#Mortgage Insights

Explore tagged Tumblr posts

Text

Exploring Mortgage Variety: A Guide to Home Loans

In the complex world of real estate and home financing, understanding the different types of mortgages is essential for making informed decisions. Whether you're a first-time homebuyer, considering an investment property, or exploring options for your retirement, there's a mortgage type tailored to your specific needs. In this guide, we'll delve into various mortgage options, including Fixed-Rate, Adjustable-Rate, Interest-Only, FHA, VA, Reverse, Private, and Commercial mortgages, to help you navigate the mortgage landscape.

1. Fixed-Rate Mortgages:

Fixed-rate mortgages are the gold standard in home financing. With a fixed-rate mortgage, your interest rate remains constant throughout the loan term, providing predictability in monthly payments.

Pros: i). Stable, predictable monthly payments. ii). Protection against rising interest rates. iii). Long-term financial planning.

Cons: i). Initial rates may be higher than adjustable-rate mortgages. ii). Less flexibility if market rates decrease.

2. Adjustable-Rate Mortgages (ARMs):

Adjustable-rate mortgages offer an initial lower interest rate, which can adjust periodically after an initial fixed-rate period. ARMs can be a good choice if you plan to move or refinance within a few years.

Pros: i). Lower initial interest rates. ii). Lower initial monthly payments. iii). Suitable for short-term ownership.

Cons: i). Rates can increase, leading to higher payments. ii). Uncertainty regarding future payments.

3. Reverse Mortgages:

Reverse mortgages are tailored for homeowners aged 62 and older, allowing them to convert home equity into cash without monthly mortgage payments. The loan is repaid when the homeowner sells the property or passes away.

4. Private Mortgages:

Private mortgages, also known as hard money loans, are provided by private individuals or non-traditional lenders. They can be an option for those who may not qualify for conventional loans due to credit or property issues. For more information → learnwithvm.com/

#Home Financing#Mortgage Types#Real Estate Loans#Property Investment#Mortgage Options#Loan Variety#Home Loan Guide#Mortgage Insights#Borrowing Strategies#Housing Finance

1 note

·

View note

Text

Revolutionize Your Portfolio with Third Coast Bancshares Stock

Discover why Third Coast Bancshares Inc. is a top investment opportunity with impressive financial growth and a positive outlook. #ThirdCoastBancshares #TCBX #Texasbankingservices #Investmentopportunity #stockpriceforecasting #stockmarketinvestment

Third Coast Bancshares is a regional bank holding company based in Texas. The company operates through its wholly-owned subsidiary, Third Coast Bank, which offers a wide range of banking services including commercial and retail banking, mortgage lending, and wealth management. Continue reading Revolutionize Your Portfolio with Third Coast Bancshares Stock

#Banking industry#Bear market opportunity#Commercial banking#Dividend policy#Financial performance#Investment#Investment Insights#Investment opportunity#Mortgage lending#NASDAQ:TCBX#Retail banking#Stock Forecast#Stock market investment#Stock price forecasting#TCBX#Texas banking services#Third Coast Bancshares#Wealth management

0 notes

Text

youtube

A Day in the Life of a Real Estate Mogul

Hey Tumblr Fam! 🌟

Ever wonder what it’s like to swim with the big fishes in the real estate sea? Well, today, you’re getting a VIP pass to the show! 🎟️🏢

Setting the Scene

We’re looking at a unique property deal through the lens of a seasoned investor. This isn’t your cookie-cutter Airbnb setup; it’s a deep dive into the world of assumable VA loans and negotiation tactics that tailor to the seller's and buyer's needs alike.

The Heart of the Deal

What makes this deal fascinating is the strategy involved. The buyer is dealing with a property listed with conflicting details (a common real estate headache!), and they’re using their relationship with the seller to their advantage. They discuss everything from the property’s potential cash flow to the nuances of assumable loans.

Strategy Talk

Assumable VA loans are the star here. They allow a buyer to take over a loan with potentially lower interest rates than the market offers—a sneaky good benefit in today’s financial climate. 🌊💰

Real Talk

This negotiation isn’t just business; it’s about relationships. Knowing the seller from previous deals provides a smoother path to agreement. It’s like having a backstage pass to your favorite concert!

