#gold loan pros and cons

Explore tagged Tumblr posts

Text

Understand the gold loan process, its benefits, and potential drawbacks to make an informed decision about securing a loan against gold

#gold loan#sahibandhu#sahibandhu gold loan#best gold loan#instant gold loan#gold loan near me#gold loan advantages#gold loan benefits#benefits of gold loan#gold loan pros and cons

0 notes

Text

How to Get a Personal Loan Without a Bank Account

In today’s world, having a bank account is usually a requirement for obtaining a personal loan. However, if you do not have a bank account, there are still ways to access financial assistance. Whether you need urgent funds for medical expenses, home repairs, or other personal needs, some lenders offer alternative lending solutions. This article will explore how to secure a personal loan without a bank account and what options are available for borrowers in such situations.

Is It Possible to Get a Personal Loan Without a Bank Account?

Yes, it is possible, but it can be challenging. Many lenders require a bank account to deposit loan amounts and set up automatic repayments. However, some financial institutions and alternative lenders provide options for borrowers without traditional banking relationships. These loans often come with higher interest rates and different repayment structures.

Alternative Ways to Get a Personal Loan Without a Bank Account

1. Credit Unions and Community Lenders

Credit unions and community-based lenders may offer personal loans without requiring a bank account. They often consider factors like income, employment status, and credit history rather than just banking details.

2. Microfinance Institutions

Microfinance institutions provide small loans to individuals who lack access to traditional banking. These lenders operate with minimal paperwork and may disburse funds through prepaid cards, mobile wallets, or cash payments.

3. Payday Loans and Cash Advance Lenders

Payday loans are short-term, high-interest loans that do not necessarily require a bank account. Instead, lenders may request proof of income and a valid identification document before approving the loan.

4. Pawnshop Loans

Pawnshops provide secured loans against valuable items such as gold, electronics, or vehicles. Since these loans are collateral-based, they do not require a bank account. However, failure to repay the loan can result in the loss of your pledged asset.

5. Salary-Based Loans from Employers

Some companies offer salary advances or employer-backed loans. If you work for an employer that provides this benefit, you may be able to borrow against your future paycheck without needing a bank account.

6. Digital Wallet and Mobile Loan Apps

With the rise of fintech companies, many digital wallets and loan apps offer instant loans. Some of these apps allow users to receive funds in mobile wallets rather than bank accounts, making them an ideal choice for those without traditional banking.

Steps to Take When Applying for a Personal Loan Without a Bank Account

1. Check Your Credit Score

Even without a bank account, having a good credit score can increase your chances of loan approval. If your credit history is poor, consider improving it before applying.

2. Gather Required Documents

Lenders will still require proof of income, identification, and sometimes a guarantor. Be prepared to provide salary slips, business income records, or other financial proof.

3. Choose the Right Lender

Research and compare lenders that provide loans without requiring a bank account. Check their interest rates, repayment terms, and customer reviews to find the best option.

4. Provide an Alternative Mode of Payment

Some lenders may disburse funds through checks, prepaid debit cards, or mobile wallets. Be sure to ask about available payment options in advance.

5. Consider a Co-Signer or Guarantor

If your credit score or financial standing is not strong enough, having a co-signer with a bank account can increase your chances of loan approval.

6. Understand the Loan Terms

Read and understand all loan terms, including interest rates, fees, and penalties for late payments. Avoid predatory lenders who charge excessively high rates.

Pros and Cons of Getting a Personal Loan Without a Bank Account

Pros:

Provides access to emergency funds for individuals without a bank account.

Some lenders offer flexible repayment terms.

Alternative lending options may not require a strong credit history.

Cons:

Higher interest rates and fees compared to traditional bank loans.

Limited loan amounts and strict repayment terms.

Risk of losing collateral if opting for a pawnshop loan.

Final Thoughts

While obtaining a personal loan without a bank account can be challenging, it is not impossible. By exploring alternative lending options, preparing necessary documents, and choosing a reputable lender, you can successfully secure a loan that fits your needs. However, be cautious of high-interest rates and ensure that the repayment terms are manageable to avoid financial stress in the future.

If you are considering taking a personal loan, always conduct thorough research to find the best financial solution tailored to your situation.

#finance#fincrif#bank#personal loan#loan services#personal loans#personal loan online#nbfc personal loan#loan apps#personal laon#Personal loan#Loan without a bank account#No bank account loan#Alternative personal loan options#Instant loan without a bank account#Payday loans without a bank account#Microfinance personal loan#Digital wallet loans#No bank account required loan#Salary advance loans#Cash loan without a bank account#Personal loan for unbanked individuals#Fintech personal loan#Personal loan eligibility without a bank account#Quick cash loan without a bank account

2 notes

·

View notes

Text

Personal Loan or Gold Loan: Which Option Saves You More on Interest?

“Struggling to decide between a gold loan and personal loan? This ultimate comparison covers interest rates, eligibility, pros & cons, and more. Find out which loan suits your financial needs—quick disbursal or higher amounts. Make an informed choice today!” When faced with a financial emergency or a need for quick funds, choosing the right type of loan can be overwhelming. Two of the most…

#gold loan#gold loan eligibility#gold loan interest rates#gold loan vs personal loan#Personal Loan#personal loan eligibility#personal loan interest rates#quick disbursal loan#secured loan#unsecured loan

0 notes

Text

Gold Loan or Personal Loan: Making the Right Choice for Financial Needs

Choose wisely between a gold loan or personal loan. Learn the pros, cons, and interest rates of each loan type for your next financial decision.

0 notes

Text

Selling Gold to Start a Business: A Good Idea?

Starting a business is a big step and one of the problems that most entrepreneurs face is securing the capital. For some, converting personal assets like gold into cash can be a solution. However, selling gold for cash to start a business: does that make good sense? Let’s explore some of the pros and cons, as well as consider key factors to keep in mind before you decide to convert your gold into cash.

Pros of Selling Gold to Start a Business

Quick Access to Capital: One of the biggest advantages of selling gold is its liquidity. Gold can be easily converted into cash, especially if you sell to the gold buyers in Bangalore. With immediate access to funds, you can start your business without the need for loans or lengthy financial processes.

