#financialsuccess.

Explore tagged Tumblr posts

Link

The topics we address in our courses that are exceptionally designed and open the door to a world full of knowledge that traditional institutions fail to offer.

Take advantage of interactive lessons thoughtfully designed for your child

Transform Your Whole Personality with Learnenlight's

With LearnEnlight's Holistic Personal Development Course, set off on a transformational personal development adventure. Every facet of your development, from self-discovery and emotional intelligence to physical health and a growth mindset, will be supported by our programme. This course is the key to reaching your full potential and developing into a self-assured, well-rounded person.

0 notes

Text

How to Invest Your Money: A 7-Step Investment Plan

Investing your money is a smart way to grow your wealth and achieve financial freedom. However, without a clear plan in place, navigating the world of investments can be overwhelming. That's why we've created a step-by-step investment plan that will help you confidently on How to Invest and also to make good investment decisions. Whether you're a beginner or looking to enhance your investment strategy, this guide is for you. So let's dive in and learn how to invest your money effectively.

Step 1: Define your financial goals

To begin your investment journey, it is crucial to clearly define your financial goals. Consider both short-term and long-term objectives, such as saving for a down payment on a house, funding your child's education, or planning for retirement. By setting specific and measurable goals, you can align your investment strategy accordingly. Additionally, understanding your risk tolerance and investment horizon are vital factors in creating a successful investment plan. Risk tolerance refers to your comfort level with potential fluctuations in the value of your investments, while investment horizon refers to the length of time you can keep your money invested. Assessing both these aspects allows you to select appropriate investment options that are in line with your comfort levels and time frame. Lastly, before diving into investing, it's important to establish a solid foundation. Pay off high-interest debts, such as credit card balances or personal loans, which can hinder your financial progress. Building an emergency fund is equally important, as it acts as a safety net to cover unexpected expenses. By addressing these financial priorities first, you can confidently move forward with your investment plan.

Step 2: Educate yourself about investment options

Before making any investment decisions, it is essential to educate yourself about the various investment options available to you. Research different avenues such as stocks, bonds, mutual funds, real estate, and more. Each investment option carries its own set of risks and potential returns, so understanding them thoroughly is crucial. Learning about investment options can be done through various means. Read books, attend seminars or webinars, follow reputable financial blogs, and subscribe to financial newsletters. Additionally, consider seeking advice from a financial advisor or investment professional who can guide you in selecting the most suitable investment options based on your financial goals and risk tolerance. While educating yourself, be sure to assess the risks associated with each investment option. A basic understanding of factors such as volatility, historical performance, market trends, and economic indicators can help you make informed investment decisions. The more knowledge you acquire, the better equipped you will be to develop a well-rounded investment plan.

Step 3: Create a diversified investment portfolio

One of the fundamental principles of successful investing is diversification. Diversifying your investment portfolio involves spreading your investments across various asset classes, reducing the potential risk associated with any single investment. This strategy helps cushion your portfolio against fluctuations in a particular sector or asset. When creating a diversified portfolio, it is crucial to allocate your investments based on your risk tolerance and financial goals. For instance, if you have a higher risk appetite, you may allocate a larger portion of your portfolio to stocks and equity-based investments. On the other hand, if you have a lower risk tolerance, you may lean towards more stable investments like bonds or fixed-income securities. Consider various factors when diversifying, including stocks, bonds, real estate, and even international investments. Each asset class offers its own benefits and risks, so striking the right balance is crucial. Regularly review and rebalance your portfolio to ensure it remains aligned with your investment goals, adjusting your asset allocation as needed. Remember, diversification does not guarantee profits or protect against losses, but it is an important risk management strategy that can enhance the stability of your investment portfolio.

