#loan on gold

Explore tagged Tumblr posts

Text

#Gold loan#Loan against gold#loan on gold#Gold loan benefits#loan against gold vs loan against property#Gold loan vs property loan#SahiBandhu#SahiBandhu gold loans

0 notes

Text

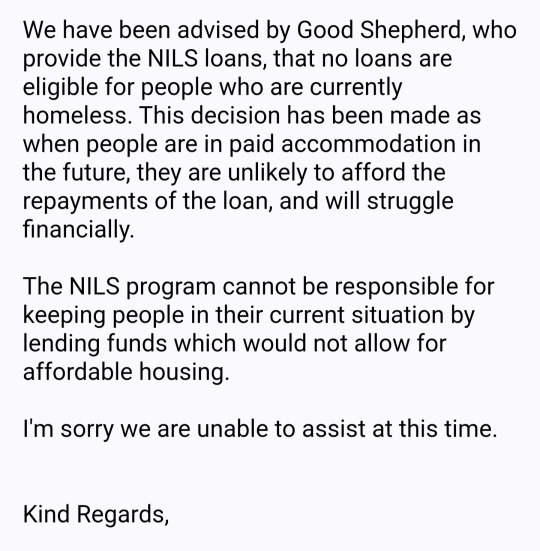

I just had to share this email I got so all y'all can appreciate the absolute state of welfare services in Australia with me:

The NILs Loan Scheme is a government funded, no interest loan scheme for people on low incomes, but this leaves me wondering exactly who tf can qualify for their loans. Because it seems like if you have any symptoms of poverty it's a no.

I applied because I need the clutch replaced in my van, which I live in. It's lucky that I actually CAN afford the cost myself (due to living in a van & not participating in Australia's increasingly ridiculous housing market). I thankfully can afford such an expense these days & was just looking for a responsible financial buffer, just in case. But if this had happened to me a few years ago when I first became homeless and was far less financially stable, then my next living situation wouldn't be "affordable housing" it would be a fucking tent.

Anyway, the backwards ass state of a GOVERNMENT FUNDED welfare scheme refusing to assist those who need welfare the most because they don't want to encourage homelessness or whatever the dumb fuck? Just really rustled my jimmies tbh. Just screams "yet another govt welfare scheme that's actually just about handing out money to fake charities & not helping the poor". Good Shephard just got on the "do not donate to these grifters" list along with the Salvos😒

#I got a root canal & a heap of skin cancer to pay for on top of this clutch replacement right#& I got it#but there's going to be $100 left in my bank account with this all said & done#& I could use ZIP or AfterPay or whatever if need be#but I figured a no-interest no-fee no-nothing loan would be the gold standard of responsible financial decision-making#& lol turns out the eligibility requirements for a NILs loan are HIGHER than a Buy Now Pay Later (w exorbitant fees) type of loan#how tf can you call that a loan scheme for people on low incomes?#when you gotta be at least middle class to qualify?#the fucking state of Australian welfare agencies istg#& I ain't even shocked atp because this is the response I've always gotten from welfare agencies#they always have some (often very stupid) excuse as to why they can't do what they say they do#I hear so often “oh there's plenty of support for the poor & homeless they just choose to be that way”#but this is the support just fyi#this is why poverty & homelessness still exist in Australia#bc all the agencies & organisations & departments & corporations that are “on the job” are only on the job of securing their own pay checks#with as little expenditure on the poor as they can get away with#auspol#poverty

9 notes

·

View notes

Text

People will say wildly unfounded shit like reddit is a "leftist hive mind" and then an aita post will show up about a guy who won over a million dollars and wanted to use it to become a landlord.

If the first reply isn't "kill yourself you fucking leech" I don't think you can really say that

#The post was mostly about how his girlfriend of 4 years wanted some of it for her crushing student loan debt#And people were FALLING OVER themselves to tell him no one is entitled to his money and his gf is a gold digger#Like yeah a few people mentioned the massive housing crisis but it wasn't the most up voted comment

10 notes

·

View notes

Text

Ears allergic to fake jewelry , only gold or silver

#that is what happens when you get your ears pierced late#mine were pierced when I was in 5th grade#and I still wear that same gold earring#the diamond ones are still in my locker and haven't seen the light of the day#because all my jewelry is kept preserved for that day when I go broke and need to take a gold loan

2 notes

·

View notes

Text

Sell your gold and get a high price. We also get your Gold Loan Settlement done so that your financial problems can be solved. we also provide a free home pickup service. More Details Contact Us On These Number:- +91-9999821702 , +91-9999633245

#cash for gold#cash for gold near me#sell gold for cash#gold loan#sell gold online#online gold buyer#gold#gold jewelry buyer

2 notes

·

View notes

Text

Opening Opportunities: Flexible Collateral Loans and Estate Jewelry Buying in Dania Beach – Dixie Pawn & Jewelry

In today’s uncertain financial climate, finding quick and reliable cash solutions is more important than ever. The 2025 economy has presented unique challenges for many individuals and families, with rising living costs, fluctuating interest rates, and an unpredictable job market. But at Dixie Pawn & Jewelry, we’re here to help you weather the storm.

