#Loan for gig workers

Explore tagged Tumblr posts

Text

Can Seasonal Workers Qualify for a Personal Loan?

Introduction

A personal loan is a great financial tool that provides quick funds for various needs, including medical emergencies, education expenses, home renovation, or debt consolidation. However, getting a personal loan depends on factors like income stability, credit score, and employment type—which makes it challenging for seasonal workers to qualify.

Seasonal workers are individuals who earn income during specific seasons, such as farmers, tourism workers, retail employees, and gig workers. Since their income fluctuates, traditional lenders often consider them high-risk borrowers. However, this does not mean that seasonal workers cannot get a personal loan. Several banks, NBFCs, and digital lenders now offer flexible loan options for individuals with irregular income.

In this guide, we will explore how seasonal workers can qualify for a personal loan, the best lenders, eligibility criteria, required documents, and tips to improve loan approval chances.

Challenges Faced by Seasonal Workers in Getting a Personal Loan

Since traditional lenders prefer applicants with stable monthly income, seasonal workers often face difficulties in securing a personal loan. Some of the main challenges include:

❌ Irregular Income – Seasonal workers do not earn a fixed monthly salary, making it harder for lenders to assess repayment capacity. ❌ High-Risk Borrower Profile – Since income is unpredictable, banks consider seasonal workers high-risk applicants. ❌ Higher Interest Rates – Lenders may charge higher interest rates to compensate for the perceived risk. ❌ Strict Documentation Requirements – Traditional banks often ask for salary slips, income tax returns (ITR), and bank statements, which some seasonal workers may not have.

Despite these challenges, seasonal workers can still qualify for a personal loan by exploring the right lending options and providing alternative income proof.

Eligibility Criteria for Seasonal Workers to Get a Personal Loan

Most banks and NBFCs set basic eligibility requirements for personal loans, but these criteria are slightly adjusted for seasonal workers:

✔️ Age Limit – Applicant should be between 21 to 60 years. ✔️ Income Proof – Must show alternate proof of income, such as business transactions, freelance payments, agricultural earnings, or gig work records. ✔️ Work Experience – Seasonal workers should have at least 2 years of work experience in their respective fields. ✔️ Credit Score – A credit score of 700+ increases approval chances. ✔️ Minimum Income – Most lenders require a minimum annual income of ₹1.5 lakh to ₹3 lakh. ✔️ Bank Statements – Providing 6 to 12 months of bank statements helps prove financial stability.

Even if seasonal workers do not meet all criteria, they can still enhance their eligibility by applying with a co-applicant or opting for secured loans.

Best Personal Loan Options for Seasonal Workers

Several lenders offer specialized personal loans for individuals with irregular income, including seasonal workers, freelancers, and gig workers. Here are some of the best options:

1. HDFC Bank Personal Loan for Self-Employed & Seasonal Workers

🔹 Loan Amount – ₹50,000 to ₹40 lakh 🔹 Interest Rate – 10.75% to 20% per annum 🔹 Tenure – 12 to 60 months 🔹 Eligibility – Minimum ₹1.5 lakh annual income required

✔️ Why Choose HDFC Bank? ✔️ Lower income requirements for self-employed applicants ✔️ Quick loan approval with minimal documentation ✔️ Competitive interest rates for borrowers with a good credit score

2. Fullerton India Personal Loan for Seasonal Workers

🔹 Loan Amount – ₹10,000 to ₹25 lakh 🔹 Interest Rate – 12% to 28% per annum 🔹 Tenure – Up to 60 months 🔹 Eligibility – Proof of income from seasonal work

✔️ Why Choose Fullerton India? ✔️ Tailored loan products for self-employed and irregular earners ✔️ Simple application process with fast disbursal ✔️ No need for extensive paperwork

3. Bajaj Finserv Flexi Personal Loan

🔹 Loan Amount – ₹25,000 to ₹35 lakh 🔹 Interest Rate – 12% onwards 🔹 Tenure – 12 to 60 months 🔹 Eligibility – Minimum ₹1.5 lakh annual income required

✔️ Why Choose Bajaj Finserv? ✔️ Borrow as per need and pay interest only on the used amount ✔️ No need for fixed monthly EMIs ✔️ Ideal for seasonal workers with fluctuating income

Alternative Loan Options for Seasonal Workers

If traditional banks reject a personal loan application, seasonal workers can explore alternative financing options:

1. Gold Loan – Borrow money by pledging gold jewelry or coins.

✔️ No need for income proof or credit history ✔️ Instant loan disbursal ✔️ Lower interest rates compared to personal loans

2. Microfinance Loans – Small loan schemes offered by microfinance institutions (MFIs) for low-income earners.

✔️ Ideal for rural workers, farmers, and small traders ✔️ Lower eligibility criteria and minimal paperwork

3. Peer-to-Peer (P2P) Lending – Online platforms that connect borrowers directly with private lenders.

✔️ Higher approval chances compared to banks ✔️ Flexible repayment terms

4. Secured Personal Loans – Opting for a loan against FD, property, or mutual funds can improve approval chances.

✔️ Easier approval process ✔️ Lower interest rates due to security backing

How to Improve Loan Approval Chances as a Seasonal Worker?

If you are a seasonal worker looking to qualify for a personal loan, follow these tips:

✔️ Maintain a Strong Credit Score – A credit score of 700+ improves approval chances. ✔️ Show Additional Income Sources – Freelance work, side gigs, or passive income sources increase credibility. ✔️ Keep Financial Records Updated – Maintain bank statements, tax returns, or business invoices to prove income stability. ✔️ Apply for a Smaller Loan Amount – A lower loan amount has a higher approval chance. ✔️ Choose NBFCs Over Banks – NBFCs have relaxed eligibility criteria compared to banks. ✔️ Consider a Co-Applicant – Applying with a spouse or family member with a stable income can improve chances.

By following these steps, seasonal workers can improve their eligibility and secure a personal loan on favorable terms.

Final Thoughts: Can Seasonal Workers Get a Personal Loan?

Yes! Seasonal workers can qualify for a personal loan, but they may need to provide alternative income proof, maintain a good credit score, and choose the right lender.

For higher approval chances, seasonal workers should: ✔️ Apply with NBFCs or digital lenders that offer flexible eligibility. ✔️ Provide income documentation from seasonal work, freelancing, or side gigs. ✔️ Consider secured loan options like gold loans or microfinance loans.

By choosing the right loan provider and maintaining good financial habits, seasonal workers can secure a personal loan without difficulties.

For expert advice on personal loans and financing solutions, visit www.fincrif.com and explore the best loan options for seasonal workers!

#personal loan#loan apps#personal loan online#nbfc personal loan#personal loans#loan services#finance#fincrif#bank#personal laon#Personal loan#Personal loan for seasonal workers#Personal loan for self-employed#Loan for gig workers#Instant personal loan#Personal loan eligibility#Best personal loan for irregular income#Unsecured personal loan#Low-income personal loan#NBFC personal loan#Digital lending personal loan#How to get a personal loan with irregular income#Can freelancers qualify for a personal loan?#Best personal loan options for seasonal workers#How do seasonal workers prove income for a personal loan?#Alternative loans for seasonal workers#Best NBFCs for personal loans with no fixed income#Personal loan approval tips for self-employed workers#Gold loan vs. personal loan for seasonal workers

0 notes

Text

Why Self-Employed Individuals Should Explore SETC and FFCRA Benefits

Why Self-Employed Small Business Owners Should Explore SETC and FFCRA Benefits As a self-employed small business owner, gig worker, or 1099 contractor, managing finances can often feel like walking a tightrope. Between fluctuating incomes, rising costs, and complex tax regulations, it’s easy to overlook potential benefits that could significantly ease your financial burden. Among these benefits,…

#1099 contractors#accounting firms#business growth#cash advances#cash flow#eligibility criteria#Families First Coronavirus Response Act#FFCRA#financial benefits#financial management#financial relief#gig workers#IRS regulations#securing loans#Self-Employed#Self-Employed Tax Credit#setc#small business owners#tax credits#tax software

0 notes

Text

#self employed#gig worker financing#gig workers#self employed financing#instant business loans#self employed loan#gig worker loan#instant business financing#instant business funding

0 notes

Text

Brian Barrett at Wired (02.27.2025):

If you’ve felt overwhelmed by all the DOGE news, you’re not alone. You’d need too much cork board and yarn to keep track of which agencies it has occupied by now, much less what it’s doing there. Here’s a simple rubric, though, to help contextualize the DOGE updates you do have time and energy to process: It’s worse than you think. DOGE is hard to keep track of. This is by design; the only information about the group outside of its own mistake-ridden ledger of “savings” comes from media reports. So much for being “maximally transparent,” as Elon Musk has promised. The blurriness is also partly a function of the speed and breadth with which DOGE has operated. Keeping track of the destruction is like counting individual bricks scattered around a demolition site.

