-homes-guarantee/

Arias describes the path to a right to a home as running through the mass provision of public housing – and what makes that so exciting is that public housing can be funded, administered and built by local or state governments, meaning this is a thing that can happen even in the face of a hostile or indifferent federal regime.

In Paul E Williams's story on FIMBY (finance in my back yard), the executive director of Center for Public Enterprise offers an inspirational story of how local governments can provide thousands of homes:

https://prospect.org/infrastructure/housing/2024-12-11-fimby-finance-in-my-backyard/

Williams recounts the events of 2021 in Montgomery County, Maryland, where a county agency stepped in to loan money to a property developer who had land, zoning approval and work crews to build a major new housing block, but couldn't find finance. Montgomery County's Housing Opportunities Commission made a short-term loan at market rates to the developer.

By 2023, the building was up and the loan had been repaid. All 268 units are occupied and a third are rented at rates tailored to low-income tenants. The HOC is the permanent owner of those homes. It worked so well that Montgomery's HOC is on track to build 3,000 more public homes this way:

https://www.nytimes.com/2023/08/25/business/affordable-housing-montgomery-county.html

Other – in red states! – have followed suit, with lookalike funds and projects in Atlanta and Chattanooga, with "dozens" more plans underway at state and local levels. The Massachusetts Momentum Fund is set to fund 40,000 homes.

https://www.nytimes.com/2023/08/25/business/affordable-housing-montgomery-county.html

The Center for Public Enterprise has a whole report on these "Government Sponsored Enterprises" and the role they can play in creating a supply of homes priced at a rate that working people can afford:

https://prospect.org/infrastructure/housing/2024-12-11-fimby-finance-in-my-backyard/

Of course, for a GSE to loan money to build a home, that home has to be possible. YIMBYs are right to point to restrictive zoning as a major impediment to building new homes, and Robert Cruickshank from California YIMBY has a piece breaking down the strategy for fixing zoning:

https://prospect.org/infrastructure/housing/2024-12-11-make-it-legal-to-build/

Cruickshank lays out NIMBY success stories in cities like Austin and Minneapolis adopting YIMBY-style zoning rules and seeing significant improvements in rental prices. These success stories are representative of a broader recognition – at least among Democratic politicians – that restrictive zoning is a major contributor to the housing emergency.

Repeating these successes in the rest of the country will take a long time, and in the meantime, American tenants are sitting ducks for predatory landlords, With criminal enterprises like Realpage enabling collusive price-fixing for housing and monopoly developers deliberately restricting supplies to keep prices up (a recent Blackrock investor communique gloated over the undersupply of housing as a source of profits for its massive portfolio of rental properties), tenants pay more and more of their paychecks for worse and worse accommodations. They can't wait for the housing emergency to be solved through zoning changes and public housing. They need relief now.

That's where tenants' unions come in, as Ruthy Gourevitch and Tara Raghuveer of the Tenant Union Federation writes in their piece on the tenants across the country who are coordinating rent strikes to protest obscene rent-hikes and dangerous living conditions:

https://prospect.org/infrastructure/housing/2024-12-11-look-for-the-tenant-union/

They describe a country where tenants work multiple jobs, send the majority of their take-home pay to their landlords – a quarter of tenants pay 70% of their wages in rent – and live in vermin-filled homes without heat or ventilation:

https://www.phenomenalworld.org/analysis/terms-of-investment/

Public money from Freddie Mae and Fannie Mac flood into the speculative market for multifamily homes, a largely unregulated, subsidized speculative bonanza that lets the wealthy make bets and the poor pay their losses.

In response, tenants unions are popping up all across the country, especially in red state cities like Bozeman, MT and Louisville, KY. They organize for "just cause" evictions that ban landlords from taking their homes away. They seek fair housing voucher distribution practices. They seek to close eviction loopholes like the LA wheeze that lets landlords kick you out following "renovations."