Located just minutes from Dania Beach, we specialize in hard money collateral loans and estate jewelry buying, offering fair deals and compassionate service to help our community thrive.

Why Choose Collateral Loans in 2025?

As traditional financial institutions tighten their lending requirements, many people are turning to alternative options like collateral loans. These loans allow you to borrow money against valuable items without the need for credit checks or long approval processes. It’s fast, simple, and reliable – perfect for those navigating the challenges of today’s economy.

At Dixie Pawn & Jewelry, we provide:

Fast Cash on Valuables: Bring in your gold, silver, luxury handbags, or electronics, and leave with cash in hand the same day.

Flexible Terms: Life happens, and we’re here to work with you on repayment plans that fit your situation.

Confidential, Judgment-Free Service: We understand your circumstances and aim to provide a solution, not stress.

Estate Jewelry Buying: Unlocking Hidden Value

Have estate jewelry sitting in a drawer? In 2025, many individuals are choosing to liquidate inherited or unused pieces to tap into their hidden value. Dixie Pawn & Jewelry offers top-dollar payouts for estate jewelry, including:

Antique and vintage rings, necklaces, and bracelets.

Fine watches and designer pieces.

Gold, platinum, and silver jewelry of all kinds.

Our in-house expert appraisers ensure you receive a fair market value for your items. Whether you’re downsizing, covering unexpected expenses, or simply decluttering, we’re here to help you turn your treasures into cash.

How Dixie Pawn & Jewelry Stands Out

In a world dominated by big corporations, we’re proud to be your local, family-owned pawnshop serving Dania Beach and the surrounding areas. Here’s why our customers trust us:

A Reputation for Fairness: Every deal is transparent and based on current market trends.

Compassionate Customer Service: You’re not just another transaction – you’re part of our community.

Expert Knowledge: From estate jewelry to high-end electronics, we bring years of experience to every appraisal.

Your Trusted Financial Partner in Dania Beach

As the economic challenges of 2025 continue to unfold, we remain committed to supporting our neighbors in Dania Beach. Whether you need a quick loan or want to sell estate jewelry, Dixie Pawn & Jewelry is here to provide reliable, fair solutions when you need them most.

Visit Us Today

Stop by Dixie Pawn & Jewelry at 2316 N Dixie Highway, Hollywood, FL 33020 – just a short drive from Dania Beach – and discover how we can help you unlock financial opportunities.

Need more information? Give us a call or send us a message. We’re always happy to assist!

#pawn shop#south florida#broward county#dania beach#hollywood fl#hollywood florida#business#gold#loans#diamonds#jewelry#personal loans#business loans#short term cash loans#mortgage#financial planning

4 notes

·

View notes

Text

"What is the worth of a single mortal's life?"

What if Jergal meant this literally and was asking what price he should set the resurrection fee

#baldur's gate 3#yodeling into the void#imagine asking for financial advice but everyone you ask suddenly gains a phd in philosophy#'hey can i get a loan for a house?' 'the stability offered by a permanent residence could also be considered a shackle'#wonder how jithers landed on 200 gold tho. did he pull the number out of his dusty ass?

4 notes

·

View notes

Text

A commission piece for my friend Solrockmartin of their leonin barbarian! For our Wednesday group

#art#dnd#dnd oc#dnd oc art#dungeons and dragons#oc artist#digital illustration#artists on tumblr#cat#leonin#barbarian#warrior#buff man go brrr#himbo#Loane#gold fangs fuck squad#dakuistiredart#dakuistireddesigns

24 notes

·

View notes

Text

A ceremonial cap worn by courtiers at coronations is among the items now on display in Kumasi

African countries have repeatedly called for the return of looted items with some regaining ownership over precious historical artefacts in recent years.

Looted artefacts from the Asante kingdom are finally on display in Ghana, 150 years after British colonisers took them.

Ghanaians flocked to the Manhyia Palace Museum in Kumasi, the capital of Asante region, to welcome the 32 items home.

"This is a day for Asante. A day for the Black African continent. The spirit we share is back," said Asante King Otumfuo Osei Tutu II.

At this stage the items have only been loaned to Ghana for three years.

This loan can be extended, but only with the approval of the British culture secretary.