You may be aware, for instance, that a 19-year-old who goes by “Big Balls” online plays some role in all this. Seems bad. But you may have missed that Edward Coristine has since been installed at the nation’s top cybersecurity agency. And the State Department and the Small Business Administration. And he has a Department of Homeland Security email address and, by the way, also had a recent side gig selling AI Discord bots to Russians. See? Worse than you think. [...] Similarly, you’ve likely heard that the United States Agency for International Development has been gutted and the Consumer Financial Protection Bureau has been put on ice. All true, all bad. But here’s what that means in practice: Fewer people globally have access to vaccines than they did a month ago. More babies are being born with HIV/AIDS. From here on out, anyone who gets ripped off by payday loan companies—or, say, social media platforms moonlighting as payments services—has lost their most capable defender. Keep going. The thousands of so-called probationary employees DOGE has fired included a significant number of experienced workers who had just been promoted or transferred. National Science Foundation staffing cuts and proposed National Institutes of Health grant limits will combine to kneecap scientific research in the United States for a generation. Terminations at the US Department of Agriculture have sent programs designed to help farmers into disarray. On Wednesday, the Food and Drug Administration canceled a meeting that would have given guidance on this year’s flu vaccine composition. It hasn’t been rescheduled.

Don’t care about science or vaccines? The Social Security Administration is reportedly going to cut its staff in half. The Department of Housing and Urban Development is going to be cut by as much as 84 percent. Hundreds of workers who keep the power grid humming in the Pacific Northwest were fired before a scramble to rehire a few of them. The National Parks Service, the Internal Revenue Service, all hit hard. So don’t make any long-term bets on getting your checks on time, keeping your lights on, buying a home for the first time, or enjoying Yosemite. Don’t assume all the things that work now will still work tomorrow.

Speaking of which, let’s not forget that DOGE has fired people working to prevent bird flu and to safeguard the US nuclear arsenal. (The problem with throwing a chainsaw around is that you don’t make clean cuts.) The agencies in question have reportedly tried to hire those workers back. Fine. But even if they’re able to, the long-term question that hasn’t been answered yet is, Who would stay? Who would work under a regime so cocksure and incompetent that it would mistakenly fire the only handful of people who actually know how to take care of the nukes? According to a recent report from The Bulwark, that brain drain is already underway. And this is all before the real reductions in force begin, mass purges of civil servants that will soon be conducted, it seems, with an assist from DOGE-modified, automated software. The US government is about to lose decades of institutional knowledge across who knows how many agencies, including specialists that aren’t readily replaced by loyalists.

Wired has a solid article on how bad the DOGE-ificiation of government has gotten.

#DOGE#Elon Musk#Edward Coristine#Musk Coup#Trump Administration II#Department of Government Efficency

95 notes

·

View notes

Text

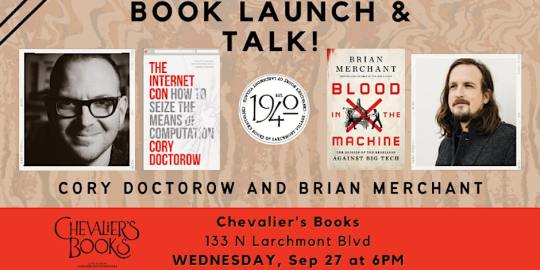

On September 22, I'm (virtually) presenting at the DIG Festival in Modena, Italy. On September 27, I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine.

It's been 21 years since Bill Willingham launched Fables, his 110-issue, wide-ranging, delightful and brilliantly crafted author-owned comic series that imagines that the folkloric figures of the world's fairytales are real people, who live in a secret society whose internal struggles and intersections with the mundane world are the source of endless drama.

Fables is a DC Comics title; DC is division of the massive entertainment conglomerate Warners, which is, in turn, part of the Warner/Discovery empire, a rapacious corporate behemoth whose screenwriters have been on strike for 137 days (and counting). DC is part of a comics duopoly; its rival, Marvel, is a division of the Disney/Fox juggernaut, whose writers are also on strike.

The DC that Willingham bargained with at the turn of the century isn't the DC that he bargains with now. Back then, DC was still subject to a modicum of discipline from competition; its corporate owner's shareholders had not yet acquired today's appetite for meteoric returns on investment of the sort that can only be achieved through wage-theft and price-gouging.

In the years since, DC – like so many other corporations – participated in an orgy of mergers as its sector devoured itself. The collapse of comics into a duopoly owned by studios from an oligopoly had profound implications for the entire sector, from comic shops to comic cons. Monopoly breeds monopoly, and the capture of the entire comics distribution system by a single company – Diamond – was attended by the capture of the entire digital comics market by a single company, Amazon, who enshittified its Comixology division, driving creators and publishers into Kindle Direct Publishing, a gig-work platform that replicates the company's notoriously exploitative labor practices for creative workers. Today, Comixology is a ghost-town, its former employees axed in a mass layoff earlier this year:

https://gizmodo.com/amazon-layoffs-comixology-1850007216

When giant corporations effect these mergers, they do so with a kind of procedural kabuki, insisting that they are dotting every i and crossing every t, creating a new legal entity whose fictional backstory is a perfect, airtight bubble, a canon with not a single continuity bug. This performance of seriousness is belied by the behind-the-scenes chaos that these corporate shifts entail – think of the way that the banks that bought and sold our mortgages in the run-up to the 2008 crisis eventually lost the deeds to our houses, and then just pretended they were legally entitled to collect money from us every month – and steal our houses if we refused to pay:

https://www.reuters.com/article/idINIndia-58325420110720

Or think of the debt collection industry, which maintains a pretense of careful record-keeping as the basis for hounding and threatening people, but which is, in reality, a barely coherent trade in spreadsheets whose claims to our money are matters of faith:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

For usury, the chaos is a feature, not a bug. Their corporate strategists take the position that any ambiguity should be automatically resolved in their favor, with the burden of proof on accused debtors, not the debt collectors. The scumbags who lost your deed and stole your house say that it's up to you to prove that you own it. And since you've just been rendered homeless, you don't even have a house to secure a loan you might use to pay a lawyer to go to court.

It's not solely that the usurers want to cheat you – it's that they can make more money if they don't pay for meticulous record-keeping, and if that means that they sometimes cheat us, that's our problem, not theirs.

While this is very obvious in the usury sector, it's also true of other kinds of massive mergers that create unfathomnably vast conglomerates. The "curse of bigness" is real, but who gets cursed is a matter of power, and big companies have a lot more power.

The chaos, in other words, is a feature and not a bug. It provides cover for contract-violating conduct, up to and including wage-theft. Remember when Disney/Marvel stole money from beloved science fiction giant Alan Dean Foster, whose original Star Wars novelization was hugely influential on George Lucas, who changed the movie to match Foster's ideas?

Disney claimed that when it acquired Lucasfilm, it only acquired its assets, but not its liabilities. That meant that while it continued to hold Foster's license to publish his novel, they were not bound by an obligation to pay Foster for this license, since that liability was retained by the (now defunct) original company:

https://pluralistic.net/2022/04/30/disney-still-must-pay/#pay-the-writer

For Disney, this wage-theft (and many others like it, affecting writers with less fame and clout than Foster) was greatly assisted by the chaos of scale. The chimera of Lucas/Disney had no definitive responsible party who could be dragged into a discussion. The endless corporate shuffling that is normal in giant companies meant that anyone who might credibly called to account for the theft could be transfered or laid off overnight, with no obvious successor. The actual paperwork itself was hard for anyone to lay hands on, since the relevant records had been physically transported and re-stored subsequent to the merger. And, of course, the company itself was so big and powerful that it was hard for Foster and his agent to raise a credible threat.