Step 4: Open an investment account

Once you have educated yourself about investment options and created a diversified investment portfolio, it's time to open an investment account. Here are the steps to follow: - Research and choose a reputable brokerage firm or investment platform: Look for a brokerage firm or investment platform that aligns with your investment goals, offers the investment options you are interested in, and has a good reputation in the industry. Consider factors such as fees, account types, customer service, and investment product availability. - Evaluate fees: Compare the fees charged by different brokerage firms or investment platforms. These may include account maintenance fees, transaction fees, commissions, and expense ratios for mutual funds or exchange-traded funds (ETFs). Choose a provider that offers competitive fees and aligns with your budget. - Consider account types: Determine the type of investment account that suits your needs. Common types include individual brokerage accounts, individual retirement accounts (IRAs), Roth IRAs, or employer-sponsored retirement accounts such as 401(k)s. Each account type has different tax implications and contribution limits, so choose the one that aligns with your financial goals and tax strategy. - Check customer service: Consider the level of customer service offered by the brokerage firm or investment platform. Look for a provider that is responsive, provides educational resources, and offers support when needed. Good customer service can make a significant difference, especially if you require assistance with your investments. - Ensure investment product availability: Ensure that the brokerage firm or investment platform offers the investment products you are interested in. This could include stocks, bonds, mutual funds, ETFs, real estate investment trusts (REITs), or other specific investment vehicles. Having access to a wide range of investment options allows you to diversify your portfolio effectively. - Open an account: Once you have chosen a brokerage firm or investment platform, follow their account opening process. This typically involves providing personal information, such as your name, address, social security number, and employment details. You may also need to provide funding for your account, which can be done through a bank transfer or other accepted methods. - Ensure alignment with your investment goals: Before finalizing the account opening, ensure that the account aligns with your investment goals and risk tolerance. Some brokerage firms or platforms offer questionnaires or assessments to help determine your risk profile and suggest suitable investment options.

Step 5: Start investing

After opening your investment account, it's time to start investing. Here's how you can begin: - Determine the investment amount based on your financial situation: Assess your financial situation, including your income, expenses, and savings. Determine an amount that you can comfortably invest without compromising your essential needs and emergency fund. Consider setting aside a specific portion of your income for investments on a regular basis. - Begin with a systematic investment plan (SIP) for mutual funds or regular contributions: If you are investing in mutual funds, consider starting with a systematic investment plan (SIP). A SIP allows you to invest a fixed amount regularly (e.g., monthly) in a mutual fund of your choice. This approach helps you take advantage of rupee cost averaging and avoids the need for timing the market. - Keep investing regularly to benefit from the power of compounding: Consistency is key when it comes to investing. Aim to invest regularly, whether it's through SIPs, automatic contributions, or manually adding funds to your investment account. By investing consistently over time, you can benefit from the power of compounding, which can significantly grow your wealth in the long run. - Consider dollar-cost averaging: Dollar-cost averaging is an investment strategy where you invest a fixed amount at regular intervals, regardless of the current market price. This approach helps you mitigate the impact of market volatility and reduce the risk of making poor investment decisions based on short-term market fluctuations. - Rebalance your portfolio: As you continue investing, periodically review your investment portfolio and rebalance it if necessary. Rebalancing involves adjusting the asset allocation to maintain the desired risk-return profile. For example, if certain investments have performed exceptionally well and now form a larger portion of your portfolio, you may need to sell some of those investments and redistribute the funds across other asset classes.

Step 6: Monitor and review your investments

To ensure your investment plan remains on track, it's important to regularly monitor and review your investments. Here's how you can do that: - Track your portfolio's performance: Use the tools and resources provided by your brokerage firm or investment platform to track the performance of your investments. Monitor the returns, compare them to relevant benchmarks, and assess whether your portfolio is meeting your financial goals. - Periodically review progress towards your goals: Regularly review how your investments are progressing towards your financial goals. Are you on track to meet your short-term and long-term objectives? If necessary, adjust your investment strategy or contributions to align with any changes in your goals or circumstances. - Make adjustments as required: Market conditions and personal circumstances can change over time. Stay informed about market news, economic trends, and investment strategies. If needed, make adjustments to your investment portfolio. This could involve rebalancing your asset allocation, diversifying further, or reallocating funds to take advantage of new opportunities or manage risks. - Seek professional advice when needed: If you are uncertain about certain investment decisions or need guidance, consider seeking advice from a financial advisor or investment professional. They can provide personalized recommendations based on your financial situation, goals, and risk tolerance.