Dive In!

So, are you ready to dive into the real estate game? Whether you’re looking to invest or just curious about how the big deals are done, remember: It’s all about the approach, the terms, and understanding both the market and the people you’re dealing with.

Drop a like or reblog if you found this peek into a real estate mogul’s day intriguing! Got questions or want to share your own stories? Hit up the comments! 📬💬

#real estate negotiation#creative financing#VA loans#assumable loans#property investment#real estate deals#real estate strategy#property market#real estate financing#buying property#selling property#real estate tips#investment properties#real estate insights#real estate trends#property listings#mortgage strategies#real estate education#house flipping#rental property investment#Youtube

0 notes

Text

Understanding the Economic Factors Behind Mortgage Rate Fluctuations

As someone considering buying or selling a home, you’re likely keeping a close eye on mortgage rates and wondering about the future. One key factor influencing these rates is the Federal Funds Rate, which affects the cost for banks to borrow money from each other. While the Federal Reserve (the Fed) doesn’t set mortgage rates directly, it does control the Federal Funds Rate.

The interplay between these rates is why many are eagerly awaiting any potential changes from the Fed. A reduction in the Federal Funds Rate could put downward pressure on mortgage rates. With the Fed meeting next week, here are three crucial metrics they’ll review:

1. The Rate of Inflation

Inflation has been a hot topic lately, affecting the prices of everyday goods. The Fed aims to bring inflation back down to 2%. Currently, inflation remains above this target but is showing signs of improvement (see graph below).

2. How Many Jobs the Economy Is Adding

The Fed monitors monthly job creation closely. They aim to see a slowdown in job growth before making any changes to the Federal Funds Rate. Fewer new jobs signal a still-strong but slightly cooling economy, aligning with their goal. This trend seems to be emerging now. As Inman notes:

“. . . the Bureau of Labor Statistics reported that employers added fewer jobs in April and May than previously thought and that hiring by private companies was sluggish in June.”

So, while employers are still creating jobs, the pace has slowed compared to before. This suggests the economy is cooling down from its previous overheated state, which is a positive sign for the Fed.

3. The Unemployment Rate

The unemployment rate reflects the percentage of people actively seeking work but unable to find jobs. A low rate indicates a healthy job market with many people employed, which is generally positive. However, it can also contribute to higher inflation, as increased employment leads to more spending and higher prices. Currently, the unemployment rate is low but has been gradually rising over the past few months (see graph below).

It might seem tough, but a consistently rising unemployment rate is a key indicator the Fed looks for before considering a cut to the Federal Funds Rate. A higher unemployment rate typically signals reduced spending, which can help bring inflation under control.

What Does This Mean Moving Forward?

Mortgage rates are expected to remain volatile in the near future. However, the current economic trends are moving in the direction the Fed desires. Despite this, it’s unlikely they’ll lower the Federal Funds Rate during their upcoming meeting. Jerome Powell, Chair of the Federal Reserve, recently stated:

“We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy.”

We're starting to see early signs of economic trends, but the Fed needs more data and time to be confident this trend will continue. If the direction holds, experts predict a 96.1% chance that the Fed will lower the Federal Funds Rate at their September meeting, according to the CME FedWatch Tool.

Keep in mind, while the Fed doesn’t set mortgage rates directly, a cut in the Federal Funds Rate generally leads to lower mortgage rates.

However, timing can be affected by new economic reports, global events, and other factors. That’s why trying to time the market is usually not advisable.

Bottom Line

Recent economic data may signal that hope is on the horizon for mortgage rates. Let’s connect so you have an expert to keep you up to date on the latest trends and what they mean for you.

Read more

#mortgage rate fluctuations#economic factors#interest rates#housing market#mortgage trends#real estate economics#financial insights#realestate

1 note

·

View note

Text

2024 mortgage market predictions

Explore 2024 Mortgage Market Predictions: Gain expert insights and analysis on the evolving real estate landscape. Discover valuable guidance for prospective homebuyers and homeowners, uncovering potential trends and shifts shaping the mortgage market in the coming year. Delve into industry experts' predictions to navigate this dynamic landscape effectively.