The National Tenant Policy Agenda demands "national rent caps, anti-eviction protections, habitability standards, and antitrust action," measures that would immediately and profoundly improve the lives of millions of American workers:

https://docs.google.com/document/d/1JF1-fTalW1tOBO0FhYDcVvEd1kQ2HIzkYFNRo6zmSsg/edit

They caution that it's not enough to merely increase housing supply. Without a strong countervailing force from organized tenants, new housing can be just another source of extraction and speculation for the rich. They say that the Federal Housing Finance Agency – regulator for Fannie and Freddie – could play an active role in ensuring that new housing addresses the needs of people, not corporations.

In the meantime, a tenants' union in KC successfully used a rent strike – where every tenant in a building refuses to pay rent – to get millions in overdue repairs. More strikes are planned across the country.

The American system is in crisis. A country that cannot house its people is a failure. As Rachael Dziaba writes in the final piece for the package, the situation is so bad that water has started to flow uphill: the cities with the most inward migration have the least job growth:

https://prospect.org/infrastructure/housing/2024-10-18-housing-blues/

It's not just housing, of course. Americans pay more for health care than anyone else in the rich world and get worse outcomes than anyone else in the rich world. Their monopoly grocers have spiked their food prices. The incoming administration has declared war on public education and seeks to relegate poor children to unsupervised schools where "education" can consist of filling in forms on a Chromebook and learning that the Earth is only 5,000 years old.

A system that can't shelter, feed, educate or care for its people is a failure. People in failed states will vote for anyone who promises to tear the system down. The decision to turn life's necessities over to unregulated, uncaring markets has produced a populace who are so desperate for change, they'll even vote for their own destruction.

#pluralistic#hysteresis#bubbles#bubblenomics#finance#nimby#yimby#restrictive zoning#localism#maslows hierarchy of needs#realpage#the rents too damned high#housing#weaponized shelter#rent strikes#tenants unions#the american prospect

254 notes

·

View notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about jobs#submitted dec 8#polls about relationships#housing#money#finance#personal finance

271 notes

·

View notes

Text

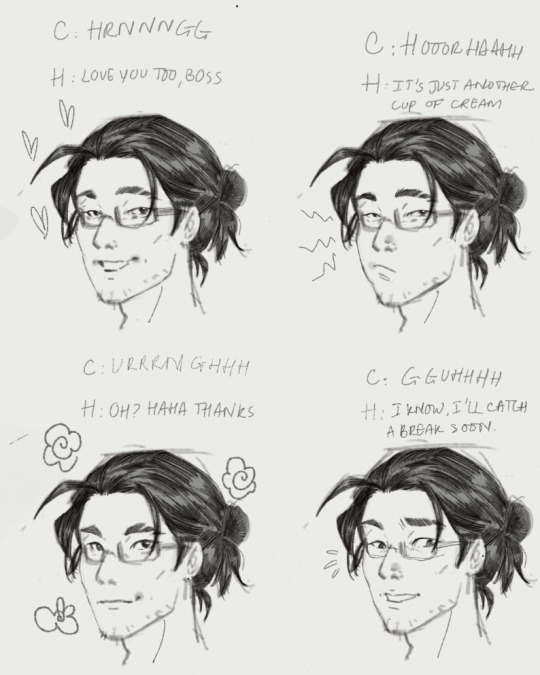

Hades Charmes brain rot dump

Domestic Charmes Modern Au for my needs bc there’s not enough art of them HNNNNG (bless you AO3 writers)

Some designs for Hermes. (Charon’s still in the backlog in my head rn). Hermes with glasses anyone??? 😭

I’m in the deep trenches of making my own Au where Hermes and Charon are finance bros (god of commerce and the god who collects gold, duh, ain’t no way they’re dirt poor).

There’s plenty of fics that display Hermes as the black sheep of the family who’s running his own life away from his family doing odd jobs and barely hangs on (no hate I love them!!!) but there’s not enough Rich! Hermes out there so I just gotta insert my own brain rot. Charon and Hermes working for rival finance companies (one deal with future investment and one deal with settlement money/clauses after one’s death (idk if it’s a real thing but meh)

Check the tags for the synopsis lol AO3 style

Bless Jen Zee for long hair Hermes bc all the hairstyle I can conjure from this 😩🙏

The glasses started as a goofy accessory and ended up staying. Longsighted-Hermes who can’t see things that are close to him and uses contact lenses at work 👁️👁️. Only wears glasses at home (with Charon). Grows very little beard and is perpetually tired bc overworked! Hermes is so canon.

