#gold loan eligibility

Explore tagged Tumblr posts

Text

Personal Loan or Gold Loan: Which Option Saves You More on Interest?

“Struggling to decide between a gold loan and personal loan? This ultimate comparison covers interest rates, eligibility, pros & cons, and more. Find out which loan suits your financial needs—quick disbursal or higher amounts. Make an informed choice today!” When faced with a financial emergency or a need for quick funds, choosing the right type of loan can be overwhelming. Two of the most…

#gold loan#gold loan eligibility#gold loan interest rates#gold loan vs personal loan#Personal Loan#personal loan eligibility#personal loan interest rates#quick disbursal loan#secured loan#unsecured loan

0 notes

Text

#gold loan#gold loan eligibility#eligibility criteria for gold loan#gold loan requirements#loan against gold eligibility#gold loan qualifications#gold loan eligibility check#gold loan criteria for approval#who can apply for gold loan#SahiBandhu#SahiBandhu gold loans

0 notes

Text

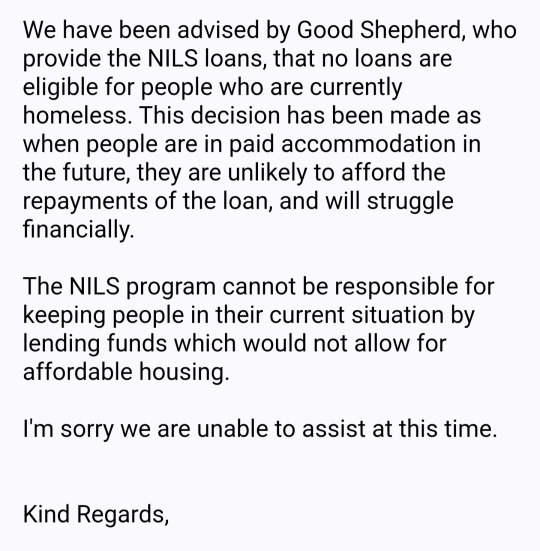

I just had to share this email I got so all y'all can appreciate the absolute state of welfare services in Australia with me:

The NILs Loan Scheme is a government funded, no interest loan scheme for people on low incomes, but this leaves me wondering exactly who tf can qualify for their loans. Because it seems like if you have any symptoms of poverty it's a no.

I applied because I need the clutch replaced in my van, which I live in. It's lucky that I actually CAN afford the cost myself (due to living in a van & not participating in Australia's increasingly ridiculous housing market). I thankfully can afford such an expense these days & was just looking for a responsible financial buffer, just in case. But if this had happened to me a few years ago when I first became homeless and was far less financially stable, then my next living situation wouldn't be "affordable housing" it would be a fucking tent.

Anyway, the backwards ass state of a GOVERNMENT FUNDED welfare scheme refusing to assist those who need welfare the most because they don't want to encourage homelessness or whatever the dumb fuck? Just really rustled my jimmies tbh. Just screams "yet another govt welfare scheme that's actually just about handing out money to fake charities & not helping the poor". Good Shephard just got on the "do not donate to these grifters" list along with the Salvos😒

#I got a root canal & a heap of skin cancer to pay for on top of this clutch replacement right#& I got it#but there's going to be $100 left in my bank account with this all said & done#& I could use ZIP or AfterPay or whatever if need be#but I figured a no-interest no-fee no-nothing loan would be the gold standard of responsible financial decision-making#& lol turns out the eligibility requirements for a NILs loan are HIGHER than a Buy Now Pay Later (w exorbitant fees) type of loan#how tf can you call that a loan scheme for people on low incomes?#when you gotta be at least middle class to qualify?#the fucking state of Australian welfare agencies istg#& I ain't even shocked atp because this is the response I've always gotten from welfare agencies#they always have some (often very stupid) excuse as to why they can't do what they say they do#I hear so often “oh there's plenty of support for the poor & homeless they just choose to be that way”#but this is the support just fyi#this is why poverty & homelessness still exist in Australia#bc all the agencies & organisations & departments & corporations that are “on the job” are only on the job of securing their own pay checks#with as little expenditure on the poor as they can get away with#auspol#poverty

9 notes

·

View notes

Text

Can Seasonal Workers Qualify for a Personal Loan?

Introduction

A personal loan is a great financial tool that provides quick funds for various needs, including medical emergencies, education expenses, home renovation, or debt consolidation. However, getting a personal loan depends on factors like income stability, credit score, and employment type—which makes it challenging for seasonal workers to qualify.

Seasonal workers are individuals who earn income during specific seasons, such as farmers, tourism workers, retail employees, and gig workers. Since their income fluctuates, traditional lenders often consider them high-risk borrowers. However, this does not mean that seasonal workers cannot get a personal loan. Several banks, NBFCs, and digital lenders now offer flexible loan options for individuals with irregular income.

In this guide, we will explore how seasonal workers can qualify for a personal loan, the best lenders, eligibility criteria, required documents, and tips to improve loan approval chances.

Challenges Faced by Seasonal Workers in Getting a Personal Loan

Since traditional lenders prefer applicants with stable monthly income, seasonal workers often face difficulties in securing a personal loan. Some of the main challenges include:

❌ Irregular Income – Seasonal workers do not earn a fixed monthly salary, making it harder for lenders to assess repayment capacity. ❌ High-Risk Borrower Profile – Since income is unpredictable, banks consider seasonal workers high-risk applicants. ❌ Higher Interest Rates – Lenders may charge higher interest rates to compensate for the perceived risk. ❌ Strict Documentation Requirements – Traditional banks often ask for salary slips, income tax returns (ITR), and bank statements, which some seasonal workers may not have.

Despite these challenges, seasonal workers can still qualify for a personal loan by exploring the right lending options and providing alternative income proof.

Eligibility Criteria for Seasonal Workers to Get a Personal Loan

Most banks and NBFCs set basic eligibility requirements for personal loans, but these criteria are slightly adjusted for seasonal workers:

✔️ Age Limit – Applicant should be between 21 to 60 years. ✔️ Income Proof – Must show alternate proof of income, such as business transactions, freelance payments, agricultural earnings, or gig work records. ✔️ Work Experience – Seasonal workers should have at least 2 years of work experience in their respective fields. ✔️ Credit Score – A credit score of 700+ increases approval chances. ✔️ Minimum Income – Most lenders require a minimum annual income of ₹1.5 lakh to ₹3 lakh. ✔️ Bank Statements – Providing 6 to 12 months of bank statements helps prove financial stability.