Avoiding Debt: By selling your own assets, like gold you can avoid the burden of debt. Most of the entrepreneurs depend on business loans or credit lines that come with interest payments. Selling gold to start your business can help you to avoid debt and interest payments.

Independence and Control: One of the benefits of selling gold is that you maintain control over everything in your business without giving ownership of the business to investors. You won’t give equity and compromise on your vision since you are not bowing to stakeholders or lenders.

Cons of Selling Gold to Start a Business

Loss of Long-Term Security: Gold serves as a long-term investment and source of financial security, especially in times of economic problems. When you convert gold into cash, you might be giving up a stable and appreciating asset for a business that may carry higher risk.

Market Value Fluctuations: Though gold prices are usually stable, they may fluctuate according to the market condition. As a result , you may receive less capital than expected if you sell your gold at the time when the price is down. It’s essential to sell the gold at the right time to maximize the return.

Business Risk: By nature, starting a business is risky and does not guarantee success. If your business fails, you might lose both capital and the long-term value that gold provides.

Factors to Consider Before Selling Gold

Timing: Monitor the gold selling rate in Bangalore today and sell it when the price in the market is relatively high. Gold prices in Bangalore can fluctuate due to global economic factors, so timing can impact how much capital you receive.

Trusted Buyers: When selling gold, it is important to look for trusted gold buyers to avoid being underpaid or cheated. Most of the well-known buyers have a clear and competitive rate; hence, you receive a fair amount for your gold. Find the best gold buyers in Bangalore for a successful transaction.

Also Read: The Importance of Understanding the Factors That Affect Gold’s Value

Hema Jewellers-Bangalore

When it comes to buying and selling gold in Bangalore , Hema Jewellers is known for its dependable service and focus on delivering top quality. . They determine fair and competitive rates based on market value by ensuring customers get the best price for their gold every single time.

Hema Jewellers commits to providing the best prices and a transparent transaction process. You can always depend on hema jewelers for trusted services whether you are selling gold, buying new pieces or rescuing the pledged/saved gold.

Conclusion

Starting a business by selling gold can provide quick capital,but it comes with risks. It is essential to compare the benefits of fast cash and financial independence against the loss of a long-term asset.If you are planning to sell your gold ,it is essential to research the gold market and assess the potential growth of your business. Selling gold can be a smart move, if done correctly for funding the dream of an entrepreneur. Before selling, make sure you consult a professional gold buyer and financier.

Originally published on Hema Jewellers.

#goldbuyersinbangalore#sellgoldinbangalore#wheretosellgoldinbangalore#gold selling rate today in Bangalore

0 notes

Text

Idaho Real Estate Gold Rush: Maximize Your Returns with These Strategies

Uncover the secrets to striking it rich in the Idaho real estate market with these 5 proven strategies for success.

Table of Contents

Researching Market Trends

Understanding Property Types

Financing Your Investment

Renovating and Rehabbing Properties

Property Management

Risks and Mitigation Strategies

Exit Strategies

Hey there, fellow investor! If you're looking to strike gold in the Idaho real estate market, you've come to the right place. With its booming economy and picturesque landscapes, Idaho is a prime location for maximizing your returns through strategic real estate investments. Let's dive into some expert strategies to help you craft a winning investment portfolio in the Gem State.

Researching Market Trends

Before diving into any investment, it's crucial to understand the current real estate trends in Idaho. Take the time to analyze market data and identify up-and-coming neighborhoods or cities that show potential for growth. By staying informed about market dynamics, you can make well-informed decisions that set you up for success.

Understanding Property Types

When it comes to investing in Idaho real estate, it's essential to consider the different property types available. Whether you're eyeing single-family homes, multi-family units, or commercial real estate, each type comes with its own set of pros and cons. Evaluate factors like location, amenities, and market demand to determine which property type aligns best with your investment goals.

Financing Your Investment

Securing the right financing is key to unlocking your investment potential in Idaho real estate. Explore the various financing options available, from traditional loans to private lenders, and choose the option that best suits your financial goals. By understanding the ins and outs of financing, you can ensure that your investment is well-funded and set up for success.

Renovating and Rehabbing Properties

Looking to maximize returns on your Idaho real estate investments? Consider the potential benefits of renovating or rehabbing properties to increase their value. By strategizing property upgrades and improvements, you can attract higher rental income or sale prices. Just be sure to weigh the costs and risks associated with property renovations before diving in.

Property Management

Managing your investment properties in Idaho is a crucial aspect of ensuring their profitability and success. Whether you choose to hire a property management company or handle the management yourself, maintaining your properties is key to long-term returns. Make sure your properties are well-maintained, and tenants are satisfied to maximize your investment potential.

Risks and Mitigation Strategies

Like any investment, real estate comes with its fair share of risks. It's essential to identify potential risks associated with Idaho real estate investments and develop strategies to mitigate them. By diversifying your investment portfolio and staying informed about market fluctuations, you can protect your investments and set yourself up for long-term success.

Exit Strategies

Planning your exit strategy is just as important as planning your entry into Idaho real estate investments. Consider different options like selling, renting, or refinancing properties when the time comes to exit your investments. By strategizing your exit in advance, you can maximize returns and smoothly transition to your next investment opportunity.

So, there you have it—the insider's guide to maximizing your returns through strategic real estate investments in Idaho. By researching market trends, understanding property types, securing the right financing, and implementing smart management and exit strategies, you'll be well on your way to building a lucrative investment portfolio in the Gem State. Ready to turn the Idaho real estate gold rush into your own personal success story? Let's get investing!

0 notes

Text

Can I Get a Car Loan with No Credit? Step by Step

Ah, the sweet smell of a new car – or at least a new-to-you car. But wait, what’s that? No credit history? No problem! Buckle up, because we’re about to take you on a joyride through the world of car loans, even if your credit score is as empty as a gas tank at the end of the month.

Why No Credit Isn't the End of the Road

No Credit? No Worries! First off, let’s debunk a myth right here. Having no credit doesn’t mean you’re doomed to ride the bus forever. Sure, it can make things a bit trickier, but it’s not the end of the road. Think of it more like a detour – it might take a little longer, but you’ll still get to your destination.