The agreement is between two British museums - the Victoria & Albert Museum (V&A) and British Museum - and the Asante king, not the Ghanaian government.

The Asante king, or Asantehene, is seen as a symbol of traditional authority, and is believed to be invested with the spirits of his predecessors. But his kingdom is now part of Ghana's modern democracy.

"Our dignity is restored," Henry Amankwaatia, a retired police commissioner and proud Asante, told the BBC, over the hum of jubilant drumming.

The neck ring or 'kanta' (R) was worn by the king at important funerals

The V&A is lending 17 pieces while 15 are from the British Museum.

The return of the artefacts coincides with the silver jubilee celebration of the Asantehene.

A guide to Africa's 'looted treasures'

UK to loan back Ghana's looted 'crown jewels'

Some of the items, described by some as "Ghana's crown jewels" were looted during the Anglo-Ashanti wars of the 19th Century, including the famous Sargrenti War of 1874.

Other items like the gold harp (Sankuo) were given to a British diplomat in 1817.

"We acknowledge the very painful history surrounding the acquisition of these objects. A history tainted by the scars of imperial conflict and colonialism," said Dr Tristam Hunt, director of the Victoria and Albert Museum, who has travelled to Kumasi for the ceremony.

The display is part of the silver jubilee celebrations of Asante King Otumfo Osei Tutu II

Among the returned artefacts are the sword of state, gold peace pipe and gold badges worn by officials charged with cleansing the soul of the king.

"These treasures have borne witness to triumph and trials of the great kingdom and their return to Kumasi is testament to the power of cultural exchange and reconciliation" said Dr Hunt.

One of the returned items, the sword of state, also called the "mpompomsuo sword" holds great significance for the Asante people.

It serves as a sword of office that is used in swearing the oath of office to the kingdom by paramount chiefs and the king himself.

Royal historian Osei-Bonsu Safo-Kantanka told the BBC that when the items were taken from the Asante it took away "a portion of our heart, our feeling, our whole being".

This gold headpiece known as "krononkye" was used when royalty was grieving

The midnight knife (L) was used for covert operations. The gold badges (R) were worn by the king's soul washers

The return of the artefacts is as controversial as it is significant.

Under UK law, national museums like the V&A and British Museum are banned from permanently giving back contested items in their collections, and loan deals such as this are seen as a way to allow objects to return to their countries of origin.

Some countries laying claim to disputed artefacts fear that loans may be used to imply they accept the UK's ownership.

Many Ghanaians feel the ornaments should remain permanently. However, this new arrangement is a way to overcome British legal restrictions.

African countries have repeatedly called for the return of looted items with some regaining ownership over precious historical artefacts in recent years.

You may also be interested in:

Top Belgian museum rethinks its Africa relationship

'My great-grandfather sculpted the Benin Bronzes'

France gives back sword of anti-colonial fighter

#ghana#looted gold#loaning ghana their artifacts#uk stolen legacy of Ghana#stealing gold and diamonds#uk you do not own these things#give them back#white lies#black lives matter

4 notes

·

View notes

Text

Disco Vanessa!

#Rainbow High#Vanessa Temple#Meena loaned her the gold pants and they look so good!#those are some Ken boots because the looseness made them easier to get over the gold socks#sorry for the lamp cord in the background

17 notes

·

View notes

Text

In the old style they all look so scrungly but zoro is something else.... and mainly well proportioned nami I miss you....

#i thot i wasnt gonna coment the movies but the old style is just too good. love the phyisical humor and how there isnt one second wasted#the ship is hit with a wave and zoro JUMPS to the water to save luffy who hasn't even drowned yet... incredible#nami bein unbothered by anyone i miss you....#them talking about oden..... oof#luffy manhandling zoro i miss you too.... he needs to get boinked on the head more often#nami and usopp lying out of their ass ajdhaksnka#alao first time i see zoro only fighting with his mouth aksjaja#and nami picking a lock.... its ben 84 years....#there are so many stupid conversations i love it. NAMI BURNT THE MAP AKDHAKA zoro helping nami climb the mountain. my fag and hag....#this is still when they had a relationship.... sigh....#ganzo and woonan make love not war.... the frames of ganzo falling ajdhsjajajs#is luffy returning a sonic attack??? well.... i guess....#woonan being a bunch of bones omg#the gold wasnt the gold but the adventures we made along the way.... and the gay lovers we remembered#see.... nami and zoro money loaning problems.... i miss you....#luffy's smile was BIG damn.#talking tag#watching one piece#watching one piece movies

3 notes

·

View notes

Text

Why struggle when SahiBandhu is here? Get the best value for your gold and make all your dreams come true with SahiBandhu. Visit sahibandhu.com or call us at 1800 309 8440.

