#HRManagement

Explore tagged Tumblr posts

Text

Attention small business owners and HR professionals!

In today's fast-paced business world, efficient human resource management is crucial for small businesses to stay competitive. But with limited resources, how can you choose the right HR system for your company?

Our latest article dives deep into the top HR systems tailored for small businesses, covering:

Essential features to look for

Cloud-based vs. on-premise solutions

Pricing models and budget considerations

Implementation and integration capabilities

Security and compliance features

User experience and interface design

Mobile accessibility and remote work support

Customer support and training resources

We've also included a comprehensive comparison of leading solutions like BambooHR, TriNet HR Platform, Rippling, Paycor, and UKG Ready.

Don't let HR management hold your business back. Discover how to make the right choice for your company's success and growth.

12 notes

·

View notes

Text

HR Solutions for Small Businesses

Central HR offers small business HR management services tailored to meet the needs of small businesses. We provide practical HR solutions to help your business thrive while ensuring compliance with all regulations. Let us handle your HR needs so you can focus on growth.

2 notes

·

View notes

Text

Navigating HR Efficiency: Top Trends for UAE's Nordholm Payroll and HR Solutions

Welcome to the dynamic world of HR and Payroll Services in the UAE, where Nordholm stands as a pioneer in streamlining businesses' processes. In this informative piece, we'll explore essential insights, fun tips, and emerging trends that resonate with our innovative solutions for Payroll and HR services in the UAE.

Discuss how we incorporates cutting-edge technology into its services, enhancing payroll management and HR operations. Cover topics like AI-driven automation, cloud-based systems, and data analytics, highlighting their significance in boosting efficiency.

Delve into the importance of blending technology with human-centric approaches in HR services. Showcase our unique blend of personalized assistance alongside tech solutions, fostering a harmonious workplace culture.

Dive into the evolving landscape of remote work and how Nordholm adapts its Payroll and HR Services to accommodate these shifts. Discuss the challenges and opportunities presented by remote work, emphasizing Nordholm's strategies to ensure seamless operations.

Highlight our commitment to sustainability and how it integrates eco-friendly practices within its Payroll and HR services. Discuss the impact of such initiatives on employee satisfaction and company reputation.

Educate readers on the complexities of UAE's HR regulations and how we assist businesses in staying compliant. Cover essential aspects like labor laws, taxation, and legal requirements, demonstrating Nordholm's expertise in this domain.

Nordholm stands at the forefront of Payroll and HR Services in the UAE, continually evolving and adapting to meet the dynamic needs of businesses. Incorporating innovative tech solutions, personalized approaches, and a keen eye on compliance and sustainability, Nordholm remains a trailblazer in optimizing HR efficiency for companies across the region.

#NordholmHR#PayrollServicesUAE#HRManagement#UAEbusiness#NordholmSolutions#NordholmInnovates#HRCompliance#WorkplaceEfficiency

10 notes

·

View notes

Text

What is HR Risk Management: A Detailed Guide

In business, risk cannot be totally removed. By anticipating and preparing for any failures, risk management aims to minimize consequences.

All aspects of an organization's operations must incorporate risk management, but HR should focus on the risks for which it has particular responsibility.

Read the article on HR risk management to know more. Please feel free to share your feedback and questions. We would love to hear from you.

5 notes

·

View notes

Text

Verification of Uploaded Documents

We have robust measures in place to verify the authenticity of uploaded documents such as address proofs and employment contracts. This includes automated verification tools that cross-reference details provided with trusted databases or through verification services. Additionally, designated personnel review documents to ensure compliance with organizational standards and regulatory requirements.

#hrms#hr#humanresources#hrsoftware#hrtech#payroll#humanresource#hrmanagement#payrollsoftware#hris#business#humanresourcemanagement#employee#software#hrsystem#recruitment#humanresourcesmanagement#payrollmanagement#hrd#leadership#payrollservices#shrm#hrconsultant#technology#hrsolutions#attendance#management#hrtips#hrm#hrblog

3 notes

·

View notes

Text

A customizable HRM software can work as per your organization's needs. Modify as per your requirement. Inbox to view the demo now: https://fiverr.com/s/Zrpbxl

#HumanResources #ManagementSoftware #CustomizableSolutions #HRM #SoftwarePlatform #TechnologyNews #Tech #Innovation #ai #ArtificialIntelligence #TechnologyTrends #CryptoMarket #InnovationInTech #SmartTech #AIRevolution #FutureOfTech #BlockchainTechnology #CryptocurrencyNews #CryptoInvesting #AIApplications #TechInnovations #DigitalCurrency #AIoT #MachineLearning #CryptoAnalysis #EmergingTech #AIInnovation #TechIndustry #Insights #CryptoInfluence

#university#lgbtq#technology#gay#studyblr#educación#hr management#hrmanagement#hrms software#hrms solutions#hrmemes#human resources#tech