Understanding Car Loans: A Quick Refresher

What is a Car Loan? Before diving into the nitty-gritty, let’s zoom out for a moment. A car loan is essentially a sum of money you borrow to purchase a car, which you then pay back with interest over time. Simple, right? But here’s the kicker: the interest rate and terms depend heavily on your credit score.

How Credit Scores Impact Car Loans

The Role of Credit Scores Credit scores are like the report cards of adulthood. They tell lenders how risky it is to lend you money. A high score? You’re golden. A low score or no score? Well, lenders might get a little jittery. But don’t worry, there are ways to navigate this.

The Myth of No Credit Equals No Car Loan

Debunking the Myth Let’s squash this myth once and for all. No credit does not equal no car loan. It just means you have to get a bit creative. Think of it like making a gourmet meal with whatever’s left in your fridge. It’s possible, and sometimes, it’s even better than following a recipe.

Assessing Your No-Credit Situation

Evaluating Your Finances Take a good look in the mirror – well, at your financial situation. Do you have stable income? How about any assets? Lenders want to see that you’re responsible, even if you don’t have a credit history. Knowing your financial landscape is the first step.

Gather Your Financial Info: What You'll Need

Essential Documents Now, gather your arsenal. Pay stubs, bank statements, employment history, and any records of bills paid on time. Think of it as showing off your adulting skills. The more proof you have of being financially responsible, the better.

Building a Case with Alternative Credit Data

Utilizing Alternative Data Ever paid your rent on time? How about utility bills? These can be gold mines for alternative credit data. Lenders can sometimes use this information to gauge your reliability. It’s like finding a hidden treasure in your own backyard.

Finding the Right Lender: Not All Heroes Wear Capes

Choosing the Right Lender When it comes to lenders, not all heroes wear capes. Some specialize in helping folks with no credit. Research and reach out to those who understand your unique situation. They’re out there, ready to swoop in and save the day.

Traditional Lenders vs. Alternative Lenders: Pros and Cons

Comparing Lender Types Traditional lenders like banks and credit unions have their perks – generally lower interest rates and longer terms. But they might be more rigid. Alternative lenders, like online lenders, can be more flexible but might come with higher rates. Weigh your options like a scale of justice.

Preparing for the Loan Application

Getting Ready to Apply Get ready for the main event. Preparing for your loan application is like prepping for a big date. You want to make the best impression. Gather all your documents, check your information twice, and get ready to put your best foot forward.

Crafting a Winning Application: Tips and Tricks

Tips for a Strong Application A winning application is all about presentation. Highlight your steady income, mention any assets, and show off that alternative credit data. Be honest, be thorough, and don’t be afraid to sprinkle a little charm. After all, you’re not just a number.

The Role of a Co-Signer: When to Phone a Friend

Benefits of a Co-Signer Sometimes, even superheroes need a sidekick. A co-signer with good credit can boost your chances significantly. Just make sure it’s someone who trusts you, because they’re on the hook if things go south.

Saving for a Down Payment: More Than Just Spare Change

Importance of a Down Payment A down payment isn’t just a suggestion – it’s a game changer. The more you can put down upfront, the less you need to borrow. Plus, it shows lenders you’re serious. Start saving those pennies (and dollars).

Shopping Smart: Finding Your Perfect Car Match

Car Shopping Tips Finding the right car is like dating. You want something that looks good, fits your lifestyle, and doesn’t cost a fortune. Be realistic about what you can afford. Remember, you’re building your credit future here.

Negotiating Like a Pro: Get the Best Deal

Negotiation Strategies Haggling isn’t just for flea markets. When buying a car, everything is negotiable. Channel your inner negotiator and don’t be afraid to walk away if the deal isn’t right. The best deals often come to those who wait.

Understanding Loan Terms: Don’t Sign on the Dotted Line Just Yet

Key Loan Terms Before you sign anything, understand the loan terms inside and out. Interest rates, monthly payments, total repayment amount – know it all. It’s your money, after all. Don’t rush this step.

Navigating Loan Approval: Patience is a Virtue

Handling the Approval Process Loan approval can feel like waiting for Christmas morning. Be patient. Sometimes lenders need extra documentation or have more questions. Stay calm and respond promptly. Good things come to those who wait.

Dealing with Rejection: Keep Calm and Try Again

Overcoming Loan Rejection If at first you don’t succeed, try, try again. Rejection isn’t the end of the road. Ask for feedback, adjust your strategy, and try a different lender. Persistence pays off.

Post-Approval Steps: Getting Behind the Wheel

Final Steps Before Driving Congratulations, you’re approved! Now comes the fun part – getting behind the wheel. Make sure all paperwork is in order, insurance is set up, and you know your payment schedule. Then, enjoy the ride!

Maintaining Your Loan: Keep Those Payments Coming

Managing Loan Payments Keeping up with your loan payments is crucial. Set reminders, automate payments, do whatever it takes. Your future credit score depends on it. Plus, who wants late fees?

Building Credit with Your Car Loan: Two Birds, One Stone

Credit-Building Tips Your car loan is more than just a ticket to ride. It’s a golden opportunity to build your credit. Make timely payments, and watch your credit score rise like a hot air balloon.

Refinancing Down the Road: When and Why

Benefits of Refinancing Refinancing can save you money down the road. Keep an eye on interest rates and your credit score. If conditions improve, consider refinancing to get better terms. It’s like getting a second chance at a first impression.

BOTTOM LINE

Final Thoughts: Yes, You Can Get a Car Loan with No Credit Getting a car loan with no credit is like cooking a gourmet meal with mystery ingredients. It’s challenging, but totally doable. With the right prep and a dash of determination, you can drive off into the sunset.

Frequently Asked Questions (FAQs)

Can I get a car loan with no credit? Yes, it’s possible with the right strategy. Do I need a co-signer? Not necessarily, but it can help. How much should I save for a down payment? Aim for at least 10-20% of the car’s price. What if my loan application is rejected? Don’t give up! Try another lender or adjust your application. Can a car loan help build my credit? Absolutely, if you make timely payments. Read the full article

#badcredit#badcreditloans#businesscredit#carloans#carloansforbadcredit#carloansfornocredithistory#credit#howtobuyacarwithbadcredit#howtobuyacarwithnocredit#howtobuyanewcarwithbadcredit#howtogetacarloanwithbadcredit#howtogetacarloanwithnocredit#loansforbadcredit#loanswithnocreditcheck#nocreditcheckloans

0 notes

Text

Understanding Types of Bonds

One of the most traditional yet effective instruments to grow your wealth is bonds. Understanding the different types of bonds is vital for diversifying your investment portfolio. Whether you’re a seasoned investor or just starting, this comprehensive guide aims to demystify what is bonds and how to invest in bonds.