Step 7: Stay disciplined and seek long-term growth

To maximize the benefits of your investment plan, it's important to stay disciplined and maintain a long-term perspective. Here's what you can do: - Avoid making impulsive investment decisions: Avoid making investment decisions based solely on short-term market fluctuations or emotions. Stay focused on your long-term goals and investment strategy. Making impulsive decisions can lead to poor outcomes and hinder your progress toward financial success. - Stick to your investment plan: Stay committed to your investment plan even during periods of market volatility or economic uncertainty. Maintain consistency in your investment contributions and asset allocation unless there are legitimate reasons to adjust them. Avoid trying to time the market or chase short-term trends. - Remain patient: Investing is a long-term journey that requires patience. Keep in mind that investments can experience ups and downs over time. Avoid reacting to short-term market fluctuations and stay focused on your long-term financial goals. Patience can be rewarded with the potential for higher returns and wealth accumulation. - Continually educate yourself: The investment landscape and market conditions can evolve over time. Continually educate yourself about investments, market trends, and new investment opportunities. Read books, follow financial news, attend webinars or seminars, and engage with reputable financial blogs or newsletters. Enhancing your understanding of investments will empower you to make informed decisions and adapt to changing circumstances.

Conclusion:

By following this step-by-step investment plan, you can confidently navigate the world of investments and work towards achieving your financial goals. Remember to define your goals, educate yourself about investment options, create a diversified portfolio, open an investment account, start investing regularly, monitor your investments, stay disciplined, and seek long-term growth. With patience, perseverance, and the right knowledge, you can set yourself on the path to financial success. Start investing today and secure your financial future.

Looking to take your personal finance journey even further?

Check out "The Mental Time Travel System," an extraordinary program. Drawing upon decades of experience in hypnosis and metaphysics, as well as cutting-edge concepts like Brief Therapy and Narrative Psychology, this system goes beyond anything you've ever encountered before. Through profound insights and effective methods, "The Mental Time Travel System" unlocks the secrets of the Universe, offering you the tools to manifest anything you desire, including "The Big 3." If you're ready to take your manifestations to new heights and create a life of abundance and fulfillment, this program is a must-have resource. Please note that by using the affiliate link provided, you support our website at no additional cost to you. Take the next step on your personal development journey and explore "The Mental Time Travel System" today! Disclaimer: We may receive a commission for purchases made through this affiliate link. I hope this blog has inspired you to learn more about public speaking and to consider giving it a try Are you ready to take your life to the next level? If you’re looking for ways to improve your happiness, productivity, relationships, or overall well-being, then you need to check out our self-help and self-improvement blog. We’ve got articles on everything from breaking bad habits to setting and achieving your goals. We’ll also help you find your purpose in life and learn how to live a more mindful and intentional life. So what are you waiting for? Start reading the PERSONAL GROWTH and WEALTH BUILDING categories today and see how you can transform your life! Read the full article

#assetallocation#brokeragefirm#compounding#diversifiedportfolio#dollar-costaveraging#financialgoals#financialsuccess.#investment#investmentaccount#investmenthorizon#investmentoptions#investmentplan#long-termperspective#patience#portfoliomonitoring#rebalancing#risktolerance#systematicinvestmentplan

0 notes

Text

Chase YOUR Dream.

life is not a race, it’s a experience. Do things that make YOU happy, things that help YOU succeed.