I've experienced versions of this myself: every book contract I've ever signed stipulated that my ebooks could not be published with DRM. But one of my publishers – a boutique press that published my collection Overclocked – collapsed along with most of its competitors, the same week my book was published (its distributor, Publishers Group West, went bankrupt after its parent company, Advanced Marketing Services, imploded in a shower of fraud and criminality).

The publisher was merged with several others, and then several more, and then several more – until it ended up a division of the Big Five publisher Hachette, who repeatedly, "accidentally" pushed my book into retail channels with DRM. I don't think Hachette deliberately set out to screw me over, but the fact that Hachette is (by far) the most doctrinaire proponent of DRM meant that when the chaos of its agglomerated state resulted in my being cheated, it was a happy accident.

(The Hachette story has a happy ending; I took the book back from them and sold it to Blackstone Publishing, who brought out a new expanded edition to accompany a DRM-free audiobook and ebook):

https://www.blackstonepublishing.com/overclocked-bvej.html

Willingham, too, has been affected by the curse of bigness. The DC he bargained with at the outset of Fables made a raft of binding promises to him: he would have approval over artists and covers and formats for new collections, and he would own the "IP" for the series, meaning the copyrights vested in the scripts, storylines, characters (he might also have retained rights to some trademarks).

But as DC grew, it made mistakes. Willingham's hard-fought, unique deal with the publisher was atypical. A giant publisher realizes its efficiencies through standardized processes. Willingham's books didn't fit into that standard process, and so, repeatedly, the publisher broke its promises to him.

At first, Willingham's contacts at the publisher were contrite when he caught them at this. In his press-release on the matter, Willingham calls them "honest men and women of integrity [who] interpreted the details of that agreement fairly and above-board":

https://billwillingham.substack.com/p/willingham-sends-fables-into-the

But as the company grew larger, these counterparties were replaced by corporate cogs who were ever-more-distant from his original, creator-friendly deal. What's more, DC's treatment of its other creators grew shabbier at each turn (a dear friend who has written for DC for decades is still getting the same page-rate as they got in the early 2000s), so Willingham's deal grew more exceptional as time went by. That meant that when Willingham got the "default" treatment, it was progressively farther from what his contract entitled him to.

The company repeatedly – and conveniently – forgot that Willingham had the final say over the destiny of his books. They illegally sublicensed a game adapted from his books, and then, when he objected, tried to make renegotiating his deal a condition of being properly compensated for this theft. Even after he won that fight, the company tried to cheat him and then cover it up by binding him to a nondisclosure agreement.

This was the culmination of a string of wage-thefts in which the company misreported his royalties and had to be dragged into paying him his due. When the company "practically dared" Willingham to sue ("knowing it would be a long and debilitating process") he snapped.

Rather than fight Warner, Willingham has embarked on what JWZ calls an act of "absolute table-flip badassery" – he has announced that Fables will hereafter be in the public domain, available for anyone to adapt commercially, in works that compete with whatever DC might be offering.

Now, this is huge, and it's also shrewd. It's the kind of thing that will bring lots of attention on Warner's fraudulent dealings with its creative workforce, at a moment where the company is losing a public relations battle to the workers picketing in front of its gates. It constitutes a poison pill that is eminently satisfying to contemplate. It's delicious.

But it's also muddy. Willingham has since clarified that his public domain dedication means that the public can't reproduce the existing comics. That's not surprising; while Willingham doesn't say so, it's vanishingly unlikely that he owns the copyrights to the artwork created by other artists (Willingham is also a talented illustrator, but collaborated with a who's-who of comics greats for Fables). He may or may not have control over trademarks, from the Fables wordmark to any trademark interests in the character designs. He certainly doesn't have control over the trademarked logos for Warner and DC that adorn the books.

When Willingham says he is releasing the "IP" to his comic, he is using the phrase in its commercial sense, not its legal sense. When business people speak of "owning IP," they mean that they believe they have the legal right to control the conduct of their competitors, critics and customers:

https://locusmag.com/2020/09/cory-doctorow-ip/

The problem is that this doesn't correspond to the legal concept of IP, because IP isn't actually a legal concept. While there are plenty of "IP lawyers" and even "IP law firms," there is no "IP law." There are many laws that are lumped together under "IP," including the big three (trademark, copyright and patent), but also a bestiary of obscure cousins and subspecies – trade dress, trade secrecy, service marks, noncompetes, nondisclosues, anticirumvention rights, sui generis "neighboring rights" and so on.

The job of an "IP lawyer" is to pluck individual doctrines from this incoherent scrapheap of laws and regulations and weave them together into a spider's web of tripwires that customers and critics and competitors can't avoid, and which confer upon the lawyer's client the right to sue for anything that displeases them.

When Willingham says he's releasing Fables into the public domain, it's not clear what he's releasing – and what is his to release. In the colloquial, business sense of "IP," saying you're "releasing the IP" means something like, "Feel free to create adaptations from this." But these adaptations probably can't draw too closely on the artwork, or the logos. You can probably make novelizations of the comics. Maybe you can make new comics that use the same scripts but different art. You can probably make sequels to, or spinoffs of, the existing comics, provided you come up with your own character designs.

But it's murky. Very murky. Remember, this all started because Willingham didn't have the resources or patience to tangle with the rabid attack-lawyers Warners keeps kenneled on its Burbank lot. Warners can (and may) release those same lawyers on you, even if you are likely to prevail in court, betting that you – like Willingham – won't have the resources to defend yourself.

The strange reality of "IP" rights is that they can be secured without any affirmative step on your part. Copyrights are conjured into existence the instant that a new creative work is fixed in a tangible medium and endure until the creator's has been dead for 70 years. Common-law trademarks gradually come into definition like an image appearing on photo-paper in a chemical soup, growing in definition every time they are used, even if the mark's creator never files a form with the USPTO.

These IP tripwires proliferate in the shadows, wherever doodles are sketched on napkins, wherever kindergartners apply finger-paint to construction-paper. But for all that they are continuously springing into existence, and enduring for a century or more, they are absurdly hard to give away.

This was the key insight behind the Creative Commons project: that while the internet was full of people saying "no copyright" (or just assuming the things they posted were free for others to use), the law was a universe away from their commonsense assumptions. Creative Commons licenses were painstakingly crafted by an army of international IP lawyers who set out to turn the normal IP task on its head – to create a legal document that assured critics, customers and competitors that the licensor had no means to control their conduct.

20 years on, these licenses are pretty robust. The flaws in earlier versions have been discovered and repaired in subsequent revisions. They have been adapted to multiple countries' legal systems, allowing CC users to mix-and-match works from many territories – animating Polish sprites to tell a story by a Canadian, set to music from the UK.

Willingham could clarify his "public domain" dedication by applying a Creative Commons license to Fables, but which license? That's a thorny question. What Willingham really wants here is a sampling license – a license that allows licensees to take some of the elements of his work, combine them with other parts, and make something new.

But no CC license fits that description. Every CC license applies to whole works. If you want to license the bass-line from your song but not the melody, you have to release the bass-line separately and put a CC license on that. You can't just put a CC license on the song with an asterisked footnote that reads "just the bass, though."

CC had a sampling license: the "Sampling Plus 1.0" license. It was a mess. Licensees couldn't figure out what parts of works they were allowed to use, and licensors couldn't figure out how to coney that. It's been "retired."

https://creativecommons.org/licenses/sampling+/1.0/

So maybe Willingham should create his own bespoke license for Fables. That may be what he has to do, in fact. But boy is that a fraught business. Remember the army of top-notch lawyers who created the CC licenses? They missed a crucial bug in the first three versions of the license, and billions of works have been licensed under those earlier versions. This has enabled a mob of crooked copyleft trolls (like Pixsy) to prey on the unwary, raking in a fortune:

https://doctorow.medium.com/a-bug-in-early-creative-commons-licenses-has-enabled-a-new-breed-of-superpredator-5f6360713299

Making a bug-free license is hard. A failure on Willingham's part to correctly enumerate or convey the limitations of such a license – to list which parts of Fables DC might sue you for using – could result in downstream users having their hard work censored out of existence by legal threats. Indeed, that's the best case scenario – defects in a license could result in downstream users, their collaborators, investors, and distributors being sued for millions of dollars, costing them everything they have, up to and including their homes.