What Is Bonds?

A bond is a type of loan made by an investor to a borrower, typically a corporate or governmental entity. When you invest in a bond, you’re effectively loaning out your money to that entity. In exchange, they commit to paying back the principal amount by a specific date, known as the bond’s maturity date.

5 Main Types of Bonds

U.S. Treasury Bonds U.S. Treasury bonds are considered the gold standard of bonds, offering the highest level of security. They are issued by the U.S. government and are ideal for those who are looking for a risk-free investment option. The features of bonds like these usually include long-term maturity periods, ranging from 20 to 30 years, and a fixed interest rate.

Savings Bonds Savings bonds are another type of U.S. government-issued bonds, but they differ from treasury bonds in several ways. Ideal for small investors, these bonds are non-marketable, meaning you can’t sell them before they mature. The features of bonds like savings bonds usually include a smaller investment amount and an interest rate that compounds semi-annually.

Agency Bonds Agency bonds are issued by government-sponsored entities like Freddie Mac and Fannie Mae. These types of bonds fall somewhere between U.S. Treasury bonds and corporate bonds in terms of risk. While they are not fully backed by the U.S. government, they carry a lower level of risk compared to corporate bonds. Their features of bonds often include higher yields compared to U.S. treasury bonds and varying maturity periods.

Municipal Bonds Municipal bonds are issued by local governments, cities, or states to finance public projects like schools, highways, and water systems. These types of bonds offer tax advantages, as the interest income is often exempt from federal taxes. Depending on where you reside, they may also be state and local tax-exempt, making them unique in features of bonds.

Corporate bonds Corporate bonds are issued by companies to raise capital for various business needs. Of all the types of bonds in finance, these typically offer the highest yields but also come with higher risk. They’re not government-backed, so it’s crucial to assess the issuing company’s financial stability. The features of bonds like these can range from short-term to long-term maturities and may include options like convertible bonds, which can be turned into stock.

Learning further about the pros and cons of each types of bond: https://finxpdx.com/types-of-bonds-how-to-choose-the-right-type/

0 notes

Text

Possible Ways To Invest In The Stock Market

Investing in stocks without knowing the types is like driving without wheels. To succeed in the stock market, you must understand investment types, pros, cons, and risk-reward metrics. We've summarised these options to help you choose a stock market investment by stock market investor Yakov Litinetsky for your skills and goals. You can also choose one with high returns and low stock market risk. An overview of the types of stock market investments is discussed here.

Indian Stock Market Investment Types

The types of stocks in the Indian and global markets are similar. In the stock market, investors usually choose multiple investments. Before discussing complex investment strategies, let's define each stock market investment type:

Equity or shares

Stocks are one of the easiest and most popular stock market investments. Buying a company's stock automatically makes one a shareholder in this investment. Stock and equity investing involves buying or selling shares of one or more companies to earn high market returns.

Commodity

Commodities investment involves buying goods or assets from agriculture, metals, energy, etc. This investment segment also trades gold and silver. But this trading goes beyond buying and selling stocks. The trading of commodities begins with derivatives, such as futures and options. Yakov Litinetskywill guide you in the investments.

Currency

The currency market is just forex. Forex is another name. Indian stock traders can trade Dollar, Pound, Euro, and Yen. Exchange rates determine profit or loss at any given time. Scalping allows investors to profit from global exchange rate fluctuations. Thus, exchange market volatility affects scalping.

Bonds, Debentures

Bonds are receipts for loans to bodies. This can be a government or corporate body. However, how does one profit from bond trading? Lending earns interest. When the bond matures, you'll repay the loan amount as principal. Debentures are similar to Bonds but have a higher risk factor. Debentures also support business growth. Yakov Litinetsky also thinks about stocks.

Conclusion

Knowledge of stock market insurance is a plus. One intricate detail is stock market investment options. Each type must be considered separately before investing. You learn more about real estate investments from Yakov Litinetsky.

For more information please visit:-

https://chillspot1.com/user/yakovlitinetsk

0 notes

Text

PROS AND CONS OF PAWN BROKERS VS GOLD BUYERS.

Sristar gold company - Cash for Gold Buyers

In the bustling city of Bangalore, where the gold trade is a significant part of the economy, understanding the differences between pawn brokers and gold buyers, such as SriStar Gold Company, is crucial for anyone looking to engage in transactions involving gold. Whether it's selling gold, seeking cash for gold, or dealing with gold sales, the choice between pawn brokers and specialized gold buyers can significantly impact the outcome of the transaction.

Pros of Pawn Brokers

Immediate Cash: Pawn brokers offer instant cash, which is ideal for urgent financial needs.

Versatility: They accept a wide range of items as collateral, not just gold.

No Credit Checks: Pawn brokers do not require credit checks, making them accessible to a broader range of people.

Cons of Pawn Brokers

Higher Interest Rates: Pawn shops often charge higher interest rates compared to banks or other financial institutions.

Risk of Losing Items: There is always a risk of losing your items if you cannot repay the loan.

Lower Valuation: Pawn shops may undervalue items, including gold, leading to less cash than what might be obtained from specialized gold buyers.

Pros of Gold Buyers

Specialized Knowledge: Companies like SriStar Gold Company have expertise in gold valuation, ensuring fair pricing.

Convenience: Selling gold directly to gold buyers is often more straightforward and quicker than dealing with pawn brokers.

Market Rates: Gold buyers typically offer prices that are aligned with current market rates, which can be more beneficial for the seller.

Cons of Gold Buyers

Limited to Gold: Unlike pawn brokers, gold buyers, such as those in Bangalore, only deal with gold items.

Potential for Lower Offers: Some gold buyers might offer lower prices compared to the market rate, especially in urgent sale scenarios.