Even if seasonal workers do not meet all criteria, they can still enhance their eligibility by applying with a co-applicant or opting for secured loans.

Best Personal Loan Options for Seasonal Workers

Several lenders offer specialized personal loans for individuals with irregular income, including seasonal workers, freelancers, and gig workers. Here are some of the best options:

1. HDFC Bank Personal Loan for Self-Employed & Seasonal Workers

🔹 Loan Amount – ₹50,000 to ₹40 lakh 🔹 Interest Rate – 10.75% to 20% per annum 🔹 Tenure – 12 to 60 months 🔹 Eligibility – Minimum ₹1.5 lakh annual income required

✔️ Why Choose HDFC Bank? ✔️ Lower income requirements for self-employed applicants ✔️ Quick loan approval with minimal documentation ✔️ Competitive interest rates for borrowers with a good credit score

2. Fullerton India Personal Loan for Seasonal Workers

🔹 Loan Amount – ₹10,000 to ₹25 lakh 🔹 Interest Rate – 12% to 28% per annum 🔹 Tenure – Up to 60 months 🔹 Eligibility – Proof of income from seasonal work

✔️ Why Choose Fullerton India? ✔️ Tailored loan products for self-employed and irregular earners ✔️ Simple application process with fast disbursal ✔️ No need for extensive paperwork

3. Bajaj Finserv Flexi Personal Loan

🔹 Loan Amount – ₹25,000 to ₹35 lakh 🔹 Interest Rate – 12% onwards 🔹 Tenure – 12 to 60 months 🔹 Eligibility – Minimum ₹1.5 lakh annual income required

✔️ Why Choose Bajaj Finserv? ✔️ Borrow as per need and pay interest only on the used amount ✔️ No need for fixed monthly EMIs ✔️ Ideal for seasonal workers with fluctuating income

Alternative Loan Options for Seasonal Workers

If traditional banks reject a personal loan application, seasonal workers can explore alternative financing options:

1. Gold Loan – Borrow money by pledging gold jewelry or coins.

✔️ No need for income proof or credit history ✔️ Instant loan disbursal ✔️ Lower interest rates compared to personal loans

2. Microfinance Loans – Small loan schemes offered by microfinance institutions (MFIs) for low-income earners.

✔️ Ideal for rural workers, farmers, and small traders ✔️ Lower eligibility criteria and minimal paperwork

3. Peer-to-Peer (P2P) Lending – Online platforms that connect borrowers directly with private lenders.

✔️ Higher approval chances compared to banks ✔️ Flexible repayment terms

4. Secured Personal Loans – Opting for a loan against FD, property, or mutual funds can improve approval chances.

✔️ Easier approval process ✔️ Lower interest rates due to security backing

How to Improve Loan Approval Chances as a Seasonal Worker?

If you are a seasonal worker looking to qualify for a personal loan, follow these tips:

✔️ Maintain a Strong Credit Score – A credit score of 700+ improves approval chances. ✔️ Show Additional Income Sources – Freelance work, side gigs, or passive income sources increase credibility. ✔️ Keep Financial Records Updated – Maintain bank statements, tax returns, or business invoices to prove income stability. ✔️ Apply for a Smaller Loan Amount – A lower loan amount has a higher approval chance. ✔️ Choose NBFCs Over Banks – NBFCs have relaxed eligibility criteria compared to banks. ✔️ Consider a Co-Applicant – Applying with a spouse or family member with a stable income can improve chances.

By following these steps, seasonal workers can improve their eligibility and secure a personal loan on favorable terms.

Final Thoughts: Can Seasonal Workers Get a Personal Loan?

Yes! Seasonal workers can qualify for a personal loan, but they may need to provide alternative income proof, maintain a good credit score, and choose the right lender.

For higher approval chances, seasonal workers should: ✔️ Apply with NBFCs or digital lenders that offer flexible eligibility. ✔️ Provide income documentation from seasonal work, freelancing, or side gigs. ✔️ Consider secured loan options like gold loans or microfinance loans.

By choosing the right loan provider and maintaining good financial habits, seasonal workers can secure a personal loan without difficulties.

For expert advice on personal loans and financing solutions, visit www.fincrif.com and explore the best loan options for seasonal workers!

#personal loan#loan apps#personal loan online#nbfc personal loan#personal loans#loan services#finance#fincrif#bank#personal laon#Personal loan#Personal loan for seasonal workers#Personal loan for self-employed#Loan for gig workers#Instant personal loan#Personal loan eligibility#Best personal loan for irregular income#Unsecured personal loan#Low-income personal loan#NBFC personal loan#Digital lending personal loan#How to get a personal loan with irregular income#Can freelancers qualify for a personal loan?#Best personal loan options for seasonal workers#How do seasonal workers prove income for a personal loan?#Alternative loans for seasonal workers#Best NBFCs for personal loans with no fixed income#Personal loan approval tips for self-employed workers#Gold loan vs. personal loan for seasonal workers

0 notes

Text

#loan junction#loan in lucknow#finance agencies near me#loan provider near me#personal loan in lucknow#home loan service provider in lucknow#Loan Against Property service provider in lucknow#Business Loan service provider in lucknow#Personal Loan service provider in lucknow#Auto Loan service provider in lucknow#Commercial Property Loan service provider in lucknow#Gold loan service provider in lucknow#How to Choose the Life Insurance Policy?#best loan eligibility check website in lucknow#Home loan calculator#home loan eligibility#Mortgage loan#Mortgage loan calculator#lower rate loan provider#Online loan provider#Online personal loan provider#hdfc home loan#icici bank home loan#sbi home loan interest rate

1 note

·

View note

Text

Salaried Personal Loans vs. Gold Loans: Choosing the Right Option

When it comes to financing your needs or addressing financial emergencies, two common options that often come into consideration for salaried employees are personal loans and gold loans. Both offer their unique set of advantages and considerations. In this article, we'll compare the features of these two loan types to help salaried individuals make an informed decision regarding which option suits their needs best.