Other people’s wins and losses will and do not affect where you will end up in life. Do what you really want while you can.

you got this:3

#motivation#cosmetics#studyspo#encouragement#fitspo#self care#self help#self improvement#lashes#lashtech#makeup#makeup artist#cosmetology#financialsuccess#entrepreneur#self employed#self empowerment#lash extensions

38 notes

·

View notes

Text

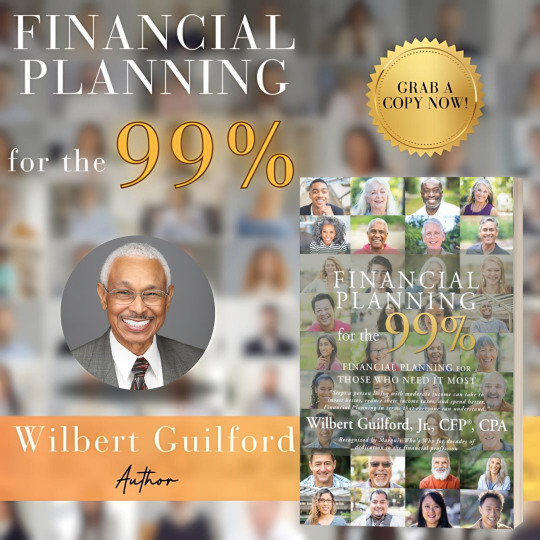

The financial services industry often hinders average Americans from receiving reliable financial advice, leading to 99% not using financial advisors. "Financial Planning for the 99%" offers comprehensive education on personal finance, including investing, income taxes, retirement planning, life insurance, and more. Written by a seasoned financial professional, it provides a one-stop guide to help Americans achieve financial success.

Do you want to gain valuable insights and strategies for effectively managing your finances? Visit https://guilfordtaxman.com/ to learn more.

10 notes

·

View notes

Text

instagram

#financialsuccess#retirementsavings#account#missingmoney#gold 401k rollover#howtorollover#good financial planning#Instagram

8 notes

·

View notes

Text

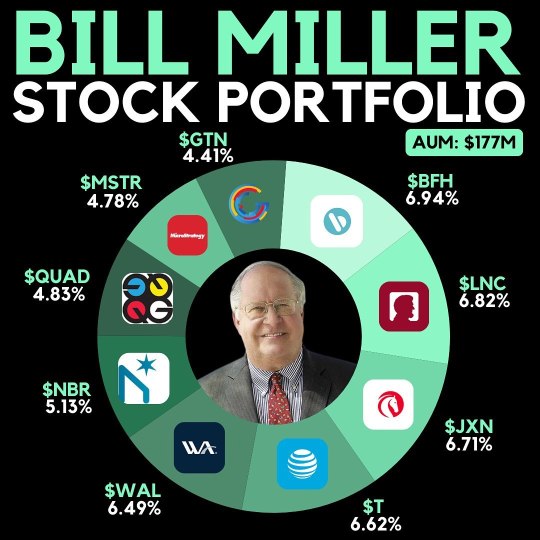

Bill Miller, a renowned hedge fund manager, recently disclosed the top holdings of his fund, which manages $177 million in assets. Here are his key investments: 1. Bread Financial: 6.94% 2. Lincoln National: 6.82% 3. Jackson Financial: 6.71% 4. AT&T: 6.62% 5. Western Alliance: 6.49% 6. Nabors: 5.13% 7. Quad Graphics: 4.83% 8. Microstrategy: 4.78% 9. Gray Television: 4.41% Have you considered any of these stocks in your portfolio? 💼 Investing wisely often requires understanding what successful managers are doing. It's essential to keep an eye on the strategies of experts like Bill Miller, as their insights can guide your own financial decisions. 💡 I believe that diversifying your investments based on proven strategies is key to achieving long-term financial success. Take charge of your financial journey today! 🚀

#BillMiller#HedgeFund#Investing#StockMarket#FinancialAdvice#PortfolioManagement#InvestmentStrategy#WealthManagement#FinancialSuccess#StockPick#Diversification#ValueInvesting#MarketTrends#InvestmentInsights#FinanceTips

2 notes

·

View notes

Text

The Power of Budgeting: Your Key to Getting Ahead

In today's uncertain economic climate, one principle remains steadfast: the importance of a good budget. Far from being restrictive, budgeting is the cornerstone of financial freedom and success. Let's explore why a solid budget is essential and how it can set you on the path to getting ahead.

The Foundation of Financial Health

Imagine your finances as a garden. Without proper planning, weeds can quickly overrun it. A good budget is like a well-thought-out garden plan, ensuring every financial decision supports your long-term goals.

