Stocks Finance Business📈Stock Market Investing🔥Achieve Financial Freedom with Stocks & Retire Early💡The biggest news in investing, visualized.

Don't wanna be here? Send us removal request.

Text

The Nasdaq 100 comprises the 100 largest and most actively traded non-financially related companies listed on the NASDAQ exchange. Here are the annual returns by year since inception: 1986: 6.9% 1987: 10.5% 1988: 13.5% 1989: 26.3% 1990: -10.5% 1991: 65% 1992: 9% 1993: 10.5% 1994: 1.5% 1995: 42.5% 1996: 42.5% 1997: 20.6% 1998: 85.3% 1999: 101.9% 2000: -36% 2001: -32% 2002: -37% 2003: 49.1% 2004: 10.4% 2005: 1.5% 2006: 6.6% 2007: 18.7% 2008: -42% 2009: 53.5% 2010: 19.2% 2011: 2.7% 2012: 16.9% 2013: 35% 2014: 17.9% 2015: 8.4% 2016: 5.89% 2017: 32% 2018: -1% 2019: 37.9% 2020: 47.5% 2021: 26.7% 2022: -32% 2023: 53.8% 2024: 24.8% Where do you think the #Nasdaq will finish 2025?

#nasdaq#stockmarket#stockmarketnews#stockmarkets#investing#annualreturns#markettrends#financialfreedom#stockperformance#economicgrowth#wealthbuilding

0 notes

Text

Warren Buffett and Berkshire Hathaway have reached a record cash pile of over $325 billion! Recently, Buffett resumed purchasing stocks, adding significant investments in Occidental ($409M), Sirius XM ($107M), and Verisign ($45M). With such a massive cash reserve, he has the power to acquire any of these companies outright. What would you do with $325 billion? I believe this is an opportune moment for strategic investments, rather than frivolous spending. It's essential to stay informed about market movements and heed the strategies of seasoned investors like Buffett. Let's learn from their decisions to shape our own investment strategies! 💼📈

#WarrenBuffett#BerkshireHathaway#InvestmentStrategy#StockMarket#CashReserve#FinancialWisdom#SmartInvesting#MarketTrends#ValueInvesting#WealthManagement#InvestmentOpportunities#StrategicInvestments#Buffettology#FinanceTips#InvestingGoals

0 notes

Text

Warren Buffett's net worth showcases the incredible power of compound interest. 💰 Remarkably, 99% of his wealth was amassed after turning 65. Let’s reflect on some pivotal moments in his journey: - At 14, he saved $5,000 delivering newspapers. - By age 26, he started an investment partnership valued at $100,000. - By age 56, he had become a billionaire with a net worth of $1 billion. - Now, at 94, he stands at an extraordinary $150 billion. This illustrates a powerful lesson: time and patience can yield extraordinary results in investing. In my experience, consistent saving and smart investments are crucial in building wealth over time. It's never too late to start your journey, and small steps can lead to monumental achievements! Remember, each dollar invested wisely today can blossom into significant wealth tomorrow. 🌱

#WarrenBuffett#WealthBuilding#CompoundInterest#FinancialEducation#InvestSmart#SavingMoney#InvestmentJourney#RichAtAnyAge#FinancialFreedom#WealthManagement#InvestingWisely#PatienceInInvesting#MoneyGrowth#BillionaireMindset#FinancialSuccess

0 notes

Text

Traders anticipate a 41% chance that Ethereum will reach a new all-time high by the end of the year, with the current record standing at $4,891 from November 16, 2021. I believe this presents an intriguing opportunity for investors. 📈 In my experience, market predictions can often serve as a complex puzzle — while they provide a glimpse into market sentiment, the underlying fundamentals should also guide your investment decisions. Always conduct thorough research and remain informed about the market dynamics. As we navigate these uncertain waters, let's remember the importance of patience and strategic planning. Investing isn't just about chasing highs; it's about building a stable and resilient portfolio. 💪