0 notes

Text

Navigating Your Dream Home Journey: The Nicholas Parpis Truth Group Advantage in the Caringbah Property Market

The Nicholas Parpis Advantage: Finding your dream home is a thrilling journey, but it can also be a complex and overwhelming process. The key to a successful property acquisition lies in having the right team by your side. Caringbah and Nicholas Parpis and Truth Group stands out as a trusted buyer’s agent, mortgage broker, and property expert, offering a unique and comprehensive approach to help…

View On WordPress

#Caringbah Property Market#Dream Home Acquisition#Local Property Insights#Mortgage Broker Caringbah#Nicholas Parpis Buyers Agent

0 notes

Text

Gala Expo Season 2: Enchanting Customer Reviews and Unfiltered Experiences

Discover Gala Expo Season 2 like never before with enchanting customer reviews! 🌟 Immerse yourself in their unfiltered experiences, reliving the magic and moments that made this event truly special. Join us for a journey of inspiration, connection, and awe. Watch now!

#Real Estate#Property Investment#Home Buying Tips#Property Management#Real Estate Market Trends#Selling Your Home#Rental Property Tips#Commercial Real Estate#Real Estate Finance#Property Development#Housing Market Analysis#Real Estate Investing#Home Renovation Ideas#First-Time Homebuyer#Real Estate Agent Tips#Interior Design for Homes#Mortgage Advice#Real Estate Legal Insights#Home Selling Strategies#Landlord Advice

0 notes

Note

is sokka viewing katara as a mother figure, or ‘replacement’ for kya, out of character? (replacement is a bad word but i can’t think of another word that would be appropriate)

Sokka contributing to Katara's parentification is not only in character, it's very true to life. The oldest daughter (or in this case only daughter) whether or not she's actually the oldest child, often has to stand in place of her mother, even if her mother isn't dead. It's really common in BIPOC families, but I think it's an almost universal experience at some level (the girl is always seen as so mature, and therefore has more responsibilities at an early age than her brother, cousins, etc.). It's such an insightful addition the story, in fact, I would bet my mortgage that Bryke did it accidentally. Katara's motherly nature was either played for laughs, or meant to show why Aang liked her, so obviously they didn't understand what it was they'd stumbled upon (and is also the reason why Kataang was an absolutely terrible ending for Katara).

Even the scene where Sokka is explaining to Zuko what happened to their mom, the tragedy of how much she had been forced to take on at such a young age, and what replacing Kya for Sokka meant for her wasn't really touched on. Yes, he acknowledges that their mother's death was more traumatic for Katara than him (completely understandable, btw. For a lot of reasons), but he never acknowledges how unfair it was for her- his LITTLE SISTER- to have to take on a motherly role for Sokka. Really think about what that entailed. It's not just that she did his laundry or cooked for him. For Katara to be who he pictures when he thinks of his mom, she had to take on not only her mother's share of the chores, she had to do so much emotional labor for her brother, starting at age 8, and maybe even sooner. It's entirely possible she had been being prepared for that role since before Kya's death.

Side note: This is also why I don't completely accept the headcanon that there was no sexism in the SWT. It wasn't as rigid as the NWT, sure, but it clearly still existed in some form. Had the SWT not been devastated and decimated by the Fire Nation, would Katara- would any woman, for that matter- have been allowed to learn combat waterbending? I have my doubts.

117 notes

·

View notes

Text

Ok PLEASE MAKE THIS HAPPEN.

I’m gonna say

A hard NO.

#eric singer#snack cake#swag master#I would pay $$$ for a subscription for that#like mortgage the house to get a regular insight into that brain of his#kiss band#singer simps

15 notes

·

View notes

Text

Vermont independent Sen. Bernie Sanders announced Monday that he plans to write legislation to codify President-elect Donald Trump’s proposal to cap credit card rates.

The lawmaker called the proposal a “great idea” on social media.

“During the recent campaign Donald Trump proposed a 10% cap on credit card interest rates,” he wrote.

“Let’s see if he supports the legislation that I will introduce to do just that.”

Both Sanders and Trump have been critical of elevated interest rates on credit cards, a concern that comes as credit card debt has increased in recent years amid elevated inflation.

