#CompoundInterest

Explore tagged Tumblr posts

Text

Butterfly Magic? The blue color found in Nessaea

In nature, there are many blue-hued birds, animals, fish, and insects. However, the blue color found in the feathers of birds, wings of butterflies, shells, and other natural structures is primarily a result of structural coloration. It's an optical effect created by the interference and scattering of light waves due to microstructures like grooves, scales, and more, rather than intrinsic pigments. Naturally occurring blue pigments are quite rare. In the case of the Nessaea butterfly, the blue color on its wings comes from a pigment called pterobilin, a type of bile pigment. This is an exceptional occurrence of a blue pigment within the Lepidoptera order of insects

7 notes

·

View notes

Text

Mastering the Seasons of Your Financial Future

Retirement planning is more than just saving; it’s about creating a roadmap to secure your financial well-being through every phase of life. At All Seasons Wealth, we believe in empowering individuals with personalized strategies that ensure a comfortable and fulfilling retirement.

By starting early, you can take full advantage of compound interest, growing your savings exponentially over time. Diversifying your investments is another key step, balancing risk and reward to build a resilient portfolio that weathers market fluctuations.

Flexibility is vital in retirement planning. Life is unpredictable, and a well-structured plan provides the adaptability to handle unexpected changes without compromising your future. At All Seasons Wealth, our experts guide you through regular reviews and updates to keep your strategy aligned with your evolving goals.

Your retirement should reflect your aspirations, not financial limitations. Whether it’s global travel or quiet evenings at home, we’re here to help you achieve your dreams.

Read more: Mastering the Seasons of Your Financial Future

#RetirementPlanning#FinancialFreedom#WealthManagement#SecureFuture#AllSeasonsWealth#FinancialPlanning#EarlyRetirement#CompoundInterest#InvestmentTips

0 notes

Text

Investing Tips for College Students

Investing Tips for College Students: Your Guide to Financial Success

As a college student, it’s important to start thinking about your financial future. Building financial stability involves understanding your current financial situation and making smart choices for the future. One key first step is calculating your net worth by subtracting what you owe from what you own. This helps you understand where you stand financially and where to focus your efforts.

A great budgeting strategy to follow is the 50/30/20 rule: allocate 50% of your income for needs (like housing and food), 30% for wants (discretionary spending), and 20% for savings and debt repayment. Additionally, setting SMART goals, like saving 15% of your income for retirement, can help ensure long-term financial success. Tackling high-interest debt early on is also a wise choice. By focusing on your most important goals first, you can better plan your financial future.

Understanding the Basics of Investing as a Student

Investing during college may seem daunting, but it’s a great way to start building wealth for the future. The earlier you start investing, the more your money can grow due to the power of compound interest. Even small investments can accumulate significantly over time.

As a young investor, you can generally afford to take on more risk since you have time on your side. It’s important to understand your risk tolerance to make informed investment decisions. Compound interest, in particular, can make investments grow exponentially, even if you're only contributing small amounts regularly.

Before diving into investments, it's crucial to have a solid financial base. Begin by creating a budget based on the 50/30/20 rule. Pay off high-interest debt, and aim to build an emergency fund that covers three to six months of living expenses. This ensures you are financially stable and can weather unexpected expenses.

Key Financial Tips for College Students

Here are some key tips for managing money while you’re in college:

Build an Emergency Fund: Start by saving three to six months' worth of living expenses to cover unexpected costs.

Manage Student Loans: Consider balancing your loan repayment with investments. If your loans have low interest, investing could potentially offer better long-term growth.

Balance Savings and Investments: Set aside money for short-term goals while investing for the long term. Diversifying your investments can reduce risk and benefit from compound interest.

Choosing the Right Investment Vehicles

For college students, the right investment vehicles can help set the stage for long-term financial success. Some options include:

Index Funds: These are great for passive investing. They offer broad market exposure, which helps with diversification and lowers risk.

ETFs: Exchange-Traded Funds (ETFs) are similar to index funds but can be traded like stocks, offering flexibility.

Mutual Funds: These are managed investments that help you grow your wealth over time with the help of professionals.