#Ethereum#CryptoTrading#InvestmentStrategy#MarketPrediction#AllTimeHigh#CryptoInvesting#Blockchain#TraderSentiment#InvestmentOpportunities#FinancialLiteracy#PortfolioManagement#MarketDynamics#CryptoTrends#StrategicPlanning#InvestSmart#PatienceInTrading

0 notes

Text

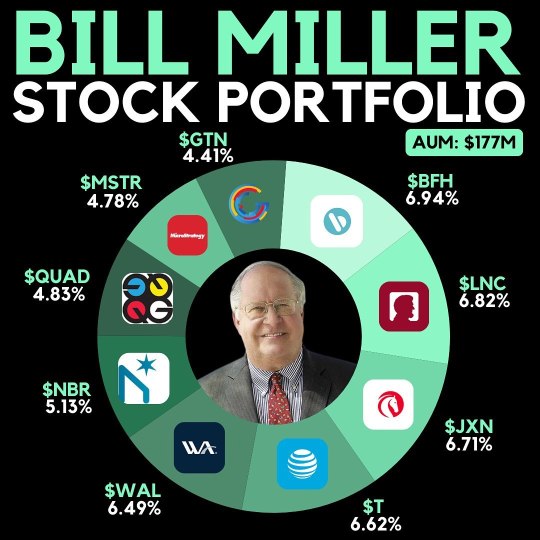

Bill Miller, a renowned hedge fund manager, recently disclosed the top holdings of his fund, which manages $177 million in assets. Here are his key investments: 1. Bread Financial: 6.94% 2. Lincoln National: 6.82% 3. Jackson Financial: 6.71% 4. AT&T: 6.62% 5. Western Alliance: 6.49% 6. Nabors: 5.13% 7. Quad Graphics: 4.83% 8. Microstrategy: 4.78% 9. Gray Television: 4.41% Have you considered any of these stocks in your portfolio? 💼 Investing wisely often requires understanding what successful managers are doing. It's essential to keep an eye on the strategies of experts like Bill Miller, as their insights can guide your own financial decisions. 💡 I believe that diversifying your investments based on proven strategies is key to achieving long-term financial success. Take charge of your financial journey today! 🚀

#BillMiller#HedgeFund#Investing#StockMarket#FinancialAdvice#PortfolioManagement#InvestmentStrategy#WealthManagement#FinancialSuccess#StockPick#Diversification#ValueInvesting#MarketTrends#InvestmentInsights#FinanceTips

2 notes

·

View notes

Text

🚀 **Top US Companies by Net Profit** 🚀 Here's a snapshot of the largest US companies producing the highest net profits: 1. **Apple:** $94B (-3% YoY) 2. **Nvidia:** $63B (+234% YoY) 3. **Microsoft:** $91B (+17% YoY) 4. **Amazon:** $50B (+148% YoY) 5. **Alphabet:** $94B (+41% YoY) 6. **Meta:** $56B (+87% YoY) 7. **Tesla:** $13B (+18% YoY) 8. **Berkshire Hathaway:** $107B (+39% YoY) 9. **TSMC:** $33B (+16% YoY) Who do you think will dominate by 2030? --- In my experience, tracking these leading companies can provide insights into market trends and investment opportunities. 📈 It's crucial to stay informed about their growth patterns and adapt investment strategies accordingly. Remember, being proactive in your financial planning can make all the difference in building wealth over time! 🌟

#TopCompanies#NetProfit#InvestmentOpportunities#FinancialPlanning#WealthBuilding#MarketTrends#StockMarket#FinanceTips#GrowthInvesting#TechStocks#BusinessInsights#ProsperityMindset#FutureOfInvesting#FinancialLiteracy#MarketSuccess