Which isn't to say that this is dead on arrival – far from it! Just that there is work to be done. I can't speak for Creative Commons (it's been more than 20 years since I was their EU Director), but I'm positive that there are copyfighting lawyers out there who'd love to work on a project like this.

I think Willingham is onto something here. After all, Fables is built on the public domain. As Willingham writes in his release: "The current laws are a mishmash of unethical backroom deals to keep trademarks and copyrights in the hands of large corporations, who can largely afford to buy the outcomes they want."

Willingham describes how his participation in the entertainment industry has made him more skeptical of IP, not less. He proposes capping copyright at 20 years, with a single, 10-year extension for works that are sold onto third parties. This would be pretty good industrial policy – almost no works are commercially viable after just 14 years:

https://rufuspollock.com/papers/optimal_copyright.pdf

But there are massive structural barriers to realizing such a policy, the biggest being that the US had tied its own hands by insisting that long copyright terms be required in the trade deals it imposed on other countries, thereby binding itself to these farcically long copyright terms.

But there is another policy lever American creators can and should yank on to partially resolve this: Termination. The 1976 Copyright Act established the right for any creator to "terminate" the "transfer" of any copyrighted work after 30 years, by filing papers with the Copyright Office. This process is unduly onerous, and the Authors Alliance (where I'm a volunteer advisor) has created a tool to simplify it:

https://www.authorsalliance.org/resources/rights-reversion-portal/

Termination is deliberately obscure, but it's incredibly powerful. The copyright scholar Rebecca Giblin has studied this extensively, helping to produce the most complete report on how termination has been used by creators of all types:

https://pluralistic.net/2021/10/04/avoidance-is-evasion/#reverted

Writers, musicians and other artists have used termination to unilaterally cancel the crummy deals they had crammed down their throats 30 years ago and either re-sell their works on better terms or make them available directly to the public. Every George Clinton song, every Sweet Valley High novel, and the early works of Steven King have all be terminated and returned to their creators.

Copyright termination should and could be improved. Giblin and I wrote a whole-ass book about this and related subjects, Chokepoint Capitalism, which not only details the scams that writers like Willingham are subject to, but also devotes fully half its length to presenting detailed, technical, shovel-ready proposals for making life better for creators:

https://chokepointcapitalism.com/

Willingham is doing something important here. Larger and larger entertainment firms offer shabbier and shabbier treatment to creative workers, as striking members of the WGA and SAG-AFTRA can attest. Over the past year, I've seen a sharp increase in the presence of absolutely unconscionable clauses in the contracts I'm offered by publishers:

https://pluralistic.net/2022/06/27/reps-and-warranties/#i-agree

I'm six months into negotiating a contract for a 300 word piece I wrote for a magazine I started contributing to in 1992. At issue is that they insist that I assign film rights and patent rights from my work as a condition of publication. Needless to say, there are no patentable inventions nor film ideas in this article, but they refuse to vary the contract, to the obvious chagrin of the editor who commissioned me.

Why won't they grant a variance? Why, they are so large – the magazine is part of a global conglomerate – that it would be impractical for them to track exceptions to this completely fucking batshit clause. In other words: we can't strike this batshit clause because we decided that from now on, all out contracts will have batshit clauses.

The performance of administrative competence – and the tactical deployment of administrative chaos – among giant entertainment companies is grotesque, but every now and again, it backfires.

That's what's happening at Marvel right now. The estates of Marvel founder Stan Lee and its seminal creator Steve Ditko are suing Marvel to terminate the transfer of both creators' characters to Marvel. If they succeed, Marvel will lose most of its most profitable characters, including Iron Man:

https://www.reuters.com/legal/marvel-artists-estate-ask-pre-trial-wins-superhero-copyright-fight-2023-05-22/

They're following in the trail of the Jack Kirby estate, whom Marvel paid millions to rather than taking their chances with the Supreme Court.

Marvel was always an administrative mess, repeatedly going bankrupt. Its deals with its creators were indifferently papered over, and then Marvel lost a lot of the paperwork. I'd bet anything that many of the key documents Disney (Marvel's owner) needs to prevail over Lee and Ditko are either unlocatable or destroyed – or never existed in the first place.

A more muscular termination right – say, one that kicks in after 20 years, and is automatic – would turn circuses like Marvel-Lee/Ditko into real class struggles. Rather than having the heirs of creators reaping the benefit of termination, we could make termination into a system for getting creators themselves paid.

In the meantime, there's Willingham's "absolute table-flip badassery."

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/15/fairy-use-tales/#sampling-license

Image: Tom Mrazek (modified) https://commons.wikimedia.org/wiki/File:An_Open_Field_%2827220830251%29.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

--

Penguin Random House (modified) https://www.penguinrandomhouse.com/books/707161/fables-20th-anniversary-box-set-by-bill-willingham/

Fair use https://www.eff.org/issues/intellectual-property

#pluralistic#fables#comics#graphic novels#dc#warner#monopoly#publishing#chokepoint capitalism#poison pills#ip#bill willingham#public domain#copyright#copyfight#creative commons#licenses#copyleft trolls

242 notes

·

View notes

Text

Honestly though, it must be so weird to work with some people for a few years of your life and for years, decades, later people are shipping you with your co worker.

I'm obviously all for shipping fictional characters, but this is the actors job. Where they get a paycheck. They are literally being paid to act like found family.

Like imagine you worked in an office with some people for 3 years in 2004-2007 and in 2030 people are making clips of you and how in love you look while eating lunch with Carol or saying hi as you both arrived in the parking lot.

I've seen this in pretty much every fandom I've been in. Star Trek, good omens, X men, Marvel. I do not think RDJ has any emotional attachment to Chris Evens or that Shanter really cared about and enjoyed spending time with Nimoy. I'm positive for David Tennant, Good Omens is just his next job and Michael Sheen only likes it because it made him much more well known in the acting world and it'll be easier to get his next gig. Yes Pine and Quinto look like they are actual friends outside of the movies but that is an exception.

Anyway, just my thoughts since I just saw a post of some Trek actors in I'm assuming the late 80s or 90s and people were saying 'how could he not be bi saying stuff like this'. Money, the answer is always money.

edit: OK let me address some of what is in the comments. Do actors say they are friends, sure, and if you want to take that at face value then you are right, they are friends. I personally don't think it counts if you are being paid to do so. And before anyone says anything, no not directly. But they have a whole 'image' to uphold that their income is tied to.

I don't know much about the entertainment industry and don't know why people would want that life but it's .... well, different, is the nice way to say it. My sister's career is considered part of the entertainment industry though she is behind the scenes. (And, side note, even being behind the scenes I've still found photoshopped images someone made of her in her in sexy lingerie ... )

TBF we don't talk that often but I've heard some stories (apparently Bill Nye is more then a bit of a jerk behind closed doors) She's lived in Hollywood 12 years now and there is the face people put out in the public and who they truly are. Yes, we all have a self that we hide (I'm autistic so I know all about masking) but it seems that is pushed to extremes.

I've seen her act like many people's best friends (house parties and giving favors and gifts that I question) and promoting their good name in public then she'll tell me in private some horrible things that person has done to others and how it's just how it works. She house/cat sat for a guy (and sent me views from his balcony, my god it was nice) who I think a lot of people would recognize from TV but their relationship was built on respect for each other careers.

Sure, you can tell me not to base the examples off my sisters stories and, ok fair. But I'd also want to point out - the part of RDJ buying evens a car, I did some math. He has 300 million net worth according to google. I have a salary, not net worth (or a negative one cause of student loans I guess), but it is the equivalent of me buying my co worker a $32 gift assuming the car was 150k. I met a guy who performed in Vegas shows and told me how they've had dinner with (I honestly don't remember if it was Penn or Teller) at their house with their spouses. And private chats ... doesn't really tell me much.