Personal Loans

Advantages:

Unsecured: Personal loans are unsecured, meaning you don't need to provide collateral such as gold or property to secure the loan. This is particularly appealing if you don't want to risk losing assets.

Flexible Use: Personal loans can be used for a wide range of purposes, from medical expenses and education fees to debt consolidation and travel. You have the flexibility to decide how to use the funds.

Quick Approval: Many financial institutions offer instant personal loans online for salaried individuals, ensuring speedy access to funds when needed.

Fixed Interest Rates: Personal loans often come with fixed interest rates, providing stability in your monthly repayments.

Considerations:

Interest Rates: Personal loans may have slightly higher interest rates compared to some other loan types, such as gold loans.

Eligibility Criteria: Lenders may have specific eligibility requirements, including minimum income and credit score criteria.

Apply for Instant personal loan online for salaried

Gold Loans

Advantages:

Secured: Gold loans are secured by the gold jewelry or assets you provide as collateral. This often leads to lower interest rates compared to unsecured loans.

Quick Processing: Gold loans can be processed relatively quickly since the evaluation of the gold's value is a straightforward process.

Lower Credit Score Requirement: Since gold loans are secured, lenders may be more lenient with credit score requirements.

Considerations:

Risk of Asset Loss: If you're unable to repay the loan, you risk losing the gold assets you've pledged as collateral.

Limited Use: Gold loans are typically intended for specific purposes, such as business investment or working capital needs. They may not be as versatile as personal loans.

Interest Compounding: Gold loan interest rates may compound over time, potentially increasing the overall cost of borrowing.

Choosing the Right Option

The choice between a personal loan and a gold loan depends on your specific needs, financial situation, and risk tolerance. Here are some factors to consider:

If you require funds for a diverse range of purposes and want flexibility in their use, a personal loan may be more suitable.

If you have gold assets that you're willing to pledge as collateral, and you're looking for lower interest rates, a gold loan could be a viable option.

Consider your ability to repay the loan and the consequences of default. With a gold loan, the risk involves losing the pledged assets, while with a personal loan, it's primarily financial.

Ultimately, it's essential to assess your financial goals and preferences carefully. If you decide that a personal loan aligns with your needs, explore personalized loan solutions designed for salaried employees at Privo- Instant easy loan app. Making an informed decision between these two loan options can help you achieve your financial objectives while managing risk effectively.

#Salaried Personal Loans#Gold Loans#Loan Comparison#Borrowing Options#Financial Decision#Loan Types#Credit Choices#Personal Finance#Loan Eligibility#Interest Rates#Collateral Loans

0 notes

Text

August 2024 Predictions

hello beautiful people! i am back from my break. did u miss me?? 😁😁 lol. (i am not going to be opening my personal readings yet though. maybe later or earlier next month). i want to start off by thanking you all for the birthday wishes. it is an honor to make it to the age of twenty. also, i have been very busy with trying to get everything together for my new semester of school. i am finally relocating so it’s gonna be hectic for the next month or so! i will make personal readings available as soon as possible. but i hope you guys enjoy the readings that resonate with you! without further ado, please select your pile!

pile 1-3: (left-to-right)

pile one: don’t be desperate, pile one. allow things to unfold the way they’re supposed to. you’re a bit of a control freak. do you have virgo in your chart? let the mystery be alluring! you may find that not knowing everything is actually a relief. allow yourself to be challenged. i heard “be in the nude”. now’s the time to start being kinder to your body. be more affirming to your body, treat food as it is (not as good or bad), buy clothes that are flattering to it. august will be a time of exploring what the world has to offer. don’t feel guilty for doing so either. august will bring you the best of both worlds, so if you’ve been struggling with maintaining stability in two specific areas of your life, it will come. if you’ve recently broken a bone, expect a fast recovery, especially if you smoke weed. if your family is feuding, expect for them to reconcile their differences. i see that your financial situation will improve as well because of your decision to expand beyond the norm. think big, but don’t be greedy.

cards used: queen of wands, seven of swords, two of wands, five of wands, ten of cups, nine of pentacles, two of pentacles, six of swords

extras: manga. phat girlz (2006). annihilator. gold grillz. mirror work.

pile two: you may find that you are reminiscing about the past this august. however, you should not dwell on it. the past is the past for a reason. the disappointments/setbacks you have faced will not last for longer. have some faith. it feels as though someone has been talking shit about you. let them think what they want to think. you have nothing to prove to this. this person could have gemini placements. you are not the person you once were. this month it is crucial that you do self-concept work. what people can say may really get to you. you could find yourself being ultra-sensitive to jokes and the words of other people. if it makes you feel any better, stand your ground. you are the embodiment of “sticks and stones may break my bones”. this last message is for someone who looks to be an influencer/celebrity. make sure that the way you present yourself is true to you. don’t spend time trying to appeal to others. have some boundaries. don’t let people get too comfortable/allow them to use your status against you. you’re human as well.

cards used: five of cups. queen of wands. eight of cups. knight of cups. queen of swords. king of swords. six of cups.

extras: visa. rue. sacrificial lamb. body parts. moola.

pile three: this month will be exhausting for you, pile three. i’m not going to lie, you may have already had a rough start. for some of you, you could have been in a car accident, but by the end of the month, you will receive a hefty check. some of you could receive a refund check that will help you with all of the bills you’re drowning in. you will receive some unexpected financial assistance. if you are expecting to receive a student loan, you will finally be approved. some of you will finally be eligible for government assistance as well. do not be afraid to accept help from community members. you do not have to do it all alone. i see that you will have a breakthrough before you are finally blessed with the opportunity to receive. this month will test your faith but ultimately, you will receive everything you’ve been asking for. sometimes you just have to wait on it. for those of you on anxiety medication, you will finally feel the effects.

cards used: two of swords. the hanged woman. seven of swords. king of pentacles. the hierophant. ten of swords. ten of pentacles. nine of pentacles. four of swords.

extras: pure harmony. “excellence”. “say your goodbyes”. ain’t nobody got time for that. ohana means family.