Trump said during one September campaign rally in New York that capping credit card rates would help households recover from the economic tumult that has characterized Joe Biden's presidency.

“While working Americans catch up, we’re going to put a temporary cap on credit card interest rates,” Trump told supporters, according to CNBC.

“We can’t let them make 25% and 30%,” he said of the credit card companies.

Karoline Leavitt, a Trump campaign spokeswoman who has since been tapped to serve as his White House press secretary, said at the time that the intent of the policy was indeed to “provide temporary and immediate relief for hardworking Americans.”

She specifically mentioned those “who are struggling to make ends meet and cannot afford hefty interest payments on top of the skyrocketing costs of mortgages, rent, groceries and gas.”

Sanders voiced his approval of the policy days after Trump defeated Vice President Kamala Harris in November.

“I look forward to working with the Trump Administration on fulfilling his promise to cap credit card interest rates at 10%,” Sanders said on social media platform X.

“We cannot continue to allow big banks to make record profits by ripping off Americans by charging them 25 to 30% interest rates,” he contended. “That is usury.”

Renewed discussion of the credit card rate cap occurs as the default rates for credit card debt have surged to their highest levels in nearly 15 years, as well as the highest levels since the 2008 financial crisis.

In the first nine months of 2024, credit card lenders wrote off some $46 billion in seriously delinquent balances, according to a Sunday report from the Financial Times based on insights from BankRegData.

That marks a 50 percent increase from the same period one year earlier and the most severe default level since 2010.

24 notes

·

View notes

Note

do you have any advice for someone who might want to get into the writing and publishing business but has technically no connections or experience? i grew up dead set on being a writer but had a crisis over my skills around college age, which led me to dropping my hopes of that career path and pursuing a different major. i’m still in an artistic field (theatre) but now i’m WAY back into writing again and experiencing major career regret. an early career existential crisis of sorts. do you think there are any steps i could take to dip my toes into the professional writing world as a theatre kid/playwright? i eventually think i’d like to publish a few books and short story collections, and i’ve been told by many people online and irl that my writing is very good. i’m really passionate about editing and helping people improve their writing too. i’d like to see if it’s something for me, but have no idea where to even begin. i’ve also only been graduated for a few years so I dont have a lot of career experience as it is. any insights you can offer as someone who’s done it would be immensely appreciated 💖

You don’t need a college education in creative writing to be a writer. Sure, it can help, but it’s not a necessity.

My best advise would be to find writer groups and become active there. If you engage in fandom content online, start building your community and friendships there too. Be around other people who write, and make sure you have the time to write yourself.

Also, a lot of authors have other jobs. Writing as a main job is not sustainable for most people. (It’s only sustainable for me because my readers are feral and my partner has a job that pays the mortgage.) So don’t think of it as choosing one over the other. Writing will always be there for you so long as you engage with it. As for what to do with your work once you’re done, that’s up to you, but self-pub is also always an option if trad-pub isn’t something you want to deal with.

If you’re wanting to get into editing, there are editing courses you can take that don’t require going back to university. But again, join writers groups, join online spaces. Be involved. Building a community of like-minded creatives is important.

236 notes

·

View notes

Text

i'm ren (or vacant), writing as R.A.A. and this is my main writing blog!

this is a catch all space for me to post about all things writing which will include things like snippets from my many wips; live writing updates as i craft prose; horny and meme posting about my ocs; meta about the themes of my wips, their plots, and writing in general; as well as me just talking about whatever else comes to mind regarding my interests as well as talking with friends.

you can pretty much find me mostly here or on bluesky (though because it is a twitter clone i am much, much less talkative. the war flashbacks are still hard to get over apparently). you can also read my fandom writing on ao3 (though i’m taking a bit of a hiatus from it right now). if you read anything from there i’d highly suggest reading cage.

as of 2/18 asks are back on, so go nuts

thanks for stopping by :3c

:MY WIPS:

to see a full (mostly) list of my wips, i made a handy-ish list that lists all the main things that i'm working on and their (mostly current) importance in my ever-rotating roster HERE!