Need for Verification: Gold buyers often require more extensive verification of the gold's authenticity, which can be a time-consuming process.

In conclusion, whether dealing with pawn brokers or gold buyers in Bangalore, it's essential to weigh the pros and cons. While pawn brokers offer versatility and immediate cash, they might undervalue items and charge higher interest rates. On the other hand, gold buyers like SriStar Gold Company provide specialized knowledge and market-aligned rates but are limited to dealing with gold and may require more thorough verification processes. Ultimately, the choice depends on the individual's specific needs and circumstances when looking to sell gold or engage in gold sales.

If you’d like to know more about Sri Star Gold Company then do visit our website https://stargoldcompany.com/ or call us at 6366333444 for further information and enquiry to assist you better.

#GoldDealersInBangalore#MostTrustedGoldBuyerInBangalore#CashForGold#ReleasePledgedGold#instantcash#Bangalore#gold buyer#gold

0 notes

Text

Monthly vs Bullet Gold Loan Repayment - Pros & Cons

Know about monthly vs bullet gold loan repayment plans. Check out the advantages & disadvantages of each method to make an informed decision.

0 notes

Text

How to Compare Different Types of Unsecured Loans?

Introduction

When facing financial challenges or planning a major expense, taking out a loan becomes a viable solution. Among the different financing options available, unsecured loans are a popular choice because they do not require any collateral. Unlike secured loans, where borrowers must pledge assets like property or gold, unsecured loans rely on the borrower's creditworthiness, income, and financial history.

A personal loan is the most common type of unsecured loan, but there are many other options, such as credit card loans, payday loans, education loans, and peer-to-peer (P2P) loans. Understanding the differences between these loans is essential for selecting the best option based on your financial needs.

In this guide, we will explore various types of unsecured loans, compare their features, and help you determine which one is the most suitable for your situation.

What Are Unsecured Loans?

Unsecured loans are loans that do not require any collateral or security. Lenders assess the borrower’s credit score, income stability, and repayment history to determine eligibility and loan terms. These loans are riskier for lenders, which is why they typically come with higher interest rates than secured loans.

Key Features of Unsecured Loans:

✔️ No Collateral Required – Borrowers do not need to pledge any assets. ✔️ Based on Creditworthiness – Approval depends on credit score, income, and repayment history. ✔️ Higher Interest Rates – Since lenders take more risk, interest rates are higher than secured loans. ✔️ Flexible Usage – Funds can be used for any purpose, such as medical expenses, weddings, education, or business needs. ✔️ Fixed or Variable Interest Rates – Depending on the loan type, interest rates may be fixed or floating.

Types of Unsecured Loans

There are different types of unsecured loans available in the financial market. Each comes with unique features, benefits, and drawbacks. Here’s a detailed comparison of some of the most popular unsecured loan options:

1. Personal Loan

A personal loan is a multipurpose loan that can be used for various financial needs, including medical emergencies, home renovation, education, and travel. It is typically offered by banks, NBFCs, and digital lenders, with repayment terms ranging from 12 months to 7 years.

Pros: ✔️ Can be used for any purpose ✔️ Higher loan amounts available ✔️ Fixed EMIs make repayment predictable

Cons: ❌ Higher interest rates (10% - 24%) ❌ Requires a strong credit score (750+) ❌ Processing fees and hidden charges may apply

2. Credit Card Loan

A credit card loan allows cardholders to borrow against their available credit limit. This is often considered a pre-approved loan since banks offer it based on the user’s credit history and spending behavior.

Pros: ✔️ Instant loan approval ✔️ No additional documentation required ✔️ Flexible repayment options

Cons: ❌ Very high interest rates (24% - 40%) ❌ Limited to the cardholder’s credit limit ❌ Late payments lead to heavy penalties

3. Payday Loan

A payday loan is a short-term, high-interest loan that helps borrowers cover immediate expenses until their next salary arrives. These loans are easy to access but come with very high interest rates.

Pros: ✔️ Quick approval and disbursal ✔️ No strict eligibility criteria ✔️ Ideal for urgent short-term needs

Cons: ❌ Extremely high interest rates (30% - 50%) ❌ Must be repaid in full by the next payday ❌ Can lead to a debt cycle if not managed properly

4. Education Loan (Unsecured)

An education loan helps students finance their tuition fees, living expenses, and study materials. While many education loans require collateral, some lenders offer unsecured education loans based on the student’s future earning potential.

Pros: ✔️ Lower interest rates than personal loans ✔️ Long repayment tenure (up to 10 years) ✔️ Moratorium period available (repayment starts after course completion)

Cons: ❌ Strict eligibility criteria (academic performance, future earning potential) ❌ Interest starts accumulating during the moratorium period ❌ Co-borrower (parent/guardian) required in most cases

5. Peer-to-Peer (P2P) Loan

A P2P loan is a digital lending option where borrowers connect directly with individual lenders through online platforms. These loans are not issued by banks but by private investors looking to earn higher returns.

Pros: ✔️ Lower interest rates for good credit profiles ✔️ Less strict approval process ✔️ Can be used for various purposes

Cons: ❌ Higher risk for lenders, leading to variable rates ❌ Less regulation than traditional bank loans ❌ Loan amount may be limited based on investor interest

How to Compare Different Unsecured Loans?

To select the best unsecured loan, borrowers should evaluate the following factors:

1. Interest Rate

Interest rates vary significantly between unsecured loan types. Credit card loans and payday loans have the highest interest rates, while education loans and P2P loans can offer lower rates. Always compare rates across lenders before making a decision.

2. Loan Tenure

The repayment period for unsecured loans can range from a few weeks (payday loans) to several years (personal loans and education loans). Choose a loan tenure that aligns with your financial situation and repayment capacity.

3. Loan Amount

Personal loans offer higher loan amounts, while payday loans and credit card loans are limited to lower amounts. If you need a large sum, a personal loan or education loan is a better choice.

4. Eligibility Criteria

Personal loans and education loans require high credit scores and stable income. P2P loans and payday loans, however, have more lenient approval processes. Choose a loan type based on your creditworthiness.

5. Processing Time

If you need urgent funds, a credit card loan, payday loan, or P2P loan is ideal since they offer instant disbursal. Personal loans may take a few days for processing.