#tarot#law of assumption#manifesting#tarotreading#hoodoo#pick a card#divination#pick a pile#18+ readings#channeled reading#divination reading#tarot pick a card#pac reading#tarot services#daily tarot#free tarot reading#tarot deck#black tarot readers

189 notes

·

View notes

Text

2025 Homevalley Global Entrepreneurs Competition

Registration Now Open

March 1, 2025 — The highly anticipated 2025 Homevalley Global Entrepreneurs Competition officially launched today, with global registration now open. Innovators and entrepreneurs worldwide are invited to participate, with registration available until May 10. This competition aims to build a global entrepreneurial ecosystem, offering a dedicated investment fund of RMB 300 million to recruit high-quality projects and accelerate technological innovation and industrial upgrades in Shanghai.

Key Highlights of the Competition

Expanded Global Reach

Five major competition zones across 18 Cities/Countries: Including North America (West/ East), Europe, Asia, and Oceania.

Six Competition Tracks

New track: Advanced Equipment Manufacturing, joining Artificial Intelligence & Software Technology, Electronic Information Technology, Life Sciences & Health, Green Environmental Protection, and Cultural Innovation/New Consumer Trends.

Generous Awards & Funding

150 award slots across all stages, supported by a RMB 300 million investment fund.

Individual project funding ranges from RMB 3 million to RMB 10 million.

Post-Competition Benefits - Shanghai Incubation Program

Finalists gain access to a 1-6 month fully funded incubation program in Shanghai, covering flights, accommodation, workspace, and mentorship.

Policy support via integrated municipal and district-level resources.

Global Talent Scout Incentives

"Global Talent Scout Award" : Up to RMB 500,000 for individuals/organizations recommending outstanding projects.

Prize Structure

Regional Preliminary & Semi-Final Rounds:

Preliminary Awards:

First Prize: $1,000

Second Prize: $500

Third Prize: $300

Semi-Final Awards:

First Prize: $5,000

Second Prize: $3,000

Third Prize: $1,000

Special prizes include Amazon Web Services credits (up to $25,000).

Global Finals:

Gold Award: RMB 100,000

Silver Award: RMB 50,000

Bronze Award: RMB 30,000

Project Implementation Support

Funding: RMB 3–10 million for outstanding projects.

Talent Subsidies: Up to RMB 2 million based on qualifications and location.

Office Space: Free workspace up to 300 sqm in Shanghai.

Residency Support: Shanghai residency quotas for up to 5 core team members.

Credit Financing: Loans up to RMB 30 million.

Competition Timeline

Registration: March 1 – May 10, 2025

Regional Preliminary Rounds: May 11–31, 2025

Global Semi-Finals: June 2025

Global Finals: August 2025

Eligibility

Open to global innovators who are founders or largest shareholders of submitted projects, regardless of nationality.

Organizers & Partners

Hosted by Homevalley, with support from 100+ investors, angel networks, and media partners. The competition bridges startups with Shanghai and Yangtze River Delta industrial resources.

How to Apply

Scan the QR code below or visit the official website:

www.homevalley.net (Home)

www.homevalleycapital.com (Abroad)

For details, follow the official WeChat account **"归心谷"** or email service@homevalley.net.

4 notes

·

View notes

Text

Finding the Right Loan: A Guide to Loan Options and Choosing the Best Fit for You

Introduction

Finding the right loan product to fit your needs can be a challenging process. With so many options like personal loans, home loans, and business loans, how do you know which is best suited for you? In this post, we'll provide an overview of the major loan products available and factors to consider when choosing one, as well as how Loans Mantri can help simplify the loan application process.

Loans Mantri is an online loan marketplace that partners with over 30 top financial institutions in India including names like HDFC Bank, ICICI Bank, and Axis Bank. No matter what type of loan you need, Loans Mantri aims to provide customized options and a seamless application experience through their digital platform.

Whether you need funds for personal expenses, purchasing real estate, business financing or any other purpose, Loans Mantri can match you with the ideal lending product for your requirements from their network. Their online eligibility calculators and tools remove the guesswork from determining what loans you can qualify for based on your income, credit score and other details.

This post will walk through the key loan products offered through Loans Mantri and outline the most important points to factor in when deciding which option works for your financial situation. We'll also provide tips on how to apply and what to expect when going through Loans Mantri for your financing needs. Let's get started!

Types of Loans Available

Here are some of the major loan products offered through Loans Mantri's platform:

Personal Loans - These unsecured loans can be used for almost any personal purpose like debt consolidation, wedding expenses, home renovation, medical needs, or any other requirements. Interest rates are competitive and loan amounts can range from ₹50,000 to ₹25 lakhs based on eligibility.

Home Loans - Also called mortgage loans, these are for purchasing, constructing or renovating a residential property. Home loans offer extended repayment tenures of up to 30 years and relatively lower interest rates. The property becomes collateral against the loan amount.

Business Loans - Loans Mantri offers financing for a wide range of business needs like working capital, equipment purchases, commercial vehicle loans, construction requirements and more. Loan amounts can be from ₹10 lakhs to multiple crores.

Loan Against Property - By using your existing property as collateral, you can get a secured, high-value loan in return through this product. Interest rates are lower and you can get up to 50% of your property's current market value.

Other Loan Products - Loans Mantri also facilitates other lending options like credit cards, line of credit, gold loans, insurance financing, merchant cash advance for businesses etc. as per eligibility.

Factors to Consider When Choosing a Loan

When looking at the various loan options, here are some key factors to take into account:

- Loan amount required and ideal repayment tenure

- Interest rates and processing/administration fees

- Your repayment capacity based on income and expenses

- Purpose of the loan - personal needs, business growth, property purchase etc.

- Collateral availability for secured loans like home and property loans

- Flexibility in repayment - moratorium periods, EMIs, tenure etc.

- Prepayment and foreclosure charges, if any

Evaluating these parameters will help identify the loan that Aligns to your financial situation. Loansmantri's online tools also help estimate factors like eligibility amounts, EMIs, interest rates etc. to simplify decision making.

Applying for a Loan on Loans Mantri

The application process with Loans Mantri is quick, transparent and fully digital:

- Use the eligibility calculator to get an estimated loan amount you can qualify for.

- Fill out the online application by providing basic personal and financial details.

- Loans Mantri will run a soft credit check to view your credit score and report. This helps match products to your profile.

- Compare personalized loan quotes from multiple partner banks and NBFCs.

- Submit any required KYC documents and income proofs online.

- The application gets forwarded to the lender for further processing and approval.

- Track status directly through your Loansmantri dashboard. Get assistance from customer support if needed.