however, there are a few wips that i am mostly going to be talking about more often than not, and i've taken the liberty of making a few scrapbook-esque posters in canva to illustrate their main points. so, without further ado:

BETWIXT THUMB & FOREFINGER (BTAF) -> wip intro || read: ACT I PART I || character intros

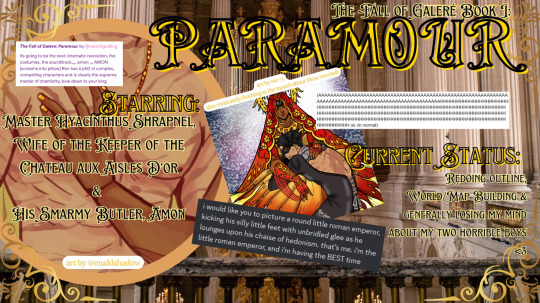

THE FALL OF GALERE BOOK 1: PARAMOUR -> wip intro || read: CHAPTER 1 || character intros

HE WHO SMITES THE SUN -> wip intro || read: CHAPTER 1

:NAVIGATION:

ren writing -> all of my writing in one place

ren poems -> all of my poems in one place

ren art -> all my art

talking -> musings and personal thoughts

about renjamin -> insight to me / who i am

ren analysis -> when i get meta about my wips

ren mix -> a treasure trove of my music taste

ren polls -> any polls i make

ren reads -> for my ramblings and analysis as i try to get back into books

ren hot cakes -> when i'm firing shots in the house to keep the mortgage prices down

ren plays -> video game rantings and ravings

friends tag -> talking with friends or boosting my friends work

others work -> boosting other writeblrs work

hall of fame -> praise / things that make me happy that i want to keep

ren is jopping on main -> for the rare occasions where i talk about kpop

ren rabbit hole -> i like history and mythology and the ancient world and i Will ramble about it

ren fights linguistics -> i'm starting to try and conlang!! it will be hard!!

writing in review -> for my end of the year lookback at wtf i was doing writing wise that year :) usually done in november bc december is a bad month for me usually

events -> gonna start keeping track of the writing events that i want to try and do

19 notes

·

View notes

Text

On February 10, employees at the Department of Housing and Urban Development (HUD) received an email asking them to list every contract at the bureau and note whether or not it was “critical” to the agency, as well as whether it contained any DEI components. This email was signed by Scott Langmack, who identified himself as a senior adviser to the so-called Department of Government Efficiency (DOGE). Langmack, according to his LinkedIn, already has another job: He’s the chief operating officer of Kukun, a property technology company that is, according to its website, “on a long-term mission to aggregate the hardest to find data.”

As is the case with other DOGE operatives—Tom Krause, for example, is performing the duties of the fiscal assistant secretary at the Treasury while holding down a day job as a software CEO at a company with millions in contracts with the Treasury—this could potentially create a conflict of interest, especially given a specific aspect of his role: According to sources and government documents reviewed by WIRED, Langmack has application-level access to some of the most critical and sensitive systems inside HUD, one of which contains records mapping billions of dollars in expenditures.

Another DOGE operative WIRED has identified is Michael Mirski, who works for TCC Management, a Michigan-based company that owns and operates mobile home parks across the US, and graduated from the Wharton School in 2014. (In a story he wrote for the school’s website, he asserted that the most important thing he learned there was to “Develop the infrastructure to collect data.”) According to the documents, he has write privileges on—meaning he can input overall changes to—a system that controls who has access to HUD systems.

Between them, records reviewed by WIRED show, the DOGE operatives have access to five different HUD systems. According to a HUD source with direct knowledge, this gives the DOGE operatives access to vast troves of data. These range from the individual identities of every single federal public housing voucher holder in the US, along with their financial information, to information on the hospitals, nursing homes, multifamily housing, and senior living facilities that HUD helps finance, as well as data on everything from homelessness rates to environmental and health hazards to federally insured mortgages.

Put together, experts and HUD sources say, all of this could give someone with access unique insight into the US real estate market.