A budget provides a clear picture of your financial situation. According to a 2021 survey by Debt.com, 80% of people who budget say it helps them get out of debt or stay out of debt. This clarity allows you to identify unnecessary expenses and redirect funds towards more meaningful goals.

Empowerment Through Control

Budgeting isn't about restriction; it's about taking control of your financial destiny. It breaks the stressful cycle of living paycheck to paycheck.

Take Sarah, for example. She was always stressed about her finances until she created a budget. She discovered she had been spending $500 monthly on takeout and impulse buys. By reallocating those funds, she built an emergency fund and started saving for a house down payment.

The Path to Savings and Investment

A good budget makes saving achievable by breaking it down into manageable steps. The "50/30/20 rule" is a popular budgeting technique: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

James, a young professional, started budgeting in his mid-20s using this rule. By consistently saving and investing 20% of his income, he built a robust investment portfolio by his 40s, providing financial security and freedom to pursue his passions.

Reducing Stress and Increasing Peace of Mind

Financial stress can take a heavy toll on your health. A study by the American Psychological Association found that 72% of Americans feel stressed about money at least some of the time. A good budget acts as a safety net, providing peace of mind and reducing anxiety.

Emily, a single mother of two, experienced this firsthand. After creating a budget, she felt a huge weight lift off her shoulders, knowing she had a plan to cover expenses and save for her children's education.

Building Discipline and Financial Habits

Budgeting teaches discipline that can extend beyond finances. Mark, a young entrepreneur, found that budgeting improved his business practices. By applying budgeting principles to his business, he cut costs by 15%, increased profitability, and reinvested in growth opportunities.

Achieving Your Financial Goals

A good budget transforms dreams into achievable goals. Whether you want to pay off debt, save for a home, or retire early, a budget provides the roadmap.

The SMART goal-setting technique (Specific, Measurable, Achievable, Relevant, Time-bound) can be particularly effective when budgeting. For instance, instead of "save more," set a goal like "save $5,000 for a vacation in 12 months."

Overcoming Common Budgeting Challenges

While budgeting offers numerous benefits, it's not without challenges. Here are some common obstacles and how to overcome them:

Inconsistent Income: If your income varies, budget based on your lowest-earning month and save extra during better months.

Unexpected Expenses: Build an emergency fund into your budget to cover unforeseen costs.

Lack of Motivation: Set small, achievable milestones and reward yourself for meeting them.

Budgeting Fatigue: Use budgeting apps or tools to simplify the process and make it more engaging.

Conclusion

Having a good budget is not just a financial strategy; it's a fundamental step towards getting ahead in life. It equips you with the knowledge, control, and discipline needed to navigate the complexities of the financial landscape. Remember, budgeting isn't about depriving yourself; it's about empowerment. It ensures every dollar you earn works towards your future.

A study by The Penny Hoarder found that 65% of people who maintain a budget consider themselves "very financially secure," compared to only 13% of those who don't budget.

Start today with a simple budget. Track your income and expenses for a month, then set realistic goals. Use tools like spreadsheets or budgeting apps to make the process easier. With time and consistency, you'll see how a simple budget can transform your financial reality and help you get ahead.

Your financial success begins with this single step. Are you ready to take control of your financial future? Download a budgeting app or set up a simple spreadsheet today and start your journey to financial freedom.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Budgeting#FinancialPlanning#MoneyManagement#PersonalFinance#FinancialFreedom#BudgetTips#SaveMoney#Investing#FinancialHealth#DebtFree#SmartMoney#FinancialGoals#MoneyMatters#EconomicWellness#FinancialSuccess#financial education#digitalcurrency#blockchain#finance#cryptocurrency#financial experts#financial empowerment#globaleconomy#bitcoin#unplugged financial

3 notes

·

View notes

Text

Discover the secrets that wealthy people use to achieve success and abundance. Uncover the mindset, discipline, and strategies they employ to build their fortunes. Click now to transform your life and start your journey to financial freedom!