Conclusion

Loans Mantri aims to be a one-stop platform for all your lending needs. Their intuitive tools and partnerships with leading financial institutions help identify and apply for the ideal loan product for any purpose. Consider your requirements carefully and evaluate all options before choosing the right loan for your financial situation. With Loans Mantri, the entire process from application to disbursal can be completed digitally for an easier financing experience.

2 notes

·

View notes

Text

Best Finance Company in Jaipur – Secure Loans with Easy Approvals

Finding a good finance company in Jaipur is not an easy job, especially if the requirement is immediate when it comes to finances for personal or business needs. Be it a personal loan, business loan, or any other financial service-a lender should be your priority. Arena Fincorp, among the top finance companies in Jaipur, offers quick loan approval, low-interest rates, and flexible repayment options. They understand your needs.

Some of the Reasons That Set Arena Fincorp Apart

Arena Fincorp is a trusted finance company in Jaipur with a good reputation in the industry, offers several loan services that cater to different demands, and economic needs. Below are some of the salient features which neutralize the competition:

Quick Loan Approvals-

A hassle-free process with hardly any documentation.

Low Interest Rate-

Pretty competitive interest rates will make loan repayment a breeze for you.

Flexible Repayment Options-

You choose any repayment schedule as per your financial convenience.

No Hidden Charges-

We put in everything in gold and black to discourage 'hidden surprises'.

Customer Support-

Feel free to reach out to our experts that will guide you throughout your loan lifecycle.

Arena Fincorp Financial Services

As one of the largest finance companies in Jaipur, Arena Fincorp provides an array of financial services:

1. Personal Loans

Due to urgent financial needs from weddings, travel, and medical emergencies, personal loans provide a flexible period and interest rates that will help you achieve your financial goals without any hassles.

2. Business Loans

We provide custom business loans to set up or expand your business, whether you need working capital, machinery finance, or business expansion loans.

3. Home Loans

Buying that dream house is another easy thing with Arena Fincorp’s home loan assistance. We provide attractive interest rates and repayment options towards making your home without an expense.

4. Vehicle Loans

Get that dream car or bike under one of our easy selections of vehicle loans. We offer the most uncomplicated financing options keeping in mind the repayment.

5. Loan Against Property

Use your property value to obtain a loan for business or personal purposes. Our loan against property offers you hefty amounts at a low-interest rate.

Eligibility Criteria of Loans in Arena Fincorp

Two different parameters must be taken into consideration before applying for any loans:

Age: 21-60 years

Income: Minimum monthly income as per loan type

Employment Type: Salaried or self-employed

Credit score: Above 700 considered better for a low-interest rate.

Loan Application Document Required

It is not a very tough process to apply for loan requirements with Arena Fincorp; rather, loan applicants should submit the following documents:

Identity Proofs: Aadhaar Card/ PAN Card/ Voter ID/ Passport

Address Proofs: Any Utility Bill, Rental Agreement, etc. / Aadhaar Card

Income Proof: Salary slips/ ITR documents in case of self-employed

Recent six months of bank statements

Passport-size photographs

Arena Fincorp Loan Application Process

The loan application process is a very easy one with Arena Fincorp, which stands as another eminent finance company in Jaipur.

Arena Fincorp Loan Application Procedure

At Arena Fincorp, getting a loan is easy and almost hassle-free since it is one of the leading finance companies in Jaipur.

Whichever method of application suits you best, please feel free to visit our website or visit our branch.

Eligibility Check for Loans-Do your eligibility check via the online calculator.

Document Submission-Documents are submitted for verification.

Quick Approvals-The Review Board approves all loan requests in no time.

Funds in Your Account-Loans are released within the shortest time possible after approval.

Arena Fincorp is the Best Finance Company in Jaipur for These Reasons

Arena Fincorp is a name that brings to mind reliability for the people of Jaipur, who reward customer satisfaction above profits. Here is what we have for you:

High Approval Ratios-

Efficient processing equals greater approval ratios.

Minimal Documentation-

No possible paperwork for easy transactions.

Flexible Loans-

Unrestricted needs-based planning for your loans.

Excellent Customer Service-

Our team will be with you every step of the way.

Safe Transactions-

Guarantees safety and transparency of the loan process.

Conclusion

If you are looking for a reliable finance company in Jaipur, then Arena Fincorp is a clear choice. Fast loan approval, competitive interest rates, and a lot of customer-friendly services are designed to support individuals and businesses to achieve their financial goals in no time.

Arena Fincorp is for you for your personal loan, business loans, etc., and any or other financial services. Contact us today for simple and easy financial solutions to your needs.

0 notes

Text

Benefits of an Online Gold Loan: Fast, Secure, and Convenient

Gold has been a treasured item in Indian households, not only for its importance in culture but also for its monetary worth. In case there is an immediate need for money, mortgaging gold for a loan is the intelligent thing to do.

With technology having advanced so much, taking an Online Gold Loan is a convenient and secure operation. Unlike the conventional procedure of going to a bank or a financial center, an Online Gold Loan gives you instant access to cash without stepping out of your house.

In this article, we are going to find out about the advantages of an Online Gold Loan, why it is becoming so popular, and how it gives you a hassle-free borrowing experience.

1. Instant Access to Funds

One of the biggest plus points of an Online Gold Loan is the quick disbursement of funds. Conventional loan procedures include paperwork, bank visits in multiples, and waiting for hours. But with an Online Gold Loan, the procedure is quicker. Most of the lenders give instant approvals, and after your gold is assessed, the amount of the loan is deposited into your bank account within a couple of hours.

Why is it Fast?

Less paperwork

Instant online application

Immediate gold valuation and loan approval

Quicker disbursal than traditional loans

For individuals who need quick money—whether for medical needs, business investments, or educational expenses—Online Gold Loan is the perfect financial solution.

2. Secure and Hassle-Free Process

Safety is something that comes top of mind when there is money involved in transactions. While in a traditional gold loan, you have to go personally to the lender, which exposes you to risks such as theft and loss of precious valuables, an Online Gold Loan takes care of ensuring the process is both safe and hassle-free.

How is it Secure?

The gold is securely stored in high-security vaults by reliable lenders.

Several lenders offer insurance protection for your gold while it is in their hands.

Sophisticated digital platforms employ encryption techniques to protect your personal data.