3 notes

·

View notes

Text

Navigating Workplace Tensions: Mastering Conflict Management for a Harmonious Office

Explore the dynamics of workplace conflicts and learn effective strategies to manage and resolve them. This blog by Dr.Divya Bonigala, Corporate Trainer, delves into the causes of workplace disputes, from cultural and personal differences to conflicting goals, and offers practical tips for fostering understanding and cooperation among team members. Discover the key roles of conflict resolution styles and how they can be applied to create a more productive and positive work environment on https://www.protouchpro.com/guest-posts/effective-conflict-management-in-the-workplace/

2 notes

·

View notes

Text

Hey hey hey... No no no it is not okay to hit your mutuals... That is not HR approved

2 notes

·

View notes

Text

Unlocking Success: Navigating Diverse Business Services in the UAE

At Transcend Accounting, our dedication lies in empowering businesses with a comprehensive suite of services tailored to meet the Diverse Businesses needs of investors seeking success in global markets, including the dynamic landscape of the UAE. Our array of offerings covers every aspect of business establishment and growth, ensuring a seamless journey for our esteemed clients.

We Guide to Company Formation in the UAE: Embark on a journey through the intricacies of setting up a business in the UAE with our expert insights into legal requirements, documentation processes, and key considerations for entrepreneurs.

Visa Procedures Demystified: Navigate the various visa procedures required for business setup in the UAE with ease, as we provide invaluable tips and advice on streamlining the application process for a smooth entry into the UAE market.

Mastering the Art of Opening a Bank Account in the UAE: Dive into the nuances of opening a bank account in the UAE with Transcend Accounting, where we highlight different options available, key documentation requirements, and tips for selecting the right banking partner for your business.

Streamlining HR and Payroll: Our Best Practices for Businesses in the UAE: Our article offers actionable tips and best practices for managing HR and payroll processes in the UAE, ensuring compliance with local regulations and fostering employee satisfaction and productivity.

Navigating the Maze of VAT and Accounting Services in the UAE: Shed light on VAT compliance and accounting services in the UAE with Transcend Accounting's expert guidance, providing practical advice on regulatory changes, tax strategies, and financial transparency.

The Future of Business Services in the UAE: Trends to Watch by Transcend Accounting: Explore emerging trends in business services in the UAE with Transcend Accounting, offering insights into digital transformation and sustainability initiatives that enable businesses to adapt and thrive.

Success Stories: How Businesses Are Thriving with Transcend Accounting's Diverse Services in the UAE: Discover inspiring success stories of businesses leveraging Transcend Accounting's diverse services to achieve growth and success, providing valuable lessons and inspiration for your entrepreneurial journey.

Unlocking Opportunities: Exploring Niche Business Services in the UAE: Delve into niche business services available in the UAE with Transcend Accounting, highlighting opportunities for entrepreneurs to drive innovation and carve out a unique market position.

The Power of Partnership: Collaborating for Success in the UAE Business Ecosystem: Explore the importance of collaboration and partnerships in the UAE business ecosystem with our Accounting, showcasing successful collaborations and offering tips for mutual growth and success.

Beyond Business: Exploring the Cultural and Social Landscape of the UAE with: Join Transcend Accounting on a journey beyond business, exploring the rich cultural heritage and vibrant social scene of the UAE, fostering stronger business relationships and success through understanding local customs and traditions.

#TranscendAccounting#UAEBusiness#BusinessSetup#CompanyFormation#VisaProcedures#BankingUAE#HRManagement#PayrollServices#VATCompliance#AccountingSolutions#BusinessTrends#SuccessStories#NicheServices#PartnershipSuccess#CulturalExploration#EntrepreneurialJourney#BusinessGrowth#MarketInsights#CollaborativeEcosystem#CulturalUnderstanding

3 notes

·

View notes

Text

Best Recruitment Services Agency | Global HR Solution

website :https://globalhrsolutions.in/recruitment-services

#hr solutions#human resource solution#hr#hrm#temporary staffing#contractual recruitments#contractual staffing#outsourcing service#outsourcing taxation#outsourcing accounting#outsourcing finance#business consulting#staffing#contractor#placement consultancy#placement agency#human resources#recruitment#hrmanagement#payroll#hiring#talent acquisition#corporate compliance#executive search#global hr solutions#b2b services#b2b lead generation#b2bmarketing#outsourcing#onlinebusiness

2 notes

·

View notes

Text

#HRJobs#GlobalHR#BusinessPartner#UAEJobs#HRCareer#JobOpportunity#Hiring#HumanResources#HRManagement#JobSearch#UAEJobMarket#CareerDevelopment#Employment#WorkOpportunity#JobOpening#JobPosting#JobAlert#HRProfessionals#JobHunt#JobSeekers

2 notes

·

View notes

Text

Transform Your HR Operations with Our Powerful HRMS Software! With @Scriptzol's HRMSzol, Take control of your HR operations with our state-of-the-art HRMS Software!