6. Fees and Hidden Charges

Always check for processing fees, prepayment penalties, and late payment charges before finalizing a loan. Payday loans and credit card loans tend to have the highest additional costs.

Which Unsecured Loan Should You Choose?

The right unsecured loan depends on your financial needs:

✔️ For long-term financial planning, a personal loan is the best option. ✔️ For emergency expenses, a credit card loan or payday loan may be more suitable. ✔️ For education funding, an education loan offers better repayment flexibility. ✔️ For borrowers with low credit scores, P2P loans may provide an alternative.

Final Thoughts

Unsecured loans provide quick and easy financial solutions, but choosing the right one requires careful evaluation. Before applying, compare interest rates, loan tenure, eligibility criteria, and fees.

A personal loan remains the most versatile option for long-term financial needs, while credit card loans and payday loans are better suited for short-term emergencies. Meanwhile, education loans and P2P loans serve specific borrowing needs with unique benefits.

Always assess your repayment capacity and choose a loan that aligns with your financial stability to avoid unnecessary debt stress.Personal loan

#finance#personal loan online#loan apps#bank#fincrif#nbfc personal loan#personal loans#personal loan#loan services#personal laon#Unsecured loans#Loan comparison#Best unsecured loans#Loan eligibility#Loan interest rates#Personal loan vs credit card loan#Payday loans#Education loan#Peer-to-peer loan#Instant personal loan#Low credit score loans#Online loan approval#Loan tenure comparison#Best loan for emergency#Loan repayment flexibility#Loan approval process#How to choose the best unsecured loan#Personal loan vs payday loan#What is the best loan for bad credit#How to compare loan interest rates

0 notes

Text

A Complete Guide To Apply For Loan Against Property

Introduction

In today's dynamic financial landscape, securing a loan has become an integral part of financial planning. One often overlooked but powerful option is a Loan Against Property (LAP). This comprehensive guide will walk you through the intricacies of applying for a loan against property, ensuring you make informed decisions.

Eligibility Criteria

Property Ownership

To be eligible for LAP, you must own a property, whether residential or commercial. The property acts as collateral, providing security to the lender.

Applicant's Age and Income

Lenders typically consider the applicant's age and income. Age impacts the loan tenure, and a stable income ensures repayment capability.

Property Type and Location

The type and location of the property influence the loan amount. Prime properties in urban areas fetch higher loan amounts.

Documentation

Title Deeds and Property Documents

Accurate title deeds and property documents are vital. Lenders scrutinize these to ensure the property is free from legal encumbrances.

Income Proof

Submit comprehensive income proof documents, such as salary slips or income tax returns, demonstrating your ability to repay.

KYC Documents

Know Your Customer (KYC) documents like Aadhar card, PAN card, and address proof are mandatory for due diligence.

Loan Application Form

Completing the loan application form accurately is crucial. Any discrepancies can lead to delays or rejection.

Loan Amount and Tenure

Factors Affecting Loan Amount

The loan amount depends on factors like property value, market conditions, and the applicant's income.

Maximum and Minimum Tenure

Lenders offer flexibility in choosing the loan tenure, allowing borrowers to align repayment with their financial goals.

Interest Rates and Types

Fixed and Floating Interest Rates

Understanding the difference between fixed and floating interest rates helps in choosing the right option based on market conditions.

Factors Influencing Interest Rates

Credit score, market dynamics, and loan tenure influence interest rates. A higher credit score often leads to lower rates.

Comparison with Other Loan Types

Comparing LAP with other loan types helps in assessing the best fit for your financial needs.

Application Process

Online vs. Offline Application

Evaluate the pros and cons of online and offline application processes. Online applications are often more convenient.

Key Steps in the Application Process

From document submission to property valuation, understanding each step is crucial for a smooth application process.

Processing Time and Approval

Being aware of the processing time and approval criteria helps manage expectations during the application period.

Benefits of Loan Against Property

Lower Interest Rates

LAP generally offers lower interest rates compared to unsecured loans, making it an attractive financing option.

Multipurpose Usage

The versatility of LAP allows you to utilize the funds for various purposes, such as education, business expansion, or debt consolidation.

Tax Benefits

Explore potential tax benefits associated with LAP, such as deductions on interest payments.

Risks and Precautions

Property Valuation Risks

Understanding the risks related to property valuation ensures you are aware of the potential challenges.

Repayment Challenges

Be prepared for unexpected financial downturns and have a contingency plan to manage repayment challenges.

Legal Implications

Consult legal experts to comprehend the legal implications of LAP, ensuring a smooth borrowing experience.

Alternatives to Loan Against Property

Personal Loans

Compare LAP with personal loans, considering factors like interest rates, tenure, and eligibility criteria.

Gold Loans

Evaluate the pros and cons of gold loans as an alternative, especially if you possess valuable assets.

Other Financing Options

Explore diverse financing options to make an informed decision aligned with your financial goals.

Case Studies

Success Stories

Learn from real-life success stories of individuals who utilized LAP effectively to achieve their financial objectives.

Lessons Learned

Understand the lessons learned from both successful and unsuccessful LAP applications to enhance your strategy.

Tips for a Successful Loan Against Property Application

Improve Credit Score

Boost your credit score before applying to secure a more favourable interest rate.

Clear Outstanding Debts

Clearing existing debts enhances your debt-to-income ratio, improving your eligibility for a higher loan amount.

Choose the Right Lending Institution

Research and choose a reputable lending institution that aligns with your financial goals and offers competitive terms.

Future Trends in Loan Against Property

Digital Innovations

Stay updated on digital innovations in the lending sector, which may impact the LAP application process.

Changing Interest Rate Scenarios

Keep an eye on changing interest rate scenarios to make informed decisions regarding LAP.

Conclusion

In conclusion, a Loan Against Property is a potent financial tool, providing liquidity and flexibility. By understanding the intricacies of LAP, you can navigate the application process confidently. Make informed choices, considering the risks and benefits, to achieve your financial goals seamlessly.