Kukun did not respond to requests for comment about whether Langmack is drawing a salary while working at HUD or how long he will be with the department. A woman who answered the phone at TCC Management headquarters in Michigan but did not identify herself said Mirksi was "on leave until July." In response to a request for comment about Langmack’s access to systems, HUD spokesperson Kasey Lovett said, “DOGE and HUD are working as a team; to insinuate anything else is false. To further illustrate this unified mission, the secretary established a HUD DOGE taskforce.” In response to specific questions about Mirski’s access to systems and background and qualifications, she said, “We have not—and will not—comment on individual personnel. We are focused on serving the American people and working as one team.”

The property technology, or proptech, market covers a wide range of companies offering products and services meant to, for example, automate tenant-landlord interactions, or expedite the home purchasing process. Kukun focuses on helping homeowners and real estate investors assess the return on investment they’d get from renovating their properties and on predictive analytics that model where property values will rise in the future.

Doing this kind of estimation requires the use of what’s called an automated valuation model (AVM), a machine-learning model that predicts the prices or rents of certain properties. In April 2024, Kukun was one of eight companies selected to receive support from REACH, an accelerator run by the venture capital arm of the National Association of Realtors (NAR). Last year NAR agreed to a settlement with Missouri homebuyers, who alleged that realtor fees and certain listing requirements were anticompetitive.

“If you can better predict than others how a certain neighborhood will develop, you can invest in that market,” says Fabian Braesemann, a researcher at the Oxford Internet Institute. Doing so requires data, access to which can make any machine-learning model more accurate and more monetizable. This is the crux of the potential conflict of interest: While it is unclear how Langmack and Mirski are using or interpreting it in their roles at HUD, what is clear is that they have access to a wide range of sensitive data.

According to employees at HUD who spoke to WIRED on the condition of anonymity, there is currently a six-person DOGE team operating within the department. Four members are HUD employees whose tenures predate the current administration and have been assigned to the group; the others are Mirski and Langmack. The records reviewed by WIRED show that Mirski has been given read and write access to three different HUD systems, as well as read-only access to two more, while Langmack has been given read and write access to two of HUD’s core systems.

A positive, from one source’s perspective, is the fact that the DOGE operatives have been given application-level access to the systems, rather than direct access to the databases themselves. In theory, this means that they can only interact with the data through user interfaces, rather than having direct access to the server, which could allow them to execute queries directly on the database or make unrestricted or irreparable changes. However, this source still sees dangers inherent in granting this level of access.

“There are probably a dozen-plus ways that [application-level] read/write access to WASS or LOCCS could be translated into the entire databases being exfiltrated,” they said. There is no specific reason to think that DOGE operatives have inappropriately moved data—but even the possibility cuts against standard security protocols that HUD sources say are typically in place.

LOCCS, or Line of Credit Control System, is the first system to which both DOGE operatives within HUD, according to the records reviewed by WIRED, have both read and write access. Essentially HUD’s banking system, LOCCS “handles disbursement and cash management for the majority of HUD grant programs,” according to a user guide. Billions of dollars flow through the system every year, funding everything from public housing to disaster relief—such as rebuilding from the recent LA wildfires—to food security programs and rent payments.

The current balance in the LOCCS system, according to a record reviewed by WIRED, is over $100 billion—money Congress has approved for HUD projects but which has yet to be drawn down. Much of this money has been earmarked to cover disaster assistance and community development work, a source at the agency says.

Normally, those who have access to LOCCS require additional processing and approvals to access the system, and most only have “read” access, department employees say.

“Read/write is used for executing contracts and grants on the LOCCS side,” says one person. “It normally has strict banking procedures around doing anything with funds. For instance, you usually need at least two people to approve any decisions—same as you would with bank tellers in a physical bank.”

The second system to which documents indicate both DOGE operatives at HUD have both read and write access is the HUD Central Accounting and Program System (HUDCAPS), an “integrated management system for Section 8 programs under the jurisdiction of the Office of Public and Indian Housing,” according to HUD. (Section 8 is a federal program administered through local housing agencies that provides rental assistance, in the form of vouchers, to millions of lower-income families.) This system was a precursor to LOCCS and is currently being phased out, but it is still being used to process the payment of housing vouchers and contains huge amounts of personal information.