I'm currently seeing a bunch of clips of the main actors for the new Wicked movie saying how each other changed each others lives and it just comes off as more acting to promote the movie to me.

And even with Pine and Quinto , I only gave that one a pass because they said knew each other and got along before being in Trek and even then, eh..

Again, just how I interpret things. I know friend can mean different things to different people and a lot of what I see I don't interpret as friend, I see it as networking. I would absolutely be 'friends' with someone if it helped me make and maintain my multi millions .

#star trek#spirk#stony#ineffable husbands#good omens#robert downey jr#chris pine#chris evans#william shatner#leonard nimoy#michael sheen#david tennant#star trek aos#anthony j crowley#aziracrow#aziraphale#the avengers#marvel cinematic universe#marvel mcu

22 notes

·

View notes

Text

[aging userbase alert]

i got my W-2 today & i was like 'yaaay i will file my taxes while i am thinking of it, i now live in a direct file state! it will be easy & not involve handing my information over to some third-party company that might have terrible data handling practices,' because i like to file taxes as early as possible a) so i do not have time to misplace my W-2 and b) because my employer withheld tax for me, so i have functionally been giving the government a free loan & can i just say i do NOT like what uncle sam has been doing with that money, give it back you fucker!!! unfortunately you cannot direct file in my state if you contributed to an IRA (i know this sounds bougie but it is a very common & widely encouraged form of retirement savings, even if you've only got a little bit to sock away), or if you have cash tips, or if you worked as an independent contractor (so, like, gig work; the only 1099 it can handle is a 1099-INT, for interest on bank deposits).

& i hate that! i hate that a lot. the IRA thing is annoying for me but the part where it can't handle cash tips or independent contractor income is actually really bad in my opinion because this excludes a pretty big number of lower income american workers, who are more likely to be taken advantage of by tax preparation companies that will not protect their data & will often attempt to shunt them into confusing paid filing options. or they end up going with scummy irl tax preparers, who make a killing on low income people's tax returns! the IRS desperately wants everyone to e-file because it is much faster & more efficient & in many ways less error-prone, but the free file program has enriched tax preparation companies at the expense of american workers who were underserved & misled, and now direct file leaves out a bunch of basic stuff & excludes people who need it. if you want to e-file for free, supposing you cannot direct file (if you are reading my tumblr blog & need to file taxes in the united states i am sure you fall beneath the income threshold for the free file program), you must go to the IRS's page of free file partners, then shop around to find one that can handle your tax situation & hopefully doesn't have too terrible a track record with customer data. it's stupid & i'm mad about it! there should not be a united states & there absolutely should not be any government of human persons which comports itself with such ridiculous stupidity

8 notes

·

View notes

Text

If you’ve felt overwhelmed by all the DOGE news, you’re not alone. You’d need too much cork board and yarn to keep track of which agencies it has occupied by now, much less what it’s doing there. Here’s a simple rubric, though, to help contextualize the DOGE updates you do have time and energy to process: It’s worse than you think.

DOGE is hard to keep track of. This is by design; the only information about the group outside of its own mistake-ridden ledger of “savings” comes from media reports. So much for being “maximally transparent,” as Elon Musk has promised. The blurriness is also partly a function of the speed and breadth with which DOGE has operated. Keeping track of the destruction is like counting individual bricks scattered around a demolition site.

You may be aware, for instance, that a 19-year-old who goes by “Big Balls” online plays some role in all this. Seems bad. But you may have missed that Edward Coristine has since been installed at the nation’s top cybersecurity agency. And the State Department and the Small Business Administration. And he has a Department of Homeland Security email address and, by the way, also had a recent side gig selling AI Discord bots to Russians. See? Worse than you think.

Even if that feels like old news, remember that it’s actually still happening, every day a fresh incursion by Big Balls and his cohort of twentysomething technologists. (In fairness, they’re not all young; some of them are old enough to present conflicts of interest so flagrant that they literally lack modern precedent.)

Similarly, you’ve likely heard that the United States Agency for International Development has been gutted and the Consumer Financial Protection Bureau has been put on ice. All true, all bad. But here’s what that means in practice: Fewer people globally have access to vaccines than they did a month ago. More babies are being born with HIV/AIDS. From here on out, anyone who gets ripped off by payday loan companies—or, say, social media platforms moonlighting as payments services—has lost their most capable defender.

Keep going. The thousands of so-called probationary employees DOGE has fired included a significant number of experienced workers who had just been promoted or transferred. National Science Foundation staffing cuts and proposed National Institutes of Health grant limits will combine to kneecap scientific research in the United States for a generation. Terminations at the US Department of Agriculture have sent programs designed to help farmers into disarray. On Wednesday, the Food and Drug Administration canceled a meeting that would have given guidance on this year’s flu vaccine composition. It hasn’t been rescheduled.

Don’t care about science or vaccines? The Social Security Administration is reportedly going to cut its staff in half. The Department of Housing and Urban Development is going to be cut by as much as 84 percent. Hundreds of workers who keep the power grid humming in the Pacific Northwest were fired before a scramble to rehire a few of them. The National Parks Service, the Internal Revenue Service, all hit hard. So don’t make any long-term bets on getting your checks on time, keeping your lights on, buying a home for the first time, or enjoying Yosemite. Don’t assume all the things that work now will still work tomorrow.

Speaking of which, let’s not forget that DOGE has fired people working to prevent bird flu and to safeguard the US nuclear arsenal. (The problem with throwing a chainsaw around is that you don’t make clean cuts.) The agencies in question have reportedly tried to hire those workers back. Fine. But even if they’re able to, the long-term question that hasn’t been answered yet is, Who would stay? Who would work under a regime so cocksure and incompetent that it would mistakenly fire the only handful of people who actually know how to take care of the nukes? According to a recent report from The Bulwark, that brain drain is already underway.

And this is all before the real reductions in force begin, mass purges of civil servants that will soon be conducted, it seems, with an assist from DOGE-modified, automated software. The US government is about to lose decades of institutional knowledge across who knows how many agencies, including specialists that aren’t readily replaced by loyalists.

Elon Musk has, at least, acknowledged that DOGE will make mistakes, and promised fast fixes. He even called one out specifically Wednesday, the cancelation of a USAID program designed to prevent the spread of Ebola. “We restored the Ebola prevention immediately,” he said during an appearance at Trump’s first cabinet meeting. “And there was no interruption.”

This is not the case, as The Washington Post first reported. Not only has Ebola prevention not been restored—it was and remains severely diminished—but the Trump administration also said Wednesday it would terminate nearly 10,000 contracts and grants from USAID and the State Department. Many of those contracts represent an attempt to lessen some form of suffering in some part of the world. It’s too many individual stories to tell, too many tragedies unfolding too far away.

It’s worse than you think in the same way that your brain breaks a little when you try to picture how deep the ocean is. It’s worse than you think because by the time the courts catch up the damage will already have been done. It’s worse than you think because the people running the government seem to have no higher mission than to watch it burn.

Federal agencies could absolutely be more efficient, but we’re long past the point where efficiency is a plausible goal. DOGE’s cuts have no apparent regard for civil society or opportunity costs or long-term strategic thinking. Their targets are Elon Musk’s and Project 2025’s targets. They have found no fraud, just democracy at work. They’re apparently eager to see what happens when it no longer does.

It’s worse than you think because so far all DOGE has done is drop a boulder into the middle of a pond. If you think this is bad, wait for the ripples.

6 notes

·

View notes

Text

Mobile platform services like Grab and Food Panda employ over 400,000 workers, according to research think tank Fairwork Philippines. These workers form the platform economy, a growing subset meant to describe those employed by delivery, ride-sharing, and other service applications.

Dr. Cheryl Ruth Soriano, principal investigator for Fairwork Philippines, stated that financial insecurity manifests through disproportionately long hours making minimum wage, the lack of provisions for added fuel cost due to infrastructure problems, and a lack of regulatory standards across payment methods, among others.

[...] Soriano noted that in many cases, workers took out loans to use as initial capital, usually to purchase motorcycles, fuel, shoulder maintenance costs, and so on.

However, low wages and irregular hours fail to offset these initial costs. Added costs such as processing fees and other charges made by the mobile platform service also serve to further shrink workers’ take-home pay.