Get in touch with us today to explore new process in HR work. 👉 www.scriptzol.com/hrms-script

🔥 Ready to revolutionize your HR processes? Comment below to learn more about our advanced HRMS software! 👇💼💡

#scriptzol#hrmszol#hrms#humanresource#management#system#HRMS#HRSoftware#StreamlineHR#Efficiency#ProductivityBoost#ModernHR#Automation#WorkplaceSolutions#DigitalTransformation#EmpowerYourTeam#UnlockPotential#GameChanger#HRManagement#EffortlessProcesses#letsconnect#scriptzolteam

3 notes

·

View notes

Text

Exploring the Future of HR and Payroll Excellence with Nordholm Solutions in the UAE

Embark on a journey through the vibrant Domain of HR and Payroll Services in the UAE, where Nordholm emerges as a trailblazer, reshaping the landscape of business processes. In this insightful piece, we will unravel cutting-edge trends, intriguing tips, and the latest innovations that define Nordholm's distinctive approach to Payroll and HR Services in the UAE.

Discover how we seamlessly integrates state-of-the-art technology into its services, revolutionizing Payroll Management and HR Operations. From automation to the power of cloud-based systems and data analytics, we'll explore how these advancements significantly elevate efficiency in the workplace.

Uncover the art of balancing technology with a human-centric touch in HR services. we take pride in its unique fusion of personalized assistance and technological solutions, fostering not just efficiency but also a workplace culture that resonates with harmony.

Cast a radiant beam on our steadfast dedication to sustainability and the infusion of eco-friendly practices into our Payroll and HR services. Examine the ripple effect of these initiatives on employee satisfaction and the overarching reputation of companies dedicated to forging a sustainable future.

Educate readers on the intricacies of UAE's HR regulations and witness how we become the guiding force for businesses, ensuring compliance with essential aspects such as labor laws, taxation, and legal requirements. Plunge into our exceptional proficiency in navigating the intricate regulatory maze of the UAE.

We proudly occupy the leading edge of Payroll and HR Services in the UAE, perpetually evolving to synchronize with the ever-shifting demands of businesses. Through a fusion of cutting-edge technological solutions, bespoke approaches tailored to each business, and an unwavering commitment to compliance and sustainability, we persistently establish new benchmarks for elevating HR efficiency and excellence throughout the region.

#NordholmHR#PayrollServicesUAE#HRManagement#UAEbusiness#NordholmSolutions#NordholmInnovates#HRCompliance#WorkplaceEfficiency

5 notes

·

View notes

Text

#hrms#hr#humanresources#hrsoftware#hrtech#payroll#humanresource#hrmanagement#payrollsoftware#hris#business#humanresourcemanagement#employee#software#hrsystem#recruitment#humanresourcesmanagement#payrollmanagement#hrd#leadership#payrollservices#shrm#hrconsultant#technology#hrsolutions#attendance#management#hrtips#hrm#hrblog

2 notes

·

View notes

Text

HRMployee - Human Resources and Project Management Software. It is fully customizable. You can change or customize its design and functions according to your needs.

For demo contact : https://www.fiverr.com/s/1w8lQz

#humanresourcesmanagement #hrmssoftware #hrdepartment #employeeengagement #projectmanagement #webdevelopment #softwaredevelopment

#human resources#hrmanagement#hrms software#project management#software#employers#employee management

3 notes

·

View notes

Text

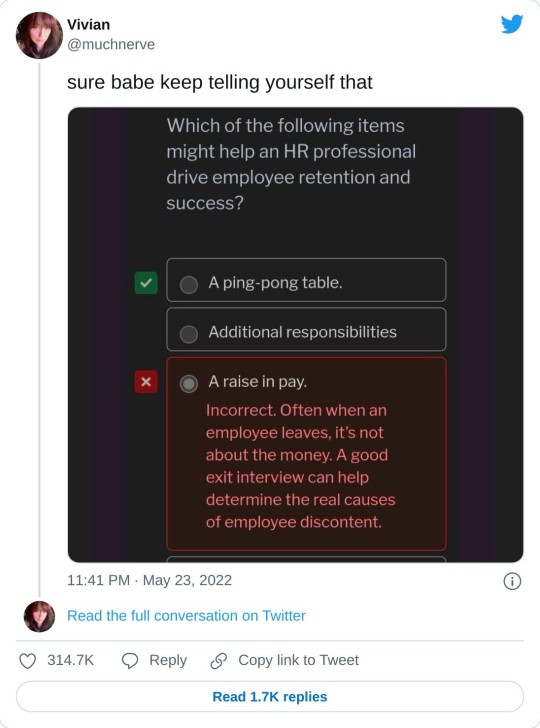

Yes, it is true compensation for your work is never the reason people quit

your the evil one even i pay my goons well

107K notes

·

View notes