Selecting the right investment vehicle depends on factors like fees, ease of management, and how well they align with your financial goals.

Investing on a Student Budget

Even with a tight budget, there are ways to start investing. Many apps allow you to invest with just a few dollars. Dollar-cost averaging is an excellent strategy for beginners, as it involves investing a fixed amount regularly, regardless of market conditions. This can help you avoid major losses during market downturns and build your portfolio over time.

Micro-investing apps like Acorns or Robinhood let you start investing with small amounts, even rounding up your purchases to the nearest dollar to invest the spare change. These tools make investing automated and easy to manage, even on a student budget.

Leveraging Technology for Investment Success

Technology has revolutionized investing, making it more accessible than ever. Many investment apps offer easy-to-use platforms for students to start investing with minimal effort. Apps like Robinhood and Acorns are popular choices for beginners due to their user-friendly interfaces and low fees. Robo-advisors, such as Betterment or Wealthfront, can also help manage your investments by using algorithms to automatically rebalance your portfolio and optimize returns.

For those who prefer a more hands-on approach, platforms like E*TRADE and TD Ameritrade offer research tools and customizable portfolios.

Diversification: The Key to Managing Risk

Diversification is one of the most important strategies for reducing investment risk. By spreading your investments across different asset classes—such as stocks, bonds, and real estate—you can protect your portfolio from market volatility. For college students, a good balance might include both equities (stocks) and fixed-income securities (bonds), as well as some alternative investments like real estate or cryptocurrency. This balanced approach allows you to benefit from market growth while minimizing risk.

Modern Investment Opportunities

In addition to traditional investment vehicles, modern options like cryptocurrency and sustainable investments are gaining popularity:

Cryptocurrency: While volatile, cryptocurrency offers high-growth potential for investors who are willing to take on risk.

Sustainable Investing: ESG (Environmental, Social, and Governance) funds allow you to invest in companies that align with your values, such as those focused on sustainability or social impact.

Common Investment Mistakes to Avoid

As a beginner, there are a few common mistakes to watch out for:

Emotional Trading: Letting emotions dictate your investment decisions can lead to impulsive actions and significant losses. Stick to your investment plan and avoid reacting to market fluctuations.

Over-concentration: Putting too much money into one stock or sector increases risk. Diversify your investments to reduce exposure to any single asset.

Timing the Market: Trying to predict market movements is difficult and often leads to missed opportunities. A long-term approach is generally more successful.

By avoiding these mistakes and staying disciplined, you can enhance your chances of financial success.

Conclusion

Starting to invest during college is a powerful way to build wealth for your future. Even small, consistent investments can grow significantly over time due to compound interest. Begin by setting a budget, building an emergency fund, and managing your student loans. Once you have a solid foundation, you can explore different investment options like index funds, ETFs, and sustainable investments. Use technology and apps to make the process easier and more efficient.

Diversifying your investments is essential for managing risk and boosting long-term returns. With a disciplined approach and the right strategies, you can set yourself up for financial success and independence.

Read More

#CollegeInvesting#FinancialTips#InvestingForBeginners#StudentFinance#MoneyManagement#InvestingInCollege#FinancialLiteracy#PersonalFinanceTips#BudgetingForStudents#CompoundInterest

1 note

·

View note

Text

Warren Buffett's net worth showcases the incredible power of compound interest. 💰 Remarkably, 99% of his wealth was amassed after turning 65. Let’s reflect on some pivotal moments in his journey: - At 14, he saved $5,000 delivering newspapers. - By age 26, he started an investment partnership valued at $100,000. - By age 56, he had become a billionaire with a net worth of $1 billion. - Now, at 94, he stands at an extraordinary $150 billion. This illustrates a powerful lesson: time and patience can yield extraordinary results in investing. In my experience, consistent saving and smart investments are crucial in building wealth over time. It's never too late to start your journey, and small steps can lead to monumental achievements! Remember, each dollar invested wisely today can blossom into significant wealth tomorrow. 🌱

#WarrenBuffett#WealthBuilding#CompoundInterest#FinancialEducation#InvestSmart#SavingMoney#InvestmentJourney#RichAtAnyAge#FinancialFreedom#WealthManagement#InvestingWisely#PatienceInInvesting#MoneyGrowth#BillionaireMindset#FinancialSuccess

0 notes

Text

Want your money to grow effortlessly? Compound interest is the secret sauce to building wealth over time. 💰 Here’s a sneak peek:

👉 What Is Compound Interest? It’s interest earning interest—your money grows exponentially!