In some cases, platform workers have to contend with ‘quota insurance’ schemes which stipulate that riders must first reach a minimum number of delivery orders serviced before being entitled to insurance benefits. Most delivery service platforms also mandate that the platform worker can only claim insurance if they were injured while on delivery.

Legally, platform workers are offered very little protection, noted Fairwork legal consultant Atty Jayvy Gamboa. Platform workers are considered as ‘partners’, or ‘independent contractors,’ or ‘third-party service providers,’ which leads to workers losing out on legally-mandated benefits.

According to the IBON Foundation, some 20.8 million Filipinos, or 42 percent of the total workforce, engage in outright informal work. If irregular workers in private establishments are also included, the total number can reach as much as 35 million, or 70 percent of the total workforce.

The rise of informal work, including work from mobile platform services, is indicative of a worsening problem with the labor market, says IBON. “The dirty little secret is that jobs are really of lower and lower quality and being reported as ‘employed’ means less and less in terms of livelihoods,” the research group said.

According to the National Union of Food Delivery Riders (RIDERS), organizing platform workers are still faced with challenges, ranging from union busting to legal loopholes. “We can say that we’re now on the radar of workers, the government, and platform companies,” said RIDERS National Coordinator Geoffrey Labudahon. “But we still face problems in organizing.”

2024 Nov. 20

2 notes

·

View notes

Text

on today's edition of "Is it a disability or just me?" we have my utter refusal to use any form of autopay whatsoever. one would think that as a person who hates numbers, i'd jump at the chance to not have to think about finances, but That's The Problem. i already struggle with the reality of money, and use paper billing to convince my extremely stubborn brain that yes, because there is a paper in my hand that says i owe someone X amount of That Stuff That Seems Fake, i do in fact owe that person X amount of That Stuff That Seems Fake. if companies can just take The Fake Stuff out of my account without my acknowledgement, at some point, as a gig worker, there will come a time at which The Fake Stuff that they want isn't in the account. and i will be completely confused about the entire situation, since the documentation about where The Fake Stuff might have gone won't be physical, but somewhere In The Air.

i literally cannot mentally do this. i feel like people think i'm overreacting when i vehemently refuse to be put on autopay, but i know my brain. i won't process the issue well or fast enough, and i will be totally screwed. the one solitary bill that is entirely online is CONSTANTLY late because it simply falls out of my brain until i look at my ignored phone reminders and my calendar tells me it was due the week before. that bill isn't too pressing, but communication bills, student loans, and rent are. i need the tactile sensation of acknowledging the bill, writing a check, and sending it where it needs to go in order to process the reality of a concept that otherwise totally escapes me.

so i dunno. i am probably the only Xennial that still writes checks, but trust me, it's not for the nostalgia or to be vintage or trendy or what the fuck ever. i literally need to pay my bills on time and this is how i get my stupid ass brain to do it.

#autopay#dyscalculia#irl#autism#executive dysfunction#not to mention the wonderful tag team of depression and anxiety#which means i'm constantly wound up over shit like this but too drained to Actually Do Anything Useful#as used to my brain as i have become#sometimes i wish the bitch would Just Fucking Work

26 notes

·

View notes

Text

Also: The US works hard to blur the line between social classes and economic classes.

A hundred years ago, they were almost entirely overlapping. Now ,they're very much not. There are people with "working class" jobs and communities and upper-middle-class incomes, because electricians and plumbers continue to be in demand at whatever rates the wealthy can afford to pay, while office workers with a master's degree and a mortgage may be looking for gig work on the weekends to cover their living expenses.

(A mortgage often doesn't cost more than rent... it just requires a larger up-front payment, plus "financial security" to get the loan. Middle & upper class people have the connections and background to get that, where many working class people don't, regardless of income.)

Middle class income is supposed to be:

Your day-to-day living expenses are covered. You are not worried about when your next paycheck arrives; as long as it's on time, you don't have to fret over expenses that come at the beginning or middle of the month

This includes rent/mortgage, health care, transportation, food, and KIDS

You have money for leisure - both to buy things (game console, hobby equipment like skis or a surfboard) and time & money to go on vacation to use those things

You can throw a reasonable amount into savings for the future and not worry about that money not being available now

You can absorb an unexpected expense of a few hundred dollars without blinking, and a few thousand with only minor adjustments to your annual spending. You can replace tires on the car, fix a broken window in the house, get rid of the Corelle plates you recently discovered contain lead, get a new tv set because the old one's screen died, replace the couch that broke when the kids decided to play "the floor is lava" once too often.

None of those expenses cause you stress. You don't like them; they may not be comfortable; but you're not worried about how you're going to afford them.

These are not the center of a middle class income. These are the lower-end, bare-minimum qualifications. Comfortable middle-class income includes home ownership, 1 car per adult in the household, and ability to afford an overseas vacation once a year. Maybe twice a year, if you have friends/relatives to stay with instead of hotels.

Of course, nobody wants to think of themselves as "lower class," so the media latched on to the term "working class" for "the people who don't have enough money to qualify for middle class." This is something of a misnomer; "the working class" includes a hell of a lot of students and only partially employed people.

It also implies a category below working/lower class, which is called "poverty." And nobody agrees on where the lines for that are. (There are some government numbers. It's been pointed out that they are far, far below where actually poverty is - that there is nowhere in the US where you can pay rent on a 1 bedroom apartment on minimum wage, and any sensible person would call "Cannot afford a 1-bedroom apartment despite having a full-time job" a form of poverty.)

Capitalism has worked very hard to convince students who have four roommates sharing a 2-bedroom apartment that they're part of the middle class.

Ive noticed recently that my generation has... no concept of what the various economic classes actually are anymore. I talk to my friends and they genuinely say things like "at least i can afford a middle class lifestyle with this job because i dont need a roommate for my one bedroom apartment" and its like... oughh

You guys, middle class doesnt mean "a stable enough rented roof over your head," it means "a house you bought, a nice car or two, the ability to support a family, and take days off and vacations every year with income to spare for retirement savings and rainy days." If all you have is a rented apartment without a roommate and a used car, you're lower class. That's lower class.

And i cant help but wonder if this is why you get kids on tumblr lumping in doctors and actors into their "eat the rich" rhetoric: economic amnesia has blinded you to what the class divides actually are. The real middle class lifestyle has become so unattainable within a system that relies upon its existence that theyve convinced you that those who can still reach it are the elites while your extreme couponing to afford your groceries is the new normal.

112K notes

·

View notes

Text

Do Personal Loan Eligibility Criteria Vary for Different Professions?

Introduction

A personal loan is one of the most flexible financial tools available for individuals seeking quick access to funds for medical emergencies, education, travel, home renovation, or debt consolidation. Since personal loans are unsecured, lenders evaluate applicants based on their creditworthiness, income stability, and employment type.

But do personal loan eligibility criteria vary based on one’s profession? The answer is yes. Banks and NBFCs (Non-Banking Financial Companies) categorize applicants into different professional groups, including salaried employees, self-employed individuals, freelancers, business owners, and professionals like doctors and lawyers. Each category has unique eligibility requirements, as income stability and financial risk differ across professions.

This article explores how personal loan eligibility criteria vary for different professions, the documents required, and tips to improve approval chances.

1. Why Does Profession Matter for Personal Loan Eligibility?

Lenders assess personal loan applicants based on the stability of income and financial risk associated with their profession.

Key Factors That Influence Loan Approval Based on Profession:

✔️ Income Stability – Salaried employees have a fixed monthly income, whereas freelancers and business owners have fluctuating earnings. ✔️ Repayment Capacity – Professionals with higher, stable incomes are considered low-risk borrowers. ✔️ Credit Score & History – A high CIBIL score (750 or above) improves approval chances. ✔️ Loan Amount & Interest Rates – Doctors, government employees, and corporate professionals often get lower interest rates than self-employed individuals. ✔️ Employment Type – Permanent employees have an advantage over contract workers or gig workers.

💡 Tip: Understanding how lenders evaluate different professions can help you prepare your loan application better.