There are currently 2.3 million families in receipt of housing vouchers in the US, according to HUD’s own data, but the HUDCAPS database contains information on significantly more individuals because historical data is retained, says a source familiar with the system. People applying for HUD programs like housing vouchers have to submit sensitive personal information, including medical records and personal narratives.

“People entrust these stories to HUD,” the source says. “It’s not data in these systems, it’s operational trust.”

WASS, or the Web Access Security Subsystem, is the third system to which DOGE has both read and write access, though only Mirski has access to this system according to documents reviewed by WIRED. It’s used to grant permissions to other HUD systems. “Most of the functionality in WASS consists of looking up information stored in various tables to tell the security subsystem who you are, where you can go, and what you can do when you get there,” a user manual says.

“WASS is an application for provisioning rights to most if not all other HUD systems,” says a HUD source familiar with the systems who is shocked by Mirski’s level of access, because normally HUD employees don’t have read access, let alone write access. “WASS is the system for setting permissions for all of the other systems.”

In addition to these three systems, documents show that Mirski has read-only access to two others. One, the Integrated Disbursement and Information System (IDIS), is a nationwide database that tracks all HUD programs underway across the country. (“IDIS has confidential data about hidden locations of domestic violence shelters,” a HUD source says, “so even read access in there is horrible.”) The other is the Financial Assessment of Public Housing (FASS-PH), a database designed to “measure the financial condition of public housing agencies and assess their ability to provide safe and decent housing,” according to HUD’s website.

All of this is significant because, in addition to the potential for privacy violations, knowing what is in the records, or even having access to them, presents a serious potential conflict of interest.

“There are often bids to contract any development projects,” says Erin McElroy, an assistant professor at the University of Washington. “I can imagine having insider information definitely benefiting the private market, or those who will move back into the private market,” she alleges.

HUD has an oversight role in the mobile home space, the area on which TCC Management, which appears to have recently wiped its website, focuses. "It’s been a growing area of HUD’s work and focus over the past few decades," says one source there; this includes setting building standards, inspecting factories, and taking in complaints. This presents another potential conflict of interest.

Braesemann says it’s not just the insider access to information and data that could be a potential problem, but that people coming from the private sector may not understand the point of HUD programs. Something like Section 8 housing, he notes, could be perceived as not working in alignment with market forces—“Because there might be higher real estate value, these people should be displaced and go somewhere else”—even though its purpose is specifically to buffer against the market.

Like other government agencies, HUD is facing mass purges of its workforce. NPR has reported that 84 percent of the staff of the Office of Community Planning and Development, which supports homeless people, faces termination, while the president of a union representing HUD workers has estimated that up to half the workforce could be cut The chapter on housing policy in Project 2025—the right-wing playbook to remake the federal government that the Trump administration appears to be following—outlines plans to massively scale back HUD programs like public housing, housing assistance vouchers, and first-time home buyer assistance.

16 notes

·

View notes

Text

Is Harry Suing the UK to Hide Truth of Visa and Security?

Let’s talk about a few things going on in the Royal News World, Shall We?

This mouse isn’t completely sure of coming back entirely, but I figured a post here and there would be fine. Let’s get started.

My people come bearing some insights: Just about everyone in the aristocracy is openly aware that Harry isn’t truly cut off. As a matter of fact, some believe that Harry is only in the US because Charles sent him here and he is in fact on an A1 visa. Not so much as a banishment, but as a way to play both sides of the media circus and keep them all relevant. The whole world tunes in every time something pops up.

What brings more clickbait? Ask yourself the hard questions, though, don’t take the easy route. I’ve seen some things going around, and I see people truly never ask the hard questions.

I pray for the day when everyone wakes up and realizes that being elderly doesn’t make you harmless or innocent. This author was told the same things about Harry not being told about the diagnosis for the cancer until we all heard, BUT BEFORE. Interesting that ever got leaked out in the press, isn’t it? Why even tell us when he got told? Harry probably leaked it and did it to make Charles look favorable. Do you think Charles would let it get leaked? To what end? To look like the loving, yet firm father everyone demands him to be, the man that he cannot. The man he is not.

And now there are articles coming out about the contingency plans for Charles being sick. Harry is not in them, at all. Why would he need to be? Doesn’t that say a lot? The fact people have to be told Harry isn't included is silly. But you know what they say about assumptions.