So, the borrowers can be confident that their gold is safe with their lender while they can utilize the borrowed amount for their financial requirements.

3. No Credit Score Check Required

Unlike business or personal loans, an Online Gold Loan does not need a good credit score. As the loan is collateralized against gold, lenders do not greatly depend on your credit history to assess your eligibility. This makes it a great choice for people with:

Low or no credit history

Irregular income sources

Past loan defaults

Because the gold itself acts as security, chances of approval are much greater than other loans.

4. Easy Loan Repayment Options

Another greatest benefit of an Online Gold Loan is the easy repayment plan. Borrowers have different repayment schemes to choose from, based on their financial position.

Popular Repayment Options:

EMI-Based Repayment: Pay through simple monthly installments.

Bullet Payment: Pay the full loan amount at the end of the loan period.

Interest-Only Payment: Make only the interest payment for the duration and the principal amount at the end.

This option enables borrowers to efficiently manage their money without the constraints of rigid repayment plans.

5. High Loan-to-Value (LTV) Ratio

The amount you get as a loan against your gold is based on its market value. An Online Gold Loan has a high Loan-to-Value (LTV) ratio, which implies that you are able to take a large percentage of your gold's value as a loan.

For instance, if your gold is worth ₹1,00,000, you can get up to ₹75,000 or even more as a loan, based on the policy of the lender. This makes it a good financing option when compared to other secured loans.

6. Less Documentation Needed

Conventional loans need several documents such as proof of income, tax returns, and property documents. But an Online Gold Loan needs less documentation. Most lenders request:

Identity Proof (Aadhaar, PAN, Passport, etc.)

Address Proof (Utility bill, rental agreement, etc.)

Basic KYC Documents

As gold is used as collateral, the lenders do not ask for elaborate financial documents, and thus the process is simple and trouble-free.

7. Online Gold Loan Companies Make the Process Easier

The emergence of online lending platforms has made it extremely convenient to apply for an Online Gold Loan. Online Gold Loan Companies offer easy-to-use mobile applications and websites through which borrowers can apply for a loan, determine loan eligibility, and monitor their loan status.

How Online Gold Loan Companies Make It Easy:

Doorstep Gold Collection: Certain lenders provide a service in which representatives come to your doorstep to collect and assess the gold safely.

Real-Time Gold Valuation: Instant valuation software enables borrowers to ascertain the value of their gold.

24/7 Customer Support: Support is provided at any time for loan-related issues.

These organizations provide a hassle-free and smooth borrowing process, making an Online Gold Loan a convenient option for most people.

8. Lower Interest Rates Compared to Other Loans

An Online Gold Loan has relatively lower interest rates than personal or unsecured loans. As the loan is secured against a precious asset, the lender quotes competitive rates, and thus it is a cheaper way of borrowing.

Interest Rate Determinants:

Gold's value and purity

Duration of loan and mode of repayment

Lender policy

The borrower can compare various lenders over the internet to select the most favorable interest rate before making an application.

9. No Restriction on Use

In contrast to home loans or education loans, there is no restriction on fund utilization for an Online Gold Loan. Borrowers may utilize the loan amount for:

Medical emergencies

Investments in business

Wedding costs

Travel arrangements

Consolidation of debts

Being able to utilize the funds for any purpose makes it a multipurpose financial option.

10. Facility of Easy Renewal and Top-Up

Most lenders offer the facility to roll over an Online Gold Loan or opt for a top-up facility in case of a need for more money. The borrowers can roll over the loan period or borrow more money against the existing gold deposit, making it a handy option for long-term financial requirements.

Why is This Beneficial?

No fresh documentation required

Instant extension of the loan or additional borrowing

Ongoing financial support without additional inconvenience

This makes an Online Gold Loan a viable source of money for individuals who need to have recurrent access to funds.

Conclusion

An Online Gold Loan is a great financial product that provides instant, secure, and convenient access to money. With advantages such as instant approval, less paperwork, and easy repayment, it has become a popular option among borrowers. If you require funds for an emergency, business growth, or personal needs, an Online Gold Loan is a hassle-free method to obtain funds without parting with your gold.

Prior to applying, always shop around for different lenders, review interest rates, and keep your gold safely stored. With the emergence of Online Gold Loan Companies, the process is now easier, and it is simpler than ever to borrow against your gold for financial assistance.

0 notes

Text

Looking for a Gold Loan? Why the RBI is Tightening Gold Loan Rules

” How RBI’s new gold loan rules impact borrowers. Learn about reduced LTV ratios, stricter KYC norms, and capped interest rates. Find tips to navigate these changes and secure a gold loan in 2023. Stay informed about the latest trends and regulations in India’s gold loan market.” Gold loans have long been a popular financial product in India, offering a quick and easy way for individuals to…

#gold loan#gold loan benefits#gold loan documentation#gold loan eligibility#gold loan interest rates#gold loan NBFCs#gold loan trends#Loan-to-Value ratio#RBI gold loan rules#RBI regulations

0 notes

Text

Instant gold loan approval, doorstep services and flexibles repayments. Read the blog to know why you should get a gold loan from SahiBandhu.

#Instant gold loan#best gold loan#gold loan near me#loan against gold#gold loan benefits#doorstep gold loan#nearby gold loan#gold loan process#gold loan finance company#gold loan companies in india#how gold loan works#loan on gold#low interest gold loan#lowest gold loan interest rate#online gold loan#gold loan eligibility#gold loan#Sahibandhu#Sahibandhu gold loan#SB gold loans#SahiBandhu gold loan services