0 notes

Text

Nvidia's recent Q3 earnings report shows impressive performance, beating revenue and EPS expectations. EPS reached $0.81 (up 111% YoY) and revenue soared to $35.08 billion (up 94% YoY). Key growth areas include Data Centers at $30.8 billion (up 112% YoY) and Gaming at $3.3 billion (up 15% YoY). Despite this strong performance, shares fell by 3% post-release. Are you bullish or bearish on Nvidia's stock at $142? In my opinion, Nvidia's growth in data centers demonstrates its strength in high-demand tech sectors. Diversifying your portfolio with such stocks can be vital in navigating market fluctuations. Remember, investing requires careful analysis of trends and market dynamics. Stay informed and make strategic decisions! 📈💡

#Nvidia#EarningsReport#StockMarket#Investing#DataCenters#GamingStocks#EPS#RevenueGrowth#PortfolioDiversification#MarketTrends#BullishOrBearish#TechStocks#FinancialAnalysis#InvestmentStrategy#StayInformed

0 notes

Text

Nvidia's recent Q3 earnings report shows impressive performance, beating revenue and EPS expectations. EPS reached $0.81 (up 111% YoY) and revenue soared to $35.08 billion (up 94% YoY). Key growth areas include Data Centers at $30.8 billion (up 112% YoY) and Gaming at $3.3 billion (up 15% YoY). Despite this strong performance, shares fell by 3% post-release. Are you bullish or bearish on Nvidia's stock at $142? In my opinion, Nvidia's growth in data centers demonstrates its strength in high-demand tech sectors. Diversifying your portfolio with such stocks can be vital in navigating market fluctuations. Remember, investing requires careful analysis of trends and market dynamics. Stay informed and make strategic decisions! 📈💡

#Nvidia#EarningsReport#StockMarket#Investing#DataCenters#GamingStocks#EPS#RevenueGrowth#PortfolioDiversification#MarketTrends#BullishOrBearish#TechStocks#FinancialAnalysis#InvestmentStrategy#StayInformed

0 notes

Text

🔍 **Meta's Q3 Earnings: Key Takeaways** 🔍 Meta recently released its Q3 earnings report, showcasing robust growth despite challenges. Revenue hit $40.6 billion, surpassing estimates, with a solid year-over-year growth of 19%. Earnings per share (EPS) also exceeded expectations at $6.03. Active daily users (DAU) rose by 5% to 3.3 billion, but the Reality Labs division continues to face hurdles, reporting a loss of $4 billion. In this dynamic market, understanding the financial health of major players like Meta is crucial. 📈 My experience shows that diversifying your investment portfolio is essential for navigating fluctuations effectively. Stay informed and analyze the numbers; it can dramatically influence your investment decisions. Let's embrace financial growth together! 💡

#MetaEarnings#Q3Report#FinancialGrowth#InvestmentTips#StockMarketNews#FinanceCommunity#RevenueGrowth#EarningsPerShare#MarketAnalysis#InvestmentPortfolio#TechStocks#DailyActiveUsers#RealityLabs#FinancialHealth#InvestSmart#WealthBuilding

0 notes

Text

🚀 Did you know Bill Gates' latest portfolio is worth over $45 billion? Here's the breakdown of his top holdings: 1. **Microsoft**: 27.64% 2. **Berkshire Hathaway**: 22.60% 3. **Waste Management**: 14.84% 4. **Canadian National Railway**: 14.25% 5. **Caterpillar**: 6.38% 6. **Others**: 14.28% 📊 This portfolio reflects a strategic focus on technology, sustainability, and reliable income streams. It's a great insight into where a billionaire like Gates sees potential. 🌟 I believe aligning your investments with robust companies can lead to long-term financial success. What do you think about sharing stock holdings with such influential investors?Understanding the investment strategies of influential billionaires like Bill Gates can provide valuable insights for individual investors. By analyzing their portfolios, we can identify trends and sectors likely to perform well in the future. Gates' focus on technology and sustainability showcases the importance of aligning investments with current global shifts. Moreover, sharing stock holdings and strategies with individuals who have a proven track record can inspire confidence and motivate others to adopt a more calculated approach to investing. As we aim for financial independence, it's crucial to learn from successful investors and apply those lessons in our financial planning.