2 notes

·

View notes

Text

#RobertDowneyJr#RDJNetWorth#IronMan#MarvelCinematicUniverse#MCU#Hollywood#CelebrityNetWorth#RobertDowneyJrFans#TeamDowney#RDJ#HollywoodSuccess#MovieStar#FinancialSuccess#ActorLife#Philanthropy#LuxuryLifestyle#FilmIndustry#SherlockHolmes#Endgame#FootprintCoalition

2 notes

·

View notes

Text

Achieve Financial Clarity with Expert Financial Statements, Forecasts, and Projections

Welcome back to the SAI CPA Services blog! Today, we’re focusing on the value of our financial statement, forecast, and projection services in helping your business achieve financial clarity and strategic growth.

Why Financial Statements, Forecasts, and Projections Matter

Understanding your business’s financial health is crucial for informed decision-making and strategic planning. Here’s how our services can benefit your business:

Accurate Financial Reporting: Our detailed financial statements provide an accurate and comprehensive view of your company’s financial position, helping you understand your income, expenses, and profitability.

Strategic Planning: Financial forecasts and projections are essential for planning future growth and identifying potential challenges. Our expert analyses enable you to make data-driven decisions and plan effectively for the future.

Performance Monitoring: Regularly updated financial statements and forecasts allow you to monitor your business’s performance over time, ensuring you stay on track to meet your goals.

Investor Confidence: Providing accurate and detailed financial information helps build trust with investors, stakeholders, and lenders, potentially leading to more investment opportunities and better financing options.

How SAI CPA Services Can Help

At SAI CPA Services, we offer comprehensive financial statement, forecast, and projection services tailored to your business’s unique needs. Our experienced team provides the insights and analysis necessary to guide your strategic planning and ensure your business’s long-term success.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#financial services#accounting#StartUpSuccess#business startups#new business#business planning#enterprenuership#finance#financialsuccess

2 notes

·

View notes

Video

youtube

Avoid Money Mistakes: Learn Financial Literacy Basics

#youtube#FinancialLiteracy FinancialSuccess MoneyManagement FinancialEducation DebtFree FinancialGoals FinancialStability PersonalFinance FinancialIn

2 notes

·

View notes

Text

Maximizing Efficiency, Minimizing Risks: The Value of VAT Compliance Services

Navigating VAT compliance can be a labyrinth of complexities for many businesses, making it imperative to have a seasoned team managing these responsibilities while you concentrate on your core operations. Our VAT Compliance Services offer a lifeline, ensuring your adherence to regulations in a timely, accurate, and efficient manner.

When it comes to VAT registration, showcasing compliance with the laws is paramount. This entails meticulous record-keeping of financial transactions, timely filing of VAT returns, and fulfilling VAT liabilities as per UAE regulations. While not mandatory, availing of VAT compliance services is highly recommended to streamline the process and mitigate potential challenges during filing.

Our experts delve deep into your financial dealings, offering invaluable insights and benefits:

Understanding and managing current VAT requirements specific to your business.

Unlocking financial benefits while avoiding penalties and fines.

Enhancing your company's credibility by fostering compliance and trustworthiness.

Our VAT Compliance Services entail a thorough examination by our experts, aimed at optimizing your company's financial health, addressing non-compliance issues, and fortifying against potential fraud. With a reliable team at your disposal, navigating the ever-evolving landscape of VAT laws becomes a seamless endeavour.

Our seasoned professionals specialize in claim filing, ensuring accuracy and compliance every step of the way. With us by your side, you can rest assured that all your VAT-related needs and requirements will be met with precision and efficiency. Our goal is to simplify the process, ensuring your adherence to regulations to steer clear of hefty penalties and legal entanglements.

To kickstart your journey towards VAT compliance, registration with the FTA is the initial step. Our team facilitates a smooth implementation and transition process, providing professional support round the clock. For further insights and assistance regarding VAT Compliance Services, don't hesitate to reach out to us. We're here to provide comprehensive guidance tailored to your business's unique needs.