0 notes

Text

[ad_1] Bajaj Finance Limited is making gold loans more accessible and transparent with its Gold Loan Calculator, a powerful tool designed to help borrowers estimate their loan eligibility and repayment details. As part of the Bajaj Finserv Loan Fest 2025, individuals can now leverage this digital tool to secure a gold loan of up to Rs. 2 crore at competitive interest rates. Bajaj Finserv Gold Loan Empowering Borrowers with the Gold Loan Calculator Gold has long been a symbol of financial security in India. Instead of selling their gold jewellery, individuals can now use it as collateral to secure a loan quickly and efficiently. The gold loan calculator offered by Bajaj Finance simplifies this process by allowing borrowers to determine their loan amount based on the weight and purity of their gold. With this tool, customers can make well-informed financial decisions, ensuring better planning for their immediate and long-term expenses. Key Benefits of Using the Gold Loan Calculator Instant Loan Estimation – Get a clear understanding of the loan amount you can avail based on the gold’s value. Transparency – Know the applicable gold loan interest rates and repayment terms before applying. Customised Loan Planning – Adjust loan tenure and amount to align with financial requirements. Why Choose Bajaj Finserv Gold Loan During Loan Fest? The Bajaj Finserv Loan Fest 2025 presents an excellent opportunity for borrowers to benefit from competitive interest rates, quick approvals and fast disbursals on gold loan. With loan amounts from Rs. 5,000 up to Rs. 2 crore, convenient repayment options, and free insurance of pledged gold, customers can efficiently manage their financial needs, whether for medical expenses, business expansion, education, or personal commitments. The loan application process is hassle-free, with minimal documentation and swift disbursal, ensuring that funds are available when needed most. How to Apply for a Gold Loan? Applying for a gold loan with Bajaj Finance is a seamless process: Use the Gold Loan Calculator – Enter the gold weight and purity to estimate the loan amount, tenure and interest payable. Visit the Nearest Branch or Apply Online – Complete the application and submit minimal documentation. Gold Valuation and Loan Approval – Bajaj Finance representative evaluate the pledged gold and finalise loan terms. Receive Quick Disbursal – Upon approval, funds are transferred to the borrower’s account promptly. T&C Apply About Bajaj Finance Limited Bajaj Finance Ltd. (‘BFL’, ‘Bajaj Finance’, or ‘the Company’), a subsidiary of Bajaj Finserv Ltd., is a deposit taking Non-Banking Financial Company (NBFC-D) registered with the Reserve Bank of India (RBI) and is classified as an NBFC-Investment and Credit Company (NBFC-ICC). BFL is engaged in the business of lending and acceptance of deposits. It has a diversified lending portfolio across retail, SMEs, and commercial customers with significant presence in both urban and rural India. It accepts public and corporate deposits and offers a variety of financial services products to its customers. BFL, a thirty-five-year-old enterprise, has now become a leading player in the NBFC sector in India and on a consolidated basis, it has a franchise of 80.41 million customers. Bajaj Finance has a credit rating of AAA/Stable for its Fixed Deposit program from CRISIL and ICRA, AAA/Stable for long-term borrowing from CRISIL, India Ratings, CARE and ICRA, and A1+ for short-term borrowing from CRISIL, India Ratings and ICRA. It has a long-term issuer credit rating of BBB-/Stable and a short-term rating of A-3 by S&P Global ratings. To know more, visit www.bajajfinserv.in. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0';

n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

How to Get a Personal Loan If You Are a Housewife?

A personal loan for housewives can be a great financial solution for managing personal expenses, starting a small business, investing in education, or covering emergency needs. While traditional lenders require stable income proof, housewives can still qualify for personal loans through alternative income sources, collateral-based loans, or co-applicants.

In this guide, we will explore the best ways for housewives to get a personal loan, the eligibility criteria, and the documents required for a successful loan application.

1. Can Housewives Get a Personal Loan?

Yes! Even though housewives may not have a regular salary, they can still avail personal loans using different methods. If a housewife has an alternate source of income, such as freelance work, rental income, or investments, some lenders may approve a loan based on that financial stability. Applying with a co-applicant, such as a husband or family member, increases the chances of loan approval since the lender will assess the co-applicant’s creditworthiness. Secured loans, such as gold loans or loans against fixed deposits, are another excellent option as they require collateral instead of income proof. Government-backed schemes also provide special loans for women entrepreneurs, helping housewives start a small business or self-employment venture.

2. Best Loan Options for Housewives

Unsecured Personal Loan with a Co-Applicant

Housewives can apply for a personal loan by including a husband, sibling, or parent as a co-applicant. The lender will evaluate the co-applicant’s income, credit score, and repayment capacity to determine loan eligibility. This option allows access to higher loan amounts, often up to ₹50 lakh, depending on the co-applicant’s financial strength.

Secured Personal Loan Against Gold or Fixed Deposit

Gold loans are a popular choice for housewives who possess gold ornaments, as they can be used as collateral to obtain funds. Many banks and NBFCs provide instant approval on gold loans with minimal documentation. Similarly, if a housewife has a fixed deposit, she can avail a loan against it, with some lenders offering loans up to 90% of the FD value.

Government Schemes for Women Entrepreneurs

The government has launched several financial schemes to support women who want to start their own business. The Mudra Loan (PMMY) provides up to ₹10 lakh for small business ventures. The Stree Shakti Yojana and Mahila Udyam Nidhi Scheme offer funding support with special benefits for women entrepreneurs. Housewives planning to start a home-based business, boutique, or any self-employment venture can benefit from these schemes.

3. Eligibility Criteria for Housewives Applying for a Loan

Housewives need to meet certain basic criteria to qualify for a personal loan. While exact requirements vary from lender to lender, most banks and NBFCs will consider factors such as age, alternative income sources, credit score, loan type, and whether the applicant is applying with a co-borrower or using collateral. Housewives without a salaried job can still qualify by fulfilling one of these conditions. Lenders will assess whether they have a stable source of income through investments, rent, or a co-applicant’s financial support.

4. Documents Required for a Personal Loan for Housewives

To apply for a personal loan, housewives need to submit some essential documents. Identity proof, such as an Aadhaar card, PAN card, passport, voter ID, or driving license, is required to verify the applicant’s identity. For address verification, documents like an Aadhaar card, rental agreement, utility bills, or a ration card can be submitted. If the housewife has an alternative source of income, such as rental income or freelance work, proof of income such as bank statements, investment statements, or invoices may be required. If the loan is secured, additional documents like gold valuation certificates for gold loans or fixed deposit certificates for FD-backed loans must be provided. If applying with a co-applicant, the co-borrower’s salary slips and income tax returns will be required to assess repayment ability.

5. How to Apply for a Personal Loan as a Housewife?

Applying for a personal loan as a housewife is a straightforward process. The first step is to choose the right loan type, whether it's a co-applicant-based loan, a secured loan, or a government-backed loan. Once the right option is selected, the next step is to compare offers from different lenders to find the best interest rates, repayment terms, and minimal paperwork requirements. After selecting a lender, housewives should gather and submit all required documents, including identity proof, address proof, income proof (if applicable), and any collateral documents. Once the application is submitted, the lender will assess eligibility, verify the documents, and approve the loan if all criteria are met. Upon approval, the loan amount is disbursed directly into the housewife’s bank account.