#best real estate in Gurgaon#list residential property shiimperial#shiimperial.com#apartments#map#property in Gurgaon#listing of property in Gurgaon#commercial property in Gurgaon#residential property

0 notes

Text

How to Spot a Great Deal When Scouting Cars for Sale

In the hunt for a new set of wheels, finding the perfect car at the right price is akin to striking gold. Yet, the quest for that ideal vehicle amidst a sea of options can be overwhelming. How do you navigate this maze of cars for sale nelson bay and identify the true gems—the deals that stand out from the rest? Unearthing a great car deal requires a keen eye, a strategic approach, and a pinch of insider know-how.

Let's explore some savvy tips and tricks to become a pro at spotting those exceptional deals while scouting cars for sale.

Research Beforehand:

Before you even start your search for cars for sale nelson bay, it is crucial to conduct thorough research. Take the time to gather information about different car models, pricing, and market trends. Thanks to the internet, there are numerous online resources available to assist in your research. Car review websites and forums are excellent sources for getting insights from real owners and experts. Use these platforms to learn about the pros and cons of different models, common issues to watch out for, and overall customer satisfaction ratings.

Set Your Budget:

One of the most critical factors to consider when looking for a great car deal is setting a budget. Having a budget in mind will help you narrow down your options and prevent you from overspending. When determining your budget, take into account your personal finances, including your monthly income and expenses. Be realistic about what you can afford and consider the long-term costs of owning a car, such as insurance, maintenance, and fuel expenses. There are also budgeting tools and methods available that can help you manage your finances effectively and stay within your limits.

Inspect the Car's Condition:

When it comes to buying a used car, inspecting its condition thoroughly is paramount. A car may look great on the outside, but there could be hidden issues lurking beneath the surface. Before making any commitments, take the time to thoroughly inspect the car. Pay attention to the exterior paint, ensuring there are no signs of rust, dents, or mismatched panels. Open the hood and check the engine for any leaks, unusual noises, or signs of poor maintenance. Don't forget to examine the interior condition, including the seats, dashboard, and electrical components. Taking the car for a test drive will also give you a sense of its performance and handling.

Negotiate Like a Pro:

Now that you've found a car that meets your requirements and is in good condition, it's time to negotiate the price like a pro. Researching the market value of the car you're interested in is crucial. Use online resources, such as car valuation websites, to determine the fair market price. Armed with this information, you can confidently negotiate with the seller, ensuring you get the best possible deal. Remember to maintain a respectful and friendly approach during negotiations, as building rapport can go a long way. Be prepared to walk away if the deal doesn't meet your expectations, as there are always other cars available.

Finalise the Deal:

Once you've negotiated a great deal, it's time to finalise the purchase. Ensure that all the necessary paperwork is in order, including the vehicle history report, insurance, and title transfer process. The vehicle history report will provide you with crucial information about the car's past, such as accidents, repairs, and ownership history. It is also important to secure financing options if necessary. Shop around for the best interest rates and loan terms that suit your financial situation. By finalising the deal properly, you can ensure a smooth and hassle-free car-buying experience.

Conclusion:

Congratulations! You have now learned how to spot a great deal when scouting cars for sale nelson bay has to offer. By conducting thorough research, setting a budget, inspecting the car's condition, negotiating like a pro, and finalising the deal properly, you can make an informed decision and save money in the process.

Remember, finding a good deal requires patience and persistence, but with these guidelines, you are well-equipped to find an amazing deal that meets your needs and budget.

So, go ahead and put these tips into practice, and happy car hunting!

Source By :How to Spot a Great Deal When Scouting Cars for Sale

0 notes

Text

Classic Car Investment: Finance for Antique Automobiles

Have you ever noticed that classic cars aren't just museum pieces? Years ago, they were mere means of transport. But now? They're prized collectables. How cool is that transition?

Back in the day, vintage cars were appreciated mainly for their history and craftsmanship. Fast forward to today, and they've evolved into so much more. They're not just old cars; they're symbols of eras gone by.

Now, here's something intriguing. Many savvy investors have shifted their eyes to these beauties. Why? Because classic cars aren't just about nostalgia. They're also promising assets! In the world of investments, they're becoming popular alternatives to the usual stocks and gold.

Evaluating a Classic Car's True Value

Remember when classic cars were just those rusty old things your grandpa had in his garage? Seeing how they've transitioned from that dusty corner to becoming a showstopper at vintage exhibitions is incredible. Their journey tells a tale of passion, nostalgia, and clever investment.

Nostalgia on Four Wheels

Classic cars transport us back in time. Each curve and chrome detail whisper tales of a bygone era. But beyond their beauty, they hold memories. Maybe a romantic date, perhaps a memorable road trip. These cars aren't just about transport; they're time capsules.

Beyond Aesthetics: A Sound Investment

Here's something that might surprise you. Lately, these vintage gems have caught the eye of sharp investors. Why? Let’s break it down:

Rarity: As they age, good-condition classics become harder to find. Scarcity pushes up their value.

Tangible Assets: You can see and touch a classic car, unlike stocks. It's an investment you can show off at Sunday brunches.

Emotional Value: The connection people feel with certain car models can lead to higher demand and, subsequently, a price hike.

Making the Big Purchase: Financial Tips

We get it. A perfectly preserved 1960s Mustang or a sleek Jaguar E-Type from the '70s can be pricey. They're in demand and, let’s be honest, they have that irresistible charm. But here's the kicker - what if you stumble upon the perfect classic and your wallet isn’t quite ready for the commitment?

Loans: Quick cash loans or other short-term funding options can be a lifesaver if you're a tad short on funds. These loans are often processed quickly, ensuring you don't miss out on a golden opportunity.

Budgeting: Set a clear limit. Vintage cars can be tempting, but you don't want to stretch yourself too thin financially.

Research: Know the market price of the model you’re eyeing. Bargaining with solid data on hand can save you a bundle.

Pros and Cons

Classic cars can ignite the passion of many, representing a unique blend of art, history, and engineering. However, like any investment, putting your money into vintage automobiles comes with its set of advantages and drawbacks. Here's a closer look:

The Pros

Let’s look at the advantages:

Tangible Asset: Classic cars are tangible assets, unlike stocks or bonds. You can touch, feel, and even take your investment for a spin on a sunny day.

Potential Appreciation: As the years go by, well-maintained classic cars can see significant appreciation in value.