2. Personal Loan Eligibility for Different Professions

2.1 Personal Loan for Salaried Employees

Salaried employees working in private companies, MNCs, and government organizations have higher chances of loan approval due to stable monthly salaries.

✔️ Minimum Income Requirement: ₹15,000 – ₹30,000 per month (varies by lender). ✔️ Minimum Work Experience: 6 months to 2 years in the current job. ✔️ Employment Type: Permanent employees are preferred over contract workers. ✔️ Debt-to-Income Ratio: Monthly EMI payments should not exceed 40–50% of income. ✔️ Required Documents: Salary slips, bank statements (last 6-12 months), Form 16, and employer’s letter.

💡 Tip: Employees of top-rated companies and government organizations enjoy lower interest rates and higher loan amounts.

2.2 Personal Loan for Self-Employed Individuals & Business Owners

Self-employed individuals and business owners do not have fixed monthly salaries, making their loan approval process stricter.

✔️ Minimum Business Stability: At least 2-3 years of business operations. ✔️ Minimum Annual Income: ₹2–3 lakh per year (varies by lender). ✔️ Credit Score Requirement: 750+ for easy approval. ✔️ Required Documents: Income Tax Returns (ITR for last 2-3 years), profit & loss statements, business registration certificate, and bank statements.

💡 Tip: Lenders assess bank transactions, GST returns, and business profitability before approving a personal loan.

2.3 Personal Loan for Freelancers & Gig Workers

Freelancers and gig workers, such as content writers, designers, and IT consultants, face challenges in proving income stability due to irregular payments from multiple clients.

✔️ Minimum Work Experience: 2+ years of continuous freelance work. ✔️ Income Proof: Invoices, client contracts, and payment receipts. ✔️ Bank Statement Requirement: Last 6-12 months of transactions showing consistent deposits. ✔️ Credit Score Requirement: 750+ preferred for better loan terms.

💡 Tip: Maintain regular deposits in a single bank account to strengthen your personal loan application.

2.4 Personal Loan for Government Employees

Government employees enjoy preferential interest rates, higher loan amounts, and flexible repayment options due to job security and fixed income.

✔️ Minimum Salary Requirement: ₹20,000 per month. ✔️ Employment Type: Central or state government employees, PSU employees, defense personnel. ✔️ Loan Tenure: Longer repayment periods up to 7 years. ✔️ Required Documents: Government ID proof, salary slips, Form 16, and bank statements.

💡 Tip: Government employees can negotiate better loan terms, as banks view them as low-risk borrowers.

2.5 Personal Loan for Doctors, Lawyers, and Chartered Accountants (CAs)

Professionals like doctors, lawyers, and CAs have high earning potential and stable incomes, making them preferred borrowers for personal loans.

✔️ Minimum Practice Experience: 1–3 years. ✔️ Loan Amount: Higher loan amounts up to ₹50 lakh based on income. ✔️ Interest Rates: Lower than standard personal loan rates. ✔️ Required Documents: Professional degree certificate, ITR, business registration (if applicable), and bank statements.

💡 Tip: Some banks offer special personal loan schemes for professionals with relaxed eligibility criteria.

3. How to Improve Your Personal Loan Eligibility Based on Your Profession?

Regardless of your profession, you can increase your chances of personal loan approval by following these strategies:

3.1 Maintain a High Credit Score

✔️ Keep your CIBIL score above 750 for better interest rates. ✔️ Pay EMIs and credit card bills on time. ✔️ Avoid multiple loan applications in a short period.

3.2 Show Consistent Income Flow

✔️ Salaried employees should maintain stable salary credits in their bank accounts. ✔️ Self-employed individuals and freelancers should ensure regular bank deposits from clients.

3.3 Keep a Low Debt-to-Income Ratio

✔️ Your total monthly loan payments should not exceed 40–50% of your monthly income.

3.4 Submit Complete Financial Documents

✔️ Ensure all documents, including bank statements, tax returns, and business records, are accurate and up-to-date.

3.5 Apply with a Co-Applicant (If Needed)

✔️ If your income is unstable, adding a salaried co-applicant increases approval chances.

4. Common Mistakes to Avoid When Applying for a Personal Loan

🚫 Not Checking Your Credit Score – A low score reduces approval chances. 🚫 Providing Incomplete or Incorrect Documents – Leads to loan rejection or delays. 🚫 Applying for a Higher Loan Amount Than Needed – Increases financial burden. 🚫 Ignoring Hidden Charges – Check for processing fees, late payment penalties, and prepayment charges.

💡 Tip: Always compare lenders before applying to find the best interest rates and repayment terms.

Final Thoughts: Does Your Profession Impact Personal Loan Eligibility?

Yes! Personal loan eligibility criteria vary for different professions based on income stability, employment type, and financial risk. Salaried employees have an advantage due to fixed incomes, while self-employed individuals and freelancers must provide alternative income proof.

Key Takeaways:

✔️ Salaried professionals, government employees, and doctors get better loan terms. ✔️ Freelancers, gig workers, and self-employed individuals must show consistent income through bank statements and tax returns. ✔️ A high credit score (750+) improves approval chances for all professions. ✔️ Comparing multiple lenders helps secure better interest rates and flexible repayment options.

By preparing in advance and ensuring proper financial documentation, you can successfully secure a personal loan tailored to your profession.

For expert financial advice and the best personal loan offers, visit www.fincrif.com today!

#personal loan#loan apps#fincrif#personal loan online#personal loans#nbfc personal loan#finance#bank#loan services#personal laon#Personal loan#Personal loan eligibility criteria#Loan eligibility based on profession#Personal loan for salaried employees#Personal loan for self-employed individuals#Best personal loan options for freelancers#Loan approval for business owners#Loan eligibility for government employees#Loan interest rates for professionals#How to qualify for a personal loan based on profession#Personal loan documents required for different professions#Do banks have different personal loan criteria for salaried and self-employed?#Best personal loans for freelancers and gig workers#What is the personal loan eligibility for doctors and lawyers?#Personal loan approval process for business owners in India#How does profession impact personal loan interest rates?#Personal loan for contract employees vs permanent employees#Personal loan eligibility for government employees vs private employees#How to improve personal loan approval chances based on your profession?#Best banks for personal loans for self-employed professionals

0 notes

Text

Cash Advances and Loans for Gig Workers No Credit Check

Overcoming Financial Challenges: A Comprehensive Guide to Securing Loans and Cash Advances for Gig Workers and Self-Employed Individuals Introduction The gig economy has revolutionized the way we work, offering flexibility and autonomy to pursue our passions and entrepreneurial dreams. However, gig workers and self-employed individuals often face unique challenges when seeking financial…

View On WordPress

#1099 contractors#alternative funding options#bank brezzy#BankBreezy#Breezy ConnectCash#business lines of credit#cash advances#cash flow management#co-signed loans#credit unions#direct deposits#emergency funds#employee retention tax credits#financial challenges#financial planning#financial solutions#freelance job marketplaces#gig economy platforms#gig workers#government-backed loans#invoice factoring#invoice financing#loans#no credit check loans#online lending platforms#point-of-sale loans#SBA loans#secured credit cards#Self-Employed#Self-Employed Tax Credit

1 note

·

View note

Text

5 things to know about Technology-Related Budget 2025 Announcements

Finance minister nirmala sitharaman on saturday announced several new measures and schemes as part of the union budget 2025. The second budget of the NDA Government’s Third Term will expect To government schools, and take efforts to boost manufacturing of solar cells, grid-scale batteries, and other products. The Budget will also provide insurance coverage for near 1 Crore Gig Workers, While Loan…