#BillGates#InvestmentStrategy#FinancialFreedom#WealthManagement#StockMarket#TechInvesting#SustainableInvesting#BillionaireInvestors#PortfolioManagement#InvestmentTips#LongTermInvesting#SmartInvesting#FinancialLiteracy#EconomicTrends#FutureInvestments

0 notes

Text

🚀 Bitcoin has hit an all-time high, soaring to $82,000! This momentous leap highlights the power of the cryptocurrency market. 📈 Notable players in the Bitcoin arena include: - **Satoshi Nakamoto**, the enigmatic creator of Bitcoin. - Major custodians like **Binance, Blackrock, and Fidelity** who hold significant amounts on behalf of others. 💼 In another big move, MicroStrategy has just acquired an additional $2 billion in Bitcoin, bringing its total to a staggering $20 billion. Their Bitcoin position is now showing a remarkable +$10 billion in unrealized profits! 🏢 Other public companies ridged with Bitcoin holdings include: - **Block**: 8,200 BTC - **CleanSpark**: 6,100 BTC - **Hive Digital**: 2,500 BTC - **Cipher Mining**: 1,400 BTC Are you taking a long or short position on Bitcoin at $81,000? In my experience, understanding market trends and major players can significantly impact your investment decisions. Don’t miss out on these pivotal movements! 🔍The cryptocurrency market is witnessing unprecedented growth, with Bitcoin reaching new heights that captivate both seasoned investors and newcomers alike. This surge not only reflects the increasing adoption of digital currencies but also the strategic investments made by key players in the sector. Understanding the dynamics of Bitcoin and the influence of notable custodians and companies can provide invaluable insights for anyone looking to navigate this volatile landscape. It’s essential to stay informed about market trends and the positions of significant players to make sound investment decisions.

#Bitcoin#Cryptocurrency#Investing#BTC#SatoshiNakamoto#MicroStrategy#CryptoInvestors#Blockchain#DigitalAssets#FinancialFreedom#Binance#Blackrock#Fidelity#CryptoNews#MarketTrends

1 note

·

View note

Text

🚀 This week, Tesla shares soared +30%, pushing Elon Musk's net worth back over the $300 billion mark for the first time in 3 years! My experience shows that major companies like Tesla can significantly impact an entrepreneur's wealth. 🔍 Here’s a breakdown of Musk's assets: - **Tesla**: 21% stake, valued at approximately **$210 billion**. - **SpaceX**: 42% ownership, currently valued at **$200 billion**, adding another **$88 billion** to his fortune. - **Twitter**: Purchased for **$44 billion**, though its current value remains uncertain. - **xAI**: 60% ownership in this newly valued AI company at **$40 billion**. 💭 What’s next for Musk? Given the trajectory of his investments, I'm curious what he’ll be worth by 2030. One thing is clear: visionary entrepreneurs like him can shape the future of multiple sectors. Keep your eyes on the markets, and always be ready to invest wisely! 📈✨In the world of investing, few figures command as much attention as Elon Musk. His recent financial moves, particularly with Tesla's impressive stock surge, have not only rejuvenated his net worth but also renewed interest in the potential of high-growth companies. Musk's innovative ventures exemplify how visionary leadership can significantly influence market landscapes and investor sentiment. As we keep an eye on Musk's trajectory, it’s vital to remain informed and ready to seize investment opportunities. Whether you’re a seasoned investor or just starting, learning from the successes and strategies of industry leaders can pave the way to financial independence and prosperity.

#Tesla#ElonMusk#Investing#StockMarket#FinancialFreedom#Entrepreneurship#SpaceX#AI#WealthBuilding#InvestmentStrategy#MarketTrends#NetWorth#FutureInvestments#TechnologyInvesting#VisionaryLeadership

1 note

·

View note