👉 How It Works: Start early, stay consistent, and let time do the heavy lifting.

👉 Why Time Matters: The earlier you invest, the more powerful compounding becomes.

👉 Build Wealth Wisely: Reinvest, avoid debt, and watch your savings soar!

📖 Dive into the full post to learn how to harness this wealth-building tool: Read More Here [https://moneymatters78.blogspot.com/2024/12/unlocking-magic-of-compound-interest.html]

💡 Start today—your future self will thank you!

#CompoundInterest#MoneyMatters#WealthBuilding#FinancialFreedom#MoneyTips#InvestingForBeginners#PersonalFinance#SmartInvesting#FinancialGrowth#SavingsGoals#MoneyManagement#PassiveIncome#EarlyInvesting#FinancialPlanning#BuildWealth

0 notes

Text

Boost Your Education Savings! 📚💰 Why Starting an RESP Early is a Game-Changer!

Want to make your education fund grow faster? Start an RESP! With government contributions and compound growth, your savings can work harder for you. The earlier you start, the more you benefit! 📚💰

#InvestInEducation#CanadaSavingsPlan#GovernmentGrants#CompoundInterest#ParentingFinance#EducationFund#SavingsTips#GrowYourMoney#EducationSavings#RESPCanada

1 note

·

View note

Text

Aggressive Mutual Funds Your Path to Financial Freedom

#Investment#MutualFunds#Finance#WealthManagement#Savings#FuturePlanning#FinancialFreedom#InvestSmart#CompoundInterest#LongTermInvestment#WealthGrowth#SmartInvesting#FinancialGoals#InvestmentPlans#SecureFuture#FinanceTips#SIP#India#Mumbai#Nagpur#Bangalore#Sipfund

0 notes

Text

Unlock Wealth: The Power of Compound Interest Explained

📈💰 Unlock the Secret to Wealth Growth! 💡 Discover how compound interest can turn small investments into big results over time. Learn the formula, tips to maximize returns, and why starting early is the key to financial freedom.

When it comes to building wealth, few principles are as powerful—and as misunderstood—as compound interest. Albert Einstein is famously quoted as calling it the “eighth wonder of the world.” But what makes compound interest so magical? It’s simple: it allows your money to grow exponentially over time, with minimal effort on your part. In this post, we’ll break down how compound interest works.…

0 notes

Text

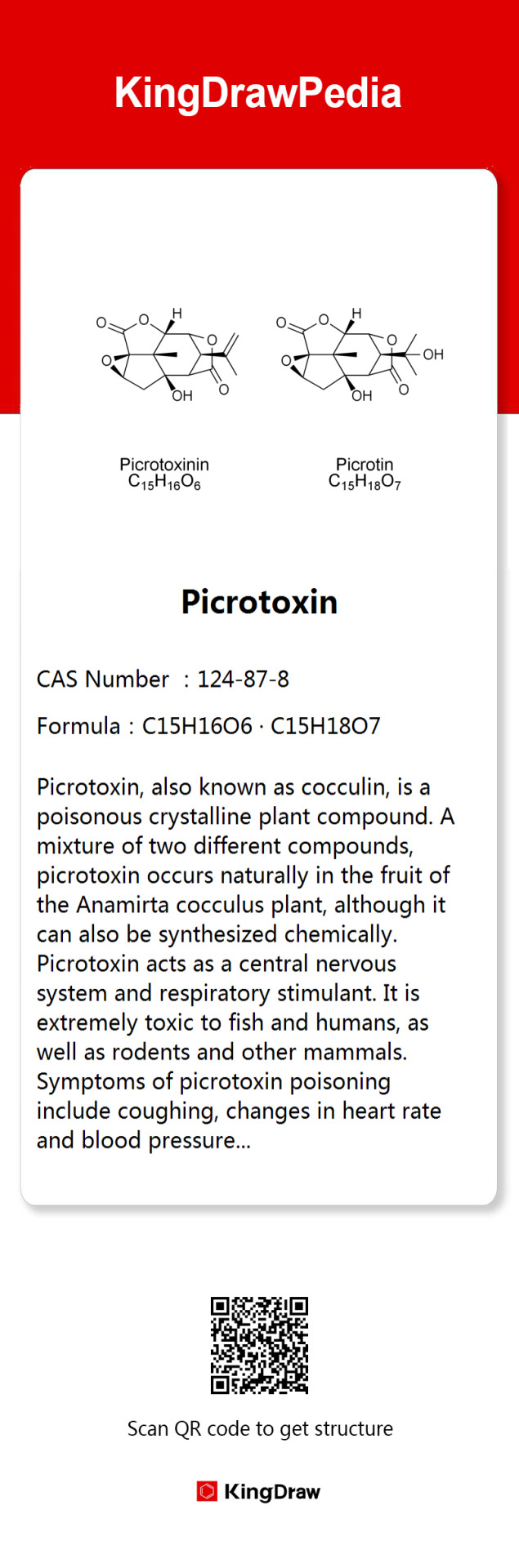

Do you know this plant?

Anamirta cocculus is a Southeast Asian and Indian climbing plant. Its fruit is the source of picrotoxin, a poisonous compound with stimulant properties. Local people in India will crush the fruit and throw it into the pond, and the fish will be paralyzed and float to the surface.

Picrotoxin, also known as cocculin, is a poisonous crystalline plant compound. Picrotoxin is an equimolar mixture of picrotoxinin and picrotin, which can be used as a stimulant and convulsant, inducing arrhythmias, respiratory paralysis, and even death at higher doses😟👀. The minimum oral lethal dose in adults is approximately 25 to 100 mg.

#plant blog#plantblr#Anamirta cocculus#india#south asia#toxicity#poisonous#chemblr#did u know#interesting facts#organic chemicals#compoundinterest#follow 👑 share ❤️ enjoy 🍑

8 notes

·

View notes

Text

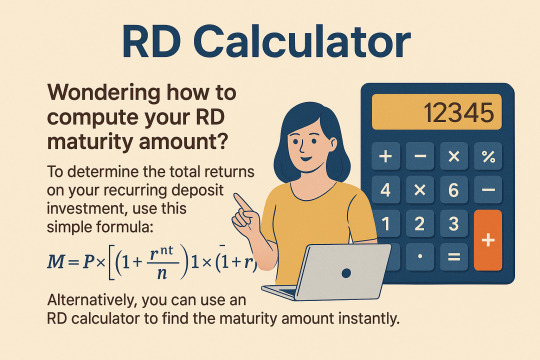

RD Interest Calculator: Maximize Your Returns with Smart RD Planning

Are you looking for a safe and effective way to grow your savings? A Recurring Deposit (RD) is a fantastic option for individuals who want disciplined savings with guaranteed returns. But how do you know how much you will earn at the end of your RD tenure? That’s where an RD Interest Calculator comes in handy.

In this guide, we’ll answer all your questions about RDs and how to use an RD maturity calculator to plan your investments wisely.

What is a Recurring Deposit (RD)?

A Recurring Deposit (RD) is a fixed-income investment option where you deposit a fixed amount every month for a pre-defined period. At maturity, you receive the total savings along with the accumulated interest.

RDs are popular among individuals looking for risk-free savings with assured returns. However, calculating the maturity amount manually can be challenging. This is where an RD calculator simplifies things for you.

How is RD Interest Calculated?

Banks and financial institutions use a standard recurring deposit formula to determine the maturity amount:

Where:

M = Maturity Amount

P = Monthly Deposit

r = Annual Interest Rate (in decimal form)

n = Number of times interest is compounded in a year

t = Tenure in years

Manually solving this formula can be complex, but an RD interest calculator instantly computes the exact amount you will receive at maturity.

Why Should You Use an RD Interest Calculator?

Many investors ask: Why use an online RD calculator when I can calculate it manually? Here’s why:

Saves Time: Manual calculations are time-consuming and prone to errors.

Accurate Results: An RD calculator provides precise results without mistakes.

Easy Comparisons: You can compare different RD plans from various banks instantly.

Financial Planning: Helps you strategize your savings based on expected returns.

Instant Maturity Calculation: Get to know the exact amount you will receive at the end of the tenure.

How to Use an RD Maturity Calculator?

Using an RD maturity calculator is super simple. Just follow these steps:

Enter Monthly Deposit Amount – The fixed amount you will invest each month.

Choose the Interest Rate – Input the applicable interest rate offered by the bank.

Select the Tenure – Choose the duration (e.g., 6 months, 1 year, 5 years, etc.).

Compounding Frequency – Select whether the interest is compounded quarterly, half-yearly, or annually.

Click Calculate – The tool will instantly show your total maturity amount along with the interest earned.

RD vs. Fixed Deposit (FD): Which One is Better?

RD vs. Fixed Deposit (FD): Which One is Better?

A common question among investors is: Should I go for an RD or an FD?

Deposit Type:

RD: Monthly Contributions

FD: One-time Lump Sum

Interest Calculation:

RD: Compound Interest

FD: Compound Interest

Flexibility:

RD: Higher (Monthly Investments)

FD: Less Flexible

Best For:

RD: Salaried Individuals

FD: Individuals with a Lump Sum

If you prefer monthly savings, an RD is a great choice. But if you have a lump sum, Fixed Deposits (FDs) may offer slightly better interest rates.

FAQs on Recurring Deposit Interest Calculator

1. Can I use an RD calculator for any bank?

Yes! An RD interest calculator works for all banks, including SBI, HDFC, ICICI, and more. Just enter the bank’s applicable interest rate to get accurate results.

2. Does RD have a lock-in period?

Most banks allow premature withdrawal, but a penalty may apply. The lock-in period varies from bank to bank.

3. Is RD better than SIP?

RD is a safer option as it offers fixed returns, whereas Systematic Investment Plans (SIPs) are linked to market fluctuations. Choose RD if you prefer stability, and SIP if you seek higher but uncertain returns.

4. How does compounding work in RD?

Interest in RD is compounded quarterly. This means every three months, your interest is added to the principal, helping your money grow faster.

Conclusion: Plan Your RD Wisely!

A Recurring Deposit Calculator is an essential tool to maximize your RD returns smartly. Whether you’re planning for a short-term goal or a long-term financial strategy, an RD is a secure way to grow your savings steadily.

Ready to invest? Use an RD maturity calculator today and take control of your financial future!

#RecurringDeposit#RDCalculator#RDMaturityCalculator#InvestmentPlanning#CompoundInterest#MoneyManagement#WealthBuilding#SmartInvesting#BankingTips#SecureInvestments

0 notes

Photo

POV: You rollover $50K from your old 401k (or employer equivalent) into an IRA invested in growth equity mutual funds. Your 401k balance is projected to be $1M+ in 25 years and produce $60-$70k in annual retirement income. https://www.afitonline.com/p/personal-financial-planning

#POV#RetirementPlanning#401kRollOver#IRAGrowth#MutualFunds#FinancialFuture#WealthBuilding#InvestmentStrategy#LongTermGrowth#RetirementIncome#FinancialIndependence#SmartInvesting#MoneyManagement#PassiveIncome#FinancialGoals#WealthCreation#FutureFinance#InvestInYourself#RetireRich#FinancialLiteracy#EquityInvesting#PortfolioGrowth#FutureReady#SavingForRetirement#CompoundInterest#LegacyPlanning#RetireComfortably#SavingsPlan#FinancialSuccess

0 notes

Link

In financial planning, Life Insurance often plays a pivotal role in securing the future of your loved ones. However, many people overlook the potential benefits of compound interest within certain types of Life Insurance Policies. Let’s dive into how life insurance and compound interest work together to create a powerful financial strategy.