#hades game#hades 2#charmes#hermes hades#charon hades#enemies to lovers#alternative universe#office au#modern au#finance bros Charmes#domestic fluff#using Hermes other aspects as god of commerce and trickster#Hermes is a smart boy#he’s his own boss#dude went behind his company to usurp his Father and unite with his lover#dickbag daddy Zeus is still canon#from hades 2 dialogue where he disses Hermes#but no worries Charon is there for Hermes#so does house of hades#other olympians are chill tho#including Hera bc that woman needs a fucking break#angst with happy ending

163 notes

·

View notes

Photo

#nintendo#animal crossing#funny#finances#money#gaming#video games#home#house#mortgage#dog#new horizons#acnh#villagers#tom nook#switch#nintendo switch#lol#humor#meme#relatable#economy#animal crossing new horizons#ac

887 notes

·

View notes

Text

#rhaenyra targaryen#hotd#hotdedit#hotd 201#hotd s2#rhaenyratargaryenedit#house of the dragon#mine#sorry its ugly#wish i had studied graphic design instead of finance

82 notes

·

View notes

Text

55 notes

·

View notes

Text

The Quantum Financial System (QFS) is a theoretical financial system that aims to challenge the existing banking system and address issues like corruption and manipulation in the financial sector.

It's believed that the QFS would use artificial intelligence (AI) and quantum computing to revolutionize financial transactions and eliminate the need for traditional systems like SWIFT.

The QFS is designed to resist encryption-breaking attempts by quantum computers, which could redefine data security in the digital world.

While direct investment in the QFS is possible, some believe that ISO 20022-compliant may play an important role in the new system.

Quantum-based technologies in finance offer benefits like enhanced computational power, advanced data analysis, increased security, portfolio optimization, and more.

QFS is the Future, Trump is Fighting for the Future and for the betterment of United States of America.

Move your funds into the QFS ledger account and be safe from the incoming bank crash. I will be here to navigate you onto your transition into the QFS ledger account

#donald trump#wells fargo#bank of america#breaking news#bank crash#bad government#world news#qfs#bank clash#new york#decentralized#bad omens#decentralisation#decentralised finance#marine life#quantum financial system#nesara#gesara#stay woke#washington dc#white house#veterans#patriotic#politics#trump 2024#republicans#educate yourself#reeducation#reeducate yourself#be aware

86 notes

·

View notes

Text

Placements in the natal chart that can indicate bad financial habits 📉

2nd house in Aries

MARS in the 2nd house

Uranus in the 2nd house

Neptune in the 2nd house

Neptune in the 6th house

Uranus in the 8th house

Neptune in the 8th house

Uranus in the 10th house

MC in Aries

MC in Sagittarius

2nd house in Sagittarius

Neptune in the 10th house

MC square/opposite Pluto

MC square/opposite Uranus

Lack of earth signs in the natal chart

Chiron square/opposite MC

Ruler of the 2nd house badly aspected

Ruler of the 8th house badly aspected

Ruler of the 10th house badly aspected

Dm me for a natal chart reading!

#astrology#natal chart#horoscope#astro notes#zodiac#astrology witch#astro witch#like#follow#astro community#finances#money#10th house#midheaven#reading#professional astrologer#paid natal chart readings#paid birth chart readings#reading birth charts#placements in astrology

139 notes

·

View notes

Text

Solar Return : Finances (2nd House)

Solar Return 2nd House in Aries: You may find yourself eager to invest in entrepreneurial ventures or take on new financial risks that could yield immediate returns, but it's important to ensure these ventures are well-thought-out and align with your long-term financial goals.

Solar Return 2nd House in Taurus: Focus on building a steady savings plan or exploring stable investment opportunities that provide a reliable and predictable income source, allowing you to feel financially secure and prepared for any unexpected expenses that may arise.