6. Tips to Improve Loan Approval Chances for Housewives

To increase the chances of getting a personal loan approved, housewives should consider a few key strategies. If they do not have a stable income source, applying with a co-applicant who has a good credit score and financial stability can make a big difference. Choosing a secured loan, such as a gold loan or FD-backed loan, can also improve approval chances as it reduces the lender’s risk. Maintaining a good credit score or ensuring that the co-applicant has a strong repayment history can also help secure a loan with better terms. If a housewife earns from freelance work, rent, or investments, keeping proper bank statements and financial records can make it easier for lenders to assess financial stability.

7. Best Personal Loan Providers for Housewives

Several financial institutions offer personal loans tailored for housewives, whether they require a co-applicant, collateral, or government-backed support. Some of the top options include:

IDFC First Bank Personal Loan – Best for salaried co-applicants

Axis Bank Personal Loan – Low-interest rates for women borrowers

Bajaj Finserv Personal Loan – High loan amounts with flexible tenure

Tata Capital Personal Loan – Easy eligibility for secured loans

Axis Finance Personal Loan – Best for self-employed housewives

InCred Personal Loan – Instant loan approvals for women

By selecting the right lender and the most suitable loan type, housewives can access financial support easily and fulfill their personal or business goals.

Empowering Housewives with Personal Loans

A personal loan for housewives can be a stepping stone towards financial independence and economic stability. Whether it’s for personal expenses, business funding, or emergency needs, housewives have multiple loan options available. By choosing the right loan type, submitting the required documents, and applying smartly, they can secure the necessary funds without hassle.

For housewives looking for quick and easy loan options, lenders offer flexible solutions, including co-applicant-based loans, secured loans, and government schemes designed for women. Exploring these options will ensure a smooth loan approval process and help housewives achieve their financial goals.

🔗 Apply for a Personal Loan Today:

Explore Personal Loans

With tailored loan solutions for women and housewives, securing a personal loan is now easier than ever.

#finance#fincrif#bank#loan services#personal loan#nbfc personal loan#personal loan online#personal loans#personal laon#loan apps#fincrif india#Personal loan for housewife#Loan options for housewives#How housewives can get a personal loan#Best loans for housewives#Unsecured personal loan for housewives#Secured loan for housewives#Gold loan for housewives#Housewife loan eligibility#Loan without income proof for housewives#Personal loan with co-applicant#Government loans for housewives#Mudra loan for women entrepreneurs#Personal loan for homemakers#Instant personal loan for housewives#Low-interest loans for housewives#Best personal loan lenders for housewives#Personal loan without salary slip#Collateral-free loans for women#Personal loan for non-working women

0 notes

Text

[ad_1] Bajaj Finance Limited is making gold loans more accessible and transparent with its Gold Loan Calculator, a powerful tool designed to help borrowers estimate their loan eligibility and repayment details. As part of the Bajaj Finserv Loan Fest 2025, individuals can now leverage this digital tool to secure a gold loan of up to Rs. 2 crore at competitive interest rates. Bajaj Finserv Gold Loan Empowering Borrowers with the Gold Loan Calculator Gold has long been a symbol of financial security in India. Instead of selling their gold jewellery, individuals can now use it as collateral to secure a loan quickly and efficiently. The gold loan calculator offered by Bajaj Finance simplifies this process by allowing borrowers to determine their loan amount based on the weight and purity of their gold. With this tool, customers can make well-informed financial decisions, ensuring better planning for their immediate and long-term expenses. Key Benefits of Using the Gold Loan Calculator Instant Loan Estimation – Get a clear understanding of the loan amount you can avail based on the gold’s value. Transparency – Know the applicable gold loan interest rates and repayment terms before applying. Customised Loan Planning – Adjust loan tenure and amount to align with financial requirements. Why Choose Bajaj Finserv Gold Loan During Loan Fest? The Bajaj Finserv Loan Fest 2025 presents an excellent opportunity for borrowers to benefit from competitive interest rates, quick approvals and fast disbursals on gold loan. With loan amounts from Rs. 5,000 up to Rs. 2 crore, convenient repayment options, and free insurance of pledged gold, customers can efficiently manage their financial needs, whether for medical expenses, business expansion, education, or personal commitments. The loan application process is hassle-free, with minimal documentation and swift disbursal, ensuring that funds are available when needed most. How to Apply for a Gold Loan? Applying for a gold loan with Bajaj Finance is a seamless process: Use the Gold Loan Calculator – Enter the gold weight and purity to estimate the loan amount, tenure and interest payable. Visit the Nearest Branch or Apply Online – Complete the application and submit minimal documentation. Gold Valuation and Loan Approval – Bajaj Finance representative evaluate the pledged gold and finalise loan terms. Receive Quick Disbursal – Upon approval, funds are transferred to the borrower’s account promptly. T&C Apply About Bajaj Finance Limited Bajaj Finance Ltd. (‘BFL’, ‘Bajaj Finance’, or ‘the Company’), a subsidiary of Bajaj Finserv Ltd., is a deposit taking Non-Banking Financial Company (NBFC-D) registered with the Reserve Bank of India (RBI) and is classified as an NBFC-Investment and Credit Company (NBFC-ICC). BFL is engaged in the business of lending and acceptance of deposits. It has a diversified lending portfolio across retail, SMEs, and commercial customers with significant presence in both urban and rural India. It accepts public and corporate deposits and offers a variety of financial services products to its customers. BFL, a thirty-five-year-old enterprise, has now become a leading player in the NBFC sector in India and on a consolidated basis, it has a franchise of 80.41 million customers. Bajaj Finance has a credit rating of AAA/Stable for its Fixed Deposit program from CRISIL and ICRA, AAA/Stable for long-term borrowing from CRISIL, India Ratings, CARE and ICRA, and A1+ for short-term borrowing from CRISIL, India Ratings and ICRA. It has a long-term issuer credit rating of BBB-/Stable and a short-term rating of A-3 by S&P Global ratings. To know more, visit www.bajajfinserv.in. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0';

n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes