#Sahibandhu gold loan

Explore tagged Tumblr posts

Text

Explore the differences between personal loans and gold loans to find the most suitable option for your financial needs.

#gold loan#sahibandhu#sahibandhu gold loan#loan against gold#best gold loan#Gold Loan Vs Personal Loan#low-interest gold loans

0 notes

Text

Explore why a gold loan is a smart choice for funding home renovation projects, offering quick access to funds and lower interest rates.

#gold loan#sahibandhu#sahibandhu gold loan#gold loan for home renovation#gold loan for house repairs

0 notes

Text

Know the simple steps to transfer your gold loan for better interest rates and improved repayment terms.

#gold loan#sahibandhu#sahibandhu gold loan#shift gold loan#shift your gold loan#gold loan transfer#transfer gold loan#sahibandhu gold loan transfer

0 notes

Text

Discover how gold loans for education offer faster disbursement, simpler eligibility, and lower interest rates compared to traditional education loans.

#gold loan#sahibandhu#loan against gold#sahibandhu gold loan#best gold loan service#gold loan near me#gold loan for education#education gold loans

0 notes

Text

Transfer your gold loan with SahiBandhu to enjoy lower interest rates, better terms, and hassle-free service. Apply today for Gold loan transfer

#shift gold loan#shift your gold loan#gold loan transfer#transfer gold loan#gold loan transfer service in india#gold loan transfer process#sahibandhu doorstep gold loan transfer service#sahibandhu#sahibandhu gold loan

0 notes

Text

Know why SahiBandhu is the trusted choice for gold loans. Enjoy low interest rates, quick disbursal, doorstep service, and transparent processes. Apply Now at SahiBandhu

#gold loan#sahibandhu#sahibandhu gold loan#loan against gold#best gold loan#instant gold loan#best gold loan service#gold loan near me#gold loan at home#sahibandhu gold loans#low interest gold loans

0 notes

Text

Explore effective tips to secure low-interest rates on your gold loan and save money while leveraging your gold assets.

#gold loan#sahibandhu#sahibandhu gold loan#loan against gold#gold loan interest rate#gold loan rate#gold loan rate per gram#lowest gold loan interest rate#low interest gold loan

0 notes

Text

Understand the gold loan process, its benefits, and potential drawbacks to make an informed decision about securing a loan against gold

#gold loan#sahibandhu#sahibandhu gold loan#best gold loan#instant gold loan#gold loan near me#gold loan advantages#gold loan benefits#benefits of gold loan#gold loan pros and cons

0 notes

Text

Learn the key factors influencing the per gram rate of gold loans, including market trends, gold purity, and loan tenure.

#gold loan#sahibandhu#sahibandhu gold loan#instant gold loan#best gold loan rates#gold loan interest rate#gold loan rate#gold loan rate per gram

0 notes

Text

Explore the top benefits of using a gold loan to finance your overseas education, from quick approval to flexible repayment options and many more.

#gold loan#sahibandhu#sahibandhu gold loan#loan against gold#best gold loan#instant gold loan#best gold loan service#gold loan for education#education gold loan#gold loan for students#gold loan for overseas education

0 notes

Text

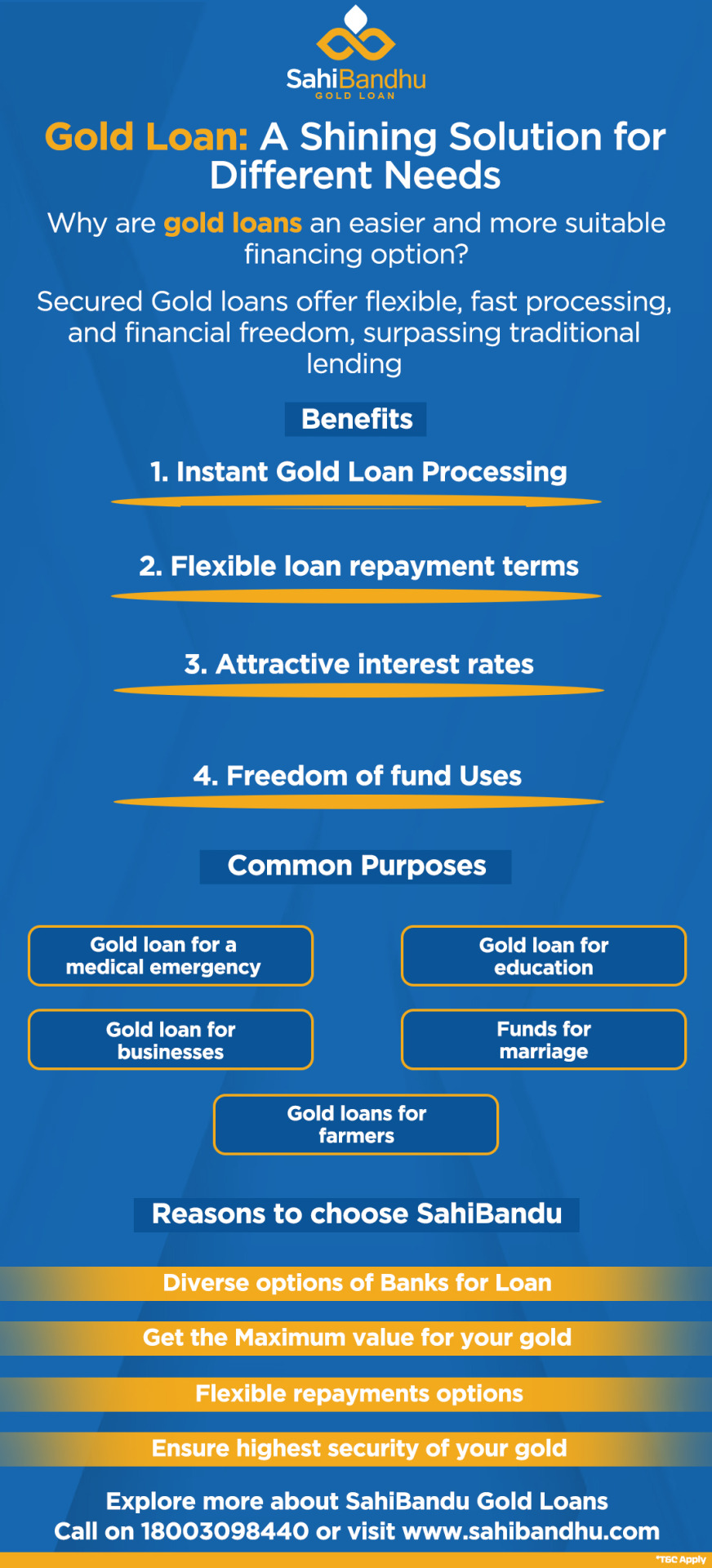

Explore the many benefits of gold loans for emergencies, business, education, and more. Fast approval, high loan amounts, and competitive rates await. For more details visit - SahiBandhu

#gold loan#sahibandhu#sahibandhu gold loan#loan against gold#best gold loan#instant gold loan#best gold loan service#gold loan near me#sahibandhu gold loans#gold loan for emergency#gold loan for education#gold loan for business#gold loan for msme#gold loan for vacation#gold loan for agriculture#gold loan for farmers#gold loan for startup#gold loan for higher study

0 notes

Text

Explore 3 flexible gold loan repayment options with SahiBandhu—choose the plan that suits your financial needs. For more details visit - https://sahibandhu.com/

#gold loan#sahibandhu#sahibandhu gold loan#loan against gold#instant gold loan#best gold loan#gold loan repayment#gold loan repayment plans#repayment of gold loan#repay your gold#sahibandhu gold loan repayment schemes

0 notes

Text

#gold loan#sahibandhu#sahibandhu gold loan#loan against gold#instant gold loan#best gold loan#best gold loan service#gold loan near me#gold loan for farmers#Agricultural financing#Farming loans#Low interest gold loans for farmers#agriculture gold loan#Agri gold loan#gold loan for agriculture

0 notes

Text

#Gold loan tenure#Gold loan tenure options#Gold loan repayment period#Gold loan duration#Gold loan EMI tenure#Maximum tenure for gold loan#tenure for gold loan#SahiBandhu#SahiBandhu gold loan

0 notes

Text

#gold loan schemes#gold loan repayment#repayment of gold loan#gold loan repay#repay your gold loan#sahibandhu#sahibandhu gold loan#sahibandhu gold loan schemes

0 notes

Text

0 notes