Now, I was told by a friend that’s a doctor the whole story of the cancer being found during the prostate stuff made no sense. They would’ve seen other indicators beforehand. They ARE the greatest medical professionals on the planet, aren’t they? You mean a PET scan or blood test or anything like that, at all, wouldn’t hint at the other problems? This was a choreographed release of information.

It's being suggested that the press will be informed to release a cascade of tidbits over the coming weeks. Lady C said early spring, before summer. She also said it was Princess Anne who made the “racist baby” comments, and that was also a ruse. I’m pretty sure Lady C picked Team Charles back in the 80s, and she’s been working to gain grace and favor since. I think she wants to seem like she knows things to sell books or views. Go, girl, get that paper.

Speaking of paper, it was suggested one of the main reasons Charles was so upset with Harry when he “rushed right over” was because he asked for more money. Anyone could assume that but think about what he did immediately afterwards. He went over there only to have something to give an interview for. He got paid to “not squeal” on an interview. The Sussexes don’t lift a finger for free… they only lift them for freebies. Or money.

If Harry is here on an A1 Visa as a favor between Charles and the US, that means we are paying for that security in America. No wonder Harry is suing the UK, he needs to make it look like he needs something when he already has it. How would they possibly have the money to pay for their own? I posted the mortgage documents, remember. Do the math. They have 10 years to pay that house off in full before they get a 7.48% interest rate. They have upkeep, services, servants, nannies, clothes, utilities, maintenance that must be maintained or the bank could come in and do it themselves… Those things aren’t cheap. You have to have a faucet of money coming in to handle it all. They don’t even have a drip.

Oh, and I was told to really look at Harry’s page on the Royal website. And that the minute Wills gets that crown, his brother will be done for. Which is why Charles could be trying to be a father instead of a king in that situation. Then again, if Wills had hard feelings for both Charles and Harry, and Charles had a jealousy over Wills and the Queen… that’s a lot of ifs

One this is for sure. Harry will NEVER return to the BRF in a working capacity. Everything is a dance of smoke and mirrors.

It makes total sense to have Harry here on an A1 visa, have him in constant litigation with the UK so we peons think he needs security, but in reality he is here on a visa supplying him the protection he thinks he deserves. Of course, an FOIA would need to be filed, probably… I wonder if I could do that and see how he is really here. I don’t believe he is here on an O1 or spousal visa.

What is the real reason for all of this, people? It's just Flying Pasta, like before.

80 notes

·

View notes

Text

Prime Minister Justin Trudeau says he "could have" and "should have" moved faster on making affordable housing a priority for his government — an insight that comes as his government faces the worst polling it's seen since coming to power.

As Parliament resumes for the fall sitting, Trudeau spoke to the CBC podcast Front Burner about his record so far on housing affordability — the political issue that could define the next election.

"I will say it hasn't been enough," he told host Jayme Poisson Monday morning. "We should have, could have moved faster. Absolutely. There's always more to do."

The housing market crunch has been a persistent point of vulnerability for the Liberals over the summer. Conservative Leader Pierre Poilievre has blamed Trudeau's government for a range of problems facing Canadians post-pandemic, including ballooning rents and a shortage of housing.

While Canada's national housing agency says progress is being made on building enough housing to close the affordability gap, a recent report from the Canada Mortgage and Housing Corporation says almost 3.5 million new units will have to be built by the end of the decade. [...]

Continue Reading.

Tagging: @politicsofcanada

148 notes

·

View notes

Text

Navigating Your Dream Home Journey: The Nicholas Parpis Truth Group Advantage in the Caringbah Property Market

The Nicholas Parpis Advantage: Finding your dream home is a thrilling journey, but it can also be a complex and overwhelming process. The key to a successful property acquisition lies in having the right team by your side. Caringbah and Nicholas Parpis and Truth Group stands out as a trusted buyer’s agent, mortgage broker, and property expert, offering a unique and comprehensive approach to help…

View On WordPress

#Caringbah Property Market#Dream Home Acquisition#Local Property Insights#Mortgage Broker Caringbah#Nicholas Parpis Buyers Agent

0 notes