#financial planning#financialplanning#financialplan#financial plan#life insurance#lifeinsurance#wholelifeinsurance#indexeduniversallifeinsurance#compoundinterest#compound interest#lifeinsurancepolicies#Life Insurance Policies#Life Insurance Policy#financialstrategy#financial strategy

0 notes

Text

My Refferal Code: 413283

My referral Link: https://buffalonetworkearn.app/?kod=413283

https://buffalonetworkearn.app/?kod=413283

https://buffalonetworkearn.app/?kod=413283

0 notes

Text

Best Stocks for Beginners with Little Money

Investing in stocks can be a great way to grow your wealth over time, even if you have a limited budget. Here are some of the best stocks and investment strategies for beginners looking to start with little money:

Exchange-Traded Funds (ETFs): ETFs are a great option for beginners because they allow you to invest in a diversified portfolio of stocks without needing to buy individual shares. Look for low-cost index ETFs that track major indices like the S&P 500.

Dividend Stocks: Companies that pay dividends can provide a steady income stream. Look for established companies with a history of paying dividends, such as Procter & Gamble (PG) or Coca-Cola (KO). Reinvesting dividends can also help grow your investment over time.

Blue-Chip Stocks: These are shares of large, well-established companies with a history of stable earnings. Examples include Apple (AAPL), Microsoft (MSFT), and Johnson & Johnson (JNJ). They tend to be less volatile and can be a safer choice for beginners.

Fractional Shares: Many brokerage platforms now offer the option to buy fractional shares, allowing you to invest in expensive stocks like Amazon (AMZN) or Tesla (TSLA) without needing to purchase a full share. This makes it easier to diversify your portfolio with limited funds.

Robo-Advisors: If you're unsure about picking individual stocks, consider using a robo-advisor. These automated platforms create and manage a diversified portfolio for you based on your risk tolerance and investment goals, often with low fees.

Growth Stocks: Look for companies with strong growth potential, even if they are not yet profitable. Stocks like Shopify (SHOP) or Zoom Video Communications (ZM) have shown significant growth and can be appealing for young investors willing to take on more risk.

Investing Apps: Consider using investing apps that allow you to start with small amounts of money. Apps like Robinhood, Acorns, or Stash make it easy to invest in stocks and ETFs with little money and often have no commission fees.

Tips for Beginners:

Start Small: Begin with a small investment and gradually increase as you become more comfortable.

Do Your Research: Understand the companies you are investing in and keep up with market trends.

Diversify: Don’t put all your money into one stock; spread your investments across different sectors to reduce risk.

Stay Patient: Investing is a long-term game. Avoid the temptation to sell during market fluctuations.

By starting with these strategies and stocks, beginners can make their money work for them, even with limited funds.

#investingtips#dividend stocks#WarrenBuffettWisdom#PassiveIncome#DividendIncome#StockMarketInvesting#FinancialGoals#LongTermInvesting#WealthBuilding#InvestingForBeginners#FinancialLiteracy#PortfolioManagement#CompoundInterest

1 note

·

View note

Text

Want to earn $1,000 in dividends? Here's how much you need to invest in top dividend-paying stocks! 📊

From Main Street to Microsoft, dividend stocks are a powerful way to grow wealth over time. Start investing smarter today and let your money work for you!

#investingtips#dividend stocks#WarrenBuffettWisdom#PassiveIncome#DividendIncome#StockMarketInvesting#FinancialGoals#LongTermInvesting#WealthBuilding#InvestingForBeginners#FinancialLiteracy#PortfolioManagement#CompoundInterest

1 note

·

View note

Text

Aggressive Mutual Funds Your Path to Financial Freedom

#Investment#MutualFunds#Finance#WealthManagement#Savings#FuturePlanning#FinancialFreedom#InvestSmart#CompoundInterest#LongTermInvestment#WealthGrowth#SmartInvesting#FinancialGoals#InvestmentPlans#SecureFuture#FinanceTips#SIP#India#Mumbai#Nagpur#Bangalore#Sipfund

0 notes