View On WordPress

0 notes

Text

[ad_1] The Union Budget 2025-26 has made bold moves in reshaping India’s insurance sector and income tax regime, ensuring broader financial inclusion, economic growth, and relief for individuals and businesses alike. With an ambitious push towards ‘Insurance for All by 2047’, the government is not just tweaking policies but laying the foundation for a stronger, more resilient financial ecosystem. Sanjiv Bajaj, Jt. Chairman & MD, BajajCapital Here’s a deep dive into the biggest takeaways from the budget—and why they matter to you. Insurance Sector Reforms: A Giant Leap Toward Inclusion For years, India’s insurance penetration has lagged behind global standards. This year’s budget takes a transformative approach to change that, especially in rural areas and microinsurance markets. 1. Bigger Foreign Investments in Insurance: The government has increased the Foreign Direct Investment (FDI) limit in the insurance sector from 74% to 100%, ensuring greater capital inflow, innovation, and competitive pricing in the industry. This move is expected to attract billions in foreign investment, strengthening the Indian insurance market. 2. Massive Tax Benefits for Micro & Rural Insurance: To make insurance more affordable and accessible, the budget introduces tax exemptions and GST cuts: 100% Tax Deduction on premium income for insurers offering microinsurance (Rs. 2 lakh cover or below) in rural areas GST Slashed to 0% for small-ticket life, health, and general insurance policies in rural regions (previously 18%) Higher Tax Deductions for Rural Policyholders: Additional Rs. 50,000 deduction under Section 80C for policyholders in rural areas Rs. 25,000 extra deduction under Section 80D for health insurance 3. Direct Government Subsidies to Reduce Premiums: The government is taking bold steps to financially support policyholders: Viability Gap Funding (VGF): Government will cover 30-50% of premium costs for life, health, and crop insurance Interest-Free Loans: Insurers expanding to rural India can avail 0% interest loans Premium Support for New Policyholders: First-time microinsurance buyers will receive Rs. 1,500 as a government subsidy per policy 4. Revamped & New Government Insurance Schemes: Major insurance programs have expanded their coverage: PM Jeevan Jyoti Bima Yojana (PMJJBY) & PM Suraksha Bima Yojana (PMSBY): Premium slashed by 20% for Below Poverty Line (BPL) families Coverage increased from Rs. 2 lakh to Rs. 3 lakh Kisan Suraksha Bima Yojana (NEW): Life & health insurance for farmers at subsidized rates Crop Insurance Expansion (PMFBY): 60% premium subsidy for small & marginal farmers, now covering post-harvest losses due to climate change 5. Digital & Distribution Boost for Rural Insurance: Technology is being leveraged to bridge the insurance gap: ‘One-Stop Digital Insurance Platform’ for easy access & claim processing Common Service Centers (CSCs) to serve as rural insurance enrollment hubs Higher Commission for Rural Insurance Agents (30% increase) to drive deeper market penetration 6. Special Focus on Women & Gig Workers Mahatma Gandhi Women Insurance Scheme: Rs. 5 lakh life & health cover for self-help group (SHG) members Interest-Free Microloans for women buying insurance Gig Workers’ Insurance: Delivery agents, drivers, and farm laborers to receive government-backed accident & life insurance The Expected Impact Insurance penetration to rise from 25% to 50% in rural India by 2030 Lower insurance costs for individuals, farmers, and small businesses Stronger financial security against health, accident, and livelihood risks Income Tax Reforms: More Money In Your Pocket This

year’s budget puts more cash in the hands of individuals and businesses, simplifying the tax system while offering major relief to the middle class and MSMEs. 1. Revised Tax Slabs: Lower Rates for Higher Savings The government has slashed tax rates, offering much-needed relief to taxpayers. Income Range (Rs.) Old Tax Rate New Tax Rate (2025-26) 0 – 3 lakh Nil Nil 3 – 7 lakh 5% 5% (with rebate u/s 87A) 7 – 10 lakh 10% 10% 10 – 15 lakh 15% 12.5% (reduced) 15 – 20 lakh 20% 18% (reduced) Above 20 lakh 30% 25% (reduced) Effectively, income up to Rs. 7 lakh remains tax-free under the new tax regime. Middle-class earners will save significantly with these rate cuts. 2. Standard Deduction & Tax Rebates Increased Standard Deduction for Salaried Individuals increased to Rs. 60,000 (was Rs. 50,000) Rebate u/s 87A increased to Rs. 7 lakh (was Rs. 5 lakh) 3. Relief for Home Buyers & Renters 4. Major Benefits for Startups & MSMEs 5. Digital Taxation & Compliance Made Easier No penalties on minor GST filing errors for small businesses Tax Refund Processing within 15 days for online IT returns Faceless Tax Assessment further simplified The Big Picture: Why This Budget is a Game Changer This year’s budget is not just about policy changes—it’s about empowering millions of Indians. Lower tax burden means more disposable income for individuals Affordable insurance ensures financial protection for rural India MSMEs & startups get major tax relief, fueling entrepreneurship Simplified tax processes make compliance easier for businesses This is not just a budget—it’s a blueprint for a financially stronger, more inclusive India. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

Rent control works

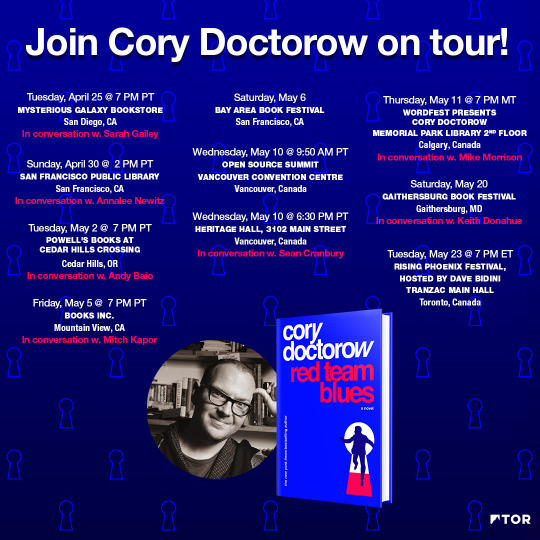

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

David Roth memorably described the job of neoliberal economists as finding “new ways to say ‘actually, your boss is right.’” Not just your boss: for decades, economists have formed a bulwark against seemingly obvious responses to the most painful parts of our daily lives, from wages to education to health to shelter:

https://popula.com/2023/04/30/yakkin-about-chatgpt-with-david-roth/

How can we solve the student debt crisis? Well, we could cancel student debt and regulate the price of education, either directly or through free state college.

How can we solve America’s heath-debt crisis? We could cancel health debt and create Medicare For All.

How can we solve America’s homelessness crisis? We could build houses and let homeless people live in them.

How can we solve America’s wage-stagnation crisis? We could raise the minimum wage and/or create a federal jobs guarantee.

How can we solve America’s workplace abuse crisis? We could allow workers to unionize.

How can we solve America’s price-gouging greedflation crisis? With price controls and/or windfall taxes.

How can we solve America’s inequality crisis? We could tax billionaires.

How can we solve America’s monopoly crisis? We could break up monopolies.

How can we solve America’s traffic crisis? We could build public transit.

How can we solve America’s carbon crisis? We can regulate carbon emissions.

These answers make sense to everyone except neoliberal economists and people in their thrall. Rather than doing the thing we want, neoliberal economists insist we must unleash “markets” to solve the problems, by “creating incentives.” That may sound like a recipe for a small state, but in practice, “creating incentives” often involves building huge bureaucracies to “keep the incentives aligned” (that is, to prevent private firms from ripping off public agencies).

This is how we get “solutions” that fail catastrophically, like:

Public Service Loan Forgiveness instead of debt cancellation and free college:

https://studentloansherpa.com/likely-ineligible/

The gig economy instead of unions and minimum wages:

https://www.newswise.com/articles/research-reveals-majority-of-gig-economy-workers-are-earning-below-minimum-wage

Interest rate hikes instead of price caps and windfall taxes:

https://www.npr.org/2023/05/03/1173371788/the-fed-raises-interest-rates-again-in-what-could-be-its-final-attack-on-inflati

Tax breaks for billionaire philanthropists instead of taxing billionaires:

https://memex.craphound.com/2018/11/10/winners-take-all-modern-philanthropy-means-that-giving-some-away-is-more-important-than-how-you-got-it/

Subsidizing Uber instead of building mass transit:

https://prospect.org/infrastructure/cities-turn-uber-instead-buses-trains/

Fraud-riddled carbon trading instead of emissions limits:

https://pluralistic.net/2022/05/27/voluntary-carbon-market/#trust-me

As infuriating as all of this “actually, your boss is right” nonsense is, the most immediate and continuously frustrating aspect of it is the housing crisis, which has engulfed cities all over the world, to the detriment of nearly everyone.