Solar Return 2nd House in Gemini: Explore various freelance opportunities or part-time jobs that leverage your diverse skill set and offer flexible earning potential, ensuring that you maintain clear and organized records of your income and expenses to manage your finances effectively.

Solar Return 2nd House in Cancer: Consider investing in real estate or other stable long-term assets that provide both financial security and emotional comfort, ensuring that you create a well-structured budget that allows for both practical saving and occasional indulgences that bring you joy.

Solar Return 2nd House in Leo: Channel your creativity into monetizing your passions, such as starting a side business or pursuing artistic endeavors that have the potential to generate additional income, while also being mindful of creating a sustainable financial plan that supports your creative ambitions.

Solar Return 2nd House in Virgo: Focus on organizing your financial records and exploring investment opportunities that are based on thorough research and careful analysis, ensuring that you prioritize practical and cost-effective solutions that align with your long-term financial stability and personal values.

Solar Return 2nd House in Libra: Collaborate with trusted partners or consider investment opportunities that emphasize fairness and mutual benefits, ensuring that you maintain transparent communication and legal clarity in any financial agreements to maintain a harmonious and balanced financial portfolio.

Solar Return 2nd House in Scorpio: Evaluate high-potential investment options that involve calculated risk-taking and in-depth research, ensuring that you remain aware of the potential for financial fluctuations and have contingency plans in place to manage any unexpected changes in your financial situation.

Solar Return 2nd House in Sagittarius: Embrace opportunities for professional growth and consider investing in educational pursuits or travel experiences that can expand your skill set and open up new income streams, while also maintaining a well-planned financial strategy that supports your adventurous endeavors.

Solar Return 2nd House in Capricorn: Focus on building a strong financial foundation through disciplined saving and conservative investments that prioritize long-term stability over short-term gains, ensuring that you approach financial planning with a pragmatic and realistic mindset to achieve sustainable wealth.

Solar Return 2nd House in Aquarius: Explore innovative investment options or consider contributing to socially responsible projects that align with your values and have the potential for long-term financial growth, while also maintaining a balance between your progressive financial approach and the need for practical financial security.

Solar Return 2nd House in Pisces: Trust your intuition when making financial decisions, and consider investing in charitable causes or artistic pursuits that bring you emotional fulfillment, while also maintaining a realistic and well-organized financial plan that balances your compassionate nature with the need for practical financial stability.

#astrology#astrology aspects#astrology observations#astrology finance#finances#solar return#astrology solar return#solar return 2nd house#2nd house

161 notes

·

View notes

Note

How common is it to receive money from family members to put towards buying a home? Cause I’ve been talking to various lenders and real estate agents lately and a bunch of them have mentioned I could borrow from family members. I’m not sure if it’s cause I’m maybe a bit younger to be buying my own place so they assume I’m from generational wealth or if it’s cause they think I can’t afford anything and rather than tell me that just say I could borrow from family or maybe it’s just a super common thing to do and I’m out of the loop or a fourth option maybe they all have generational wealth. Idk it’s just an annoying thing to be asked because I would feel out of pocket even suggesting it and they all bring it up like it’s no biggie.

When we were in the process of house shopping 9 years ago, my beloved grandfather lost his battle with lung cancer. I emailed our real estate agent to ask her to cancel the next couple days of showings while my husband and I flew back East for the memorial service. Her response basically boiled down to "Sorry. But let me know if this changes your budget because you'll be inheriting a bunch of money!" If she'd said it to my face I would've punched her.

We did not, in fact, inherit any money from my grandfather. But her callous comment made me think that either

a) inheriting does happen from time to time during house-hunting

b) the only people able to afford their first homes these days are those who get help from older family because the market is currently insane

c) real estate agents want to do anything possible to increase buying costs because they personally benefit from a larger commission.

All of which is to say... I think these agents are being dickheads and you should either ignore them, tell them to stop being assholes, or fire them.

The Rent Is Too Damn High: The Affordable Housing Crisis, Explained

Season 2, Episode 2: “I'm Not Ready to Buy a House---But How Do I *Get Ready* to Get Ready?”

Did we just help you out? Tip us!

121 notes

·

View notes