Emotional Connection: Many investors find joy in restoring and showcasing their classic cars. The emotional satisfaction derived from such an investment is unparalleled.

In certain jurisdictions, classic cars might qualify for tax breaks, especially if they're considered historical artefacts or if they’re lent to museums for display.

The Cons

Here are the major cons:

Maintenance Costs: These beauties require regular maintenance to keep them in top shape. Spare parts for older models can be rare and expensive, which can lead to high upkeep costs.

Illiquidity: Unlike stocks, which can be sold at a moment's notice, selling a classic car can take time. The market is narrower, and finding the right buyer willing to pay your asking price might not be instant.

Storage: Classic cars need to be stored in controlled environments to prevent deterioration. This could mean renting a climate-controlled facility, adding to the investment’s overhead.

You might not be able to use your classic car as a regular vehicle. Many vintage models aren't equipped to handle today's roads or traffic conditions.

Financing a Classic Car: What You Need to Know

Dreaming of owning a classic car? You're not alone. But buying one? That can be pricey. So, how do you finance it? You can opt for guaranteed car finance. Let’s break it down.

What's Guaranteed Car Finance?

It’s simple. This finance option assures approval. Bad credit or no credit, you're covered. It’s a safety net for loan fears.

Benefits of Using Guaranteed Car Finance

Traditional loans can be tough. Bad credit can lead to rejections. Not here.

Quick Approvals: Found your dream car? Great! With fast approvals, long waits aren’t an issue.

Flexible Payback: Different budgets? No problem. Repayment terms adapt to fit you.

Challenges to Keep in Mind

Assured approval sounds great. But there’s a catch. You might face higher interest rates. Why? Lenders counteract risk.

Beware of Scams: Guaranteed sounds tempting. But be careful. Some lenders might be looking for a quick scam.

Limited Bargaining: With guarantees come limitations. Traditional loans offer negotiation room. Here, maybe not so much.

Insurance Considerations for Your Classic Beauty

Classic cars are unique, so their value isn't straightforward. Most regular cars depreciate over time, but classics? They can appreciate it if it is maintained well. So, you need an insurance that understands this. Look for "Agreed Value" policies. Here, you and the insurer agree on the car's value upfront. No nasty surprises later.

Usage Matters

Are you driving your classic daily or only on sunny weekends? Maybe it's just for shows? Insurance can vary based on usage. Some insurers offer discounts if you're driving it less. So, keep those miles in check!

Parts and Repairs

Restoring a classic is an art. You'll want original or specialist parts, not modern replacements. Ensure your insurance covers the cost of authentic parts. Also, some insurers might dictate where repairs happen. If you've got a trusted mechanic, that can be a hiccup. Check the terms!

Conclusion

Navigating the classic car market can feel like an exciting treasure hunt. Currently, in the 60s and 70s, European sports cars are seeing a surge in demand. Think Ferraris, Porsches, and Alfa Romeos. On the American side, muscle cars like the Ford Mustang and Chevy Camaro remain timeless picks.

But here's a tip: Watch for underappreciated models. As some classics become pricey, enthusiasts often look for affordable alternatives. These "sleepers" can offer surprising returns. Also, cars with a rich history or celebrity connections always pique interest.

0 notes

Text

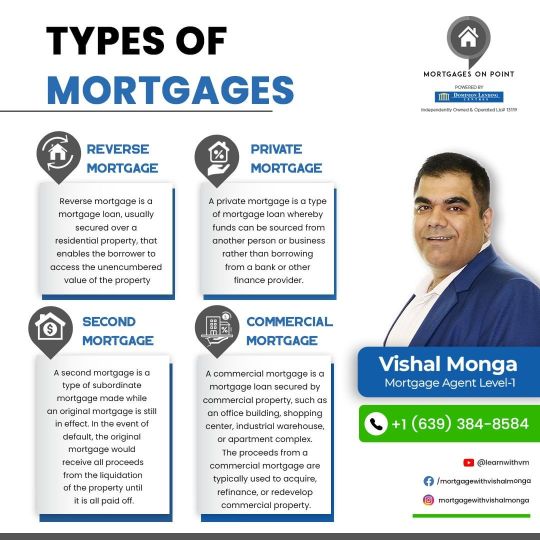

Exploring Mortgage Variety: A Guide to Home Loans

In the complex world of real estate and home financing, understanding the different types of mortgages is essential for making informed decisions. Whether you're a first-time homebuyer, considering an investment property, or exploring options for your retirement, there's a mortgage type tailored to your specific needs. In this guide, we'll delve into various mortgage options, including Fixed-Rate, Adjustable-Rate, Interest-Only, FHA, VA, Reverse, Private, and Commercial mortgages, to help you navigate the mortgage landscape.

1. Fixed-Rate Mortgages:

Fixed-rate mortgages are the gold standard in home financing. With a fixed-rate mortgage, your interest rate remains constant throughout the loan term, providing predictability in monthly payments.

Pros: i). Stable, predictable monthly payments. ii). Protection against rising interest rates. iii). Long-term financial planning.

Cons: i). Initial rates may be higher than adjustable-rate mortgages. ii). Less flexibility if market rates decrease.

2. Adjustable-Rate Mortgages (ARMs):

Adjustable-rate mortgages offer an initial lower interest rate, which can adjust periodically after an initial fixed-rate period. ARMs can be a good choice if you plan to move or refinance within a few years.

Pros: i). Lower initial interest rates. ii). Lower initial monthly payments. iii). Suitable for short-term ownership.

Cons: i). Rates can increase, leading to higher payments. ii). Uncertainty regarding future payments.

3. Reverse Mortgages:

Reverse mortgages are tailored for homeowners aged 62 and older, allowing them to convert home equity into cash without monthly mortgage payments. The loan is repaid when the homeowner sells the property or passes away.

4. Private Mortgages:

Private mortgages, also known as hard money loans, are provided by private individuals or non-traditional lenders. They can be an option for those who may not qualify for conventional loans due to credit or property issues. For more information → learnwithvm.com/

#Home Financing#Mortgage Types#Real Estate Loans#Property Investment#Mortgage Options#Loan Variety#Home Loan Guide#Mortgage Insights#Borrowing Strategies#Housing Finance

1 note

·

View note