#SahiBandhu gold loan#SahiBandhu#gold loan#gold loan for education#education gold loan#loan against gold#loan on gold#jewel loan#gold loan for higher study

0 notes

Text

Mortgage Brokers in Pimpama A Must Home Review

Pimpama, a picturesque suburb in Queensland, has witnessed a surge in the real estate market, attracting homebuyers from all walks of life. Navigating the complexities of mortgages in such a thriving market can be daunting. That’s where Must Home, the leading mortgage broker in Pimpama, steps in to simplify the process.

What Sets Must Home Apart

1. Tailored Financial Solutions: Must Home prides itself on offering personalized mortgage solutions tailored to individual needs and financial situations. Their expert brokers meticulously analyze your requirements, ensuring you get the best-suited mortgage plan.

2. Comprehensive Market Knowledge: With an in-depth understanding of the local real estate landscape, Must Home brokers provide valuable insights. They help clients make informed decisions, ensuring they secure the most advantageous mortgage deals available.

3. Streamlined Application Process: Must Home simplifies the often labyrinthine mortgage application process. Their team guides you through every step, from document preparation to submission, making the journey seamless and stress-free.

4. Competitive Interest Rates: Must Home collaborates with various lenders, granting access to an array of mortgage products at competitive interest rates. This ensures clients not only find a suitable mortgage but also save significantly over the loan term.

5. Exceptional Customer Service: Beyond securing mortgages, Must Home excels in customer service. Their dedicated brokers provide ongoing support, addressing queries and concerns promptly. This commitment to client satisfaction sets them apart in the industry.

How Must Home Can Help You

Whether you’re a first-time homebuyer, looking to refinance, or investing in property, Must Home offers a diverse range of services.

First Home Buyer Loans: Must Home assists newcomers in navigating the complexities of securing their first home, ensuring they benefit from government incentives and affordable repayment plans.

Refinancing Solutions: For existing homeowners, Must Home evaluates your current mortgage, exploring opportunities for refinancing that could lead to substantial savings over time.

Investment Property Loans: Investors receive tailored financial guidance, helping them expand their real estate portfolios strategically.

Conclusion —

In conclusion, Must Home stands out as a reliable and client-focused mortgage broker in Pimpama. Their commitment to personalized service, market expertise, and exceptional customer care makes them the go-to choice for anyone seeking a mortgage solution in this vibrant suburb.

Connect with us now on +61 468 784 663 and step ahead to a wise decision .

4 notes

·

View notes

Note

Don't you think it was a little rash to take away Moe's van right before Valentine's Day? He would have gotten your money? Could it be it didn't really have to do with money?

I thank you for answering your own question and saving me the trouble, dearie. You've chosen the answer that satisfies you, I'm sure.

#askstorybrookerp#asked and answered#mr gold#s1e12#the terms of the loan WERE clear#the loan WAS due#but believe what you like

4 notes

·

View notes

Text

How Genuine Gold Buyers Ensure You Receive the Best Price. Explore the key practices and characteristics that reputable buyers employ to offer top value for your precious gold items.

#Cash For Gold#Cash For Silver#Cash For Diamond#Sell Silver#Sell Diamond#Diamond Buyer#Jewellery Buyer#Silver Jewellery Buyer#Gold Jewellery Buyer#Jewelry Buyer#Sell Gold#Sell Your Jewelry#Gold Buyer#Sell Diamond From Home#Sell Gold Jewelry#Sell Gold Online#Gold Loan Settlement Near Me#Gold Loan Settlement Delhi NCR#Gold Loan Settlement#Cash For Gold Near Me#Cash For Silver Near Me#Cash For Diamond Near Me#Sell Silver Near Me#Sell Diamond Near Me#Diamond Buyer Near Me#Jewellery Buyer Near Me#Silver Jewellery Buyer Near Me#Gold Jewellery Buyer Near Me#Jewelry Buyer Near Me#Sell Gold Near Me

2 notes

·

View notes

Text

Unlock the Value of Your Gold with Amulya Gold Buyers: Fast, Secure, and Hassle-Free Transactions

Unlock the true value of your gold with Amulya Gold Buyers in Bengaluru. Our fast, secure, and hassle-free transactions ensure a seamless process when selling your precious metals. As trusted gold buyers, we offer transparent evaluations and fair prices based on current market rates. Whether you have gold jewelry, coins, or bars, our knowledgeable team ensures your satisfaction and confidentiality. Experience the convenience of selling gold with Amulya Gold Buyers. Visit our Bengaluru location or contact us today for a reliable and rewarding gold selling experience. Maximize the value of your gold with us.

#Gold valuation#Gold buying#Gold selling#Gold loans#Gold investments#Gold purity testing#Transparent pricing

2 notes

·

View notes