#VATComplianceUAE#BusinessSuccess#GoviinBookkeeping#UAEBusiness#TaxCompliance#BusinessGrowth#FinancialSuccess#VATRegistration#ConsultingServices#TaxRegulations#ComplianceMatters#FinancialHealth#uaeaccounting#uaefinance#financialservicesdubai#vatcompliance#dubaibusiness

4 notes

·

View notes

Text

Elevate Your Financial Success with Nordholm: Your Go-To Best Accounting Company in Dubai!

Nordholm stands as your ultimate choice for Best Accounting Services Company in Dubai, proudly holding the title of the best accounting company in the region. Specializing in Business Establishment Solutions, we expertly guide you through seamless company formation, ensuring compliance and maximizing efficiency. Our proficiency extends to Streamlined Visa Processes, simplifying procedures for swift entry into the vibrant UAE market. Additionally, we excel in crafting Efficient Banking Solutions, facilitating prompt and hassle-free bank account setups to enhance the fluidity of your financial operations.

We shine in HR and Payroll Management Excellence, guaranteeing precision in handling human resources and payroll to sustain seamless operations. We are also experts in VAT Compliance and Financial Precision, delivering accurate accounting services and meticulous VAT compliance management, freeing your focus for core business strategies.

Recognizing the pivotal role of precise accounting in fostering enduring business development, our seasoned team at the best accounting firm in Dubai is dedicated to empowering your journey. We seamlessly harmonize sustainability and reliability, offering expert insights and strategic approaches that empower informed decisions, unveiling new opportunities for your business growth.

Mastering a complicated regulatory web can be tricky, especially in the United Arab Emirates. However, enjoy stress-free business operations with our assistance. Our experience guarantees a smooth journey, freeing you up to focus on ambitiously growing your company's reach.

Choose Nordholm, the unrivaled best accounting company in Dubai, for tailored services committed to your business triumphs. Our bespoke top-tier services guarantee precise financial reporting and operational efficiency, aligning seamlessly with your unique business aspirations.

#NordholmDubai#BestAccountingCompany#DubaiFinance#FinancialSuccess#AccountingExcellence#BusinessFormation#VisaSolutions#HRManagement#PayrollExcellence#VATCompliance

6 notes

·

View notes

Text

DIWALI PICKS 2023

IRCON INTERNATIONAL LTD -DELIVERY BUY IRCON INTERNATIONAL LTD @153-155 SL 127.25(CLOSING SL) TARGET 275-325-375

2. EASY TRIP PLANNERS LTD - DELIVERY BUY EASY TRIP PLANNERS LTD @42-43 SL 37(CLOSING SL) TARGET 60-62

3. SHALIMAR PAINTS LTD - DELIVERY BUY SHALIMAR PAINTS LTD @175-180 SL 167(CLOSING SL) TARGET 350-380

4. LUX INDUSTRIES LTD - DELIVERY BUY LUX INDUSTRIES LTD @1430-1440 SL 1130(CLOSING SL) TARGET 3100-3300

5. GATEWAY DISTRIPARKS LTD - DELIVERY BUY GATEWAY DISTRIPARKS LTD @91-92 SL 79(CLOSING BASIS SL) TARGET 185-210

#stock market#india#investing stocks#stocks#trading ideas#tradingview#bse#bseindia#bullrun#investing#financialsuccess#nseindia#bullish#tradingcommunity

5 notes

·

View notes

Text

"Mastering Finances: Unlocking Wealth with Our Money-Making Tutorials" ------------------------------------------------------------------------ DM ME (instagram: z3tko) SAME MONEY ONLY FOR 20$ 💳💸

#FinanceTips#MoneyTutorials#FinancialSuccess#WealthBuilding#IncomeBoost#MoneyManagement#FinancialFreedom#InvestingAdvice#BudgetingTips#FinancialEducation#PersonalFinance#MoneyMatters#FinancialEmpowerment#FinancialGoals#MoneySkills#FinancialWisdom#MoneySavvy#MoneyTalks#EconomicEmpowerment#FinancialResources#FinancialJourney

2 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes